CommScope Raises Second Quarter 2007 Guidance

June 27 2007 - 8:02AM

PR Newswire (US)

HICKORY, N.C., June 27 /PRNewswire-FirstCall/ -- CommScope, Inc.

(NYSE:CTV), a global leader in infrastructure solutions for

communications networks, today raised its financial guidance for

the second quarter of 2007. For the second quarter of 2007,

CommScope expects revenue to be $500 - $510 million. Due to the

continued execution of the company's strategy to reduce costs,

favorable market conditions and increased demand for bandwidth,

CommScope now expects its operating margin for the second quarter

of 2007 to be 15% - 16%, excluding special items. The company

previously expected to report revenue of $490 - $510 million and

operating margin of 14.5% - 15.5%, excluding special items.

CommScope also reconfirmed its calendar year 2007 financial

guidance. As previously announced on April 26, 2007, the company

expects calendar year 2007 revenue to be in the range of $1.84 -

$1.89 billion and operating margin to be in the range of 13.5% -

14.5%, excluding special items. CommScope expects to announce its

financial results for the second quarter of 2007 at the end of

July. In a separate announcement today, CommScope and Andrew

Corporation (NASDAQ:ANDW) announced that the companies have entered

into a definitive agreement, unanimously approved by their

respective Boards of Directors, under which CommScope will acquire

all of the outstanding shares of Andrew for $15.00 per share, at

least 90 percent in cash, creating a global leader in

infrastructure solutions for communications networks. The companies

expect to close the transaction by the end of 2007, subject to

completion of customary closing conditions. About CommScope

CommScope, Inc. (NYSE:CTVNYSE:-NYSE:www.commscope.com) is a world

leader in infrastructure solutions for communication networks.

Through its SYSTIMAX(R) Solutions(TM) and Uniprise(R) Solutions

brands CommScope is the global leader in structured cabling systems

for business enterprise applications. It is also the world's

largest manufacturer of coaxial cable for Hybrid Fiber Coaxial

applications and one of the leading North American providers of

environmentally secure cabinets for DSL and FTTN applications.

Backed by strong research and development, CommScope combines

technical expertise and proprietary technology with global

manufacturing capability to provide customers with high-performance

wired or wireless cabling solutions. Forward-Looking Statements

This press release contains forward-looking statements regarding,

among other things, the proposed business combination between

CommScope and Andrew and the anticipated consequences and benefits

of such transaction, and other financial and operational items

relating to CommScope and Andrew. Statements made in the future

tense, and statements using words such as "intend," "goal,"

"estimate," "expect," "expectations," "project," "projections,"

