UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date of Report (date of earliest event reported):

January 22, 2025

ENLINK MIDSTREAM, LLC

(Exact name of registrant as specified in

its charter)

| Delaware |

|

001-36336 |

|

46-4108528 |

(State or Other Jurisdiction of

Incorporation or Organization) |

|

(Commission File

Number) |

|

(I.R.S. Employer Identification No.) |

1722

ROUTH STREET, SUITE

1300

DALLAS, Texas |

|

75201 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (214) 953-9500

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

x Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

SECURITIES REGISTERED PURSUANT TO SECTION 12(b)

OF THE SECURITIES EXCHANGE ACT OF 1934:

| Title of Each Class |

|

Symbol |

|

Name of Exchange on which Registered |

| Common Units Representing Limited Liability Company Interests |

|

ENLC |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

As previously disclosed, on

November 24, 2024, EnLink Midstream, LLC, a Delaware limited liability company (“EnLink”), EnLink Midstream Manager,

LLC, a Delaware limited liability company and the managing member of EnLink (the “Manager”), ONEOK, Inc.,

an Oklahoma corporation (“ONEOK”), Elk Merger Sub I, L.L.C., a Delaware limited liability company and a direct, wholly-owned

subsidiary of ONEOK (“Merger Sub I”), and Elk Merger Sub II, L.L.C., a Delaware limited liability company and a direct, wholly-owned

subsidiary of ONEOK (“Merger Sub II” and, together with Merger Sub I, the “Merger Subs”), entered into a definitive

Agreement and Plan of Merger (the “Merger Agreement”). Upon the terms and subject to the conditions set forth in the Merger

Agreement, Merger Sub I will merge with and into EnLink (the “First Merger”), with EnLink surviving and continuing to exist

as a Delaware limited liability company and, promptly following the First Merger, EnLink will merge with and into Merger Sub II (the “Second

Merger” and, together with the First Merger, the “Mergers” and, together with the other transactions contemplated

by the Merger Agreement, the “Transaction”), with Merger Sub II surviving and continuing to exist

as a Delaware limited liability company.

In connection with the Transaction, ONEOK filed

with the Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 (as amended, the “Registration

Statement”) to register the shares of ONEOK’s common stock to be issued pursuant to the Transaction, which includes a prospectus

of ONEOK and a proxy statement of EnLink (the “Proxy Statement/Prospectus”). The Registration Statement was declared effective

on December 30, 2024 and EnLink filed the definitive Proxy Statement/Prospectus with the SEC on December 31, 2024. The definitive

Proxy Statement/Prospectus was first mailed to EnLink’s unitholders on December 31, 2024.

Litigation Related to the Transaction

Following the filing of the Registration Statement,

and as of the date of this Current Report on Form 8-K (this “Current Report”), EnLink has, to its knowledge, received

several demand letters from purported unitholders of EnLink (collectively, the “Demand Letters”) and three complaints have

been filed with respect to the Mergers. The complaints are captioned as follows: John Thompson v. EnLink Midstream, LLC, et al.,

was filed in the Supreme Court of the State of New York, New York County (the “Thompson Complaint”), William Johnson v.

EnLink Midstream, LLC, et al., was filed in the Supreme Court of the State of New York, New York County (the “Johnson Complaint”),

and Robert Garfield v. EnLink Midstream, LLC, ONEOK, Inc., et al., was filed in the Circuit Court of the Twentieth Judicial

Circuit in and for Charlotte County, Florida (the “Garfield Complaint” and, together with the Thompson Complaint and the

Johnson Complaint, the “Complaints”).

The Demand Letters and the Complaints allege that,

among other things, the Proxy Statement/Prospectus contains certain disclosure deficiencies and/or incomplete information regarding the

Mergers. Although the outcome of, or estimate of the possible loss or range of loss from, these matters cannot be predicted, EnLink believes

that the allegations contained in the Demand Letters and the Complaints are without merit.

