- 17% orders growth (14% organic) driven by pump project awards,

rail share gains and connectors demand

- 8% revenue growth (6% organic) driven by strength across all

segments

- 610 basis points operating margin expansion to 23.5%, including

$48 million preliminary gain on divestiture of Wolverine Advanced

Materials (Wolverine); 60 basis points adjusted operating margin

expansion to 18.3%

- 46% EPS growth primarily driven by the gain on the Wolverine

divestiture; 7% adjusted EPS growth driven by pricing actions,

volume and productivity

- Raising midpoint of full year EPS guidance given continued

outperformance

Oct. 29, 2024-- ITT Inc. (NYSE: ITT) today reported financial

results for the third quarter ended September 28, 2024. Revenue

increased 8% versus prior year (6% organic) primarily driven by

Friction and rail share gains in Motion Technologies (MT), short

cycle demand in Industrial Process (IP) and connectors growth in

Connect & Control Technologies (CCT). The Svanehøj and kSARIA

acquisitions contributed 7% to total revenue growth, while the

divestiture of Wolverine had a (4%) impact.

Third quarter operating income of $208 million increased 45%

versus prior year primarily due to the $48 million preliminary gain

on the divestiture of Wolverine in July. On an adjusted basis,

operating income increased 11% due to higher sales volume, pricing

actions and productivity, partially offset by higher material and

labor costs, temporary acquisition amortization and unfavorable

foreign currency impacts.

EPS for the third quarter of $1.96 increased 46% versus prior

year primarily due to the previously mentioned gain on sale.

Adjusted EPS of $1.46 increased 7% compared to prior year primarily

driven by higher operating income and partially offset by higher

interest expense due to acquisitions.

Net cash from operating activities for the third quarter of $124

million decreased 27% versus prior year primarily driven by higher

working capital, partially offset by higher operating income. Free

cash flow for the quarter of $87 million decreased 41% versus prior

year. On a year-to-date basis, operating cash flow is down $(28)

million and free cash flow is down $(47) million due to higher

working capital, higher interest payments and capital expenditures,

partially offset by higher segment operating income.

Table 1. Third Quarter Performance

Q3

2024

Q3

2023

Change

Revenue

$

885.2

$

822.1

7.7

%

Organic Growth

5.5

%

Operating Income

$

207.9

$

143.1

45.3

%

Operating Margin

23.5

%

17.4

%

610

bps

Adjusted Operating Income

$

161.6

$

145.5

11.1

%

Adjusted Operating Margin

18.3

%

17.7

%

60

bps

Earnings Per Share

$

1.96

$

1.34

46.3

%

Adjusted Earnings Per Share

$

1.46

$

1.37

6.6

%

Net Cash from Operating Activities

$

123.9

$

169.8

(27.0)

%

Free Cash Flow

$

87.3

$

147.6

(40.9)

%

Note: all results unaudited; dollars in millions except for per

share amounts

Management Commentary

“Our third quarter results demonstrate the strength of the ITT

businesses and of our people. Our teams once again outperformed

with strong profitable growth and continued margin expansion. This

quarter, once again, all of our businesses contributed: growth in

our short-cycle flow business was robust, Friction continued to

outperform, we took further share in rail and drove over twenty

percent growth in industrial connectors. Furthermore, our legacy

business surpassed our long-term margin target for the second

consecutive quarter. On top of this, we also deployed more than $1

billion of capital year to date.

As a result of our strong performance thus far, we are raising

the midpoint of our full year EPS outlook. Excluding the temporary

acquisition amortization, we are driving to over $6 of earnings in

2024 on the strength of our execution and outperformance. This

organic value creation should continue with mid-teens orders growth

this quarter, leading to a record ending backlog of $1.7 billion.

Our growing backlog and ramping contributions from acquisitions

give us a strong foundation for long term growth, whilst we keep on

building a robust M&A pipeline with higher growth and higher

margin businesses,” said ITT’s Chief Executive Officer and

President Luca Savi.

