| |

Filed

by Honda Motor Co., Ltd.

Pursuant

to Rule 425 under the U.S. Securities Act of 1933

Subject

Companies: Honda Motor Co., Ltd. (File Number: 001-07628) and

Nissan

Motor Co., Ltd. (File Number: 132-_____)

|

December 23, 2024

Honda Motor Co., Ltd.

Nissan Motor Co., Ltd.

Notice of Execution of Memorandum of Understanding

regarding the Consideration of a Business Integration through the Establishment of a Joint Holding Company (Joint Share Transfer) between

Honda Motor Co., Ltd. (Securities Code: 7267) and Nissan Motor Co., Ltd. (Securities Code: 7201)

Honda Motor Co., Ltd.

(“Honda”) and Nissan Motor Co., Ltd., (“Nissan”; Honda and Nissan are collectively referred to as the

”Companies”) have agreed to begin discussions and consideration toward a business integration (the “Business

Integration”) and have resolved at the boards of directors of each of the Companies to sign a memorandum of understanding

regarding the consideration of the Business Integration, which has been duly executed.

| 1. | Background and Purpose of

the Business Integration |

| (1) | Background of the Business

Integration |

Honda, since its establishment in

1948, has developed, manufactured, and marketed motorcycles, automobiles, power products and compact aircraft globally, under its founder’s

ideals to “help with technologies for people.” It has also committed to realizing a society with zero environmental impact

and zero traffic collision fatalities under its philosophy of "Respect for the Individual" and "the Three Joys" (the

joy of buying, the joy of selling, and the joy of creating). This is guided by the company principle: "Maintaining a global viewpoint,

we are dedicated to supplying products of the highest quality, yet at a reasonable price for worldwide customer satisfaction." By

realizing the future mobility, Honda dreams of and a mobility society that people desire, while addressing societal issues related to

“environment” and “safety.” Honda aspires to chart a new trajectory of growth as a comprehensive mobility company.

Nissan has been involved in the

manufacturing, sales, and related business of automotive products since its establishment in 1933. Guided by its corporate purpose of

"Driving innovation to enrich people's lives," Nissan has achieved substantial growth through its diverse global operations,

contributing positively to the economy. As a leading global automotive manufacturer, Nissan is committed to addressing the challenges

faced by society, placing a high priority on all stakeholders, such as customers, shareholders, employees, and local communities. It remains

dedicated to providing valuable and sustainable mobility solutions for the future.

As the Companies

engage in their respective businesses to address social challenges, it is essential to strengthen areas such as environmental technologies,

electrification technologies, and software development to further accelerate their efforts toward achieving a carbon-neutral society and

a zero-traffic fatalities society, the Companies signed a memorandum of understanding on March 15, 2024 regarding a strategic partnership

for the era of vehicle intelligence and electrification. Since then, the Companies have held discussions aimed at collaboration in various

fields.

Furthermore,

on August 1, 2024 the Companies signed a further memorandum of understanding to deepen the framework of the strategic partnership. The

Companies also announced that they had agreed to carry out joint research in fundamental technologies in the area of platforms for next-generation

software-defined vehicles (SDVs), particularly in the areas crucial for intelligence and electrification, to advance focused discussions

toward more concrete collaboration.

Throughout

the process, the Companies have engaged in discussions in consideration of various possibilities and options. At the same time, the business

environment for the Companies and the wider automotive industry has rapidly changed and the speed of technological innovation has continued

to accelerate. The memorandum of understanding between the Companies announced today is aimed to serve as an option to maintain global

competitiveness and for the Companies to continue to deliver more attractive products and services to customers worldwide.

| (2) | Purpose of the Business Integration |

If the Business Integration

can be realized, the Companies can aim to integrate their respective management resources such as knowledge, human resources, and

technologies; create deeper synergies; enhance the ability to respond to market changes; and expect to improve mid- to long-term

corporate value. Additionally, the Companies can aim to further contribute to the development of Japan's industrial base as a

“leading global mobility company” by integrating the Companies’ four-wheel-vehicle and Honda's motorcycle and

power products businesses as well as other businesses, including aircraft, continue to make the brands of the Companies more

attractive and deliver more attractive and innovative products and services to customers worldwide.

