CVR Energy, Inc. (“CVR Energy” or the “Company”) (NYSE: CVI) today

announced net income of $353 million, or $3.51 per diluted share,

on net sales of $2.5 billion for the third quarter of 2023,

compared to net income of $93 million, or 92 cents per diluted

share, on net sales of $2.7 billion for the third quarter of 2022.

Adjusted earnings for the third quarter of 2023 was $1.89 per

diluted share compared to adjusted earnings of $1.90 per diluted

share in the third quarter of 2022. Third quarter 2023 EBITDA was

$530 million, compared to third quarter 2022 EBITDA of $181

million. Adjusted EBITDA for the third quarter of 2023 was $313

million, compared to Adjusted EBITDA of $313 million in the third

quarter of 2022.

“CVR Energy achieved solid results for the 2023

third quarter driven by continued strong crack spreads,” said Dave

Lamp, CVR Energy’s Chief Executive Officer. “In addition to our

third quarter 2023 cash dividend of 50 cents, our Board of

Directors was pleased to approve a special dividend of $1.50 per

share, bringing our year-to-date declared dividends to $4.00 per

share.

“CVR Partners posted solid operating results for

the 2023 third quarter driven by safe, reliable operations with a

combined ammonia production rate of 99 percent,” Lamp said. “CVR

Partners also announced a cash distribution of $1.55 per common

unit for the 2023 third quarter.”

Petroleum

The Petroleum Segment reported third quarter

2023 operating income of $431 million on net sales of $2.3 billion,

compared to operating income of $137 million on net sales of $2.5

billion in the third quarter of 2022.

Refining margin per total throughput barrel was

$31.05 in the third quarter of 2023, compared to $16.56 during the

same period in 2022. The increase in refining margin of $300

million was primarily due to lower Renewable Fuel Standard (“RFS”)

related expense and favorable inventory valuations. The Group 3

2-1-1 crack spread decreased by $4.84 per barrel relative to the

third quarter of 2022, driven by a tightening distillate crack

spread due primarily to recession concerns and slowing demand

trends.

The Petroleum Segment recognized costs to comply

with the RFS of $90 million, or $4.64 per throughput barrel,

which excludes the RINs’ revaluation benefit impact of $173

million, or $8.88 per total throughput barrel, for the third

quarter of 2023. This is compared to RFS compliance costs of

$98 million, or $5.28 per throughput barrel, which excludes

the RINs’ revaluation expense impact of $38 million, or $2.06 per

total throughput barrel, for the third quarter of 2022. The

decrease in RFS compliance costs in 2023 was primarily related to a

decrease in RIN prices, coupled with an increase in RINs generated

by ethanol and biodiesel blending for the third quarter of 2023

compared to the 2022 period. The favorable RINs’ revaluation in

2023 was a result of a mark-to-market benefit in the current period

due to a decline in RIN prices and a lower outstanding obligation

in the current period compared to the 2022 period.

The Petroleum Segment also recognized a third

quarter 2023 derivative net loss of $98 million, or $5.01 per total

throughput barrel, compared to a derivative net gain of $13

million, or 71 cents per total throughput barrel, for the third

quarter of 2022. Included in this derivative net loss for the third

quarter of 2023 was a $53 million unrealized loss, primarily a

result of crack spread swaps, inventory hedging activity and

Canadian crude forward purchases and sales, compared to a $25

million unrealized gain for the third quarter of 2022. Offsetting

these impacts, crude oil prices increased during the quarter, which

led to a favorable inventory valuation impact of $82 million, or

$4.18 per total throughput barrel, compared to an unfavorable

inventory valuation impact of $107 million, or $5.78 per total

throughput barrel, during the third quarter of 2022.

Third quarter 2023 combined total throughput was

approximately 212,000 bpd, compared to approximately 202,000 bpd of

combined total throughput for the third quarter of 2022.

Nitrogen Fertilizer

The Nitrogen Fertilizer Segment reported

operating income of $8 million on net sales of $131 million for the

third quarter of 2023, compared to an operating loss of $12 million

on net sales of $156 million for the third quarter of 2022.

CVR Partners, LP’s (“CVR Partners”) fertilizer

facilities produced a combined 217,000 tons of ammonia during the

third quarter of 2023, of which 68,000 net tons were available for

sale while the rest was upgraded to other fertilizer products,

including 358,000 tons of urea ammonia nitrate (“UAN”). During the

third quarter 2022, the fertilizer facilities produced 114,000 tons

of ammonia, of which 36,000 net tons were available for sale while

the remainder was upgraded to other fertilizer products, including

184,000 tons of UAN. These increases were due to operating

reliability after completing the planned turnarounds at both

fertilizer facilities during the third quarter of 2022.

Third quarter 2023 average realized gate prices

for UAN showed a reduction over the prior year, down 48 percent to

$223 per ton, and ammonia was down 56 percent over the prior year

to $365 per ton. Average realized gate prices for UAN and

ammonia were $433 and $837 per ton, respectively, for the third

quarter of 2022.

Corporate and Other

The Company reported an income tax expense of

$84 million, or 19.3 percent of income before income taxes, for the

three months ended September 30, 2023, as compared to an income tax

expense of $7 million, or 8.3 percent of income before income

taxes, for the three months ended September 30, 2022. The increases

in income tax expense and effective tax rate were due primarily to

changes in pretax earnings and earnings attributable to

noncontrolling interest.