Table 2. Third Quarter Segment Results

Revenue

Operating Income

Operating Margin

Q3 2024

Reported Change

Organic Growth

Q3 2024

Reported Change

Adjusted Change

Q3 2024

Reported Change

Adjusted Change

Motion Technologies

344.9

(4.1)%

4.7%

110.0

85.2%

2.1%

31.9%

1,540 bps

110 bps

Industrial Process

333.8

19.3%

6.1%

69.8

7.9%

7.1%

20.9%

(220) bps

(240) bps

Connect & Control Technologies

207.2

12.6%

5.7%

38.1

14.8%

17.9%

18.4%

40 bps

90 bps

Note: all results unaudited; excludes

intercompany eliminations of $0.7; comparisons to Q3 2023

Motion Technologies revenue decreased $15 million primarily due

to the Wolverine divestiture in July 2024, partially offset by

higher sales volume from Friction and rail demand in KONI.

Operating income increased $51 million primarily due to the $48

million gain on sale, productivity actions and lower material and

overhead costs, partially offset by foreign currency impact and

higher labor costs.

Industrial Process revenue increased $54 million primarily due

to the acquisition of Svanehøj, which closed in January 2024, and

growth in baseline pumps, valves and aftermarket parts and service.

Operating income increased by approximately $5 million primarily

due to productivity actions, higher sales volume and pricing,

partially offset by higher material, labor and overhead costs,

foreign currency and Svanehøj temporary acquisition

amortization.

Connect & Control Technologies revenue increased $23 million

primarily driven by the acquisition of kSARIA, which closed in

September 2024, pricing actions and growth in defense and

industrial connectors. Operating income increased $5 million

primarily due to pricing, productivity actions and contributions

from kSARIA, partially offset by higher material, labor and

overhead costs.

Quarterly Dividend

The company announced today a quarterly dividend of $0.319 per

share on its outstanding common stock. ITT’s Board of Directors

approved the cash dividend for the fourth quarter of 2024, which

will be payable on Tuesday, Dec. 31, to shareholders of record as

of the close of business on Friday, Nov. 29.

2024 Guidance

The company is raising its full-year revenue and operating

margin guidance above the previous midpoint, while also raising the

midpoint of its adjusted EPS outlook despite the incremental

interest expense and purchase price amortization from the kSARIA

acquisition. We now expect revenue growth of 10% to 12%, up 5% to

7% on an organic basis; operating margin of 18.4% to 18.7% and

adjusted operating margin of 17.4% to 17.7%, up 50 to 80 bps (up

130 to 160 bps excluding acquisition dilution); full year EPS of

$6.16 to $6.22 and adjusted EPS of $5.80 to $5.86, up 11% to 12%

for the full year. We now expect free cash flow of ~$450 million,

representing ~12% free cash flow margin for the full year.

It is not possible, without unreasonable efforts, to estimate

the impacts of foreign currency fluctuations, acquisitions and

certain other special items that may occur in 2024 as these items

are inherently uncertain and difficult to predict. As a result, we

are unable to quantify certain amounts that would be included in a

reconciliation of organic revenue growth and adjusted segment

operating margin to the most directly comparable GAAP financial

measures without unreasonable efforts and accordingly we have not

provided reconciliations for these forward-looking non-GAAP

financial measures.

Investor Conference Call Details

ITT’s management will host a conference call for investors on

Tuesday, Oct. 29 at 8:30 a.m. Eastern Time. The briefing can be

accessed live via a webcast, which is available on the company’s

website: https://investors.itt.com. A replay of the webcast will be

available beginning two hours after the webcast. Reconciliations of

non-GAAP financial performance metrics to their most comparable

U.S. GAAP financial performance metrics are defined and presented

below and should not be considered a substitute for, nor superior

to, the financial data prepared in accordance with U.S. GAAP.