EnLink believes that no supplemental disclosures are required under

applicable laws; however, in order to avoid the risk of the Demand Letters and the Complaints delaying the Mergers and minimize the expense

of defending the Complaints, and without admitting any liability or wrongdoing, EnLink is voluntarily making certain disclosures below

that supplement those contained in the Proxy Statement/Prospectus (the “Supplemental Disclosures”). These Supplemental Disclosures,

and disclosures on certain other matters, are provided in this Current Report. Nothing in this Current Report shall be deemed an admission

of the legal necessity or materiality under applicable laws of any of the disclosures set forth herein. To the contrary, EnLink specifically

denies all allegations in the Demand Letters and the Complaints, including that any additional disclosure was or is required or material.

The Board of Directors of the Manager (the “EnLink Board”) and the Conflicts Committee of the EnLink Board unanimously recommend

that the EnLink unitholders vote “FOR” the merger proposal being considered at EnLink’s special meeting of unitholders.

It is possible that additional or similar complaints

or demand letters may be received by EnLink alleging similar or additional disclosure deficiencies between the date of this Current Report

and consummation of the Transaction. If any such additional or similar complaints or demand letters are received, EnLink may not necessarily

disclose such events.

The information contained in this Current Report

is incorporated by reference into the Proxy Statement/Prospectus and the Registration Statement. All page references in this Current

Report are to pages of the definitive Proxy Statement/Prospectus filed with the SEC on December 31, 2024, and all terms used

in this Current Report, but not otherwise defined, shall have the meanings ascribed to such terms in the Proxy Statement/Prospectus. New

text within restated language from the Proxy Statement/Prospectus is indicated in bold, underlined text (e.g., bold, underlined

text) and removed language within the restated language from the Proxy Statement/Prospectus is indicated in strikethrough text

(e.g., strikethrough text), as applicable. The following information should be read in conjunction with the Proxy Statement/Prospectus

and the Registration Statement, which should be read in their entirety. To the extent that information in this Current Report differs

from or updates information contained in the Proxy Statement/Prospectus or the Registration Statement, the information in this Current

Report shall supersede or supplement such information in the Proxy Statement/Prospectus or the Registration Statement.

SUPPLEMENTAL DISCLOSURE

The following disclosure replaces the second full paragraph on

page 49 of the Proxy Statement/Prospectus under the heading “The Mergers—Opinion of EnLink Conflicts

Committee’s Financial Advisor—Analysis of EnLink—Discounted Cash Flow Analysis”:

For EnLink’s discounted cash flow analysis,

based on its professional experience and judgement, Evercore assumed a range of discount rates of 8.0% to 9.5% based on

EnLink’s WACC, a range of EBITDA multiples of 8.5x to 11.0x applied to EnLink’s terminal period EBITDA and a range of perpetuity

growth rates of -0.25% to 0.25% applied to EnLink’s terminal period cash flows based on the EnLink Financial Projections, as applicable,

to derive a range of enterprise values. Evercore adjusted such enterprise values for projected debt, preferred equity and cash as of December 31,

2024, and divided the resulting equity values by the number of fully-diluted EnLink Units as of December 31, 2024, which was

approximately 461 million. The discounted cash flow analysis utilizing the EBITDA multiple terminal value methodology resulted

in an implied equity value per EnLink Unit range of $15.42 to $22.86. When assuming the closing share price of ONEOK Common Stock on November 22,

2024, this range implies exchange ratios of 0.1317x to 0.1953x, which compares to the Exchange Ratio of 0.1412x. The discounted cash flow

analysis utilizing the perpetuity growth rate methodology to calculate terminal value resulted in an implied equity value per EnLink Unit

range of $13.92 to $20.08. When assuming the closing share price of OKE on November 22, 2024, this range implies exchange ratios

of 0.1189x to 0.1715x, which compares to the Exchange Ratio of 0.1412x.

