UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 11-K

|

|

|

|

|

|

|

(Mark

One)

|

|

|

[X]

|

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the fiscal year ended December 31, 2020

|

|

|

OR

|

|

[ ]

|

TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the transition period from _____________ to ______________

|

|

|

|

|

|

Commission file number 1-12626

|

|

|

|

A. Full Title of the plan and the address of the plan, if different from that of the issuer named below:

|

|

|

|

EASTMAN INVESTMENT AND EMPLOYEE STOCK OWNERSHIP PLAN

|

|

|

|

B. Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:

|

|

|

|

EASTMAN CHEMICAL COMPANY

|

|

200 S. Wilcox Drive

|

|

Kingsport, Tennessee 37662

|

Eastman Investment and Employee Stock Ownership Plan

Table of Contents

|

|

|

|

|

|

|

|

Report of Independent Registered Public Accounting Firm

|

|

|

|

|

|

Basic Financial Statements:

|

|

|

|

|

|

Statements of Net Assets Available for Benefits at December 31, 2020 and 2019

|

|

|

|

|

|

Statements of Changes in Net Assets Available for Benefits for the years ended December 31, 2020 and 2019

|

|

|

|

|

|

Notes to Financial Statements

|

4-15

|

|

|

|

|

Additional Information (Note A):

|

|

|

|

|

|

Schedule of Assets (Held at End of Year) at December 31, 2020

|

17-31

|

|

|

|

|

Signatures

|

|

|

|

|

|

Exhibits

|

|

|

|

|

|

|

|

|

|

Note A:

|

Other supplemental schedules required by Section 2520.103-10 of the Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974 have been omitted because they are not applicable.

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Plan Participants, Investment Plan Committee, and Plan Administrator of the

Eastman Investment and Employee Stock Ownership Plan

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of the Eastman Investment and Employee Stock Ownership Plan (the "Plan") as of December 31, 2020 and 2019, and the related statements of changes in net assets available for benefits for the years then ended, and the related notes and schedule (collectively referred to as the financial statements). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Eastman Investment and Employee Stock Ownership Plan as of December 31, 2020 and 2019, and the changes in net assets available for benefits for the years then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan's management. Our responsibility is to express an opinion on the Plan's financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) ("PCAOB") and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Plan's internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Supplemental Information

The supplemental information contained in the Schedule of Assets (Held at End of Year) as of December 31, 2020 has been subjected to audit procedures performed in conjunction with the audit of the Plan's financial statements. The supplemental information is the responsibility of the Plan's management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ Brown Smith Wallace, LLP

We have served as the Plan's auditor since 2014.

St. Louis, Missouri

June 21, 2021

Eastman Investment and Employee Stock Ownership Plan

Statements of Net Assets Available for Benefits

December 31, 2020 and 2019

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2020

|

|

|

|

|

|

2019

|

|

|

|

|

|

|

|

Non-

|

|

|

|

|

|

Non-

|

|

|

|

|

|

Participant

|

|

participant

|

|

|

|

Participant

|

|

participant

|

|

|

|

|

|

Directed

|

|

Directed

|

|

Total

|

|

Directed

|

|

Directed

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments at fair value

|

|

$

|

2,461,345

|

|

|

$

|

201,632

|

|

|

$

|

2,662,977

|

|

|

$

|

2,299,430

|

|

|

$

|

165,990

|

|

|

$

|

2,465,420

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments at contract value

|

|

815,382

|

|

|

—

|

|

|

815,382

|

|

|

708,755

|

|

|

—

|

|

|

708,755

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total investments

|

|

3,276,727

|

|

|

201,632

|

|

|

3,478,359

|

|

|

3,008,185

|

|

|

165,990

|

|

|

3,174,175

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Receivables:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Plan sponsor contributions

|

|

36,341

|

|

|

11,597

|

|

|

47,938

|

|

|

36,513

|

|

|

12,569

|

|

|

49,082

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes receivable from participants

|

|

49,704

|

|

|

—

|

|

|

49,704

|

|

|

53,475

|

|

|

—

|

|

|

53,475

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other receivables

|

|

3,591

|

|

|

1,849

|

|

|

5,440

|

|

|

3,111

|

|

|

1,368

|

|

|

4,479

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

3,366,363

|

|

|

215,078

|

|

|

3,581,441

|

|

|

3,101,284

|

|

|

179,927

|

|

|

3,281,211

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other liabilities

|

|

377

|

|

|

1,458

|

|

|

1,835

|

|

|

1,903

|

|

|

2,402

|

|

|

4,305

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities

|

|

377

|

|

|

1,458

|

|

|

1,835

|

|

|

1,903

|

|

|

2,402

|

|

|

4,305

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net assets available for benefits

|

|

$

|

3,365,986

|

|

|

$

|

213,620

|

|

|

$

|

3,579,606

|

|

|

$

|

3,099,381

|

|

|

$

|

177,525

|

|

|

$

|

3,276,906

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these financial statements.

Eastman Investment and Employee Stock Ownership Plan

Statements of Changes in Net Assets Available for Benefits

For the Years Ended December 31, 2020 and 2019

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2020

|

|

|

|

|

|

2019

|

|

|

|

|

|

|

|

Non-

|

|

|

|

|

|

Non-

|

|

|

|

|

|

Participant

|

|

participant

|

|

|

|

Participant

|

|

participant

|

|

|

|

|

|

Directed

|

|

Directed

|

|

Total

|

|

Directed

|

|

Directed

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additions to net assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest

|

|

$

|

15,644

|

|

|

$

|

—

|

|

|

$

|

15,644

|

|

|

$

|

17,972

|

|

|

$

|

—

|

|

|

$

|

17,972

|

|

|

Dividends

|

|

12,691

|

|

|

5,641

|

|

|

18,332

|

|

|

14,025

|

|

|

5,405

|

|

|

19,430

|

|

|

Net appreciation in fair value of investments

|

|

390,059

|

|

|

43,683

|

|

|

433,742

|

|

|

438,981

|

|

|

12,016

|

|

|

450,997

|

|

|

Net investment gain

|

|

418,394

|

|

|

49,324

|

|

|

467,718

|

|

|

470,978

|

|

|

17,421

|

|

|

488,399

|

|

|

Interest income from notes receivable

|

|

2,833

|

|

|

—

|

|

|

2,833

|

|

|

2,960

|

|

|

—

|

|

|

2,960

|

|

|

Participant contributions

|

|

110,888

|

|

|

—

|

|

|

110,888

|

|

|

110,100

|

|

|

—

|

|

|

110,100

|

|

|

Plan sponsor contributions

|

|

55,048

|

|

|

11,597

|

|

|

66,645

|

|

|

54,934

|

|

|

12,569

|

|

|

67,503

|

|

|

Total additions

|

|

587,163

|

|

|

60,921

|

|

|

648,084

|

|

|

638,972

|

|

|

29,990

|

|

|

668,962

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deductions from net assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Distributions to and withdrawals by participants

