Announces Portfolio Actions to Reshape Company

and Maximize Value Creation

Wiley (NYSE: WLY) today reported results for

the fourth quarter and fiscal year ended April 30, 2023. The

Company is announcing strategic actions that will focus Wiley on

its leading global position in the development and application of

new knowledge and drive greater profitability, growth, and value

creation.

STRATEGIC FOCUS

- Go Forward: Focusing Wiley on its strongest and most

profitable businesses and large market opportunities in Research

and Learning.

- Portfolio Actions: Divesting non-core education

businesses, including University Services (known as online program

management), Wiley Edge (formerly Talent Development) and

CrossKnowledge. These assets will be reported as “businesses held

for sale” starting in Q1 2024. In Q4 2023, Wiley divested its test

prep and Advancement Courses lines in Academic.

- Fiscal 2024 Transition Year: Streamlining organization

and rightsizing cost structure to reflect these portfolio actions.

The benefits of these actions will be realized in Fiscal 2025 and

Fiscal 2026.

FOURTH QUARTER SUMMARY (results vs. prior year)

- GAAP Results: Revenue of $526 million (-4%), Operating

income of $82 million (+41%), and EPS of $1.22 (+$0.46).

- Adjusted Results at Constant Currency: Revenue of $526

million (-2%), Adjusted EBITDA of $137 million (+23%), and Adjusted

EPS of $1.45 (+32%).

FULL YEAR SUMMARY (results vs. prior year)

- GAAP Results: Revenue of $2,020 million (-3%), Operating

income of $56 million (-$163 million), and EPS of $0.31 (-$2.31).

GAAP earnings performance primarily due to $100 million

($1.77/share) of non-cash goodwill impairment in Education

Services/University Services and restructuring charges totalling

$49 million ($0.66/share).

- Adjusted Results at constant currency: Revenue of $2,020

million (0%), Adjusted EBITDA of $422 million (-2%), and Adjusted

EPS of $3.84 (-8%).

- Cash from Operations of $277 million (-$62 million) and

Free Cash Flow of $173 million (-$50 million) mainly due to

higher restructuring payments and interest payments.

MANAGEMENT COMMENTARY

“Today we are announcing strategic actions that will make Wiley

simpler, stronger, and more profitable by focusing on our

long-standing position as a global leader in research, publishing

and digital solutions that accelerate the creation and application

of new knowledge,” said Brian Napack, President and CEO. “Our goal,

as always, is to maximize value creation for our shareholders and

deliver impact for all our stakeholders. The actions that we are

now taking will allow us to materially improve our performance and

margins in Fiscal 2025 and 2026 and position us for sustained,

profitable growth in the years ahead. We look forward to discussing

this at our investor day later this year."

FINANCIAL PERFORMANCE

See accompanying financial tables for the Fourth Quarter and

Fiscal Year 2023.

Research

- Fourth Quarter Revenue of $280 million was down 6%, or

5% at constant currency mainly due to the Hindawi publishing

disruption and macroeconomic headwinds impacting our corporate

offerings. As discussed in the third quarter, Hindawi’s special

issues program was suspended due to the presence in certain special

issues of compromised articles. To date, Wiley has closed four

Hindawi journals and retracted over 1,700 articles. Full Year

Revenue of $1,080 million was down 3% as reported, or flat at

constant currency.

- Fourth Quarter Adjusted EBITDA of $106 million was up 4%

at constant currency on cost savings initiatives and lower employee

costs. Full Year Adjusted EBITDA of $377 million was down 2%

at constant currency mainly driven by investments to scale

publishing and solutions partially offset by lower royalty costs

largely due to the product mix. Full Year Adjusted EBITDA margin of

34.9% was in line with prior year.

Academic

- Fourth Quarter Revenue of $183 million was down 3%, or

2% at constant currency due to modest declines in both Academic

Publishing and University Services. Full Year Revenue of

$690 million was down 9% as reported, or down 7% at constant

currency, with print declines in publishing partially offsetting

growth in digital courseware and continued enrollment challenges

and lower tuition share in services.

- Fourth Quarter Adjusted EBITDA of $55 million was up 30%

at constant currency on restructuring savings. Full Year

Adjusted EBITDA of $148 million was down 13% at constant

currency driven primarily by revenue performance and higher

distribution and technology costs. Full Year Adjusted EBITDA margin

of 21.4% compared to 22.8% in the prior year.

Talent

- Fourth Quarter Revenue of $63 million was up 8%, or 12%

at constant currency due to growth in placements and assessments.

Full Year Revenue of $249 million was up 17% as reported, or

24% at constant currency with double-digit growth in placements and

assessments (corporate training) driving performance.

- Fourth Quarter Adjusted EBITDA of $13 million was up 10%

at constant currency mainly due to revenue performance and

restructuring savings. Full Year Adjusted EBITDA of $52

million was up 18% at constant currency driven primarily by revenue

performance partially offset by increased inflationary impacts on

placements and investments to scale talent development. Full Year

Adjusted EBITDA margin of 21.1% vs. 21.6% in prior year.

Adjusted Corporate Expenses (Adjusted EBITDA)

- Fourth Quarter Adjusted Corporate Expenses of $37

million declined 15% at constant currency due to lower employee

costs. Full Year Adjusted Corporate Expenses of $155 million

declined 8% at constant currency primarily due to lower employee

related costs, including lower annual incentive compensation for

fiscal year 2023.

