false

0000027904

0000027904

2025-03-10

2025-03-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

March 10, 2025

DELTA AIR LINES,

INC.

(Exact name of

registrant as specified in its charter)

| Delaware | |

001-05424 | |

58-0218548 |

(State or other jurisdiction

of incorporation) | |

(Commission

File Number) | |

(IRS Employer

Identification No.) |

P.O. Box 20706, Atlanta, Georgia 30320-6001

(Address of principal executive offices)

Registrant’s telephone number, including

area code: (404) 715-2600

Registrant’s Website address: www.delta.com

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

☐ Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered

pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol |

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

DAL |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17

CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

| Item 7.01 | Regulation FD Disclosure. |

As previously announced, executives of Delta Air Lines, Inc. (“Delta”)

are presenting at the J.P. Morgan Industrials Conference on March 11, 2025 at 7:30 a.m. ET. The presentation to be used in conjunction

with the event is furnished as Exhibit 99.1 to this Form 8-K.

Ahead of this presentation, Delta is revising its March quarter outlook,

previously provided on January 10, 2025, as set forth below.

Delta expects to deliver total revenue growth for the March

quarter of 3 to 4 percent year-over-year. The outlook has been impacted by the recent reduction in consumer and corporate confidence

caused by increased macro uncertainty, driving softness in Domestic demand. Premium, international and loyalty revenue growth trends

are consistent with expectations and reflect the resilience of Delta’s diversified revenue base.

| |

1Q25 Forecast |

Initial Guidance |

| Total Revenue YoY |

Up 3% - 4% |

Up 7% - 9% |

| Operating Margin |

4% - 5% |

6% - 8% |

| Earnings Per Share |

$0.30 - $0.50 |

$0.70 - $1.00 |

Reconciliation of Non-GAAP Financial Measures

The financial measures included above (“non-GAAP financial measures”)

are derived from Delta’s Consolidated Financial Statements, but are not presented in accordance with accounting principles generally

accepted in the U.S. (“GAAP”). Under the U.S. Securities and Exchange Commission rules, non-GAAP financial measures may be

considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for or superior to GAAP

results.

Included below are reconciliations of certain non-GAAP financial measures

to the most directly comparable GAAP financial measures. Reconciliations below may not calculate exactly due to rounding. The following

adjustments are made to provide comparability between the reported periods, if applicable, and for the reasons indicated below:

Third-party refinery sales. Refinery sales to third

parties, and related expenses, are not related to our airline segment. Excluding these sales therefore provides a more meaningful comparison

of our airline operations to the rest of the airline industry.

MTM adjustments on investments. Mark-to-market (“MTM”)

adjustments are defined as fair value changes recorded in periods other than the settlement period. Unrealized gains/losses result from

our equity investments that are accounted for at fair value in non-operating expense. The gains/losses are driven by changes in stock

prices, foreign currency fluctuations and other valuation techniques for investments in certain companies, particularly those without

publicly-traded shares. Adjusting for these gains/losses allows investors to better understand and analyze our core operational performance

in the periods shown.

