Form 424B3 - Prospectus [Rule 424(b)(3)]

July 10 2024 - 3:02PM

Edgar (US Regulatory)

Index supplement to the prospectus dated April 13, 2023, the prospectus supplement dated April 13, 2023, the product supplement no. 4 - I dated April 13, 2023 and the underlying supplement no. 5 - II dated March 5, 2024. Registration Statement Nos. 333 - 270004 and 333 - 270004 - 01 D ate d Jul y 10 , 2024 Rul e 424(b)(3) PER F ORMANCE UP D A TE The MerQube US Large - Cap Vol Advantage Index attempts to provide a dynamic rules - based exposure to an unfunded rolling position in E - Mini S&P 500 ® futures (the “Futures Contracts”), which reference the S&P 500 ® Index, while targeting a level volatility of 35 % , with a maximum exposure to the Futures Contracts of 500 % and a minimum exposure to the Futures Contracts of 0 % . The Index is subject to a 6.0% per annum daily deduction. The Index was established on February 11, 2022. Levels are published on Bloomberg using the ticker MQUSLVA. Hypothetical and actual historical performance: Jun 2014 through Jun 2024 Please see the footnotes at the bottom of this page and “Backtesting” on the following page for information on backtested performance and proxies. Hypothetical and actual historical returns and volatilities: Jun 2014 through Jun 2024 MerQube US Large - Cap Vol Advantage Index S&P 500 Index Backtested 50 Jun - 14 Jun - 16 Jun - 18 1 0 0 1 5 0 2 0 0 2 5 0 3 0 0 Ju n - 2 0 Ju n - 2 2 Ju n - 24 Actual 10 Y ear V olatili t y (Annualized) 10 Y ear R eturn (Annualized) 5 Y ear R eturn (Annualized) 3 Y ear R eturn (Annualized) 1 Y ear R eturn 29.89% 10.69% 14.14% 6.86% 39.80% MerQube US Large - Cap Vol Advantage Index 17.80% 10.79% 13.17% 8.31% 22.70% S&P 500 Ind e x Historical exposure at end - of - day: Apr 2024 through Jun 2024 Hypothetical and actual historical monthly and annual returns: Jan 2015 through Jun 2024 Year Dec Nov Oct Sep Aug Jul Jun May Apr Mar Feb Jan - 24.07% - 6.60% - 3.38% 17.28% - 4.40% - 17.29% - 0.09% - 4.65% 3.29% - 0.41% - 8.39% 10.90% - 8.86% 2015 8.14% 3.35% 5.37% - 6.30% - 4.01% - 0.64% 10.44% - 2.68% 4.22% - 0.53% 13.77% - 1.49% - 11.03% 2016 73.07% 2.31% 12.43% 9.87% 6.02% - 1.03% 7.49% 1.42% 4.00% - 0.25% - 2.43% 14.83% 3.01% 2017 - 18.54% - 14.51% 0.42% - 15.25% 0.99% 8.66% 9.31% 0.66% 4.38% - 1.20% - 12.41% - 15.93% 22.09% 2018 59.16% 7.23% 12.28% 5.26% 2.30% - 6.78% 0.84% 14.02% - 15.83% 11.77% 0.32% 6.76% 13.69% 2019 8.44% 6.16% 10.42% - 6.30% - 6.15% 13.10% 7.27% - 0.46% 4.51% 9.72% - 6.92% - 19.13% 0.92% 2020 42.86% 4.30% - 1.83% 17.25% - 12.19% 6.76% 5.66% 3.71% 0.66% 11.97% 6.10% 1.18% - 4.27% 2021 - 40.09% - 11.77% 7.38% 8.73% - 12.75% - 8.48% 13.14% - 12.93% - 0.98% - 14.75% 4.68% - 4.54% - 12.36% 2022 30.15% 11.26% 18.61% - 5.38% - 14.22% - 7.89% 7.68% 13.69% - 0.08% 2.25% 2.08% - 5.83% 9.72% 2023 31.60% 7.81% 11.20% - 10.73% 6.58% 12.36% 2.69% 2024 JU L Y 2024 MerQube US Large - Cap Vol Advantage Index Historical performance measures for the Index represent hypothetical backtested performance through February 10, 2022 (labeled “Backtested” in the chart above); and actual performance from February 11, 2022 through June 28, 2024 (labeled “Actual” in the chart above). The hypothetical backtested and historical levels presented herein have not been verified by J.P. Morgan, and hypothetical historical levels have inherent limitations. PAST PERFORMANCE AND BACKTESTED PERFORMANCE ARE NOT INDICATIVE OF FUTURE RESULTS. Please see the Disclaimer on the following page. Investing in the notes linked to the Index involves a number of risks. See “Selected Risks” on page 2 of this document, “Risk Factors” in the relevant product supplement and underlying supplement and “Selected Risk Considerations” in the relevant pricing supplement. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the notes or passed upon the accuracy or the adequacy of this document or the accompanying product supplement, underlying supplement, prospectus supplement or prospectus. Any representation to the contrary is a criminal offense. The notes are not bank deposits, are not insured by the Federal Deposit Insurance Corporation or any other governmental agency and are not obligations of, or guaranteed by, a bank. June 2024 Exposure Period 280.71% 06/03 - 06/06 270.87% 06/07 - 06/13 277.46% 06/14 - 06/20 324.61% 06/21 - 06/27 323.37% 06/28 M a y 2024 Exposure Period 230.19% 05/01 — 05/02 289.90% 05/03 — 05/09 288.63% 05/10 — 05/16 351.73% 05/17 — 05/23 360.85% 05/24 — 05/30 280.71% 05/31 April 2024 Exposure Period 312.69% 04/01 — 04/04 213.22% 04/05 — 04/11 176.85% 04/12 — 04/18 190.92% 04/19 — 04/25 230.19% 04/26 — 04/30

