Certified Annual Shareholder Report for Management Investment Companies (n-csr)

September 24 2020 - 3:58PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED

MANAGEMENT INVESTMENT

COMPANIES

Investment Company Act file

number 811- 21131

John Hancock Preferred Income Fund

(Exact name of registrant as specified in charter)

200 Berkeley Street, Boston, Massachusetts 02116

(Address of principal

executive offices) (Zip code)

Salvatore

Schiavone

Treasurer

200 Berkeley Street

Boston, Massachusetts 02116

(Name

and address of agent for service)

Registrant's telephone number, including

area code: 617-663-4497

|

Date of fiscal year end:

|

July 31

|

|

|

|

|

Date of reporting period:

|

July 31, 2020

|

ITEM 1. REPORTS TO STOCKHOLDERS.

John Hancock

Preferred Income Fund

Ticker: HPI

Annual report

7/31/2020

Beginning on

January 1, 2021, as permitted by regulations adopted by the Securities and Exchange

Commission, paper copies of the fund's shareholder reports such as

this one will no longer be sent by mail, unless you specifically

request paper copies of the reports from the transfer agent or from

your financial intermediary. Instead, the reports will be made

available on our website, and you will be notified by mail each time

a report is posted and be provided with a website link to access

the report.

If you have already elected to receive shareholder reports

electronically, you will not be affected by this change and you do

not need to take any action. You may elect to receive shareholder

reports and other communications electronically by calling the

transfer agent, Computershare, at 800-852-0218, by going to

"Communication Preferences" at computershare.com/investor, or by

contacting your financial intermediary.

You may elect to receive all reports in paper, free of charge, at any

time. You can inform the transfer agent or your financial

intermediary that you wish to continue receiving paper copies of your

shareholder reports by following the instructions listed above. Your

election to receive reports in paper will apply to all funds held

with John Hancock Investment Management or your financial

intermediary.

A message to shareholders

Dear shareholder,

The financial markets delivered strong returns during first half of

the 12-month period ended

July 31, 2020; however, heightened fears over the coronavirus (COVID-19) sent

markets tumbling during the latter half of February and early March.

Yet by the end of the first quarter, equity markets began to rise—and

this comeback gathered momentum during the final four months of the

period; however, holdings of preferred shares in certain market

segments did not participate fully in the rebound.

Of course, it would be a mistake to consider this market turnaround a

trustworthy signal of assured or swift economic recovery. While there

has been economic growth in most of the United States, the pace has

slowed in many areas as spending remains far below pre-pandemic

levels.

From an investment perspective, we continue to think that maintaining

a focus on long-term objectives while pursuing a risk-aware strategy

is a prudent way forward. Above all, we believe the counsel of a

trusted financial professional continues to matter now more than

ever. Periods of heightened uncertainty are precisely the time to

review your financial goals and follow a plan that helps you make the

most of what continues to be a challenging situation.

On behalf of everyone at John Hancock Investment Management, I'd like

to take this opportunity to welcome new shareholders and thank

existing shareholders for the continued trust you've placed in us.

Sincerely,

Andrew G. Arnott

President and CEO,

John Hancock Investment Management

Head of Wealth and Asset Management,

United States and Europe

This commentary reflects the CEO's views as of this report's period

end and are subject to change at any time. Diversification does not

guarantee investment returns and does not eliminate risk of loss. All

investments entail risks, including the possible loss of principal.

For more up-to-date information, you can visit our website at

jhinvestments.com.

John Hancock

Preferred Income Fund

Table of contents

|

|

|

|

|

2

|

|

Your fund at a glance

|

|

6

|

|

Manager's discussion of fund performance

|

|

8

|

|

Fund's investments

|

|

16

|

|

Financial statements

|

|

20

|

|

Financial highlights

|

|

21

|

|

Notes to financial statements

|

|

30

|

|

Report of independent registered public accounting firm

|

|

31

|

|

Tax information

|

|

32

|

|

Additional information

|

|

35

|

|

Shareholder meeting

|

|

36

|

|

Continuation of investment advisory and subadvisory agreements

|

|

43

|

|

Trustees and Officers

|

|

47

|

|

More information

|

ANNUAL REPORT | JOHN HANCOCK PREFERRED INCOME FUND 1

INVESTMENT OBJECTIVE

The fund seeks to provide a high level of current income consistent

with preservation of capital. The fund's secondary investment

objective is to provide growth of capital to the extent consistent

with its primary objective.

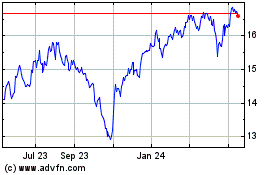

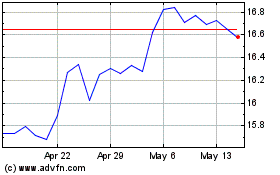

AVERAGE ANNUAL TOTAL RETURNS AS OF 7/31/2020 (%)

The ICE Bank of America Hybrid Preferred Securities Index is a subset

of the ICE Bank of America Fixed Rate Preferred Securities Index,

including all subordinated securities with a payment deferral

feature. The ICE Bank of America Fixed Rate Preferred Securities

Index tracks the performance of fixed-rate U.S. dollar-denominated

preferred securities issued in the U.S. domestic market. Qualifying

securities must have an investment-grade rating and the country of

risk must also have an investment-grade rating.

It is not possible to invest directly in an index. Index figures do

not reflect expenses or sales charges, which would result in lower

returns.

The performance data contained within this material represents past

performance, which does not guarantee future results.

Investment returns and principal value will fluctuate and a

shareholder may sustain losses. Further, the fund's performance at

net asset value (NAV) is different from the fund's performance at

closing market price because the closing market price is subject to

the dynamics of secondary market trading. Market risk may be

increased when shares are purchased at a premium to NAV or sold at a

discount to NAV. Current month-end performance may be higher or lower

than the performance cited. The fund's most recent performance can be

found at jhinvestments.com or by calling 800-852-0218.

ANNUAL REPORT | JOHN HANCOCK PREFERRED INCOME FUND 2

PERFORMANCE HIGHLIGHTS OVER THE LAST TWELVE MONTHS

The spread of COVID-19 was the key driver of the preferred market's performance

After benefiting from a period of relative calm from August 2019

through January 2020, preferred securities came under severe pressure

during the global markets sell-off in March 2020.

Energy holdings hurt performance

A decline in energy demand, an effect of the pandemic, hampered the

fund's return.

Communication services holdings boosted relative performance

Investors' demand for companies benefiting from the work-from-home

trend helped telecommunications holdings.

PORTFOLIO COMPOSITION AS OF 7/31/2020 (%)

ANNUAL REPORT | JOHN HANCOCK PREFERRED INCOME FUND 3

SECTOR COMPOSITION AS OF

7/31/2020 (%)

QUALITY COMPOSITION AS OF

7/31/2020 (%)

ANNUAL REPORT | JOHN HANCOCK PREFERRED INCOME FUND 4

A note about risks

As is the case with all exchange-listed closed-end funds, shares of

this fund may trade at a discount or a premium to the fund's net

asset value (NAV). An investment in the fund is subject to investment

and market risks, including the possible loss of the entire principal

invested. There is no guarantee prior distribution levels will be

maintained, and distributions may include a substantial tax return of

capital. A return of capital is the return of all or a portion of a

shareholder's investment in the fund. For the fiscal year ended

July 31, 2020, the fund's aggregate distributions included a return of capital of

$0.08 per share, or 5.07% of aggregate distributions, which could

impact the tax treatment of a subsequent sale of fund shares.