Total Revenue, adjusted

| | |

Three Months Ended | |

| | |

(Projected) | |

| |

| (in billions) | |

March 31, 2025 | | |

March 31, 2024 | |

| Total revenue | |

$ | 13.9 - 14.1 | | |

$ | 13.7 | |

| Adjusted for: | |

| | | |

| | |

| Third-party refinery sales | |

| ~ (1.0 | ) | |

| (1.2 | ) |

| Total revenue, adjusted | |

$ | 12.9 - 13.1 | | |

$ | 12.6 | |

Operating Margin, adjusted

| |

Three Months Ended |

| |

(Projected) |

| |

March 31, 2025 |

| Operating margin |

3 - 4 |

% |

| Adjusted for: |

|

|

| Third-party refinery sales |

~ 1 |

|

| Operating margin, adjusted |

4 - 5 |

% |

Pre-Tax Income, Net Income, and Diluted

Earnings per Share, adjusted

| | |

Three Months Ended | | |

Three Months Ended | |

| | |

(Projected) | | |

(Projected) | |

| |

March 31, 2025 | | |

March 31, 2025 | |

| | |

Pre-Tax | | |

Income | | |

Net | | |

Earnings | |

| (in billions, except per share data) | |

Income | | |

Tax | | |

Income | | |

Per Diluted Share | |

| GAAP | |

$ | 0.4 - 0.5 | | |

$ | ~ (0.1 | ) | |

$ | 0.3 - 0.4 | | |

$ | 0.40 - 0.60 | |

| Adjusted for: | |

| | | |

| | | |

| | | |

| | |

| MTM adjustments on investments | |

| ~ (0.1 | ) | |

| | | |

| | | |

| | |

| Non-GAAP | |

$ | 0.3 - 0.4 | | |

$ | ~ (0.1 | ) | |

$ | 0.2 - 0.3 | | |

$ | 0.30 - 0.50 | |

In accordance with general instruction B.2 of Form 8-K, the information

in this report (including Exhibit 99.1) that is being furnished pursuant to Item 7.01 of Form 8-K shall not be deemed to be “filed”

for the purposes of Section 18 of the Securities Exchange Act, as amended, or otherwise subject to liabilities of that section, nor shall

they be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as expressly set forth in

such filing. This report will not be deemed an admission as to the materiality of any information in the report that is required to be

disclosed solely by Regulation FD.

Forward Looking Statements

Statements made in this Form 8-K that are not historical facts,

including statements regarding our estimates, expectations, beliefs, intentions, projections, goals, aspirations, commitments or strategies

for the future, should be considered “forward-looking statements” under the Securities Act of 1933, as amended, the Securities

Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. Such statements are not guarantees or promised

outcomes and should not be construed as such. All forward-looking statements involve a number of risks and uncertainties that could cause

actual results to differ materially from the estimates, expectations, beliefs, intentions, projections, goals, aspirations, commitments

and strategies reflected in or suggested by the forward-looking statements. These risks and uncertainties include, but are not limited

to, the possible effects of serious accidents involving our aircraft or aircraft of our airline partners; breaches or lapses in the security

of technology systems we use and rely on, which could compromise the data stored within them, as well as failure to comply with evolving

global privacy and security regulatory obligations or adequately address increasing customer focus on privacy issues and data security;

disruptions in our information technology infrastructure; our dependence on technology in our operations; increases in the cost of aircraft

fuel; extended disruptions in the supply of aircraft fuel, including from Monroe Energy, LLC (“Monroe”), a wholly-owned subsidiary

of Delta that operates the Trainer refinery; failure to receive the expected results or returns from our commercial relationships with

airlines in other parts of the world and the investments we have in certain of those airlines; the effects of a significant disruption

in the operations or performance of third parties on which we rely; failure to comply with the financial and other covenants in our financing

agreements; labor-related disruptions; the effects on our business of seasonality and other factors beyond our control, such as changes

in value in our equity investments, severe weather conditions, natural disasters or other environmental events, including from the impact

of climate change; failure or inability of insurance to cover a significant liability at Monroe’s refinery; failure to comply with

existing and future environmental regulations to which Monroe’s refinery operations are subject, including costs related to compliance

with renewable fuel standard regulations; significant damage to our reputation and brand, including from exposure to significant adverse

publicity or inability to achieve certain sustainability goals; our ability to retain senior management and other key employees, and to

maintain our company culture; disease outbreaks or other public health threats, and measures implemented to combat them; the effects of

terrorist attacks, geopolitical conflict or security events; competitive conditions in the airline industry; extended interruptions or

disruptions in service at major airports at which we operate or significant problems associated with types of aircraft or engines we operate;

the effects of extensive regulatory and legal compliance requirements we are subject to; the impact of environmental regulation, including

but not limited to regulation of hazardous substances, increased regulation to reduce emissions and other risks associated with climate

change, and the cost of compliance with more stringent environmental regulations; and unfavorable economic or political conditions in

the markets in which we operate or volatility in currency exchange rates.