|

|

335,796

|

|

|

8,729

|

|

|

344,525

|

|

|

361,588

|

|

|

11,317

|

|

|

372,905

|

|

|

Administrative expenses

|

|

859

|

|

|

—

|

|

|

859

|

|

|

835

|

|

|

—

|

|

|

835

|

|

|

Total deductions

|

|

336,655

|

|

|

8,729

|

|

|

345,384

|

|

|

362,423

|

|

|

11,317

|

|

|

373,740

|

|

|

Net increase in net assets

|

|

250,508

|

|

|

52,192

|

|

|

302,700

|

|

|

276,549

|

|

|

18,673

|

|

|

295,222

|

|

|

Transfers from non-participant directed

|

|

16,097

|

|

|

(16,097)

|

|

|

—

|

|

|

9,953

|

|

|

(9,953)

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net assets available for benefits at beginning of year

|

|

3,099,381

|

|

|

177,525

|

|

|

3,276,906

|

|

|

2,812,879

|

|

|

168,805

|

|

|

2,981,684

|

|

|

Net assets available for benefits at end of year

|

|

$

|

3,365,986

|

|

|

$

|

213,620

|

|

|

$

|

3,579,606

|

|

|

$

|

3,099,381

|

|

|

$

|

177,525

|

|

|

$

|

3,276,906

|

|

The accompanying notes are an integral part of these financial statements.

Eastman Investment and Employee Stock Ownership Plan

Notes to Financial Statements

1.DESCRIPTION OF PLAN

The Eastman Investment and Employee Stock Ownership Plan (the "Plan") is a defined contribution plan of a controlled group of corporations consisting of Eastman Chemical Company and certain of its wholly-owned subsidiaries operating in the United States ("Eastman", the "Company" or the "Plan Sponsor"). The Plan is organized pursuant to Sections 401(a) and (k) and Section 4975(e) (7) of the Internal Revenue Code ("IRC"). All United States employees of Eastman, with the exception of certain limited service and special program employees, and employees covered by a collective bargaining agreement with the Company, unless the collective bargaining agreement or the Plan specifically provides for participation, are eligible to participate in the Plan on their first day of employment with Eastman. The Plan was adopted by Eastman, the Plan Sponsor, on January 1, 1994 and is subject to the Employee Retirement Income Security Act of 1974 ("ERISA"). The Plan is administered by the Investment Plan Committee ("IPCO"), which is the Plan Administrator and is comprised of Eastman employees. The Plan has trusts which are administered by the Fidelity Management Trust Company (the "Trustee"). The trusts include the Eastman Chemical Trust and the Eastman Stock Ownership Plan ("ESOP") Trust.

Money in the forfeiture account of the Plan is available to be used both to offset future Company contributions and for various administrative expenses of the Plan. The balance of the forfeiture account at December 31, 2020 and 2019 was $63,514 and $452,969, respectively. There was approximately $450,000 used to offset employer contributions in 2020. There was approximately $100,000 used to offset employer contributions and $65,000 to reduce plan expenses in 2019.

On or after January 1, 2007, each eligible employee hired by the Company will, in addition to the Retirement Savings Contribution ("RSC"), be automatically enrolled as a participant in the Eastman Investment Plan ("EIP") portion of the Plan. The participants will be deemed to have elected to defer 7% of their qualifying compensation each pay period to the EIP portion of the Plan, unless they affirmatively decline or they elect to contribute a percentage other than 7%. Each participant will also be eligible to receive a matching contribution from the Company equal to 50% of the first 7% of their pay that they contribute to the Plan each pay period. Plan participants may elect to enroll in an automatic annual increase program with an increase to deferral rates each year until the participant's deferral reaches 40%. Their contributions will be invested in a Vanguard Target Date Fund that has a target retirement date closest to the year in which the participant reaches age 65 until changed by the participant.

Coronavirus Aid, Relief and Economic Security Act

The Coronavirus Aid, Relief, and Economic Security ("CARES") Act became law on March 27, 2020. The CARES Act was a response to the market volatility and instability resulting from the coronavirus pandemic and provides special distribution options and rollover rules for retirement plans and IRAs and expands permissible loans for certain retirement plans. Under the CARES Act, the Plan added a distribution option, which allows for penalty free withdrawals up to $100,000 until December 31, 2020 that may be repaid over a three-year period (including income taxes). The Plan also increased the maximum loan amount from $50,000 or 50% of a participant's vested account balance to $100,000 or 100% of a participant's vested balance for loans issued up until September 23, 2020 and permitted new and existing loan repayments to be deferred through December 31, 2020. Required minimum distributions for calendar year 2020 are waived for retired and retirement eligible individuals.

For additional information regarding the Plan, see the complete Plan documents.

Eastman Investment and Employee Stock Ownership Plan

Notes to Financial Statements

Contributions and vesting

Contributions to the Plan are made through two separate provisions: (1) deferral of qualifying compensation and (2) contributions by the Plan Sponsor of cash or its common stock to the participants' accounts as determined by the Compensation and Management Development Committee of the Board of Directors of Eastman.

The Plan includes a salary deferral provision allowing eligible employees to defer up to 40% of qualifying compensation, as defined in the Plan, up to the statutory limit of $19,500 for 2020 and $19,000 for 2019 as permitted by the IRC. For the catch-up salary deferral, an eligible employee who attained age 50 before the close of the calendar year was allowed to defer up to an additional $6,500 for 2020 and $6,000 for 2019 of qualifying compensation, as defined in the Plan, up to certain IRC limitations. Plan Sponsor contributions are also subject to certain other limitations. Participants' salary deferrals are contributed to the Plan by Eastman on behalf of the participants. The Plan's Trustee invests amounts contributed to the Plan, as designated by the participant, in common stock of Eastman, various mutual funds, and/or interest in a guaranteed investment contract fund (see Notes 6 and 7). Generally, participants may transfer amounts among the funds on any business day. Additionally, participants may diversify amounts from their ESOP Fund account within the Plan (see Note 10). Each participant is at all times 100% vested in their account, with the exception of amounts transferred from other plans, which may continue to be subject to the former plans' vesting requirements, as applicable.

The Plan requires for the RSC to be contributed either to the employee's ESOP Fund accounts for employee's first five RSC contributions or into other Plan funds, as directed by the participant, for participants with more than five RSC contributions. For participants with more than five RSC contributions, the RSC is allocated to participant-directed funds in accordance with each participant's investment elections at such time as the RSC is made.

