UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a16 OR 15d16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For February 23, 2021

Harmony Gold Mining Company Limited

Randfontein Office Park

Corner Main Reef Road and Ward Avenue Randfontein, 1759

South Africa

(Address of principal executive offices)

*-

(Indicate by check mark whether the registrant files or will file annual reports under cover of

Form 20 F or Form 40F.)

Form 20F ☒ Form 40F ☐

(Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g32(b) under the Securities Exchange Act of 1934.)

Yes ☐ No ☒

Harmony Gold Mining Company Limited

Registration number 1950/038232/06

Incorporated in the Republic of South Africa

ISIN: ZAE000015228

JSE share code: HAR

(“Harmony” and/or “the Company”)

RESULTS FOR THE INTERIM PERIOD ENDED 31 DECEMBER 2020 – SHORT FORM ANNOUNCEMENT

Johannesburg, Tuesday, 23 February 2021. Harmony Gold Mining Company Limited (“Harmony” or “the Company”) is pleased to announce its financial and operating results for the interim period ended 31 December 2020 (“H1FY21”) compared to the six-months ended 31 December 2019 (“H1FY20”).

•336% increase in net profit to R5.8bn (US$356m) from R1.3bn (US$91m)

•Revenue increased by 39% to R21.6bn (US$1.3bn) from R15.5bn (US$1.1bn)

•69% increase in operating free cash flow margin to 22% from 13%

•65% increase in production profit to R6.8bn (US$417m) from R4.1bn (US$280m)

•Net debt to EBITDA at 0.1x

•EPS increased by 288% to 966 SA cents (59 US cents) from 249 SA cents (17 US cents)

•HEPS increased by 211% to 775 SA cents (48 US cents) from 249 SA cents (17 US cents)

•Interim dividend of 110 SA cents (approximately 7.5 US cents) per share declared (December 2019: nil)

“The exceptional performance achieved in the first half of FY21 substantiates the growth strategy that we set out to pursue at the beginning of 2016. Through astute acquisitions, we have successfully added quality ounces to our portfolio and de-risked our asset portfolio. We are also seeing a significant improvement in our overall grade and cash flow. Harmony is no longer a marginal gold producer, but an emerging mining specialist with a diversified and de-risked asset portfolio. On the back of our investment in growth assets, a stronger operational performance from our mines in H1FY21 and a strategy aimed at delivering positive shareholder returns, we are pleased to announce an interim dividend of 110 SA cents (approximately 7.5 US cents),” said Peter Steenkamp, chief executive officer of Harmony.

Notice of Interim Gross Cash Dividend

Our dividend declaration for the six months ended 31 December 2020 is as follows:

Declaration of interim gross cash ordinary dividend no. 89

The Board has approved, and notice is hereby given, that an interim gross cash dividend of 110 SA cents (7.5 US cents*) per ordinary share in respect of the six months ended 31 December 2020, has been declared payable to the registered shareholders of Harmony on Monday, 19 April 2021.

In accordance with paragraphs 11.17(a)(i) to (x) and 11.17(c) of the JSE Listings Requirements the following additional information is disclosed:

•The dividend has been declared out of income reserves;

•The local Dividend Withholding Tax rate is 20% (twenty percent);

•The gross local dividend amount is 110 SA cents (7.5 US cents*) per ordinary share for shareholders exempt from the Dividend Withholding Tax;

•The net local dividend amount is 88 SA cents per ordinary share for shareholders liable to pay the Dividend Withholding Tax;

•Harmony currently has 616 052 197 ordinary shares in issue (which includes 6 154 630 treasury shares); and

•Harmony’s income tax reference number is 9240/012/60/0.

A dividend No. 89 of 110 SA cents (7.5 US cents*) per ordinary share, being the dividend for the six months ended 31 December 2020, has been declared payable on Monday 19 April 2021 to those shareholders recorded in the books of the company at the close of business on Friday, 16 April 2021. The dividend is declared in the currency of the Republic of South Africa. Any change in address or dividend instruction to apply to this dividend must be received by the company’s transfer secretaries or registrar not later than Friday, 9 April 2021.

