UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

|

|

|

|

|

|

|

|

|

|

|

x

|

|

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2020

or

|

|

|

|

|

|

|

|

|

|

|

o

|

|

TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from _____________to_____________

Commission File Number 001-35081

A. Full title of the plan and the address of the plan, if different from that of the issuer named below:

KINDER MORGAN SAVINGS PLAN

B. Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:

Kinder Morgan, Inc.

1001 Louisiana Street, Suite 1000

Houston, Texas 77002

Kinder Morgan Savings Plan

Index to Financial Statements and Supplemental Schedule

|

|

|

|

|

|

|

|

|

Pages

|

|

|

|

|

|

|

|

|

|

|

Financial Statements:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental Schedule*:

|

|

|

|

|

|

Schedule H, Part IV, Line 4i - Schedule of Assets (Held at End of Year) as of December 31, 2020

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Other schedules required by Section 2520.103-10 of the Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974, as amended, have been omitted because they are not applicable.

Report of Independent Registered Public Accounting Firm

To the Fiduciary Committee and Plan Participants of the

Kinder Morgan Savings Plan:

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of the Kinder Morgan Savings Plan (the “Plan”) as of December 31, 2020 and 2019, the related statement of changes in net assets available for benefits for the year ended December 31, 2020, and the related notes to the financial statements (collectively, the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2020 and 2019, and the changes in net assets available for benefits for the year ended December 31, 2020, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risk of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by the Plan’s management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Report on Supplemental Information

The supplemental information in the accompanying Schedule H, Part IV, Line 4i - Schedule of Assets (Held at End of Year) as of December 31, 2020, has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental information is presented for the purpose of additional analysis and is not a required part of the financial statements but includes supplemental information required by the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. The supplemental information is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information in the accompanying schedule, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information in the accompanying schedule is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/Ham, Langston & Brezina, L.L.P.

We have served as the Plan’s auditor since 2006.

Houston, Texas

June 25, 2021

Kinder Morgan Savings Plan

Statements of Net Assets Available for Benefits

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31,

|

|

|

2020

|

|

2019

|

|

Assets

|

|

|

|

|

|

|

|

|

|

Investments, at fair value (See Notes 2, 3 and 4)

|

$

|

2,372,983

|

|

|

$

|

2,157,529

|

|

|

Fully benefit-responsive investment contracts at contract value

|

277,308

|

|

|

269,930

|

|

|

Notes receivable from Participants

|

51,231

|

|

|

56,193

|

|

|

Other assets

|

—

|

|

|

430

|

|

|

Total assets

|

2,701,522

|

|

|

2,484,082

|

|

|

|

|

|

|

|

Liabilities

|

|

|

|

|

Unsettled securities purchased payable

|

435

|

|

|

—

|

|

|

Administrative expenses payable

|

297

|

|

|

378

|

|

|

Total liabilities

|

732

|

|

|

378

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net assets available for benefits

|

$

|

2,700,790

|

|

|

$

|

2,483,704

|

|

The accompanying notes are an integral part of these financial statements.

Kinder Morgan Savings Plan

Statement of Changes in Net Assets Available for Benefits

(In thousands)

|

|

|

|

|

|

|

|

|

Year Ended

December 31, 2020

|

|

Additions to net assets attributable to:

|

|

|

Investment income:

|

|

|

Interest income

|

$

|

32

|

|

|

Dividend income

|

22,912

|

|

|

Net appreciation in fair value of investments

|

313,874

|

|

|

Other, net

|

161

|

|

|

Total investment income

|

336,979

|

|

|

|

|

|

Interest income on notes receivable from Participants

|

3,476

|

|

|

|

|

|

|

|

|

|

|

|

Contributions:

|

|

|

Participant contributions

|

96,710

|

|

|

Employer contributions

|

52,636

|

|

|

Rollovers

|

7,472

|

|

|

Total contributions

|

156,818

|

|

|

|

|

|

Total additions

|

497,273

|

|

|

|

|

|

Deductions from net assets attributable to:

|

|

|

Benefits paid to Participants

|

276,734

|

|

|

Administrative fees

|

3,453

|

|

|

Total deductions

|

280,187

|

|

|

|

|

|

Net increase in net assets available for benefits

|

217,086

|

|

|

|

|

|

Net assets available for benefits

|

|

|

Beginning of year

|

2,483,704

|

|

|

End of year

|

$

|

2,700,790

|

|

The accompanying notes are an integral part of this financial statement.

|

|

|

|

Kinder Morgan Savings Plan

Notes to Financial Statements

|

1. DESCRIPTION OF THE PLAN

General

The following description of the Kinder Morgan Savings Plan (the Plan) provides only general information. Plan participants (Participants) should refer to the Plan document for a more complete description of the Plan’s provisions.

The Plan is a defined contribution plan established in 1945 for the benefit of eligible employees of Kinder Morgan, Inc. (the Company or Employer) and generally covers all full-time employees and part-time employees who have completed at least 1,000 hours of service in a calendar year. Certain employee classifications and some employees covered by collective bargaining agreements are not covered by the Plan. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (ERISA). Benefits under the Plan are not guaranteed by the Pension Benefit Guaranty Corporation.