| (3) | Potential Synergies from the

Business Integration |

The

Companies will aim to become a world-class mobility company with sales revenue exceeding JPY 30 trillion and an operating profit of

more than JPY 3 trillion by swiftly realizing synergy effects between the Companies resulting from the Business Integration. The

potential synergies expected at this stage are as follows. Going forward, the Companies will examine and analyze more specific

synergies based on discussions within the integration preparatory committee to be established by the Companies and the results of

due diligence to be conducted in the future.

| (i) | Scale Advantages

by Standardizing Vehicle Platforms |

By standardizing the vehicle platforms

of the Companies across various product segments, the Companies expect to create stronger products, reduce costs, enhance development

efficiencies, and improve investment efficiencies through standardized production processes.

The integration is projected to increase

sales and operational volumes, allowing the Companies to reduce development costs per vehicle, including for future digital services,

while maximizing profits.

By accelerating

the mutual complementation of their global vehicle offerings - including ICE (internal combustion engine), HEV (hybrid), PHEV (plug-in

hybrid), and EV (electric vehicles) models - the Companies will be better positioned to meet diverse customer needs around the world and

deliver optimal products, leading to improved customer satisfaction.

| (ii) | Enhancement

of Development Capabilities and Cost Synergies through the Integration of R&D Functions |

The

Companies have started joint research in fundamental technologies in the area of vehicle platforms for next-generation SDVs, which

is the cornerstone of the field of intelligence. The Companies are progressing efforts towards standardizing specifications and

mutual supply of key components such as batteries, which are crucial for EVs, and e-Axle, which is expected to be equipped in

next-generation EVs. After the realization of Business Integration, the Companies will encompass more integrated collaboration across all

R&D functions, including fundamental research and vehicle application technology research. This approach is expected to enable

the Companies to efficiently and swiftly enhance their technological expertise, achieving both improvements in development

capabilities and reductions in development costs through the integration of overlapping functions.

| (iii) | Optimizing

Manufacturing System and Facilities |

The Companies

anticipate that optimizing their manufacturing plants and energy service facilities, combined with improved collaboration through the

shared use of production lines, will result in a substantial improvement in capacity utilization leading to a decrease in fixed costs.

| (iv) | Strengthening

Competitiveness Advantage across the Supply Chain through the Integration of Purchasing Functions |

To fully leverage

the synergies from optimizing development and production capacity, the Companies intend to boost their competitiveness by improving and

streamlining purchasing operations and source common parts from the same the supply chain and in collaboration with business partners.

| (v) | Realizing

Cost Synergies through Operational Efficiency Improvements |

The Companies

expect that the integration of systems and back-office operations, along with the upgrade and standardization of operational processes,

will drive significant cost reductions.

| (vi) | Acquisition

of Scale Advantages through Integration of Sales Finance |

By integrating

relevant areas of sales finance functions of the Companies and expanding the scale of operations, the Companies aim to provide a range

of mobility solutions, including new financial services throughout the vehicle lifecycle, to customers of both organizations.

| (vii) | Establishment

of Talent Foundation for Intelligence and Electrification |

The human resources

of the Companies are an invaluable asset, and establishing a strong human resource foundation is crucial for the transformation that will

come with the Business Integration. After the integration, increased employee exchanges and technical collaboration between the Companies

are expected to promote further skill development. Moreover, by leveraging each company's access to talent markets, attracting exceptional

talent will become more attainable.

| 2. | Summary of the Business

Integration |

| (1) | Method of the Business Integration |

The

Companies plan to establish, through a joint share transfer (the “Share Transfer”), a joint holding company that will be

the parent company of both companies. This will be subject to approval at each company's general meeting of shareholders and

obtaining necessary approvals from relevant authorities for the Business Integration, based on the result of the consideration of

the Business Integration and the premise that Nissan's turnaround actions* are

steadily executed. The Companies will be fully owned subsidiaries of the joint holding company.

However, should

any procedural necessities arise regarding the Share Transfer or for any other reasons, the Companies may consult and agree to modify

the above structure in the future.