EPS

- Fourth Quarter GAAP EPS of $1.22 compared to $0.76 in

the prior year period mainly due to the earnings improvement and a

gain from the sale of test prep and advancement courses. Full

Year GAAP EPS was $0.31 compared to $2.62 in the prior year,

primarily due to non-cash impairment and restructuring charges

totalling $2.43 per share. In the third quarter, Wiley recorded a

non-cash goodwill impairment charge of $100 million, or $1.77 per

share, for its Education Services and University Services

businesses. For the full year, Wiley recorded restructuring charges

totalling $49 million, or $0.66 per share, related to targeted

headcount reductions and real estate consolidation.

- Fourth Quarter Adjusted EPS of $1.45 was up 32% at

constant currency primarily due to higher Adjusted Operating Income

mainly from restructuring savings. Full Year Adjusted EPS of

$3.84 was down 8% at constant currency primarily due to lower

Adjusted Operating Income and higher interest expense.

Balance Sheet, Cash Flow, and Capital Allocation

- Net Debt-to-EBITDA Ratio (Trailing Twelve Months) at

year end was 1.5x compared to 1.6x at prior year end.

- Net Cash Provided by Operating Activities (Full Year)

was $277 million compared to $339 million in the prior year period.

This is primarily due to higher restructuring payments (+$21

million), higher interest expense (+$18 million), and lower cash

earnings. Free Cash Flow less Product Development Spending

(Full Year) was $173 million compared to $223 million in the prior

year period, primarily due to higher restructuring payments, higher

interest payments, and lower cash earnings, offsetting lower

capex.

- Returns to Shareholders: The Company raised its dividend

for the 29th consecutive year in Fiscal 2023. For the year, Wiley

utilized $77 million for dividends and $35 million to repurchase

832,000 shares at an average cost per share of $42.07. This

compares to 544,000 shares repurchased in the prior year. There

were no material acquisitions in Fiscal 2023.

FISCAL YEAR 2024 TRANSITION YEAR OUTLOOK

Wiley’s Fiscal 2024 outlook excludes businesses held for sale:

University Services, Wiley Edge (Talent Development), and

CrossKnowledge, as well as those businesses sold in Fiscal 2023

(test prep and advancement courses). These assets will be reported

as businesses ‘held for sale” starting in Q1 2024. Collectively,

these businesses generated $393 million of revenue (19% of Wiley)

and $43 million of Adjusted EBITDA (10% of Wiley) in Fiscal

2023.

Wiley’s go-forward reporting structure will consist of two

segments: (1) Research and (2) Learning. Research is

unchanged with reporting lines of Research Publishing and Research

Solutions. Learning will include reporting lines of Academic

(education publishing) and Professional (professional publishing

and assessments). Wiley will begin to report on this structure in

the first quarter and provide two years of pro forma results for

comparability.

Metric ($millions, except EPS)

Fiscal 2023 All

Company

Fiscal 2023

Ex-Divestitures

Fiscal 2024 Outlook

Ex-Divestitures

Adjusted Revenue*

$2,020

$1,627

$1,580 to $1,630

Research

$1,080

Flat (+3% ex-Hindawi)

Learning

$547

Down low single digits

Adjusted EBITDA*

$422

$379

$305 to $330

Adjusted EPS*

$3.84

$3.48

$2.05 to $2.40

*Wiley’s Fiscal 2024 outlook (“Adjusted Revenue,” “Adjusted

EBITDA,” and “Adjusted EPS”) exclude businesses held for sale,

including University Services, Wiley Edge (formerly Talent

Development), and CrossKnowledge, as well as those sold in Fiscal

2023: Test Prep and Advancement Courses.

Fiscal Year 2024 Transition Year Outlook

- Adjusted Revenue – primarily due to the Hindawi special

issues publishing pause and continued softness in consumer and

corporate spending. Note, this is a new metric defined as revenue

adjusted to exclude businesses held for sale.

- Adjusted EBITDA – primarily due to projected revenue

performance, notably Hindawi, and higher employee costs from the

combination of an incentive compensation reset and wage inflation.

From its portfolio and restructuring actions, the Company expects

material performance and margin improvement in Fiscal 2025 and

Fiscal 2026.

- Adjusted EPS – further impacted by $0.42 of

non-operational items including a higher tax rate (-$0.21/share),

pension expense (-$0.11/share), and interest expense

(-$0.10/share). Wiley’s higher tax rate is primarily due to a less

favorable mix of earnings by country and an increase in the UK

statutory rate. Wiley froze its U.S. and U.K. pension programs in

2015, and they are approximately 90% funded.

Wiley is not providing a Free Cash Flow outlook due to the

uncertainty around both the timing of divestitures and the size and

scope of restructuring payments.

EARNINGS CONFERENCE CALL

Scheduled for today, June 15 at 10:00 am (ET). Access webcast at

Investor Relations at investors.wiley.com, or directly at

https://events.q4inc.com/attendee/368565267. U.S. callers, please

dial (888) 210-3346 and enter the participant code 2521217#.

International callers, please dial (646) 960-0253 and enter the

participant code 2521217#.

ABOUT WILEY

Wiley is one of the world’s largest publishers and a global

leader in scientific research and career-connected education.

Founded in 1807, Wiley enables discovery, powers education, and

shapes workforces. Through its industry-leading content, digital

platforms, and knowledge networks, the company delivers on its

timeless mission to unlock human potential. Visit us at Wiley.com.