The following disclosure hereby supplements the disclosure on

page 50 of the Proxy Statement/Prospectus under the heading “The Mergers—Opinion of EnLink Conflicts

Committee’s Financial Advisor—Analysis of EnLink—Public Companies and Partnerships Trading Analysis” by

inserting the paragraph and table below following the second full paragraph:

The range of Enterprise Value to EBITDA trading

multiples of the gathering and processing public companies and MLPs are set forth below.

| Company/MLP |

|

Enterprise Value/2025 EBITDA |

|

Enterprise Value/2026 EBITDA |

| Antero Midstream Corporation |

|

9.9x |

|

9.6x |

| DT Midstream, Inc. |

|

12.5x |

|

12.0x |

| Hess Midstream LP |

|

9.0x |

|

8.3x |

| Kinetik Holdings Inc. |

|

12.0x |

|

10.9x |

| Targa Resources Corp. |

|

12.9x |

|

11.9x |

| Western Midstream Partners, LP |

|

9.0x |

|

8.6x |

The following disclosure replaces the last full paragraph on page 51

of the Proxy Statement/Prospectus under the heading “The Mergers—Opinion of EnLink Conflicts Committee’s Financial Advisor—Analysis

of EnLink—Precedent M&A Transaction Analysis”:

Based on Evercore’s review of the above precedent

transactions, Evercore selected a range of relevant implied multiples of Enterprise Value to EBITDA of 8.0x to 10.0x. Evercore then applied

the range of selected multiples to EnLink’s 2025E Adjusted EBITDA as shown in the section entitled “The

Mergers — Unaudited Financial Projections of EnLink” and adjusted for projected preferred equity, debt and cash as

of December 31, 2024, and then divided the result by the number of fully-diluted EnLink Units outstanding as of December 31,

2024, which was approximately 461 million, which resulted in an implied equity value per EnLink Unit range of $11.92 to

$18.01. When assuming the closing share price of ONEOK Common Stock on November 22, 2024, this range implies exchange ratios of 0.1018x

to 0.1538x, which compares to the Exchange Ratio of 0.1412x.

The following disclosure replaces the second full paragraph

beginning on page 51 of the Proxy Statement/Prospectus under the heading “The Mergers—Opinion of EnLink Conflicts

Committee’s Financial Advisor—Analysis of ONEOK—Assumptions with Respect to ONEOK”:

Evercore performed a series of analyses to derive

indicative valuation ranges for ONEOK Common Stock. Evercore performed its analyses utilizing selected Wall Street Research

reports, as directed to Evercore by which reflect input from ONEOK management (the “ONEOK Financial

Projections”). No financial projections were provided by ONEOK.

The following disclosure replaces in its entirety the disclosure

beginning on page 51 of the Proxy Statement/Prospectus under the heading “The Mergers—Opinion of EnLink Conflicts Committee’s

Financial Advisor—Analysis of ONEOK—Discounted Cash Flow Analysis”:

Based on its professional experience and

judgement, Evercore assumed a range of discount rates of 7.5% to 9.0% based on ONEOK’s WACC, a range of EBITDA multiples

of 11.0x to 13.0x applied to ONEOK’s terminal period EBITDA and a range of perpetuity growth rates of 1.25% to 1.75% applied to

ONEOK’s terminal period cash flows to derive a range of enterprise values. Evercore adjusted such enterprise values for projected

debt, preferred equity, noncontrolling interest and cash as of December 31, 2024 and divided the resulting equity values by the number

of projected ONEOK Common Stock outstanding as of December 31, 2024, which was approximately 584 million. The discounted

cash flow analysis utilizing the EBITDA multiple terminal value methodology resulted in an implied equity value per ONEOK Common Stock

range of $110.25 to $144.56. The discounted cash flow analysis utilizing the perpetuity growth rate methodology to calculate terminal

value resulted in an implied equity value per ONEOK Common Stock range of $95.51 to $146.63.

The following disclosure hereby supplements the disclosure on

page 52 of the Proxy Statement/Prospectus under the heading “The Mergers—Opinion of EnLink Conflicts

Committee’s Financial Advisor—Analysis of ONEOK—Public Companies and Partnerships Trading Analysis” by

inserting the paragraph and table below following the second full paragraph:

The range of Enterprise Value

to EBITDA trading multiples of the large-cap/diversified midstream companies and mid-stream C-corporations are set forth below.