The renewable diesel unit at the Wynnewood

refinery continued to increase production, with total vegetable oil

throughputs for the third quarter of 2023 of approximately 23.8

million gallons, up from 17.7 million gallons in the third quarter

of 2022. The increase was due primarily to operations at the

renewable diesel unit still ramping up in the third quarter of 2022

as this was the first full quarter of operations after the unit’s

completion in April 2022.

Cash, Debt and Dividend

Consolidated cash and cash equivalents were $889

million at September 30, 2023, an increase of $379 million from

December 31, 2022. Consolidated total debt and finance lease

obligations were $1.6 billion at September 30, 2023, including $547

million held by the Nitrogen Fertilizer Segment.

On September 26, 2023, CVR Partners and

certain of its subsidiaries entered into Amendment No. 1 to the

Credit Agreement (the “ABL Amendment”). The ABL Amendment amended

that certain Credit Agreement, dated as of September 30, 2021 (as

amended, the “Nitrogen Fertilizer ABL”), to, among other things,

(i) increase the aggregate principal amount available under the

credit facility by an additional $15 million to a total of $50

million in the aggregate, with an incremental facility of an

additional $15 million in the aggregate subject to additional

lender commitments and certain other conditions, and (ii) extend

the maturity date by an additional four years to September 26,

2028. The proceeds of the Nitrogen Fertilizer ABL may be used to

fund working capital, capital expenditures and for other general

corporate purposes.

CVR Energy announced a third quarter 2023 cash

dividend of 50 cents per share. In addition, the Company announced

a special dividend of $1.50 per share. The quarterly and special

dividends, as declared by CVR Energy’s Board of Directors, will be

paid on November 20, 2023, to stockholders of record as of

November 13, 2023.

Today, CVR Partners announced that the Board of

Directors of its general partner declared a third quarter 2023 cash

distribution of $1.55 per common unit, which will be paid on

November 20, 2023, to common unitholders of record as of

November 13, 2023.

Third Quarter

2023 Earnings Conference Call

CVR Energy previously announced that it will

host its third quarter 2023 Earnings Conference Call on Tuesday,

October 31, at 1 p.m. Eastern. The Earnings Conference Call

may also include discussion of Company developments,

forward-looking information and other material information about

business and financial matters.

The third quarter 2023 Earnings Conference Call

will be webcast live and can be accessed on the Investor Relations

section of CVR Energy’s website at www.CVREnergy.com. For investors

or analysts who want to participate during the call, the dial-in

number is (877) 407-8291. The webcast will be archived and

available for 14 days at

https://edge.media-server.com/mmc/p/ez75egze. A repeat of the call

also can be accessed for 14 days by dialing (877) 660-6853,

conference ID 13741665.

Forward-Looking StatementsThis

news release may contain forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended.

Statements concerning current estimates, expectations and

projections about future results, performance, prospects,

opportunities, plans, actions and events and other statements,

concerns, or matters that are not historical facts are

“forward-looking statements,” as that term is defined under the

federal securities laws. These forward-looking statements include,

but are not limited to, statements regarding future: drivers of

results; crack spreads, including the continued strength thereof;

production rates of CVR Partners, including the impact thereof on

results; net income and sales; adjusted earnings including the

drivers thereof; EBITDA and Adjusted EBITDA; operating income; net

sales; refining margin and the drivers thereof; RFS expense;

inventory valuation impacts; crack spreads, including the

tightening of distillate cracks; recession; demand trends; cost to

comply with the Renewable Fuel Standard, RIN prices and level and

valuation of our net RVO; CVR Energy’s blending activity, including

its impact on RFS compliance costs; derivative activities and

realized and unrealized gains or losses associated therewith; crude

oil pricing; throughput rates, including factors impacting same;

crude oil supply; UAN, ammonia and nitrogen fertilizer production,

demand, pricing and sales volumes, including the factors impacting

same; rates at which ammonia will be upgraded to other fertilizer

products; operational reliability, including the factors impacting

same; tax rates and expense; quarterly and special dividends and

distributions, including the timing, payment and amount (if any)

thereof; production rates of our renewable diesel unit and related

feedstock throughput, including factors impacting same; any

decision to return a unit back to hydrocarbon processing following

renewable conversion; cash and cash equivalent levels; credit

facility availability; continued safe and reliable operations;

operating expenses, capital expenditures, depreciation and

amortization and turnaround expense; the expected timing and

completion of turnaround projects; renewables initiatives;

conversion of hydrocrackers at Coffeyville and/or feed pretreaters,

including the completion, operation, capacities, timing, costs,

optionality and benefits thereof; carbon capture and

decarbonization initiatives; labor supply shortages, labor

difficulties, labor disputes or strikes; utilization rates; global

fertilizer industry conditions; crop and planting conditions;

natural gas and global energy costs; and other matters. You can

generally identify forward-looking statements by our use of

forward-looking terminology such as “outlook,” “anticipate,”

“believe,” “continue,” “could,” “estimate,” “expect,” “explore,”

“evaluate,” “intend,” “may,” “might,” “plan,” “potential,”