Plan Administration

The Plan is administered by the Company's Fiduciary Committee. Empower Retirement provides recordkeeping services for the Plan. The maintenance and custody of the Plan assets is administered by Great-West Trust Company, LLC (the Trustee). Invesco Trust Company (Invesco) manages a separate account, known as the Stable Value Fund (See Note 3). Invesco serves as the custodian for the Stable Value Fund.

Contributions

Participants may elect to make pre-tax contributions from 1% to 50% of their annual compensation, limited by requirements of the Internal Revenue Code (IRC). Participants may discontinue their elections to contribute at any time. All new Participants are automatically enrolled in the Plan with a pre-tax contribution by the Participant of 6% of their eligible annual compensation. Within the first 30 days of hire, employees may opt out of automatic enrollment. The Company has established a goal percentage rate of 12% (SmartGoal). Every February the Participants who have not opted out of automatic enrollment and who have a participation rate below the SmartGoal will automatically get a 1% increase until the Participant meets the SmartGoal. Participants can opt out of the SmartGoal at any time. Participants may also contribute amounts representing distributions from other qualified defined benefit or defined contribution plans.

The Company makes a Qualified Non-Elective Contribution (QNEC) to the Plan on behalf of each Participant. The QNEC is equal to 5% of eligible compensation and is deposited as of each pay period.

Company contributions for bargaining Participants follow the respective collective bargaining agreements. All QNEC and other Company contributions are invested according to Participants’ investment elections on file or the default, if no election is filed. Participants can transfer from the default fund(s) to any other available investment fund(s) at any time.

For the year ended December 31, 2020, the Company's contributions totaled approximately $52,636,000.

The Plan provides an option for Participants to make after-tax Roth contributions (Roth 401(k) option) to a separate Participant account. Unlike traditional 401(k) plans, where Participant contributions are made with pre-tax dollars, earnings grow tax-deferred and the withdrawals are treated as taxable income, Roth 401(k) contributions are made with after-tax dollars, earnings are tax-free, and the withdrawals are tax-free if they occur after both (i) the fifth year of participation in the Roth 401(k) option, and (ii) attainment of age 59 ½, death or disability. The Company contribution will still be considered taxable income at the time of withdrawal.

Under the IRC, annual additions under the Plan and all other qualified plans sponsored by the Company are limited to the lesser of 100% of eligible compensation or $57,000 for each Participant for 2020. Annual additions are defined as Company contributions and Participant contributions.

Participant Accounts

Each Participant’s account is credited with Participant contributions, Company contributions, and earnings. Participant accounts are charged with a quarterly fee for administrative expenses. The benefit to which a participant is entitled is the benefit that can be provided from the participant’s vested account.

|

|

|

|

Kinder Morgan Savings Plan

Notes to Financial Statements

|

Benefits/Vesting

Company contributions vest on the second anniversary of the date of hire. Vesting of Company contributions for bargaining Participants will follow the respective collective bargaining agreements.

Participant contributions may be withdrawn in the event of unusual expenses connected with illness or disability, for college or funeral expenses for a Participant or his or her dependents, for the repair of damage to a primary residence caused by fire, storm, or other casualties, or for the purchase of a primary residence, as defined in the Plan document. If not withdrawn earlier, a Participant’s account will be available for distribution, rollover, or payable in the event of termination of employment, death, or termination of the Plan. If upon termination, a Participant’s account is $1,000 or less, a lump-sum distribution will automatically be made. If a Participant’s account is greater than $1,000, the Participant’s distribution options are: lump-sum distribution, partial distribution, or periodic installments. Upon termination, Participants whose accounts exceed $1,000 may choose to leave their accounts in the Plan until age 72, when minimum distributions are required under the IRC.

On Mach 27, 2020, the “Coronavirus Aid, Relief, and Economic Security Act” (the CARES Act) was signed in to law. The CARES Act, among other things, included several relief provisions available to tax-qualifed retirement plans and their participants. The Plan’s management evaluated the relief provisions available to the plan participants and implemented the following provisions for 2020:

•Emergency coronavirus distributions up to $100,000;

•Increased the maximum loan amount to the lesser of $100,000 or 100% of the vested balance for loans taken out between March 27, 2020 and September 22, 2020;

•Loan repayment suspension and extension of loan terms up to one year; and

•Suspension of Required Minimum Distribution for 2020.

Plan Termination

Although it has not expressed any intent to do so, the Company has the right under the Plan to discontinue its contributions at any time and to terminate the Plan, subject to the provisions of ERISA. In the event of Plan termination, Participants would become fully vested in Company contributions.

Notes Receivable from Participants

Participants may borrow, from the vested portion of their Plan accounts, a minimum of $1,000 up to a maximum equal to the lesser of 50% of their vested balance or $50,000, minus the highest outstanding loan balance from the previous 12 months. The Participants' loans are secured by their vested balances. All loans are charged an interest rate equal to the prime rate on the first business day of the month of issuance plus 2% and the rate remains fixed during the life of the loan. The loans are subject to certain restrictions as defined in the Plan document and applicable restrictions under the IRC. Certain provisions related to loans detailed in the Benefits/Vesting section above were modified in 2020 due to the CARES Act.