*

Nissan‘s actions

to turnaround its performance and create a leaner, more resilient business capable of swiftly adapting to changes in the

market.

| (2) | Matters concerning the Listing

of the Joint Holding Company |

Shares

of the newly established joint holding company under consideration are planned to be newly listed (technical listing) on the Prime

Market of the Tokyo Stock Exchange (“TSE”).

The listing is scheduled for August 2026.

In addition,

the Share Transfer will result in the Companies becoming wholly-owned subsidiaries of the joint holding company, and therefore the Companies

will become wholly owned subsidiaries of the joint holding company and will be scheduled to be delisted from the TSE. However,

shareholders of the Companies will continue to be able to trade shares of the joint holding company issued during this share transfer

on the TSE.

The listing

date of the joint holding company and the delisting date for the Companies will be determined in accordance with the regulations of the

TSE.

| (3) | Schedule for the Business Integration |

| Board of Directors Resolutions |

December 23, 2024 (Today) |

| Execution of the Memorandum of Understanding |

December 23, 2024 (Today) |

| Execution of a definitive agreement concerning the Business Integration |

June 2025 (Planned) |

Extraordinary General Shareholders’ Meetings of the Companies

(Resolutions to approve the Share Transfer) |

April 2026 (Planned) |

| Delisting from the Tokyo Stock Exchange (TSE) |

End

of July - August 2026 (Planned) |

| Effective date of the Share Transfer |

August 2026 (Planned) |

(Note) The above schedule is tentative

and may change as a result of the consultation by the Companies. In addition, an announcement will be promptly made if there arise reasons,

such as procedures under applicable competition laws, to change the schedule of the Business Integration process or to cancel the Business

Integration itself.

| (4) | Details of the Share Allocation

in this Share Transfer (Share Transfer Ratio) |

The share

transfer ratio for the share transfer will be determined by the time of concluding the final definitive agreement regarding the

consideration of the Business Integration. The determination will be based on the results of due diligence, third-party valuations

with reference to the average closing prices of each company's shares over a certain period prior to the announcement of the

memorandum of understanding.

Furthermore,

Honda has retained Nomura Securities Co., Ltd. as its financial advisor, while Nissan has retained Mizuho Securities Co., Ltd. and BofA

Securities, Inc. as its financial advisors, for the consideration of Business Integration.

| (5) | Stock Acquisition Rights and

Bonds with Stock Acquisition Rights |

The Companies

have not issued stock acquisition rights or bonds with stock acquisition rights.

| (6) | Driving Force of the Business

Integration |

Aiming for

the smooth realization of the Business Integration, the Companies will establish an integration preparatory committee to conduct focused

discussions concerning the Business Integration.

| (7) | Management Structure Following

the realization of Business Integration |

At the time

of the effective date of the share transfer, it is planned that Honda will nominate a majority of each of the internal and external directors

of the joint holding company. President and representative director or president and representative executive officer of the joint holding

company will be selected from among the directors nominated by Honda.

Additionally,

the Companies plan to continue coexisting and developing the brands held by the Companies equally.

Other details

of the joint holding company, including the name, registered office, representatives, executive composition, and organizational structure

will be determined by the time of the execution of the definitive agreement, based on discussions and consideration aligned within the

purpose of the business integration at the upcoming integration preparatory committee, as well as the results of the due diligence.

Regarding

the organizational structure of the joint holding company, and the Companies which will become wholly-owned subsidiaries of the

joint holding company after the realization of Business Integration, the optimal structure for realizing synergies, including the

integration of R&D functions, purchasing functions, and manufacturing functions, will be discussed and considered within the

integration preparatory committee, with the aim of establishing an organizational structure that enables efficient and highly

competitive business operations after the Business Integration.

| (8) | Exclusive Negotiation Rights |

The

Companies shall bear an obligation of exclusive negotiation, mutually prohibiting each other from engaging in acts that are

contradictory to the memorandum of understanding and acts that significantly hinder the achievement of the purpose of the Business