Plan Sponsor contributions may be paid at any time during the plan year and subsequent to such plan year through the due date for filing the Company's federal income tax return, including any extensions. Contributions may be paid to the ESOP Trust in cash or shares of Eastman common stock and are deposited in the Company contribution account. Allocations to the participants' accounts from the Company contribution account will be made each plan year to participants who are eligible employees on the date designated by the Company. Participants are not permitted to make contributions to the ESOP Trust.

Employees may elect to transfer, into any of the Plan's fund options, balances received from (1) lump sum payouts from the Eastman Retirement Assistance Plan, Solutia Cash Balance Pension Plan, Solutia Employees' Pension Plan, or Sterling Chemicals Pension Plan, qualified defined benefit plans also sponsored by Eastman Chemical Company, (2) a former employer's 401(a) and 401(k) plan, or (3) an employee's individual retirement account containing amounts received from a qualified defined contribution plan under Section 401(a) and 401(k) of the IRC. All rollover contributions into the Plan must meet the applicable IRC requirements.

Eastman Investment and Employee Stock Ownership Plan

Notes to Financial Statements

Notes receivable from participants

The IPCO may grant a note receivable (loan) of at least $1,000 to a participant provided that the aggregate of the participant's notes receivable does not exceed the lesser of (1) $50,000 reduced by the excess, if any, of (a) the participant's highest notes receivable balance from the preceding 12 months over (b) the outstanding total notes receivable balance from the Plan on the date on which the notes receivable was made, or (2) 50% of the non-forfeitable portion of the participant's account. Additional limitations on the availability of loans may apply to individuals who are categorized as "insiders" for purposes of federal securities laws. In accordance with the Plan provisions, the rate of interest on new participant notes receivable approximates current market rates. The term of any notes receivable from participants is determined by IPCO and shall not exceed five years. Notes receivable from participants transferred to the Plan from acquisitions carry terms applicable under that plan and may have terms that exceed five years. Notes receivable from participants are valued at their unpaid principal balance plus any accrued but unpaid interest. Interest income is recorded on the accrual basis. Related fees are recorded as administrative expenses and are expensed when they are incurred. No allowance for credit losses has been recorded as of December 31, 2020 or 2019. If a participant ceases to make loan repayments and the Plan Administrator deems the participant loan to be in default, the participant loan is reduced and a benefit payment is recorded. At December 31, 2020, $49.7 million in notes receivable from participants were outstanding with interest rates ranging from 4.25% to 6.5% and various maturity dates through January 2026. At December 31, 2019, $53.5 million in notes receivable from participants were outstanding with interest rates ranging from 4.25% to 6.5% and various maturity dates through January 2026.

Distributions

Distributions from the Plan require the approval of IPCO or its designee and are made under the following circumstances:

•Upon attaining age 59½, a participant may elect to receive a lump sum cash distribution of their total or partial account value while still actively employed.

•Upon separation of service from Eastman for any reason except death, the full value of a participant's account is distributed in a lump sum payment for those participants whose account value is less than or equal to $1,000. Separated participants with accounts in excess of $1,000 may elect either (1) to defer distribution until a later date but, in no event, later than April 1 of the calendar year following the year a participant attains age 72 or (2) an immediate lump-sum distribution of the participant's account or, at the election of the participant, distributions in monthly or annual installments. Participants in the Eastman Stock Fund or ESOP Fund may elect a lump sum distribution in Eastman common stock.

•In the event of death, the value of a participant's account is paid in a lump sum if the designated beneficiary is not the surviving spouse or if the account value is less than or equal to $1,000. If the beneficiary is a surviving spouse and the participant account value exceeds $1,000, payment will be made in either a lump-sum amount or, at the election of the surviving spouse, in monthly or annual installments.

•Distributions to participants shall commence in the year following the year a participant attains age 72, unless the participant is still actively employed with the Company.

Eastman Investment and Employee Stock Ownership Plan

Notes to Financial Statements

•Approval of hardship withdrawals will only be granted in order to meet obligations relating to the payment of substantial out-of-pocket medical expenses, the purchase of a primary residence, the payment of tuition or other post-secondary educational expenses, or payments to prevent eviction or foreclosure. They are also granted for payment of funeral expenses for a deceased parent, spouse or child of the participant, or payment of expenses for repair or damage to the participant's principal residence. Hardship withdrawals may not exceed the value of the participant's accounts in the Plan on the date of withdrawal.

•The Trustee is authorized to honor qualified domestic relation orders issued and served in accordance with Section 414(p) of the IRC.

Investment of ESOP Fund Assets

ESOP Fund assets are invested primarily in Eastman common stock. However, at IPCO's discretion, funds may also be invested in other securities or held in cash.

Investment assets can be acquired by the ESOP Fund in three ways:

•The Company may make a direct contribution of cash to the ESOP Fund, which would then be used to purchase Eastman common stock or other securities.

•The Company may contribute shares of Eastman common stock directly to the ESOP Fund.

•The Company may direct the Trustee to obtain a loan to purchase securities (i.e., leveraged ESOP). Until the loan is repaid, securities acquired with the respective loan proceeds are not available to be allocated to participants' accounts and are maintained in a "Loan Suspense Account". On the last day of each plan year, a proportionate share of securities relating to loan amounts which have been repaid will be transferred out of the Loan Suspense Account and allocated to the accounts of ESOP Fund participants. The ESOP Fund currently is not a leveraged ESOP.

Dividends attributable to the ESOP Fund

IPCO may direct that Eastman common stock dividends attributable to the non-participant directed ESOP Fund be (a) allocated to the accounts of participants, (b) paid in cash to the participants on a nondiscriminatory basis, or (c) paid by the Company directly to participants. Alternatively, dividends received from Eastman common stock maintained in the Loan Suspense Account may be applied to reduce the related loan balance.

Allocations to participants' ESOP Fund accounts

Separate participant accounts are established to reflect each participant's interest in the ESOP Fund and are maintained under the unit value method of accounting. The ESOP Fund account maintained for each participant consists of:

•Plan Sponsor contributions made or invested in shares of Eastman common stock.

•Shares of Eastman common stock purchased with assets transferred to the ESOP Fund pursuant to the spin-off from Eastman Kodak Company and/or acquired with the proceeds of a loan released from the Loan Suspense Account.

Eastman Investment and Employee Stock Ownership Plan

Notes to Financial Statements

•An allocable share of short-term interest and money market funds held in the ESOP Fund for purposes of payment of expenses and similar purposes.

•After-tax contributions transferred to the ESOP Fund pursuant to the spin-off from Eastman Kodak Company (such after-tax contributions are no longer permitted under the ESOP provisions).