Forfeitures

Forfeitures of non-vested Employer contributions remain in the Plan and earn interest income. For the year ended December 31, 2020, terminated Participants forfeited $1,147,000 of Employer contributions, and available forfeitures in the amount of $1,370,000 were used to reduce Company QNEC.

2. SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accompanying financial statements are prepared on the accrual basis of accounting in conformity with the accounting principles contained in the Financial Accounting Standards Board’s (FASB) Accounting Standards Codification, the single source of generally accepted accounting principles in the United States of America (U.S. GAAP).

|

|

|

|

Kinder Morgan Savings Plan

Notes to Financial Statements

|

Use of Estimates

The preparation of the Plan’s financial statements in conformity with U.S. GAAP requires the Plan’s management to make estimates and assumptions. These estimates and assumptions affect the reported amounts of assets, liabilities and changes therein and the disclosure of contingent assets and liabilities and changes therein. Actual results could differ from these estimates.

Risks and Uncertainties

The Plan provides for investments in various investment securities. Investments, in general, are exposed to various risks, such as interest rate, credit and overall market volatility risk. Due to the level of risk associated with certain investments, it is reasonably possible that changes in the values of investments will occur in the near term and that such changes could materially affect Participants’ account balances and the amounts shown in the accompanying Statements of Net Assets Available for Benefits and Statements of Changes in Net Assets Available for Benefits.

The continued global economic uncertainty associated with the novel coronavirus (COVID-19) pandemic has resulted in significant volatility in global financial markets. This volatility has affected, and may continue to affect, the value of the Plan’s net assets available for benefits. The effects of economic and market conditions subsequent to December 31, 2020 are not reflected in these financial statements and future effects on the Plan’s net assets available for benefits cannot be predicted due to uncertainty regarding the duration and scope of the pandemic and other changing market conditions.

Investment Valuation and Income Recognition

Shares of registered investment companies (mutual funds) are accounted for at fair market values as determined by quoted market prices in an active market. The Plan’s interest in common collective trust funds are based on the fair value of the funds' underlying investments as based on information reported by the investment advisor using the audited financial statements of the funds at year-end. Common stocks and exchange traded funds are valued at the closing price reported on the active markets on which the individual securities are traded. Bonds are valued using pricing models using observable inputs for similar securities.

The Plan invests in fully benefit-responsive investment contracts (FBRIC) held in a stable value fund and the FBRICs are accounted for at contract value. Contract value is the relevant measure for the portion of the net assets available for benefits of a defined contribution plan attributable to FBRICs because contract value is the amount Participants would normally receive if they were to initiate permitted transactions under the terms of the Plan.

The Plan presents in the accompanying Statement of Changes in Net Assets Available for Benefits the net appreciation in the fair value of investments, which consists of realized gains and losses, and the net change in unrealized appreciation (depreciation) on investments. Unrealized appreciation (depreciation) is the difference between the fair value of the investment at the end of the current year and the cost of the investment, if acquired during the Plan year, or the fair value of the investment at the beginning of the Plan year. Purchases and sales of the funds are reflected on a trade date basis. Interest income is recognized when earned. Dividends are recognized on the ex-dividend date.

Notes Receivable from Participants

Notes receivable from Participants are measured at their unpaid principal balance plus any accrued but unpaid interest. Interest income is recorded on an accrual basis. No allowance for credit losses have been recorded as of December 31, 2020 and 2019. Delinquent notes receivable from Participants are reclassified as distributions based upon the terms of the Plan document.

Administrative and Investment Expenses

General administrative expenses are paid by the Plan through the quarterly per Participant administrative fees. Expenses associated with any Qualified Domestic Relations Orders, loans and distributions are paid by the Participants who incur these services. Fees for any administrative expenses not covered by the quarterly per Participant administrative fees are paid by the Company. Investment expenses are included within “Net appreciation in fair value of investments” on our accompanying Statements of Changes in Net Assets Available for Benefits.

|

|

|

|

Kinder Morgan Savings Plan

Notes to Financial Statements

|

Payment of Benefits

Benefits are recorded when paid.

Subsequent Events

Plan management has evaluated all subsequent events through June 25, 2021, which is the date the financial statements were issued, and has concluded that there are no significant events to be reported.

3. INVESTMENT CONTRACTS

The Plan, through its Invesco Stable Value Fund (the Fund), holds investments in common collective trust funds and a money market fund. To reduce the risk of market losses on these investments, the Fund entered into synthetic investment contracts with financial institutions and insurance companies. A synthetic guaranteed investment contract (GIC) includes a wrapper contract, which is an agreement for the wrap issuer, such as a bank or insurance company, to make payments to the Fund in certain circumstances. With synthetic GICs, the underlying investments are owned by the Fund and held in trust for Plan participants. The wrapper contract amortizes the realized and unrealized gains and losses on the underlying fixed income investments, typically over the duration of the investment, through adjustments to the future interest crediting rate. The issuer of the wrapper contract provides assurance that the adjustments to the interest crediting rate do not result in a future interest crediting rate that is less than zero. Synthetic investment contracts enable its participants to transact at the investments' contract value by protecting the principal amount invested over a specified period of time. The assets underlying the investment contracts are owned by the Plan. These synthetic investment contracts are fully benefit-responsive, and their contract value is reflected in the accompanying Statements of Net Assets Available for Benefits. Contract value represents the original cost of the contract, plus interest (based upon the crediting rates of the underlying contracts) and deposits, reduced by administrative fees, transfers out, and withdrawals.

