Equity Commonwealth (NYSE: EQC) today reported financial results

for the quarter ended September 30, 2018. All per share results are

reported on a diluted basis.

Financial results for the quarter ended September 30,

2018

Net income attributable to common shareholders was $30.8

million, or $0.25 per share, for the quarter ended September 30,

2018. This compares to net income attributable to common

shareholders of $31.2 million, or $0.25 per share, for the quarter

ended September 30, 2017.

Funds from Operations (FFO), as defined by the National

Association of Real Estate Investment Trusts, for the quarter ended

September 30, 2018, were $20.9 million, or $0.17 per share. This

compares to FFO for the quarter ended September 30, 2017 of $27.0

million, or $0.22 per share. The following items impacted FFO for

the quarter ended September 30, 2018, compared to the corresponding

2017 period:

- ($0.15) per share of income from

properties sold;

- $0.05 per share of interest expense

savings;

- $0.04 per of share of increase in

interest and other income (net of a $0.02 per share loss on the

sale of a mortgage receivable); and

- $0.01 per share of general &

administrative expense savings.

Normalized FFO was $21.6 million, or $0.18 per share. This

compares to Normalized FFO for the quarter ended September 30, 2017

of $24.0 million, or $0.19 per share. The following items impacted

Normalized FFO for the quarter ended September 30, 2018, compared

to the corresponding 2017 period:

- ($0.15) per share of income from

properties sold;

- $0.06 per of share of increase in

interest and other income;

- $0.05 per share of interest expense

savings;

- $0.02 per share of increase in same

property cash NOI; and

- $0.01 per share of general &

administrative expense savings.

Normalized FFO begins with FFO and eliminates certain items

that, by their nature, are not comparable from period to period,

non-cash items, and items that tend to obscure the company’s

operating performance. Definitions of FFO, Normalized FFO and

reconciliations to net income, determined in accordance with U.S.

generally accepted accounting principles, or GAAP, are included at

the end of this press release.

For the quarter ended September 30, 2018, the company’s balance

of cash and marketable securities net of distributions payable was

$2.6 billion. Total debt outstanding was $280 million and

availability under the company’s revolving credit facility was $750

million.

The weighted average number of diluted common shares outstanding

when calculating net income per share for the quarter ended

September 30, 2018 was 122,850,928 shares, compared to 125,174,651

for the quarter ended September 30, 2017. The weighted average

number of diluted common shares outstanding when calculating FFO or

Normalized FFO per share for the quarter ended September 30, 2018

was 122,896,648 shares, compared to 125,174,651 for the quarter

ended September 30, 2017.

Same property results for the quarter ended September 30,

2018

The company’s same property portfolio at the end of the quarter

consisted of 11 properties totaling 5.4 million square feet.

Operating results were as follows:

- The same property portfolio was 94.0%

leased as of September 30, 2018, compared to 91.8% as of June 30,

2018, and 91.1% as of September 30, 2017.

- The same property portfolio commenced

occupancy was 91.3% as of September 30, 2018, compared to 89.9% as

of June 30, 2018, and 87.5% as of September 30, 2017.

- Same property NOI increased 1.7% when

compared to the same period in 2017.

- Same property cash NOI increased 9.1%

when compared to the same period in 2017.

- The company entered into leases for

approximately 563,000 square feet, including new leases for

approximately 562,000 square feet and renewal leases for

approximately 1,000 square feet.

- GAAP rental rates on new and renewal

leases were 11.0% higher compared to prior GAAP rental rates for

the same space.

- Cash rental rates on new and renewal

leases were 1.2% lower compared to prior cash rental rates for the

same space.

The definitions and reconciliations of same property NOI and

same property cash NOI to operating income, determined in

accordance with GAAP, are included at the end of this press

release. The same property portfolio includes properties

continuously owned from July 1, 2017 through September 30,

2018.

Significant events during the quarter ended September 30,

2018

- The company completed dispositions

totaling $170.5 million. The properties sold during the quarter

included:

- 777 East Eisenhower Parkway, a 39.8%

leased, 290,530 square foot office building in Ann Arbor, Michigan,

for a gross sale price of $29.5 million.

