false

0001677576

0001677576

2024-03-04

2024-03-04

0001677576

us-gaap:CommonStockMember

2024-03-04

2024-03-04

0001677576

us-gaap:SeriesAPreferredStockMember

2024-03-04

2024-03-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to

Section 13 or 15(d)

of the Securities

Exchange Act of 1934

Date of

Report (Date of earliest event reported): March 4, 2024

Innovative Industrial

Properties, Inc.

(Exact name

of registrant as specified in its charter)

| Maryland |

|

001-37949 |

|

81-2963381 |

|

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File No.) |

|

(I.R.S. Employer

Identification No.) |

1389 Center

Drive, Suite 200

Park City, UT

84098

(Address of

principal executive offices, including zip code)

Registrant’s

telephone number, including area code: (858) 997-3332

Check the appropriate box below if

the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant

to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company

¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities Registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on

which registered |

| Common Stock, par value $0.001 per share |

|

IIPR |

|

New York Stock Exchange |

| Series A Preferred Stock, par value $0.001 per share |

|

IIPR-PA |

|

New York Stock Exchange |

Item 7.01

Regulation FD Disclosure.

On

March 4, 2024, Innovative Industrial Properties, Inc. (the “Company”) posted an investor presentation to its website located

at http://investors.innovativeindustrialproperties.com/. A copy of the investor presentation is attached hereto as Exhibit 99.1 and

is incorporated by reference herein.

The

information contained in this Current Report, including Exhibit 99.1 referenced herein, is being furnished and shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section.

Such information shall not be incorporated by reference into any filing of the Company, whether made before or after the date hereof,

regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and

Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: March 4, 2024 |

INNOVATIVE INDUSTRIAL PROPERTIES, INC. |

| |

|

| |

|

|

| |

By: |

/s/ David Smith |

| |

Name: |

David Smith |

| |

Title: |

Chief Financial Officer |

| |

|

Exhibit 99.1

Innovative Industrial Properties 1 INNOVATIVE INDUSTRIAL PROPERTIES NYSE: IIPR INNOVATIVEINDUSTRIALPROPERTIES.COM COMPANY PRESENTATION POSTED: MARCH 4, 2024