Follow us on Facebook, Twitter, LinkedIn and Instagram.

NON-GAAP FINANCIAL MEASURES

Wiley provides non-GAAP financial measures and performance

results such as “Adjusted EPS,” “Adjusted Operating Income,”

“Adjusted EBITDA,” “Adjusted CTP,” “Adjusted Income before Taxes,”

“Adjusted Income Tax Provision,” “Adjusted Effective Income Tax

Rate,” “Free Cash Flow less Product Development Spending,” “organic

revenue,” “Adjusted Revenue,” and results on a Constant Currency

basis to assess underlying business performance and trends.

Management believes non-GAAP financial measures, which exclude the

impact of restructuring charges and credits and certain other

items, and the impact of acquisitions provide a useful comparable

basis to analyze operating results and earnings. See the

reconciliations of non-GAAP financial measures and explanations of

the uses of non-GAAP measures in the supplementary information. We

have not provided our 2024 outlook for the most directly comparable

U.S. GAAP financial measures, as they are not available without

unreasonable effort due to the high variability, complexity, and

low visibility with respect to certain items, including

restructuring charges and credits, gains and losses on foreign

currency, and other gains and losses. These items are uncertain,

depend on various factors, and could be material to our

consolidated results computed in accordance with U.S. GAAP.

FORWARD-LOOKING STATEMENTS

This release contains certain forward-looking statements

concerning the Company's operations, performance, and financial

condition. Reliance should not be placed on forward-looking

statements, as actual results may differ materially from those in

any forward-looking statements. Any such forward-looking statements

are based upon a number of assumptions and estimates that are

inherently subject to uncertainties and contingencies, many of

which are beyond the control of the Company and are subject to

change based on many important factors. Such factors include, but

are not limited to: (i) the level of investment in new technologies

and products; (ii) subscriber renewal rates for the Company's

journals; (iii) the financial stability and liquidity of journal

subscription agents; (iv) the consolidation of book wholesalers and

retail accounts; (v) the market position and financial stability of

key online retailers; (vi) the seasonal nature of the Company's

educational business and the impact of the used book market; (vii)

worldwide economic and political conditions; (viii) the Company's

ability to protect its copyrights and other intellectual property

worldwide (ix) the ability of the Company to successfully integrate

acquired operations and realize expected opportunities; (x) the

ability to realize operating savings over time and in fiscal year

2024 in connection with our multiyear Business Optimization Program

and our Fiscal Year 2023 Restructuring Program; and (xi) other

factors detailed from time to time in the Company's filings with

the Securities and Exchange Commission. The Company undertakes no

obligation to update or revise any such forward-looking statements

to reflect subsequent events or circumstances.

CATEGORY: EARNINGS RELEASES

SUPPLEMENTARY INFORMATION (1)(2) CONDENSED CONSOLIDATED

STATEMENTS OF NET INCOME (Dollars in thousands, except per

share information) (unaudited) Three Months

Ended Year Ended April 30, April 30,

2023

2022

2023

2022

Revenue, net

$

526,127

$

545,653

$

2,019,900

$

2,082,928

Costs and expenses: Cost of sales

174,157

187,004

692,541

700,658

Operating and administrative expenses

245,821

279,331

1,037,399

1,079,585

Impairment of goodwill (3)

-

-

99,800

-

Restructuring and related charges (credits)

4,185

(266

)

49,389

(1,427

)

Amortization of intangible assets

19,492

21,153

84,881

84,836

Total costs and expenses

443,655

487,222

1,964,010

1,863,652

Operating income

82,472

58,431

55,890

219,276

As a % of revenue

15.7

%

10.7

%

2.8

%

10.5

%

Interest expense

(10,560

)

(5,063

)

(37,745

)

(19,802

)

Foreign exchange transaction gains (losses)

611

(1,704

)

894

(3,192

)

Gain on sale of businesses and certain assets

10,177

-

10,177

3,694

Other income, net

2,908

161

3,884

9,685

Income before taxes

85,608

51,825

33,100

209,661

Provision for income taxes

17,264

8,679

15,867

61,352

Effective tax rate

20.2

%

16.7

%

47.9

%

29.3

%

Net income

$

68,344

$

43,146

$

17,233

$

148,309

As a % of revenue

13.0

%

7.9

%

0.9

%

7.1

%

Earnings per share Basic

$

1.23

$

0.78

$

0.31

$

2.66

Diluted

$

1.22

$

0.76

$

0.31

$

2.62

Weighted average number of common shares outstanding

Basic

55,355

55,668

55,558

55,759

Diluted

56,137

56,529

56,355

56,598

Notes: (1) The supplementary information

included in this press release for the three months and year ended

April 30, 2023 is preliminary and subject to change prior to the

filing of our upcoming Annual Report on Form 10-K with the

Securities and Exchange Commission. (2) All amounts are

approximate due to rounding. (3) As previously announced, in

the third quarter of fiscal year 2023 we reorganized our Education

lines of business into two new customer-centric segments. Our new

segment reporting structure consists of three reportable segments

which includes Research (no changes), Academic, and Talent, as well

as a Corporate expense category (no change). As a result of this

realignment, we were required to test goodwill for impairment

immediately before and after the realignment. Prior to the

realignment, we concluded that the fair value of the Education

Services reporting unit was below its carrying value, which

resulted in a pre-tax non-cash goodwill impairment of $31.0

million. After the realignment, we concluded that the fair value of

the University Services reporting unit within the Academic segment

was below its carrying value which resulted in an additional

pre-tax non-cash goodwill impairment of $68.8 million.

