FY 2023 Net Income and AFFO Per Share Increased

5% and 7% over 2022, Respectively

Innovative Industrial Properties, Inc. (IIP), the first and only

real estate company on the New York Stock Exchange (NYSE: IIPR)

focused on the regulated U.S. cannabis industry, announced today

results for the fourth quarter and year ended December 31,

2023.

Full Year 2023

- Generated total revenues of approximately $309.5 million,

representing an increase of 12% over 2022.

- Recorded net income attributable to common stockholders of

approximately $164.2 million, or $5.77 per share (all per share

amounts in this press release are reported on a diluted basis

unless otherwise noted).

- Recorded adjusted funds from operations (AFFO) and normalized

funds from operations (Normalized FFO) of approximately $256.5

million and $234.1 million, increases of 10% and 9% over 2022,

respectively.

- Declared dividends to common stockholders totaling $7.22 per

share, increasing IIP’s common stock dividends declared each year

since its inception in 2016.

- Committed up to approximately $119.5 million (excluding

transaction costs) for the payment of purchase prices and funding

of qualifying building infrastructure improvements for two property

acquisitions, lease amendments for three properties, two new leases

in the existing portfolio and an additional commitment under a

construction loan where IIP is lender.

- Sold a portfolio of properties in March located in California

for $16.2 million (excluding transaction costs), which included

secured seller financing with the buyer of the property for $16.1

million (interest only, payable monthly).

- Published IIP’s third annual Sustainability Report,

highlighting IIP’s commitment to sound environmental management,

collaborative community engagement and corporate governance

principles that align to the core values of the IIP team, and

available on its corporate website at

www.innovativeindustrialproperties.com.

- At year-end, IIP’s footprint comprised 108 properties totaling

8.9 million rentable square feet in 19 states.

Years Ended December

31,

(Per share)

2023

2022

$ Change

% Change

Net income attributable to common

stockholders

$5.77

$5.52

$0.25

5%

Normalized FFO

$8.29

$7.76

$0.53

7%

AFFO

$9.08

$8.45

$0.63

7%

Fourth Quarter 2023

Financial Results and Dividend

- Generated total revenues of approximately $79.2 million in the

quarter, representing a 12% increase from the prior year’s

quarter.

- Recorded net income attributable to common stockholders of

approximately $41.3 million for the quarter, or $1.45 per

share.

- Recorded AFFO of approximately $64.3 million, or $2.28 per

share, each increases of 8% from the prior year’s quarter,

respectively.

- Paid a quarterly dividend of $1.82 per common share on January

12, 2024 to stockholders of record as of December 29, 2023.

Three Months Ended December

31,

(Per share)

2023

2022

$ Change

% Change

Net income attributable to common

stockholders

$1.45

$1.46

($0.01)

(1%)

Normalized FFO

$2.07

$1.95

$0.12

6%

AFFO

$2.28

$2.12

$0.16

8%

Financing Activity

- Entered into a loan and security agreement (the Loan Agreement)

with a federally regulated commercial bank, which matures on

October 23, 2026 and provides $30.0 million in aggregate

commitments for secured revolving loans (the Revolving Credit

Facility).

- Issued shares of common stock under IIP’s “at-the-market”

offering program (ATM Program) for net proceeds of approximately

$9.6 million.

Portfolio – Leasing and New Commitments

- Executed a new lease for the property located at 9410 Davis

Highway in Dimondale, Michigan, which is under redevelopment as a

regulated cannabis cultivation and processing facility and was

previously leased to Green Peak Industries, Inc. (Green Peak).

- Entered into a lease amendment with a subsidiary of Goodness

Growth Holdings, Inc. at one of IIP’s New York properties, to,

among other things, increase base rent and increase the improvement

allowance under the lease by $14.0 million.

Portfolio – Rent Collection

- Rent collection for IIP’s operating portfolio (calculated as

base rent and property management fees collected as a percentage of

contractually due base rent and property management fees) was 100%

for the fourth quarter.

- Rent collected for the quarter includes approximately $0.8

million of security deposits applied for the payment of rent in

connection with an amendment with 4Front Ventures Corp. (4Front) at

one of IIP’s Illinois properties, and approximately $0.7 million of

$1.7 million collected in December 2023 from a subsidiary of SH

Parent, Inc. (Parallel) pursuant to a consent judgment awarded in

IIP’s favor and applied to rent due from Parallel for October 2023

at one of IIP’s Pennsylvania properties (Parallel vacated that

property on October 31, 2023).