Under certain events, the amounts withdrawn from investment contracts may be payable at fair value rather than contract value. These events include termination of the Plan, a material adverse change to the provisions of the Plan, if the Employer elects to withdraw from an investment contract or if the terms of a successor plan do not meet the contract issuer’s criteria for the issuance of a similar contract. In some cases, an investment contract issuer may terminate a contract with the Plan and settle at an amount different than the contract value. Examples of these events include the Plan’s loss of its qualified status, material breaches of responsibilities that are not cured or material and adverse changes to the provisions of the Plan.

4. FAIR VALUE MEASUREMENTS

Fair value is a market-based measurement that is determined based on assumptions (inputs) that market participants would use in pricing an asset or liability. Inputs may be observable or unobservable, and valuation techniques used to measure fair value should maximize the use of relevant observable inputs and minimize the use of unobservable inputs. The Plan uses a hierarchical disclosure framework that ranks the quality and reliability of information used to determine fair values.

The hierarchy is associated with the level of pricing observability utilized in measuring fair value and defines three levels of inputs to the fair value measurement process—quoted prices are the most reliable valuation inputs, whereas model values that include inputs based on unobservable data are the least reliable.

The three broad levels of inputs defined by the fair value hierarchy are as follows:

Level 1 Inputs to the valuation methodology are unadjusted quoted prices for identical assets or liabilities in active markets that the Plan has the ability to access at the measurement date.

Level 2 Inputs to the valuation methodology include:

•Quoted prices for similar assets or liabilities in active markets;

•Quoted prices for identical or similar assets or liabilities in inactive markets;

•Inputs other than quoted prices that are observable for the asset or liability; and

•Inputs that are derived principally from or corroborated by observable market data by correlation or other means.

|

|

|

|

Kinder Morgan Savings Plan

Notes to Financial Statements

|

If the asset or liability has a specified (contractual) term, the Level 2 input must be observable for substantially the full term of the asset or liability.

Level 3 Unobservable inputs for the asset or liability. These unobservable inputs reflect the entity’s own assumptions about the assumptions that market participants would use in pricing the asset or liability, and are developed based on the best information available in the circumstances (which might include the reporting entity’s own data).

The asset’s or liability’s fair value measurement level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. Valuation techniques used need to maximize the use of observable inputs and minimize the use of unobservable inputs.

In determining fair value, the Plan uses two different approaches (the market approach and the income approach) depending on the nature of the assets and liabilities. The market approach uses prices and other relevant data based on market transactions involving identical or comparable assets and liabilities. The income approach uses valuation techniques to convert future amounts, such as cash flows or earnings, to a single present amount, with the measurement based on the value indicated by current market expectations about those future amounts.

Following is a description of the valuation methodologies and approaches used for assets measured at fair value. There have been no changes in the methodologies used at December 31, 2020 and 2019.

Common and preferred equity and exchange traded funds: Valued at the closing price reported on the active market on which the individual securities are traded. (Market approach)

Corporate bonds: Valued using pricing models maximizing the use of observable inputs for similar securities. This includes basing value on yields currently available on comparable securities of issuers with similar credit ratings. Corporate bonds are held in self-directed brokerage accounts. (Income approach)

Registered investment companies (mutual funds): Valued at the daily closing price as reported by the mutual fund. Mutual funds held by the Plan are open-end mutual funds that are registered with the Securities and Exchange Commission. These funds are required to publish their daily net asset value (NAV) and to transact at that price. The mutual funds held by the Plan are deemed to be actively traded. (Market approach)

|

|

|

|

Kinder Morgan Savings Plan

Notes to Financial Statements

|

The following tables set forth by level, within the fair value hierarchy, the Plan’s assets at fair value as of December 31, 2020 and 2019:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets at Fair Value as of December 31, 2020

|

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

|

|

(In thousands)

|

|

Kinder Morgan, Inc. Common Stock

|

|

$

|

59,641

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

59,641

|

|

|

Registered investment companies (mutual funds)

|

|

247,053

|

|

|

—

|

|

|

—

|

|

|

247,053

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Self-directed brokerage accounts

|

|

65,088

|

|

|

44

|

|

|

—

|

|

|

65,132

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets in the fair value hierarchy

|

|

$

|

371,782

|

|

|

$

|

44

|

|

|

$

|

—

|

|

|

371,826

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments measured at NAV(a)

|

|

|

|

|

|

|

|

2,001,157

|

|

|

Investments at fair value

|

|

|

|

|

|

|

|

$

|

2,372,983

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets at Fair Value as of December 31, 2019

|

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

|

|

(In thousands)

|

|

Kinder Morgan, Inc. Common Stock

|

|

$

|

89,896

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

89,896

|

|

|

Registered investment companies (mutual funds)

|

|

219,213

|

|

|

—

|

|

|

—

|

|

|

219,213

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Self-directed brokerage accounts

