Energy Transfer LP (NYSE: ET) today announced the pricing of its

concurrent offerings of $1.0 billion aggregate principal amount of

5.250% senior notes due 2029, $1.25 billion aggregate principal

amount of 5.600% senior notes due 2034 and $1.25 billion aggregate

principal amount of 6.050% senior notes due 2054 (together, the

“senior notes”), and $400 million aggregate principal amount of

7.125% fixed-to-fixed reset rate junior subordinated notes due 2054

(the “junior subordinated notes”) at a price to the public of

99.797%, 99.741%, 99.461%, and 100.000%, respectively, of their

face value.

The sale of the senior notes and the junior subordinated notes

are expected to settle on June 21, 2024, subject to the

satisfaction of customary closing conditions. The settlement of the

senior notes is not conditioned on the settlement of the junior

subordinated notes, and the settlement of the junior subordinated

notes is not conditioned on the settlement of the senior notes.

Energy Transfer intends to use the net proceeds of approximately

$3.463 billion (before offering expenses) from the senior notes

offering and $396 million (before offering expenses) from the

junior subordinated notes offering to fund all or a portion of the

cash consideration for its previously announced acquisition of WTG

Midstream Holdings LLC, refinance existing indebtedness, including

borrowings under its revolving credit facility, redeem all of its

outstanding Series A Fixed-to-Floating Rate Cumulative Redeemable

Perpetual Preferred Units (the “Series A preferred units” ), and

for general partnership purposes. This press release does not

constitute a notice of redemption with respect to, or an offer to

purchase, any indebtedness or Series A preferred units.

In connection with the pricing of the concurrent offerings,

Energy Transfer issued a notice to redeem all of its outstanding

Series A preferred units at a redemption price per unit of

$1,009.87899, which is equal to $1,000.00 per unit plus unpaid

distributions to, but excluding, June 21, 2024.

Barclays Capital Inc., J.P. Morgan Securities LLC, MUFG

Securities Americas Inc., TD Securities (USA) LLC and Wells Fargo

Securities, LLC are acting as joint book-running managers for the

senior notes offering and the junior subordinated notes

offering.

The concurrent offerings of the senior notes and the junior

subordinated notes are being made pursuant to an effective shelf

registration statement and prospectus filed by Energy Transfer with

the Securities and Exchange Commission (“SEC”). The concurrent

offerings of the senior notes and the junior subordinated notes may

each be made only by means of a prospectus and related prospectus

supplement meeting the requirements of Section 10 of the Securities

Act of 1933, as amended, copies of which may be obtained for each

of the senior notes and the junior subordinated notes,

respectively, from the following addresses:

Barclays Capital Inc.

c/o Broadridge Financial Solutions

1155 Long Island Avenue

Edgewood, NY 11717

Email:

barclaysprospectus@broadridge.com

1-888-603-5847

J.P. Morgan Securities, LLC

383 Madison Avenue

New York, NY 10017

Attention: Investment Grade Syndicate

Desk

Fax: (212) 834-6081

MUFG Securities Americas Inc.

1221 Avenue of the Americas, 6th Floor

New York, NY 10020

Attention: Capital Markets Group

1-877-649-6848

TD Securities (USA) LLC

1 Vanderbilt Avenue, 11th Floor

New York, NY 10017

Attention: DCM-Transaction Advisory

1-855-495-9846

Well Fargo Securities, LLC

608 2nd Avenue South, Suite 1000

Minneapolis, MN 55402

Attention: WFS Customer Service

Email:

wfscustomerservice@wellsfargo.com

1-800-645-3751

You may also obtain these documents for free when they are

available by visiting EDGAR on the SEC website at www.sec.gov.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy the securities described herein,

nor shall there be any sale of these securities in any state or

jurisdiction in which such an offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such jurisdiction.

Energy Transfer LP owns and operates one of the largest

and most diversified portfolios of energy assets in the United

States, with more than 125,000 miles of pipeline and associated

energy infrastructure. Energy Transfer’s strategic network spans 44

states with assets in all of the major U.S. production basins.

Energy Transfer is a publicly traded limited partnership with core

operations that include complementary natural gas midstream,

intrastate and interstate transportation and storage assets; crude

oil, natural gas liquids (“NGL”) and refined product transportation

and terminalling assets; and NGL fractionation. Energy Transfer

also owns Lake Charles LNG Company, as well as the general partner

interests, the incentive distribution rights and approximately 21%

of the outstanding common units of Sunoco LP (NYSE: SUN), and the

general partner interests and approximately 39% of the outstanding

common units of USA Compression Partners, LP (NYSE: USAC).

Forward-Looking Statements

Statements about the offering may be forward-looking statements.

Forward-looking statements can be identified by words such as

“anticipates,” “believes,” “intends,” “projects,” “plans,”

“expects,” “continues,” “estimates,” “goals,” “forecasts,” “may,”

“will” and other similar expressions. These forward-looking

statements rely on a number of assumptions concerning future events

and are subject to a number of uncertainties and factors, many of

which are outside the control of Energy Transfer, and a variety of

risks that could cause results to differ materially from those

expected by management of Energy Transfer. Important information

about issues that could cause actual results to differ materially

from those expected by management of Energy Transfer can be found

in Energy Transfer’s public periodic filings with the SEC,

including its Annual Report on Form 10-K. Energy Transfer

undertakes no obligation to update or revise forward-looking

statements to reflect changed assumptions, the occurrence of

unanticipated events or changes to future operating results over

time.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240606747356/en/

Energy Transfer LP

Investor Relations: Bill Baerg, Brent Ratliff,

Lyndsay Hannah, 214-981-0795

Media Relations: Media@energytransfer.com

214-840-5820

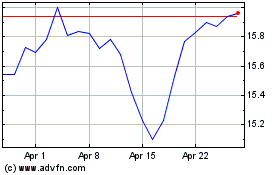

Energy Transfer (NYSE:ET)

Historical Stock Chart

From Nov 2024 to Dec 2024

Energy Transfer (NYSE:ET)

Historical Stock Chart

From Dec 2023 to Dec 2024