The number of units allocated to a participant's account in any year is based on the ratio of the participant's compensation to the total compensation of all eligible employees entitled to share in the allocation for that plan year. In any year in which a Company contribution is made, a participant's allocation will not be less than one share of stock.

Federal law limits the total annual contributions that may be made on a participant's behalf to all defined contribution and defined benefit plans offered by the Company. Participants will be notified if their total annual contribution is limited by this legal maximum.

2.SUMMARY OF ACCOUNTING POLICIES

The following accounting policies, which conform to accounting principles generally accepted in the United States of America ("US GAAP"), have been used consistently in the preparation of the Plan's financial statements.

Basis of accounting

The Plan's financial statements are prepared on the accrual basis of accounting.

Use of estimates

The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and changes therein, and disclosures of contingent assets and liabilities. Actual results could differ from those estimates.

Investment policy and valuation

The Plan's investments are stated at fair value except for its fully benefit responsive investment contract, which is valued at contract value (see Note 7). If available, quoted market prices are used to value investments. IPCO determines the Plan's valuation policies utilizing information provided by Fidelity Investments and the Director of Benefits Finance and Investments. See Note 8 for discussion of fair value measurements.

For investments in the ESOP Fund and the Eastman Stock Fund, the Trustee may keep any portion of participant and Plan Sponsor contributions temporarily in cash or liquid investments as it may deem advisable. All dividends, interest or gains derived from investment in each fund are reinvested in the respective fund by the Trustee.

Purchases and sales of investments are recorded on a trade-date basis. Interest income is accrued when earned. Dividend income is recorded at the ex-dividend date.

The Plan presents in the Statements of Changes in Net Assets Available for Benefits the net appreciation in the fair value of its investments which consists of the realized gains or losses and the unrealized appreciation on those investments.

Eastman Investment and Employee Stock Ownership Plan

Notes to Financial Statements

Payments to participants

Benefit payments to participants are recorded when paid.

3.RISKS AND UNCERTAINTIES

Investment securities are exposed to various risks, such as interest rate risk, market risk, and credit risk. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect participant account balances and the amounts reported in the financial statements. Included in investments at December 31, 2020 and 2019 are shares of the Plan Sponsor's common stock amounting to approximately $304 million and $306 million, respectively. This investment represents 8.7% and 9.6% of total investments at December 31, 2020 and 2019, respectively. A significant decline in the market value of the Plan Sponsor's stock would significantly affect the net assets available for benefits.

4.CONTRIBUTIONS

Participant contributions represent qualifying compensation and other qualifying employee bonuses withheld from participating employees by Eastman and contributed to the Plan. Contributions are invested in the Plan's funds as directed by the participants, with the exception of the ESOP Fund, subject to ERISA funding limitations. The Plan has accrued Company contributions for participant-directed funds of $36.3 million and $36.5 million and for the non-participant-directed ESOP Fund of $11.6 million and $12.6 million at December 31, 2020 and 2019, respectively.

5.NOTES RECEIVABLE FROM PARTICIPANTS

The Plan Trustee makes loans to participants in accordance with Plan provisions. The loans are reflected as notes receivable from participants. Notes receivable from participants are accounted for as a transfer from the fund directed by the participant to the Notes Receivable from Participants Fund. The principal portion of participant repayments reduces the Notes Receivable from Participants Fund receivable. The principal and interest repaid are directed to funds to which the participant's current contributions are directed; the principal is accounted for as a transfer and the interest accounted for as income in the fund to which the participant's current contributions are directed. The Notes Receivable from Participants Fund's net assets and other changes in net assets are included in the participant-directed funds in the Statements of Net Assets and Changes in Net Assets Available for Benefits, respectively. Notes receivable from participants are valued at their unpaid principal balance plus any accrued but unpaid interest.

Unless otherwise specified by the participant, the proceeds of new notes receivable will be withdrawn from the investment funds on a pro-rata basis. Outstanding notes receivable from participants at December 31, 2020 and 2019 were approximately $49.7 million and $53.5 million, respectively. Interest income earned on notes receivable from participants is credited directly to the participants' accounts and was approximately $2.8 million and $3.0 million in 2020 and 2019, respectively.

Eastman Investment and Employee Stock Ownership Plan

Notes to Financial Statements

6.INVESTMENTS

At December 31, 2020 and 2019, the Plan's assets were invested in common stock, mutual funds, collective investment trusts, and managed income fund, including synthetic investment contracts (see Note 7) and bonds. Subject to certain limitations, participants are provided the option of directing their contributions among the investment options. The Plan also holds an interest in the non-participant directed Eastman ESOP Fund, which invests in Eastman Chemical Company common stock and short-term interest funds. The following table presents the Plan's investments by type at December 31, 2020 and 2019, respectively.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in thousands)

|

2020

|

|

2019

|

|

|

|

|

|

|

Cash and cash equivalents

|

$

|

3,651

|

|

|

$

|

5,562

|

|

|

Common stock - Eastman Chemical Company

|

303,851

|

|

|

305,542

|

|

|

Common stock - other

|

120,759

|

|

|

125,370

|

|

|

Mutual funds

|

684,501

|

|

|

612,195

|

|

|

Collective investment trusts

|

1,424,586

|

|

|

1,326,203

|

|

|

Pooled separate accounts

|

—

|

|

|

3,620

|

|

|

Managed income fund

|

815,382

|

|

|

708,755

|

|

|

Self-directed brokerage account - mutual funds

|

125,629

|

|

|

86,928

|

|

|

Total

|

$

|

3,478,359

|

|

|

$

|

3,174,175

|

|

The following investment options, which invest primarily in common stock of the Plan Sponsor, were available to participants in 2020 and 2019:

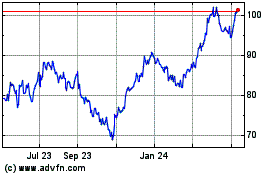

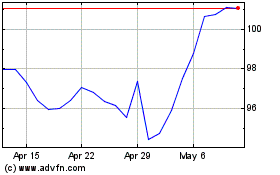

Eastman Stock Fund

This participant-directed fund consists primarily of Eastman common stock. Purchases and sales of Eastman common stock are generally made on the open market on behalf of and as elected by Plan participants. During 2020, the Trustee purchased 1,470,402 shares of Eastman common stock for the fund at an average price of $53.22 per share, and sold 2,216,695 shares of Eastman common stock for the fund at an average price of $77.63 per share. During 2019, the Trustee purchased 772,101 shares of Eastman common stock for the fund at an average price of $70.41 per share, and sold 1,076,235 shares of Eastman common stock for the fund at an average price of $78.23 per share. Dividends paid from the Eastman Stock Fund totaled $5.1 million in both 2020 and 2019.