Safe Harbor Statement

This release contains “forward-looking statements” intended to

qualify for the safe harbor from liability established by the

Private Securities Litigation Reform Act of 1995. In addition, the

conference call (including the financial results presentation

material) may include, and officers and representatives of ITT may

from time to time make and discuss, projections, goals,

assumptions, and statements that may constitute “forward-looking

statements”. These forward-looking statements are not historical

facts, but rather represent only a belief regarding future events

based on current expectations, estimates, assumptions and

projections about our business, future financial results and the

industry in which we operate, and other legal, regulatory, and

economic developments. These forward-looking statements include,

but are not limited to, future strategic plans and other statements

that describe the company’s business strategy, outlook, objectives,

plans, intentions or goals, and any discussion of future events and

future operating or financial performance.

We use words such as “anticipate,” “believe,” “continue,”

“could,” “estimate,” “expect,” “future,” “guidance,” “project,”

“intend,” “may,” “plan,” “potential,” “project,” “should,”

“target,” “will,” and other similar expressions to identify such

forward-looking statements. Forward-looking statements are

uncertain and, by their nature, many are inherently unpredictable

and outside of ITT’s control, and involve known and unknown risks,

uncertainties and other important factors that could cause actual

results to differ materially from those expressed or implied in, or

reasonably inferred from, such forward-looking statements.

Where in any forward-looking statement we express an expectation

or belief as to future results or events, such expectation or

belief is based on current plans and expectations of our

management, expressed in good faith and believed to have a

reasonable basis. However, we cannot provide any assurance that the

expectation or belief will occur or that anticipated results will

be achieved or accomplished.

Among the factors that could cause our results to differ

materially from those indicated by forward-looking statements are

risks and uncertainties inherent in our business including, without

limitation:

- uncertain global economic and capital markets conditions, which

have been influenced by heightened geopolitical tensions,

inflation, changes in monetary policies, the threat of a possible

regional or global economic recession, trade disputes between the

U.S. and its trading partners, political and social unrest, and the

availability and fluctuations in prices of energy and commodities,

including steel, oil, copper and tin;

- fluctuations in interest rates and the impact of such

fluctuations on customer behavior and on our cost of debt;

- fluctuations in foreign currency exchange rates and the impact

of such fluctuations on our revenues, customer demand for our

products and on our hedging arrangements;

- volatility in raw material prices and our suppliers’ ability to

meet quality and delivery requirements;

- impacts and risk of liabilities from recent mergers,

acquisitions, or venture investments, and past divestitures and

spin-offs;

- our inability to hire or retain key personnel;

- failure to compete successfully and innovate in our

markets;

- failure to manage the distribution of products and services

effectively;

- failure to protect our intellectual property rights or

violations of the intellectual property rights of others;

- the extent to which there are quality problems with respect to

manufacturing processes or finished goods;

- the risk of cybersecurity breaches or failure of any

information systems used by the Company, including any flaws in the

implementation of any enterprise resource planning systems;

- loss of or decrease in sales from our most significant

customers;

- risks due to our operations and sales outside the U.S. and in

emerging markets, including the imposition of tariffs and trade

sanctions;

- fluctuations in demand or customers’ levels of capital

investment, maintenance expenditures, production, and market

cyclicality;

- the risk of material business interruptions, particularly at

our manufacturing facilities;

- risks related to government contracting, including changes in

levels of government spending and regulatory and contractual

requirements applicable to sales to the U.S. government;

- fluctuations in our effective tax rate, including as a result

of changing tax laws and other possible tax reform legislation in

the U.S. and other jurisdictions;

- changes in environmental laws or regulations, discovery of

previously unknown or more extensive contamination, or the failure

of a potentially responsible party to perform;

- failure to comply with the U.S. Foreign Corrupt Practices Act

(or other applicable anti-corruption legislation), export controls

and trade sanctions; and

- risk of product liability claims and litigation.