Year-to-Date 2024

Portfolio – Leasing and New Commitments

- Amended IIP’s lease and development agreement with PharmaCann

Inc. at one of IIP’s New York properties to increase the

improvement allowance by $16.0 million, adjust base rent

accordingly and extend the lease term.

- Executed a new lease with a tenant at one of IIP’s retail

properties in Michigan that was previously leased to Green

Peak.

- Executed a non-binding letter of intent with Lume Cannabis Co.

to lease IIP’s property located at 10070 Harvest Park in Dimondale,

Michigan, which is currently occupied by the receiver for Green

Peak and expected to be returned to IIP on March 1, 2024.

Financing Activity

- Amended Loan Agreement to upsize the Revolving Credit Facility

to $45.0 million.

- Exchanged approximately $4.3 million principal amount of IIP’s

3.75% Exchangeable Senior Notes due 2024 (the Exchangeable Senior

Notes) for a combination of cash and shares of IIP common stock

prior to maturity, and paid off the remaining $100,000 principal

amount at maturity.

Portfolio – Rent Collection

- Rent collection for IIP’s operating portfolio was 100%

year-to-date through February 2024.

Balance Sheet Highlights (at December 31, 2023)

- 12% debt to total gross assets, with approximately $2.6 billion

in total gross assets.

- Total liquidity was approximately $177.2 million as of December

31, 2023, consisting of cash and cash equivalents and short-term

investments (each as reported in IIP’s consolidated balance sheet

as of December 31, 2023) and availability under the Revolving

Credit Facility.

- No debt maturities until May 2026, other than $4.4 million

principal amount of Exchangeable Senior Notes which was exchanged

or paid off in full subsequent to year-end.

- Debt service coverage ratio of 16.4x (calculated in accordance

with IIP’s 5.50% Unsecured Senior Notes due 2026).

Property Portfolio Statistics (as of December 31,

2023)

- Total property portfolio comprises 108 properties across 19

states, with approximately 8.9 million rentable square feet

(including approximately 1.4 million rentable square feet under

development / redevelopment), consisting of:

- Operating portfolio: 103 properties, representing approximately

8.2 million rentable square feet.

- Under development / redevelopment portfolio contains five

properties expected to comprise 715,000 rentable square feet at

completion, of which 460,000 rentable square feet (64% of total) is

pre-leased or under a non-binding letter of intent to lease, with

the remainder comprised of one property totaling 192,000 square

feet in San Bernardino, California and twelve acres of land to be

developed in San Marcos, Texas. The five properties in the

development / redevelopment portfolio are as follows:

- Perez Road in Cathedral City, California (pre-leased)

- Davis Highway in Dimondale, Michigan (pre-leased)

- 63795 19th Avenue in Palm Springs, California (non-binding

letter of intent to lease)

- Inland Center Drive in San Bernardino, California

- Leah Avenue in San Marcos, Texas

- Operating portfolio:

- 95.8% leased (triple-net).

- Weighted-average remaining lease term: 14.6 years.

- Total invested / committed capital per square foot: $275.

- By annualized base rent (excluding non-cannabis tenants that

comprise less than 1% of annualized base rent in the aggregate):

- No tenant represents more than 16% of annualized base

rent.

- No state represents more than 15% of annualized base rent.

- Multi-state operators (MSOs) represent 90% of annualized base

rent.

- Public company operators represent 62% of annualized base

rent.

- Industrial (cultivation and/or processing), retail (dispensing)

and combined industrial/retail represent 92%, 2% and 6% of the

operating portfolio, respectively.

Financial Results

For the three months ended December 31, 2023, IIP generated

total revenues of approximately $79.2 million, compared to

approximately $70.5 million for the same period in 2022, an

increase of 12%. The increase was primarily driven by an increase

in tenant reimbursements versus the prior period, as well as

activity in prior periods for the acquisition and leasing of new

properties, additional building infrastructure allowances provided

to tenants at certain properties that resulted in increases to base

rent and contractual rental escalations at certain properties.

Total revenues for the three months ended December 31, 2023 and

2022 included approximately $6.6 million and $3.0 million,

respectively, of tenant reimbursements for property insurance

premiums and property taxes. Rental revenues for the three months

ended December 31, 2023 also included (1) approximately $0.8

million of security deposits applied for payment of rent for a

lease with 4Front; (2) approximately $0.2 million of the $0.4

million in payments received from Kings Garden, Inc. (Kings Garden)

pursuant to an offer of judgment for lease defaults on certain

California properties previously occupied by Kings Garden; and (3)

approximately $1.7 million received as partial payment of a consent

order against Parallel for lease defaults at one of IIP’s

Pennsylvania properties previously leased to Parallel.