Fixed-income investments are subject to interest-rate risk; their

value will normally decline as interest rates rise or if a creditor,

grantor, or counterparty is unable or unwilling to make principal,

interest, or settlement payments. Preferred stock dividends are

payable only if declared by the issuer's board. Preferred stock may

be subject to redemption provisions. The market value of convertible

securities tend to fall as interest rates rise and rise as interest

rates fall. Convertible preferred stock's value can depend heavily on

the underlying common stock's value. Investments in higher-yielding,

lower-rated securities are subject to a higher risk of default. An

issuer of securities held by the fund may default, have its credit

rating downgraded, or otherwise perform poorly, which may affect fund

performance. Liquidity—the extent to which a security may be sold or

a derivative position closed without negatively affecting its market

value—may be impaired by reduced trading volume, heightened

volatility, rising interest rates, and other market conditions.

Domestic and foreign equity markets have experienced increased

volatility and turmoil which may adversely affect the fund and

issuers worldwide. The fund's use of leverage creates additional

risks, including greater volatility of the fund's NAV, market price,

and returns. There is no assurance that the fund's leverage strategy

will be successful. In addition, in volatile market environments, the

fund could be required to sell securities in the portfolio in order

to comply with regulatory or other debt compliance requirements,

which could negatively impact the fund's performance. Focusing on a

particular industry or sector may increase the fund's volatility and

make it more susceptible to market, economic, and regulatory risks as

well as other factors affecting those industries or sectors.

A widespread health crisis such as a global pandemic could cause

substantial market volatility, exchange trading suspensions and

closures,and affect fund performance. For example, the novel

coronavirus disease (COVID-19) has resulted in significant

disruptions to global business activity. The impact of a health

crisis and other epidemics and pandemics that may arise in the

future, could affect the global economy in ways that cannot

necessarily be foreseen at the present time. A health crisis may

exacerbate other pre-existing political, social, and economic risks.

Any such impact could adversely affect the fund's performance,

resulting in losses to your investment.

The fund normally will invest at least 25%, measured at the time of

purchase, of its total assets in the industries composing the

utilities sector, which includes telecommunications companies. When

the fund's investments focus on one or more sectors of the economy,

they are far less diversified than the broad securities markets. This

means that the fund may be more volatile than other funds, and the

values of its investments may go up and down more rapidly. Because

utility companies are capital intensive, they can be hurt by higher

interest rates, which would increase the companies' interest burden.

They can also be affected by costs in connection with capital

construction programs, costs associated with environmental and other

regulations, and the effects of economic declines, surplus capacity,

and increased competition. In addition, the fund may invest in

financial services companies, which can be hurt by economic declines,

changes in interest rates, and regulatory and market impacts. The

fund's investments in securities of foreign issuers involve special

risks, such as political, economic, and currency risks and

differences in accounting standards and financial reporting.

Cybersecurity incidents may allow an unauthorized party to gain

access to fund assets, customer data, or proprietary information, or

cause a fund or its service providers to suffer data corruption or

lose operational functionality. Similar incidents affecting issuers

of a fund's securities may negatively affect performance.

ANNUAL REPORT | JOHN HANCOCK PREFERRED INCOME FUND 5

Manager's discussion of fund performance

How would you describe the investment backdrop during the 12 months ended

July 31, 2020?

Preferred securities suffered significant losses for the period,

hamstrung by poor performance during late February and throughout

March when growing investor anxiety over the COVID-19 pandemic led to

extreme global market volatility, with preferreds hit particularly

hard. April marked the beginning of a robust rebound that persisted

through period end, triggered largely by the U.S. Federal Reserve's

(Fed's) moves to cut interest rates and restore liquidity to

financial markets, as well as fiscal stimulus designed to shore up

the U.S. economy. Even after this late period rally, many preferreds

still hadn't fully recovered from their March lows by period end as

they tend to be issued by energy, utilities, and financial services

firms that saw their values hurt by the pandemic.

What elements of the fund's positioning affected results?

The fund's overweighting in the energy sector detracted from

performance relative to its comparative index, the ICE Bank of

America Hybrid Preferred Securities Index. The energy sector

performed poorly as investors began to discount future energy demand

in light of the forced pandemic-related shutdown of the economy. Even

the midstream energy companies—firms that process, store, and

transport oil and gas—were caught up in the sector's decline, even

though they tend to be less sensitive to commodity prices.

TOP 10 ISSUERS AS OF 7/31/2020 (%)

|

|

|

|

DTE Energy Company

|

5.3

|

|

CenterPoint Energy, Inc.

|

3.8

|

|

Morgan Stanley

|

3.7

|

|

Algonquin Power & Utilities Corp.

|

3.4

|

|

U.S. Cellular Corp.

|

3.3

|

|

Southern California Edison Company

|

3.2

|

|

PPL Capital Funding, Inc.

|

3.0

|

|

Citigroup, Inc.

|

3.0

|

|

South Jersey Industries, Inc.

|

2.9

|

|

Duke Energy Corp.

|

2.8

|

|

TOTAL

|

34.4

|

|

As a percentage of total investments.

|

|

Cash and cash equivalents are not included.

|

ANNUAL REPORT | JOHN HANCOCK PREFERRED INCOME FUND 6

Also detracting from performance were sales of Kinder Morgan, Inc.

and Stanley Black & Decker, Inc. These sales permitted a reduction of

the fund's leverage in March, a strategy we pursued to manage the

portfolio's overall risk profile. Given the weak market environment

at the time, the sale of these securities resulted in losses for

the fund.

In contrast, the fund's overweighting in the communication services

sector contributed, with holdings in U.S. Cellular Corp. and

Telephone and Data Systems, Inc. adding value amid investors' search

for companies that would benefit from the work-from-home trend.

Elsewhere, the fund's overweighting in electric utility preferreds

further boosted relative performance.

How was the fund positioned at the end of the period?

We believe preferred securities will continue to recover over the

next 6 to 12 months. We think interest rates will remain low given

the economic impact of the coronavirus and that it will be some time

before the Fed decides to raise rates for fear of derailing a

recovery. The yields on preferreds looked very attractive relative to

the 10-year U.S. Treasury bond as of the end of July, at wide levels

not seen since the 2008 financial crisis. As the economy slowly goes

back to normal, we expect this spread to revert to the historical

mean, which will likely provide significant upside to preferred

securities. The credit quality of the average preferred issue is very

good, in our view, at an average of investment grade. We believe

that, over time, preferreds' credit quality and attractive valuations

will be recognized by the market and result in price appreciation for

the asset class.

MANAGED BY

|

|

|

Joseph H. Bozoyan, CFA, Manulife IM (US)

|

|

Brad Lutz, CFA, Manulife IM (US)

|

The views expressed in this report are exclusively those of Joseph H.

Bozoyan, CFA, Manulife Investment Management, and are subject to

change. They are not meant as investment advice. Please note that the

holdings discussed in this report may not have been held by the fund

for the entire period. Portfolio composition is subject to review in

accordance with the fund's investment strategy and may vary in the

future. Current and future portfolio holdings are subject to risk.

ANNUAL REPORT | JOHN HANCOCK PREFERRED INCOME FUND 7

AS OF 7-31-20

|

|

|

|

|

Shares

|

Value

|

|

Preferred

securities (A) 114.8% (77.8% of Total investments)

|

|

|

$554,116,459

|

|

(Cost

$567,745,020)

|

|

|

|

|

|

|

Communication

services 11.3%

|

|

|

|

54,705,519

|

|

Diversified

telecommunication services 2.7%

|

|

|

|

|

|

Qwest

Corp., 6.125% (B)

|

|

|

|

30,000

|

715,800

|

|

Qwest

Corp., 6.500%

|

|

|

|

136,705

|

3,349,273

|

|

Qwest

Corp., 6.750%

|

|

|

|

360,000

|

9,147,600

|

|

Wireless

telecommunication services 8.6%

|

|

|

|

|

|

Telephone

& Data Systems, Inc., 6.625% (B)

|

|

|

|

233,381

|

6,018,896

|

|

Telephone

& Data Systems, Inc., 6.875%

|

|

|

|

119,781

|

3,029,261

|

|

Telephone

& Data Systems, Inc., 7.000% (B)

|

|

|

|

340,000

|

8,595,200

|

|

U.S.

