FREYR Battery, Inc. (NYSE: FREY) (“FREYR” or the “Company”), a

developer of sustainable clean energy capacity and solutions, today

reported financial results for the third quarter of 2024.

Results Overview, Financing, and Liquidity

- FREYR reported a net loss attributable to stockholders for the

third quarter of 2024 of $(27.5) million, or $(0.20) per diluted

share compared to a net loss for the third quarter of 2023 of

$(9.8) million or $(0.07) per diluted share. The increase in net

loss in the third quarter of 2024 was primarily due to a $1.1

million warrant liability fair value adjustment for the three

months ended September 30, 2024, compared to $24.4 million for the

three months ended September 30, 2023, and a restructuring charge

of $4.5 million for the three months ended September 30, 2024

compared to none for the three months ended September 30,

2023.

- As of September 30, 2024, FREYR had cash, cash equivalents, and

restricted cash of $184.1 million, and no debt.

FREYR BATTERY, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands, except per

share data)

(Unaudited)

September 30,

2024

December 31,

2023

ASSETS

Current assets:

Cash and cash equivalents

$

181,851

$

253,339

Restricted cash

2,202

22,403

Prepaid assets

2,838

2,168

Other current assets

12,583

34,044

Total current assets

199,474

311,954

Property and equipment, net

368,342

366,357

Intangible assets, net

2,700

2,813

Long-term investments

21,819

22,303

Right-of-use asset under operating

leases

22,640

24,476

Other long-term assets

10

4,282

Total assets

$

614,985

$

732,185

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

10,080

$

18,113

Accrued liabilities and other

21,254

30,790

Share-based compensation liability

19

281

Total current liabilities

31,353

49,184

Warrant liability

721

2,025

Operating lease liability

16,775

18,816

Other long-term liabilities

27,446

27,444

Total liabilities

76,295

97,469

Commitments and contingencies

Stockholders’ equity:

Preferred stock, $0.01 par value, 10,000

shares authorized, none issued and outstanding as of both September

30, 2024 and December 31, 2023

—

—

Common stock, $0.01 par value, 355,000

shares authorized as of both September 30, 2024 and December 31,

2023; 140,490 issued and outstanding as of September 30, 2024; and

139,705 issued and outstanding as of December 31, 2023

1,405

1,397

Additional paid-in capital

929,324

925,623

Accumulated other comprehensive loss

(34,035

)

(18,826

)

Accumulated deficit

(358,004

)

(274,999

)

Total stockholders' equity

538,690

633,195

Non-controlling interests

—

1,521

Total equity

538,690

634,716

Total liabilities and equity

$

614,985

$

732,185

FREYR BATTERY, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(In thousands, except per

share amounts)

(Unaudited)

Three months ended

September 30,

Nine months ended

September 30,

2024

2023

2024

2023

Operating expenses:

General and administrative

$

18,515

$

27,772

$

61,386

$

85,405

Research and development

8,616

7,086

30,854

18,295

Restructuring charge

4,507

—

4,644

—

Share of net loss of equity method

investee

150

153

484

208

Total operating expenses

31,788

35,011

97,368

103,908

Loss from operations

(31,788

)

(35,011

)

(97,368

)

(103,908

)

Other income (expense):

Warrant liability fair value

adjustment

1,096

24,399

1,294

23,248

Interest income, net

1,074

1,284

3,627

6,042

Foreign currency transaction (loss)

gain

(110

)

(3,213

)

1,245

20,546

Other income, net

2,172

2,537

7,806

6,103

Total other income

4,232

25,007

13,972

55,939

Loss before income taxes

(27,556

)

(10,004

)

(83,396

)

(47,969

)

Income tax expense

—

—

(11

)

(341

)

Net loss

(27,556

)

(10,004

)

(83,407

)

(48,310

)

Net loss attributable to non-controlling

interests

81

219

402

517

Net loss attributable to stockholders

$

(27,475

)