JOHN

WILEY & SONS, INC. SUPPLEMENTARY INFORMATION (1) (2)

RECONCILIATION OF US GAAP MEASURES to NON-GAAP MEASURES

(unaudited) Reconciliation of US GAAP EPS to

Non-GAAP Adjusted EPS Three Months Ended Year

Ended April 30, April 30,

2023

2022

2023

2022

US GAAP Earnings Per Share - Diluted

$

1.22

$

0.76

$

0.31

$

2.62

Adjustments: Impairment of goodwill

0.09

-

1.77

-

Legal settlement (3)

-

-

0.05

-

Pension income related to the wind up of the Russia plan (4)

(0.02

)

-

(0.02

)

-

Restructuring and related charges (credits)

0.06

-

0.66

(0.02

)

Foreign exchange (gains) losses on intercompany transactions,

including the write off of certaincumulative translation

adjustments (4)

(0.01

)

0.02

0.01

0.02

Amortization of acquired intangible assets (5)

0.26

0.29

1.21

1.21

Gain on sale of businesses and certain assets (6)

(0.11

)

-

(0.11

)

(0.05

)

Income tax adjustments (8)

(0.04

)

0.01

(0.04

)

0.38

Non-GAAP Adjusted Earnings Per Share - Diluted

$

1.45

$

1.08

$

3.84

$

4.16

Reconciliation of US GAAP Income Before Taxes to Non-GAAP

Adjusted Income Before Taxes Three Months Ended Year

Ended (amounts in thousands)

April 30, April 30,

2023

2022

2023

2022

US GAAP Income Before Taxes

$

85,608

$

51,825

$

33,100

$

209,661

Pretax Impact of Adjustments: Impairment of goodwill

-

-

99,800

-

Legal settlement (3)

-

-

3,671

-

Pension income related to the wind up of the Russia plan (4)

(1,750

)

-

(1,750

)

-

Restructuring and related charges (credits)

4,185

(266

)

49,389

(1,427

)

Foreign exchange (gains) losses on intercompany transactions,

including the write off of certaincumulative translation

adjustments (4)

(449

)

1,019

457

1,513

Amortization of acquired intangible assets (5)

20,566

22,265

89,177

89,346

Gain on sale of businesses and certain assets (6)

(10,177

)

-

(10,177

)

(3,694

)

Non-GAAP Adjusted Income Before Taxes

$

97,983

$

74,843

$

263,667

$

295,399

Reconciliation of US GAAP Income Tax Provision to

Non-GAAP Adjusted Income Tax Provision, including our US GAAP

Effective Tax Rate and our Non-GAAP Adjusted Effective Tax Rate

US GAAP Income Tax Provision

$

17,264

$

8,679

$

15,867

$

61,352

Income Tax Impact of Adjustments (7) Impairment of goodwill

(4,857

)

-

-

-

Legal settlement (3)

-

-

716

-

Pension income related to the wind up of the Russia plan (4)

(437

)

-

(437

)

-

Restructuring and related charges (credits)

992

(142

)

12,151

(260

)

Foreign exchange (gains) losses on intercompany transactions,

including the write off of certaincumulative translation

adjustments (4)

(142

)

41

132

597

Amortization of acquired intangible assets (5)

5,372

6,017

20,183

20,816

Gain on sale of businesses and certain assets (6)

(3,860

)

-

(3,860

)

(922

)

Income Tax Adjustments: Impact of increase in UK statutory rate on

deferred tax balances (8)

2,370

(689

)

2,370

(21,415

)