“predict,” “seek,” “should,” or “will,” or the negative thereof or

other variations thereon or comparable terminology. These

forward-looking statements are only predictions and involve known

and unknown risks and uncertainties, many of which are beyond our

control. Investors are cautioned that various factors may affect

these forward-looking statements, including the rate of any

economic improvement, demand for fossil fuels, price volatility of

crude oil, other feedstocks and refined products (among others);

the ability of the Company to pay cash dividends and CVR Partners

to make cash distributions; potential operating hazards; costs of

compliance with existing, or compliance with new, laws and

regulations and potential liabilities arising therefrom; impacts of

planting season on CVR Partners; our controlling shareholder’s

intention regarding ownership of our common stock, including any

dispositions of our common stock; the health and economic effects

of the COVID-19 pandemic and any variant thereof; general economic

and business conditions; political disturbances, geopolitical

instability and tensions, and associated changes in global trade

policies and economic sanctions, including, but not limited to, in

connection with the Russia/Ukraine and Israel/Hamas conflicts;

impacts of plant outages and weather events on throughput volume;

risks related to the conclusion of consideration of a spin-off of

some or all of Company’s interests in its nitrogen fertilizer

business or potential future reconsideration thereof; our ability

to refinance our debt on acceptable terms or at all; and other

risks. For additional discussion of risk factors which may affect

our results, please see the risk factors and other disclosures

included in our most recent Annual Report on Form 10-K, any

subsequently filed Quarterly Reports on Form 10-Q and our other

Securities and Exchange Commission (“SEC”) filings. These and other

risks may cause our actual results, performance or achievements to

differ materially from any future results, performance or

achievements expressed or implied by these forward-looking

statements. Given these risks and uncertainties, you are cautioned

not to place undue reliance on such forward-looking statements. The

forward-looking statements included in this news release are made

only as of the date hereof. CVR Energy disclaims any intention or

obligation to update publicly or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, except to the extent required by law.

About CVR Energy, Inc.

Headquartered in Sugar Land, Texas, CVR Energy

is a diversified holding company primarily engaged in the

renewables, petroleum refining and marketing business as well as in

the nitrogen fertilizer manufacturing business through its interest

in CVR Partners. CVR Energy subsidiaries serve as the general

partner and own 37 percent of the common units of CVR Partners.

Investors and others should note that CVR Energy

may announce material information using SEC filings, press

releases, public conference calls, webcasts and the Investor

Relations page of its website. CVR Energy may use these channels to

distribute material information about the Company and to

communicate important information about the Company, corporate

initiatives and other matters. Information that CVR Energy posts on

its website could be deemed material; therefore, CVR Energy

encourages investors, the media, its customers, business partners

and others interested in the Company to review the information

posted on its website.

For further information, please contact:

Investor RelationsRichard

RobertsCVR Energy, Inc.(281)

207-3205InvestorRelations@CVREnergy.com

Media RelationsBrandee

StephensCVR Energy, Inc. (281)

207-3516MediaRelations@CVREnergy.com

Non-GAAP Measures

Our management uses certain non-GAAP performance

measures, and reconciliations to those measures, to evaluate

current and past performance and prospects for the future to

supplement our financial information presented in accordance with

accounting principles generally accepted in the United States

(“GAAP”). These non-GAAP financial measures are important factors

in assessing our operating results and profitability and include

the performance and liquidity measures defined below.

The following are non-GAAP measures we present

for the period ended September 30, 2023:

EBITDA - Consolidated net income (loss) before

(i) interest expense, net, (ii) income tax expense (benefit) and

(iii) depreciation and amortization expense.

Petroleum EBITDA and Nitrogen Fertilizer EBITDA

- Segment net income (loss) before segment (i) interest expense,

net, (ii) income tax expense (benefit), and (iii) depreciation and

amortization.

Refining Margin - The difference between our

Petroleum Segment net sales and cost of materials and other.

Refining Margin, adjusted for Inventory

Valuation Impacts - Refining Margin adjusted to exclude the impact

of current period market price and volume fluctuations on crude oil

and refined product inventories purchased in prior periods and

lower of cost or net realizable value adjustments, if applicable.

We record our commodity inventories on the first-in-first-out

basis. As a result, significant current period fluctuations in

market prices and the volumes we hold in inventory can have

favorable or unfavorable impacts on our refining margins as

compared to similar metrics used by other publicly-traded companies

in the refining industry.

Refining Margin and Refining Margin adjusted for

Inventory Valuation Impacts, per Throughput Barrel - Refining

Margin and Refining Margin adjusted for Inventory Valuation Impacts

divided by the total throughput barrels during the period, which is

calculated as total throughput barrels per day times the number of

days in the period.

Direct Operating Expenses per Throughput Barrel

- Direct operating expenses for our Petroleum Segment divided by

total throughput barrels for the period, which is calculated as

total throughput barrels per day times the number of days in the

period.

Adjusted EBITDA, Adjusted Petroleum EBITDA and

Adjusted Nitrogen Fertilizer EBITDA - EBITDA, Petroleum EBITDA and

Nitrogen Fertilizer EBITDA adjusted for certain significant

non-cash items and items that management believes are not

attributable to or indicative of our on-going operations or that

may obscure our underlying results and trends.

Adjusted Earnings (Loss) per Share - Earnings

(loss) per share adjusted for certain significant non-cash items

and items that management believes are not attributable to or

indicative of our on-going operations or that may obscure our

underlying results and trends.

Free Cash Flow - Net cash provided by (used in)

operating activities less capital expenditures and capitalized

turnaround expenditures.

Net Debt and Finance Lease Obligations - Net

debt and finance lease obligations is total debt and finance lease

obligations reduced for cash and cash equivalents.

Total Debt and Net Debt and Finance Lease

Obligations to EBITDA Exclusive of Nitrogen Fertilizer - Total debt

and net debt and finance lease obligations is calculated as the

consolidated debt and net debt and finance lease obligations less

the Nitrogen Fertilizer Segment’s debt and net debt and finance

lease obligations as of the most recent period ended divided by

EBITDA exclusive of the Nitrogen Fertilizer Segment for the most

recent twelve-month period.