JU L Y 2024 | MerQube US La r ge - C ap V ol A d va n tage Ind e x S electe d Risks Our affiliate, J.P. Morgan Securities LLC (“JPMS”), coordinated with the Index Sponsor in the development of the Index. The level of the Index will include a 6.0% per annum daily deduction. MerQube (the “Index Sponsor”) may adjust the Index in a way that affects its level, and the Index Sponsor has no obligation to consider your interests. The Index may not approximate its target volatility. The Index is subject to risks associated with the use of significant leverage. Th e Ind e x m a y b e significa n tl y uni n v ested. The Index may be adversely affected if later futures contracts have higher prices than an expiring futures contract included in the Index. The Index is an “excess return” index and not a “total return” index because it does not reflect interest that could be earned on funds notionally committed to the trading of futures contracts. The Index, which was established on February 11, 2022, has a limited operating history and may perform in unanticipated ways. The Index is subject to significant risks associated with futures contracts, including volatility. An investment linked to the Index will be subject to risks associated with non - U.S. securities. Concentration risks associated with the Index may adversely affect the value of investments linked to the Index. Suspension or disruptions of market trading in the futures contracts included in the Index may adversely affect the value of investments linked to the Index. The official settlement price and intraday trading prices of the relevant futures contracts included in the Index may not be readily available. Changes in the margin requirements for the underlying futures contracts included in the Index may adversely affect the value of investments linked to the Index. The Index may not be successful or outperform any alternative strategy that may be employed of the Constituent. The risks identified above are not exhaustive. You should also review carefully the related “Risk Factors” section in the prospectus supplement and the relevant product supplement and underlying supplement and the “Selected Risk Considerations” in the relevant pricing supplement. Disclaimer The information contained in this document is for discussion purposes only . Any information relating to performance contained in these materials is illustrative and no assurance is given that any indicative returns, performance or results, whether historical or hypothetical, will be achieved . These terms are subject to change, and J . P . Morgan undertakes no duty to update this information . This document shall be amended, superseded and replaced in its entirety by a subsequent preliminary pricing supplement and/or pricing supplement, and the documents referred to therein . In the event any inconsistency between the information presented herein and any such preliminary pricing supplement and/or pricing supplement, such preliminary pricing supplement and/or pricing supplement shall govern . Backtesting : Hypothetical backtested performance measures have inherent limitations . Alternative modelling techniques might produce significantly different results and may prove to be more appropriate . Past performance, and especially hypothetical back - tested performance, is not indicative of future results . This type of information has inherent limitations and you should carefully consider these limitations before placing reliance on such information . Use of h ypothetic al ba ck tested r eturns Any backtested historical performance and weighting information included herein is hypothetical . The constituent may not have traded in the manner shown in the hypothetical backtest of the Index included herein, and no representation is being made that the Index will achieve similar performance . The hypothetical historical levels presented herein have not been verified by an independent third party, and such hypothetical historical levels have inherent limitations . There are frequently significant differences between hypothetical backtested performance and actual subsequent performance . The results obtained from backtesting information should not be considered indicative of the actual results that might be obtained from an investment in notes referencing the Index . J . P . Morgan provides no assurance or guarantee that