Non-GAAP Adjusted Income Tax Provision

$

16,702

$

13,906

$

47,122

$

60,168

US GAAP Effective Tax Rate

20.2

%

16.7

%

47.9

%

29.3

%

Non-GAAP Adjusted Effective Tax Rate

17.0

%

18.6

%

17.9

%

20.4

%

Notes: (1) See Explanation of Usage of Non-GAAP

Performance Measures included in this supplementary information for

additional details on the reasons why management believes

presentation of each non-GAAP performance measure provides useful

information to investors. The supplementary information included in

this press release for the three months and year ended April 30,

2023 is preliminary and subject to change prior to the filing of

our upcoming Annual Report on Form 10-K with the Securities and

Exchange Commission. (2) All amounts are approximate due to

rounding. (3) We settled a litigation matter related to

consideration for a previous acquisition for $3.7 million during

the three months ended January 31, 2023. This amount is reflected

in Operating and administrative expenses on our Condensed

Consolidated Statements of Income. (4) In the three months

and year ended April 30, 2023, due to the closure of our operations

in Russia, there was a curtailment and settlement credit due to the

wind up of the Russia Pension Plan of $1.8 million which is

reflected in Other income, net on our Condensed Consolidated

Statements of Income. In addition, we wrote off the $1.1 million

cumulative translation adjustment in earnings because the Russia

entity was deemed substantially liquidated. This amount is

reflected in Foreign exchange gains (losses) on our Condensed

Consolidated Statements of Income. (5) Reflects the

amortization of intangible assets established on the opening

balance sheet for an acquired business. This includes the

amortization of intangible assets such as developed technology,

customer relationships, tradenames, etc., which is reflected in the

"Amortization of intangible assets" line in the Condensed

Consolidated Statements of Income. It also includes the

amortization of acquired product development assets, which is

reflected in Cost of sales in the Condensed Consolidated Statements

of Income. (6) In the three months and year ended April 30,

2023, the gain on sale of businesses is due to the sale of Wiley's

Efficient Learning test prep portfolio business and our advancement

courses business, which were both included in our Academic segment,

and resulted in a pretax gain of approximately $10.2 million (net

of tax gain of $6.3 million). For the year ended April 30, 2022,

the gain on sale of certain assets is due to the sale of our world

languages product portfolio, which was included in our Academic

segment, and resulted in a pretax gain of approximately $3.7

million (net of tax gain of $2.8 million). (7) For the three

months ended April 30, 2023, the tax impact was $4.3 million of

current tax benefit and $3.7 million of deferred taxes. For the

year ended April 30, 2023, substantially all of the tax impact was

from deferred taxes. For the three months and year ended April 30,

2022, substantially all of the tax impact was from deferred taxes.

(8) In the three months ended July 31, 2021, the UK enacted

legislation that increased its statutory rate from 19% to 25%

effective April 1, 2023. This resulted in a $21.4 million non-cash

deferred tax expense from the re-measurement of the Company’s

applicable UK net deferred tax liabilities during the three months

ended July 31, 2021. These adjustments impacted deferred taxes. For

the three months and year ended April 30, 2023, we recorded a $2.4

million non-cash deferred tax benefit related to pensions due to

the UK statutory rate change. These adjustments impacted deferred

taxes.

JOHN WILEY & SONS, INC. SUPPLEMENTARY

INFORMATION (1) RECONCILIATION OF US GAAP NET INCOME TO

NON-GAAP EBITDA AND ADJUSTED EBITDA (unaudited)

Three Months Ended Year Ended April 30,

April 30,

2023

2022

2023

2022

Net Income

$

68,344

$

43,146

$

17,233

$

148,309

Interest expense

10,560

5,063

37,745

19,802

Provision for income taxes

17,264

8,679

15,867

61,352

Depreciation and amortization

50,111

52,686

213,253

215,170

Non-GAAP EBITDA

146,279

109,574

284,098

444,633

Impairment of goodwill

-

-

99,800

-

Legal settlement

-

-

3,671

-

Restructuring and related charges (credits)

4,185

(266

)

49,389

(1,427

)

Foreign exchange (gains) losses on intercompany transactions,

including thewrite off of certain cumulative translation

adjustments

(611

)

1,704

(894

)

3,192

Gain on sale of businesses and certain assets

(10,177

)

-

(10,177

)

(3,694

)

Other income, net

(2,908

)

(161

)

(3,884

)

(9,685

)

Non-GAAP Adjusted EBITDA

$

136,768

$

110,851

$

422,003

$

433,019

Adjusted EBITDA Margin

26.0

%

20.3

%

20.9

%

20.8

%

Notes: (1) See Explanation of Usage of Non-GAAP

Performance Measures included in this supplementary information for

additional details on the reasons why management believes

presentation of each non-GAAP performance measure provides useful

information to investors. The supplementary information included in

this press release for the three months and year ended April 30,

2023 is preliminary and subject to change prior to the filing of

our upcoming Annual Report on Form 10-K with the Securities and

Exchange Commission.

JOHN WILEY & SONS, INC.

SUPPLEMENTARY INFORMATION (1) (2) (3) SEGMENT RESULTS

(in thousands) (unaudited)

% Change

Three Months Ended April

30,

Favorable

(Unfavorable)

2023

2022 (3)

Reported

Constant Currency

Research: Revenue, net Research Publishing (4)

$

240,889

$

257,025

-6

%

-5

%

Research Solutions (4)

39,550

41,067

-4

%

-2

%

Total Revenue, net

$

280,439

$

298,092

-6

%

-5

%

Contribution to Profit

$

82,640

$

76,985

7

%

6

%

Adjustments: Restructuring charges

605

-

#

#

Non-GAAP Adjusted Contribution to Profit

$

83,245

$

76,985

8

%

7

%

Depreciation and amortization

22,700

23,759

4

%

3

%

Non-GAAP Adjusted EBITDA

$

105,945

$

100,744

5

%

4

%

Adjusted EBITDA margin

37.8

%

33.8

%

Academic: Revenue, net Academic Publishing

$

127,024

$

130,965

-3

%

-1

%

University Services

55,764

58,405

-5

%

-4

%

Total Revenue, net

$

182,788

$

189,370

-3

%

-2

%

Contribution to Profit

$

36,512

$

22,542

62

%

63

%

Adjustments: Restructuring charges (credits)

275

(123

)

#

#

Impairment of goodwill

-

-

#

#

Non-GAAP Adjusted Contribution to Profit

$

36,787

$

22,419

64

%

65

%

Depreciation and amortization

18,194

20,099

9

%

9

%

Non-GAAP Adjusted EBITDA

$

54,981

$

42,518

29

%

30

%

Adjusted EBITDA margin

30.1

%

22.5

%

Talent: Total Revenue, net

$

62,900

$

58,191

8

%

12

%

Contribution to Profit

$

7,516

$

7,566

-1

%

2

%

Adjustments: Restructuring charges (credits)

609

(222

)

