Innovative Industrial Properties Announces Tax Treatment of 2023 Distributions

January 26 2024 - 5:29PM

Business Wire

Innovative Industrial Properties, Inc. (IIP) (NYSE: IIPR) today

announced the tax treatment of its 2023 distributions as

follows:

Security Description: Common Stock

CUSIP: 45781V101 Ticker Symbol: IIPR

Record Date

Payable Date

Total Distribution Per

Share

Allocable to 2023

Taxable Ordinary

Dividend

Return of Capital

Long-Term Capital Gain

Unrecaptured Section 1250

Gain(1)

Section

199A

Dividend(2)

12/30/2022

01/13/2023

$1.800000

$1.470000

$1.470000

$0.000000

$0.000000

$0.000000

$1.470000

03/31/2023

04/14/2023

$1.800000

$1.800000

$1.800000

$0.000000

$0.000000

$0.000000

$1.800000

06/30/2023

07/14/2023

$1.800000

$1.800000

$1.800000

$0.000000

$0.000000

$0.000000

$1.800000

09/29/2023

10/13/2023

$1.800000

$1.800000

$1.800000

$0.000000

$0.000000

$0.000000

$1.800000

12/29/2023

01/12/2024

$1.820000

$0.830000

$0.830000

$0.000000

$0.000000

$0.000000

$0.830000

Totals

$9.020000

$7.700000

$7.700000

$0.000000

$0.000000

$0.000000

$7.700000

Security Description: 9.00% Series A

Cumulative Redeemable Preferred Stock CUSIP: 45781V200

Ticker Symbol: IIPR PR A

Record Date

Payable Date

Total Distribution Per

Share

Allocable to 2023

Taxable Ordinary

Dividend

Return of Capital

Long-Term Capital Gain

Unrecaptured Section 1250

Gain(1)

Section

199A

Dividend(2)

03/31/2023

04/14/2023

$0.562500

$0.562500

$0.562500

$0.000000

$0.000000

$0.000000

$0.562500

06/30/2023

07/14/2023

$0.562500

$0.562500

$0.562500

$0.000000

$0.000000

$0.000000

$0.562500

09/29/2023

10/13/2023

$0.562500

$0.562500

$0.562500

$0.000000

$0.000000

$0.000000

$0.562500

12/29/2023

01/12/2024

$0.562500

$0.562500

$0.562500

$0.000000

$0.000000

$0.000000

$0.562500

Totals

$2.250000

$2.250000

$2.250000

$0.000000

$0.000000

$0.000000

$2.250000

(1)

These amounts are a subset of, and included in, Long-Term

Capital Gain amounts.

(2)

These amounts are a subset of, and included in, Taxable

Ordinary Dividend amounts.

The common stock distribution with a record date of December 29,

2023 will be a split-year distribution, with $0.83 allocable to

2023 for federal income tax purposes and $0.99 allocable to 2024

for federal income tax purposes.

As previously disclosed by IIP on January 26, 2023 in its press

release announcing the tax treatment of 2022 dividends, the common

stock distribution with a record date of December 30, 2022 was a

split-year distribution, with $0.33 allocable to 2022 for federal

income tax purposes and $1.47 allocable to 2023 for federal income

tax purposes, and the 9.00% Series A Cumulative Redeemable

Preferred Stock distribution with a record date of December 30,

2022 was allocable entirely to 2022 for federal income tax

purposes.

IIP did not incur any foreign taxes in 2023. Stockholders are

encouraged to consult with their personal tax advisors as to their

specific tax treatment of IIP’s distributions.

About Innovative Industrial Properties

Innovative Industrial Properties, Inc. is a self-advised

Maryland corporation focused on the acquisition, ownership and

management of specialized industrial properties leased to

experienced, state-licensed operators for their regulated cannabis

facilities. Innovative Industrial Properties, Inc. has elected to

be taxed as a real estate investment trust, commencing with the

year ended December 31, 2017. Additional information is available

at www.innovativeindustrialproperties.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240126622212/en/

David Smith Chief Financial Officer Innovative Industrial

Properties, Inc. (858) 997-3332

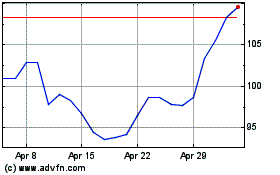

Innovative Industrial Pr... (NYSE:IIPR)

Historical Stock Chart

From Nov 2024 to Dec 2024

Innovative Industrial Pr... (NYSE:IIPR)

Historical Stock Chart

From Dec 2023 to Dec 2024