For the year ended December 31, 2023, IIP generated total

revenues of approximately $309.5 million, compared to approximately

$276.4 million for 2022, an increase of 12%. Of that increase,

approximately $13.3 million was related to tenant reimbursements

for property insurance premiums and property taxes, which increased

to approximately $23.4 million for the year ended December 31,

2023, compared to approximately $10.1 million for the year ended

December 31, 2022. The increase in tenant reimbursements was

primarily due to a change in IIP’s policy from allowing tenants to

pay property taxes directly to taxing authorities to IIP making tax

payments directly to taxing authorities and then billing tenants

for property tax reimbursements starting in January 2023. The

remaining increase was driven primarily by the acquisition and

leasing of new properties, additional building infrastructure

allowances provided to tenants at certain properties that resulted

in adjustments to base rent, and contractual rental escalations at

certain properties, partially offset by the previously disclosed

defaults of tenants for which IIP did not receive or record revenue

and the termination of certain leases with Green Peak, Kings

Garden, Medical Investor Holdings, LLC (Vertical) and Parallel.

During the twelve months ended December 31, 2023, IIP collected 98%

of contractual rents and did not collect rents totaling

approximately $4.8 million (including approximately $4.5 million of

contractual base rents and property management fees and $0.3

million for tenant reimbursements for property insurance premiums

and taxes from three tenants).

For the three months ended December 31, 2023, IIP recorded net

income attributable to common stockholders of approximately $41.3

million, or $1.45 per share; funds from operations (FFO) of

approximately $58.4 million, or $2.07 per share; Normalized FFO of

approximately $58.6 million, or $2.07 per share; and AFFO of

approximately $64.3 million, or $2.28 per share.

For the year ended December 31, 2023, IIP recorded net income

attributable to common stockholders of approximately $164.2

million, or $5.77 per share; FFO of approximately $231.6 million,

or $8.20 per share; Normalized FFO of approximately $234.1 million,

or $8.29 per share; and AFFO of approximately $256.5 million, or

$9.08 per share.

IIP paid a quarterly dividend of $1.82 per common share on

January 12, 2024 to stockholders of record as of December 29, 2023.

IIP’s AFFO payout ratio was 80% (calculated by dividing the common

stock dividend declared per share by IIP’s AFFO per common share

for the quarter). The common stock dividends declared for the

twelve months ended December 31, 2023 totaled $7.22 per common

share. IIP has increased its common stock dividends declared each

year since its inception in 2016.

FFO, Normalized FFO and AFFO are supplemental non-GAAP financial

measures used in the real estate industry to measure and compare

the operating performance of real estate companies. A complete

reconciliation containing adjustments from GAAP net income

attributable to common stockholders to FFO, Normalized FFO and AFFO

and definitions of terms are included at the end of this

release.

Financing Activity

In October 2023, IIP Operating Partnership, LP, IIP’s operating

partnership subsidiary (the Operating Partnership), entered into a

Loan Agreement with a federally regulated commercial bank, as

lender and as agent for lenders that become party thereto from time

to time. The Loan Agreement matures on October 23, 2026, and was

upsized in February 2024 to provide for $45.0 million in aggregate

commitments for a Revolving Credit Facility, the availability of

which is based on a borrowing base consisting of real properties

owned by subsidiaries (the Subsidiary Guarantors) of the Operating

Partnership that satisfy eligibility criteria set forth in the Loan

Agreement. The obligations of the Operating Partnership under the

Loan Agreement are guaranteed by IIP and the Subsidiary Guarantors,

and are secured by (i) operating accounts of the Operating

Partnership into which lease payments under the real property

included in the borrowing base are paid, (ii) the equity interest

of the Subsidiary Guarantors, (iii) the real estate included in the

borrowing base and the leases and rents thereunder, and (iv) all

personal property of the Subsidiary Guarantors. Borrowings under

the Loan Agreement bear interest at a variable rate based on the

greater of the prime rate and an applicable margin based on

deposits with the participating bank(s) and a stipulated interest

rate. The Loan Agreement is subject to certain liquidity and

operating covenants and includes customary representations and

warranties, affirmative and negative covenants and events of

default. The Loan Agreement also allows the Operating Partnership,

subject to the satisfaction of certain conditions, to request

additional revolving loan commitments up to a specified amount.