Innovative Industrial Properties 2 FORWARD LOOKING STATEMENTS This presentation and our associated comments include "forward - looking statements" (within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended) that are subject to risks and uncertain tie s. In particular, statements pertaining to our capital resources, portfolio performance and results of operations contain forward - looking statements. Likewise, our statements regarding anticipated growth in our funds from operations and anticipated market and regulatory conditions, our strategic direction, our dividend rate and policy, demographics, results of operations, plans and objectives are forward - looking statements. Forward - looking statements involve numerous risks and uncertainties, and you should not rely on them as predictions of future events. Forward - looking statements depend on a ssumptions, data or methods which may be incorrect or imprecise, and we may not be able to realize them. We do not guarantee that the transactions and events described will happen as described ( or that they will happen at all). You can identify forward - looking statements by the use of forward - looking terminology such as "believes“, "expects“, "may“, "will“, "should“, "seeks“, "approximately“, "int ends“, "plans“, "estimates" or "anticipates" or the negative of these words and phrases or similar words or phrases. You can also identify forward - looking statements by discussions of strategy, plans or inten tions. The following factors, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward - looking statements: rates of default on l eases for our assets; concentration of our portfolio of assets and limited number of tenants; the estimated growth in and evolving market dynamics of the regulated cannabis market; the demand for regu lat ed cannabis facilities; inflation dynamics; our ability to improve our internal control over financial reporting, including our inability to remediate an identified material weakness, and the cost s a nd the time associated with such efforts; the impact of pandemics on us, our business, our tenants, or the economy generally; war and other hostilities, including the conflicts in Ukraine and Israel; ou r b usiness and investment strategy; our projected operating results; actions and initiatives of the U.S. or state governments and changes to government policies and the execution and impact of these actions , i nitiatives and policies, including the fact that cannabis remains illegal under federal law; availability of suitable investment opportunities in the regulated cannabis industry; our understanding of ou r competition and our potential tenants’ alternative financing sources; the expected medical - use or adult - use cannabis legalization in certain states; shifts in public opinion regarding regulated cannabis ; the potential impact on us from litigation matters, including rising liability and insurance costs; the additional risks that may be associated with certain of our tenants cultivating, processing and/or d isp ensing adult - use cannabis in our facilities; the state of the U.S. economy generally or in specific geographic areas; economic trends and economic recoveries; our ability to access equity or debt capi tal ; financing rates for our target assets; our level of indebtedness, which could reduce funds available for other business purposes and reduce our operational flexibility; covenants in our debt instru men ts, which may limit our flexibility and adversely affect our financial condition; our ability to maintain our investment grade credit rating; changes in the values of our assets; our expected port fol io of assets; our expected investments; interest rate mismatches between our assets and our borrowings used to fund such investments; changes in interest rates and the market value of our assets; th e d egree to which any interest rate or other hedging strategies may or may not protect us from interest rate volatility; the impact of and changes in governmental regulations, tax law and rates, accou nti ng guidance and similar matters; our ability to maintain our qualification as a real estate investment trust for U.S. federal income tax purposes; our ability to maintain our exemption from registration un der the Investment Company Act of 1940; availability of qualified personnel; and market trends in our industry, interest rates, real estate values, the securities markets or the general economy. The risks included here are not exhaustive, and additional factors could adversely affect our business and financial performa nce . In addition, we discussed a number of material risks in our most recent Annual Report on Form 10 - K and subsequent Quarterly Reports on Form 10 - Q. Those risks continue to be relevant to our performance and financial condition. Moreover, we operate in a very competitive and rapidly changing environment. New risk factors emerge from time to time and it is not possible for management to predict all such risk factors, nor can it assess the impact of all such risk factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from th ose contained in any forward - looking statements. Any forward - looking statement made by us speaks only of the date on which we make it. We undertake no obligation to publicly update or revise any fo rward - looking statements, whether as a result of new information, future events or otherwise, except as may be required by law. Stockholders and investors are cautioned not to unduly rely on suc h forward - looking statements when evaluating the information presented in our filings and reports. Market and industry data are included in this presentation. We have obtained substantially all of this information from inter nal studies, public filings, other independent published industry sources and market studies prepared by third parties. We believe these internal studies, public filings, other independent published indu str y sources and market studies prepared by third parties are reliable. However, this information may prove to be inaccurate. No representation or warranty is made as to the accuracy of such inform ati on. All amounts shown in this presentation are unaudited. This is not an offer to sell or solicitation to buy securities of Innovative Industrial Properties, Inc. Any offers to sell or solicitations to buy securities of Innovative Industrial Properties, Inc. shall be made only by means of a prospectus approved for that purpose.

Innovative Industrial Properties 3 Founded in 2016 We are the first and only publicly traded company on the New York Stock Exchange (NYSE: IIPR) to provide real estate capital to the regulated cannabis industry WHY IIPR WAS FORMED Specialized Real Estate U.S. cannabis operators require mission critical facilities with specialized buildouts to optimize environment and conform to licensing and zoning requirements Outsized Need for Capital U.S. cannabis operators have an outsized need for capital to fund growth Rapid Adoption of State Legalization As of November 2023, 40 states and Washington, D.C. have legalized cannabis for medical - use, and 24 states and Washington, D.C. have legalized cannabis for adult - use (2) Large and Growing Industry Regulated cannabis sales estimated to grow to $43 billion by 2027, almost double 2022 estimated regulated sales of $26 billion (1) Limited Access to Financing Due to federal prohibition and being a nascent industry, U.S. cannabis operators were historically required to fund growth through highly dilutive forms of capital absent other forms of financing (1) Source : BDSA Legal Cannabis Market Forecast (October 2023 ) . (2) Source : 2023 U . S . Cannabis Report, New Frontier Data, National Conference of State Legislatures (www . ncsl . org), MJBizDaily (mjbizdaily . com) .

Innovative Industrial Properties 4 COMPANY VALUE SPOTLIGHT NNN cannabis REIT • Large diversified portfolio of over $2.4B of cannabis real estate • Diversified across 19 states and 30 tenants (1) • Contractual, annual escalations provide built in cash flow growth History of providing value to shareholders • Consistent dividend and AFFO per share growth • 54% CAGR in dividend and AFFO per share from ’17 - ’23 (2) • Low leverage and diversified capital structure Seasoned management team with significant experience across the REIT space • Our founder, Alan Gold, has a history of establishing real estate companies • Senior management team with long term public REIT experience IIP provides direct investment exposure to cannabis with the stability of real estate • The only NYSE - listed cannabis REIT • High growth industry with an estimated 11% CAGR over next 5 years (3) • Exposure to different cannabis markets and tenants Net Lease Properties Consistent Track Record Experienced REIT Team Investing in Cannabis Real Estate (1) Each “Tenant” represents the parent company of the tenant, for which the parent company has provided a corporate guaranty . A parent company may have multiple tenant subsidiaries across IIP’s properties . Includes two pre - leased tenants . Excludes non - cannabis tenants . Per share amounts are reported on a diluted basis . (2) "CAGR" represents compound annualized growth rate for the relevant metric . (3) See footnote ( 1 ) on page 3 .