Cellular Corp., 6.950% (B)(C)

|

|

|

|

720,000

|

18,576,000

|

|

U.S.

Cellular Corp., 7.250% (B)(C)

|

|

|

|

205,514

|

5,273,489

|

|

Consumer

discretionary 0.4%

|

|

|

|

1,837,080

|

|

Internet

and direct marketing retail 0.4%

|

|

|

|

|

|

QVC,

Inc., 6.250%

|

|

|

|

81,000

|

1,837,080

|

|

Consumer

staples 2.4%

|

|

|

|

11,726,000

|

|

Food

products 2.4%

|

|

|

|

|

|

Ocean

Spray Cranberries, Inc., 6.250% (D)

|

|

|

|

143,000

|

11,726,000

|

|

Energy

1.9%

|

|

|

|

8,954,900

|

|

Oil,

gas and consumable fuels 1.9%

|

|

|

|

|

|

Enbridge,

Inc. (6.375% to 4-15-23, then 3 month LIBOR + 3.593%) (B)(C)

|

|

|

|

210,000

|

5,229,000

|

|

NuStar

Logistics LP (3 month LIBOR + 6.734%), 7.009% (E)

|

|

|

|

185,000

|

3,725,900

|

|

Financials

40.6%

|

|

|

|

196,006,278

|

|

Banks

18.8%

|

|

|

|

|

|

Bank

of America Corp., 6.000% (B)

|

|

|

|

134,281

|

3,664,528

|

|

Bank

of America Corp. (6.450% to 12-15-66, then 3 month LIBOR + 1.327%) (B)

|

|

|

|

135,000

|

3,586,950

|

|

Citigroup

Capital XIII (3 month LIBOR + 6.370%), 6.638% (E)

|

|

|

|

384,725

|

10,387,575

|

|

Citigroup,

Inc. (7.125% to 9-30-23, then 3 month LIBOR + 4.040%)

|

|

|

|

318,337

|

9,037,587

|

|

Fifth

Third Bancorp, 6.000% (B)

|

|

|

|

234,293

|

6,279,052

|

|

First

Republic Bank, 4.700% (B)(C)

|

|

|

|

164,175

|

4,265,267

|

|

GMAC

Capital Trust I (3 month LIBOR + 5.785%), 6.177% (E)

|

|

|

|

450,544

|

10,844,594

|

|

Pinnacle

Financial Partners, Inc., 6.750%

|

|

|

|

175,000

|

4,550,000

|

|

Synovus

Financial Corp. (6.300% to 6-21-23, then 3 month LIBOR + 3.352%) (B)

|

|

|

|

188,000

|

4,726,320

|

|

8

|

JOHN HANCOCK PREFERRED

INCOME FUND | ANNUAL REPORT

|

SEE NOTES TO FINANCIAL

STATEMENTS

|

|

|

|

|

|

Shares

|

Value

|

|

Financials

(continued)

|

|

|

|

|

|

Banks

(continued)

|

|

|

|

|

|

The

PNC Financial Services Group, Inc. (6.125% to 5-1-22, then 3 month LIBOR + 4.067%) (B)

|

|

|

|

187,000

|

$5,075,180

|

|

Truist

Financial Corp., Series G, 5.200% (B)

|

|

|

|

351,250

|

8,911,213

|

|

U.S.

Bancorp (6.500% to 1-15-22, then 3 month LIBOR + 4.468%) (B)

|

|

|

|

185,000

|

4,943,200

|

|

Wells

Fargo & Company (6.625% to 3-15-24, then 3 month LIBOR + 3.690%) (B)(C)

|

|

|

|

322,025

|

8,627,050

|

|

Wells

Fargo & Company, 6.000%

|

|

|

|

24,955

|

647,582

|

|

Wells

Fargo & Company, 7.500%

|

|

|

|

3,500

|

4,730,250

|

|

Western

Alliance Bancorp, 6.250%

|

|

|

|

21,000

|

535,710

|

|

Capital

markets 5.5%

|

|

|

|

|

|

Morgan

Stanley (6.375% to 10-15-24, then 3 month LIBOR + 3.708%) (B)

|

|

|

|

235,000

|

6,636,400

|

|

Morgan

Stanley (6.875% to 1-15-24, then 3 month LIBOR + 3.940%)

|

|

|

|

100,000

|

2,870,000

|

|

Morgan

Stanley (7.125% to 10-15-23, then 3 month LIBOR + 4.320%)

|

|

|

|

595,424

|

17,118,440

|

|

Consumer

finance 1.3%

|

|

|

|

|

|

Navient

Corp., 6.000% (B)

|

|

|

|

294,071

|

6,440,155

|

|

Insurance

14.8%

|

|

|

|

|

|

AEGON

Funding Company LLC, 5.100% (B)(C)

|

|

|

|

324,625

|

8,138,349

|

|

American

Equity Investment Life Holding Company (6.625% to 9-1-25, then 5 Year CMT + 6.297%)

|

|

|

|

158,375

|

3,948,289

|

|

American

Financial Group, Inc., 5.125% (B)

|

|

|

|

153,425

|

4,065,763

|

|

American

International Group, Inc., 5.850% (B)(C)

|

|

|

|

249,000

|

6,857,460

|

|

Athene

Holding, Ltd., Series A (6.350% to 6-30-29, then 3 month LIBOR + 4.253%) (B)(C)

|

|

|

|

305,000

|

7,948,300

|

|

Brighthouse

Financial, Inc., 6.600%

|

|

|

|

281,775

|

7,455,767

|

|

Prudential

Financial, Inc., 5.750% (B)

|

|

|

|

140,000

|

3,648,400

|

|

Prudential

PLC, 6.500% (B)(C)

|

|

|

|

154,500

|

4,295,100

|

|

Prudential

PLC, 6.750% (B)(C)

|

|

|

|

51,000

|

1,390,770

|

|

The

Hartford Financial Services Group, Inc. (7.875% to 4-15-22, then 3 month LIBOR + 5.596%) (B)

|

|

|

|

58,227

|

1,664,710

|

|

Unum

Group, 6.250%

|

|

|

|

147,500

|

3,882,200

|

|

W.R.

