UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________

FORM 6-K

_________________________

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT TO RUEE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month

of February 2025

Commission File No. 001-37596

_________________________

FERRARI N.V.

(Translation of Registrant’s Name Into

English)

_________________________

Via Abetone Inferiore n.4

1-41053 Maranello (MO)

Italy

Tel. No.:+39 0536 949111

(Address of Principal Executive Offices)

_________________________

(Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F x Form 40-F ¨

The documents attached hereto as Exhibit 99.1

and Exhibit 99.2 are hereby incorporated by reference into the registration statement on Form F-3 (No. 333-285251) of Ferrari N.V. and

shall be a part thereof from the date on which such documents are furnished, to the extent not superseded by documents or reports subsequently

filed or furnished.

The following exhibits are furnished herewith:

Exhibit 99.1 Press release issued by Ferrari N.V.

dated February 27, 2025.

Exhibit 99.2: Underwriting Agreement, by and between

Ferrari N.V., Exor N.V. and the several Underwriters named in Schedule I thereto, dated as of February 27, 2025.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Date: February 27, 2025 |

FERRARI N.V. |

| |

|

| |

By: |

/s/ Antonio Picca Piccon |

| |

Name: |

Antonio Picca Piccon |

| |

Title: |

Chief Financial Officer |

Exhibit 99.1

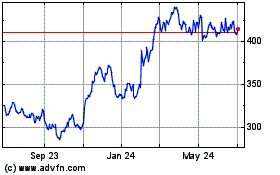

FERRARI PARTICIPATED AS A PURCHASER IN EXOR’S ACCELERATED

BOOKBUILD OFFERING

Maranello (Italy), February 27, 2025 –

Ferrari N.V. (NYSE/EXM: RACE) (“Ferrari” or the “Company”) announces that, following the

accelerated bookbuild offering made by Exor N.V. (“Exor”) on February 26, 2025, the Company has participated

in the offering by agreeing to repurchase 666,666 common shares for a total consideration of approx. Euro 300 million, at the same

price per share determined by the offering (the “Transaction”). The Transaction is being financed by

Ferrari’s cash on hand.

The Transaction represents the seventh tranche

of the multi-year share buyback program of approximately Euro 2.0 billion announced during our 2022 Capital Markets Day (the “Program”)

and it falls within the limitations of the share buyback mandate approved at the April 17, 2024 Annual General Meeting of Shareholders,

duly communicated to the market, which authorized the purchase of up to 10% of the Company’s common shares during the eighteen-month

period following such Shareholders’ Meeting.

The Transaction is expected to settle on March 3,

2025.

Following the Transaction, the Company will

continue to execute the Program consistently with the progress of its Industrial Free Cash Flow generation.

A comprehensive overview of the transactions

carried out under the buyback program is available on Ferrari’s corporate website under the Buyback Programs section (https://www.ferrari.com/en-EN/corporate/buyback-programs).

A registration statement on Form F-3

(including a prospectus) relating to the offering of Ferrari’s common shares by Exor has been filed with the U.S. Securities and

Exchange Commission (the “SEC”) on February 26, 2025. Copies of the prospectus can be accessed for free through the

SEC’s website at www.sec.gov. Alternatively, copies may be obtained from: J.P. Morgan Securities LLC, c/o Broadridge Financial

Solutions, 1155 Long Island Avenue, Edgewood, NY 11717, or by email at prospectus-eq_fi@jpmchase.com and postsalemanualrequests@broadridge.com;

Goldman Sachs & Co. LLC, Prospectus Department, 200 West Street, New York, NY 10282, telephone: 1-866-471-2526, facsimile: 212-902-9316,

or by email at Prospectus-ny@ny.email.gs.com.

This press release contains information that

qualifies, or may qualify, as inside information as defined in article 7(1) of Regulation (EU) 596/2014 of 16 April 2014 (the

Market Abuse Regulation).

This notice does not constitute an offer to

sell or a solicitation of an offer to buy securities in any jurisdiction where such offer or solicitation would be unlawful.

You should not reply to this announcement.

Any reply e-mail communication, including those you generate by using the “Reply” function on your email software, will be

ignored or rejected.

This communication is addressed in any member state of the European

Economic Area only to those persons who are qualified investors in such member state (“Qualified Investors”) within the meaning

of Regulation (EU) 2017/1129 and such other persons as this announcement may be addressed on legal grounds, and no person that is not

a Qualified Investor may act or rely on this announcement or any of its contents.

This communication is directed only at (i) persons

who are outside the United Kingdom, (ii) investment professionals falling within Article 19(5) of the Financial Services

and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”) or (iii) high net worth entities, and other persons

to whom it may lawfully be communicated, falling within Article 49(2)(a) to (d) of the Order (all such persons together

being referred to as “relevant persons”). Any investment activity to which this communication relates will only be available

to, and will only be engaged in with, relevant persons. Any person who is not a relevant person should not act or rely on this communication.

Ferrari N.V.

Amsterdam, The Netherlands |

Registered Office:

Via Abetone Inferiore N. 4,

I – 41053 Maranello (MO) Italy |

Dutch trade registration number:

64060977 |

corporate. ferrari.com

Exhibit 99.2

FERRARI N.V.

6,666,667 Common Shares

Underwriting Agreement

February 27, 2025

Goldman Sachs Bank Europe SE

Marienturm, Taunusanlage 9-10,

60329 Frankfurt am Main,

Germany

J.P. Morgan Securities LLC

383 Madison Avenue

New York, New York 10179

As Representatives of the several Underwriters listed in Schedule 1

hereto

Ladies and Gentlemen:

Exor N.V., a public company with limited liability incorporated under

the laws of the Netherlands and having its official seat in Amsterdam, the Netherlands (the “Selling Shareholder”)

proposes to sell to the several Underwriters listed in Schedule 1 hereto (the “Underwriters”), for whom you are acting

as representatives (the “Representatives”), (i) an aggregate of 6,666,667 Common Shares (as defined below), par

value €0.01 per share, for resale to the public (the “Underwritten Shares”) and (ii) the number of shares

of the Company’s Common Shares for resale to the Company set forth in Schedule 2 hereto (the “Repurchase Shares”

and together with the Underwritten Shares, the “Shares”), of Ferrari N.V., a public company with limited liability

incorporated under the laws of the Netherlands and having its official seat in Amsterdam, the Netherlands (the “Company”).

The common shares of the Company outstanding on the date hereof are referred to herein as the “Common Shares”.

Subject to the sale of the Underwritten Shares by the Selling Shareholder

to the Underwriters in accordance with the terms of this Agreement (as defined below), the Underwriters propose to sell to the Company,

and the Company proposes to purchase from the Underwriters, the Repurchase Shares pursuant to Section 2 of this Agreement (the “Share

Repurchase”).

The Company and the Selling Shareholder hereby confirm their agreement

with the several Underwriters concerning the purchase and sale of the Shares, as follows:

| 1. | Registration Statement. The Company has prepared and filed with the Securities and Exchange Commission (the “Commission”)

under the Securities Act of 1933, as amended, and the rules and regulations of the Commission thereunder (collectively, the “Securities

Act”), a registration statement on Form F-3ASR (File No. 333-285251), including a prospectus, relating to the Shares.