More information on factors that could cause actual results or

events to differ materially from those anticipated is included in

our Annual Report on Form 10-K for the year ended December 31, 2023

(particularly under the caption "Risk Factors"), our Quarterly

Reports on Form 10-Q and in other documents we file from time to

time with the SEC.

The forward-looking statements included in this release speak

only as of the date hereof. We undertake no obligation (and

expressly disclaim any obligation) to update any forward-looking

statements, whether written or oral or as a result of new

information, future events or otherwise.

CONSOLIDATED CONDENSED STATEMENTS OF

OPERATIONS (UNAUDITED)

(IN MILLIONS, EXCEPT PER SHARE

AMOUNTS)

Three Months Ended

Nine Months Ended

September 28,

2024

September 30,

2023

September 28,

2024

September 30,

2023

Revenue

$

885.2

$

822.1

$

2,701.7

$

2,453.9

Cost of revenue

571.2

542.7

1,770.8

1,632.6

Gross profit

314.0

279.4

930.9

821.3

General and administrative expenses

74.8

66.9

223.1

210.8

Sales and marketing expenses

50.5

44.4

151.2

131.2

Research and development expenses

28.6

25.0

88.3

77.1

Gain on sale of businesses

(47.8

)

—

(47.8

)

(7.2

)

Operating income

207.9

143.1

516.1

409.4

Interest expense

10.0

4.2

25.1

15.4

Interest income

(1.6

)

(1.9

)

(5.0

)

(6.5

)

Other non-operating income, net

(0.2

)

(0.9

)

(1.9

)

(1.5

)

Income before income tax expense

199.7

141.7

497.9

402.0

Income tax expense

37.8

29.9

103.6

80.6

Income from continuing operations

161.9

111.8

394.3

321.4

Loss from discontinued operations, net of

income tax

(0.2

)

—

(0.2

)

—

Net income

161.7

111.8

394.1

321.4

Less: Income attributable to

noncontrolling interests

0.6

1.0

2.8

2.4

Net income attributable to ITT Inc.

$

161.1

$

110.8

$

391.3

$

319.0

Amounts attributable to ITT

Inc.:

Income from continuing operations

$

161.3

$

110.8

$

391.5

$

319.0

Loss from discontinued operations, net of

tax

(0.2

)

—

(0.2

)

—

Net income attributable to ITT Inc.

$

161.1

$

110.8

$

391.3

$

319.0

Earnings per share attributable to ITT

Inc.:

Basic:

Continuing operations

$

1.98

$

1.35

$

4.78

$

3.87

Discontinued operations

(0.01

)

—

—

—

Net income

$

1.97

$

1.35

$

4.78

$

3.87

Diluted:

Continuing operations

$

1.96

$

1.34

$

4.75

$

3.86

Discontinued operations

—

—

—

—

Net income

$

1.96

$

1.34

$

4.75

$

3.86

Weighted average common shares – basic

81.6

82.1

81.9

82.4

Weighted average common shares –

diluted

82.1

82.5

82.4

82.7

CONSOLIDATED CONDENSED BALANCE SHEETS

(UNAUDITED)

(IN MILLIONS, EXCEPT PER SHARE

AMOUNTS)

As of the Period Ended

September 28,

2024

December 31,

2023

Assets

Current assets:

Cash and cash equivalents

$

460.9

$

489.2

Receivables, net

802.0

675.2

Inventories

620.5

575.4

Other current assets

127.4

117.9

Total current assets

2,010.8

1,857.7

Non-current assets:

Plant, property and equipment, net

578.8

561.0

Goodwill

1,498.3

1,016.3

Other intangible assets, net

462.9

116.6

Other non-current assets

393.7

381.0

Total non-current assets

2,933.7

2,074.9

Total assets

$

4,944.5

$

3,932.6

Liabilities and Shareholders’

Equity

Current liabilities:

Short-term borrowings

$

362.6

$

187.7

Accounts payable

460.4

437.0

Accrued and other current liabilities

451.7

413.1

Total current liabilities

1,274.7

1,037.8

Non-current liabilities:

Long-term debt

467.8

5.7

Postretirement benefits

135.0

138.7

Other non-current liabilities

311.3

211.3

Total non-current liabilities

914.1

355.7

Total liabilities

2,188.8

1,393.5

Shareholders’ equity:

Common stock:

Authorized – 250.0 shares, $1 par value

per share

Issued and outstanding – 81.5 shares and

82.1 shares, respectively

81.5

82.1

Retained earnings

2,993.2

2,778.0

Accumulated other comprehensive income

(loss):

Postretirement benefits

(5.2

)

(1.6

)

Cumulative translation adjustments

(320.3

)

(330.3

)

Total accumulated other comprehensive

loss

(325.5

)

(331.9

)

Total ITT Inc. shareholders’ equity

2,749.2

2,528.2

Noncontrolling interests

6.5

10.9

Total shareholders’ equity

2,755.7

2,539.1

Total liabilities and shareholders’

equity

$

4,944.5

$

3,932.6

CONSOLIDATED CONDENSED STATEMENTS OF

CASH FLOWS (UNAUDITED)

(IN MILLIONS)

For the Nine Months Ended

September 28,

2024

September 30,

2023

Operating Activities

Income from continuing operations

attributable to ITT Inc.

$

391.5

$

319.0

Adjustments to income from continuing

operations:

Depreciation and amortization

100.7

82.8

Equity-based compensation

19.8

15.1

Gain on sale of business

(47.8

)

(7.2

)

Other non-cash charges, net

23.8

22.5

Changes in assets and liabilities:

Change in receivables

(93.5

)

(54.7

)

Change in inventories

(2.6

)

(40.9

)

Change in contract assets

(5.0

)

0.5

Change in contract liabilities

(1.6

)

11.1

Change in accounts payable

(11.4

)

16.5

Change in accrued expenses

(14.1

)

29.4

Change in income taxes

(15.4

)

(2.1

)

Other, net

(5.0

)

(24.4

)

Net Cash – Operating Activities

339.4

367.6

Investing Activities

Capital expenditures

(87.5

)

(68.5

)

Proceeds from sale of business

162.4

10.5

Acquisitions, net of cash acquired

(864.8

)

(79.3

)

Other, net

(4.7

)

(4.7

)

Net Cash – Investing Activities

(794.6

)

(142.0

)

Financing Activities

Commercial paper, net borrowings

174.7

(204.3

)

Long-term debt issued, net of debt

issuance costs

762.4

—

Long-term debt, repayments

(301.3

)

(1.2

)

Share repurchases under repurchase

plan

(104.0

)

(60.0

)

Payments for taxes related to net share

settlement of stock incentive plans

(13.2

)

(6.7

)

Dividends paid

(78.7

)

(71.9

)

Other, net

(7.9

)

(1.1

)

Net Cash – Financing Activities

432.0

(345.2

)

Exchange rate effects on cash and cash

equivalents

(4.4

)

(10.4

)

Net cash – operating activities of

discontinued operations

(0.4

)

(0.2

)

Net change in cash and cash

equivalents

(28.0

)

(130.2

)

Cash and cash equivalents – beginning of

year (includes restricted cash of $0.7 and $0.7, respectively)

489.9

561.9

Cash and Cash Equivalents – End of Period

(includes restricted cash of $1.0 and $0.9, respectively)

$

461.9

$

431.7

Supplemental Disclosures of Cash Flow

and Non-Cash Information:

Cash paid for Interest

$

21.3

$

12.3

Cash paid for Income taxes, net of refunds

received

$

106.8

$

72.0

Capital expenditures included in current

liabilities

$

23.0

$

16.3

Key Performance Indicators and Non-GAAP

Measures

ITT reviews a variety of key performance indicators including

revenue, operating income and margin, earnings per share, order

growth, and backlog. In addition, we consider certain measures to

be useful to management and investors when evaluating our operating

performance for the periods presented. These measures provide a

tool for evaluating our ongoing operations and management of assets

from period to period. This information can assist investors in

assessing our financial performance and measures our ability to

generate capital for deployment among competing strategic

alternatives and initiatives, including, but not limited to,

acquisitions, dividends, and share repurchases. Some of these

metrics, however, are not measures of financial performance under

accounting principles generally accepted in the United States of

America (GAAP) and should not be considered a substitute for

measures determined in accordance with GAAP. We consider the

following non-GAAP measures, which may not be comparable to

similarly titled measures reported by other companies, to be key

performance indicators for purposes of our reconciliation

tables.