|

|

51,822

|

|

|

47

|

|

|

—

|

|

|

51,869

|

|

|

Total assets in the fair value hierarchy

|

|

$

|

360,931

|

|

|

$

|

47

|

|

|

$

|

—

|

|

|

360,978

|

|

|

|

|

|

|

Investments measured at NAV(a)

|

|

1,796,551

|

|

|

Investments at fair value

|

|

|

|

|

|

|

|

$

|

2,157,529

|

|

(a) In accordance with the FASB’s Accounting Standards Codification Subtopic 820-10, certain investments that were measured using NAV as a practical expedient per share (or its equivalent) have not been classified in the fair value hierarchy. The fair value amounts presented in this table are intended to permit reconciliation of the fair value hierarchy to the line items presented in the Statements of Net Assets Available For Benefits.

|

|

|

|

Kinder Morgan Savings Plan

Notes to Financial Statements

|

Fair Value of Investments in Entities that Use NAV

The following tables summarize investments measured at fair value based on NAV as a practical expedient as of December 31, 2020 and 2019:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2020

|

|

Fair Value

|

|

Unfunded Commitments

|

|

Redemption Frequency

(if currently eligible)

|

|

Redemption Notice Period

|

|

|

|

(In thousands)

|

|

|

|

|

|

|

|

Common Collective Trusts

|

|

|

|

|

|

|

|

|

|

State Street S&P 500 Index Securities Lending Series Fund Class II

|

|

$

|

363,284

|

|

|

n/a

|

|

Daily

|

|

*

|

|

State Street Global All Cap Equity Ex-U.S. Index Securities Lending Class II

|

|

207,079

|

|

|

n/a

|

|

Daily

|

|

*

|

|

Columbia Trust Focused Large Cap Growth Fund Institutional 1

|

|

197,604

|

|

|

n/a

|

|

Daily

|

|

*

|

|

State Street U.S. Bond Index Securities Lending Series Fund Class XIV

|

|

175,637

|

|

|

n/a

|

|

Daily

|

|

*

|

|

State Street Target Retirement 2030 Securities Lending Series Fund Class V

|

|

126,102

|

|

|

n/a

|

|

Daily

|

|

*

|

|

State Street S&P Midcap Index Securities Lending Series Fund Class XIV

|

|

117,503

|

|

|

n/a

|

|

Daily

|

|

*

|

|

State Street Target Retirement 2025 Securities Lending Series Fund Class V

|

|

112,694

|

|

|

n/a

|

|

Daily

|

|

*

|

|

State Street Target Retirement 2040 Securities Lending Series Fund Class V

|

|

98,289

|

|

|

n/a

|

|

Daily

|

|

*

|

|

State Street Target Retirement 2020 Securities Lending Series Fund Class V

|

|

96,416

|

|

|

n/a

|

|

Daily

|

|

*

|

|

State Street Target Retirement 2035 Securities Lending Series Fund Class V

|

|

78,663

|

|

|

n/a

|

|

Daily

|

|

*

|

|

State Street Target Retirement 2045 Securities Lending Series Fund Class V

|

|

75,841

|

|

|

n/a

|

|

Daily

|

|

*

|

|

Loomis Sayles Core Plus Fixed Income Fund

|

|

70,577

|

|

|

n/a

|

|

Daily

|

|

*

|

|

State Street Target Retirement Income Securities Lending Series Fund Class V

|

|

68,107

|

|

|

n/a

|

|

Daily

|

|

*

|

|

State Street Target Retirement 2050 Securities Lending Series Fund Class V

|

|

61,058

|

|

|

n/a

|

|

Daily

|

|

*

|

|

MFS International Equity Fund Class IV

|

|

59,156

|

|

|

n/a

|

|

Daily

|

|

10 days

|

|

State Street Target Retirement 2055 Securities Lending Series Fund Class V

|

|

35,159

|

|

|

n/a

|

|

Daily

|

|

*

|

|

State Street Russell Small Cap Index Securities Lending Series Fund Class II

|

|

26,461

|

|

|

n/a

|

|

Daily

|

|

*

|

|

TS&W Mid Cap Value Trust

|

|

12,073

|

|

|

n/a

|

|

Daily

|

|

*

|

|

State Street Emerging Markets Index Securities Lending Series Fund Class II

|

|

11,088

|

|

|

n/a

|

|

Daily

|

|

*

|

|

State Street Target Retirement 2060 Securities Lending Series Fund Class V

|

|

8,080

|

|

|

n/a

|

|

Daily

|

|

*

|

|

State Street Target Retirement 2065 Securities Lending Series Fund Class V

|

|

286

|

|

|

n/a

|

|

Daily

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

2,001,157

|

|

|

|

|

|

|

|

|

|

|

|

Kinder Morgan Savings Plan

Notes to Financial Statements

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2019

|

|

Fair Value

|

|

Unfunded Commitments

|

|

Redemption Frequency

(if currently eligible)

|

|

Redemption Notice Period

|

|

|

|

(In thousands)

