Energy Transfer Completes Acquisition of WTG Midstream

July 15 2024 - 4:15PM

Business Wire

Expands Permian Basin pipeline and processing

network providing further access to growing supplies of natural gas

and NGLs

Energy Transfer LP (NYSE: ET) (Energy Transfer) announced today

the completion of its previously announced acquisition of WTG

Midstream Holdings LLC (WTG). Total consideration for the

transaction was $2,275 million in cash and approximately 50.8

million newly issued ET common units.

The acquired assets add approximately 6,000 miles of

complementary gas gathering pipelines that extend Energy Transfer’s

network in the Midland Basin. Also, as part of the transaction, the

Partnership added eight gas processing plants with a total capacity

of approximately 1.3 Bcf/d, and two additional processing plants

which are under construction.

The transaction is expected to add a growing supply of NGL and

natural gas volumes to Energy Transfer’s system, providing

incremental revenue from gathering and processing activities along

with downstream transportation and fractionation fees. The

Partnership expects the WTG assets to add approximately $0.04 of

Distributable Cash Flow (DCF) per common unit in 2025, increasing

to approximately $0.07 per common unit in 2027.

About Energy Transfer

Energy Transfer LP (NYSE: ET) owns and operates one of the

largest and most diversified portfolios of energy assets in the

United States, with more than 130,000 miles of pipeline and

associated energy infrastructure. Energy Transfer’s strategic

network spans 44 states with assets in all of the major U.S.

production basins. Energy Transfer is a publicly traded limited

partnership with core operations that include complementary natural

gas midstream, intrastate and interstate transportation and storage

assets; crude oil, natural gas liquids (“NGL”) and refined product

transportation and terminalling assets; and NGL fractionation.

Energy Transfer also owns Lake Charles LNG Company, as well as the

general partner interests, the incentive distribution rights and

approximately 21% of the outstanding common units of Sunoco LP

(NYSE: SUN), and the general partner interests and approximately

39% of the outstanding common units of USA Compression Partners, LP

(NYSE: USAC). For more information, visit the Energy Transfer LP

website at www.energytransfer.com.

Forward-Looking Statements

This communication contains “forward-looking statements”. In

this context, forward-looking statements often address future

business and financial events, conditions, expectations, plans or

ambitions, and often include, but are not limited to, words such as

“believe,” “expect,” “may,” “will,” “should,” “could,” “would,”

“anticipate,” “estimate,” “intend,” “plan,” “seek,” “see,” “target”

or similar expressions, or variations or negatives of these words,

but not all forward-looking statements include such words.

Forward-looking statements by their nature address matters that

are, to different degrees, uncertain, such as statements about the

consummation of the transaction and the anticipated benefits

thereof. All such forward-looking statements are based upon current

plans, estimates, expectations and ambitions that are subject to

risks, uncertainties and assumptions, many of which are beyond the

control of Energy Transfer, that could cause actual results to

differ materially from those expressed in such forward-looking

statements. Important risk factors that may cause such a difference

include, but are not limited to: anticipated tax treatment,

unforeseen liabilities, future capital expenditures, revenues,

expenses, earnings, synergies, economic performance, indebtedness,

financial condition, losses, future prospects, business and

management strategies for the management, expansion and growth of

the combined company’s operations; the ability of Energy Transfer

to integrate the business successfully and to achieve anticipated

synergies and value creation; potential litigation relating to the

transaction; the risk that disruptions from the transaction will

harm Energy Transfer’s business, including current plans and

operations and that management’s time and attention will be

diverted on transaction-related issues; potential adverse reactions

or changes to business relationships, including with employees

suppliers, customers, competitors or credit rating agencies,

resulting from the completion of the transaction; rating agency

actions; legislative, regulatory and economic developments, changes

in local, national, or international laws, regulations, and

policies affecting Energy Transfer; changes in the supply, demand

or price of oil, natural gas, and natural gas liquids; those risks

described in Item 1A of Energy Transfer’s Annual Report on Form

10-K, filed with the Securities and Exchange Commission (the “SEC”)

on February 16, 2024, and its subsequent Quarterly Reports on Form

10‑Q and Current Reports on Form 8-K.

While the list of factors presented here is considered

representative, no such list should be considered to be a complete

statement of all potential risks and uncertainties. Unlisted

factors may present significant additional obstacles to the

realization of forward-looking statements. Energy Transfer cautions

you not to place undue reliance on any of these forward-looking

statements as they are not guarantees of future performance or

outcomes and that actual performance and outcomes, including,

without limitation, our actual results of operations, financial

condition and liquidity, and the development of new markets or

market segments in which we operate, may differ materially from

those made in or suggested by the forward-looking statements

contained in this communication. Energy Transfer does not assume

any obligation to publicly provide revisions or updates to any

forward-looking statements, whether as a result of new information,

future developments or otherwise, should circumstances change,

except as otherwise required by securities and other applicable

laws. Neither future distribution of this communication nor the

continued availability of this communication in archive form on

Energy Transfer’s website should be deemed to constitute an update

or re-affirmation of these statements as of any future date.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240715198616/en/

Energy Transfer Investor Relations: Bill Baerg,

Brent Ratliff, Lyndsay Hannah, 214-981-0795 Media Relations:

Media@energytransfer.com 214-840-5820

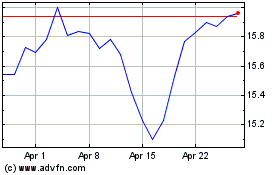

Energy Transfer (NYSE:ET)

Historical Stock Chart

From Nov 2024 to Dec 2024

Energy Transfer (NYSE:ET)

Historical Stock Chart

From Dec 2023 to Dec 2024