During the three months and year ended December 31, 2023, IIP

issued 101,061 shares of its common stock under its ATM Program for

net proceeds of approximately $9.6 million.

Subsequent to year-end, IIP exchanged approximately $4.3 million

principal amount of its Exchangeable Senior Notes for a combination

of cash and shares of IIP common stock prior to maturity, in

accordance with the terms of the indenture, and paid off the

remaining $100,000 principal amount at maturity.

Supplemental Information

Supplemental financial information is available in the Investor

Relations section of IIP’s website at

www.innovativeindustrialproperties.com.

Teleconference and Webcast

Innovative Industrial Properties, Inc. will conduct a conference

call and webcast at 10:00 a.m. Pacific Time (1:00 p.m. Eastern

Time) on Tuesday, February 27, 2024 to discuss IIP’s financial

results and operations for the fourth quarter and year ended

December 31, 2023. The call will be open to all interested

investors through a live audio webcast at the Investor Relations

section of IIP’s website at www.innovativeindustrialproperties.com,

or live by calling 1-877-328-5514 (domestic) or 1-412-902-6764

(international) and asking to be joined to the Innovative

Industrial Properties, Inc. conference call. The complete webcast

will be archived for 90 days on IIP’s website. A telephone playback

of the conference call will also be available from 12:00 p.m.

Pacific Time on Tuesday, February 27, 2024 until 12:00 p.m. Pacific

Time on Tuesday, March 5, 2024, by calling 1-877-344-7529

(domestic), 855-669-9658 (Canada) or 1-412-317-0088 (international)

and using access code 9779220.

About Innovative Industrial Properties

Innovative Industrial Properties, Inc. is a self-advised

Maryland corporation focused on the acquisition, ownership and

management of specialized properties leased to experienced,

state-licensed operators for their regulated cannabis facilities.

Innovative Industrial Properties, Inc. has elected to be taxed as a

real estate investment trust, commencing with the year ended

December 31, 2017. Additional information is available at

www.innovativeindustrialproperties.com.

This press release contains statements that IIP believes to be

“forward-looking statements” within the meaning of the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

All statements other than historical facts are forward-looking

statements. When used in this press release, words such as IIP

“expects,” “intends,” “plans,” “estimates,” “anticipates,”

“believes” or “should” or the negative thereof or similar

terminology are generally intended to identify forward-looking

statements. Such forward-looking statements are subject to risks

and uncertainties that could cause actual results to differ

materially from those expressed in, or implied by, such statements.

Investors should not place undue reliance upon forward-looking

statements. IIP disclaims any obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise.

INNOVATIVE INDUSTRIAL

PROPERTIES, INC.

CONSOLIDATED BALANCE

SHEETS

(Unaudited)

(In thousands, except share and

per share amounts)

December 31,

December 31,

Assets

2023

2022

Real estate, at cost:

Land

$

142,524

$

139,953

Buildings and improvements

2,108,218

2,010,628

Construction in progress

117,773

54,106

Total real estate, at cost

2,368,515

2,204,687

Less accumulated depreciation

(202,692

)

(138,405

)

Net real estate held for investment

2,165,823

2,066,282

Construction loan receivable

22,000

18,021

Cash and cash equivalents

140,249

87,122

Restricted cash

1,450

1,450

Investments

21,948

200,935

Right of use office lease asset

1,355

1,739

In-place lease intangible assets, net

8,245

9,105

Other assets, net

30,020

30,182

Total assets

$

2,391,090

$

2,414,836

Liabilities and stockholders’

equity

Liabilities:

Exchangeable Senior Notes, net

$

4,431

$

6,380

Notes due 2026, net

296,449

295,115

Building improvements and construction

funding payable

9,591

29,376

Accounts payable and accrued expenses

11,406

10,615

Dividends payable

51,827

50,840

Rent received in advance and tenant

security deposits

59,358

58,716

Other liabilities

5,056

1,901

Total liabilities

438,118

452,943

Stockholders’ equity:

Preferred stock, par value $0.001 per

share, 50,000,000 shares authorized: 9.00% Series A cumulative

redeemable preferred stock, $15,000 liquidation preference ($25.00

per share), 600,000 shares issued and outstanding at December 31,

2023 and December 31, 2022

14,009

14,009

Common stock, par value $0.001 per share,

50,000,000 shares authorized: 28,140,891 and 27,972,830 shares

issued and outstanding at December 31, 2023 and December 31, 2022,

respectively

28

28

Additional paid-in capital

2,095,789

2,065,248

Dividends in excess of earnings

(156,854

)

(117,392

)

Total stockholders’ equity

1,952,972

1,961,893

Total liabilities and

stockholders’ equity

$

2,391,090

$

2,414,836

INNOVATIVE INDUSTRIAL

PROPERTIES, INC.