|

|

|

|

|

|

|

|

Common Collective Trusts

|

|

|

|

|

|

|

|

|

|

State Street S&P 500 Index Securities Lending Series Fund Class II

|

|

$

|

343,147

|

|

|

n/a

|

|

Daily

|

|

*

|

|

State Street Global All Cap Equity Ex-U.S. Index Securities Lending Class II

|

|

187,688

|

|

|

n/a

|

|

Daily

|

|

*

|

|

State Street U.S. Bond Index Securities Lending Series Fund Class XIV

|

|

152,652

|

|

|

n/a

|

|

Daily

|

|

*

|

|

Columbia Trust Focused Large Cap Growth Fund Institutional 1

|

|

149,907

|

|

|

n/a

|

|

Daily

|

|

n/a

|

|

State Street Target Retirement 2030 Securities Lending Series Fund Class V

|

|

112,175

|

|

|

n/a

|

|

Daily

|

|

*

|

|

State Street Target Retirement 2025 Securities Lending Series Fund Class V

|

|

105,631

|

|

|

n/a

|

|

Daily

|

|

*

|

|

State Street S&P Midcap Index Securities Lending Series Fund Class XIV

|

|

104,606

|

|

|

n/a

|

|

Daily

|

|

*

|

|

State Street Target Retirement 2020 Securities Lending Series Fund Class V

|

|

101,305

|

|

|

n/a

|

|

Daily

|

|

*

|

|

State Street Target Retirement 2040 Securities Lending Series Fund Class V

|

|

85,535

|

|

|

n/a

|

|

Daily

|

|

*

|

|

State Street Target Retirement 2035 Securities Lending Series Fund Class V

|

|

65,090

|

|

|

n/a

|

|

Daily

|

|

*

|

|

Loomis Sayles Core Plus Fixed Income Fund

|

|

63,988

|

|

|

n/a

|

|

Daily

|

|

n/a

|

|

State Street Target Retirement 2045 Securities Lending Series Fund Class V

|

|

62,773

|

|

|

n/a

|

|

Daily

|

|

*

|

|

MFS International Equity Fund Class IV

|

|

61,711

|

|

|

n/a

|

|

Daily

|

|

10 days

|

|

State Street Target Retirement 2050 Securities Lending Series Fund Class V

|

|

48,139

|

|

|

n/a

|

|

Daily

|

|

*

|

|

State Street Target Retirement Income Securities Lending Series Fund Class V

|

|

37,499

|

|

|

n/a

|

|

Daily

|

|

*

|

|

State Street Target Retirement 2015 Securities Lending Series Fund Class V

|

|

31,566

|

|

|

n/a

|

|

Daily

|

|

*

|

|

State Street Target Retirement 2055 Securities Lending Series Fund Class V

|

|

26,965

|

|

|

n/a

|

|

Daily

|

|

*

|

|

State Street Russell Small Cap Index Securities Lending Series Fund Class II

|

|

26,046

|

|

|

n/a

|

|

Daily

|

|

*

|

|

WEDGE Capital Mid Cap Value Fund

|

|

15,027

|

|

|

n/a

|

|

Daily

|

|

30 days

|

|

State Street Emerging Markets Index Securities Lending Series Fund Class II

|

|

10,320

|

|

|

n/a

|

|

Daily

|

|

*

|

|

State Street Target Retirement 2060 Securities Lending Series Fund Class V

|

|

4,781

|

|

|

n/a

|

|

Daily

|

|

*

|

|

|

|

$

|

1,796,551

|

|

|

|

|

|

|

|

* Redemptions normally settle on trade date plus one business day. State Street Global Advisors (SSgA) also requests notice 15 days in advance of trade date for all plan-directed redemptions that are of significant size, as determined by SSgA.

|

|

|

|

Kinder Morgan Savings Plan

Notes to Financial Statements

|

5. TAX STATUS

The Plan is qualified under the IRC as exempt from federal income taxes, and the Plan received a favorable determination letter from the Internal Revenue Service on March 21, 2016. The Plan has been amended since receiving this determination; however, the Company's Fiduciary Committee believes that the Plan is currently designed and being operated in compliance with the applicable requirements of the IRC. Therefore, the Company's Fiduciary Committee believes that the Plan was tax exempt as of the financial statement dates. Employer contributions to the Plan and all earnings from Plan investments are not taxable to Participants until a partial or complete distribution of such contributions and associated accumulated earnings are made.

Accounting principles generally accepted in the Unites States of America require plan management to evaluate tax positions taken by the plan and recognize a tax liability if the plan has taken an uncertain tax position that may not be sustained upon examination by the IRS. The Plan is subject to routine audits by taxing jurisdictions; however there are currently no audits for any tax periods in progress.

6. PARTY-IN-INTEREST TRANSACTIONS

Certain Plan investments are in accounts managed by the Trustee, Invesco and the Plan has notes receivable from certain of its Participants. Additionally, the Plan invests in shares of the Company’s common stock. These transactions qualify as party-in-interest transactions, as defined by ERISA. However, such transactions are permitted under the provisions of the Plan and are exempt from the prohibition of party-in-interest transactions under ERISA.