Integration ("Competing Transactions") with any third party during the effective period of the memorandum of

understanding. However, if either party receives a bona fide proposal regarding a Competing Transaction from a third party and it is

deemed that compliance with the exclusive negotiation obligation or failure to consider, discuss, agree, or consent to such proposal

would likely give rise to a specific risk of violation of the duty of care owed by directors and others, the exclusive negotiation

obligation may be exempted under certain conditions. Furthermore, if, as a result of an exemption from the exclusive negotiation

obligation, the party receiving a proposal for a Competing Transaction from a third party agrees to or consents to that proposal,

and the closing of such Competing Transaction is completed, that party shall be obligated to pay the other party a cancellation fee

of JPY 100 billion.

| 3. | Outline of the Parties to

the Share Transfer |

| (1) |

Company name |

Honda Motor Co., Ltd. |

Nissan Motor Co., Ltd. |

| (2) |

Registered office |

2-1-1, Minami-Aoyama, Minato-ku, Tokyo |

2, Takara-cho, Kanagawa-ku, Yokohama-shi, Kanagawa |

| (3) |

Title and name of

representative |

Toshihiro Mibe,

Director, President and Representative Executive Officer |

Makoto Uchida,

Representative Executive Officer, President and Chief

Executive Officer |

| (4) |

Description of

Business |

The

Motorcycle business operations, Automobile business operations, Power Products business operations, and other business

operations. |

Development, production, and sales, of automobiles |

| (5) |

Stated capital

(as of September 30, 2024) |

86,067 million yen |

605,814 million yen |

| (6) |

Date of establishment |

September 24, 1948 |

December 26, 1933 |

| (7) |

Number of issued

and outstanding

shares

(as of September 30, 2024) |

5,280,000,000 shares |

3,909,472,212 shares |

| (8) |

Account closing

Date |

March 31 |

March 31 |

| (9) |

Number of employees

(as of March 31, 2024) |

194,993 |

133,580 |

| (10) |

Major suppliers |

Hitachi Astemo, Ltd.

Denso Corporation

STEEL CENTER CO., LTD.

TS TECH CO., LTD.

Sumitomo Electric Industries, Ltd.

TACHI-S CO., LTD.

Panasonic Automotive Systems Co., Ltd.

AISIN CORPORATION

Hitachi Astemo Ueda Ltd.

Mitsubishi Electric Corporation |

Marelli Corporation

Hitachi Astemo, Ltd.

Faurecia-Nippon Seiki Co., Ltd.

Panasonic Automotive Systems Co., Ltd.

Denso Corporation

Sumitomo Electric Industries, Ltd.

Bosch Corporation

Yazaki Corporation

Topre Corporation

Koito Manufacturing Co., Ltd. |

| (11) |

Main financing banks |

MUFG Bank, Ltd.

Mizuho Bank, Ltd.

Sumitomo Mitsui Banking Corporation

Saitama Resona Bank, Ltd. |

Mizuho Bank, Ltd.

MUFG Bank, Ltd.

Sumitomo Mitsui Banking Corporation

|

| (12) |

Major shareholders and ownership percentage

(as of September 30, 2024) |

The Master Trust Bank of Japan, Ltd. (Trust Account)

16.81%

Custody Bank of

Japan, Ltd. (Trust Account) 6.65%

Moxley and Company (Standing proxy: MUFG Bank, Ltd.)

5.55%

State Street Bank and Trust Company 505001 (Standing

proxy: Mizuho Bank, Ltd.) 2.97%

Meiji Yasuda Life Insurance Company (Standing proxy:

Custody Bank of Japan, Ltd.) 2.95%

JPMorgan Securities Japan Co., Ltd. 2.14%

State Street Bank West Client - Treaty (Standing

proxy: Mizuho Bank, Ltd.) 1.99%

Nippon Life Insurance Company (Standing proxy: The

Master Trust Bank of Japan, Ltd.) 1.72%

JP MORGAN CHASE BANK 385781 (Standing proxy: Mizuho

Bank, Ltd.) 1.49%

AXA Life Insurance Co., Ltd. 1.22%

|

NATIXIS SA AS TRUSTEE FOR FIDUCIE NEWTON 701910 (Standing

proxy: Mizuho Bank, Ltd. Payment Sales Department) 22.8%

Renault S.A. (Standing proxy: Mizuho Bank, Ltd. Payment

Sales Department) 16.3%

The Master Trust Bank of Japan, Ltd. (Shintaku-guchi)