| Company/MLP |

|

Enterprise Value/2025 EBITDA |

|

Enterprise Value/2026 EBITDA |

| Energy Transfer LP |

|

8.5x |

|

8.3x |

| Enterprise Products Partners L.P. |

|

9.9x |

|

9.5x |

| Kinder Morgan, Inc. |

|

11.5x |

|

11.1x |

| MPLX LP |

|

10.1x |

|

9.7x |

| The Williams Companies, Inc. |

|

13.4x |

|

12.7x |

The following disclosure is inserted as a new subsection at

the top of page 61 of the Proxy Statement/Prospectus under the heading “The Mergers—Potential Employment Arrangements

with ONEOK”:

Potential Employment Arrangements with ONEOK

Any of EnLink’s executive officers who become

officers or employees or who otherwise are retained to provide services to ONEOK or its affiliates may, prior to, on or following the

Effective Time, enter into new compensation arrangements with ONEOK or its affiliates. As of the date of this proxy statement/prospectus,

no new individualized compensation arrangements between EnLink’s executive officers and ONEOK or its affiliates relating to employment,

compensation or benefits of EnLink’s executive officers following the consummation of the Mergers (i) have been established

or (ii) have otherwise been discussed, communicated, or negotiated with ONEOK.

FORWARD-LOOKING STATEMENTS

This Current Report contains “forward-looking

statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended. All statements, other than statements of historical fact, included in this communication that address

activities, events or developments that ONEOK or EnLink expects, believes or anticipates will or may occur in the future are forward-looking

statements. Words such as “estimate,” “project,” “predict,” “believe,” “expect,”

“anticipate,” “potential,” “opportunity,” “create,” “intend,” “could,”

“would,” “may,” “plan,” “will,” “guidance,” “look,” “goal,”

“target,” “future,” “build,” “focus,” “continue,” “strive,” “allow”

or the negative of such terms or other variations thereof and words and terms of similar substance used in connection with any discussion

of future plans, actions, or events identify forward-looking statements. However, the absence of these words does not mean that the statements

are not forward-looking. These forward-looking statements include, but are not limited to, statements regarding the Transaction, the expected

closing of the Transaction and the timing thereof, and descriptions of ONEOK, EnLink and their combined operations after giving effect

to the Transaction. There are a number of risks and uncertainties that could cause actual results to differ materially from the forward-looking

statements included in this communication. These include the risk that ONEOK will not be able to successfully integrate EnLink’s

business; the risk that cost savings, synergies and growth from the Transaction may not be fully realized or may take longer to realize

than expected; the risk that the credit ratings following the Transaction may be different from what ONEOK expects; the risk that a condition

to closing of the Transaction may not be satisfied, that a party may terminate the merger agreement relating to the Transaction or that

the closing of the Transaction might be delayed or not occur at all; the possibility that EnLink unitholders may not approve the Transaction;

the risk of potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement

or completion of the Transaction; risks related to the occurrence of any other event, change or circumstance that could give rise to the

termination of the merger agreement related to the Transaction; the risk that changes in ONEOK’s capital structure could have adverse

effects on the market value of its securities; risks related to the ability of the parties to retain customers and retain and hire key

personnel and maintain relationships with their suppliers and customers and on each of the companies’ operating results and business

generally; the risk that the Transaction could distract ONEOK’s and EnLink’s respective management teams from ongoing business

operations or cause either of the companies to incur substantial costs; risks related to the impact of any economic downturn and any substantial

decline in commodity prices; the risk of changes in governmental regulations or enforcement practices, especially with respect to environmental,

health and safety matters; and other important factors that could cause actual results to differ materially from those projected. All

such factors are difficult to predict and are beyond ONEOK’s or EnLink’s control, including those detailed in ONEOK’s

Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K that are available on ONEOK’s

website at www.oneok.com and on the website of the SEC at www.sec.gov, and those detailed in EnLink’s

Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K that are available on EnLink’s

website at www.enlink.com and on the website of the SEC at www.sec.gov. All forward-looking statements are

based on assumptions that ONEOK and EnLink believe to be reasonable but that may not prove to be accurate. Any forward-looking statement

speaks only as of the date on which such statement is made, neither ONEOK nor EnLink undertakes any obligation to correct or update any

forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law. Readers

are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof.