- 8750 Bryn Mawr Avenue, a 95.5% leased,

636,078 square foot, office property in Chicago, Illinois, for a

gross sale price of $141 million.

- The company announced a special,

one-time cash distribution of $2.50 per common share, which was

paid on October 23, 2018 to shareholders of record on October 9,

2018.

Subsequent Events

- The company currently has 4 properties

totaling 2.9 million square feet in various stages of the sale

process.

Earnings Conference Call & Supplemental Data

Equity Commonwealth will host a conference call to discuss third

quarter results on Thursday, October 25, 2018, at 9:00 A.M. CT. The

conference call will be available via live audio webcast on the

Investor Relations section of the company’s website

(www.eqcre.com). A replay of the audio webcast will also be

available following the call.

A copy of EQC’s Third Quarter 2018 Supplemental Operating and

Financial Data is available on the Investor Relations section of

EQC’s website at www.eqcre.com.

About Equity Commonwealth

Equity Commonwealth (NYSE: EQC) is a Chicago based, internally

managed and self-advised real estate investment trust (REIT) with

commercial office properties in the United States. As of September

30, 2018, EQC’s portfolio comprised 11 properties and 5.4 million

square feet.

Regulation FD Disclosures

We intend to use any of the following to comply with our

disclosure obligations under Regulation FD: press releases, SEC

filings, public conference calls, or our website. We routinely post

important information on our website at www.eqcre.com, including

information that may be deemed to be material. We encourage

investors and others interested in the company to monitor these

distribution channels for material disclosures.

Forward-Looking Statements

Some of the statements contained in this press release

constitute forward-looking statements within the meaning of the

federal securities laws, including, but not limited to, statements

regarding share repurchases, marketing the company’s properties for

sale and consummating asset sales. Any forward-looking statements

contained in this press release are intended to be made pursuant to

the safe harbor provisions of Section 21E of the Securities

Exchange Act of 1934. Forward-looking statements relate to

expectations, beliefs, projections, future plans and strategies,

anticipated events or trends and similar expressions concerning

matters that are not historical facts. In some cases, you can

identify forward-looking statements by the use of forward-looking

terminology such as “may,” “will,” “should,” “expects,” “intends,”

“plans,” “anticipates,” “believes,” “estimates,” “predicts,”

“potential,” or the negative of these words and phrases or similar

words or phrases which are predictions of or indicate future events

or trends and which do not relate solely to historical matters. You

can also identify forward-looking statements by discussions of

strategy, plans or intentions.

The forward-looking statements contained in this press release

reflect the company’s current views about future events and are

subject to numerous known and unknown risks, uncertainties,

assumptions and changes in circumstances that may cause the

company’s actual results to differ significantly from those

expressed in any forward-looking statement. We do not guarantee

that the transactions and events described will happen as described

(or that they will happen at all).

While forward-looking statements reflect the company’s good

faith beliefs, they are not guarantees of future performance. We

disclaim any obligation to publicly update or revise any

forward-looking statement to reflect changes in underlying

assumptions or factors, of new information, data or methods, future

events or other changes. For a further discussion of these and

other factors that could cause the company’s future results to

differ materially from any forward-looking statements, see the

section entitled “Risk Factors” in the company’s most recent Annual

Report on Form 10-K and in the company’s Quarterly Reports on Form

10-Q for subsequent quarters.

CONDENSED CONSOLIDATED BALANCE SHEETS

(amounts in thousands, except share

data)

September 30, 2018 December 31,

2017 ASSETS

Real estate properties: Land $ 137,329 $ 191,775

Buildings and improvements 1,000,822 1,555,836

1,138,151 1,747,611 Accumulated depreciation (370,854 ) (450,718 )