CONSOLIDATED STATEMENTS OF

INCOME

For the Three Months and Years

Ended December 31, 2023 and 2022

(Unaudited)

(In thousands, except share and

per share amounts)

For the Three Months

Ended

For the Year Ended

December 31,

December 31,

2023

2022

2023

2022

Revenues:

Rental (including tenant

reimbursements)

$

78,615

$

69,923

$

307,349

$

274,377

Other

541

538

2,157

1,982

Total revenues

79,156

70,461

309,506

276,359

Expenses:

Property expenses

7,193

3,288

24,893

10,520

General and administrative expense

10,908

10,232

42,832

38,520

Depreciation and amortization expense

17,098

16,302

67,194

61,303

Total expenses

35,199

29,822

134,919

110,343

Gain on sale of real estate

—

3,601

—

3,601

Income from operations

43,957

44,240

174,587

169,617

Interest and other income

1,821

1,784

8,446

3,195

Interest expense

(4,145

)

(4,518

)

(17,467

)

(18,301

)

Gain (loss) on exchange of Exchangeable

Senior Notes

—

—

22

(125

)

Net income

41,633

41,506

165,588

154,386

Preferred stock dividends

(338

)

(338

)

(1,352

)

(1,352

)

Net income attributable to common

stockholders

$

41,295

$

41,168

$

164,236

$

153,034

Net income attributable to common

stockholders per share:

Basic

$

1.46

$

1.47

$

5.82

$

5.57

Diluted

$

1.45

$

1.46

$

5.77

$

5.52

Weighted-average shares outstanding:

Basic

27,996,393

27,938,804

27,977,807

27,345,047

Diluted

28,279,834

28,160,261

28,255,797

27,663,169

INNOVATIVE INDUSTRIAL

PROPERTIES, INC.

CONSOLIDATED FFO, NORMALIZED

FFO AND AFFO

For the Three Months and Years

Ended December 31, 2023 and 2022

(Unaudited)

(In thousands, except share and

per share amounts)

For the Three Months

Ended

For the Year Ended

December 31,

December 31,

2023

2022

2023

2022

Net income attributable to common

stockholders

$

41,295

$

41,168

$

164,236

$

153,034

Real estate depreciation and

amortization

17,098

16,302

67,194

61,303

Gain on sale of real estate

—

(3,601

)

—

(3,601

)

FFO attributable to common stockholders

(basic)

58,393

53,869

231,430

210,736

Cash and non-cash interest expense on

Exchangeable Senior Notes

50

72

219

546

FFO attributable to common stockholders

(diluted)

58,443

53,941

231,649

211,282

Financing expense

—

249

—

367

Litigation-related expense

152

779

2,480

3,010

Loss (gain) on exchange of Exchangeable

Senior Notes

—

—

(22

)

125

Normalized FFO attributable to common

stockholders (diluted)

58,595

54,969

234,107

214,784

Interest income on seller-financed

note(1)

403

—

1,342

—

Stock-based compensation

4,934

4,312

19,581

17,507

Non-cash interest expense

383

321

1,375

1,255

Above-market lease amortization

23

23

92

91

AFFO attributable to common stockholders

(diluted)

$

64,338

$

59,625

$

256,497

$

233,637

FFO per common share – diluted

$

2.07

$

1.92

$

8.20

$

7.64

Normalized FFO per common share –

diluted

$

2.07

$

1.95

$

8.29

$

7.76

AFFO per common share – diluted

$

2.28

$

2.12

$

9.08

$

8.45

Weighted average common shares outstanding

– basic

27,996,393

27,938,804

27,977,807

27,345,047

Restricted stock and RSUs

206,667

117,831

196,821

116,046

Dilutive effect of Exchangeable Senior

Notes

76,774

103,626

81,169

202,076

Weighted average common shares outstanding

– diluted

28,279,834

28,160,261

28,255,797

27,663,169

____________

(1)

Amount reflects the non-refundable

interest paid on the seller-financed note issued to IIP by the

buyer in connection with IIP’s disposition of a portfolio of four

properties in southern California, which is recognized as a deposit

liability and is included in other liabilities in IIP’s

consolidated balance sheet as of December 31, 2023, as the

transaction did not qualify for recognition as a completed

sale.

