Guggenheim Build America Bonds Managed Duration Trust Announces Modifications to Certain Non-Fundamental Investment Policies ...

May 20 2016 - 4:30PM

Guggenheim Build America Bonds Managed Duration Trust (“GBAB” or

the “Trust”) today announced that the Trust’s Board of Trustees

(the “Board”) approved modifications to certain non-fundamental

investment policies and the name of the Trust, which will become

effective as of July 26, 2016.

The Trust will continue to pursue its primary investment

objective of providing current income with a secondary objective of

long-term capital appreciation. However, as a result of these

investment policy changes, the Trust will no longer be required to

invest a specific percentage of its Managed Assets in Build America

Bonds (“BABs”).

|

Current Policy |

New Policy (Effective July 26, 2016) |

|

Under normal market conditions, the Trust will invest at least 80%

of its Managed Assets in BABs. |

Under normal market conditions, the Trust will invest at least 80%

of its Managed Assets in taxable municipal securities, including

BABs. |

|

Under normal market conditions, the Trust may invest up to 20% of

Managed Assets in securities other than BABs, including taxable

municipal securities that do not qualify for federal subsidy

payments under the American Reinvestment and Recovery Act,

municipal securities the interest income from which is exempt from

regular federal income tax (sometimes referred to as “tax-exempt

municipal securities”), asset-backed securities, senior loans and

other income producing securities. |

Under normal market conditions, the Trust may invest up to 20% of

its Managed Assets in securities other than taxable municipal

securities, including tax-exempt municipal securities, asset-backed

securities, senior loans and other income producing

securities. |

| |

|

In connection with the investment policy changes described

herein, the Trust will be required to change its name. Upon the

effective date, the Trust will change its name to “Guggenheim

Taxable Municipal Managed Duration Trust”. The Trust will continue

to trade on the NYSE under its current ticker symbol, “GBAB”.

Given the uncertainty around the continuation of the BABs

program at the time of the Trust’s commencement of operations in

2010, the Trust’s initial public offering prospectus stated that if

the BABs program was not extended and there ceased to be new

issuances of BABs or other taxable municipal securities with

interest payments subsidized by the U.S. Government through direct

pay subsidies, the Board of Trustees intended to evaluate potential

actions with respect to the Trust, which could include, among other

things, changes to the non-fundamental investment policies of the

Trust to permit the Trust to broaden its investment focus, for

example to taxable municipal securities generally, merger of the

Trust into another fund or termination of the Trust.

Given that there have been no new issuances of BABs, the

investment policy changes described herein reflect the Board’s

evaluation of the Trust pursuant to its prospectus. The Trust

believes that these investment policy changes are appropriate at

this time to potentially diversify the Trust’s portfolio by

broadening its investment universe and providing portfolio

management flexibility to take advantage of relative value

opportunities in the taxable municipal market as a whole.

No other changes to the Trust’s other investment policies or the

Trust’s portfolio management team are currently anticipated, nor is

it currently anticipated that there will be substantial portfolio

turnover in conjunction with these changes in the immediate

future.

No action is required by shareholders of the Trust in connection

with these investment policy changes.

For the most up-to-date information and a more complete

discussion of the risk considerations associated with an investment

in the Trust, please visit the Trust’s website at

guggenheiminvestments.com/GBAB.

About Guggenheim Investments

Guggenheim Investments is the global asset management and

investment advisory division of Guggenheim Partners, with $199

billion* in total assets across fixed income, equity, and

alternative strategies. We focus on the return and risk needs of

insurance companies, corporate and public pension funds, sovereign

wealth funds, endowments and foundations, consultants, wealth

managers, and high-net-worth investors. Our 275+ investment

professionals perform rigorous research to understand market trends

and identify undervalued opportunities in areas that are often

complex and underfollowed. This approach to investment management

has enabled us to deliver innovative strategies providing

diversification opportunities and attractive long-term results.

*Guggenheim Investments total asset figure is as of

03.31.2016. The assets include leverage of $11.4bn for assets under

management and $0.5bn for assets for which we provide

administrative services. Guggenheim Investments represents the

following affiliated investment management businesses: Guggenheim

Partners Investment Management, LLC, Security Investors, LLC,

Guggenheim Funds Investment Advisors, LLC, Guggenheim Funds

Distributors, LLC, Guggenheim Real Estate, LLC, Transparent Value

Advisors, LLC, GS GAMMA Advisors, LLC, Guggenheim Partners Europe

Limited, and Guggenheim Partners India Management.

This information does not represent an offer to sell securities

of the Trust and it is not soliciting an offer to buy securities of

the Trust. There can be no assurance that the Trust will achieve

its investment objectives. Investment in the Trust involves

operating expenses and fees. The net asset value of the Trust will

fluctuate with the value of the underlying securities. It is

important to note that closed-end funds trade on their market

value, not net asset value, and closed-end funds often trade at a

discount to their net asset value. The market value of fixed income

securities will change in response to interest rate changes and

market conditions among other things. In general, bond prices fall

when interest rates rise and vice versa.

Investors should consider the investment objectives and

policies, risk considerations, charges and expenses of any

investment before they invest. For this and more information visit

www.guggenheiminvestments.com.

Analyst Inquiries

William T. Korvercefs@guggenheiminvestments.com

Not FDIC-Insured | Not

Bank-Guaranteed | May Lose ValueGuggenheim Funds Distributors, LLC

(member FINRA/SIPC)

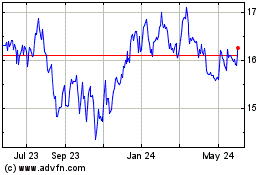

Guggenheim Taxable Munic... (NYSE:GBAB)

Historical Stock Chart

From Jun 2024 to Jul 2024

Guggenheim Taxable Munic... (NYSE:GBAB)

Historical Stock Chart

From Jul 2023 to Jul 2024