8.6%

J.P. MORGAN SE - LUXEMBOURG BRANCH 381648 (Standing

proxy: Mizuho Bank, Ltd. Payment Sales Department) 3.2%

Suntera (Cayman) Limited as trustee of ECM Master

Fund (Standing proxy: GOLDMAN SACHS JAPAN CO., LTD.) 2.5%

Custody Bank of

Japan, Ltd. (Shintaku-guchi) 1.6%

State Street Bank West Client - Treaty 505234 (Standing

proxy: Mizuho Bank, Ltd. Payment Sales Department) 1.2%

Nippon Life Insurance Company (Standing proxy: The

Master Trust Bank of Japan, Ltd.) 1.0%

Moxley and Company (Standing proxy: Mizuho Bank,

Ltd. Payment Sales Department) 0.9%

The Nomura Trust and Banking (Shintaku-guchi) 0.6% |

| (13) |

Relationship between companies |

| Capital |

None |

| Personnel |

None |

| Transactional |

None |

| Status as a related party |

None |

| (14) |

Operating results and financial condition for the last

three fiscal years

(Figures are millions of yen unless otherwise indicated) |

| |

Honda (IFRS) |

|

Nissan Motor (JGAAP) |

|

Fiscal year ended

March 2022 |

Fiscal year ended

March 2023 |

Fiscal year ended

March 2024 |

Fiscal year ended

March 2022 |

Fiscal year ended

March 2023 |

Fiscal year ended

March 2024 |

| Equity attributable to owners of the parent |

10,472,824 |

11,184,250 |

12,696,995 |

Consolidated net assets |

5,029,584 |

5,615,140 |

6,470,543 |

| Total liabilities and equity |

23,973,153 |

24,670,067 |

29,774,150 |

Consolidated total assets |

16,371,481 |

17,598,581 |

19,855,151 |

| Equity attributable to owners of the parent per share (yen) |

2,040.77 |

2,239.98 |

2,629.37 |

Consolidated net assets per share (yen) |

1,170.17 |

1,310.74 |

1,599.28 |

| Sales revenue |

14,552,696 |

16,907,725 |

20,428,802 |

Sales revenue |

8,424,585 |

10,596,695 |

12,685,716 |

| Operating Profit |

871,232 |

780,769 |

1,381,977 |

Consolidated operating profit |

247,307 |

377,109 |

568,718 |

| |

- |

- |

- |

Consolidated ordinary profit |

306,117 |

515,443 |

702,161 |

|

Profit for the year attributable to:

Owners of the parent . |

707,067 |

651,416 |

1,107,174 |

Profit for the year attributable to owners of the parent |

215,533 |

221,900 |

426,649 |

| Basic

earnings per share for the year attributable to owners of the parent (yen) |

137.03 |

128.01 |

225.88 |

Earnings

per share attributable to owners of the parent (yen) |

55.07 |

56.67 |

110.47 |

| Dividends per share (yen) |

120.00 |

120.00 |

126.00 |

Dividends per share (yen) |

5 |

10 |

20 |

| (Note | 1) Honda has adopted International Financial Reporting Standards (IFRS) for its consolidated financial

statements. Honda has omitted the disclosure of "Consolidated ordinary profit" as there are no corresponding items. |

| (Note | 2) Honda conducted a three-for-one stock split of its common shares, with the record date of

September 30, 2023, and the effective date of October 1, 2023. The equity attributable to owners of the parent per share and basic

earnings per share for the year (attributable to owners of the parent) for the year are calculated under the assumption that the

stock split occurred at the start of the fiscal year ended March 2022. For the dividends per share, the interim dividend amount for

the fiscal year ended March 2024 was JPY 87, before the stock split, and the year-end dividend amount was JPY 39, after the stock

split, resulting in a total annual dividend amount of JPY 126. |

The Companies may file a registration statement on

Form F-4 (“Form F-4”) with the U.S. Securities and Exchange Commission (the “SEC”) in connection with the possible