In compliance with the requirements of Strate Proprietary Limited (Strate) and the JSE Listings Requirements, the salient dates for payment of the dividend are as follows:

|

|

|

|

|

|

|

|

Last date to trade ordinary shares cum-dividend is

|

Tuesday, 13 April 2021

|

|

Ordinary shares trade ex-dividend

|

Wednesday, 14 April 2021

|

|

Record date

|

Friday, 16 April 2021

|

|

Payment date

|

Monday, 19 April 2021

|

No dematerialisation or rematerialisation of share certificates may occur between Wednesday, 14 April 2021 and Friday, 16 April 2021, both dates inclusive, nor may any transfers between registers take place during this period.

On payment date, dividends due to holders of certificated securities on the SA share register will either be electronically transferred to such shareholders' bank accounts or, in the absence of suitable mandates, dividends will be held in escrow by Harmony until suitable mandates are received to electronically transfer dividends to such shareholders.

Dividends in respect of dematerialised shareholdings will be credited to such shareholders' accounts with the relevant Central Securities Depository Participant (CSDP) or broker.

The holders of American Depositary Receipts (ADRs) should confirm dividend details with the depository bank. Assuming an exchange rate of R14.64/US$1* the dividend payable on an ADR is equivalent to US7.5 cents for ADR holders before dividend tax. However, the actual rate of payment will depend on the exchange rate on the date for currency conversion.

*Based on an exchange rate of R14.64/US$1 at 19 February 2021. However, the actual rate of payment will depend on the exchange rate on the date for currency

Short form announcement:

This short-form announcement is the responsibility of the board of directors of the Company (“Board”).

Shareholders are advised that this short-form announcement represents a summary of the information contained in the full announcement (“results booklet”) and does not contain full or

complete details published on the Stock Exchange News Service (“SENS”), via the JSE link and on Harmony’s website (www.harmony.co.za) on 23 February 2021.

The financial results as contained in the condensed consolidated financial statements for the six months ended 31 December 2020 have been reviewed by PricewaterhouseCoopers Inc., who expressed an unmodified review conclusion thereon.

Any investment decisions by investors and/or shareholders should be based on a consideration of the full announcement as a whole and shareholders are encouraged to review the results booklet, which is available for viewing on the Company’s website referred to above and via the JSE link at https://senspdf.jse.co.za/documents/2021/jse/isse/HARE/HY21Result.pdf.

The results booklet is also available for inspection at the registered office of the Company, Randfontein Office Park, Randfontein, 1760, Corner Main Reef Road/Ward Avenue, Randfontein, and at the offices of the sponsors, J.P. Morgan. Inspection of the results booklet is available to investors and/or shareholders at no charge, during normal business hours from today, 23 February 2021, until 28 February 2021.

Copies of the results booklet may be requested from HarmonyIR@harmony.co.za

Ends.

For more details, contact:

Jared Coetzer

Head: Investor Relations

+27 (0)82 746 4120

Max Manoeli

Investor Relations Manager

+27(0)82 759 1775 (mobile)

Marian van der Walt

Senior Group Executive: Enterprise Risk Management and Investor Relations

+27(0)82 888 1242 (mobile)

Johannesburg, South Africa

23 February 2021

Sponsor:

J.P. Morgan Equities South Africa Proprietary Limited

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on

its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Harmony Gold Mining Company Limited

|

|

|

|

|

Date: February 23, 2021

|

By: /s/ Boipelo Lekubo

|

|

|

Name: Boipelo Lekubo

|

|

|

Title: Financial Director

|

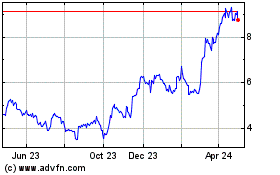

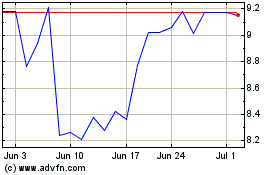

Harmony Gold Mining (NYSE:HMY)

Historical Stock Chart

From Apr 2024 to May 2024

Harmony Gold Mining (NYSE:HMY)

Historical Stock Chart

From May 2023 to May 2024