Kepco Buys 100% Of Bylong Coal Mine For A$403 Million From Anglo

July 05 2010 - 3:29AM

Dow Jones News

State-run Korea Electric Power Corp. (015760.SE) said Monday

that it has reached an agreement to buy the Bylong coal mine from

Anglo American PLC (AAL.LN) for A$403 million ($340 million) as

part of the Australian company's efforts to sell off a total of

five coal assets.

Kepco will wholly own the Bylong mine, which has total indicated

and inferred resources of 420 million metric tons of low-ash

thermal coal, used for power generation, extractable via open-cut

and underground mines, the Korean utility firm said in a

statement.

The company said it plans to start producing at Bylong in 2016,

and eventually achieve coal output of 7.5 million tons a year.

Separately, Korea's largest steel producer by sales, Posco

(005490.SE), said it and Australia's Cockatoo Coal Ltd. (COK.AU)

will jointly buy 100% of Anglo American's smaller Sutton Forest

asset.

A Kepco official said that the company was among 70 bidders,

including Posco and Cockatoo, for the five assets Anglo American is

putting up for sale.

Kepco said a final contract is likely after Anglo American

receives approval for the sale from both its board and the

Australian government's foreign investment review committee,

expected in the fourth quarter of this year.

"Our coal self-sufficiency ratio will rise to 24% from 12% as a

result of the deal, which also puts us into supplier status," Kepco

said.

State-owned Korean energy companies, including Kepco, invested a

combined $4.5 billion last year in overseas resources companies and

energy development projects, bringing total spending over the past

10 years to $9.48 billion, as part of their efforts to secure

stable supply of energy sources.

Posco said in a statement that it has agreed to pay A$50 million

for a 70% stake in Sutton Forest, while Cockatoo will buy the

remainder. It didn't specify the total value of the deal. Kepco

said in its statement that the deal is worth A$72 million

overall.

Sutton Forest is a smaller asset, with an inferred 115 million

tons of coal resources, but is attractive because it could produce

both metallurgical coal, used in steelmaking, and thermal coal.

Both are relatively close to railways leading to export

terminals on the coast--Sutton Forest is near Port Kembla and

Bylong is within reach of the port of Newcastle.

Separately, Cockatoo has won a bid to buy a 51% stake in

Ownaview and two other mines from Anglo for a combined A$105

million, Kepco said. The remaining 49% of the three mines is owned

by Mitsui & Co. (8031.TO).

Kepco said it will allow Cockatoo to run Bylong and also give

the Australian company an option to buy 30% of the mine at an

advantageous price in three years.

In return, Kepco said it will take over the 51% stake in

Ownaview from Cockatoo.

Anglo American is selling the assets because they don't form

part of its growth plans in the short-to-medium term. The company's

existing Australian coal mining operations aren't affected by its

decision to sell exploration projects.

Goldman Sachs JBWere is advising Anglo American on the sales

process.

Kepco is invested in Cockatoo Coal with a 3.3% stake, and its

other Australian investments include a minority interest in the

Moorlaben thermal coal mine operated by China's Yanzhou Coal Mining

Co. (1171.HK).

-By In-Soo Nam, Dow Jones Newswires; 822-3700-1902;

In-Soo.Nam@dowjones.com

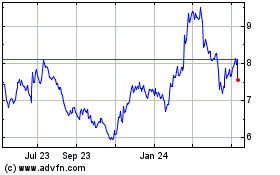

Korea Electric Power (NYSE:KEP)

Historical Stock Chart

From Dec 2024 to Jan 2025

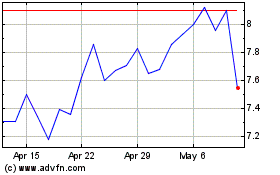

Korea Electric Power (NYSE:KEP)

Historical Stock Chart

From Jan 2024 to Jan 2025