Share Transfer pertaining to the Business Integration between the Companies, if it is conducted. The Form F-4 (if filed in connection

with the Share Transfer) will contain a prospectus and other documents. If a Form F-4 is filed and declared effective, the prospectus

contained in the Form F-4 will be mailed to U.S. shareholders of the Companies prior to the shareholders’ meetings at which the

Share Transfer will be voted upon. The Form F-4 and prospectus (if the Form F-4 is filed) will contain important information about the

Companies, the Share Transfer and related matters. U.S. shareholders of the Companies to whom the prospectus is distributed are urged

to read the Form F-4, the prospectus and other documents that may be filed with the SEC in connection with the Share Transfer carefully

before they make any decision at the respective shareholders’ meeting with respect to the Share Transfer. Any documents filed or

furnished with the SEC in connection with the Share Transfer will be made available when filed, free of charge, on the SEC’s web

site at www.sec.gov. In addition, the documents will be mailed to any shareholder of Honda or Nissan upon request for free of charge.

To make a request, please refer to the following contact information.

| Honda Motor Co., Ltd. |

Nissan Motor Co., Ltd. |

|

2-1-1, Minami-Aoyama

Minato-ku, Tokyo 107-8556

Japan |

1-1, Takashima 1-chome

Nishi-ku, Yokohama, Kanagawa, 220-8686 Japan |

| Attention: Masao Kawaguchi |

Attention: Julian Krell |

| Head of Accounting and Finance Supervisory Unit |

Vice President, IR Department |

| (Tel. +81-3-3423-1111) |

(Tel. +81-45-523-5523) |

FORWARD-LOOKING STATEMENTS

This document includes “forward-looking

statements” that reflect the plans and expectations of the Companies in relation to, and the benefits resulting from, the Business

Integration and the potential benefits that may be realized through it. To the extent that statements in this document do not relate to

historical or current facts, they constitute forward-looking statements. These forward-looking statements are based on the current assumptions

and beliefs of the Companies in light of the information currently available, and involve known and unknown risks, uncertainties and other

factors. Such risks, uncertainties and other factors may cause the actual results, performance, achievements or financial position of

one or the Companies (or the group after the Business Integration) to be materially different from any future results, performance, achievements

or financial position expressed or implied by these forward-looking statements.

The Companies undertake no obligation

to and have no intention to publicly update any forward-looking statements after the date of this document. Investors are advised to consult

any further disclosures by the Companies (or the group after the Business Integration) in their subsequent filings in Japan and filings

with the SEC pursuant to the U.S. Securities Exchange Act of 1934.

The risks, uncertainties and

other factors referred to above include, without limitation:

| ・ | changes in the economic situation, market demand,

and competitive environment surrounding the automobile market in and outside Japan |

| ・ | financial uncertainty domestically and internationally,

or changes in other general economic or industry situation |

| ・ | interest rates and other market risks |

| ・ | changes in the credit ratings of the Companies |

| ・ | changes in laws and regulations (including environmental

regulations) related to the business activities of the Companies |

| ・ | increases in tariffs, introduction of import regulations,

and other changes in the major markets of the Companies |

| ・ | failure to finalize the definitive agreement(s)

concerning the Business Integration |

| ・ | delays in the review or approvals from relevant

authorities needed for the Business Integration, or failure to obtain such approvals from relevant authorities |

| ・ | the possibility of not being able to realize the

synergies or added value expected from the Business Integration, or achieving such realizations become difficult; and |

| ・ | other risks associated with completing the Business

Integration. |

End

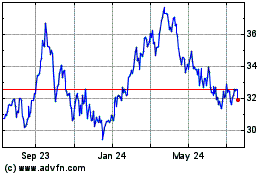

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Feb 2025 to Mar 2025

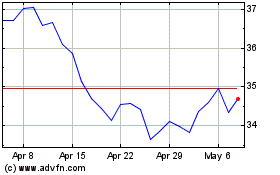

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Mar 2024 to Mar 2025