Such registration statement, as amended on the date of its effectiveness, including the information, if any, deemed pursuant to Rule 430A

or Rule 430B under the Securities Act to be part of the registration statement at the time of its effectiveness (“Rule 430

Information”), is referred to herein as the “Registration Statement”; and the related prospectus in the form

first used to confirm sales of the Shares (or made available upon request of purchasers pursuant to Rule 173 under the Securities

Act) is hereinafter referred to as the “Prospectus,” and the term “Preliminary Prospectus” means

any preliminary form of the Prospectus. Capitalized terms used but not defined herein shall have the meanings given to such terms in the

Registration Statement and the Prospectus. |

Any reference in this Underwriting Agreement (this “Agreement”)

to the Registration Statement, Preliminary Prospectus or the Prospectus shall be deemed to refer to and include the documents incorporated

by reference therein pursuant to Item 6 of Form F-3 under the Securities Act, as of the effective date of the Registration Statement,

the date of the Prospectus or the date hereof, as the case may be, and any reference to “amend”, “amendment” or

“supplement” with respect to the Registration Statement, Preliminary Prospectus or the Prospectus shall be deemed to refer

to and include any documents filed after such date under the Securities Exchange Act of 1934, as amended, and the rules and regulations

of the Commission thereunder (collectively, the “Exchange Act”) that are deemed to be incorporated by reference therein.

At or prior to the Applicable Time (as defined below), the

Company had prepared the following information: a Prospectus dated February 26, 2025, a Preliminary Prospectus dated February 26,

2025, the press releases published pursuant to Rule 134 under the Securities Act (“Company Press Releases”) and

any “free-writing prospectus” (as defined pursuant to Rule 405 under the Securities Act) listed on Annex A hereto (collectively

with the pricing information set forth in Annex A, the “Pricing Disclosure Package”).

“Applicable Time” means 2:30 A.M. CET, on February 27, 2025.

| 2. | Purchase of the Shares by the Underwriters and by the Company. |

| (a) | The Selling Shareholder agrees to sell to the several Underwriters as provided in this Agreement, and each Underwriter, on the basis

of the representations, warranties and agreements set forth herein and subject to the conditions set forth herein, agrees, severally and

not jointly, to purchase from the Selling Shareholder: |

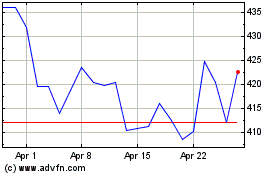

(i) the number of Underwritten Shares as set forth

opposite the name of such Underwriter in (x) Schedule 1-A hereto at a price per Underwritten Share of €447.75 per Underwritten

Share (the “EUR Underwritten Shares” and the “EUR Underwritten Shares Purchase Price”) and (y)

Schedule 1-B hereto at a price per Underwritten Share of $469.78 (the “USD Underwritten Shares” and the

“USD Underwritten Shares Purchase Price” and, together with the EUR Underwritten Shares Purchase Price, the

“Underwritten Shares Purchase Price”); and

(ii) the number of Repurchase Shares as set forth opposite

the name of such Underwriter in Schedule 2 hereto at a price per Repurchase Share of €450.00, corresponding to $472.14 per

Repurchase Share (the “Repurchase Shares Purchase Price”).

| (b) | Subject to the sale of the Underwritten Shares by the Selling Shareholder pursuant to the terms of this Agreement and the other terms

and conditions and in reliance upon the representations and warranties herein set forth, the Underwriters agree to sell to the Company,

severally and not jointly, and the Company agrees to purchase from the Underwriters, at the Repurchase Shares Purchase Price, the number

of Repurchase Shares as set forth opposite each such Underwriter’s name in Schedule 2 hereto. |

| (c) | The Underwritten Shares Purchase Price and the Repurchase Share Purchase Price were determined with due regard to the closing price

of the Shares on Euronext Milan on the date hereof. The Company and the Selling Shareholder understand that the Underwriters intend to

make a public offering of the Underwritten Shares as soon after the effectiveness of this Agreement as in the judgment of the Representatives

is advisable, and initially to offer the Underwritten Shares on the terms set forth in the Prospectus. The Company acknowledges and agrees

that the Underwriters may offer and sell the Underwritten Shares to or through any affiliate of an Underwriter. |

| (d) | Payment for the Shares shall be made by wire transfer of funds (i) immediately available in Milan in relation to the Shares

purchased in Euros (EUR), at 12:00 P.M. CET and (ii) immediately available in New York in relation to the Shares purchased in U.S.

dollars (US$) at 9:00 A.M. New York City time, in each case on March 3, 2025, or at such other time or place on the same or

such other date, not later than the second business day thereafter, as the Representatives, the Company and the Selling Shareholder

may agree upon in writing. The time and date of such payment for the Underwritten Shares is referred to herein as the

“Closing Date”. |

| (e) | Subject to the sale of the Underwritten Shares by the Selling Shareholder to the Underwriters pursuant to the terms of this Agreement,

delivery of the Underwritten Shares shall be made ultimately on the Closing Date and payment for the Repurchase Shares shall be made on

the Closing Date. Any Underwritten Shares delivered to the Representatives for the respective accounts of the Underwriters prior to the

satisfaction on the Closing Date of the conditions set out herein to the sale of the Underwritten Shares by the Selling Shareholder to

the Underwriters pursuant to the terms of this Agreement, shall be held for the account of the Selling Shareholder. Delivery of the Repurchase

Shares shall be made for the account of the Company by the Representatives for the respective accounts of the several Underwriters against

payment by the Company of the aggregate purchase price of the Repurchase Shares being sold by the Underwriters to or upon the order of

the Representatives by wire transfer payable in same-day funds to the accounts specified by the Representatives. |

| (f) | Each of the Company and the Selling Shareholder acknowledges and agrees that the Underwriters are acting solely in the capacity of

an arm’s length contractual counterparty to the Company and the Selling Shareholder, respectively, with respect to the offering

of Shares contemplated hereby (including in connection with determining the terms of the offering) and not as a financial advisor or a

fiduciary to, or an agent of, the Company, the Selling Shareholder or any other person. Additionally, neither the Representatives nor

any other Underwriters are advising the Company or any other person as to any legal, tax, investment, accounting or regulatory matters

in any jurisdiction. Each of the Company and the Selling Shareholder shall consult with its own advisors concerning such matters and shall

be responsible for making its own independent investigation and appraisal of the transactions contemplated hereby, and the Underwriters

shall have no responsibility or liability to the Company or the Selling Shareholder with respect thereto. Any review by the Underwriters

of the Company, the Selling Shareholder, the transactions contemplated hereby or other matters relating to such transactions will be performed

solely for the benefit of the Underwriters and shall not be on behalf of the Company or the Selling Shareholder. |

| (g) | Payment for the Underwritten Shares to be purchased on the Closing Date shall be made against delivery to the Representatives for

the respective accounts of the several Underwriters of the Underwritten Shares to be purchased on such date (such date, the “Time

of Delivery”), with any transfer taxes payable in connection with the sale of such Shares duly paid by the Selling Shareholder.

Delivery of the Underwritten Shares shall be made through the facilities of The Depository Trust Company (“DTC”) or

Monte Titoli S.p.A. (“Euronext Securities Milan”), as applicable, unless the Representatives shall otherwise instruct.