Innovative Industrial Properties 5 OUR BUSINESS MODEL & BENEFITS Structured long - term cash flows • Generally, 15 - 20 year initial lease terms (vs. ~5 years for traditional industrial leases) • Leases generally subject to parent company guarantees covering operations throughout the United States Capital efficient lease structure • Target leases are generally 100% triple - net ⚬ No recurring capital expenditures during lease term ⚬ All property expenses paid by the tenant, including capital repairs and replacements Strong initial rental yields with annual escalations We work closely with state - licensed cannabis operators Provide non - dilutive capital Facilitate our tenants’ growth plans Execute sale - leasebacks and fund improvements for cultivation, processing and retail properties

Innovative Industrial Properties 6 9 14 17 19 19 19 2018 2019 2020 2021 2022 2023 8 18 20 26 29 30 2018 2019 2020 2021 2022 2023 167.4M 690.0M 1.3B 2.0B 2.3B 2.4B 2018 2019 2020 2021 2022 2023 11 45 65 102 110 108 2018 2019 2020 2021 2022 2023 # of Tenants by Yea r (5) # of Properties by Year # of States by Year Capital Committed by Year ($) (1) IIPR AS OF DECEMBER 31, 2023 Note : Data as of December 31 , 2023 , unless otherwise noted . (1) Total Committed / Invested Capital includes ( 1 ) total investments in properties (consisting of purchase price and improvements reimbursed to tenants, if any, but excluding transaction costs) and ( 2 ) total additional commitments to reimburse certain tenants for completion of construction and improvements at the properties . Excludes a $ 23 . 0 million loan commitment from us to a developer for construction of a regulated cannabis cultivation and processing facility in California and a seller - financed note issued to us by the buyer in connection with our disposition of a portfolio of four properties in southern California . (2) Operating Portfolio is defined as all properties that (a) are leased or (b) are not leased but ready for their intended use . Includes approximately 816 , 000 square feet under development or redevelopment . Vacancy included three industrial properties, a portion of one industrial property, and three other retail properties, totaling 284 , 000 square feet . (3) Reflects annualized common stock dividend paid on January 12 , 2024 of $ 1 . 82 per share . The decision to declare or pay dividends is in the sole discretion of our board of directors in light of conditions then existing, and there can be no assurance that a dividend will be declared or paid for any time period in any amount . (4) Weighted average lease length calculated by weighting the remaining lease term based on the base rent and management fees, after the expiration of applicable base rent phase - in periods for the Operating Portfolio . (5) See footnote ( 1 ) on page 4 . $2. 4 B Total Committed / Invested Capital (1) 108 Properties (Operating Portfolio - 103) (2) 8.2M Rentable Square Feet - Operating Portfolio (2) 19 U.S. States $7.28 Q4 2023 Annualized Dividend (3) $79.2M Q4 2023 Total Revenue 14.6 Years Weighted Average Lease Length (4)

Innovative Industrial Properties 7 PORTFOLIO OVERVIEW IIPR has a geographically diversified portfolio of properties throughout the United States State Diversification (1) IL PA MA MI NY FL OH NJ CA MD Other Total 14.7% 14.1% 13.6% 10.6% 10.2% 8.3% 5.4% 4.6% 4.1% 3.9% 10.5% 100% Public vs. Private (1)(2) 62% Public 38% Private Note : Data as of December 31 , 2023 , unless otherwise noted . (1) As a % of Annualized Base Rent (“ABR”) . ABR is calculated by multiplying the sum of contractually due base rents and property management fees for the last month in the quarter, by twelve . (2) “MSO” stands for Multi - State Operator which means the tenant (or guarantor) conducts cannabis operations in more than one state . “SSO” stands for Single - State Operator which means the tenant (or guarantor) conducts cannabis operations in a single state . Excludes non - cannabis tenants that comprise less than 1 % of annualized base rent in the aggregate . (3) “Industrial” reflects facilities utilized or expected to be utilized for regulated cannabis cultivation, processing and/or distribution activities, which can consist of industrial and/or greenhouse space . Property Type (1) 2% Retail 92% Industrial (3) 6% Industrial / Retail Operator Type (1)(2) 90% MSO 10% SSO