767,297 1,296,893 Assets held for sale — 97,688 Acquired real

estate leases, net 596 23,847 Cash and cash equivalents 2,673,328

2,351,693 Marketable securities 248,838 276,928 Restricted cash

9,708 8,897 Rents receivable, net of allowance for doubtful

accounts of $5,816 and $4,771, respectively 50,103 93,436 Other

assets, net 63,858 87,563

Total assets $ 3,813,728

$ 4,236,945

LIABILITIES AND EQUITY

Revolving credit facility $ — $

— Senior unsecured debt, net 248,258 815,984 Mortgage notes

payable, net 31,643 32,594 Liabilities related to properties held

for sale — 1,840 Accounts payable, accrued expenses and other

46,896 74,956 Rent collected in advance 8,182 11,076 Distributions

payable 309,238 —

Total liabilities $ 644,217

$ 936,450

Shareholders' equity: Preferred shares of beneficial interest,

$0.01 par value: 50,000,000 shares authorized; Series D preferred

shares; 6 1/2% cumulative convertible; 4,915,196 shares issued and

outstanding, aggregate liquidation preference of $122,880 $ 119,263

$ 119,263 Common shares of beneficial interest, $0.01 par value:

350,000,000 shares authorized; 121,482,673 and 124,217,616 shares

issued and outstanding, respectively 1,215 1,242 Additional paid in

capital 4,306,020 4,380,313 Cumulative net income 2,855,557

2,596,259 Cumulative other comprehensive loss (1,006 ) (95 )

Cumulative common distributions (3,418,995 ) (3,111,868 )

Cumulative preferred distributions (693,736 ) (685,748 ) Total

shareholders’ equity 3,168,318 3,299,366 Noncontrolling interest

1,193 1,129

Total

equity $ 3,169,511

$ 3,300,495 Total liabilities and

equity $ 3,813,728

$ 4,236,945

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

(amounts in thousands, except per share

data)

Three

Months Ended Nine Months Ended

September 30, September 30, 2018

2017 2018 2017

Revenues: Rental income $ 34,138 $

61,091 $ 112,898 $ 215,648 Tenant reimbursements and other income

12,735 16,707

41,199 53,300

Total revenues

$ 46,873 $

77,798 $ 154,097

$ 268,948 Expenses: Operating

expenses $ 20,257 $ 32,380 $ 64,377 $ 110,751 Depreciation and

amortization 11,287 21,133 38,211 71,970 General and administrative

10,905 11,689 35,466 35,727 Loss on asset impairment

— — 12,087

19,714

Total expenses $

42,449 $ 65,202

$ 150,141 $

238,162

Operating

income $ 4,424

$ 12,596 $ 3,956

$ 30,786 Interest

and other income, net 12,626 7,596 31,074 17,987 Interest expense

(including net amortization of debt discounts, premiums and

deferred financing fees of $559, $784, $2,005 and $2,346,

respectively) (5,085 ) (11,510 ) (21,550 ) (41,387 ) Loss on early

extinguishment of debt — (203 ) (6,403 ) (266 ) Gain on sale of

properties, net 20,877 25,080 253,025

44,670 Income before income taxes 32,842 33,559 260,102

51,790 Income tax expense (65 ) (335 )

(2,616 ) (555 )

Net income

$ 32,777 $ 33,224

$ 257,486

$ 51,235 Net income attributable to

noncontrolling interest (13 ) (12 )

(90 ) (18 )

Net income attributable to

Equity Commonwealth $ 32,764

$ 33,212 $

257,396 $ 51,217

Preferred distributions (1,997 ) (1,997 )

(5,991 ) (5,991 )

Net income

attributable to Equity Commonwealth common shareholders

$ 30,767 $ 31,215

$ 251,405

$ 45,226 Weighted average common shares

outstanding — basic (1) 121,845 124,089 122,504

124,068 Weighted average common shares outstanding —

diluted (1) 122,851 125,175 123,389 125,194

Earnings per common share attributable to Equity

Commonwealth common shareholders: Basic $ 0.25 $ 0.25

$ 2.05

$

0.36 Diluted $ 0.25 $ 0.25 $ 2.04

$

0.36 Distributions declared per common share $ 2.50

$ — $ 2.50

$

—

(1) Weighted average common shares outstanding for

the three months ended September 30, 2018 and 2017 includes 362 and

0 unvested, earned RSUs, respectively. Weighted average common

shares outstanding for the nine months ended September 30, 2018 and

2017 includes 344 and 0 unvested, earned RSUs, respectively.