Delivery of the Repurchase Securities shall be made through the facilities of Euronext Securities Milan unless the Company shall otherwise

instruct. |

| 3. | Representations and Warranties of the Company. The Company represents and warrants to each Underwriter and to the Selling Shareholder

that: |

| (a) | Preliminary Prospectus. No order preventing or suspending the use of the Preliminary Prospectus has been issued by the Commission,

and the Preliminary Prospectus included in the Pricing Disclosure Package, at the time of filing thereof, complied in all material respects

with the Securities Act, and the Preliminary Prospectus, at the time of filing thereof, did not contain any untrue statement of a material

fact or omit to state a material fact necessary in order to make the statements therein, in the light of the circumstances under which

they were made, not misleading; provided that the Company makes no representation and warranty with respect to any statements or

omissions made in reliance upon and in conformity with information relating to any Underwriter or the Selling Shareholder furnished to

the Company in writing by such Underwriter through the Representatives or by the Selling Shareholder, as the case may be, expressly for

use in the Preliminary Prospectus, it being understood and agreed that the only such information furnished by any Underwriter consists

of the information described as such in Section 9(c) hereof. |

| (b) | Pricing Disclosure Package. The Pricing Disclosure Package as of the Applicable Time did not, and as of the Closing Date will

not, contain any untrue statement of a material fact or omit to state a material fact necessary in order to make the statements therein,

in the light of the circumstances under which they were made, not misleading; provided that the Company makes no representation

or warranty with respect to any statements or omissions made in reliance upon and in conformity with information relating to any Underwriter

or the Selling Shareholder furnished to the Company in writing by such Underwriter or the Selling Shareholder, as the case may be, through

the Representatives, expressly for use in such Pricing Disclosure Package, it being understood and agreed that the only such information

furnished by any Underwriter consists of the information described as such in Section 9(c) hereof, and it being further understood

and agreed that such information furnished by the Selling Shareholder consists of the Selling Shareholder Information (as defined in Section 4(e) hereof). |

| (c) | Issuer Free Writing Prospectus. Other than the Registration Statement, the Preliminary Prospectus and the Prospectus, the Company

(including its agents and representatives, other than the Underwriters in their capacity as such) has not prepared, made, used, authorized,

approved or referred to and will not prepare, make, use, authorize, approve or refer to any “written communication” (as defined

in Rule 405 under the Securities Act) that constitutes an offer to sell or solicitation of an offer to buy the Shares (each such

communication by the Company or its agents and representatives (other than a communication referred to in clause (i) below) an “Issuer

Free Writing Prospectus”) other than (i) any document not constituting a prospectus pursuant to Section 2(a)(10)(a) of

the Securities Act or Rule 134 under the Securities Act or (ii) the documents listed on Annex A hereto or any other written

communications approved in writing in advance by the Representatives. Each such Issuer Free Writing Prospectus complied in all material

respects with the Securities Act, has been or will be (within the time period specified in Rule 433) filed in accordance with the

Securities Act (to the extent required thereby) and does not conflict with the information contained in the Registration Statement or

the Pricing Disclosure Package, and, when taken together with the Preliminary Prospectus accompanying, or delivered prior to delivery

of, such Issuer Free Writing Prospectus, did not, and as of the Closing Date will not, contain any untrue statement of a material fact

or omit to state a material fact necessary in order to make the statements therein, in the light of the circumstances under which they

were made, not misleading; provided that the Company makes no representation or warranty with respect to any statements or omissions

made in each such Issuer Free Writing Prospectus or in the Preliminary Prospectus in reliance upon and in conformity with information

relating to any Underwriter furnished to the Company in writing by such Underwriter through the Representatives expressly for use in such

Issuer Free Writing Prospectus or Preliminary Prospectus, it being understood and agreed that the only such information furnished by any

Underwriter consists of the information described as such in Section 9(c) hereof. |

| (d) | Registration Statement and Prospectus. The Registration Statement is an “automatic shelf registration statement”

as defined under Rule 405 of the Securities Act that has been filed with the Commission not earlier than three years prior to the

date hereof; and no notice of objection of the Commission to the use of such registration statement or any post-effective amendment thereto

pursuant to Rule 401(g)(2) under the Securities Act has been received by the Company. No order suspending the effectiveness

of the Registration Statement has been issued by the Commission, and no proceeding for that purpose or pursuant to Section 8A of

the Securities Act against the Company or related to the offering of the Shares has been initiated or threatened by the Commission; as

of the applicable effective date of the Registration Statement and any post-effective amendment thereto, the Registration Statement and

any such post-effective amendment complied and will comply in all material respects with the Securities Act, and did not and will not

contain any untrue statement of a material fact or omit to state a material fact required to be stated therein or necessary in order to

make the statements therein not misleading; and as of the date of the Prospectus and any amendment or supplement thereto and as of the

Closing Date, the Prospectus will comply in all material respects with the Securities Act and will not contain any untrue statement of

a material fact or omit to state a material fact necessary in order to make the statements therein, in the light of the circumstances

under which they were made, not misleading; provided that the Company makes no representation and warranty with respect to any

statements or omissions made in reliance upon and in conformity with information relating to any Underwriter furnished to the Company

in writing by such Underwriter through the Representatives expressly for use in the Registration Statement and the Prospectus and any

amendment or supplement thereto, it being understood and agreed that the only such information furnished by any Underwriter consists of

the information described as such in Section 9(c) hereof. |

| (e) | Financial Statements. The Financial Statements of the Company comply in all material respects with the applicable requirements

of the Securities Act and the Exchange Act, as applicable, and present fairly the consolidated financial position of the Company and its

subsidiaries as of the dates indicated and the results of their operations and the changes in their cash flows for the periods specified;

the Financial Statements have been prepared in conformity with the International Financial Reporting Standards issued by the International

Accounting Standards Board (“IFRS”) applied on a consistent basis throughout the periods involved, except as may be

expressly stated in the related notes thereto; and all disclosures included or incorporated by reference in the Registration Statement,

the Pricing Disclosure Package and the Prospectus regarding “non-IFRS financial measures” (as such term is defined by the

rules and regulations of Commission) comply with Regulation G of the Exchange Act and Item 10 of Regulation S-K of the Securities

Act, to the extent applicable. For purposes of this Agreement, “Financial Statements” means the consolidated financial

statements, together with the related schedules and notes, of the Company and its consolidated subsidiaries included in the Registration

Statement, the Pricing Disclosure Package and the Prospectus. |

| (f) | No Material Adverse Change. Except as otherwise disclosed in the Registration Statement, the Pricing Disclosure Package or

the Prospectus (exclusive of any amendment or supplement thereto following the Applicable Time), since the date of the most recent Financial

Statements included or incorporated by reference in the Registration Statement, the Pricing Disclosure Package and the Prospectus, (i) there

has not been any change in the capital stock (other than purchases of shares pursuant to the Company’s share buyback program, the

issuance of Common Shares upon exercise of stock options and warrants described as outstanding in, and the grant of options and awards

under existing equity incentive plans described in, the Registration Statement, the Pricing Disclosure Package and the Prospectus), or

long-term debt of the Company or any of its subsidiaries, (ii) there has not been any material adverse change, or any development

that could reasonably be expected to result in a material adverse change, in the business, financial condition, shareholders’ equity

or results of operations of the Company and its subsidiaries, considered as one entity (any such change being a “Material Adverse

Change”), and (iii) there has been no dividend or distribution of any kind declared, paid or made by the Company or, except

for dividends paid to the Company or other subsidiaries, any of its subsidiaries on any class of capital stock or repurchase or redemption

by the Company or any of its subsidiaries of any class of capital stock. |

| (g) | Organization and Good Standing. The Company and each of its Significant Subsidiaries have been duly incorporated or formed,

as applicable, and are validly existing under the laws of their respective jurisdictions of organization and are duly qualified to do

business in each jurisdiction in which their respective ownership or lease of property or the conduct of their respective businesses requires

such qualification, except where the failure to be so qualified would not, individually or in the aggregate, result in a Material Adverse

Change. The Company is in good standing (where such concept is applicable) under the laws of its jurisdiction of organization and is in

good standing (where such concept is applicable) in each jurisdiction in which its respective ownership or lease of property or the conduct

of its respective businesses requires such qualification. The Company and each of its Significant Subsidiaries have all corporate power

and authority necessary to own or hold their respective properties and to conduct the businesses in which they are engaged, except where

the failure to be so qualified or have such power or authority would not, individually or in the aggregate, result in a Material Adverse