We present these measures because we believe

they may help investors, analysts, lenders and ratings agencies

analyze our results of operations and liquidity in conjunction with

our U.S. GAAP results, including but not limited to our operating

performance as compared to other publicly-traded companies in the

refining and fertilizer industries, without regard to historical

cost basis or financing methods and our ability to incur and

service debt and fund capital expenditures. Non-GAAP measures have

important limitations as analytical tools, because they exclude

some, but not all, items that affect net earnings and operating

income. These measures should not be considered substitutes for

their most directly comparable U.S. GAAP financial measures. See

“Non-GAAP Reconciliations” included herein for reconciliation of

these amounts. Due to rounding, numbers presented within this

section may not add or equal to numbers or totals presented

elsewhere within this document.

Factors Affecting Comparability of Our

Financial Results

Petroleum Segment

Our results of operations for the periods

presented may not be comparable with prior periods or to our

results of operations in the future due to capitalized expenditures

as part of planned turnarounds. Total capitalized expenditures were

$2 million and $4 million during the three months ended September

30, 2023 and 2022, respectively, and $53 million and $73 million

during the nine months ended September 30, 2023 and 2022,

respectively. The next planned turnarounds are currently scheduled

to take place in the spring of 2024 at the Wynnewood Refinery and

in 2025 at the Coffeyville Refinery.

Nitrogen Fertilizer Segment

Our results of operations for the periods

presented may not be comparable with prior periods or to our

results of operations in the future due to expenses incurred as

part of planned turnarounds. We incurred turnaround expenses of

$1 million and $31 million during the three months ended

September 30, 2023 and 2022, respectively, and $2 million and

$33 million during the nine months ended September 30, 2023

and 2022, respectively. The next planned turnarounds are currently

scheduled to take place in 2025 at the Coffeyville Fertilizer

Facility and in 2026 at the East Dubuque Fertilizer Facility.

| |

|

CVR Energy, Inc. (all information in this release

is unaudited) |

| |

|

Consolidated Statement of Operations Data |

| |

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

| (in millions, except per share

data) |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Net sales |

$ |

2,522 |

|

|

$ |

2,699 |

|

|

$ |

7,045 |

|

|

$ |

8,216 |

|

| Operating costs and

expenses: |

|

|

|

|

|

|

|

|

Cost of materials and other |

|

1,787 |

|

|

|

2,267 |

|

|

|

5,211 |

|

|

|

6,619 |

|

|

Direct operating expenses (exclusive of depreciation and

amortization) |

|

170 |

|

|

|

218 |

|

|

|

503 |

|

|

|

545 |

|

|

Depreciation and amortization |

|

80 |

|

|

|

74 |

|

|

|

217 |

|

|

|

210 |

|

|

Cost of sales |

|

2,037 |

|

|

|

2,559 |

|

|

|

5,931 |

|

|

|

7,374 |

|

| Selling, general and

administrative expenses (exclusive of depreciation and

amortization) |

|

38 |

|

|

|

35 |

|

|

|

109 |

|

|

|

110 |

|

| Depreciation and

amortization |

|

1 |

|

|

|

1 |

|

|

|

4 |

|

|

|

5 |

|

| Loss on asset disposal |

|

1 |

|

|

|

1 |

|

|

|

1 |

|

|

|

1 |

|

|

Operating income |

|

445 |

|

|

|

103 |

|

|

|

1,000 |

|

|

|

726 |

|

| Other (expense) income: |

|

|

|

|

|

|

|

|

Interest expense, net |

|

(11 |

) |

|

|

(19 |

) |

|

|

(44 |

) |

|

|

(67 |

) |

|

Other income (expense), net |

|

4 |

|

|

|

3 |

|

|

|

10 |

|

|

|

(81 |

) |

|

Income before income tax expense |

|

438 |

|

|

|

87 |

|

|

|

966 |

|

|

|

578 |

|

| Income tax expense |

|

84 |

|

|

|

7 |

|

|

|

185 |

|

|

|

106 |

|

|

Net income |

|

354 |

|

|

|

80 |

|

|

|

781 |

|

|

|

472 |

|

| Less: Net income (loss)

attributable to noncontrolling interest |

|

1 |

|

|

|

(13 |

) |

|

|

103 |

|

|

|

121 |

|

|

Net income attributable to CVR Energy

stockholders |

$ |

353 |

|

|

$ |

93 |

|

|

$ |

678 |

|

|

$ |

351 |

|

| |

|

|

|

|

|

|

|

|

Basic and diluted earnings per share |

$ |

3.51 |

|

|

$ |

0.92 |

|

|

$ |

6.74 |

|

|

$ |

3.49 |

|

|

Dividends declared per share |

$ |

1.50 |

|

|

$ |

3.00 |

|

|

$ |

2.50 |

|

|

$ |

3.40 |

|

| |

|

|

|

|

|

|

|

| Adjusted earnings per

share |

$ |

1.89 |

|

|

$ |

1.90 |

|

|

$ |

4.98 |

|

|

$ |

4.37 |

|

| EBITDA* |

$ |

530 |

|

|

$ |

181 |

|

|

$ |

1,231 |

|

|

$ |

860 |

|

| Adjusted EBITDA * |

$ |

313 |

|

|

$ |

313 |

|

|

$ |

994 |

|

|

$ |

979 |

|

| |

|

|

|

|

|

|

|

| Weighted-average common shares

outstanding - basic and diluted |

|

100.5 |

|

|

|

100.5 |

|

|

|

100.5 |

|

|

|

100.5 |

|

__________________________* See “Non-GAAP

Reconciliations” section below.