Berkley Corp., 5.625% (B)(C)

|

|

|

|

716,641

|

18,152,517

|

|

Thrifts

and mortgage finance 0.2%

|

|

|

|

|

|

Federal

National Mortgage Association, Series S, 8.250% (F)

|

|

|

|

80,000

|

681,600

|

|

SEE NOTES TO FINANCIAL

STATEMENTS

|

ANNUAL REPORT | JOHN HANCOCK PREFERRED INCOME FUND

|

9

|

|

|

|

|

|

Shares

|

Value

|

|

Information

technology 2.3%

|

|

|

|

$10,838,645

|

|

Semiconductors

and semiconductor equipment 2.3%

|

|

|

|

|

|

Broadcom,

Inc., 8.000% (B)

|

|

|

|

9,500

|

10,838,645

|

|

Real

estate 4.5%

|

|

|

|

21,866,775

|

|

Equity

real estate investment trusts 4.5%

|

|

|

|

|

|

American

Homes 4 Rent, Series E, 6.350%

|

|

|

|

99,975

|

2,604,349

|

|

American

Homes 4 Rent, Series F, 5.875% (B)

|

|

|

|

165,575

|

4,362,901

|

|

Digital

Realty Trust, Inc., 6.350%

|

|

|

|

922

|

23,391

|

|

Diversified

Healthcare Trust, 5.625%

|

|

|

|

821,432

|

14,876,134

|

|

Utilities

51.4%

|

|

|

|

248,181,262

|

|

Electric

utilities 20.1%

|

|

|

|

|

|

Duke

Energy Corp., 5.125% (B)(C)

|

|

|

|

511,525

|

13,207,576

|

|

Duke

Energy Corp., 5.750% (B)

|

|

|

|

240,000

|

6,842,400

|

|

Entergy

Louisiana LLC, 5.250% (B)

|

|

|

|

141,476

|

3,727,893

|

|

Interstate

Power & Light Company, 5.100% (B)(C)

|

|

|

|

170,000

|

4,329,900

|

|

NextEra

Energy, Inc., 5.279% (B)(C)

|

|

|

|

200,000

|

9,688,000

|

|

NSTAR

Electric Company, 4.780% (B)

|

|

|

|

15,143

|

1,544,737

|

|

PG&E

Corp., 5.500%

|

|

|

|

55,000

|

5,513,750

|

|

PPL

Capital Funding, Inc., 5.900% (B)

|

|

|

|

837,439

|

21,547,305

|

|

SCE

Trust II, 5.100% (B)(C)

|

|

|

|

511,190

|

12,350,350

|

|

SCE

Trust III (5.750% to 3-15-24, then 3 month LIBOR + 2.990%) (B)

|

|

|

|

20,000

|

451,600

|

|

The

Southern Company, 6.250% (B)(C)

|

|

|

|

149,524

|

3,812,862

|

|

The

Southern Company, 6.750% (B)

|

|

|

|

300,000

|

13,836,000

|

|

Gas

utilities 4.2%

|

|

|

|

|

|

South

Jersey Industries, Inc., 5.625% (B)

|

|

|

|

239,275

|

6,182,866

|

|

South

Jersey Industries, Inc., 7.250%

|

|

|

|

357,100

|

14,130,447

|

|

Multi-utilities

27.1%

|

|

|

|

|

|

Algonquin

Power & Utilities Corp. (6.200% to 7-1-24, then 3 month LIBOR + 4.010%)

|

|

|

|

354,930

|

9,604,406

|

|

Algonquin

Power & Utilities Corp. (6.875% to 10-17-23, then 3 month LIBOR + 3.677%)

|

|

|

|

526,441

|

14,398,161

|

|

CenterPoint

Energy, Inc., 7.000% (B)

|

|

|

|

755,000

|

27,293,250

|

|

CMS

Energy Corp., 5.625% (B)

|

|

|

|

225,000

|

6,156,000

|

|

Dominion

Energy, Inc., 7.250% (B)

|

|

|

|

69,300

|

7,206,507

|

|

DTE

Energy Company (Callable 9-1-20), 5.250% (B)

|

|

|

|

248,120

|

6,371,722

|

|

DTE

Energy Company (Callable 12-1-22), 5.250% (B)

|

|

|

|

240,000

|

6,386,400

|

|

DTE

Energy Company, 6.000% (B)(C)

|

|

|

|

94,150

|

2,508,156

|

|

DTE

Energy Company, 6.250% (B)

|

|

|

|

503,000

|

22,680,270

|

|

Integrys

Holding, Inc. (6.000% to 8-1-23, then 3 month LIBOR + 3.220%) (B)

|

|

|

|

272,500

|

6,928,408

|

|

10

|

JOHN HANCOCK PREFERRED

INCOME FUND | ANNUAL REPORT

|

SEE NOTES TO FINANCIAL

STATEMENTS

|

|

|

|

|

|

Shares

|

Value

|

|

Utilities

(continued)

|

|

|

|

|

|

Multi-utilities

(continued)

|

|

|

|

|

|

NiSource,

Inc. (6.500% to 3-15-24, then 5 Year CMT + 3.632%) (B)(C)

|

|

|

|

344,000

|

$9,442,800

|

|

Sempra

Energy, 5.750% (B)(C)

|

|

|

|

338,000

|

9,098,960

|

|

|

|

Sempra

Energy, 6.750%

|

|

|

|

28,400

|

2,940,536

|

|

Common

stocks 3.4% (2.3% of Total investments)

|

|

|

$16,500,663

|

|

(Cost

$27,444,514)

|

|

|

|

|

|

|

Communication

services 0.4%

|

|

|

|

1,833,500

|

|

Diversified

telecommunication services 0.4%

|

|

|

|

|

|

CenturyLink,

Inc. (B)(C)

|

|

|

|

190,000

|

1,833,500

|

|

Energy

3.0%

|

|

|

|

14,667,163

|

|

Oil,

gas and consumable fuels 3.0%

|

|

|

|

|

|

BP

PLC, ADR (B)(C)

|

|

|

|

172,500

|

3,801,900

|

|

Equitrans

Midstream Corp. (B)

|

|

|

|

442,012

|

4,265,416

|

|

The

Williams Companies, Inc. (B)(C)

|

|

|

|

345,000

|

6,599,847

|

|

|

|

|

Rate

(%)

|

Maturity

date

|

|

Par

value^

|

Value

|

|

Corporate

bonds 29.1% (19.7% of Total investments)

|

|

|

$140,398,841

|

|

(Cost

$148,255,827)

|

|

|

|

|

|

|

Communication

services 1.4%

|

|

|

|

6,756,435

|

|

Wireless

telecommunication services 1.4%

|

|

|

|

|

|

SoftBank

Group Corp. (6.875% to 7-19-27, then 5 Year ICE Swap Rate + 4.854%) (B)(G)

|

6.875

|

07-19-27

|

|

6,955,000

|

6,756,435

|

|

Consumer

discretionary 2.3%

|

|

|

|

11,258,779

|

|

Automobiles

2.3%

|

|

|

|

|

|

General

Motors Financial Company, Inc. (6.500% to 9-30-28, then 3 month LIBOR + 3.436%) (G)

|

6.500

|

09-30-28

|

|

11,922,000

|

11,258,779

|

|

Consumer

staples 0.2%

|

|

|

|

818,300

|

|

Food

products 0.2%

|

|

|

|

|

|

Land

O' Lakes, Inc. (D)(G)

|

8.000

|

07-16-25

|

|

835,000

|

818,300

|

|

Energy

4.6%

|

|

|

|

22,102,056

|

|

Oil,

gas and consumable fuels 4.6%

|

|

|

|

|

|

DCP

Midstream LP (7.375% to 12-15-22, then 3 month LIBOR + 5.148%) (G)

|

7.375

|

12-15-22

|

|

11,787,000

|

8,701,095

|

|

Energy

Transfer Operating LP (3 month LIBOR + 3.018%) (B)(E)

|

3.269

|

11-01-66

|

|

8,800,000

|

4,400,000

|

|

Energy

Transfer Operating LP (6.625% to 2-15-28, then 3 month LIBOR + 4.155%) (B)(C)(G)

|

6.625

|

02-15-28

|

|

8,000,000

|

5,760,000

|

|

MPLX

LP (6.875% to 2-15-23, then 3 month LIBOR + 4.652%) (G)

|

6.875

|

02-15-23

|

|

3,700,000

|

3,240,961

|

|

SEE NOTES TO FINANCIAL

STATEMENTS

|

ANNUAL REPORT | JOHN HANCOCK PREFERRED INCOME FUND

|

11

|

|

|

Rate

(%)