Change. All of the issued and outstanding capital stock or other ownership interest of each subsidiary has been duly authorized and validly

issued, is fully paid and nonassessable (if applicable) and is owned by the Company, directly or through subsidiaries, free and clear

of any security interest, mortgage, pledge, lien, encumbrance or claim, except as described in the Registration Statement, the Pricing

Disclosure Package or the Prospectus or except as would not be material to the Company and its subsidiaries, taken as a whole. “Significant

Subsidiary”, means each of the subsidiaries of the Company listed in Schedule 3 to this Agreement, which are the only Significant

Subsidiaries of the Company. |

| (h) | Capitalization. The Company has an authorized capitalization as set forth in the Registration Statement, the Pricing Disclosure

Package and the Prospectus; all of the outstanding common shares and special voting shares of the Company (including the Shares to be

sold by the Selling Shareholders) have been duly and validly authorized and issued and are fully paid and non-assessable and are not subject

to any pre-emptive or similar rights; except as described in or expressly contemplated by the Registration Statement, Pricing Disclosure

Package and the Prospectus, there are no outstanding rights (including, without limitation, pre-emptive rights), warrants or options to

acquire, or instruments convertible into or exchangeable for, any shares of capital stock or other equity interest in the Company or any

of its subsidiaries, or any contract, commitment, agreement, understanding or arrangement of any kind relating to the issuance of any

capital stock of the Company or any such subsidiary, any such convertible or exchangeable securities or any such rights, warrants or options;

the capital stock of the Company conforms in all material respects to the description thereof contained in the Registration Statement,

the Pricing Disclosure Package and the Prospectus. |

| |

(i) |

Due Authorization. The Company has full right, power and authority to execute and deliver this Agreement and to perform its obligations

hereunder; and all corporate action required to be taken for the due and proper authorization, execution and delivery by it of this Agreement

and the consummation by it of the transactions contemplated hereby has been duly and validly taken. |

| (j) | Underwriting Agreement. This Agreement has been duly authorized, executed and delivered by the Company. |

| (k) | The Shares. The Shares have been duly and validly issued and conform to the descriptions thereof in the Registration Statement,

the Pricing Disclosure Package and the Prospectus. |

| (l) | No Violation or Default. Neither the Company nor any of its Significant Subsidiaries is (i) in violation of its articles

of association, charter, bylaws or other similar organizational document or (ii) in default (or, with the giving of notice or lapse

of time, would be in default) (“Default”) under any indenture, mortgage, loan or credit agreement, note, contract,

franchise, lease or other instrument to which the Company or any of its Significant Subsidiaries is a party or by which it or any of them

may be bound or to which any of the property or assets of the Company or any of its Significant Subsidiaries is subject (each, an “Existing

Instrument”), except, in the case of clause (ii) of this Section 3(l), for such Defaults as would not, individually

or in the aggregate, result in a Material Adverse Change. |

| (m) | No Conflicts. The execution and delivery of and the performance by the Company of its obligations under this Agreement, the

consummation by the Company of the transactions contemplated by this Agreement or the Pricing Disclosure Package and Prospectus will not

(i) result in any violation of the provisions of the articles of association, charter, bylaws or similar organizational document

of the Company or any of its Significant Subsidiaries, (ii) conflict with or constitute a breach of, or Default or a Debt Repayment

Triggering Event (as defined below) under, or result in the creation or imposition of any lien, charge or encumbrance upon any property

or assets of the Company or any of its subsidiaries pursuant to, or require the consent of any other party to, any Existing Instrument,

except for such conflicts, breaches, Defaults, liens, charges or encumbrances as would not, individually or in the aggregate, result in

a Material Adverse Change and (iii) result in any violation of any law, administrative regulation or administrative or court decree

applicable to the Company or any subsidiary, except for such conflicts, breaches or violations as would not, individually or in the aggregate,

reasonably be expected to result in a Material Adverse Change. As used herein, a “Debt Repayment Triggering Event”

means any event or condition which gives, or with the giving of notice or lapse of time would give, the holder of any note, debenture

or other evidence of indebtedness (or any person acting on such holder’s behalf) the right to require the repurchase, redemption

or repayment of all or a portion of such indebtedness by the Company or any of its subsidiaries. |

| (n) | No Consents Required. No consent, approval, authorization, order, license, registration or qualification of or with any court

or arbitrator or governmental or regulatory authority is required for the execution and delivery of and the performance by the Company

of its obligations under this Agreement and the consummation by the Company of the transactions contemplated by this Agreement, except

for the registration of the Shares under the Securities Act and such consents, approvals, authorizations, orders and registrations or

qualifications as may be required by the Financial Industry Regulatory Authority, Inc. (“FINRA”), the blue sky

laws of any jurisdiction and under applicable state securities laws in connection with the purchase and distribution of the Shares by

the Underwriters and any notification of the Netherlands Authority for the Financial Markets (Autoriteit Financiele Markten) pursuant

to Section 5:34, Section 5:35 and/or Section 5:38 of the Dutch Financial Supervision Act (Wet op het financieel toezicht). |

| (o) | Legal Proceedings. There are no legal, governmental or regulatory actions, suits, arbitrations or proceedings pending or, to

the Company’s knowledge, threatened (i) against or affecting the Company or any of its subsidiaries or (ii) that have

as the subject thereof any property owned or leased by the Company or any of its subsidiaries which action, suit or proceeding, in the

case of either clause (i) or (ii), is reasonably likely to result in a Material Adverse Change or which would restrain or enjoin

the delivery of the Shares by the Selling Shareholder or which in any way affects the validity of the Shares. No labor dispute with the

employees of the Company or any of its subsidiaries or, to the Company’s knowledge, with the employees of any principal supplier

of the Company, exists or, to the Company’s knowledge, is threatened or imminent that is reasonably likely to result in a Material

Adverse Change. |

| (p) | Independent Accountants. EY S.p.A., the former independent registered public accounting firm for the Company and Deloitte &

Touche S.p.A., the current independent registered public accounting firm of the Company, each of who have certified certain Financial

Statements of the Company and its subsidiaries and delivered their respective reports with respect to the audited consolidated financial

statements and schedules filed with the Commission as part of the Registration Statement, and included or incorporated by reference in

each of the Registration Statement, Prospectus and Preliminary Prospectus, are each an independent registered public accounting firm with

respect to the Company and its subsidiaries within the applicable rules and regulations adopted by the Commission and the Public

Company Accounting Oversight Board (United States) (“PCAOB”) and as required by the Securities Act. |

| (q) | No Undisclosed Relationships. No relationship, direct or, to the Company’s knowledge, indirect, exists between or among

any of the Company or any affiliate of the Company, on the one hand, and any director, officer, member, shareholder, customer or supplier

of the Company or any affiliate of the Company, on the other hand, which would be required by the Securities Act to be disclosed in the

Registration Statement, the Pricing Disclosure Package or the Prospectus and are not so disclosed. There are no outstanding loans, advances