| |

| Selected

Balance Sheet Data |

| |

| (in millions) |

September 30, 2023 |

|

December 31, 2022 |

|

Cash and cash equivalents |

$ |

889 |

|

$ |

510 |

|

Working capital |

|

576 |

|

|

154 |

|

Total assets |

|

4,421 |

|

|

4,119 |

|

Total debt and finance lease obligations, including current

portion |

|

1,590 |

|

|

1,591 |

|

Total liabilities |

|

3,269 |

|

|

3,328 |

|

Total CVR stockholders’ equity |

|

957 |

|

|

531 |

| |

| Selected

Cash Flow Data |

| |

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

| (in millions) |

2023 |

|

2022 |

|

2023 |

|

2022 |

| Net cash provided by (used

in): |

|

|

|

|

|

|

|

|

Operating activities |

$ |

370 |

|

|

$ |

156 |

|

|

$ |

984 |

|

|

$ |

868 |

|

|

Investing activities |

|

(51 |

) |

|

|

(61 |

) |

|

|

(181 |

) |

|

|

(217 |

) |

|

Financing activities |

|

(181 |

) |

|

|

(370 |

) |

|

|

(424 |

) |

|

|

(543 |

) |

|

Net increase (decrease) in cash and cash equivalents and

restricted cash |

$ |

138 |

|

|

$ |

(275 |

) |

|

$ |

379 |

|

|

$ |

108 |

|

| |

|

|

|

|

|

|

|

| Free cash flow* |

$ |

318 |

|

|

$ |

93 |

|

|

$ |

802 |

|

|

$ |

649 |

|

__________________________* See “Non-GAAP

Reconciliations” section below.

| |

| Selected

Segment Data |

| |

| |

Three Months Ended September 30, 2023 |

|

Nine Months Ended September 30, 2023 |

| (in millions) |

Petroleum |

|

NitrogenFertilizer |

|

Consolidated |

|

Petroleum |

|

Nitrogen Fertilizer |

|

Consolidated |

|

Net sales |

$ |

2,298 |

|

$ |

131 |

|

$ |

2,522 |

|

$ |

6,290 |

|

$ |

540 |

|

$ |

7,045 |

| Operating income |

|

431 |

|

|

8 |

|

|

445 |

|

|

838 |

|

|

184 |

|

|

1,000 |

| Net income |

|

460 |

|

|

1 |

|

|

354 |

|

|

913 |

|

|

162 |

|

|

781 |

| EBITDA* |

|

484 |

|

|

32 |

|

|

530 |

|

|

989 |

|

|

243 |

|

|

1,231 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Capital expenditures (1) |

|

|

|

|

|

|

|

|

|

|

|

|

Maintenance capital expenditures |

$ |

20 |

|

$ |

8 |

|

$ |

30 |

|

$ |

70 |

|

$ |

17 |

|

$ |

92 |

|

Growth capital expenditures |

|

6 |

|

|

— |

|

|

21 |

|

|

9 |

|

|

1 |

|

|

56 |

|

Total capital expenditures |

$ |

26 |

|

$ |

8 |

|

$ |

51 |

|

$ |

79 |

|

$ |

18 |

|

$ |

148 |

| |

Three Months Ended September 30, 2022 |

|

Nine Months Ended September 30, 2022 |

| (in millions) |

Petroleum |

|

Nitrogen Fertilizer |

|

Consolidated |

|

Petroleum |

|

Nitrogen Fertilizer |

|

Consolidated |

|

Net sales |

$ |

2,474 |

|

$ |

156 |

|

|

$ |

2,699 |

|

$ |

7,497 |

|

$ |

623 |

|

$ |

8,216 |

| Operating income |

|

137 |

|

|

(12 |

) |

|

|

103 |

|

|

564 |

|

|

218 |

|

|

726 |

| Net income |

|

152 |

|

|

(20 |

) |

|

|

80 |

|

|

584 |

|

|

191 |

|

|

472 |

| EBITDA* |

|

186 |

|

|

10 |

|

|

|

181 |

|

|

700 |

|

|

281 |

|

|

860 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Capital expenditures (1) |

|

|

|

|

|

|

|

|

|

|

|

|

Maintenance capital expenditures |

$ |

22 |

|

$ |

25 |

|

|

$ |

52 |

|

$ |

59 |

|

$ |

38 |

|

$ |

103 |

|

Growth capital expenditures |

|

1 |

|

|

— |

|

|

|

16 |

|

|

2 |

|

|

1 |

|

|

56 |

|

Total capital expenditures |

$ |

23 |

|

$ |

25 |

|

|

$ |

68 |

|

$ |

61 |

|

$ |

38 |

|

$ |

158 |

__________________________* See “Non-GAAP

Reconciliations” section below.(1) Capital

expenditures are shown exclusive of capitalized turnaround

expenditures.