Innovative Industrial Properties 8 SIX - YEAR FINANCIAL PERFORMANCE TRACK RECORD Note : Dollars in thousands . (1) “Net Operating Income (NOI)” reported as total revenue less property expenses on the company’s consolidated statements of income . (2) See footnote ( 2 ) on page 4 . (3) “G&A” reported as “general and administrative expense” on the company’s consolidated statements of income . (4) See the company’s applicable periodic reports filed with the SEC for definitions of funds from operations (“FFO”) and adjusted funds from operations ("AFFO") (each a supplemental non - GAAP financial measure) and reconciliation of FFO and AFFO to GAAP net income attributable to common stockholders . $9,727 $34,992 $98,078 $174,958 $233,637 $256,497 2018 2019 2020 2021 2022 2023 Year Over Year AFFO (2)(4) Year Over Year G&A as a % of NOI (1)(3) $6,375 $9,818 $14,182 $22,961 $38,520 $42,832 44.4% 22.6% 12.7% 11.5% 14.5% 15.0% 2018 2019 2020 2021 2022 2023 G&A G&A % of NOI Year Over Year FFO (2)(4) $8,262 $30,722 $92,403 $154,414 $210,736 $231,430 2018 2019 2020 2021 2022 2023 Year Over Year Net Operating Income (NOI) (1)(2) $14,342 $43,352 $111,944 $200,108 $265,839 $284,613 2018 2019 2020 2021 2022 2023

Innovative Industrial Properties 9 $30.0M $73.3M $167.4M $690.0M $1.3B $2.0B $2.3B $2.4B 100% 100% 100% 100% 99% 100% 97% 98% 2016 2017 2018 2019 2020 2021 2022 2023 Invested Capital % Rent Collection Historical Rent Collection (Operating Portfolio) (3) (1%) 2% (4%) 7% 11% 8% 1% 14% 39% 1-Year CAGR 3-Year CAGR 5-Year CAGR REIT(2) S&P 500 IIPR Common Stock Dividend Per Share (1) (0%) 12% 9% 12% 14% 13% (1%) 17% 43% 1-Year CAGR 3-Year CAGR 5-Year CAGR REIT(2) S&P 500 IIPR (Diluted) Net Income Attributable to Common Stockholders Per Share (1) COMPARATIVE PERFORMANCE (1) Per S&P Capital IQ Pro latest available data as of February 27 , 2024 . S&P Capital IQ Pro excludes outliers for each index . See footnote ( 2 ) on page 4 . (2) REIT index is made up of constituent data for the FTSE NAREIT U . S . Real Estate Index Series found on the National Association of Real Estate Investment Trusts (“NAREIT”) website, representing publicly traded REITs across the United States . (3) Calculated as base rent and property management fees collected over contractual base rent and property management fees due for the period . For 2022 , rent collection includes 1 ) security deposits applied for the payment of rent totaling approximately $ 0 . 5 million, subject to scheduled repayment, and 2 ) security deposits applied in connection with non - payment of rent for defaulting tenants totaling approximately $ 2 . 2 million . For 2023 , rent collection includes 1 ) security deposits applied for the payment of rent totaling approximately $ 5 . 6 million, subject to scheduled repayment, 2 ) security deposits applied in connection with non - payment of rent for defaulting tenants totaling approximately $ 3 . 1 million, and 3 ) approximately $ 0 . 7 million of $ 1 . 7 million collected in December 2023 from Parallel pursuant to a consent judgment awarded in IIP’s favor and applied to rent due from Parallel for October 2023 at one of IIP’s Pennsylvania properties (Parallel vacated that property on October 31 , 2023 ) .