(except advances for business expenses in the ordinary course of business) or guarantees of indebtedness by the Company or any of its

subsidiaries to or for the benefit of any of the officers or directors of the Company or any affiliate of the Company or any of their

respective family members, other than intercompany loans between or among the Company and its consolidated subsidiaries. |

| (r) | Investment Company Act. The Company is not and, after giving effect to the offering and sale of the Shares as described in

the Registration Statement, the Pricing Disclosure Package and the Prospectus, will not be an “investment company” required

to register under the Investment Company Act of 1940, as amended (the “Investment Company Act” which term, as used

herein, includes the rules and regulations of the Commission thereunder). |

| (s) | Taxes. The Company and its subsidiaries have filed all material necessary national, federal, state and foreign income and franchise

tax returns or have properly requested extensions thereof and have paid all material taxes required to be paid by any of them in all jurisdictions

in which they are required to so pay, and withheld in full all taxes required to be withheld by any of them in all jurisdictions in which

they are required to so withhold, including any related or similar material assessment, fine or penalty levied against any of them except

as may be being contested in good faith and by appropriate proceedings. The Company has made adequate charges, accruals and reserves in

accordance with IFRS in the Financial Statements in respect of all national, federal, state and foreign income and franchise taxes for

all periods as to which the tax liability of the Company or any of its Significant Subsidiaries has not been finally determined. |

| (t) | Licenses and Permits. Except as would not reasonably be expected to result in a Material Adverse Change, the Company and each

of its Significant Subsidiaries possess such valid and current licenses, sub-licenses, certificates, authorizations or permits issued

by the appropriate state, federal or foreign regulatory agencies or bodies necessary to own, lease and operate their respective properties

and to conduct their respective businesses in all material respects as described in the Registration Statement, the Pricing Disclosure

Package and the Prospectus, and neither the Company nor any subsidiary has received any notice of proceedings relating to the revocation

or modification of, or non-compliance with, any such license, sub-license, certificate, authorization or permit which, singly or in the

aggregate, would reasonably be expected to result in a Material Adverse Change. |

| (u) | Labor Matters. There is no strike, labor dispute, labor disturbance, slowdown or stoppage pending or, to the Company’s

knowledge, threatened against the Company or any of its subsidiaries or threatened or pending against any of their respective principal

suppliers, except as would not, individually or in the aggregate, result in a Material Adverse Change. There has been no violation, except

as would not, individually or in the aggregate, result in a Material Adverse Change, of any (A) national, state, provincial or local

law relating to discrimination in hiring, promotion or pay of employees, or (B) applicable classification, wage or hour laws applicable

to the Company. |

| (v) | Compliance with and Liability under Environmental Laws. Except as disclosed in the Registration Statement, the Pricing Disclosure

Package and the Prospectus or as would otherwise not, individually or in the aggregate, reasonably be expected to result in a Material

Adverse Change: |

| (i) | each of the Company and its subsidiaries, and their respective operations and facilities, are in compliance with applicable Environmental

Laws (as defined below), and have obtained and are in compliance with all permits, licenses or other governmental authorizations or approvals,

and have made all filings and provided all financial assurances and notices, required for the ownership and operation of their respective

businesses, properties and facilities under applicable Environmental Laws; |

| (ii) | there is no claim, proceeding, action or cause of action filed with a court or governmental authority, no investigation with respect

to which the Company has received written notice alleging actual or potential liability on the part of the Company or any of its subsidiaries

based on or pursuant to any Environmental Law pending or, to the Company’s knowledge, threatened against the Company or any of its

subsidiaries or any person or entity whose liability under or pursuant to any Environmental Law the Company or any of its subsidiaries

has retained or assumed either contractually or by operation of law; |

| (iii) | neither the Company nor any of its subsidiaries is conducting or paying for, in whole or in part, any investigation, response or other

corrective action pursuant to any Environmental Law at any site or facility, nor is any of them subject or a party to any order, judgment,

decree, contract or agreement which imposes any obligation or liability under any Environmental Law; and |

| (iv) | there has been no Release (as defined below) of any Materials of Environmental Concern (as defined below) and, to the Company’s

knowledge, there are no other past or present actions, activities, circumstances, conditions or occurrences, that would reasonably be

expected to result in a violation of or liability under any Environmental Law on the part of the Company or any of its subsidiaries, including

without limitation, any such liability which the Company or any of its subsidiaries has retained or assumed either contractually or by

operation of law. |

For purposes of this Agreement, “Environment”

means ambient air, indoor air, surface water, groundwater, drinking water, soil, surface and subsurface strata, and natural resources

such as wetlands, flora and fauna. “Environmental Laws” means the common law and all federal, state, local and foreign

laws, rules, regulations, ordinances, codes, orders, decrees, judgments and injunctions issued, promulgated or entered thereunder, relating

to pollution or protection of the Environment or human health from exposure to Materials of Environmental Concern, including without limitation,

those relating to (x) the Release of Materials of Environmental Concern or (y) the manufacture, processing, distribution, use,

generation, treatment, storage, transport, handling or recycling of Materials of Environmental Concern. “Materials of Environmental

Concern” means any substance, material, pollutant, contaminant, chemical, waste, compound, or constituent, in any form, including

without limitation, petroleum and petroleum products, subject to regulation or which can give rise to liability under any Environmental

Law. “Release” means any release, spill, emission, discharge, deposit, disposal, leaking, pumping, pouring, dumping,

emptying, injection or leaching into the Environment, or into, from or through any building, structure or facility.

| (w) | Compliance with Pension Laws. All employee benefit plans and all pension plans established or maintained by the Company, its

subsidiaries, or for which the Company or its subsidiaries could have any liability, are in compliance with all applicable statutes, orders,

rule and regulations and other law, except for any violations that, individually or in the aggregate, would not be reasonably likely

to result in material liability to the Company and its subsidiaries taken as a whole. All such plans (i) have been maintained in

accordance with all applicable legal requirements, (ii) if they are intended to qualify for special tax treatment, meet all the requirements

for such treatment and (iii) if they are intended to be funded and/or book-reserved, are fully funded and/or book-reserved, as appropriate,

based upon reasonable actuarial assumptions, except in each case as would not, individually or in the aggregate, result in a Material

Adverse Change. |

| (x) | Disclosure Controls. The Company has established and

maintains “disclosure controls and procedures” (as such term is defined in Rules 13a-15 and 15d-15 under the Exchange

Act that are designed to ensure that material information relating to the Company and its subsidiaries is made known to the chief executive

officer and chief financial officer of the Company by persons within the Company or its subsidiaries, and such disclosure controls and

procedures are reasonably effective to perform the functions for which they were established subject to the limitations of any such control

system. The Company’s auditors and the Audit Committee of the Company’s Board of Directors have been advised of: (i) any

significant deficiencies or material weaknesses known to the Company in the design or operation of internal control over financial reporting

that have materially adversely affected or are reasonably likely to materially adversely affect the Company’s ability to record,

process, summarize, and report financial information and (ii) any fraud, whether or not material, that involves management or other

employees who have a significant role in the Company’s internal control over financial reporting. |

| (y) | Accounting Controls. The Company and its subsidiaries

maintain a system of accounting controls designed to provide reasonable assurances that (i) transactions are executed in accordance

with management’s general or specific authorization; (ii) transactions are recorded as necessary to permit preparation of

financial statements in conformity with IFRS and to maintain accountability for assets; (iii) access to assets is permitted only

in accordance with management’s general or specific authorization; (iv) the recorded accountability for assets is compared

with existing assets at reasonable intervals and appropriate action is taken with respect to any differences and (v) the interactive

data in eXtensible Business Reporting Language included or incorporated by reference in the Registration Statement, the Prospectus and

the Pricing Disclosure Package fairly presents the information called for in all material respects and is prepared in accordance with

the Commission’s rules and guidelines applicable thereto. Based on the Company’s most recent evaluation of its internal

controls over financial reporting pursuant to Rule 13a-15(c) of the Exchange Act, there were no material weaknesses in the

Company’s internal controls as of December 31, 2024. |

| (z) | Cybersecurity; Data Protection. The Company and its subsidiaries have, in all material respects, taken technical and organizational

measures necessary to protect the information technology assets and equipment, computers, systems, networks, hardware, software, websites,

applications, and databases (collectively, “IT Systems”) and data (including all personal, personally identifiable,

sensitive, confidential or regulated data (“Personal Data”)) used in connection with their businesses. Without limiting

the foregoing, the Company and its subsidiaries have implemented and maintained commercially reasonable controls, policies, procedures,

and safeguards to maintain and protect their material confidential information and the integrity, continuous operation, redundancy and

security of all IT Systems and Data and which are designed to protect against and prevent any breaches, violations, outages or unauthorized

uses of or accesses to any IT Systems or Personal Data (each, a “Breach”). The Company and its subsidiaries are presently

in compliance with all applicable laws or statutes and all judgments, orders, rules and regulations of any court or arbitrator or

governmental or regulatory authority, internal policies and contractual obligations relating to the privacy and security of IT Systems

and Personal Data and to the protection of such IT Systems and Personal Data from unauthorized use, access, misappropriation or modification,

except for any noncompliance as would not, individually or in the aggregate, reasonably be expected to result in a Material Adverse Change.