| |

| Selected

Balance Sheet Data |

| |

| |

September 30, 2023 |

|

December 31, 2022 |

| (in millions) |

Petroleum |

|

Nitrogen Fertilizer |

|

Consolidated |

|

Petroleum |

|

Nitrogen Fertilizer |

|

Consolidated |

|

Cash and cash equivalents (1) |

$ |

618 |

|

$ |

89 |

|

$ |

889 |

|

$ |

235 |

|

$ |

86 |

|

$ |

510 |

| Total assets |

|

4,635 |

|

|

1,019 |

|

|

4,421 |

|

|

4,354 |

|

|

1,100 |

|

|

4,119 |

| Total debt and finance lease

obligations, including current portion (2) |

|

46 |

|

|

547 |

|

|

1,590 |

|

|

48 |

|

|

547 |

|

|

1,591 |

__________________________(1) Corporate cash and

cash equivalents consisted of $182 million and $189 million at

September 30, 2023 and December 31, 2022,

respectively.(2) Corporate total debt and finance

lease obligations, including current portion consisted of $997

million and $996 million at September 30, 2023 and December 31,

2022, respectively.

| |

| Petroleum

Segment |

| |

| Key

Operating Metrics per Total Throughput Barrel |

| |

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

|

(in millions) |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Refining margin * |

$ |

31.05 |

|

$ |

16.56 |

|

$ |

24.33 |

|

$ |

19.82 |

| Refining margin adjusted for

inventory valuation impacts * |

|

26.87 |

|

|

22.34 |

|

|

23.46 |

|

|

18.66 |

| Direct operating expenses

* |

|

5.39 |

|

|

5.53 |

|

|

5.58 |

|

|

5.74 |

__________________________* See “Non-GAAP Reconciliations”

section below.

| |

| Throughput

Data by Refinery |

| |

|

|

|

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

|

(in bpd) |

2023 |

|

2022 |

|

2023 |

|

2022 |

| Coffeyville |

|

|

|

|

|

|

|

|

Regional crude |

68,176 |

|

60,762 |

|

62,442 |

|

55,675 |

|

WTI |

27,837 |

|

30,261 |

|

30,161 |

|

37,465 |

|

WTL |

— |

|

312 |

|

— |

|

544 |

|

WTS |

— |

|

1,222 |

|

— |

|

412 |

|

Midland WTI |

— |

|

— |

|

— |

|

858 |

|

Condensate |

7,401 |

|

10,674 |

|

7,718 |

|

10,871 |

|

Heavy Canadian |

2,731 |

|

7,372 |

|

2,307 |

|

6,869 |

|

DJ Basin |

20,504 |

|

13,526 |

|

17,006 |

|

14,092 |

|

Bakken |

962 |

|

— |

|

324 |

|

— |

|

Other feedstocks and blendstocks |

12,260 |

|

8,846 |

|

12,538 |

|

9,811 |

| Wynnewood |

|

|

|

|

|

|

|

|

Regional crude |

53,554 |

|

45,840 |

|

51,519 |

|

45,553 |

|

WTL |

— |

|

4,915 |

|

1,639 |

|

2,323 |

|

Midland WTI |

543 |

|

— |

|

183 |

|

539 |

|

WTS |

— |

|

— |

|

— |

|

191 |

|

Condensate |

15,780 |

|

15,313 |

|

14,567 |

|

12,121 |

|

Other feedstocks and blendstocks |

2,672 |

|

2,614 |

|

2,984 |

|

2,774 |

|

Total throughput |

212,420 |

|

201,657 |

|

203,388 |

|

200,098 |

| |

|

Production Data by Refinery |

| |

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

|

(in bpd) |

2023 |

|

2022 |

|

2023 |

|

2022 |

| Coffeyville |

|

|

|

|

|

|

|

|

Gasoline |

69,833 |

|

|

67,048 |

|

|

67,463 |

|

|

71,005 |

|

|

Distillate |

60,661 |

|

|

56,848 |

|

|

56,311 |

|

|

56,768 |

|

|

Other liquid products |

4,463 |

|

|

4,832 |

|

|

4,461 |

|

|

5,183 |

|

|

Solids |

4,416 |

|

|

4,741 |

|

|

3,896 |

|

|

4,482 |

|

| Wynnewood |

|

|

|

|

|

|

|

|

Gasoline |

36,997 |

|

|

36,423 |

|

|

37,656 |

|

|

33,040 |

|

|

Distillate |

25,615 |

|

|

24,605 |

|

|

24,825 |

|

|

23,154 |

|

|

Other liquid products |

9,038 |

|

|

6,264 |

|

|

7,355 |

|

|

5,436 |

|

|

Solids |

9 |

|

|

8 |

|

|

10 |

|

|

12 |

|

|

Total production |

211,032 |

|

|

200,769 |

|

|

201,977 |

|

|

199,080 |

|

| |

|

|

|

|

|

|

|

| Light product yield (as % of

crude throughput) (1) |

97.8 |

% |

|

97.2 |

% |

|

99.1 |

% |

|

98.1 |

% |

| Liquid volume yield (as % of

total throughput) (2) |

97.3 |

% |

|

97.2 |

% |

|

97.4 |

% |

|

97.2 |

% |

| Distillate yield (as % of

crude throughput) (3) |

43.7 |

% |

|

42.8 |

% |

|

43.2 |

% |

|

42.6 |

% |

__________________________(1) Total Gasoline

and Distillate divided by total Regional crude, WTI, WTL, Midland

WTI, WTS, Condensate, Heavy Canadian, DJ Basin, and Bakken

throughput.(2) Total Gasoline, Distillate, and

Other liquid products divided by total

throughput.(3) Total Distillate divided by total

Regional crude, WTI, WTL, Midland WTI, WTS, Condensate, Heavy

Canadian, DJ Basin, and Bakken throughput.