#

#

Non-GAAP Adjusted Contribution to Profit

$

8,125

$

7,344

11

%

14

%

Depreciation and amortization

4,760

4,693

-1

%

-3

%

Non-GAAP Adjusted EBITDA

$

12,885

$

12,037

7

%

10

%

Adjusted EBITDA margin

20.5

%

20.7

%

Corporate Expenses:

$

(44,196

)

$

(48,662

)

9

%

7

%

Adjustments: Restructuring charges

2,696

79

#

#

Non-GAAP Adjusted Contribution to Profit

$

(41,500

)

$

(48,583

)

15

%

13

%

Depreciation and amortization

4,457

4,135

-8

%

-9

%

Non-GAAP Adjusted EBITDA

$

(37,043

)

$

(44,448

)

17

%

15

%

Consolidated Results: Revenue, net

$

526,127

$

545,653

-4

%

-2

%

Operating Income

$

82,472

$

58,431

41

%

39

%

Adjustments: Restructuring charges (credits)

4,185

(266

)

#

#

Non-GAAP Adjusted Operating Income

$

86,657

$

58,165

49

%

47

%

Depreciation and amortization

50,111

52,686

5

%

4

%

Non-GAAP Adjusted EBITDA

$

136,768

$

110,851

23

%

23

%

Adjusted EBITDA margin

26.0

%

20.3

%

Notes: (1) The supplementary information included in

this press release for the three months and year ended April 30,

2023 is preliminary and subject to change prior to the filing of

our upcoming Annual Report on Form 10-K with the Securities and

Exchange Commission. (2) All amounts are approximate due to

rounding. (3) In the three months ended January 31, 2023, we

reorganized our Education lines of business into two new

customer-centric segments. The Academic segment addresses the

university customer group and includes Academic Publishing and

University Services. The Talent segment addresses the corporate

customer group and will be focused on delivering training,

sourcing, and upskilling solutions. Our new segment reporting

structure consists of three reportable segments which includes

Research (no changes), Academic, and Talent, as well as a Corporate

expense category (no change), which includes certain costs that are

not allocated to the reportable segments. Prior period segment

results have been revised to the new segment presentation. There

were no changes to our consolidated financial results. (4)

As previously announced in May 2022, our revenue by product type

previously referred to as Research Platforms was changed to

Research Solutions. Research Solutions includes infrastructure and

publishing services that help societies and corporations thrive in

a complex knowledge ecosystem. In addition to Platforms (Atypon),

certain product offerings such as corporate sales which included

the recent acquisitions of Madgex Holdings Limited (Madgex), and

Bio-Rad Laboratories Inc.’s Informatics products (Informatics) that

were previously included in Research Publishing moved to Research

Solutions to align with our strategic focus. Research Solutions

also includes product offerings related to certain recent

acquisitions such as J&J, and EJP. Prior period results have

been revised to the new presentation. There were no changes to the

total Research segment or our consolidated financial results. The

revenue was $24.9 million for the three months ended April 30,

2022, $93.3 million for the year ended April 30, 2022, and $80.3

million for the year ended April 30, 2021. (5) In the three

months ended January 31, 2023, we settled a litigation matter

related to consideration for a previous acquisition for $3.7

million. (6) On January 1, 2020, Wiley acquired mthree, a

talent placement provider that addresses the IT skills gap by

finding, training, and placing job-ready technology talent in roles

with leading corporations worldwide. Its results of operations are

included in our Talent segment. In late May 2022, Wiley renamed the

mthree talent development solution to Wiley Edge and discontinued

use of the mthree trademark during the three months ended July 31,

2022. As a result of these actions, we determined that a revision

of the useful life was warranted, and the intangible asset was

fully amortized over its remaining useful life resulting in

accelerated amortization expense of $4.6 million in the three

months ended July 31, 2022. # Variance greater than 100%

JOHN WILEY & SONS, INC. SUPPLEMENTARY INFORMATION (1)

(2) (3) SEGMENT RESULTS (in thousands)

(unaudited) % Change Year Ended April 30,

Favorable (Unfavorable)

2023

2022 (3)

Reported ConstantCurrency Research:

Revenue, net Research Publishing (4)

$

926,773

$

963,715

-4

%

-1

%

Research Solutions (4)

153,538

147,628

4

%

7

%

Total Revenue, net

$

1,080,311

$

1,111,343

-3

%

0

%

Contribution to Profit

$

281,802

$

294,989

-4

%

-4

%

Adjustments: Restructuring charges

2,182

238

#

#

Non-GAAP Adjusted Contribution to Profit

$

283,984

$

295,227

-4

%

-3

%

Depreciation and amortization

93,008

94,899

2

%

-1

%

Non-GAAP Adjusted EBITDA

$

376,992

$

390,126

-3

%

-2

%

Adjusted EBITDA margin

34.9

%

35.1

%

Academic: Revenue, net Academic Publishing

$

481,752

$

531,705

-9

%

-7

%

University Services

208,656

227,407

-8

%

-8

%

Total Revenue, net

$

690,408

$

759,112

-9

%

-7

%

Contribution to Profit

$

(41,887

)

$

91,717

#

#

Adjustments: Restructuring charges (credits)

10,366

(470

)