CALCULATION OF FUNDS FROM OPERATIONS (FFO) AND NORMALIZED

FFO (amounts in thousands, except per share data)

Three Months Ended

Nine Months Ended September 30,

September 30, 2018

2017 2018 2017

Calculation of FFO

Net income $ 32,777 $ 33,224 $

257,486 $ 51,235 Real estate depreciation and amortization

10,978 20,842 37,298 71,077 Loss on asset impairment — — 12,087

19,714 Gain on sale of properties, net (20,877 ) (25,080 ) (253,025

) (44,670 ) FFO attributable to Equity Commonwealth 22,878 28,986

53,846 97,356 Preferred distributions (1,997 )

(1,997 ) (5,991 ) (5,991 )

FFO attributable

to EQC common shareholders and unitholders

$ 20,881 $ 26,989

$ 47,855 $

91,365

Calculation of Normalized

FFO

FFO attributable to EQC common shareholders and

unitholders $ 20,881 $ 26,989 $ 47,855 $ 91,365 Lease value

amortization (4 ) 388 76 1,479 Straight line rent adjustments

(1,435 ) (3,557 ) (3,985 ) (12,487 ) Loss on early extinguishment

of debt — 203 6,403 266 Loss on sale of securities — — 4,987 — Loss

on sale of real estate mortgage receivable 2,117 — 2,117 — Income

taxes related to gains on property sales 25

— 2,498 —

Normalized FFO attributable to EQC common shareholders and

unitholders $ 21,584

$ 24,023 $ 59,951

$ 80,623 Weighted average

common shares and units outstanding -- basic (1) 121,891

124,132 122,548 124,105 Weighted average

common shares and units outstanding -- diluted (1) 122,897

125,175 123,433 125,194 FFO

attributable to EQC common shareholders and unitholders per share

and unit -- basic $ 0.17 $ 0.22 $ 0.39 $ 0.74

FFO attributable to EQC common shareholders and unitholders

per share and unit -- diluted $ 0.17 $ 0.22 $ 0.39

$ 0.73 Normalized FFO attributable to EQC common

shareholders and unitholders per share and unit -- basic $ 0.18

$ 0.19 $ 0.49 $ 0.65 Normalized FFO

attributable to EQC common shareholders and unitholders per share

and unit -- diluted $ 0.18 $ 0.19 $ 0.49 $

0.64

(1)

Our calculations of FFO and Normalized FFO

attributable to EQC common shareholders and unitholders per share and unit - basic

for the three and nine months ended September 30, 2018 include 46

and 44 LTIP/Operating Partnership Units, respectively, that are

excluded from the calculation of basic earnings per common share

attributable to EQC common shareholders

(only). Our calculations of FFO and Normalized FFO

attributable to EQC common shareholders and unitholders per share and unit - basic

for the three and nine months ended September 30, 2017 include 43

and 37 LTIP/Operating Partnership Units, respectively, that are

excluded from the calculation of basic earnings per common share

attributable to EQC common shareholders

(only).

We compute FFO in accordance with standards established by

NAREIT. NAREIT defines FFO as net income (loss), calculated in

accordance with GAAP, excluding real estate depreciation and

amortization, gains (or losses) from sales of depreciable property,

impairment of depreciable real estate, and our portion of these

items related to equity investees and noncontrolling interests. Our

calculation of Normalized FFO differs from NAREIT’s definition of

FFO because we exclude certain items that we view as nonrecurring

or impacting comparability from period to period. FFO and

Normalized FFO are supplemental non-GAAP financial measures. We

consider FFO and Normalized FFO to be appropriate measures of

operating performance for a REIT, along with net income (loss), net

income (loss) attributable to EQC common shareholders, operating

income (loss) and cash flow from operating activities.