Organic Revenues and Organic Orders are defined,

respectively, as revenue and orders, excluding the impacts of

foreign currency fluctuations, acquisitions, and divestitures that

may or may not qualify as discontinued operations. Current year

activity from acquisitions is excluded for twelve months following

the closing date of acquisition. The period-over-period change

resulting from foreign currency fluctuations is estimated using a

fixed exchange rate for both the current and prior periods. Prior

year revenue and orders are adjusted to exclude activity during the

comparable period for twelve months post-closing date for

divestitures that do not qualify as discontinued operations. We

believe that reporting organic revenue and organic orders provide

useful information to investors by helping identify underlying

trends in our business and facilitating comparisons of our revenue

performance with prior and future periods and to our peers.

Adjusted Operating Income is defined as operating income

adjusted to exclude special items that include, but are not limited

to, restructuring, certain asset impairment charges, certain

acquisition- and divestiture-related impacts, and unusual or

infrequent operating items. Special items represent charges or

credits that impact current results, which management views as

unrelated to the Company's ongoing operations and performance.

Adjusted Operating Margin is defined as adjusted operating

income divided by revenue. We believe these financial measures are

useful to investors and other users of our financial statements in

evaluating ongoing operating profitability, as well as in

evaluating operating performance in relation to our

competitors.

Adjusted Income from Continuing Operations is defined as

income from continuing operations attributable to ITT Inc. adjusted

to exclude special items that include, but are not limited to,

restructuring, certain asset impairment charges, certain

acquisition- and divestiture-related impacts, income tax

settlements or adjustments, and unusual or infrequent items.

Special items represent charges or credits, on an after-tax basis,

that impact current results, which management views as unrelated to

the Company’s ongoing operations and performance. The after-tax

basis of each special item is determined using the jurisdictional

tax rate of where the expense or benefit occurred. Adjusted

Income from Continuing Operations per Diluted Share (Adjusted

EPS) is defined as adjusted income from continuing operations

divided by diluted weighted average common shares outstanding. We

believe that adjusted income from continuing operations and

adjusted EPS are useful to investors and other users of our

financial statements in evaluating ongoing operating profitability,

as well as in evaluating operating performance in relation to our

competitors.

Free Cash Flow is defined as net cash provided by

operating activities less capital expenditures. Free Cash Flow

Margin is defined as free cash flow divided by revenue. We

believe that free cash flow and free cash flow margin provide

useful information to investors as it provides insight into a

primary cash flow metric used by management to monitor and evaluate

cash flows generated by our operations.

ITT Inc. Non-GAAP

Reconciliation Statements (In millions; all amounts

unaudited)

Reconciliation of Revenue to

Organic Revenue

MT

IP

CCT

Elim

Total

2024 Revenue

$

344.9

$

333.8

$

207.2

$

(0.7

)

$

885.2

Less: Acquisitions

—

40.0

15.3

(0.1

)

55.2

Less: Foreign currency translation

1.5

(3.1

)

—

(0.1

)

(1.7

)

2024 Organic revenue

$

343.4

$

296.9

$

191.9

$

(0.5

)

$

831.7

2023 Revenue

$

359.5

$

279.8

$

184.0

$

(1.2

)

$

822.1

Less: Divestitures

31.4

—

2.5

—

33.9

2023 Organic revenue

$

328.1

$

279.8

$

181.5

$

(1.2

)