Innovative Industrial Properties 10 IIP Portfolio Third Quarter 2023 (3) Tenant Information Annualized Base Rent (ABR) (1) ABR # of Adjusted Market MSO #Tenant $ % Square Feet (2) / Square Foot Leases Revenue EBITDA (4) Capitalization (5) / SSO (6) 1PharmaCann $45,181 15.8% 697 $65 11 Private Co. Private Co. Private Co. MSO 2Ascend Wellness Holdings 29,651 10.4% 624 $48 4 $141 $30 $201 MSO 3Green Thumb Industries 21,674 7.6% 664 $33 3 275 83 2,669 MSO 4Curaleaf 19,941 7.0% 578 $35 8 333 75 3,063 MSO 5Trulieve 18,807 6.6% 740 $25 6 275 78 965 MSO 6The Cannabist Company (f/k/a Columbia Care) 17,472 6.1% 588 $30 21 129 20 194 MSO 7Holistic Industries 17,315 6.1% 333 $52 5 Private Co. Private Co. Private Co. MSO 8 4Front Ventures (7) 16,255 5.7% 488 $33 4 23 3 66 MSO 9Cresco Labs 16,242 5.7% 379 $43 5 191 49 461 MSO 10Parallel 15,423 5.4% 593 $26 2 Private Co. Private Co. Private Co. MSO Top 10 Tenants Total $217,961 76.4% 5,684 $38 69 TOP TEN TENANTS BY ABR Note : Data as of December 31 , 2023 , unless otherwise noted . (1) Dollars in thousands, see footnote ( 1 ) on page 7 . (2) Square feet in thousands . (3) Dollars in millions, based on each company’s public securities filings and earnings release, available at www . sec . gov, www . sedar . com, or each company’s respective website, for the quarter ended September 30 , 2023 . (4) Adjusted EBITDA is a non - GAAP financial measure utilized in the industry . For definitions and reconciliations of Adjusted EBITDA to net income, see each company’s public securities filings, available at www . sec . gov or www . sedar . com . (5) Dollars in millions, per S&P Capital IQ Pro as of 12 / 31 / 2023 . (6) See footnote ( 2 ) on page 7 . (7) Includes one property acquired in January 2022 for $ 16 . 0 million which did not satisfy the requirements for sale - leaseback accounting and therefore, the transaction is recognized as a note receivable and is included in other assets, net on our consolidated balance sheet . Top ten tenants represent ~76% of the company’s annualized base rent

Innovative Industrial Properties 11 Balance Sheet Statistics $4.4 Million $300.0 Million 2024 2025 2026 2027 2028 Thereafter Exchangeable Senior Notes Notes Due 2026 BALANCE SHEET HIGHLIGHTS Debt Overview Exchangeable Senior Notes: • Remaining $4.4 million 3.75% exchangeable senior notes exchanged or paid off in full in February 2024 Unsecured Senior Notes: • Investment Grade Rating BBB+ from Egan Jones, since May 2021 • $300.0M of 5.50% unsecured senior notes due May 25, 2026 Capital Structure (2) Debt Maturity Profile (3) Note : As of December 31 , 2023 , unless otherwise noted . (1) Calculated in accordance with the indenture governing the Notes due 2026 , included in the Current Report on Form 8 - K filed with the Securities and Exchange Commission on May 25 , 2021 . (2) Share price per S&P Capital IQ Pro as of 12 / 31 / 2023 . (3) Principal amount shown as provided in the Company’s latest quarterly filing . $0.0B $0.5B $1.0B $1.5B $2.0B $2.5B $3.0B $2.8B in Common Equity $15.0M in Preferred Equity $304.4M in Gross Debt 12% Debt to Total Gross Assets (1) >16x Debt Service Coverage Ratio (1) No Material Debt Maturities Until 2026 IIP Is One of the Lowest Leveraged Public REITs

Innovative Industrial Properties 12 LICENSING, ZONING, & REGULATORY DYNAMICS Establishing a Cultivation, Processing or Dispensary Facility is a Multifaceted Process with Significant Hurdles • A regulated cannabis operator must obtain proper licensing from the state for the facility • Licensing driven by state specific program requirements, including limited licensing, costs and applicant requirements for licensing, identification of specific real estate for license approval • In many states, a highly competitive process, with highly valued license Licensing Zoning Regulatory • Limited opportunities for locating regulated cannabis facilities based on zoning and permitting requirements imposed at county and city levels, including community support • Extensive negotiations with local governments for permitting and approvals • Highly regulated at the state and local levels, including extensive security, fire protection, seed to sale tracking, testing, and other requirements • Periodic inspections by local fire and safety officials and cannabis authorities to ensure compliance