7. RECONCILIATION OF THE PLAN FINANCIAL STATEMENTS TO FORM 5500

The following is a reconciliation of the Plan’s net assets available for benefits per the accompanying financial statements to Form 5500:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31,

|

|

|

2020

|

|

2019

|

|

|

(In thousands)

|

|

Net assets available for benefits per the financial statements

|

$

|

2,700,790

|

|

|

$

|

2,483,704

|

|

|

Deemed distributions of notes receivable from Participants

|

—

|

|

|

(2,200)

|

|

|

Difference between fair value and contract value for interest in collective trusts relating to fully benefit-responsive investment contracts

|

13,194

|

|

|

5,731

|

|

|

Net assets available for benefits per Form 5500

|

$

|

2,713,984

|

|

|

$

|

2,487,235

|

|

The following is a reconciliation of the change in net assets available for benefits per the accompanying financial statements to Form 5500:

|

|

|

|

|

|

|

|

|

Year Ended

December 31, 2020

|

|

|

(In thousands)

|

|

Net increase in net assets available for benefits per the financial statements

|

$

|

217,086

|

|

|

Change in deemed distributions of notes receivable from Participants

|

2,200

|

|

|

Change in difference between fair value and contract value for interest in collective trusts relating to fully benefit-responsive investment contracts

|

7,463

|

|

|

Net increase in net assets available for benefits per Form 5500

|

$

|

226,749

|

|

Amounts allocated to deemed distributions of notes receivable from Participants are recorded as a receivable in the accompanying financial statements and recorded as an expense on Form 5500.

A note receivable from a Participant is deemed distributed during the plan year under the provisions of IRC section 72(p) and Treasury Regulation section 1.72(p) if the note receivable is treated as a note receivable solely of the Participant’s individual account and the Participant has discontinued payment of the note receivable as of the end of the year. In accordance with

|

|

|

|

Kinder Morgan Savings Plan

Notes to Financial Statements

|

GAAP, the note receivable balance is still considered as an outstanding note receivable until the note receivable obligation has been satisfied and is not treated as an actual distribution until such time as a distributable event occurs.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kinder Morgan Savings Plan

|

|

Schedule H, Part IV, Line 4i - Schedule of Assets (Held at End of Year)

|

|

As of December 31, 2020

|

|

(In thousands)

|

|

EIN: 80-0682103

|

|

|

|

|

|

PN: 002

|

|

|

|

|

|

(a)

|

(b) Identity of Issue, Borrower, Lessor or Similar Party

|

|

(c) Description of Investment Including Maturity Date, Rate of Interest, Collateral, Par or Maturity Value