Except as otherwise disclosed in the Registration Statement, the Pricing Disclosure Package or the Prospectus, to the knowledge of the

Company, there have been no material Breaches, and the Company and its subsidiaries have not been notified of and have no knowledge of

any event or condition that would reasonably be expected to result in, any material Breach. |

| (aa) | No Unlawful Payments. Neither the Company nor, to the

knowledge of the Company, any subsidiary, director, officer, employee, agent, controlled affiliate or other person associated with or

acting on behalf of the Company or any of its subsidiaries has (i) used any corporate funds for any unlawful contribution, gift,

entertainment or other unlawful expense relating to political activity; (ii) made or taken an act in furtherance of an offer, promise

or authorization of any direct or indirect unlawful payment or benefit to any foreign or domestic government or regulatory official or

employee, including of any government-owned or controlled entity or of a public international organization, or any person acting in an

official capacity for or on behalf of any of the foregoing, or any political party or party official or candidate for political office;

(iii) violated in the three years preceding the date of this Agreement or is in violation of any provision of the Foreign Corrupt

Practices Act of 1977, as amended, or any applicable law or regulation implementing the OECD Convention on Combating Bribery of Foreign

Public Officials in International Business Transactions, or committed an offence under the Bribery Act 2010 of the United Kingdom or

any other applicable anti-bribery or anti-corruption laws or (iv) made, offered, agreed, requested or taken an act in furtherance

of any unlawful bribe or other unlawful benefit, including, without limitation, any rebate, payoff, influence payment, kickback or other

unlawful or improper payment or benefit, except in each case as would not, individually or in the aggregate, result in a Material Adverse

Change. The Company and its subsidiaries have instituted and maintain policies and procedures designed to promote and achieve compliance

with such anti-bribery and anti-corruption laws in all material respects. |

| (bb) | Compliance with Anti-Money Laundering Laws. The operations of the Company and its subsidiaries are and have been conducted

at all times in compliance in all material respects with applicable financial recordkeeping and reporting requirements, including those

of the Currency and Foreign Transactions Reporting Act of 1970, as amended, the applicable money laundering statutes of all jurisdictions

where the Company or any of its subsidiaries conducts business, the rules and regulations thereunder and any related or similar rules,

regulations or guidelines issued, administered or enforced by any governmental or regulatory agency (collectively, the “Anti-Money

Laundering Laws”) and no action, suit or proceeding by or before any court or governmental or regulatory agency, authority or

body or any arbitrator involving the Company or any of its subsidiaries with respect to the Anti-Money Laundering Laws is pending or,

to the knowledge of the Company, threatened. |

| (cc) | No Conflicts with Sanctions Laws. Neither the Company nor, to the knowledge of the Company, any subsidiary, director, officer,

employee, agent, controlled affiliate or other person acting on behalf of the Company or any of its subsidiaries, is currently the subject

or, to the Company’s knowledge, the target of any sanctions administered or enforced by the U.S. government, (including, without

limitation, the Office of Foreign Assets Control of the U.S. Department of the Treasury or the U.S. Department of State and including,

without limitation, the designation as a “specially designated national” or “blocked person”), the United Nations

Security Council, the European Union or His Majesty’s Treasury (collectively, “Sanctions”), nor is the Company,

any of its subsidiaries located, incorporated, organized or resident in a country or territory that is the subject or the target of Sanctions,

including, without limitation, the Crimea Region of Ukraine, the so-called Donetsk People’s Republic, the so-called Luhansk People’s

Republic, Cuba, Iran, North Korea, and Syria (each, a “Sanctioned Country”). |

| (dd) | No Broker’s Fees. Neither the Company nor any of its subsidiaries is a party to any contract, agreement or understanding

with any person (other than this Agreement) that would give rise to a valid claim against the Company or any of its subsidiaries or any

Underwriter for a brokerage commission, finder’s fee or like payment in connection with the offering and sale of the Shares. |

| (ee) | No Stabilization. The Company has not taken, directly

or indirectly, any action designed to or that could reasonably be expected to cause or result in any stabilization or manipulation of

the price of the Shares, it being understood that any action of any of the Underwriters and their respective affiliates shall not constitute

action by the Company. |

| (ff) | Status under the Securities Act. At the time of filing

the Registration Statement and any post-effective amendment thereto, at the earliest time thereafter that the Company or any offering

participant made a bona fide offer (within the meaning of Rule 164(h)(2) under the Securities Act) of the Shares and

at the date hereof, the Company was not and is not an “ineligible issuer” and is a “well-known seasoned issuer”,

in each case as defined in Rule 405 under the Securities Act. |

| (gg) | Stamp, Value Added and Withholding Taxes. Except (a) for

any net income, capital gains or franchise taxes imposed on the Underwriters by Italy, the Netherlands, or the United States or any political

subdivision or taxing authority thereof or therein as a result of any present or former connection (other than any connection resulting

solely from the transactions contemplated by this Agreement) between the Underwriters and the jurisdiction imposing such tax or (b) as

disclosed in the Registration Statement, the Pricing Disclosure Package and the Prospectus, no value added tax or other similar taxes

levied by reference to added value or sales (“VAT”), stamp duties, registration taxes (other than Italian registration

tax arising if this Agreement or any agreement for the sale of the Shares or any transfer of the Shares by the Underwriters is (i) filed

with an Italian court or with an Italian administrative authority, (ii) referred to in another document executed between the same

parties and subject to registration or in a judicial decision (including arbitration), (iii) voluntarily registered or (iv) executed

in Italy), sale or transfer taxes or other similar taxes or duties are payable by or on behalf of the Underwriters in Italy, the Netherlands,

the United States or any political subdivision or taxing authority thereof (each, a “Taxing Jurisdiction”) solely

in connection with (A) the execution, delivery and performance of this Agreement, (B) the sale and delivery of the Shares to

the Underwriters in the manner contemplated by this Agreement and the Prospectus or (C) the sale and delivery by the Underwriters

of the Shares as contemplated herein and disclosed in the Registration Statement, the Pricing Disclosure Package and the Prospectus,

and all payments to be made by the Company on or by virtue of the execution, delivery, performance or enforcement of this Agreement,

under the current laws of any Taxing Jurisdiction, will not be subject to withholding, duties, levies, deductions, charges or other taxes

and are otherwise payable free and clear of any other withholding, duty, levy, deduction, charge or other tax in the Taxing Jurisdiction

and without the necessity of obtaining any governmental authorization in the Taxing Jurisdiction. |

| (hh) | No Immunity. Neither the Company nor any of its properties

or assets has immunity from any legal process (whether through service of notice, attachment prior to judgment, attachment in aid of

execution, execution, set-off or otherwise) or from jurisdiction of any Dutch, U.S. federal or New York state court; and, to the extent

that the Company or any of its subsidiaries or any of its properties or assets may have or may hereafter become entitled to any such

right of immunity in any such court in which proceedings arising out of, or relating to the transactions contemplated by this Agreement,