Innovative Industrial Properties 13 UNDERWRITING & MONITORING • Evaluation of financial projections utilizing existing knowledge of industry dynamics • Detailed review of financial statements, strategic initiatives, and growth plans • Experienced management team • Alignment of management within ownership of the business Detailed Background on Management Ability to Raise Capital Detailed Financial Underwriting Guarantees and Security Deposits Ongoing Monitoring • Quarterly reviews and requests for information pertaining to financials and ongoing operations of all properties • Meetings with tenants to talk through operations and financials • Evaluation of the macro environment surrounding strategic capital raising in the tenants’ prospective markets • History of successful capital raising and a cash balance on hand today • Leases generally subject to parent company guarantees covering operations throughout the United States • Security deposits with larger deposits for less mature tenants

Innovative Industrial Properties 14 CANNABIS IS A LARGE AND GROWING INDUSTRY $26B $43B 2022 2023E 2024E 2025E 2026E 2027E Long - Term Growth Outlook for Cannabis $43B Estimated Legal Cannabis Sales by 2027 (1) 68% U.S. Population of States with an IIP Presence (2) ~15K Cannabis Dispensaries in the United States (3) (1) See footnote ( 1 ) on page 3 . See footnote ( 2 ) on page 4 . (2) Per 2020 US Census Data . (3) Per Pew Research Center (February 2024 ) . US Legal Cannabis Sales Forecast (1)

Innovative Industrial Properties 15 EXECUTIVE CHAIRMAN & CO - FOUNDER Alan Gold Executive Chairman & Co - Founder Co - founder of BioMed Realty Trust (formerly NYSE: BMR); served as Chairman and CEO from inception of its predecessor in 1998 through BMR’s sale in 2016 • Owner and operator of high - quality life science real estate • Previously publicly traded investment grade REIT Co - founded Alexandria Real Estate Equities (NYSE: ARE) in 1994 and served as President and a director until 1998 • Invests in office buildings and laboratories leased to life science and technology companies Executive Chairman of IQHQ, Inc. • Privately - held life science real estate company with properties in both the U.S. and U.K. Alan Gold has experience starting real estate companies focused on nuanced, regulated industries.

Innovative Industrial Properties 16 SENIOR MANAGEMENT TEAM David Smith • 20+ years of finance and real estate experience • Former CFO of Aventine Property Group, Inc. CFO and Treasurer • 35+ years of legal and regulatory experience • Previously co - founded Iso Nano International, LLC Paul Smithers President, CEO and Co - Founder • 18+ years of real estate and accounting experience • Former Senior Associate, Investments and Asset Management at BioMed Realty CIO Ben Regin Catherine Hastings • 20+ years of accounting and real estate experience • Former VP, Internal Audit of BioMed Realty COO • Former VP, Corporate Legal of BioMed Realty • Former attorney at Latham & Watkins LLP Brian Wolfe VP, GC, and Secretary Andy Bui • Former Senior Director, Financial Reporting at BioMed Realty VP, Chief Accounting Officer • 20+ years legal experience representing real estate matters • Former attorney at Foley & Lardner LLP VP, Real Estate Counsel Kelly Spicher Tracie Hager • 30+ years of experience in property management • Former VP, Property Management at BioMed Realty VP, Asset Management

v3.24.0.1

Cover

|

Mar. 04, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Mar. 04, 2024

|

| Entity File Number |

001-37949

|

| Entity Registrant Name |

Innovative Industrial

Properties, Inc.

|

| Entity Central Index Key |

0001677576

|

| Entity Tax Identification Number |

81-2963381

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity Address, Address Line One |

1389 Center

Drive

|

| Entity Address, Address Line Two |

Suite 200

|

| Entity Address, City or Town |

Park City

|

| Entity Address, State or Province |

UT

|

| Entity Address, Postal Zip Code |

84098

|

| City Area Code |

858

|

| Local Phone Number |

997-3332

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

IIPR

|

| Security Exchange Name |

NYSE

|

| Series A Preferred Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Series A Preferred Stock, par value $0.001 per share

|

| Trading Symbol |

IIPR-PA

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesAPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

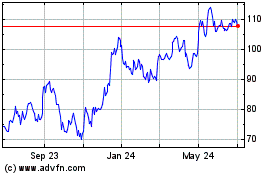

Innovative Industrial Pr... (NYSE:IIPR)

Historical Stock Chart

From Nov 2024 to Dec 2024

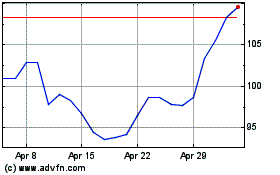

Innovative Industrial Pr... (NYSE:IIPR)

Historical Stock Chart

From Dec 2023 to Dec 2024