Eastman ESOP Fund

This non-participant directed fund consists primarily of Eastman common stock. Purchases and sales of Eastman common stock are generally made on the open market, on behalf of its participants and as directed by the Plan's guidelines. During 2020, the Trustee purchased 194,498 shares of Eastman common stock for the fund at an average price of $70.00 per share, and sold 284,614 shares of Eastman common stock for the fund at an average price of $79.43 per share. During 2019, the Trustee purchased 208,800 shares of Eastman common stock for the fund at an average price of $80.50 per share, and sold 252,211 shares of Eastman common stock for the fund at an average price of $76.80 per share. Participants can elect to have the dividends paid in cash or reinvested back into the Eastman ESOP fund.

Eastman Investment and Employee Stock Ownership Plan

Notes to Financial Statements

7.SYNTHETIC INVESTMENT CONTRACTS

The Plan invests in the Managed Income Fund (the "Fund"), which invests in synthetic investment contracts, totaling $815 million and $709 million at December 31, 2020 and 2019, respectively. The term "synthetic" investment contract is used to describe a variety of investment contracts under which a Plan retains ownership of the invested assets, or owns units of an account or trust which holds the invested assets. A synthetic investment contract, also referred to as a "wrap" contract, is negotiated with an independent financial institution. Under the terms of these investment contracts, the contract issuer ensures the Plan's ability to pay eligible employee benefits at book value. The investment performance of a synthetic investment contract may be a function of the investment performance of the invested assets. Participants can redeem interest in this daily and there is no notice period on these redemptions.

A wrap contract is an agreement by another party, such as a bank or insurer, to make payments to the Fund in certain circumstances. Wrap contracts are designed to allow a stable value fund, such as the Fund, to maintain a constant net asset value ("NAV") and to protect the Fund in extreme circumstances. In a typical wrap contract, the wrap issuer agrees to pay the Fund the difference between the contract value and the market value of the covered assets once the market value has been totally exhausted. Though relatively unlikely, this could happen if the Fund experiences significant redemptions (redemption of most of the Fund's shares) during a time when the market value of the Fund's covered assets are below their contract value and market value is ultimately reduced to zero. If that occurs, the wrap issuer agrees to pay the Fund an amount sufficient to cover shareholder redemptions and certain other payments (such as fund expenses), provided all the terms of the wrap contract have been met. Purchasing wrap contracts is similar to buying insurance, in that the Fund pays a relatively small amount to protect against a relatively unlikely event (the redemption of most of the shares of the Fund). Fees paid by the Fund for wrap contracts are a component of the Fund's expenses.

Wrap contracts accrue interest using a formula called the "crediting rate". Wrap contracts use the crediting rate formula to convert market value changes in the covered assets into income distributions in order to minimize the difference between the market and contract value of the covered assets over time. Using the crediting rate formula, an estimated future market value is calculated by compounding the Fund's current market value at the Fund's current yield to maturity for a period equal to the Fund's duration. The crediting rate is the discount rate that equates the estimated future market value with the Fund's current contract value. Crediting rates are reset quarterly. The wrap contracts provide a guarantee that the crediting rate will not fall below zero percent.

The crediting rate, and hence the Fund's return, may be affected by many factors, including purchases and redemptions by shareholders. The precise impact on the Fund depends on whether the market value of the covered assets is higher or lower than the contract value of those assets. If the market value of the covered assets is higher than their contract value, the crediting rate will ordinarily be higher than the yield of the covered assets. Under these circumstances, cash from new investors will tend to lower the crediting rate and the Fund's return, and redemptions by existing shareholders will tend to increase the crediting rate and the Fund's return.

Eastman Investment and Employee Stock Ownership Plan

Notes to Financial Statements

The Fund and the wrap contracts purchased by the Fund are designed to pay all participant-initiated transactions at contract value. Participant-initiated transactions are those transactions allowed by the underlying defined contribution plan (typically this would include withdrawals for benefits, loans, or transfers to non-competing funds within the Plan). However, the wrap contracts limit the ability of the Fund to transact at contract value upon the occurrence of certain events. These events include:

•The Plan's failure to qualify under Section 401(a) or Section 401(k) of the IRC.

•The establishment of a defined contribution plan that competes with the Plan for employee contributions.

•Any substantive modification of the Plan or the administration of the Plan that is not consented to by the wrap issuer.

•Complete or partial termination of the Plan.

•Any change in law, regulation or administrative ruling applicable to the Plan that could have a material adverse effect on the Fund's cash flow.

•Merger or consolidation of the Plan with another plan, the transfer of Plan assets to another plan, or the sale, spin-off or merger of a subsidiary or division of the Plan Sponsor.

•Any communication given to participants by the Plan Sponsor or any other Plan fiduciary that is designed to induce or influence participants not to invest in the Fund or to transfer assets out of the Fund.

•Exclusion of a group of previously eligible employees from eligibility in the Plan.

•Any early retirement program, group termination, group layoff, facility closing, or similar program.

•Any transfer of assets from the Fund directly to a competing option.

At this time, the occurrence of any of these events is not considered probable by IPCO.

8.FAIR VALUE MEASUREMENT

Following is a description of the valuation methodologies used for assets measured at fair value:

•Common stock: Valued at the closing price reported on the active market on which the individual securities are traded.

•Mutual funds: Valued at the daily closing price as reported by the fund. Mutual funds held by the Plan are open-end mutual funds that are registered with the Securities and Exchange Commission. These funds are required to publish their daily net asset value and to transact at that price. The mutual funds held by the Plan are deemed to be actively traded.

•Collective investment trusts: The Plan's collective trust investments are held in separate investment accounts, which are valued using the readily determinable fair value ("RDFV"). The RDFV is based on the value of the underlying assets owned by the fund, which include a mix of U.S. and international equities, fixed income investments, target date funds, and short-term investments. The collective trust investments held by the Plan publish their RDFV daily and transact at that price.

•Pooled separate accounts: The Plan's pooled separate accounts are held in separate investment accounts at an insurance company, which are valued using RDFV. The RDFV is based on the value of the underlying assets owned by the fund, which include a mix of U.S. and international equities, fixed income investments, target date funds, and short-term investments. The pooled separate accounts held by the Plan publish their RDFV daily and transact at that price.

Eastman Investment and Employee Stock Ownership Plan

Notes to Financial Statements

•Self-directed brokerage account - mutual funds: Unit valuation based on the published underlying NAV of the mutual funds. These mutual funds are deemed to be actively traded.

The methods described above may produce a fair value calculation that may not be indicative of net realizable value or reflective of future fair values. Furthermore, while the Plan believes its valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different fair value measurement at the reporting date.