may at any time be commenced, the Company has, pursuant to Section 21(c) of this Agreement, waived, and it will waive, or will

cause its subsidiaries to waive, such right to the extent permitted by law. |

| (ii) | Passive Foreign Investment Company. The Company does

not believe that it is a passive foreign investment company, as defined in section 1297 of the Code for its most recently completed taxable

year and the Company does not expect to be a PFIC for the current or any future taxable year. |

| (jj) | Legality. The legality, validity, enforceability or admissibility

into evidence of this Agreement or the Shares in the Netherlands is not dependent upon any such document being submitted into, filed

or recorded with any court or other authority in any such jurisdiction on or before the date hereof or that any tax, imposition or charge

be paid in any such jurisdiction on or in respect of any such document. |

| (kk) | Foreign Issuer. The Company is a “foreign private

issuer” as defined in Rule 405 under the Securities Act and the Company has filed, on a timely basis, with the Commission

all reports and documents required to be filed under Section 13 or 15(d) of the Exchange Act in the manner and within the time

periods required by the Exchange Act. |

| 4. | Representations and Warranties of the Selling Shareholder. The Selling Shareholder represents and warrants to each Underwriter

that: |

| (a) | Required Consents; Authority. All consents, approvals, authorizations and orders necessary for the execution and delivery by

the Selling Shareholder of this Agreement, and for the sale and delivery of the Shares to be sold by the Selling Shareholder hereunder,

have been obtained; and the Selling Shareholder has full right, power and authority to enter into this Agreement and to sell, assign,

transfer and deliver the Shares to be sold by the Selling Shareholder hereunder; this Agreement has been duly authorized, executed and

delivered by the Selling Shareholder. |

| (b) | No Conflicts. The execution, delivery and performance by the Selling Shareholder of this Agreement, the sale of the Shares

to be sold by the Selling Shareholder and the consummation by the Selling Shareholder of the transactions contemplated herein will not

(i) conflict with or result in a breach or violation of any of the terms or provisions of, or constitute a default under, or result

in the creation or imposition of any lien, charge or encumbrance upon any property or assets of the Selling Shareholder pursuant to, any

indenture, mortgage, deed of trust, loan agreement or other agreement or instrument to which the Selling Shareholder is a party or by

which the Selling Shareholder is bound or to which any of the property or assets of the Selling Shareholder is subject, (ii) result

in any violation of the provisions of the charter or by-laws or similar organizational documents of the Selling Shareholder or (iii) result

in the violation of any law or statute or any judgment, order, rule or regulation of any court or arbitrator or governmental or regulatory

agency. |

| (c) | Title to Shares. The Selling Shareholder has good and valid title to the Shares to be sold at the Closing Date by the Selling

Shareholder hereunder, free and clear of all liens, encumbrances, equities or adverse claims; the Selling Shareholder will have, immediately

prior to the Closing Date good and valid title to the Shares to be sold at the Closing Date by the Selling Shareholder, free and clear

of all liens, encumbrances, equities or adverse claims; and, upon delivery of the certificates representing such Shares and payment therefor

pursuant hereto, good and valid title to such Shares, free and clear of all liens, encumbrances, equities or adverse claims, will pass

to the several Underwriters. |

| (d) | No Stabilization. The Selling Shareholder has not taken and will not take, directly or indirectly, any action designed to or

that could reasonably be expected to cause or result in any stabilization or manipulation of the price of the Shares, it being understood

that any action of any of the Underwriters and their respective affiliates shall not constitute an indirect action by the Company. |

| (e) | Pricing Disclosure Package and Prospectus. All Selling Shareholder Information included in the Registration Statement, the

Prospectus and the Pricing Disclosure Package, at the Applicable Time did not, and as of the Closing Date will not, contain any untrue

statement of material fact or omit to state a material fact necessary in order to make the statements therein, in light of the circumstances

under which they were made, not misleading; it being understood that the “Selling Shareholder Information” shall consist

solely of information relating to the Selling Shareholder that has been furnished to the Company in writing by the Selling Shareholder

expressly for use in the Pricing Disclosure Package (including any Pricing Disclosure Package that has subsequently been amended), Registration

Statement or the Prospectus (or any amendment or supplement thereto). |

| (f) | Issuer Free Writing Prospectus. Other than the Registration Statement, the Preliminary Prospectus and the Prospectus, the Selling

Shareholder (including its agents and representatives, other than the Underwriters in their capacity as such) has not prepared, made used,

authorized, approved or referred to and will not prepare, make, use, authorize, approve or refer to any Issuer Free Writing Prospectus,

other than (i) any document not constituting a prospectus pursuant to Section 2(a)(10)(a) of the Securities Act or Rule 134

under the Securities Act, (ii) any press releases issued by the Selling Shareholder outside the United States in reliance on Rule 135e

under the Securities Act (the “Selling Shareholder Press Releases”) or (iii) the documents listed on Annex A hereto

and any other written communications approved in writing in advance by the Company and the Representatives. |

| (g) | Legality. The legality, validity, enforceability or admissibility into evidence of any of the Registration Statement, the Pricing

Disclosure Package, the Prospectus, this Agreement or the Shares in the Netherlands or the United Kingdom is not dependent upon such document

being submitted into, filed or recorded with any court or other authority in any such jurisdiction on or before the date hereof or that

any tax, imposition or charge be paid in any such jurisdiction on or in respect of any such document. |

| (h) | No Broker’s Fees. The Selling Shareholder is not a party to any contract, agreement or understanding with any person

(other than this Agreement) that would give rise to a valid claim against the Company or any of its subsidiaries or any Underwriter for

a brokerage commission, finder’s fee or like payment in connection with the offering and sale of the Shares. |

| 5. | Further Agreements of the Company. The Company covenants and agrees with each Underwriter and the Selling Shareholder that: |

| (a) | Required Filings. The Company will file the final Prospectus with the Commission within the time period specified by Rule 424(b) and

Rule 430B under the Securities Act (but it being expressly understood that such filing shall be effected prior to the Time of Delivery)

will file any Issuer Free Writing Prospectus to the extent required by Rule 433 under the Securities Act; and will furnish copies

of the Prospectus and each Issuer Free Writing Prospectus (to the extent not previously delivered) to the Underwriters (copies of which

will also be delivered to the Selling Shareholder) in New York City prior to 10:00 A.M., New York City time, on the business day next

succeeding the date of this Agreement in such quantities as the Representatives may reasonably request. |

| (b) | Delivery of Copies. The Company will upon request deliver, without charge, (i) to the Representatives, two signed copies

of the Registration Statement as originally filed and each amendment thereto, in each case including all exhibits and consents filed therewith

and (ii) to each Underwriter (A) a conformed copy of the Registration Statement as originally filed and each amendment thereto

(without exhibits) and (B) during the Prospectus Delivery Period (as defined below), as many copies of the Prospectus (including

all amendments and supplements thereto and each Issuer Free Writing Prospectus) as the Representatives may reasonably request (copies

of the Registration Statement and Prospectus will also be delivered to the Selling Shareholder). As used herein, the term “Prospectus