We believe that FFO and Normalized FFO provide useful

information to investors because by excluding the effects of

certain historical amounts, such as depreciation expense, FFO and

Normalized FFO may facilitate a comparison of our operating

performance between periods and with other REITs. FFO and

Normalized FFO do not represent cash generated by operating

activities in accordance with GAAP and should not be considered as

alternatives to net income (loss), net income (loss) attributable

to EQC common shareholders, operating income (loss) or cash flow

from operating activities, determined in accordance with GAAP, or

as indicators of our financial performance or liquidity, nor are

these measures necessarily indicative of sufficient cash flow to

fund all of our needs. These measures should be considered in

conjunction with net income (loss), net income (loss) attributable

to EQC common shareholders, operating income (loss) and cash flow

from operating activities as presented in our condensed

consolidated statements of operations, condensed consolidated

statements of comprehensive income and condensed consolidated

statements of cash flows. Other REITs and real estate companies may

calculate FFO and Normalized FFO differently than we do.

CALCULATION OF SAME PROPERTY NET OPERATING INCOME (NOI)

AND SAME PROPERTY CASH BASIS NOI (amounts in thousands)

For the Three Months Ended

9/30/2018 6/30/2018

3/31/2018 12/31/2017

9/30/2017 Calculation of Same Property NOI and Same

Property Cash Basis NOI:

Rental income $ 34,138 $ 35,211 $ 43,549 $

54,672 $ 61,091 Tenant reimbursements and other income 12,735

13,425 15,039 16,951 16,707 Operating expenses

(20,257 ) (19,521 ) (24,599 )

(30,674 ) (32,380 )

NOI

$ 26,616 $ 29,115

$ 33,989

$ 40,949 $ 45,418

Straight line rent adjustments (1,435 ) (1,022 ) (1,528 )

(1,938 ) (3,557 ) Lease value amortization (4 ) (18 ) 98 295 388

Lease termination fees (395 ) (1,557 )

(965 ) (942 ) (1,477 )

Cash Basis NOI $ 24,782

$ 26,518 $

31,594 $ 38,364

$ 40,772 Cash Basis NOI from

non-same properties (1) (58 ) (1,856 )

(7,579 ) (14,905 )

(18,110 )

Same Property Cash Basis NOI

$ 24,724 $ 24,662

$ 24,015

$ 23,459 $ 22,662

Non-cash rental income and lease termination fees from same

properties 1,120 1,107

1,084 1,192

2,745

Same Property NOI $

25,844 $ 25,769

$ 25,099 $

24,651 $ 25,407

Reconciliation of Same Property NOI to GAAP Operating

Income:

Same Property

NOI $ 25,844

$ 25,769 $ 25,099

$ 24,651

$ 25,407 Non-cash rental income and lease

termination fees from same properties (1,120 )

(1,107 ) (1,084 ) (1,192 )

(2,745 )

Same Property Cash Basis NOI

$ 24,724 $

24,662 $ 24,015

$ 23,459 $

22,662 Cash Basis NOI from non-same properties (1)

58 1,856

7,579 14,905 18,110

Cash Basis NOI $ 24,782

$ 26,518

$ 31,594 $ 38,364

$ 40,772 Straight line

rent adjustments 1,435 1,022 1,528 1,938 3,557 Lease value

amortization 4 18 (98 ) (295 ) (388 ) Lease termination fees

395 1,557 965

942 1,477

NOI $ 26,616

$ 29,115 $

33,989 $ 40,949

$ 45,418 Depreciation and

amortization (11,287 ) (13,021 ) (13,903 ) (18,738 ) (21,133 )

General and administrative (10,905 ) (11,222 ) (13,339 ) (12,033 )

(11,689 ) Loss on asset impairment —

— (12,087 ) —

—

Operating Income (Loss)

$ 4,424 $ 4,872

$ (5,340 )

$ 10,178 $ 12,596

(1) Cash Basis NOI from non-same properties for all

periods presented includes the operations of properties disposed or

classified as held for sale and land parcels.