| |

| Key

Market Indicators |

| |

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

| |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

West Texas Intermediate (WTI) NYMEX |

$ |

82.22 |

|

|

$ |

91.43 |

|

|

$ |

77.25 |

|

|

$ |

98.35 |

|

| Crude Oil Differentials to

WTI: |

|

|

|

|

|

|

|

|

Brent |

|

3.71 |

|

|

|

6.27 |

|

|

|

4.70 |

|

|

|

4.14 |

|

|

WCS (heavy sour) |

|

(15.91 |

) |

|

|

(20.50 |

) |

|

|

(16.33 |

) |

|

|

(16.25 |

) |

|

Condensate |

|

(0.22 |

) |

|

|

0.03 |

|

|

|

(0.18 |

) |

|

|

(0.16 |

) |

|

Midland Cushing |

|

1.53 |

|

|

|

1.98 |

|

|

|

1.32 |

|

|

|

1.52 |

|

| NYMEX Crack Spreads: |

|

|

|

|

|

|

|

|

Gasoline |

|

32.40 |

|

|

|

30.07 |

|

|

|

32.61 |

|

|

|

33.31 |

|

|

Heating Oil |

|

45.20 |

|

|

|

57.56 |

|

|

|

40.35 |

|

|

|

51.00 |

|

|

NYMEX 2-1-1 Crack Spread |

|

38.80 |

|

|

|

43.82 |

|

|

|

36.48 |

|

|

|

42.16 |

|

| PADD II Group 3 Product

Basis: |

|

|

|

|

|

|

|

|

Gasoline |

|

0.84 |

|

|

|

(2.75 |

) |

|

|

(2.39 |

) |

|

|

(6.49 |

) |

|

Ultra-Low Sulfur Diesel |

|

(0.25 |

) |

|

|

3.01 |

|

|

|

(0.38 |

) |

|

|

(1.06 |

) |

| PADD II Group 3 Product Crack

Spread: |

|

|

|

|

|

|

|

|

Gasoline |

|

33.24 |

|

|

|

27.32 |

|

|

|

30.22 |

|

|

|

26.82 |

|

|

Ultra-Low Sulfur Diesel |

|

44.96 |

|

|

|

60.57 |

|

|

|

39.97 |

|

|

|

49.95 |

|

| PADD II Group 3 2-1-1 |

|

39.10 |

|

|

|

43.94 |

|

|

|

35.10 |

|

|

|

38.38 |

|

| |

| Nitrogen

Fertilizer Segment: |

| |

| Ammonia

Utilization Rates (1) |

| |

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

|

(percent of capacity utilization) |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Consolidated |

99 |

% |

|

52 |

% |

|

101 |

% |

|

76 |

% |

__________________________(1) Reflects our ammonia

utilization rates on a consolidated basis. Utilization is an

important measure used by management to assess operational output

at each of CVR Partners’ facilities. Utilization is calculated as

actual tons produced divided by capacity. We present our

utilization for the three and nine months ended September 30, 2023

and 2022 and take into account the impact of our current turnaround

cycles on any specific period. Additionally, we present utilization

solely on ammonia production rather than each nitrogen product as

it provides a comparative baseline against industry peers and

eliminates the disparity of plant configurations for upgrade of

ammonia into other nitrogen products. With our efforts being

primarily focused on ammonia upgrade capabilities, this measure

provides a meaningful view of how well we operate.

| |

| Sales and

Production Data |

| |

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

| |

2023 |

|

2022 |

|

2023 |

|

2022 |

| Consolidated sales (thousand

tons): |

|

|

|

|

|

|

|

|

Ammonia |

|

62 |

|

|

27 |

|

|

183 |

|

|

118 |

|

UAN |

|

387 |

|

|

275 |

|

|

1,075 |

|

|

884 |

| |

|

|

|

|

|

|

|

| Consolidated product pricing

at gate (dollars per ton):(1) |

|

|

|

|

|

|

|

|

Ammonia |

$ |

365 |

|

$ |

837 |

|

$ |

633 |

|

$ |

1,062 |

|

UAN |

|

223 |

|

|

433 |

|

|

330 |

|

|

496 |

| |

|

|

|

|

|

|

|

| Consolidated production volume

(thousand tons): |

|

|

|

|

|

|

|

|

Ammonia (gross produced) (2) |

|

217 |

|

|

114 |

|

|

660 |

|

|

494 |

|

Ammonia (net available for sale) (2) |

|

68 |

|

|

36 |

|

|

200 |

|

|

137 |

|

UAN |

|

358 |

|

|

184 |

|

|

1,063 |

|

|

832 |

| |

|

|

|

|

|

|

|

| Feedstock: |

|

|

|

|

|

|

|

|

Petroleum coke used in production (thousand tons) |

|

131 |

|

|

74 |

|

|

386 |

|

|

298 |

|

Petroleum coke used in production (dollars per ton) |

$ |

84.09 |

|

$ |

51.54 |

|

$ |

78.49 |

|

$ |

52.68 |

|

Natural gas used in production (thousands of MMBtu) (3) |

|

2,133 |

|

|

1,120 |

|

|

6,429 |

|

|

4,817 |

|

Natural gas used in production (dollars per MMBtu) (3) |

$ |

2.67 |

|

$ |

7.19 |

|

$ |

3.57 |

|

$ |

6.65 |

|

Natural gas in cost of materials and other (thousands of MMBtu)

(3) |

|

2,636 |

|

|

1,330 |

|

|

6,354 |

|

|

4,566 |

|

Natural gas in cost of materials and other (dollars per MMBtu)

(3) |

$ |

2.51 |

|

$ |

7.84 |

|

$ |

4.21 |

|

$ |

6.40 |

__________________________(1) Product pricing at

gate represents sales less freight revenue divided by product sales

volume in tons and is shown in order to provide a pricing measure

that is comparable across the fertilizer

industry.(2) Gross tons produced for ammonia

represent total ammonia produced, including ammonia produced that

was upgraded into other fertilizer products. Net tons available for

sale represent ammonia available for sale that was not upgraded

into other fertilizer products.(3) The feedstock

natural gas shown above does not include natural gas used for fuel.