US GAAP provides a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). The three levels of the fair value hierarchy under US GAAP are described below:

Level 1 - Quoted prices (unadjusted) in active markets for identical assets or liabilities.

Level 2 - Quoted prices for similar assets or liabilities in active markets; quoted prices for identical or similar assets or liabilities in inactive markets; inputs other than quoted prices that are observable for the asset or liability; or inputs that are derived principally from or corroborated by observable market data by correlation or other means.

Level 3 - Unobservable inputs based on the Plan's assumptions used to measure assets and liabilities at fair value.

A financial instrument's classification within the hierarchy is determined based on the lowest level input that is significant to the fair value measurement.

The following tables set forth by level, within the fair value hierarchy, the Plan's assets at fair value as of December 31, 2020 and 2019:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in thousands)

|

December 31, 2020

|

|

December 31, 2019

|

|

Description

|

Quoted Prices in Active Markets for Identical Assets

(Level 1)

|

|

Quoted Prices in Active Markets for Identical Assets

(Level 1)

|

|

Cash and cash equivalents

|

$

|

3,651

|

|

|

$

|

5,562

|

|

|

Common stock - Eastman Chemical Company

|

303,851

|

|

|

305,542

|

|

|

Common stock - other

|

120,759

|

|

|

125,370

|

|

|

Mutual funds

|

684,501

|

|

|

612,195

|

|

|

Collective investment trusts

|

1,424,586

|

|

|

1,326,203

|

|

|

Pooled separate accounts

|

—

|

|

|

3,620

|

|

|

Self-directed brokerage account - mutual funds

|

125,629

|

|

|

86,928

|

|

|

Total

|

$

|

2,662,977

|

|

|

$

|

2,465,420

|

|

There are no redemption restrictions on the mutual fund investments, collective investment trusts, or pooled separate accounts. They are fully liquid and can be redeemed on a daily basis. There are no Level 2 or Level 3 investments at December 31, 2020 and 2019.

Eastman Investment and Employee Stock Ownership Plan

Notes to Financial Statements

9.OTHER RECEIVABLES AND OTHER LIABILITIES

Other receivables in the amount of $5.4 million and $4.5 million at December 31, 2020 and 2019, respectively, represent interest and dividends receivable, as well as receivables from the sale of investments. Other liabilities in the amount of $1.8 million and $4.3 million at December 31, 2020 and 2019, respectively, represent liabilities from the purchase of investments.

10.DIVERSIFICATION FROM ESOP FUND

A participant may direct that all or any portion of his ESOP Fund account be transferred to other funds in the Plan without restrictions. During 2020 and 2019, $16.1 million and $10.0 million, respectively, were transferred from the ESOP Fund within the Plan in connection with this program.

11.PLAN TERMINATION

Although it has not expressed any intent to do so, the Company has the right under the Plan to discontinue its contributions at any time and to terminate the Plan subject to the provisions of ERISA. In the event of termination, participant accounts will be distributed to individual participants in accordance with the Plan document and ERISA provisions.

12.FEDERAL INCOME TAX STATUS

The Internal Revenue Service ("IRS") has determined and informed the Plan Sponsor by a letter dated May 11, 2015, that the Plan and related trust are designed in accordance with applicable sections of the IRC. Although the Plan has been amended since receiving the determination letter, the Plan administrator and the Plan's tax counsel believe that the Plan is designed, and is currently being operated, in compliance with the applicable requirements of the IRC and, therefore, believe the Plan is qualified, and the related trust is tax-exempt. No provision for income taxes has been included in the Plan's financial statements.

US GAAP requires Plan management to evaluate tax positions taken by the Plan and recognize a tax liability (or asset) if the plan has taken an uncertain position that more likely than not would not be sustained upon examination by the IRS. The Plan Administrator has analyzed the tax positions by the Plan, and has concluded that as of December 31, 2020 and 2019, there are no uncertain positions taken or expected to be taken that would require recognition of a liability (or asset) or disclosure in the financial statements. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress.

13.PLAN EXPENSES

Reasonable expenses of administering the Plan, unless paid by the Company, shall be paid by the Plan. For both 2020 and 2019, trustee fees associated with the Eastman Stock Fund and the Eastman ESOP Fund were paid with assets of those individual funds. Brokerage fees, transfer taxes, investment fees and other expenses incidental to the purchase and sale of securities and investments shall be included in the cost of such securities or investments or deducted from the sales proceeds. Administration fees for notes receivable from participants are deducted quarterly from the accounts of participants with outstanding notes receivable balances. Origination fees from notes receivable from participants are deducted from the participant's account at the inception of the note receivable. As of April 2016, the EIP fee methodology was changed to improve fee transparency. The methodology was changed from a revenue sharing model to a flat-dollar payment model. The flat-dollar payment is charged quarterly to the participant account and covers administrative fees including recordkeeping, legal, and consulting. Investment related fees are charged directly to the participant account via the investment NAV.

Eastman Investment and Employee Stock Ownership Plan

Notes to Financial Statements

14.RELATED PARTIES

Certain Plan investments are shares of mutual funds managed by the Trustee as defined by the Plan and, therefore, these transactions qualify as party-in-interest transactions, which are exempt from prohibited transaction rules. The Plan also invests in the common stock of the Plan Sponsor as well as notes receivable from Plan participants, both of which qualify as parties-in-interest to the Plan and are exempt from prohibited transaction rules (see Note 6).

15.SUBSEQUENT EVENTS

The Plan Administrator has evaluated events occurring between December 31, 2020 and June 21, 2021 for proper recording and disclosure in these financial statements.

Supplemental Schedule

Eastman Investment and Employee Stock Ownership Plan

Schedule H, Line 4 (i) - Schedule of Assets (Held at End of Year)

December 31, 2020

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

(b)

Identity of issue, borrower, lessor, or similar party

|

(c)

Description of investment, including maturity date, rate of interest, collateral, par or maturity value

|

(d)

Historical Cost

|

(e)

Current Value

|

|

*

|

Eastman Chemical Company

|

Common Stock, Participant directed, 1,032 Shares

|

**

|

$

|

103,533

|

|

|

*

|

Eastman Chemical Company

|

Common Stock, Non-Participant directed, 1,998 Shares

|

102,810

|

|

200,318

|

|

|

|

Subtotal – Common Stock – Eastman Chemical Co

|

|

|

303,851

|

|

|

|

Abbott Laboratories

|

Common Stock, 2 Shares

|

**

|

267

|

|

|

|

Accenture Plc Cl A

|

Common Stock, 3 Shares

|

**

|

822

|

|

|

|

Air Products & Chemicals Inc.