$

788.2

Organic Revenue Growth - $

$

15.3

$

17.1

$

10.4

$

43.5

Organic Revenue Growth - %

4.7

%

6.1

%

5.7

%

5.5

%

Reported Revenue Growth - $

$

(14.6

)

$

54.0

$

23.2

$

63.1

Reported Revenue Growth - %

(4.1

)%

19.3

%

12.6

%

7.7

%

Reconciliation of Orders to

Organic Orders

MT

IP

CCT

Elim

Total

2024 Orders

$

353.3

$

407.8

$

205.5

$

(1.2

)

$

965.4

Less: Acquisitions

—

60.7

6.5

—

67.2

Less: Foreign currency translation

1.6

(5.0

)

—

(0.1

)

(3.5

)

2024 Organic orders

$

351.7

$

352.1

$

199.0

$

(1.1

)

$

901.7

2023 Orders

$

366.6

$

270.8

$

187.4

$

(0.7

)

$

824.1

Less: Divestitures

31.4

—

1.7

—

33.1

2023 Organic orders

$

335.2

$

270.8

$

185.7

$

(0.7

)

$

791.0

Organic Orders Growth - $

$

16.5

$

81.3

$

13.3

$

110.7

Organic Orders Growth - %

4.9

%

30.0

%

7.2

%

14.0

%

Reported Orders Growth - $

$

(13.3

)

$

137.0

$

18.1

$

141.3

Reported Orders Growth - %

(3.6

)%

50.6

%

9.7

%

17.1

%

Note: Immaterial differences due to

rounding.

ITT Inc. Non-GAAP Reconciliation Statements

(In millions; all amounts

unaudited)

Reconciliations of Operating

Income/Margin to Adjusted Operating Income/Margin

Third Quarter 2024

Third Quarter 2023

MT

IP

CCT

Corporate

ITT

MT

IP

CCT

Corporate

ITT

Reported Operating Income

$

110.0

$

69.8

$

38.1

$

(10.0

)

$

207.9

$

59.4

$

64.7

$

33.2

$

(14.2

)

$

143.1

Gain on sale of Wolverine business

(47.8

)

—

—

—

(47.8

)

—

—

—

—

—

Restructuring costs

0.2

0.4

0.2

—

0.8

1.1

0.6

0.2

—

1.9

Acquisition-related expenses

—

(0.4

)

1.2

—

0.8

—

—

—

—

—

Impacts related to Russia-Ukraine war

(0.1

)

—

—

—

(0.1

)

0.5

—

—

—

0.5

Other special items

—

—

—

—

—

—

(0.1

)

0.1

—

—

Adjusted Operating Income

$

62.3

$

69.8

$

39.5

$

(10.0

)

$

161.6

$

61.0

$

65.2

$

33.5

$

(14.2

)

$

145.5

Change in Operating Income

85.2

%

7.9

%

14.8

%

(29.6

)%

45.3

%

Change in Adjusted Operating Income

2.1

%

7.1

%

17.9

%

(29.6

)%

11.1

%

Reported Operating Margin

31.9

%

20.9

%

18.4

%

23.5

%

16.5

%

23.1

%

18.0

%

17.4

%

Impact of special item adjustments

-1380 bps

0 bps

70 bps

-520 bps

50 bps

20 bps

20 bps

30 bps

Adjusted Operating Margin

18.1

%

20.9

%

19.1

%

18.3

%

17.0

%

23.3

%

18.2

%

17.7

%

Change in Operating Margin

1540 bps

-220 bps

40 bps

610 bps

Change in Adjusted Operating Margin

110 bps

-240 bps

90 bps

60 bps

Note: Immaterial differences due to

rounding.

ITT Inc. Non-GAAP

Reconciliation Statements

(In millions; all amounts

unaudited)

Reconciliation of Reported vs.