#

#

Impairment of goodwill

99,800

-

#

#

Non-GAAP Adjusted Contribution to Profit

$

68,279

$

91,247

-25

%

-23

%

Depreciation and amortization

79,741

81,721

2

%

1

%

Non-GAAP Adjusted EBITDA

$

148,020

$

172,968

-14

%

-13

%

Adjusted EBITDA margin

21.4

%

22.8

%

Talent: Total Revenue, net

$

249,181

$

212,473

17

%

24

%

Contribution to Profit

$

25,404

$

23,936

6

%

10

%

Adjustments: Restructuring charges

3,009

23

#

#

Accelerated amortization of an intangible asset (6)

4,594

#

-

#

#

Non-GAAP Adjusted Contribution to Profit

$

33,007

$

23,959

38

%

41

%

Depreciation and amortization

19,448

21,997

12

%

7

%

Non-GAAP Adjusted EBITDA

$

52,455

$

45,956

14

%

18

%

Adjusted EBITDA margin

21.1

%

21.6

%

Corporate Expenses:

$

(209,429

)

$

(191,366

)

-9

%

-13

%

Adjustments: Restructuring charges (credits)

33,832

(1,218

)

#

#

Legal settlement (5)

3,671

-

#

#

Non-GAAP Adjusted Contribution to Profit

$

(171,926

)

$

(192,584

)

11

%

7

%

Depreciation and amortization

16,462

16,553

1

%

-2

%

Non-GAAP Adjusted EBITDA

$

(155,464

)

$

(176,031

)

12

%

8

%

Consolidated Results: Revenue, net

$

2,019,900

$

2,082,928

-3

%

0

%

Operating Income

$

55,890

$

219,276

-75

%

-76

%

Adjustments: Restructuring charges (credits)

49,389

#

(1,427

)

#

#

Impairment of goodwill

99,800

-

#

#

Legal settlement (5)

3,671

-

#

#

Accelerated amortization of an intangible asset (6)

4,594

-

#

#

Non-GAAP Adjusted Operating Income

$

213,344

$

217,849

-2

%

-3

%

Depreciation and amortization

208,659

215,170

3

%

1

%

Non-GAAP Adjusted EBITDA

$

422,003

$

433,019

-3

%

-2

%

Adjusted EBITDA margin

20.9

%

20.8

%

# Variance greater than 100%

JOHN WILEY & SONS,

INC. SUPPLEMENTARY INFORMATION (1) CONDENSED

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION (in

thousands) (unaudited)

April 30,

April 30,

2023

2022

Assets: Current assets Cash and cash equivalents

$

106,714

$

100,397

Accounts receivable, net

310,121

331,960

Inventories, net

30,733

36,585

Prepaid expenses and other current assets

93,711

81,924

Total current assets

541,279

550,866

Technology, property and equipment, net

247,149

271,572

Intangible assets, net

854,794

931,429

Goodwill

1,204,050

1,302,142

Operating lease right-of-use assets

91,197

111,719

Other non-current assets

170,341

193,967

Total assets

$

3,108,810

$

3,361,695

Liabilities and shareholders' equity: Current

liabilities Accounts payable

$

84,325

$

77,438

Accrued royalties

113,423

101,596

Short-term portion of long-term debt

5,000

18,750

Contract liabilities

504,695

538,126

Accrued employment costs

80,458

117,121

Short-term portion of operating lease liabilities

19,673

20,576

Other accrued liabilities

87,979

95,812

Total current liabilities

895,553

969,419

Long-term debt

743,292

768,277

Accrued pension liability

86,304

78,622

Deferred income tax liabilities

144,042

180,065

Operating lease liabilities

115,540

132,541

Other long-term liabilities

79,052

90,502

Total liabilities

2,063,783

2,219,426

Shareholders' equity

1,045,027

1,142,269

Total liabilities and shareholders' equity

$

3,108,810

$

3,361,695

Notes: (1) The supplementary information included in

this press release for April 30, 2023 is preliminary and subject to

change prior to the filing of our upcoming Annual Report on Form

10-K with the Securities and Exchange Commission.

JOHN WILEY

& SONS, INC. SUPPLEMENTARY INFORMATION (1)

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (in

thousands) (unaudited)

Year Ended

April 30,

2023

2022

Operating activities: Net income

$

17,233

$

148,309

Impairment of goodwill

99,800

-

Amortization of intangible assets

84,881

84,836

Amortization of product development assets

32,366

35,162

Depreciation and amortization of technology, property, and

equipment

96,006

95,172

Other noncash charges

85,419

80,050

Net change in operating assets and liabilities

(138,634

)

(104,429

)

Net cash provided by operating activities

277,071

339,100

Investing activities: Additions to technology,

property, and equipment

(81,155

)

(88,843

)

Product development spending

(22,958

)

(27,015

)

Businesses acquired in purchase transactions, net of cash acquired

(7,292

)

(75,703

)

Proceeds related to the sale of businesses and certain assets

15,585

3,375

Acquisitions of publication rights and other

(2,578

)

(5,838

)

Net cash used in investing activities

(98,398

)

(194,024

)

Financing activities: Net debt repayments

(38,934

)

(10,996

)

Cash dividends

(77,298

)

(77,205

)

Purchases of treasury shares

(35,000

)

(30,000

)

Other

(17,336

)

(13,437

)

Net cash used in financing activities

(168,568

)

(131,638

)

Effects of exchange rate changes on cash, cash

equivalents and restricted cash

(3,570

)

(7,070

)

Change in cash, cash equivalents and restricted cash for

period

6,535

6,368

Cash, cash equivalents and restricted cash -

beginning

100,727

94,359

Cash, cash equivalents and restricted cash - ending

$

107,262

$

100,727

CALCULATION OF NON-GAAP FREE CASH FLOW LESS PRODUCT

DEVELOPMENT SPENDING (2)

Year Ended

April 30,

2023

2022

Net cash provided by operating activities

$

277,071

$

339,100

Less: Additions to technology, property, and equipment

(81,155

)

(88,843

)

Less: Product development spending

(22,958

)

(27,015

)

Free cash flow less product development spending

$

172,958

$

223,242

Notes: (1) The supplementary information included in

this press release for the year ended April 30, 2023 is preliminary

and subject to change prior to the filing of our upcoming Annual

Report on Form 10-K with the Securities and Exchange Commission.