Delivery Period” means such period of time after the first date of the public offering of the Shares as in the opinion of counsel

for the Underwriters a prospectus relating to the Shares is required by law to be delivered (or required to be delivered but for Rule 172

under the Securities Act) in connection with sales of the Shares by any Underwriter or dealer. |

| (c) | Amendments or Supplements, Issuer Free Writing Prospectuses. Before preparing, using, authorizing, approving, referring

to or filing any Issuer Free Writing Prospectus, and before filing any amendment or supplement to the Registration Statement or the Prospectus,

the Company will furnish to the Representatives and counsel for the Underwriters a copy of the proposed Issuer Free Writing Prospectus,

amendment or supplement (a copy will also be delivered to the Selling Shareholder) for review and will not prepare, use, authorize, approve,

refer to or file any such Issuer Free Writing Prospectus or file any such proposed amendment or supplement to which the Representatives

or the Selling Shareholder reasonably object, in writing, on a timely basis (unless, in the Company’s good faith judgment, such

action is necessary to comply with applicable law). |

| (d) | Notice to the Representatives and Selling Shareholder. The Company will advise the Representatives and the Selling Shareholder

promptly (i) when the Registration Statement has become effective; (ii) when any amendment to the Registration Statement has

been filed or becomes effective; (iii) when any supplement to the Prospectus or any Issuer Free Writing Prospectus or any amendment

to the Prospectus has been filed or distributed; (iv) of any request by the Commission for any amendment to the Registration Statement

or any amendment or supplement to the Prospectus or the receipt of any comments from the Commission relating to the Registration Statement

or any other request by the Commission for any additional information; (v) of the issuance by the Commission of any order suspending

the effectiveness of the Registration Statement or preventing or suspending the use of any Preliminary Prospectus, any of the Pricing

Disclosure Package or the Prospectus or the initiation or, to the Company’s knowledge, threatening of any proceeding for that purpose

or pursuant to Section 8A of the Securities Act; (vi) of the occurrence of any event or development within the Prospectus Delivery

Period as a result of which the Prospectus, the Pricing Disclosure Package or any Issuer Free Writing Prospectus as then amended or supplemented

would include any untrue statement of a material fact or omit to state a material fact necessary in order to make the statements therein,

in the light of the circumstances existing when the Prospectus, the Pricing Disclosure Package, or any such Issuer Free Writing Prospectus

is delivered to a purchaser, not misleading; (vii) of the receipt by the Company of any notice of objection of the Commission to

the use of the Registration Statement or any post-effective amendment thereto pursuant to Rule 401(g)(2) under the Securities

Act; and (viii) of the receipt by the Company of any notice with respect to any suspension of the qualification of the Shares for

offer and sale in any jurisdiction or the initiation or, to the Company’s knowledge, threatening of any proceeding for such purpose;

and the Company will use its reasonable best efforts to prevent the issuance of any such order suspending the effectiveness of the Registration

Statement, preventing or suspending the use of any Preliminary Prospectus, any of the Pricing Disclosure Package or the Prospectus or

suspending any such qualification of the Shares and, if any such order is issued, will obtain as soon as possible the withdrawal thereof. |

| (e) | Ongoing Compliance. (i) If during the Prospectus Delivery Period (A) any event or development shall occur or condition

shall exist as a result of which the Prospectus as then amended or supplemented would include any untrue statement of a material fact

or omit to state any material fact necessary in order to make the statements therein, in the light of the circumstances existing when

the Prospectus is delivered to a purchaser, not misleading or (B) it is necessary to amend or supplement the Prospectus to comply

with law, the Company will promptly after becoming aware of such circumstances notify the Underwriters and the Selling Shareholder thereof

and forthwith prepare and, subject to paragraph (c) of this Section 5, file with the Commission and furnish to the Underwriters,

the Selling Shareholder and to such dealers as the Representatives may designate such amendments or supplements to the Prospectus (or

any document to be filed with the Commission and incorporated by reference therein) as may be necessary so that the statements in the

Prospectus as so amended or supplemented (or any document to be filed with the Commission and incorporated by reference therein) will

not, in the light of the circumstances existing when the Prospectus is delivered to a purchaser, be misleading or so that the Prospectus

will comply with law and (ii) if at any time prior to the Closing Date (A) any event or development shall occur or condition

shall exist as a result of which the Pricing Disclosure Package as then amended or supplemented would include any untrue statement of

a material fact or omit to state any material fact necessary in order to make the statements therein, in the light of the circumstances

existing when the Pricing Disclosure Package is delivered to a purchaser, not misleading or (B) it is necessary to amend or supplement

the Pricing Disclosure Package to comply with law, the Company will promptly notify the Underwriters and the Selling Shareholder thereof

and forthwith prepare and, subject to paragraph (c) of this Section 5, file with the Commission (to the extent required) and

furnish to the Underwriters, to the Selling Shareholder and to such dealers as the Representatives may designate such amendments or supplements

to the Pricing Disclosure Package (or any document to be filed with the Commission and incorporated by reference therein) as may be necessary

so that the statements in the Pricing Disclosure Package as so amended or supplemented will not, in the light of the circumstances existing

when the Pricing Disclosure Package is delivered to a purchaser, be misleading or so that the Pricing Disclosure Package will comply with

law. |

| (f) | Blue Sky Compliance. The Company will qualify the Shares for offer and sale under the securities or blue sky laws of such jurisdictions

within the United States as the Representatives shall reasonably request and will continue such qualifications in effect so long as required

for distribution of the Shares; provided that the Company shall not be required to (i) qualify as a foreign corporation or

other entity or as a dealer in securities in any such jurisdiction where it would not otherwise be required to so qualify, (ii) file

any general consent to service of process in any such jurisdiction or (iii) subject itself to taxation in any jurisdiction in which

it is not otherwise so subject. |

| (g) | No Stabilization. The Company will not take, directly or indirectly, any action designed to or that could reasonably be expected

to cause or result in any stabilization or manipulation of the price of the Common Shares, it being understood that any action of any

of the Underwriters and their respective affiliates shall not constitute an indirect action by the Company. |

| (h) | Reports. For a period of two years from the date hereof, the Company will furnish to the Representatives, as soon as they are

available, copies of all reports or other communications (financial or other) furnished to holders of the Shares, and copies of any reports

and financial statements furnished to or filed with the Commission or any national securities exchange or automatic quotation system;

provided the Company will be deemed to have furnished such reports and financial statements to the Representatives to the extent

they are filed on the Commission’s EDGAR system. |

| (i) | Record Retention. The Company will, pursuant to reasonable procedures developed in good faith, retain copies of each Issuer

Free Writing Prospectus that is not filed with the Commission in accordance with Rule 433 under the Securities Act. |

| (j) | Foreign Private Issuer. The Company will promptly notify the Underwriters if the Company ceases to be a Foreign Private Issuer

at any time prior to completion of the distribution of Shares within the meaning of the Securities Act. |

| 6. | Further Agreements of the Selling Shareholder. The Selling Shareholder covenants and agrees with each Underwriter that: |

| (a) | Clear Market. For a period of 360 days after the date of the Prospectus, the Selling Shareholder will not (i) offer, pledge,

sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, grant any option, right or warrant

to purchase, lend or otherwise transfer or dispose of, directly or indirectly, any Common Shares or any securities convertible into or

exercisable or exchangeable for Common Shares, or publicly disclose the intention to make any offer, sale, pledge, disposition or filing

or (ii) enter into any hedging, swap or other agreement or transaction that transfers, in whole or in part, any of the economic consequences

of ownership of the Common Shares or any such other securities, whether any such transaction described in clause (i) or (ii) above

is to be settled by delivery of Common Shares or such other securities, in cash or otherwise, without the prior written consent of the

Representatives, other than the Shares to be sold hereunder. |

| (b) | Tax Form. It will deliver or has delivered to the Representatives prior to or at the Closing Date a properly completed and

executed United States Treasury Department Form W-8. |

| (c) | Use of Proceeds. The Selling Shareholder will not directly or indirectly use the proceeds of the offering of the Shares hereunder,

or lend, contribute or otherwise make available such proceeds to a subsidiary, joint venture partner or other person or entity (i) to

fund or facilitate any activities of or business with any person that, at the time of such funding or facilitation, is the subject of

target of Sanctions, (ii) to fund or facilitate any activities of or business in any Sanctioned Country or (iii) in any other