FFO and FFO per share are operating performance measures adopted

by the National Association of Real Estate Investment Trusts, Inc.

(NAREIT). NAREIT defines FFO as the most commonly accepted and

reported measure of a REIT’s operating performance equal to net

income, computed in accordance with accounting principles generally

accepted in the United States (GAAP), excluding gains (or losses)

from sales of property, depreciation, amortization and impairment

related to real estate properties, and after adjustments for

unconsolidated partnerships and joint ventures.

Management believes that net income, as defined by GAAP, is the

most appropriate earnings measurement. However, management believes

FFO and FFO per share to be supplemental measures of a REIT’s

performance because they provide an understanding of the operating

performance of IIP’s properties without giving effect to certain

significant non-cash items, primarily depreciation expense.

Historical cost accounting for real estate assets in accordance

with GAAP assumes that the value of real estate assets diminishes

predictably over time. However, real estate values instead have

historically risen or fallen with market conditions. IIP believes

that by excluding the effect of depreciation, FFO and FFO per share

can facilitate comparisons of operating performance between

periods. IIP reports FFO and FFO per share because these measures

are observed by management to also be the predominant measures used

by the REIT industry and industry analysts to evaluate REITs and

because FFO per share is consistently reported, discussed, and

compared by research analysts in their notes and publications about

REITs. For these reasons, management has deemed it appropriate to

disclose and discuss FFO and FFO per share.

IIP computes Normalized FFO by adjusting FFO, as defined by

NAREIT, to exclude certain GAAP income and expense amounts that

management believes are infrequent and unusual in nature and/or not

related to IIP’s core real estate operations. Exclusion of these

items from similar FFO-type metrics is common within the equity

REIT industry, and management believes that presentation of

Normalized FFO and Normalized FFO per share provides investors with

a metric to assist in their evaluation of IIP’s operating

performance across multiple periods and in comparison to the

operating performance of other companies, because it removes the

effect of unusual items that are not expected to impact IIP’s

operating performance on an ongoing basis. Normalized FFO is used

by management in evaluating the performance of its core business

operations. Items included in calculating FFO that may be excluded

in calculating Normalized FFO include certain transaction-related

gains, losses, income or expense or other non-core amounts as they

occur.

Management believes that AFFO and AFFO per share are also

appropriate supplemental measures of a REIT’s operating

performance. IIP calculates AFFO by adjusting Normalized FFO for

certain cash and non-cash items.

For all periods presented, FFO (diluted), Normalized FFO, AFFO

and FFO, Normalized FFO and AFFO per diluted share include the

dilutive impact of the assumed full exchange of the Exchangeable

Senior Notes for shares of common stock.

For all periods presented, as the performance thresholds for

vesting of the performance share units were not met as measured as

of the respective dates, they were excluded from the calculation of

weighted average common shares outstanding – diluted.

IIP’s computation of FFO, Normalized FFO and AFFO may differ

from the methodology for calculating FFO, Normalized FFO and AFFO

utilized by other equity REITs and, accordingly, may not be

comparable to such REITs. Further, FFO, Normalized FFO and AFFO do

not represent cash flow available for management’s discretionary

use. FFO, Normalized FFO and AFFO should not be considered as an

alternative to net income (computed in accordance with GAAP) as an

indicator of IIP’s financial performance or to cash flow from

operating activities (computed in accordance with GAAP) as an

indicator of IIP’s liquidity, nor is it indicative of funds

available to fund IIP’s cash needs, including IIP’s ability to pay

dividends or make distributions. FFO, Normalized FFO and AFFO

should be considered only as supplements to net income computed in

accordance with GAAP as measures of IIP’s operations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240226379041/en/

David Smith Chief Financial Officer Innovative Industrial

Properties, Inc. (858) 997-3332

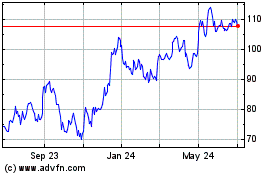

Innovative Industrial Pr... (NYSE:IIPR)

Historical Stock Chart

From Nov 2024 to Dec 2024

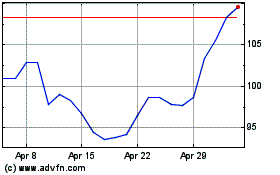

Innovative Industrial Pr... (NYSE:IIPR)

Historical Stock Chart

From Dec 2023 to Dec 2024