CALCULATION OF SAME PROPERTY NET

OPERATING INCOME (NOI) AND SAME PROPERTY CASH BASIS NOI

(amounts in thousands)

For the Nine Months Ended September

30, 2018 2017 Calculation

of Same Property NOI and Same Property Cash Basis NOI:

Rental income $ 112,898 $ 215,648 Tenant

reimbursements and other income 41,199 53,300 Operating expenses

(64,377 ) (110,751 )

NOI

$ 89,720

$ 158,197 Straight line rent adjustments

(3,985 ) (12,487 ) Lease value amortization 76 1,479 Lease

termination fees (2,917 ) (4,002

)

Cash Basis NOI $ 82,894

$ 143,187 Cash Basis NOI

from non-same properties (1) (9,493 )

(78,164 )

Same Property Cash Basis NOI

$ 73,401 $

65,023 Non-cash rental income and lease termination

fees from same properties 3,311

10,011

Same Property NOI

$ 76,712 $

75,034 Reconciliation of Same Property NOI

to GAAP Operating Income:

Same Property NOI $

76,712 $ 75,034

Non-cash rental income and lease termination fees from same

properties (3,311 ) (10,011 )

Same Property Cash Basis NOI $

73,401 $ 65,023

Cash Basis NOI from non-same properties (1)

9,493 78,164

Cash Basis

NOI $ 82,894

$ 143,187 Straight line rent

adjustments 3,985 12,487 Lease value amortization (76 ) (1,479 )

Lease termination fees 2,917

4,002

NOI $ 89,720

$ 158,197

Depreciation and amortization (38,211 ) (71,970 ) General and

administrative (35,466 ) (35,727 ) Loss on asset impairment

(12,087 ) (19,714 )

Operating

Income $ 3,956

$ 30,786 (1) Cash Basis NOI from

non-same properties for all periods presented includes the

operations of properties disposed or classified as held for sale

and land parcels.

NOI is income from our real estate operations including lease

termination fees received from tenants less our property operating

expenses. NOI excludes amortization of capitalized tenant

improvement costs and leasing commissions and corporate level

expenses. Cash Basis NOI is NOI excluding the effects of straight

line rent adjustments, lease value amortization, and lease

termination fees. The quarter-to-date same property versions of

these measures include the results of properties continuously owned

from July 1, 2017 through September 30, 2018. The year-to-date same

property versions of these measures include the results of

properties continuously owned from January 1, 2017 through

September 30, 2018. Land parcels and properties classified as held

for sale within our condensed consolidated balance sheets are

excluded from the same property versions of these measures.

We consider these supplemental non-GAAP financial measures to be

appropriate supplemental measures to net income (loss) because they

help to understand the operations of our properties. We use these

measures internally to evaluate property level performance, and we

believe that they provide useful information to investors regarding

our results of operations because they reflect only those income

and expense items that are incurred at the property level and may

facilitate comparisons of our operating performance between periods

and with other REITs. Cash Basis NOI is among the factors

considered with respect to acquisition, disposition and financing

decisions. These measures do not represent cash generated by

operating activities in accordance with GAAP and should not be

considered as an alternative to net income (loss), net income

(loss) attributable to EQC common shareholders, operating income

(loss) or cash flow from operating activities, determined in

accordance with GAAP, or as indicators of our financial performance

or liquidity, nor are these measures necessarily indicative of

sufficient cash flow to fund all of our needs. These measures

should be considered in conjunction with net income (loss), net

income (loss) attributable to EQC common shareholders, operating

income (loss) and cash flow from operating activities as presented

in our condensed consolidated statements of operations, condensed

consolidated statements of comprehensive income and condensed

consolidated statements of cash flows. Other REITs and real estate

companies may calculate these measures differently than we do.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181024005826/en/

Equity CommonwealthSarah Byrnes, Investor Relations(312)

646-2801ir@eqcre.com

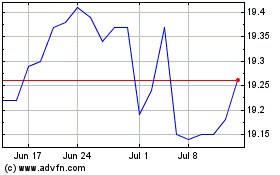

Equity Commonwealth (NYSE:EQC)

Historical Stock Chart

From Aug 2024 to Sep 2024

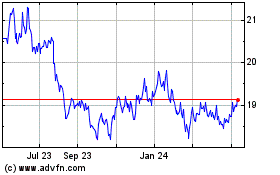

Equity Commonwealth (NYSE:EQC)

Historical Stock Chart

From Sep 2023 to Sep 2024