|

Maturity

date

|

|

Par

value^

|

Value

|

|

Financials

14.8%

|

|

|

|

$71,279,337

|

|

Banks

9.1%

|

|

|

|

|

|

Barclays

PLC (7.750% to 9-15-23, then 5 Year U.S. Swap Rate + 4.842%) (B)(G)

|

7.750

|

09-15-23

|

|

1,837,000

|

1,871,444

|

|

Barclays

PLC (8.000% to 6-15-24, then 5 Year CMT + 5.672%) (G)

|

8.000

|

06-15-24

|

|

3,226,000

|

3,415,528

|

|

Citigroup,

Inc. (6.125% to 11-15-20, then 3 month LIBOR + 4.478%) (G)

|

6.125

|

11-15-20

|

|

1,650,000

|

1,645,875

|

|

Citizens

Financial Group, Inc. (6.375% to 4-6-24, then 3 month LIBOR + 3.157%) (B)(G)

|

6.375

|

04-06-24

|

|

7,500,000

|

7,232,288

|

|

Comerica,

Inc. (5.625% to 7-1-25, then 5 Year CMT + 5.291%) (G)

|

5.625

|

07-01-25

|

|

3,500,000

|

3,737,300

|

|

Huntington

Bancshares, Inc. (5.625% to 7-15-30, then 10 Year CMT + 4.945%) (G)

|

5.625

|

07-15-30

|

|

2,000,000

|

2,207,460

|

|

JPMorgan

Chase & Co. (3 month LIBOR + 3.320%) (B)(C)(E)(G)

|

3.616

|

10-01-20

|

|

5,230,000

|

4,894,135

|

|

JPMorgan

Chase & Co. (6.750% to 2-1-24, then 3 month LIBOR + 3.780%) (B)(G)

|

6.750

|

02-01-24

|

|

6,000,000

|

6,649,980

|

|

Lloyds

Banking Group PLC (7.500% to 6-27-24, then 5 Year U.S. Swap Rate + 4.760%) (B)(G)

|

7.500

|

06-27-24

|

|

7,500,000

|

7,912,500

|

|

Regions

Financial Corp. (5.750% to 6-15-25, then 5 Year CMT + 5.430%) (G)

|

5.750

|

06-15-25

|

|

2,300,000

|

2,449,500

|

|

Wells

Fargo & Company (5.900% to 6-15-24, then 3 month LIBOR + 3.110%) (B)(G)

|

5.900

|

06-15-24

|

|

2,000,000

|

2,031,922

|

|

Capital

markets 1.5%

|

|

|

|

|

|

The

Bank of New York Mellon Corp. (4.700% to 9-20-25, then 5 Year CMT + 4.358%) (B)(G)

|

4.700

|

09-20-25

|

|

3,000,000

|

3,248,340

|

|

The

Charles Schwab Corp. (5.375% to 6-1-25, then 5 Year CMT + 4.971%) (B)(G)

|

5.375

|

06-01-25

|

|

3,800,000

|

4,161,000

|

|

Consumer

finance 1.0%

|

|

|

|

|

|

Discover

Financial Services (6.125% to 6-23-25, then 5 Year CMT + 5.783%) (G)

|

6.125

|

06-23-25

|

|

4,300,000

|

4,570,040

|

|

Insurance

3.2%

|

|

|

|

|

|

Markel

Corp. (6.000% to 6-1-25, then 5 Year CMT + 5.662%) (G)

|

6.000

|

06-01-25

|

|

2,500,000

|

2,628,125

|

|

MetLife,

Inc. (5.875% to 3-15-28, then 3 month LIBOR + 2.959%) (B)(C)(G)

|

5.875

|

03-15-28

|

|

5,000,000

|

5,475,000

|

|

SBL

Holdings, Inc. (7.000% to 5-13-25, then 5 Year CMT + 5.580%) (B)(D)(G)

|

7.000

|

05-13-25

|

|

8,536,000

|

7,148,900

|

|

Materials

0.6%

|

|

|

|

2,929,174

|

|

Chemicals

0.6%

|

|

|

|

|

|

Braskem

Netherlands Finance BV (8.500% to 10-24-25, then 5 Year CMT + 8.220%) (D)

|

8.500

|

01-23-81

|

|

2,900,000

|

2,929,174

|

|

12

|

JOHN HANCOCK PREFERRED

INCOME FUND | ANNUAL REPORT

|

SEE NOTES TO FINANCIAL

STATEMENTS

|

|

|

Rate

(%)

|

Maturity

date

|

|

Par

value^

|

Value

|

|

Utilities

5.2%

|

|

|

|

$25,254,760

|

|

Electric

utilities 2.8%

|

|

|

|

|

|

Emera,

Inc. (6.750% to 6-15-26, then 3 month LIBOR + 5.440%) (B)(C)

|

6.750

|

06-15-76

|

|

3,224,000

|

3,583,476

|

|

Southern

California Edison Company (6.250% to 2-1-22, then 3 month LIBOR + 4.199%) (B)(C)(G)

|

6.250

|

02-01-22

|

|

10,000,000

|

9,900,000

|

|

Multi-utilities

2.4%

|

|

|

|

|

|

CMS

Energy Corp. (4.750% to 3-1-30, then 5 Year CMT + 4.116%) (B)

|

4.750

|

06-01-50

|

|

4,250,000

|

4,537,917

|

|

Dominion

Energy, Inc. (5.750% to 10-1-24, then 3 month LIBOR + 3.057%) (B)(C)

|

5.750

|

10-01-54

|

|

5,000,000

|

5,283,367

|

|

|

|

NiSource,

Inc. (5.650% to 6-15-23, then 5 Year CMT + 2.843%) (B)(G)

|

5.650

|

06-15-23

|

|

2,000,000

|

1,950,000

|

|

Capital

preferred securities (H) 0.1% (0.1% of Total investments)

|

|

|

$580,033

|

|

(Cost

$588,281)

|

|

|

|

|

|

|

Financials

0.1%

|

|

|

|

580,033

|

|

Banks

0.1%

|

|

|

|

|

|

Wachovia

Capital Trust III (Greater of 3 month LIBOR + 0.930% or 5.570%) (B)(E)(G)

|

5.570

|

08-31-20

|

|

583,000

|

580,033

|

|

|

|

|

|

|

|

Par

value^

|

Value

|

|

Short-term

investments 0.2% (0.1% of Total investments)

|

|

|

$810,000

|

|

(Cost

$810,000)

|

|

|

|

|

|

|

Repurchase

agreement 0.2%

|

|

|

|

|

810,000

|

|

Repurchase

Agreement with State Street Corp. dated 7-31-20 at 0.000% to be repurchased at $810,000 on 8-3-20, collateralized by $796,300 U.S. Treasury Notes, 1.625% due 11-15-22 (valued at $826,225)

|

|

|

|

810,000

|

810,000

|

|

|

|

Total

investments (Cost $744,843,642) 147.6%

|

|

|

|

$712,405,996

|

|

Other

assets and liabilities, net (47.6%)

|

|

|

|

(229,737,177)

|

|

Total

net assets 100.0%

|

|

|

|

|

$482,668,819

|

|

The percentage shown

for each investment category is the total value of the category as a percentage of the net assets of the fund unless otherwise indicated.

|

|

^All

par values are denominated in U.S. dollars unless otherwise indicated.

|

|

Security

Abbreviations and Legend

|

|

ADR

|

American

Depositary Receipt

|

|

CMT

|

Constant

Maturity Treasury

|

|

ICE

|

Intercontinental

Exchange

|

|

LIBOR

|

London

Interbank Offered Rate

|

|

(A)

|

Includes

preferred stocks and hybrid securities with characteristics of both equity and debt that pay dividends on a periodic basis.

|

|

(B)

|

All of a

portion of this security is pledged as collateral pursuant to the Credit Facility Agreement. Total collateral value at 7-31-20 was $479,081,336. A portion of the securities pledged as collateral were loaned pursuant to the Credit Facility Agreement.