$

(9,785

)

$

(83,005

)

$

(47,793

)

Weighted average shares outstanding -

basic and diluted

140,490

139,705

140,102

139,705

Net loss per share attributable to

stockholders - basic and diluted

$

(0.20

)

$

(0.07

)

$

(0.59

)

$

(0.34

)

Other comprehensive (loss) income:

Net loss

$

(27,556

)

$

(10,004

)

$

(83,407

)

$

(48,310

)

Foreign currency translation

adjustments

5,973

6,134

(15,209

)

(48,009

)

Total comprehensive loss

$

(21,583

)

$

(3,870

)

$

(98,616

)

$

(96,319

)

Comprehensive loss attributable to

non-controlling interests

81

219

402

517

Comprehensive loss attributable to

stockholders

$

(21,502

)

$

(3,651

)

$

(98,214

)

$

(95,802

)

FREYR BATTERY, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

Nine months ended

September 30,

2024

2023

Cash flows from operating

activities:

Net loss

$

(83,407

)

$

(48,310

)

Adjustments to reconcile net loss to cash

used in operating activities:

Share-based compensation expense

6,449

7,859

Depreciation and amortization

7,028

1,922

Reduction in the carrying amount of

right-of-use assets

1,282

1,005

Warrant liability fair value

adjustment

(1,294

)

(23,248

)

Share of net loss of equity method

investee

484

208

Foreign currency transaction net

unrealized gain

(1,075

)

(19,346

)

Other

—

(929

)

Changes in assets and liabilities:

Prepaid assets and other current

assets

13

1,672

Accounts payable, accrued liabilities and

other

(429

)

28,401

Operating lease liability

(1,626

)

(3,212

)

Net cash used in operating activities

(72,575

)

(53,978

)

Cash flows from investing

activities:

Proceeds from the return of property and

equipment deposits

22,735

—

Proceeds from property related grants

—

3,500

Purchases of property and equipment

(34,683

)

(168,811

)

Investments in equity method investee

—

(1,655

)

Purchases of other long-term assets

—

(1,000

)

Net cash used in investing activities

(11,948

)

(167,966

)

Cash flows from financing

activities:

Payment for non-controlling interest

(4,130

)

—

Net cash used in financing activities

(4,130

)

—

Effect of changes in foreign exchange

rates on cash, cash equivalents, and restricted cash

(3,036

)

(13,240

)

Net decrease in cash, cash equivalents,

and restricted cash

(91,689

)

(235,184

)

Cash, cash equivalents, and restricted

cash at beginning of period

275,742

563,045

Cash, cash equivalents, and restricted

cash at end of period

$

184,053

$

327,861

Supplementary disclosure for non-cash

activities:

Accrued purchases of property and

equipment

$

6,133

$

11,187

Reconciliation to condensed

consolidated balance sheets:

Cash and cash equivalents

$

181,851

$

299,419

Restricted cash

2,202

28,442

Cash, cash equivalents, and restricted

cash

$

184,053

$

327,861

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241105739786/en/

Investor contact: Jeffrey Spittel Senior Vice President,

Investor Relations and Corporate Development

jeffrey.spittel@freyrbattery.com Tel: (+1) 409-599-5706

Media contact: Amy Jaick Global Head of Communications

amy.jaick@freyrbattery.com Tel: (+1) 973 713-5585

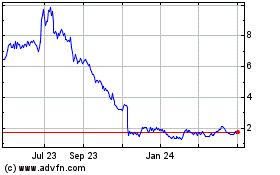

FREYR Battery (NYSE:FREY)

Historical Stock Chart

From Nov 2024 to Dec 2024

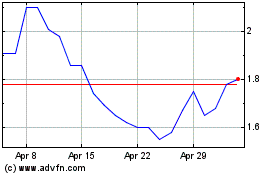

FREYR Battery (NYSE:FREY)

Historical Stock Chart

From Dec 2023 to Dec 2024