NO OFFER OR SOLICITATION

This communication is not intended to and shall

not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or

approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior

to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means

of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

ADDITIONAL INFORMATION AND WHERE TO FIND IT

In connection with the Transaction, ONEOK filed

with the SEC the Registration Statement to register the shares of ONEOK’s common stock to be issued pursuant to the Transaction,

which includes the Proxy Statement/Prospectus. Each of ONEOK and EnLink may also file other documents with the SEC regarding the Transaction. This

document is not a substitute for the Registration Statement, Proxy Statement/Prospectus or any other document which ONEOK or EnLink has

filed or may file with the SEC in connection with the Transaction. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SECURITY HOLDERS

ARE URGED TO READ THE REGISTRATION STATEMENT, PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT HAVE BEEN OR MAY BE

FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME

AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTION, THE RISKS RELATED THERETO, AND RELATED MATTERS.

The Registration Statement was declared effective by the SEC on December 30, 2024, and EnLink mailed the definitive Proxy Statement/Prospectus

to its unitholders on or about December 31, 2024. Investors and security holders will be able to obtain free copies of the Registration

Statement and the definitive Proxy Statement/Prospectus, as each may be amended or supplemented from time to time, and other relevant

documents filed by ONEOK and EnLink with the SEC (when available) through the website maintained by the SEC at www.sec.gov.

Copies of documents filed with the SEC by ONEOK, including the definitive Proxy Statement/Prospectus, are available free of charge from

ONEOK’s website at www.oneok.com under the “Investors” tab. Copies of documents filed with the SEC

by EnLink, including the definitive Proxy Statement/Prospectus, are available free of charge from EnLink’s website at www.enlink.com under

the “Investors” tab.

PARTICIPANTS IN THE SOLICITATION

ONEOK, EnLink and certain of their (or EnLink’s

managing member’s) respective directors and executive officers may be deemed to be participants in the solicitation of

proxies in respect of the Transaction. Information about ONEOK’s directors and executive officers is available in ONEOK’s

Annual Report on Form 10-K for the 2023 fiscal year filed with the SEC on February 27, 2024, and its revised definitive

proxy statement for the 2024 annual meeting of shareholders filed with the SEC on May 1, 2024, and in the Proxy Statement/Prospectus.

Information about the directors and executive officers of EnLink’s managing member is available in its Annual Report on Form 10-K for

the 2023 fiscal year filed with the SEC on February 21, 2024, and in the Proxy Statement/Prospectus. Other information regarding

the participants in the solicitations and a description of their direct and indirect interests, by security holdings or otherwise, is

set forth in the Registration Statement, the Proxy Statement/Prospectus and other relevant materials when filed with the SEC regarding

the Transaction when they become available. Investors should read the Proxy Statement/Prospectus carefully before making any voting or

investment decisions. Copies of the documents filed with the SEC by ONEOK and EnLink are available free of charge through the website

maintained by the SEC at www.sec.gov. Additionally, copies of documents filed with the SEC by ONEOK, including the Proxy Statement/Prospectus,

are available free of charge from ONEOK’s website at www.oneok.com and copies of documents filed with the SEC by

EnLink, including the Proxy Statement/Prospectus, are available free of charge from EnLink’s website at www.enlink.com.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ENLINK MIDSTREAM, LLC |

| |

|

| |

By: |

EnLink Midstream Manager, LLC, |

| |

|

its Managing Member |

| Date: January 22, 2025 |

By: |

/s/ Benjamin D. Lamb |

| |

|

Benjamin D. Lamb |

| |

|

Executive Vice President and Chief Financial

Officer |

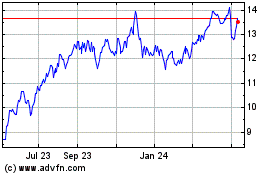

EnLink Midstream (NYSE:ENLC)

Historical Stock Chart

From Dec 2024 to Jan 2025

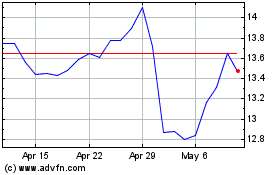

EnLink Midstream (NYSE:ENLC)

Historical Stock Chart

From Jan 2024 to Jan 2025