The value of securities on loan amounted to $196,347,691.

|

|

SEE NOTES TO FINANCIAL

STATEMENTS

|

ANNUAL REPORT | JOHN HANCOCK PREFERRED INCOME FUND

|

13

|

|

(C)

|

All or a portion of this

security is on loan as of 7-31-20, and is a component of the fund's leverage under the Credit Facility Agreement.

|

|

(D)

|

These

securities are exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be resold, normally to qualified institutional buyers, in transactions exempt from registration.

|

|

(E)

|

Variable

rate obligation. The coupon rate shown represents the rate at period end.

|

|

(F)

|

Non-income

producing security.

|

|

(G)

|

Perpetual

bonds have no stated maturity date. Date shown as maturity date is next call date.

|

|

(H)

|

Includes

hybrid securities with characteristics of both equity and debt that trade with, and pay, interest income.

|

|

14

|

JOHN HANCOCK PREFERRED

INCOME FUND | ANNUAL REPORT

|

SEE NOTES TO FINANCIAL

STATEMENTS

|

DERIVATIVES

FUTURES

|

Open

contracts

|

Number

of

contracts

|

Position

|

Expiration

date

|

Notional

basis^

|

Notional

value^

|

Unrealized

appreciation

(depreciation)

|

|

10-Year

U.S. Treasury Note Futures

|

640

|

Short

|

Sep

2020

|

$(88,883,635)

|

$(89,650,000)

|

$(766,365)

|

|

|

|

|

|

|

|

$(766,365)

|

^ Notional basis refers to the

contractual amount agreed upon at inception of open contracts; notional value represents the current value of the open contract.

SWAPS

|

Interest

rate swaps

|

Counterparty

(OTC)/

Centrally cleared

|

Notional

amount

|

Currency

|

Payments

made

|

Payments

received

|

Fixed

payment

frequency

|

Floating

payment

frequency

|

Maturity

date

|

Unamortized

upfront

payment paid

(received)

|

Unrealized

appreciation

(depreciation)

|

Value

|

|

Centrally

cleared

|

73,000,000

|

USD

|

Fixed

2.136%

|

USD

3 month LIBOR BBA(a)

|

Semi-Annual

|

Quarterly

|

Oct

2022

|

—

|

$(3,600,598)

|

$(3,600,598)

|

|

|

|

|

|

|

|

|

|

—

|

$(3,600,598)

|

$(3,600,598)

|

|

(a)

|

At 7-31-20, the 3 month LIBOR

was 0.249%.

|

|

Derivatives

Currency Abbreviations

|

|

USD

|

U.S.

Dollar

|

|

Derivatives

Abbreviations

|

|

BBA

|

The

British Banker's Association

|

|

LIBOR

|

London

Interbank Offered Rate

|

|

OTC

|

Over-the-counter

|

At 7-31-20, the aggregate cost of

investments for federal income tax purposes was $744,203,083. Net unrealized depreciation aggregated to $36,164,050, of which $19,167,005 related to gross unrealized appreciation and $55,331,055 related to gross unrealized depreciation.

See Notes to financial statements regarding investment

transactions and other derivatives information.

|

SEE NOTES TO FINANCIAL

STATEMENTS

|

ANNUAL REPORT | JOHN HANCOCK PREFERRED INCOME FUND

|

15

|

STATEMENT OF ASSETS AND LIABILITIES 7-31-20

|

Assets

|

|

|

Unaffiliated

investments, at value (Cost $744,843,642)

|

$712,405,996

|

|

Receivable

for centrally cleared swaps

|

773,559

|

|

Collateral

held at broker for futures contracts

|

1,280,000

|

|

Dividends

and interest receivable

|

3,253,942

|

|

Receivable

for investments sold

|

1,123,364

|

|

Other

assets

|

43,050

|

|

Total

assets

|

718,879,911

|

|

Liabilities

|

|

|

Payable

for futures variation margin

|

40,032

|

|

Due

to custodian

|

357,417

|

|

Credit

facility agreement payable

|

235,500,000

|

|

Interest

payable

|

176,904

|

|

Payable

to affiliates

|

|

|

Accounting

and legal services fees

|

21,915

|

|

Trustees'

fees

|

141

|

|

Other

liabilities and accrued expenses

|

114,683

|

|

Total

liabilities

|

236,211,092

|

|

Net

assets

|

$482,668,819

|

|

Net

assets consist of

|

|

|

Paid-in

capital

|

$546,096,628

|

|

Total

distributable earnings (loss)

|

(63,427,809)

|

|

Net

assets

|

$482,668,819

|

|

|

|

Net

asset value per share

|

|

|

Based

on 26,192,030 shares of beneficial interest outstanding - unlimited number of shares authorized with no par value

|

$18.43

|

|

16

|

JOHN HANCOCK PREFERRED

INCOME FUND | ANNUAL REPORT

|

SEE NOTES TO FINANCIAL

STATEMENTS

|

STATEMENT OF OPERATIONS For

the year ended 7-31-20

|

Investment

income

|

|

|

Dividends

|

$39,729,539

|

|

Interest

|

8,941,468

|

|

Total

investment income

|

48,671,007

|

|

Expenses

|

|

|

Investment

management fees

|

5,911,847

|

|

Interest

expense

|

5,595,487

|

|

Accounting

and legal services fees

|

81,600

|

|

Transfer

agent fees

|

27,604

|

|

Trustees'

fees

|

40,809

|

|

Custodian

fees

|

74,601

|

|

Printing

and postage

|

144,025

|

|

Professional

fees

|

65,925

|

|

Stock

exchange listing fees

|

25,573

|

|

Other

|

24,886

|

|

Total

expenses

|

11,992,357

|

|

Less

expense reductions

|

(56,216)

|

|

Net

expenses

|

11,936,141

|

|

Net

investment income

|

36,734,866

|

|

Realized

and unrealized gain (loss)

|

|

|

Net

realized gain (loss) on

|

|

|

Unaffiliated

investments

|

(10,967,996)

|

|

Futures

contracts

|

(8,538,819)

|

|

Swap

contracts

|

(263,764)

|

|

|

(19,770,579)

|

|

Change

in net unrealized appreciation (depreciation) of

|

|

|

Unaffiliated

investments

|

(53,477,151)

|

|

Futures

contracts

|

650,016

|

|

Swap

contracts

|

(2,516,190)

|

|

|

(55,343,325)

|

|

Net

realized and unrealized loss

|

(75,113,904)

|

|

Decrease

in net assets from operations

|

$(38,379,038)

|

|

SEE NOTES TO FINANCIAL

STATEMENTS

|

ANNUAL REPORT | JOHN HANCOCK PREFERRED INCOME FUND

|

17

|

STATEMENTS OF CHANGES IN NET ASSETS

|

|

Year

ended

7-31-20

|

Year

ended

7-31-19

|

|

Increase

(decrease) in net assets

|

|

|

|

From

operations

|

|

|

|

Net

investment income

|

$36,734,866

|

$34,842,691

|

|

Net

realized loss

|

(19,770,579)

|

(4,911,293)

|

|

Change

in net unrealized appreciation (depreciation)

|

(55,343,325)

|

14,262,649

|

|

Increase

(decrease) in net assets resulting from operations

|

(38,379,038)