"plans," "anticipates," "believe," "think," "confident" and

"scheduled" and similar expressions are intended to identify

forward-looking statements. Forward- looking statements are not a

guarantee of performance and are subject to a number of risks and

uncertainties, many of which are difficult to predict and are

beyond the control of CommScope or Andrew. These risks and

uncertainties could cause actual results to differ materially from

those expressed in or implied by the forward-looking statements,

and therefore should be carefully considered. Relevant risks and

uncertainties relating to the proposed transaction include, but are

not limited to: the fact that Andrew may be required to write off a

portion of the $412 million of Base Station Subsystems goodwill as

a non-cash charge to earnings as reported in Andrew's quarterly

report on Form 10-Q for the period ended March 31, 2007; the risk

that required regulatory review and approval may not be obtained in

a timely manner, if at all; Andrew's shareholders may not approve

the proposed transaction; the anticipated benefits and synergies of

the proposed transaction may not be realized; the integration of

Andrew's operations with CommScope could be materially delayed or

may be more costly or difficult than expected; the proposed

transaction may not be consummated; legal proceedings may be

commenced by or against CommScope or Andrew. Relevant risks and

uncertainties generally applicable to CommScope and Andrew include,

but are not limited to: changes in cost and availability of key raw

materials and the ability to recover these costs from customers

through price increases; customer demand for products and the

ability to maintain existing business alliances with key customers

or distributors; the risk that internal production capacity and

that of contract manufacturers may be insufficient to meet customer

demand for products; the risk that customers might cancel orders

placed or that orders currently placed may affect order levels in

the future; continuing consolidation among customers; competitive

pricing and acceptance of products; industry competition and the

ability to retain customers through product innovation; possible

production disruption due to supplier or contract manufacturer

bankruptcy, reorganization or restructuring; successful ongoing

operation of our vertical integration activities; ability to

achieve expected sales, growth and earnings goals; costs of

protecting or defending intellectual property; ability to obtain

capital on commercially reasonable terms; regulatory changes

affecting us or the industries we serve. For a more complete

description of factors that could cause such a difference, please

see CommScope's filings with the Securities and Exchange Commission

(SEC), which are available on CommScope's website or at

http://www.sec.gov/, and Andrew's filings with the SEC, which are

available on Andrew's website or at http://www.sec.gov/. In

providing forward-looking statements, neither CommScope nor Andrew

intends, and neither undertakes any duty or obligation, to update

these statements as a result of new information, future events or

otherwise. Additional Information In connection with the proposed

merger, CommScope intends to file a registration statement with the

SEC on Form S-4 and CommScope and Andrew expect to mail a proxy

statement/prospectus to Andrew's stockholders containing

information about the merger. INVESTORS AND SECURITY HOLDERS ARE

URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY

STATEMENT/PROSPECTUS CAREFULLY WHEN THEY ARE AVAILABLE. The

registration statement and the proxy statement/prospectus will

contain important information about CommScope, Andrew, the merger,

and related matters. Investors and security holders will be able to

obtain free copies of these documents through the web site

maintained by the SEC at http://www.sec.gov/. In addition to the

registration statement and the proxy statement/prospectus,

CommScope and Andrew file annual, quarterly, and special reports,

proxy statements, and other information with the SEC. Printed

copies of these documents can also be obtained free of charge

(other than a reasonable duplicating charge for exhibits to our

reports on Form 10-K, Form 10-Q and Form 8-K) by any stockholder

who requests them from either CommScope's or Andrew's Investor

Relations Department: Investor Relations CommScope, Inc. 1100

CommScope Place, SE P.O. Box 339 Hickory, North Carolina 28602

U.S.A. Phone: 1-828-324-2200 Fax: 1-828-982-1708 E-mail: Investor

Relations Andrew Corporation 3 Westbrook Corporate Center Suite 900

Westchester, Illinois 60154 U.S.A. Phone: 1-800-232-6767 or

1-708-236-6616 Fax: 1-708-492-3774 E-mail: CommScope, Andrew and

their respective directors and executive officers and other members

of management and employees may be deemed to be participants in the

solicitation of proxies from Andrew stockholders in connection with

the proposed transaction. Information about CommScope's directors

and executive officers and their ownership of CommScope common

stock is set forth in the definitive proxy statement for

CommScope's 2007 annual meeting of stockholders, as filed by

CommScope with the SEC on Schedule 14A on March 16, 2007.

Information about Andrew's directors and executive officers and

their ownership of Andrew common stock is set forth in the

definitive proxy statement for Andrew's 2007 annual meeting of

stockholders, as filed by Andrew with the SEC on Schedule 14A on

December 29, 2006. Other information regarding the participants in

the proxy solicitation will be contained in the proxy

statement/prospectus and other relevant materials to be filed with

the SEC when they become available. Contact: Phil Armstrong

Investor Relations & Corporate Communications +1-828-323-4848

DATASOURCE: CommScope, Inc. CONTACT: Phil Armstrong, Investor

Relations & Corporate Communications for CommScope, Inc.,

+1-828-323-4848, Web site: http://www.commscope.com/

Copyright

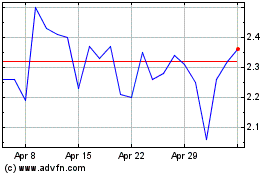

Innovid (NYSE:CTV)

Historical Stock Chart

From Jun 2024 to Jul 2024

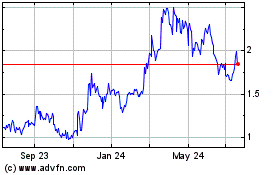

Innovid (NYSE:CTV)

Historical Stock Chart

From Jul 2023 to Jul 2024