Dun & Bradstreet Global Supply Chain Continuity Index Dips in Wake of Geopolitical Conflicts and Climate-Induced Disruptions in Key Shipping Routes

January 16 2024 - 8:45AM

Business Wire

Global Business Optimism Insights report finds

higher optimism for Q1 2024 amid push for growth

Dun & Bradstreet (NYSE:DNB), a leading global provider of

business decisioning data and analytics, today released its Q1 2024

Global Business Optimism Insights report. The quarterly report

shows a downturn in global supply chain continuity due to

geopolitical tensions, trade disputes, and climate-related

disruptions in maritime trade causing both higher delivery costs

and delayed delivery times. The report also indicates that

businesses—having endured multiple challenges such as the pandemic,

conflicts, and monetary tightening—are now adopting a growth

mindset, as reflected in the overall optimism index.

“Global businesses are now maintaining a balance between

optimism and realism and are adopting a more pragmatic stance

towards their future. Leaders have endured frequent economic

disruptions over the past few years and have become more adept at

dealing with them; however, they remain cautious of geopolitical

conflicts and supply chain disruptions,” said Neeraj Sahai,

President, Dun & Bradstreet International. “This shift in

mindset suggests anticipation of additional growth in the

forthcoming quarters, albeit with an underlying sense of continued

caution."

Business leaders are looking at growth opportunities and risks

through multiple lenses, as substantiated by Dun & Bradstreet’s

report. While concern remains over the global supply chain,

businesses appear to have a higher tolerance for potential risk and

greater adaptability, as a result of their experience managing

disruption over the past few years. Key findings from the report’s

five indices reveal:

- The Global Business Optimism Index increased

by 6.6% in Q1 2024 compared with Q4 2023, indicating that

businesses in advanced economies now feel more confident about

their ability to absorb geopolitical and policy shocks, and are

focusing more on growth opportunities.

- The Global Supply Chain Continuity Index fell sharply

by 6.3% for Q1 2024 compared with Q4 2023, with suppliers’

delivery time and delivery cost indices both deteriorating.

Executives also report that climate-induced disruptions and trade

disputes are contributing to decreased optimism. This index

declined equally for both advanced and emerging economies, with

each receding 6% from the last quarter.

- The Global Business Financial Confidence Index increased by

10.1% in Q1 2024 compared with Q4 2023; in addition, liquidity

is expected to increase across firms of all sizes and businesses

are more optimistic about their competitive positioning,

particularly large firms with greater resources employed in

liquidity risk management.

- The Global Business Investment Confidence Index rose

10.7% in Q1 2024 compared with Q4 2023. This reading reflects a

high absolute level of optimism and a growing consensus that major

central banks in advanced economies have reached a peak in the

current interest rate hike cycle.

- The Global Business Environmental, Social and Governance

(ESG) Index increased 7% in Q4 2023 to 61.9, in contrast to a 4.7%

decline in Q3 2023, reflecting a positive shift in the

commitment of firms worldwide towards sustainability practices. The

favorable sentiment towards ESG practices reflects an elevated

awareness of sustainability, underscored by the recent agreement

among nations at the COP28 conference.

*Descriptions and information about the indices can be found on

page 25 of the report.

"Despite the acknowledgement of economic and political headwinds

across the globe, it’s important to note that business leaders are

expected to begin 2024 with a relatively positive economic

outlook,” said Arun Singh, Global Chief Economist, Dun &

Bradstreet. “However, confidence in the resilience of supply chains

is facing pressure due to continued geopolitical tensions and

climate events. These factors have compelled companies to reroute

supply chains, which has led to congestion along transit routes.

Business leaders are experiencing both higher delivery costs and

delayed delivery times—a reminder of pandemic-related

challenges.”

About the Global Business Optimism Insights Report

The Global Business Insights Optimism report is an amalgamation

of five indices computed for 32 economies including the Global

Business Optimism Index, Global Business Supply Chain Continuity

Index, Global Business Financial Confidence Index, Global Business

Investment Confidence Index and Global Business ESG Index. These

five indices were created by synthesizing findings from a survey of

approximately 10,000 businesses in the last quarter alongside

insights from Dun & Bradstreet, leveraging the firm’s

proprietary data and economic expertise. These indices reflect

overall business optimism and expectations about supply chain

continuity, financial and investment conditions and ESG

initiatives. The indices range from 0 to 100, with a reading above

50 indicating an improvement and a reading below 50 indicating a

deterioration in optimism.

View the full report and corresponding records here.

About Dun & Bradstreet

Dun & Bradstreet, a leading global provider of business

decisioning data and analytics, enables companies around the world

to improve their business performance. Dun & Bradstreet’s Data

Cloud fuels solutions and delivers insights that empower customers

to accelerate revenue, lower cost, mitigate risk, and transform

their businesses. Since 1841, companies of every size have relied

on Dun & Bradstreet to help them manage risk and reveal

opportunity. For more information on Dun & Bradstreet, please

visit www.dnb.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240116720109/en/

Media: Dawn McAbee 904-648-6328 Mcabeed@dnb.com

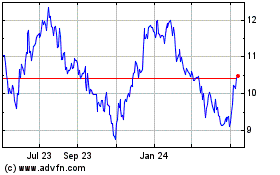

Dun and Bradstreet (NYSE:DNB)

Historical Stock Chart

From Oct 2024 to Nov 2024

Dun and Bradstreet (NYSE:DNB)

Historical Stock Chart

From Nov 2023 to Nov 2024