Report of Foreign Issuer (6-k)

May 02 2019 - 12:25PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of

April

, 2019

EMPRESA DISTRIBUIDORA Y COMERCIALIZADORA NORTE S.A. (EDENOR)

(DISTRIBUTION AND MARKETING COMPANY OF THE NORTH )

(Translation of Registrant's Name Into English)

Argentina

(Jurisdiction of incorporation or organization)

Av. del Libertador 6363,

12th Floor,

City of Buenos Aires (A1428ARG),

Tel: 54-11-4346-5000

(Address of principal executive offices)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F

X

Form 40-F

(Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes

No

X

(If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

.)

EXTRACT FROM THE RELEVANT PART OF EDENOR’S S.A. BOARD OF DIRECTORS MINUTE N° 432 DE EDENOR S.A.

MINUTE Nº 432

: In the Autonomous City of Buenos Aires, on the 8

th

days of April 2019, at 4 PM in the corporate address of the Company Av del Libertador 6363, the members of the Board of Directors of EMPRESA DISTRIBUIDORA Y COMERCIALIZADORA NORTE S.A. (Edenor S.A.) (the “Company”) whose signatures appear at the end of this minute are gathered namely: Ricardo Alejandro Torres, María Carolina Sigwald, Eduardo Llanos, Emilio Basavilbaso, Miguel Ángel De Godoy, Lucas Amado, Carlos Alberto Lorenzetti, Mariano García Mithieux. Permanent auditors Germán Wetzler Malbrán and Jorge Pardo on behalf of the Audit Committee are present. Mr. Leandro Montero, Edenor’s Finance and Control Director of the Company is also present. The meeting is chaired by the Board of Directors’ Chairman, Mr. Ricardo Torres, who after verifying that there is quorum, declares the meeting to be in session and submits for the consideration of the Directors the

FIRST ISSUE

of the Agenda timely informed […].[…] Afterwards, the following issue of the Agenda is taken into consideration: 2

°) Consideration of the repurchase of own shares

. The Chairman expresses that due to the difference between the price of the Company’s assets and the market quote which does not reflect the economic reality that these have at present nor its potential in the future, resulting in a deterioration of the interest of the Company’s shareholders, it is convenient and put forwards the approval of the acquisition of the Company’s own shares. Likewise, the Chairman points out that at present the Company has availability of funds, thus he proposes to perform the acquisition of own shares in accordance with the following terms and conditions

1.

Purpose

: contribute to the reduction of the existing difference between the value of the Company based on the value of shares and, the value of the Company based on the market quote of its shares, within the aim of contributing to the market strengthening, allocating the Company’s liquidity in an efficient manner.

2.

Amount to be invested: up to $800.000.000 (eight million pesos)

:

3.

Maximum number of shares or maximum percentage of capital stock which will be subjected to the acquisition

: Shares in portfolio shall not exceed, jointly, the limit of 10% of capital stock (The Company’s portfolio, currently, has 29.604.808 Class B shares, equivalent to 3,2660% of capital stock).

4.

Daily limit for transactions in the Argentine market

: pursuant to provisions of Law 26.831, it shall be up to 25% of the daily transaction average volume experienced by the shares during the 90 (ninety) previous working days.

5.

Price to be paid for shares

: up to a maximum of US$ 23 per ADR in the New York Stock Exchange or the amount in pesos equivalent to US$ 1,15 per share in Bolsas y Mercados Argentinos S.A., taking as a reference the closing exchange rate of the day preceding the transaction.

6.

Source of funds: the acquisitions are performed with realized net sales.

Pursuant to the provisions of the Securities and Exchange Commission’s regulations under its Section 12, Part II, Chapter I, Title II, the Company at present has sufficient solvency to perform the mentioned acquisitions without affecting its solvency, as evidenced by the Annual Financial Statements at 31.12.18 approved by the Board of Directors in the meeting held on March 8th, 2019.

7.

Terms to carry out acquisitions

: the Company shall acquire shares for the term of 120 (one hundred and twenty) calendar days, as from the working day following the publication of the announcement of the Company to acquire its own shares, subject to any renovation or extension of the term decided by the Board of Directors, which will be notified to the investing audience by the same means.

8.

Internal communication:

Directors, auditors and first line managers will be informed that being in force a decision of the Company to acquire its own shares, they shall not be entitled to sell the Company shares owned or administered by them direct or indirectly, during the corresponding term.

Having submitted the proposal for consideration, and after a brief exchange of opinions the Board of Directors DECIDES to approve the acquisition of own shares by unanimous vote […] there being no further issues to be discussed; the Chairman concludes the meeting at 5 pm.

Signed below by: Ricardo Torres, María Carolina Sigwald, Eduardo Llanos, Emilio Basavilbaso, Lucas Amado, Carlos Lorenzetti, Miguel De Godoy and Mariano García Mithieux.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Empresa Distribuidora y Comercializadora Norte S.A.

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Leandro Montero

|

|

|

Leandro Montero

|

|

|

Chief Financial Officer

|

Date:

April

30, 2019

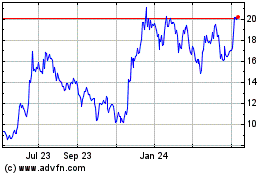

Empresa Distribuidora Y ... (NYSE:EDN)

Historical Stock Chart

From Jun 2024 to Jul 2024

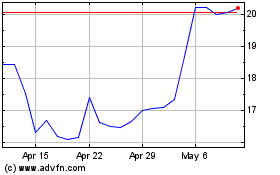

Empresa Distribuidora Y ... (NYSE:EDN)

Historical Stock Chart

From Jul 2023 to Jul 2024