Adjusted Income from Continuing Operating and Diluted EPS

Income from Continuing

Operations

Diluted Earnings per Share

Q3 2024

Q3 2023

% Change

Q3 2024

Q3 2023

% Change

Reported

$

161.3

$

110.8

45.6

%

$

1.96

$

1.34

46.3

%

Special Items Expense / (Income):

Gain on sale of Wolverine business

(47.8

)

—

(0.58

)

—

Restructuring costs

0.8

1.9

0.01

0.03

Acquisition-related costs

0.8

—

0.01

—

Impacts related to Russia-Ukraine war

(0.1

)

0.5

—

0.01

Net tax benefit of pre-tax special

items

(0.7

)

(0.5

)

(0.01

)

(0.01

)

Other tax-related special items [a]

5.6

0.3

0.07

—

Adjusted

$

119.9

$

113.0

6.1

%

$

1.46

$

1.37

6.6

%

Note: Amounts may not calculate due to

rounding.

Per share amounts are based on diluted

weighted average common shares outstanding.

[a]

2024 includes a tax expense on

distributions of $4.6, tax expense from valuation allowance impacts

of $2.2, and a tax benefit on return to accrual adjustments of

($1.3).

ITT Inc. Non-GAAP

Reconciliation Statements

(In millions; all amounts

unaudited)

Reconciliation of GAAP vs

Adjusted EPS Guidance - Full Year 2024

2024 Full-Year

Guidance

Low

High

EPS from Continuing Operations - GAAP

$

6.16

$

6.22

Gain on sale of Wolverine business

(0.58

)

(0.58

)

Estimated restructuring

0.07

0.07

Other special items

0.06

0.06

Tax on special Items

0.09

0.09

EPS from Continuing Operations -

Adjusted

$

5.80

$

5.86

Note: The Company has provided

forward-looking non-GAAP financial measures for organic revenue

growth and adjusted operating margin. It is not possible, without

unreasonable efforts, to estimate the impacts of foreign currency

fluctuations, acquisitions, and certain other special items that

may occur in 2024 as these items are inherently uncertain and

difficult to predict. As a result, the Company is unable to

quantify certain amounts that would be included in a reconciliation

of organic revenue growth and adjusted operating margin to the most

directly comparable GAAP financial measures without unreasonable

efforts and accordingly has not provided reconciliations for these

forward looking non-GAAP financial measures.

ITT Inc. Non-GAAP

Reconciliation Statements

(In millions; all amounts

unaudited)

Reconciliation of Cash from

Operating Activities to Free Cash Flow

Three Months Ended

Nine Months Ended

FY 2024

9/28/2024

9/30/2023

9/28/2024

9/30/2023

Guidance

Net Cash - Operating Activities

$

123.9

$

169.8

$

339.4

$

367.6

$

600.0

Less: Capital expenditures

36.6

22.2

87.5

68.5

150.0

Free Cash Flow

$

87.3

$

147.6

$

251.9

$

299.1

$

450.0

Revenue

$

885.2

$

822.1

$

2,701.7

$

2,453.9

$

3,630.0

[a]

Free Cash Flow Margin

9.9

%

18.0

%

9.3

%

12.2

%

12.4

%

[a] Revenue included in the full year 2024

free cash flow margin guidance represents the expected revenue

growth mid-point.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241029279489/en/

Investor Contact Mark Macaluso +1 914-641-2064

mark.macaluso@itt.com

Media Contact Phil Terrigno +1 914-641-2143

phil.terrigno@itt.com

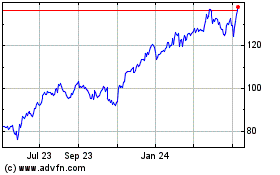

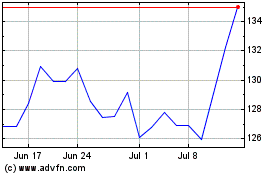

ITT (NYSE:ITT)

Historical Stock Chart

From Nov 2024 to Dec 2024

ITT (NYSE:ITT)

Historical Stock Chart

From Dec 2023 to Dec 2024