|

Common Stock, 6 Shares

|

**

|

1,583

|

|

|

|

Alexandria Real Estate Equity Income REIT

|

Common Stock, 3 Shares

|

**

|

448

|

|

|

|

Altria Group Inc

|

Common Stock, 22 Shares

|

**

|

905

|

|

|

|

American Express Co

|

Common Stock, 15 Shares

|

**

|

1,840

|

|

|

|

AmerisourceBergen Corp

|

Common Stock, 10 Shares

|

**

|

1,013

|

|

|

|

Amgen Inc

|

Common Stock, 3 Shares

|

**

|

673

|

|

|

|

Analog Devices Inc

|

Common Stock, 19 Shares

|

**

|

2,805

|

|

|

|

Apple Inc

|

Common Stock, 7 Shares

|

**

|

933

|

|

|

|

Arthur J Gallaghar and Co

|

Common Stock, 8 Shares

|

**

|

983

|

|

|

|

Automatic Data Processing Inc

|

Common Stock, 6 Shares

|

**

|

1,053

|

|

|

|

Avalonbay Communities Inc REIT

|

Common Stock, 5 Shares

|

**

|

730

|

|

|

|

Bank of America Corporation

|

Common Stock, 85 Shares

|

**

|

2,591

|

|

|

|

Becton Dickinson & Co

|

Common Stock, 5 Shares

|

**

|

1,188

|

|

|

|

Best Buy Co Inc

|

Common Stock, 12 Shares

|

**

|

1,183

|

|

|

|

Blackrock Inc

|

Common Stock, 4 Shares

|

**

|

3,038

|

|

|

|

Boston Properties Inc

|

Common Stock, 3 Shares

|

**

|

326

|

|

|

|

Bristol-Myers Squibb Co

|

Common Stock, 43 Shares

|

**

|

2,645

|

|

|

|

Capital One Financial Corp

|

Common Stock, 6 Shares

|

**

|

627

|

|

|

|

Chevron Corp

|

Common Stock, 20 Shares

|

**

|

1,679

|

|

|

|

Chubb Ltd

|

Common Stock, 9 Shares

|

**

|

1,334

|

|

|

|

Citigroup Inc

|

Common Stock, 14 Shares

|

**

|

878

|

|

|

|

CME Group Inc Cl A

|

Common Stock, 14 Shares

|

**

|

2,569

|

|

|

|

CMS Energy Corp

|

Common Stock, 17 Shares

|

**

|

1,041

|

|

|

|

Coca Cola Co

|

Common Stock, 21 Shares

|

**

|

1,131

|

|

|

|

Comcast Corp Cl A

|

Common Stock, 62 Shares

|

**

|

3,258

|

|

|

|

ConocoPhillips

|

Common Stock, 48 Shares

|

**

|

1,934

|

|

|

|

CVS Health Corp

|

Common Stock, 16 Shares

|

**

|

1,093

|

|

|

|

Deere & Co

|

Common Stock, 6 Shares

|

**

|

1,515

|

|

|

|

Dover Corp

|

Common Stock, 19 Shares

|

**

|

2,389

|

|

|

|

Eaton Corp PLC

|

Common Stock, 18 Shares

|

**

|

2,153

|

|

|

|

Entergy Corp

|

Common Stock, 6 Shares

|

**

|

622

|

|

|

|

EOG Resources Inc

|

Common Stock, 16 Shares

|

**

|

794

|

|

|

|

Fidelity Natl Inform Svcs Inc

|

Common Stock, 11 Shares

|

**

|

1,509

|

|

|

|

General Dynamics Corporation

|

Common Stock, 10 Shares

|

**

|

1,551

|

|

|

|

Hartford Finl Svcs Group Inc

|

Common Stock, 19 Shares

|

**

|

952

|

|

|

|

Hasbro Inc

|

Common Stock, 10 Shares

|

**

|

963

|

|

|

|

Home Depot Inc

|

Common Stock, 8 Shares

|

**

|

2,139

|

|

|

|

Honeywell Intl Inc

|

Common Stock, 5 Shares

|

**

|

1,020

|

|

|

|

Intl Bus Mach Corp

|

Common Stock, 8 Shares

|

**

|

1,051

|

|

Eastman Investment and Employee Stock Ownership Plan

Schedule H, Line 4 (i) - Schedule of Assets (Held at End of Year)

December 31, 2020

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

(b) Identity of issue, borrower, lessor, or similar party

|

(c) Description of investment, including maturity date, rate of interest, collateral, par or maturity value