Additional information concerning risks and uncertainties that could

cause differences between actual results and forward-looking statements is contained in our Securities and Exchange Commission (SEC) filings,

including our Annual Report on Form 10-K for the fiscal year ended December 31, 2024 and other filings filed with the SEC from time to

time. Caution should be taken not to place undue reliance on our forward-looking statements, which represent our views only as of the

date of this Form 8-K, and which we undertake no obligation to update except to the extent required by law.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| |

Exhibit 99.1 |

Presentation |

| |

|

|

| |

Exhibit 104 |

The cover page from this Current Report on Form 8-K, formatted in Inline XBRL |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

DELTA AIR LINES, INC. |

| |

|

|

| |

|

|

| |

|

|

| |

By: |

/s/ Daniel C. Janki |

| |

|

Daniel C. Janki |

| |

|

Executive Vice President & Chief Financial Officer |

March 10, 2025

Exhibit 99.1

Industrials Conference March 11, 2025

Statements made in this presentation that are not historical facts, including statements regarding our estimates, expectations, beliefs, intentions, projections, goals, aspirations, commitments or strategies for the future, should be considered “forward - looking statements” under the Securities Act of 1933, as amended, the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. Such statements are not guarantees or promised outcomes and should not be construed as such. All forward - looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from the estimates, expectations, beliefs, intentions, projections, goals, aspirations, commitments and strategies reflected in or suggested by the forward - looking statements. These risks and uncertainties include, but are not limited to, the possible effects of serious accidents involving our aircraft or aircraft of our airline partners; breaches or lapses in the security of technology systems we use and rely on, which could compromise the data stored within them, as well as failure to comply with evolving global privacy and security regulatory obligations or adequately address increasing customer focus on privacy issues and data security; disruptions in our information technology infrastructure; our dependence on technology in our operations; increases in the cost of aircraft fuel; extended disruptions in the supply of aircraft fuel, including from Monroe Energy, LLC ( “Monroe”), a wholly - owned subsidiary of Delta that operates the Trainer refinery; failure to receive the expected results or returns from our commercial relationships with airlines in other parts of the world and the investments we have in certain of those airlines; the effects of a significant disruption in the operations or performance of third parties on which we rely; failure to comply with the financial and other covenants in our financing agreements; labor - related disruptions; the effects on our business of seasonality and other factors beyond our control, such as changes in value in our equity investments, severe weather conditions, natural disasters or other environmental events, including from the impact of climate change; failure or inability of insurance to cover a significant liability at Monroe’s refinery; failure to comply with existing and future environmental reg ula tions to which Monroe’s refinery operations are subject, including costs related to compliance with renewable fuel standard regulations; significant damage to our reputation and brand, including from exposure to significant adverse publicity or inability to achieve certain sustainability goals; our ability to retain senior management and other key employees, and to maintain our company culture; disease outbreaks or other public health threats, and measures implemented to combat them; the effects of terrorist attacks, geopolitical conflict or security events; competitive conditions in the airline industry; extended interruptions or disruptions in service at major airports at which we operate or significant problems associated with types of aircraft or engines we operate; the effects of extensive regulatory and legal compliance requirements we are subject to; the impact of environmental regulation, including but not limited to regulation of hazardous substances, increased regulation to reduce emissions and other risks associated with climate change, and the cost of compliance with more stringent environmental regulations; and unfavorable economic or political conditions in the markets in which we operate or volatility in currency exchange rates. Additional information concerning risks and uncertainties that could cause differences between actual results and forward - looking statements is contained in our Securities and Exchange Commission (SEC) filings, including our Annual Report on Form 10 - K for the fiscal year ended December 31, 2024 and other filings filed with the SEC from time to time. Caution should be taken not to place undue reliance on our forward - looking statements, which represent our views only as of the date of this presentation, and which we undertake no obligation to update except to the extent required by law. 2 SAFE HARBOR

CURRENT ENVIRONMENT EVOLVING March Quarter outlook impacted by increased macro uncertainty SOLIDLY PROFITABLE MARCH QUARTER REFLECTS DELTA’S DURABILITY 3 ▪ Consumer & corporate confidence ▪ Softer close - in demand ▪ Oil prices have declined $10 per barrel from peak levels in the quarter What has changed What has not changed ▪ Constructive industry structure with increased focus on financial health ▪ Strength in premium, loyalty, Transatlantic & Pacific revenue ▪ Industry - leading operational & cost execution

EPS growth: Average annual; Free Cash Flow: Annual VALUE CREATION FRAMEWORK Three - to - five - year financial targets deliver sustained value creation MARGIN EXPA N SION Note: Adjusted for special items; historical non - GAAP financial measures reconciled in Appendix DURABLE EARNINGS AND FREE CASH FLOW BALANCE SHEET STRENGTH Mid - teens Operating Margin 1x Gross Leverage 10% EPS Growth $3 - 5B Free Cash Flow 15%+ RETURN ON INVESTED CAPITAL $40B+ UNENCUMBERED ASSETS 4