|

44,194,047

|

|

Distributions

to shareholders

|

|

|

|

From

earnings

|

(37,561,339)

|

(36,386,401)

|

|

From

tax return of capital

|

(2,007,312)

|

(7,360,791)

|

|

Total

distributions

|

(39,568,651)

|

(43,747,192)

|

|

Fund

share transactions

|

|

|

|

Issued

pursuant to Dividend Reinvestment Plan

|

2,381,995

|

1,068,633

|

|

Total

increase (decrease)

|

(75,565,694)

|

1,515,488

|

|

Net

assets

|

|

|

|

Beginning

of year

|

558,234,513

|

556,719,025

|

|

End

of year

|

$482,668,819

|

$558,234,513

|

|

Share

activity

|

|

|

|

Shares

outstanding

|

|

|

|

Beginning

of year

|

26,070,792

|

26,020,486

|

|

Issued

pursuant to Dividend Reinvestment Plan

|

121,238

|

50,306

|

|

End

of year

|

26,192,030

|

26,070,792

|

|

18

|

JOHN HANCOCK PREFERRED

INCOME FUND | ANNUAL REPORT

|

SEE NOTES TO FINANCIAL

STATEMENTS

|

STATEMENT OF CASH FLOWS For

the year ended 7-31-20

|

|

|

|

Cash

flows from operating activities

|

|

|

Net

decrease in net assets from operations

|

$(38,379,038)

|

|

Adjustments

to reconcile net decrease in net assets from operations to net cash provided by operating activities:

|

|

|

Long-term

investments purchased

|

(269,055,015)

|

|

Long-term

investments sold

|

337,989,987

|

|

Net

purchases and sales in short-term investments

|

(330,046)

|

|

Net

amortization of premium (discount)

|

507,857

|

|

(Increase)

Decrease in assets:

|

|

|

Receivable

for centrally cleared swaps

|

(94,785)

|

|

Collateral

held at broker for futures contracts

|

(533,000)

|

|

Dividends

and interest receivable

|

92,543

|

|

Receivable

for investments sold

|

2,790,057

|

|

Other

assets

|

8,889

|

|

Increase

(Decrease) in liabilities:

|

|

|

Payable

for futures variation margin

|

(9,955)

|

|

Payable

for investments purchased

|

(3,890,589)

|

|

Interest

payable

|

(579,810)

|

|

Payable

to affiliates

|

(46,741)

|

|

Other

liabilities and accrued expenses

|

(13,117)

|

|

Net

change in unrealized (appreciation) depreciation on:

|

|

|

Investments

|

53,477,151

|

|

Net

realized (gain) loss on:

|

|

|

Investments

|

10,967,996

|

|

Proceeds

received as return of capital

|

807,981

|

|

Net

cash provided by operating activities

|

$93,710,365

|

|

Cash

flows provided by (used in) financing activities

|

|

|

Distributions

to shareholders

|

$(37,186,656)

|

|

Increase

in due to custodian

|

357,417

|

|

Borrowings

(repayments) under the credit facility agreement

|

(57,000,000)

|

|

Net

cash used in financing activities

|

$(93,829,239)

|

|

Net

decrease in cash

|

$(118,874)

|

|

Cash

at beginning of year

|

$118,874

|

|

Cash

at end of year

|

—

|

|

Supplemental

disclosure of cash flow information:

|

|

|

Cash

paid for interest

|

$(6,175,297)

|

|

Noncash

financing activities not included herein consists of reinvestment distributions

|

$2,381,995

|

|

SEE NOTES TO FINANCIAL

STATEMENTS

|

ANNUAL REPORT | JOHN HANCOCK PREFERRED INCOME FUND

|

19

|

|

Period

ended

|

7-31-20

|

7-31-19

|

7-31-18

|

7-31-17

|

7-31-16

|

|

Per

share operating performance

|

|

|

|

|

|

|

Net

asset value, beginning of period

|

$21.41

|

$21.40

|

$22.15

|

$22.82

|

$21.75

|

|

Net

investment income1

|

1.41

|

1.34

|

1.51

|

1.61

|

1.60

|

|

Net

realized and unrealized gain (loss) on investments

|

(2.87)

|

0.35

|

(0.58)

|

(0.60)

|

1.15

|

|

Total

from investment operations

|

(1.46)

|

1.69

|

0.93

|

1.01

|

2.75

|

|

Less

distributions

|

|

|

|

|

|

|

From

net investment income

|

(1.44)

|

(1.40)

|

(1.68)

|

(1.68)

|

(1.55)

|

|

From

tax return of capital

|

(0.08)

|

(0.28)

|

—

|

—

|

(0.13)

|

|

Total

distributions

|

(1.52)

|

(1.68)

|

(1.68)

|

(1.68)

|

(1.68)

|

|

Net

asset value, end of period

|

$18.43

|

$21.41

|

$21.40

|

$22.15

|

$22.82

|

|

Per

share market value, end of period

|

$20.80

|

$24.30

|

$21.95

|

$22.29

|

$23.22

|

|

Total

return at net asset value (%)2,3

|

(7.14)

|

8.35

|

4.61

|

4.94

|

13.66

|

|

Total

return at market value (%)2

|

(7.67)

|

19.90

|

6.62

|

3.78

|

27.30

|

|

Ratios

and supplemental data

|

|

|

|

|

|

|

Net

assets, end of period (in millions)

|

$483

|

$558

|

$557

|

$576

|

$593

|

|

Ratios

(as a percentage of average net assets):

|

|

|

|

|

|

|

Expenses

before reductions

|

2.32

|

2.95

|

2.49

|

2.05

|

1.79

|

|

Expenses

including reductions4

|

2.31

|

2.94

|

2.48

|

2.04

|

1.78

|

|

Net

investment income

|

7.12

|

6.49

|

7.10

|

7.40

|

7.33

|

|

Portfolio

turnover (%)

|

35

|

37

|

24

|

20

|

14

|

|

Senior

securities

|

|

|

|

|

|

|

Total

debt outstanding end of period (in millions)

|

$236

|

$293

|

$293

|

$293

|

$293

|

|

Asset

coverage per $1,000 of debt5

|

$3,050

|

$2,908

|

$2,903

|

$2,970

|

$3,027

|

|

1

|

Based

on average daily shares outstanding.

|

|

2

|

Total

return based on net asset value reflects changes in the fund’s net asset value during each period. Total return based on market value reflects changes in market value. Each figure assumes that distributions from income, capital gains and tax

return of capital, if any, were reinvested.

|

|

3

|

Total

returns would have been lower had certain expenses not been reduced during the applicable periods.

|

|

4

|

Expenses

including reductions excluding interest expense were 1.24%, 1.25%, 1.24%, 1.25% and 1.23% for the periods ended 7-31-20, 7-31-19, 7-31-18, 7-31-17 and 7-31-16, respectively.

|

|

5

|

Asset

coverage equals the total net assets plus borrowings divided by the borrowings of the fund outstanding at period end (Note 7). As debt outstanding changes, the level of invested assets may change accordingly. Asset coverage ratio provides a measure

of leverage.

|

|

20

|

JOHN HANCOCK PREFERRED

INCOME FUND | ANNUAL REPORT

|

SEE NOTES TO FINANCIAL

STATEMENTS

|

Notes to financial statements

Note 1—Organization

John Hancock Preferred Income Fund (the fund) is a closed-end

management investment company organized as a Massachusetts business trust and registered under the Investment Company Act of 1940, as amended (the 1940 Act).

Note 2—Significant accounting policies

The financial statements have been prepared in conformity with

accounting principles generally accepted in the United States of America (US GAAP), which require management to make certain estimates and assumptions as of the date of the financial statements. Actual results could differ from those estimates and

those differences could be significant. The fund qualifies as an investment company under Topic 946 of Accounting Standards Codification of US GAAP.