|

|

(e) Current Value**

|

|

Mutual Fund

|

|

|

|

|

|

|

Dodge & Cox Stock Fund

|

|

Registered Investment Company

|

|

$

|

102,214

|

|

|

|

Harbor Small Cap Growth Fund Institutional Shares

|

|

Registered Investment Company

|

|

63,670

|

|

|

|

Artisan Mid Cap Fund Institutional Shares

|

|

Registered Investment Company

|

|

53,668

|

|

|

|

Harbor Small Cap Value Fund Institutional Shares

|

|

Registered Investment Company

|

|

19,305

|

|

|

|

|

|

Total Mutual Fund

|

|

238,857

|

|

|

Common Collective Trust

|

|

|

|

|

|

|

State Street S&P 500 Index Securities Lending Series Fund Class II

|

|

Common Collective Trust

|

|

363,284

|

|

|

|

State Street Global All Cap Equity Ex-U.S. Index Securities Lending Class II

|

|

Common Collective Trust

|

|

207,079

|

|

|

|

Columbia Trust Focused Large Cap Growth Fund Institutional 1

|

|

Common Collective Trust

|

|

197,604

|

|

|

|

State Street U.S. Bond Index Securities Lending Series Fund Class XIV

|

|

Common Collective Trust

|

|

175,637

|

|

|

|

State Street Target Retirement 2030 Securities Lending Series Fund Class V

|

|

Common Collective Trust

|

|

126,102

|

|

|

|

State Street S&P Midcap Index Securities Lending Series Class XIV

|

|

Common Collective Trust

|

|

117,503

|

|

|

|

State Street Target Retirement 2025 Securities Lending Series Fund Class V

|

|

Common Collective Trust

|

|

112,694

|

|

|

|

State Street Target Retirement 2040 Securities Lending Series Fund Class V

|

|

Common Collective Trust

|

|

98,289

|

|

|

|

State Street Target Retirement 2020 Securities Lending Series Fund Class V

|

|

Common Collective Trust

|

|

96,416

|

|

|

|

State Street Target Retirement 2035 Securities Lending Series Fund Class V

|

|

Common Collective Trust

|

|

78,663

|

|

|

|

State Street Target Retirement 2045 Securities Lending Series Fund Class V

|

|

Common Collective Trust

|

|

75,841

|

|

|

|

Loomis Sayles Core Plus Fixed Income Fund

|

|

Common Collective Trust

|

|

70,577

|

|

|

|

State Street Target Retirement Income Securities Lending Series Fund Class V

|

|

Common Collective Trust

|

|

68,107

|

|

|

|

State Street Target Retirement 2050 Securities Lending Series Fund Class V

|

|

Common Collective Trust

|

|

61,058

|

|

|

|

MFS International Equity Fund Class IV

|

|

Common Collective Trust

|

|

59,156

|

|

|

|

State Street Target Retirement 2055 Securities Lending Series Fund Class V

|

|

Common Collective Trust

|

|

35,159

|

|

|

|

State Street Russell Small Cap Index Securities Lending Series Fund Class II

|

|

Common Collective Trust

|

|

26,461

|

|

|

|

TS&W Mid Cap Value Trust

|

|

Common Collective Trust

|

|

12,073

|

|

|

|

State Street Emerging Markets Index Securities Lending Series Fund Class II

|

|

Common Collective Trust

|

|

11,088

|

|

|

|

State Street Target Retirement 2060 Securities Lending Series Fund Class V

|

|

Common Collective Trust

|

|

8,080

|

|

|

|

State Street Target Retirement 2065 Securities Lending Series Fund Class V

|

|

Common Collective Trust

|

|

286

|

|

|

|

|

|

Total Common Collective Trust

|

|

2,001,157

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kinder Morgan Savings Plan

|

|

Schedule H, Part IV, Line 4i - Schedule of Assets (Held at End of Year)

|

|

As of December 31, 2020

|

|

(In thousands)

|

|

EIN: 80-0682103

|

|

|

|

|

|

PN: 002

|

|

|

|

|

|

Self-Directed Brokerage Account

|

|

|

|

|

|

|

Self-Directed Brokerage Account

|

|

Common Stock, Interest-bearing Cash, Bonds, Exchange Traded Funds, and Mutual Funds

|

|

65,066

|

|

|

*

|

Self-Directed Brokerage Account

|

|

Kinder Morgan, Inc. Common Stock

|

|

66

|

|

|

|

|

|

Total Self-Directed Brokerage Account

|

|

65,132

|

|

|

Stable Value Fund

|

|

|

|

|

|

*

|

IGT Invesco High Quality Short-term Bond Fund

|

|

Common Collective Trust

|

|

139,909

|

|

|

*

|

IGT Jennison A or Better Intermediate Fund

|

|

Common Collective Trust

|

|

30,268

|

|

|

*

|

IGT Invesco A or Better Intermediate Fund

|

|

Common Collective Trust

|

|

29,988

|

|

|

*

|

IGT Loomis Sayles A or Better Intermediate Fund

|

|

Common Collective Trust

|

|

15,183

|

|

|

*

|

IGT PIMCO A or Better Intermediate Fund

|

|

Common Collective Trust

|

|

15,130

|

|

|

*

|

IGT Invesco A or Better Core Fixed Income Fund

|

|

Common Collective Trust

|

|

15,099

|

|

|

*

|

IGT Loomis Sayles A or Better Core Fixed Income Fund

|

|

Common Collective Trust

|

|

15,079

|

|

|

*

|

IGT PIMCO A or Better Core Fixed Income Fund

|

|

Common Collective Trust

|

|

14,928

|

|

|

*

|

IGT Dodge and Cox A or Better Core Fund

|

|

Common Collective Trust

|

|

14,918

|

|

|

|

|

|

Total Wrapped Holdings

|

|

290,502

|

|

|

|

Morgan Stanley Institutional Liquidity Government Portfolio

|

|

Registered Investment Company

|

|

8,196

|

|

|

|

|

|

Total Stable Value Fund

|

|

298,698

|

|

|

Kinder Morgan Stock Fund

|

|

|

|

|

|

*

|

Kinder Morgan, Inc.

|

|

Kinder Morgan, Inc. Common Stock

|

|

59,641

|

|

|

Participant Loans

|

|

|

|

|

|

*

|

The Plan

|

|

Participant loans with terms ranging from 0 to 30 years and interest rates ranging from 3.25% to 10.50%

|

|

51,231

|

|

|

|

|

|

Total Assets (Held at End of Year)

|

|

$

|

2,714,716

|

|

|

|

|

|

|

|

|

|

*

|

Represents party-in-interest transactions (Note 6).

|

|

|

|

|

|

**

|

Cost information is not required for participant directed investments.

|

|

|

EXHIBIT INDEX

Exhibit Number Description

Pursuant to the requirements of the Securities Exchange Act of 1934, Kinder Morgan, Inc.'s Fiduciary Committee has duly caused this annual report to be signed by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

KINDER MORGAN SAVINGS PLAN

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Matthew Wojtalewicz

|

|

|

|

Matthew Wojtalewicz,

|

|

|

|

Member of the Fiduciary Committee of

|

|

|

|

Kinder Morgan, Inc.

|

|

Date: June 25, 2021

|

|

|

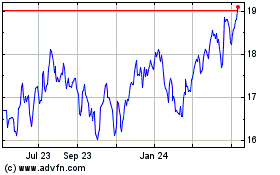

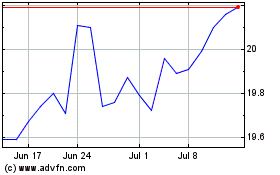

Kinder Morgan (NYSE:KMI)

Historical Stock Chart

From Aug 2024 to Sep 2024

Kinder Morgan (NYSE:KMI)

Historical Stock Chart

From Sep 2023 to Sep 2024