notes linked to the Index will operate or would have operated in the past in a manner consistent with these materials . The hypothetical historical levels presented herein have not been verified by an independent third party, and such hypothetical historical levels have inherent limitations . Alternative simulations, techniques, modeling or assumptions might produce significantly different results and prove to be more appropriate . Actual results will vary, perhaps materially, from the hypothetical backtested returns and allocations presented in this document . HISTORICAL AND BACKTESTED PERFORMANCE AND ALLOCATIONS ARE NOT INDICATIVE OF FUTURE RESULTS . Hypothetical back - tested performance measures have inherent limitations . Hypothetical back - tested performance is derived by means of the retroactive application of a back - tested model that has been designed with the benefit of hindsight . Hypothetical back - tested results are neither an indicator nor a guarantee of future returns . Alternative modelling techniques might produce significantly different results and may prove to be more appropriate . A copy of the index methodology is available upon request or can be viewed on MerQube’s website . MerQube performed the calculation of the hypothetical back - tested performance data . Neither J . P . Morgan Securities LLC (JPMS), nor any of its affiliates paid MerQube to perform these calculations . JPMS has entered into a license agreement with MerQube, Inc . that provides for an exclusive license to it and certain of its affiliated or subsidiary companies, in exchange for a fee, of the right to use the Indices, which are owned and published by MerQube, Inc . JPMS worked with MerQube in developing the guidelines and policies governing the composition and calculation of the Index . The policies and judgments for which JPMS was responsible could have an impact, positive or negative, on the level of the Index and the value of your notes . JPMS is under no obligation to consider your interests as an investor in the notes in its role in developing the guidelines and policies governing the Index or making judgments that may affect the level of the Index . The 10 Year Volatility (Annualized) on the previous page is a measure of market risk, calculated as of the square root of two hundred and fifty - two ( 252 ) multiplied by the sample standard deviation of the daily logarithmic returns of each applicable index or portfolio (considering only days for which levels are available for all three) over the preceding 10 years . Investment suitability must be determined individually for each investor, and notes linked to the Index may not be suitable for all investors . This material is not a product of J . P . Morgan Research Departments . Neither MerQube, Inc . nor any of its affiliates (collectively, “MerQube”) is the issuer or producer of any investment linked to the Index referenced herein and MerQube has no duties, responsibilities, or obligations to investors in such investment . The Index is a product of MerQube and has been licensed for use by JPMS (“Licensee”) and its affiliates . Such index is calculated using, among other things, market data or other information (“Input Data”) from one or more sources (each a “Data Provider”) . MerQube® is a registered trademark of MerQube, Inc . These trademarks have been licensed for certain purposes by Licensee, including use by Licensee’s affiliate in its capacity as the issuer of investments linked to the Index . Such investments are not sponsored, endorsed, sold or promoted by MerQube, any Data Provider, or any other third party, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the Input Data, Index or any associated data . Copyright © 2024 JPMorgan Chase & Co . All rights reserved . For additional regulatory disclosures, please consult : www . jpmorgan . com/disclosures . Information contained on this website is not incorporated by reference in, and should not be considered part of, this document . This monthly update document replaces and supersedes all prior written materials of this type previously provided with respect to the Index .

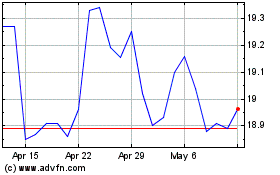

JP Morgan Chase (NYSE:JPM-M)

Historical Stock Chart

From Oct 2024 to Nov 2024

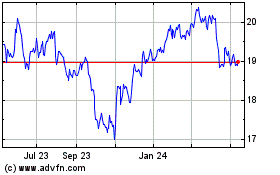

JP Morgan Chase (NYSE:JPM-M)

Historical Stock Chart

From Nov 2023 to Nov 2024