More States Pursue Rent Control -- Spelling Bad News for Landlords -- 2nd Update

April 23 2019 - 10:11AM

Dow Jones News

By Will Parker

Big apartment owners are forecast to post strong earnings when

they start reporting this week, but a number of state-sponsored

rent-control measures are starting to raise longer-term

concerns.

While most of the dozen or so proposals aimed at curbing rent

increases are in their early stages, some states have already taken

action.

Oregon passed a law in February that capped rent increases to 7%

plus the local inflation rate. Democrats in the Colorado

legislature introduced a bill this month to repeal a longstanding

ban on rent control, which would allow local governments to set

their own rent limits. New York lawmakers are also weighing a cap

on rent increases.

Equity Residential, AvalonBay Communities Inc. and Essex

Property Trust are among the apartment real-estate investment

trusts that could be hit by these measures, which have gained

momentum after Democrats took control or increased their numbers in

several state legislatures last year.

The prospect of tougher rent control laws hangs over the

industry at a time when the apartment business has been strong

otherwise, and analysts have a positive near-term outlook.

A recent Barclays PLC report forecast apartment REIT earnings to

be strong for the first quarter of 2019, citing high occupancy

rates and low apartment turnover. "The tone we're expecting from

the multifamily guys should be fairly positive," said Ross

Smotrich, a Barclays analyst.

But Mr. Smotrich said speculation over the spread of rent

control laws is difficult to account for in longer-term

forecasts.

John Pawlowksi, an analyst for the real-estate research firm

Green Street Advisors, said the new bills could cause apartment

stocks to underperform, despite positive market fundamentals. Green

Street downgraded California-focused Essex Property Trust shares to

"sell," in part because of political possibilities, he said.

Shares of the six largest apartment REITs are up 9.8% year to

date, compared with a 16% gain for the S&P 500 stock index.

SunTrust Robinson Humphrey last summer downgraded Equity

Residential from "buy" to "hold." The firm pointed to the

landlord's exposure to California, which last year had a ballot

measure that would have repealed longstanding limitations on rent

control.

The real-estate industry spent millions of dollars to help

defeat that measure. But California lawmakers have introduced two

new bills that would allow deeper rent control, and some of the

other bills have rattled the apartment market.

Equity Residential Chief Executive Officer Mark Parrell said his

company plans to expand its political efforts in other states,

emphasizing new construction as a way to address affordability

issues.

"You should expect us to be active trying to convince both the

public and the policy makers of the value of these supply-driven

solutions," he said in an interview.

In New York, where a bill to cap rent increases on apartments

statewide has the support of the chairman of the State Senate's

housing committee, multifamily building sales in the first quarter

of 2019 dropped to their lowest point in six years.

While New York State Assembly Speaker Carl Heastie hasn't made

that bill part of his housing reform agenda for this year, his

spokesman seemed to leave the door open for the statewide rent

control measure: "The Assembly Majority has always been a strong

supporter of tenants and tenant rights, and this is a new issue

that we will be further exploring in our upcoming hearings."

Most New York proposals focus on apartments already covered by

existing rent protections. Increased regulation of those units

could boost rents on market-rate apartments, if it means less

investment and less supply, said Joseph D. Fisher, chief financial

officer of Colorado-based landlord UDR Inc. in a February earnings

call.

While most of UDR's New York portfolio consists of market-rate

apartments, a property it acquired earlier this year in the

Williamsburg section of Brooklyn is regulated under current New

York laws.

--Inti Pacheco contributed to this article.

(END) Dow Jones Newswires

April 23, 2019 09:56 ET (13:56 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

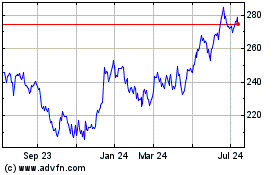

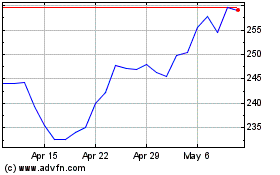

Essex Property (NYSE:ESS)

Historical Stock Chart

From Apr 2024 to May 2024

Essex Property (NYSE:ESS)

Historical Stock Chart

From May 2023 to May 2024