|

(d) Historical Cost

|

(e) Current Value

|

|

|

Johnson & Johnson

|

Common Stock, 17 Shares

|

**

|

2,740

|

|

|

|

Lilly (Eli) & Co

|

Common Stock, 9 Shares

|

**

|

1,585

|

|

|

|

Marsh & McLennan Cos Inc

|

Common Stock, 3 Shares

|

**

|

409

|

|

|

|

McDonalds Corp

|

Common Stock, 8 Shares

|

**

|

1,814

|

|

|

|

Medtronic Plc

|

Common Stock, 21 Shares

|

**

|

2,447

|

|

|

|

Merck & Co Inc New

|

Common Stock, 12 Shares

|

**

|

963

|

|

|

|

Metlife Inc

|

Common Stock, 20 Shares

|

**

|

958

|

|

|

|

Microsoft Inc

|

Common Stock, 8 Shares

|

**

|

1,826

|

|

|

|

Mondelez Intl Inc

|

Common Stock, 31 Shares

|

**

|

1,838

|

|

|

|

Morgan Stanley

|

Common Stock, 30 Shares

|

**

|

2,085

|

|

|

|

Nextera Energy

|

Common Stock, 31 Shares

|

**

|

2,358

|

|

|

|

Norfolk Southern Corp

|

Common Stock, 7 Shares

|

**

|

1,762

|

|

|

|

Northern Trust Corp

|

Common Stock, 6 Shares

|

**

|

571

|

|

|

|

Northrop Grumman Corp

|

Common Stock, 3 Shares

|

**

|

930

|

|

|

|

Otis Worldwide Corp

|

Common Stock, 5 Shares

|

**

|

346

|

|

|

|

Parker Hannifin Corp

|

Common Stock, 8 Shares

|

**

|

2,116

|

|

|

|

Pepsico Inc

|

Common Stock, 10 Shares

|

**

|

1,523

|

|

|

|

Pfizer Inc

|

Common Stock, 20 Shares

|

**

|

737

|

|

|

|

Philip Morris Intl Inc

|

Common Stock, 28 Shares

|

**

|

2,357

|

|

|

|

PNC Financial Services Grp Inc

|

Common Stock, 18 Shares

|

**

|

2,662

|

|

|

|

PPG Industries Inc

|

Common Stock, 14 Shares

|

**

|

1,977

|

|

|

|

Price (T Rowe) Group Inc

|

Common Stock, 8 Shares

|

**

|

1,187

|

|

|

|

Proctor & Gamble Co

|

Common Stock, 10 Shares

|

**

|

1,343

|

|

|

|

Progressive Corp Ohio

|

Common Stock, 10 Shares

|

**

|

959

|

|

|

|

Prologis Inc REIT

|

Common Stock, 5 Shares

|

**

|

518

|

|

|

|

Public Svc Enterprise Grp Inc

|

Common Stock, 13 Shares

|

**

|

737

|

|

|

|

Raytheon Technologies Corp

|

Common Stock, 29 Shares

|

**

|

2,067

|

|

|

|

Realty Income Corp REIT

|

Common Stock, 3 Shares

|

**

|

199

|

|

|

|

Republic Services Inc

|

Common Stock, 11 Shares

|

**

|

1,017

|

|

|

|

Schwab Charles Corp

|

Common Stock, 24 Shares

|

**

|

1,282

|

|

|

|

Stanley Black & Decker Inc

|

Common Stock, 6 Shares

|

**

|

1,054

|

|

|

|

Starbucks Corp

|

Common Stock, 9 Shares

|

**

|

936

|

|

|

|

Sysco Corp

|

Common Stock, 24 Shares

|

**

|

1,801

|

|

|

|

Texas Instruments Inc

|

Common Stock, 16 Shares

|

**

|

2,648

|

|

|

|

TJX Companies Inc New

|

Common Stock, 23 Shares

|

**

|

1,572

|

|

|

|

Trane Technologies PLC

|

Common Stock, 5 Shares

|

**

|

688

|

|

|

|

Truist Finl Corp

|

Common Stock, 26 Shares

|

**

|

1,224

|

|

|

|

UnitedHealth Group Inc

|

Common Stock, 7 Shares

|

**

|

2,430

|

|

|

|

US Bancorp Del

|

Common Stock, 27 Shares

|

**

|

1,266

|

|

|

|

Valero Energy Corp

|

Common Stock, 7 Shares

|

**

|

398

|

|

|

|

Ventas Inc REIT

|

Common Stock, 8 Shares

|

**

|

369

|

|

|

|

Verizon Communications Inc

|

Common Stock, 34 Shares

|

**

|

1,986

|

|

|

|

VF Corp

|

Common Stock, 8 Shares

|

**

|

716

|

|

|

|

Vornado Realty Trust

|

Common Stock, 3 Shares

|

**

|

126

|

|

|

|

Walmart Inc

|

Common Stock, 11 Shares

|

**

|

1,649

|

|

Eastman Investment and Employee Stock Ownership Plan

Schedule H, Line 4 (i) - Schedule of Assets (Held at End of Year)

December 31, 2020

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

(b) Identity of issue, borrower, lessor, or similar party

|

(c) Description of investment, including maturity date, rate of interest, collateral, par or maturity value

|

(d) Historical Cost

|

(e) Current Value

|

|

|

Xcel Energy Inc

|

Common Stock, 20 Shares

|

**

|

1,355

|

|

|

|

Subtotal - Common Stock – Other

|

|

|

120,759

|

|

|

*

|

Fidelity Management Trust Company

|

Interest Bearing Cash, Participant directed

|

**

|

1,875

|

|

|

*

|

Fidelity Management Trust Company

|

Interest Bearing Cash, Non-Participant directed

|

1,314

|

1,314

|

|

|

|

JPMORGAN USG MMKT FD CAP SHARE

|

Interest Bearing Cash Equivalents

|

**

|

462

|

|

|

|

Subtotal – Cash and Cash Equivalents

|

|

|

3,651

|

|

|

|

DFA US SMALL CAP VALUE I

|

Registered Investment Company 1,274 shares

|

**

|

43,881

|

|

|

|

DODGE & COX STOCK FUND

|

Registered Investment Company 672 shares

|

**

|

129,385

|

|

|

*

|

FID GOVT MMKT

|

Registered Investment Company 375 shares

|

**

|

375

|

|

|

*

|

FID US BOND INDX

|

Registered Investment Company 4,264 shares

|

**

|

53,083

|

|

|

*

|

FID GLB EX US IDX

|

Registered Investment Company 2,033 shares

|

**

|

29,616

|

|

|

*

|

FID 500 INDEX

|

Registered Investment Company 2,249 shares

|

**

|

292,735

|

|

|

*

|

FID EXT MKT IDX

|

Registered Investment Company 1,138 shares

|

**

|

95,017

|

|

|

|

NB GENESIS R6

|

Registered Investment Company 575 shares

|

**

|

40,409

|

|

|

|

Sub-Total Mutual Funds

|

|

|

684,501

|

|

|

|

BTC STR COMP NL M

|

Collective Investment Trust 67 shares

|

**

|

803

|

|

|

|

ARROWST ACWI EX-US A

|

Collective Investment Trust 443 shares

|

**

|

66,373

|

|

|

|

PRU CORE PL BD CL 5

|

Collective Investment Trust 428 shares

|

**

|

84,211

|

|

|

|

LOOMIS SAYLES & CO SMC GWTH C

|

Collective Investment Trust 1,710 shares

|

**

|

41,601

|

|

|

*

|

FID BLUE CHIP GR POOL

|

Collective Investment Trust 4,455 shares

|

**

|

134,897

|

|

|

|

VANGUARD TARGET INC

|

Collective Investment Trust 791 shares

|

**

|

40,865

|

|

|

|

VANGUARD TARGET 2015

|

Collective Investment Trust 593 shares

|

**

|

35,319

|

|

|

|

VANGUARD TARGET 2020

|

Collective Investment Trust 1,843 shares

|

**

|

120,488

|

|

|

|

VANGUARD TARGET 2025

|

Collective Investment Trust 2,769 shares

|

**

|

193,228

|

|

|

|

VANGUARD TARGET 2030

|

Collective Investment Trust 3,083 shares

|

**

|

226,962

|

|

|

|

VANGUARD TARGET 2035

|

Collective Investment Trust 1,646 shares

|

**

|

127,550

|

|

|

|

VANGUARD TARGET 2040

|

Collective Investment Trust 1,372 shares

|

**

|

110,418

|

|

|

|

VANGUARD TARGET 2045

|

Collective Investment Trust 932 shares

|

**

|

76,163

|

|

|

|

VANGUARD TARGET 2050

|

Collective Investment Trust 1,135 shares

|

**

|

92,999

|

|

|

|

VANGUARD TARGET 2055

|

Collective Investment Trust 571 shares

|

**

|

46,706

|