FX FRIDAY: Cleveland Fed's Top Economist Sees US '11 GDP Below 3%

June 10 2011 - 2:30PM

Dow Jones News

The U.S. economy's slowdown should prove temporary as supply

disruptions stemming from Japan's earthquake are solved earlier

than anticipated and gasoline prices remain tame, a top economist

at the Federal Reserve Bank of Cleveland said Friday.

However, Cleveland Fed Research Director Mark Schweitzer

cautioned that the U.S. economy is unlikely to grow at a very

strong pace for some time as continued troubles in housing weigh on

consumer confidence and spending.

U.S. gross domestic product, the broadest measure of economic

activity, should expand by less than 3.0% in 2011 after high energy

prices weighed on consumer spending and Japan's disaster hit auto

sales in the first half of the year, the central bank economist

said.

At the end of April, the Fed projected that GDP would grow

between 3.1% and 3.3% this year, but officials are likely to

downgrade their forecasts at their next meeting on June 21-22.

For 2012, Schweitzer said he expects the economy to pick up some

speed, expanding between 3.5% and 4.0%. That is only slightly below

the Fed's April growth forecast of between 3.5% and 4.2%.

"There has been some negative news lately, but it doesn't look

that problematic," Schweitzer said in an interview on the sidelines

of the Cleveland Fed's policy summit, which this year focused on

housing.

Japan's earthquake and tsunami, which the economist said hit the

production of cars by Honda Motor Co. (7267.TO, HMC) in the

Cleveland Fed district, could shave up to three-quarters of a

percentage point off GDP in the current quarter, though he declined

to provide a specific number. In the first quarter, GDP rose by an

annual rate of just 1.8%.

Looking forward, Japan is making quick progress in fixing the

supply disruptions and it looks as if problems will be solved by

the third quarter, instead of at the end of the year as originally

feared, Schweitzer said.

That should also help the jobs market, the Cleveland Fed

economist said, noting that the persistently high level of jobless

claims may be due partly to one-off reasons such as workers at

auto-parts companies losing their jobs temporarily.

"It looks like gasoline prices will likely remain on the low

side," Schweitzer noted as another factor that should help growth

later in the year and in 2012.

Still, he warned that Americans' continued concerns about never

turning the corner in the housing market could weigh on the economy

for a long time.

On Thursday, Fed Vice Chairwoman Janet Yellen told the Cleveland

summit that the recovery in the housing sector is likely to be a

long and drawn-out process.

-By Luca Di Leo, Dow Jones Newswires; 202-862-6682;

luca.dileo@dowjones.com

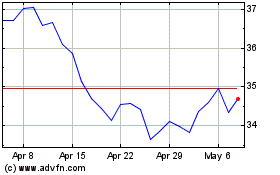

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Jun 2024 to Jul 2024

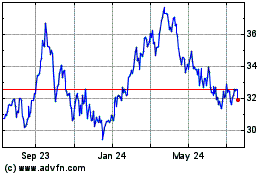

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Jul 2023 to Jul 2024