D e lta 2024 L on g - T erm Target MARGIN EXPANS I O N DURABLE EARNINGS AND FREE CASH FLOW BALANCE SHEET STRENGTH PRIORITIZING RETURN ON INVESTED CAPITAL Delivering returns that are in the upper half of the S&P 500 I n dus t ry 2024 RETURN ON INVESTED CAPITAL 15% 13% DAL WACC 8% Note: Adjusted for special items; historical non - GAAP financial measures reconciled in Appendix

BALANCED CAPITAL ALLOCATION $9 - 11B ANNUAL OPERATING CASH FLOW 50% SHAREHOLDER RETURNS Debt reduction, dividends, repurchases 50% REI N V E S T FOR GROWTH CONSISTENT, DISCIPLINED REINVESTMENT REDUCE FINANCIAL RISK THROUGH DEBT PAYDOWN STEADY DIVIDEND GROWTH INCREASE SHAREHOLDER RETURNS

7 Q&A

Non-GAAP Financial Measures

Delta sometimes uses information ("non-GAAP financial measures") that is derived from the Consolidated Financial Statements, but that

is not presented in accordance with accounting principles generally accepted in the U.S. (“GAAP”). Under the U.S. Securities

and Exchange Commission rules, non-GAAP financial measures may be considered in addition to results prepared in accordance with GAAP,

but should not be considered a substitute for or superior to GAAP results. The table below shows a reconciliation of the non-GAAP financial

measure used in this presentation to the most directly comparable GAAP financial measure. The reconciliation may not calculate due to

rounding.

Delta is not able to reconcile certain forward looking non-GAAP financial measures used in this presentation without unreasonable

effort because the adjusting items such as those used in the reconciliations below will not be known until the end of the indicated future

periods and could be significant.

Non-GAAP Financial Measures

After-tax Return on Invested Capital ("ROIC"). We present after-tax return on invested capital as management

believes this metric is helpful to investors in assessing the company's ability to generate returns using its invested capital. Return

on invested capital is tax-effected adjusted operating income (using our effective tax rate for each respective period) divided by average

adjusted invested capital. Average stockholders' equity and average adjusted gross debt are calculated using amounts as of the end of

the current period and comparable period in the prior year. All adjustments to calculate ROIC are intended to provide a more meaningful

comparison of our results to comparable companies.

MTM adjustments and settlements on hedges. Mark-to-market ("MTM") adjustments are defined as fair value changes

recorded in periods other than the settlement period. MTM fair value changes are not necessarily indicative of the actual settlement

value of the underlying hedge in the contract settlement period. Settlements represent cash received or paid on hedge contracts settled

during the applicable period.

Interest expense included in aircraft rent. This adjustment relates to interest expense related to operating

lease financing transactions. Adjusting for these results allows investors to better understand our core operational performance in the

periods shown as it neutralizes the effect of lease financing structure.

| | |

Year Ended | |

| (in millions) | |

December 31, 2024 | |

| Operating income | |

$ | 5,995 | |

| Adjusted for: | |

| | |

| MTM adjustments and settlements on hedges | |

| 21 | |

| Interest expense included in aircraft rent | |

| 165 | |

| Adjusted operating income | |

$ | 6,181 | |

| Tax effect | |

| (1,442 | ) |

| Tax-effected adjusted operating income | |

$ | 4,739 | |

| | |

| | |

| Average stockholders' equity | |

$ | 13,186 | |

| Average adjusted gross debt | |

| 23,590 | |

| Averaged adjusted invested capital | |

$ | 36,776 | |

| | |

| | |

| After-tax Return on Invested Capital | |

| 12.9% | |

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

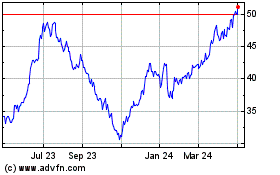

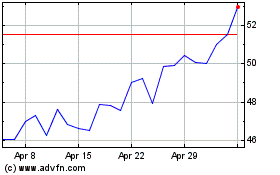

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Feb 2025 to Mar 2025

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Mar 2024 to Mar 2025