Events or transactions occurring after the end of the fiscal

period through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the fund:

Security valuation. Investments

are stated at value as of the scheduled close of regular trading on the New York Stock Exchange (NYSE), normally at 4:00 P.M., Eastern Time. In case of emergency or other disruption resulting in the NYSE not opening for trading or the NYSE closing

at a time other than the regularly scheduled close, the net asset value (NAV) may be determined as of the regularly scheduled close of the NYSE pursuant to the fund's Valuation Policies and Procedures.

In order to value the securities, the fund uses the following

valuation techniques: Equity securities, including exchange-traded or closed-end funds, are typically valued at the last sale price or official closing price on the exchange or principal market where the security trades. In the event there were no

sales during the day or closing prices are not available, the securities are valued using the last available bid price. Debt obligations are typically valued based on evaluated prices provided by an independent pricing vendor. Independent pricing

vendors utilize matrix pricing, which takes into account factors such as institutional-size trading in similar groups of securities, yield, quality, coupon rate, maturity, type of issue, trading characteristics and other market data, as well as

broker supplied prices. Futures contracts are typically valued at the last traded price on the exchange on which they trade. Swaps are generally valued using evaluated prices obtained from an independent pricing vendor.

In certain instances, the Pricing Committee may determine to

value equity securities using prices obtained from another exchange or market if trading on the exchange or market on which prices are typically obtained did not open for trading as scheduled, or if trading closed earlier than scheduled, and trading

occurred as normal on another exchange or market.

Other

portfolio securities and assets, for which reliable market quotations are not readily available, are valued at fair value as determined in good faith by the fund's Pricing Committee following procedures established by the Board of Trustees. The

frequency with which these fair valuation procedures are used cannot be predicted and fair value of securities may differ significantly from the value that would have been used had a ready market for such securities existed.

The fund uses a three-tier hierarchy to prioritize the pricing

assumptions, referred to as inputs, used in valuation techniques to measure fair value. Level 1 includes securities valued using quoted prices in active markets for identical securities, including registered investment companies. Level 2 includes

securities valued using other significant observable inputs. Observable inputs may include quoted prices for similar securities, interest rates, prepayment speeds and credit risk. Prices for securities valued using these inputs are received from

independent pricing vendors and brokers and are based on an evaluation of the inputs described. Level 3 includes securities valued using significant unobservable inputs when market prices are not readily available or reliable, including the fund's

own assumptions in determining the fair value of investments. Factors used in determining value may include market or issuer specific events or trends, changes in interest rates and credit quality. The inputs or

|

|

ANNUAL REPORT | JOHN HANCOCK PREFERRED INCOME FUND

|

21

|

methodology used for valuing securities are not necessarily an

indication of the risks associated with investing in those securities. Changes in valuation techniques and related inputs may result in transfers into or out of an assigned level within the disclosure hierarchy.

The following is a summary of the values by input

classification of the fund's investments as of July 31, 2020, by major security category or type:

|

|

Total

value at

7-31-20

|

Level

1

quoted

price

|

Level

2

significant

observable

inputs

|

Level

3

significant

unobservable

inputs

|

|

Investments

in securities:

|

|

|

|

|

|

Assets

|

|

|

|

|

|

Preferred

securities

|

|

|

|

|

|

Communication

services

|

$54,705,519

|

$54,705,519

|

—

|

—

|

|

Consumer

discretionary

|

1,837,080

|

1,837,080

|

—

|

—

|

|

Consumer

staples

|

11,726,000

|

—

|

$11,726,000

|

—

|

|

Energy

|

8,954,900

|

8,954,900

|

—

|

—

|

|

Financials

|

196,006,278

|

196,006,278

|

—

|

—

|

|

Information

technology

|

10,838,645

|

10,838,645

|

—

|

—

|

|

Real

estate

|

21,866,775

|

21,866,775

|

—

|

—

|

|

Utilities

|

248,181,262

|

241,252,854

|

6,928,408

|

—

|

|

Common

stocks

|

16,500,663

|

16,500,663

|

—

|

—

|

|

Corporate

bonds

|

140,398,841

|

—

|

140,398,841

|

—

|

|

Capital

preferred securities

|

580,033

|

—

|

580,033

|

—

|

|

Short-term

investments

|

810,000

|

—

|

810,000

|

—

|

|

Total

investments in securities

|

$712,405,996

|

$551,962,714

|

$160,443,282

|

—

|

|

Derivatives:

|

|

|

|

|

|

Liabilities

|

|

|

|

|

|

Futures

|

$(766,365)

|

$(766,365)

|

—

|

—

|

|

Swap

contracts

|

(3,600,598)

|

—

|

$(3,600,598)

|

—

|

Repurchase agreements. The fund may enter into repurchase agreements. When the fund enters into a repurchase agreement, it receives collateral that is held in a segregated account by the fund's custodian, or for tri-party repurchase

agreements, collateral is held at a third-party custodian bank in a segregated account for the benefit of the fund. The collateral amount is marked-to-market and monitored on a daily basis to ensure that the collateral held is in an amount not less

than the principal amount of the repurchase agreement plus any accrued interest. Collateral received by the fund for repurchase agreements is disclosed in the Fund's investments as part of the caption related to the repurchase

agreement.

Repurchase agreements are typically

governed by the terms and conditions of the Master Repurchase Agreement and/or Global Master Repurchase Agreement (collectively, MRA). Upon an event of default, the non-defaulting party may close out all transactions traded under the MRA and net

amounts owed. Absent an event of default, assets and liabilities resulting from repurchase agreements are not offset in the Statement of assets and liabilities. In the event of a default by the counterparty, realization of the collateral proceeds

could be delayed, during which time the collateral value may decline or the counterparty may have insufficient assets to pay claims resulting from close-out of the transactions.

|

22

|

JOHN HANCOCK PREFERRED

INCOME FUND | ANNUAL REPORT

|

|

Real estate investment trusts.

The fund may invest in real estate investment trusts (REITs). Distributions from REITs may be recorded as income and subsequently characterized by the REIT at the end of the fiscal year as a reduction of cost of investments and/or as a realized

gain. As a result, the fund will estimate the components of distributions from these securities. Such estimates are revised when the actual components of the distributions are known.

Security transactions and related investment income. Investment security transactions are accounted for on a trade date plus one basis for daily NAV calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest

income is accrued as earned. Interest income includes coupon interest and amortization/accretion of premiums/discounts on debt securities. Debt obligations may be placed in a non-accrual status and related interest income may be reduced by stopping

current accruals and writing off interest receivable when the collection of all or a portion of interest has become doubtful. Dividend income is recorded on the ex-date, except for dividends of certain foreign securities where the dividend may not

be known until after the ex-date. In those cases, dividend income, net of withholding taxes, is recorded when the fund becomes aware of the dividends. Non-cash dividends, if any, are recorded at the fair market value of the securities received.

Distributions received on securities that represent a tax return of capital and/or capital gain, if any, are recorded as a reduction of cost of investments and/or as a realized gain, if amounts are estimable. Gains and losses on securities sold are

determined on the basis of identified cost and may include proceeds from litigation.

Overdrafts. Pursuant to the

custodian agreement, the fund’s custodian may, in its discretion, advance funds to the fund to make properly authorized payments. When such payments result in an overdraft, the fund is obligated to repay the custodian for any overdraft,

including any costs or expenses associated with the overdraft. The custodian may have a lien, security interest or security entitlement in any fund property that is not otherwise segregated or pledged, to the maximum extent permitted by law, to the

extent of any overdraft.