(2) See Explanation of Usage of Non-GAAP Performance Measures

included in this supplemental information.

JOHN WILEY & SONS, INC.

EXPLANATION OF USAGE OF NON-GAAP PERFORMANCE MEASURES

In this earnings release and supplemental information, management

may present the following non-GAAP performance measures: · Adjusted

Earnings Per Share (Adjusted EPS); · Free Cash Flow less Product

Development Spending; · Adjusted Revenue; · Adjusted Contribution

to Profit and margin; · Adjusted Operating Income and margin; ·

Adjusted Income Before Taxes; · Adjusted Income Tax Provision; ·

Adjusted Effective Tax Rate; · EBITDA, Adjusted EBITDA and margin;

· Organic revenue; and · Results on a constant currency basis.

Management uses these non-GAAP performance measures as supplemental

indicators of our operating performance and financial position as

well as for internal reporting and forecasting purposes, when

publicly providing our outlook, to evaluate our performance and

calculate incentive compensation. We present these non-GAAP

performance measures in addition to US GAAP financial results

because we believe that these non-GAAP performance measures provide

useful information to certain investors and financial analysts for

operational trends and comparisons over time. The use of these

non-GAAP performance measures may also provide a consistent basis

to evaluate operating profitability and performance trends by

excluding items that we do not consider to be controllable

activities for this purpose. The performance metric used by our

chief operating decision maker to evaluate performance of our

reportable segments is Adjusted Contribution to Profit. We present

both Adjusted Contribution to Profit and Adjusted EBITDA for each

of our reportable segments as we believe Adjusted EBITDA provides

additional useful information to certain investors and financial

analysts for operational trends and comparisons over time. It

removes the impact of depreciation and amortization expense, as

well as presents a consistent basis to evaluate operating

profitability and compare our financial performance to that of our

peer companies and competitors. For example: · Adjusted EPS,

Adjusted Revenue, Adjusted Contribution to Profit, Adjusted

Operating Income, Adjusted Income Before Taxes, Adjusted Income Tax

Provision, Adjusted Effective Tax Rate, Adjusted EBITDA, and

organic revenue (excluding acquisitions) provide a more comparable

basis to analyze operating results and earnings and are measures

commonly used by shareholders to measure our performance. · Free

Cash Flow less Product Development Spending helps assess our

ability, over the long term, to create value for our shareholders

as it represents cash available to repay debt, pay common stock

dividends, and fund share repurchases and acquisitions. · Results

on a constant currency basis remove distortion from the effects of

foreign currency movements to provide better comparability of our

business trends from period to period. We measure our performance

excluding the impact of foreign currency (or at constant currency),

which means that we apply the same foreign currency exchange rates

for the current and equivalent prior period. In addition, we have

historically provided these or similar non-GAAP performance

measures and understand that some investors and financial analysts

find this information helpful in analyzing our operating margins

and net income, and in comparing our financial performance to that

of our peer companies and competitors. Based on interactions with

investors, we also believe that our non-GAAP performance measures

are regarded as useful to our investors as supplemental to our US

GAAP financial results, and that there is no confusion regarding

the adjustments or our operating performance to our investors due

to the comprehensive nature of our disclosures. We have not

provided our 2024 outlook for the most directly comparable US GAAP

financial measures, as they are not available without unreasonable

effort due to the high variability, complexity, and low visibility

with respect to certain items, including restructuring charges and

credits, gains and losses on foreign currency, and other gains and

losses. These items are uncertain, depend on various factors, and

could be material to our consolidated results computed in

accordance with US GAAP. Non-GAAP performance measures do not have

standardized meanings prescribed by US GAAP and therefore may not

be comparable to the calculation of similar measures used by other

companies and should not be viewed as alternatives to measures of

financial results under US GAAP. The adjusted metrics have

limitations as analytical tools, and should not be considered in

isolation from, or as a substitute for, US GAAP information. It

does not purport to represent any similarly titled US GAAP

information and is not an indicator of our performance under US

GAAP. Non-GAAP financial metrics that we present may not be

comparable with similarly titled measures used by others. Investors

are cautioned against placing undue reliance on these non-GAAP

measures.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230615137658/en/

Investor Contact: Brian Campbell 201.748.6874

brian.campbell@wiley.com

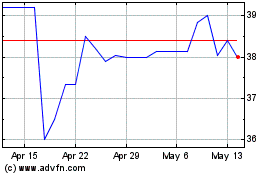

John Wiley and Sons (NYSE:WLYB)

Historical Stock Chart

From Jan 2025 to Feb 2025

John Wiley and Sons (NYSE:WLYB)

Historical Stock Chart

From Feb 2024 to Feb 2025