The cost of fuel natural gas is included in direct operating

expense.

| |

| Key

Market Indicators |

| |

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

| |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Ammonia — Southern plains (dollars per ton) |

$ |

429 |

|

$ |

934 |

|

$ |

533 |

|

$ |

1,149 |

| Ammonia — Corn belt (dollars

per ton) |

|

501 |

|

|

1,048 |

|

|

621 |

|

|

1,275 |

| UAN — Corn belt (dollars per

ton) |

|

272 |

|

|

496 |

|

|

314 |

|

|

581 |

| |

|

|

|

|

|

|

|

| Natural gas NYMEX (dollars per

MMBtu) |

$ |

2.66 |

|

$ |

7.95 |

|

$ |

2.58 |

|

$ |

6.70 |

| |

|

|

|

|

|

|

|

|

|

|

|

Q4 2023 Outlook

The table below summarizes our outlook for

certain operational statistics and financial information for the

fourth quarter of 2023. See “Forward-Looking Statements” above.

| |

Q4 2023 |

| |

Low |

|

High |

| Petroleum |

|

|

|

|

Total throughput (bpd) |

|

205,000 |

|

|

|

220,000 |

|

|

Direct operating expenses (in millions) (1) |

$ |

95 |

|

|

$ |

105 |

|

| |

|

|

|

| Renewables (2) |

|

|

|

|

Total throughput (in millions of gallons) |

|

15 |

|

|

|

20 |

|

|

Direct operating expenses (in millions) (1) |

$ |

6 |

|

|

$ |

8 |

|

| |

|

|

|

| Nitrogen Fertilizer |

|

|

|

|

Ammonia utilization rates |

|

|

|

|

Consolidated |

|

90 |

% |

|

|

95 |

% |

|

Coffeyville Fertilizer Facility |

|

95 |

% |

|

|

100 |

% |

|

East Dubuque Fertilizer Facility |

|

85 |

% |

|

|

90 |

% |

|

Direct operating expenses (in millions) (1) |

$ |

55 |

|

|

$ |

60 |

|

| |

|

|

|

| Capital Expenditures (in

millions) (3) |

|

|

|

|

Petroleum |

$ |

40 |

|

|

$ |

45 |

|

|

Renewables (2) |

|

13 |

|

|

|

17 |

|

|

Nitrogen Fertilizer |

|

10 |

|

|

|

15 |

|

|

Other |

|

2 |

|

|

|

4 |

|

|

Total capital expenditures |

$ |

65 |

|

|

$ |

81 |

|

__________________________(1) Direct operating

expenses are shown exclusive of depreciation and amortization and,

for the Nitrogen Fertilizer Segment, turnaround expenses and

inventory valuation impacts.(2) Renewables

reflects spending on the Wynnewood renewable diesel unit project.

As of September 30, 2023, Renewables does not meet the definition

of a reportable segment as defined under Accounting Standards

Codification 280.(3) Capital expenditures is

disclosed on an accrual basis.

| |

| Non-GAAP

Reconciliations: |

| |

|

Reconciliation of Net Income

to EBITDA and Adjusted EBITDA |

| |

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

| (in millions) |

2023 |

|

2022 |

|

2023 |

|

|

2022 |

|

|

Net income |

$ |

354 |

|

|

$ |

80 |

|

|

$ |

781 |

|

|

$ |

472 |

|

|

Interest expense, net |

|

11 |

|

|

|

19 |

|

|

|

44 |

|

|

|

67 |

|

|

Income tax expense |

|

84 |

|

|

|

7 |

|

|

|

185 |

|

|

|

106 |

|

|

Depreciation and amortization |

|

81 |

|

|

|

75 |

|

|

|

221 |

|

|

|

215 |

|

|

EBITDA |

|

530 |

|

|

|

181 |

|

|

|

1,231 |

|

|

|

860 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

Revaluation of RFS liability |

|

(174 |

) |

|

|

38 |

|

|

|

(228 |

) |

|

|

108 |

|

|

Unrealized loss (gain) on derivatives, net |

|

48 |

|

|

|

(20 |

) |

|

|

35 |

|

|

|

(5 |

) |

|

Inventory valuation impacts, (favorable) unfavorable |

|

(91 |

) |

|

|

114 |

|

|

|

(44 |

) |

|

|

(63 |

) |

|

Call Option Lawsuits settlement |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

79 |

|

|

Adjusted EBITDA |

$ |

313 |

|

|

$ |

313 |

|

|

$ |

994 |

|

|

$ |

979 |

|

| |

|

Reconciliation of Basic and Diluted

Earnings per Share to Adjusted

Earnings per Share |

| |

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

| |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Basic and diluted earnings per share |

$ |

3.51 |

|

|

$ |

0.92 |

|

|

$ |

6.74 |

|

|

$ |

3.49 |

|

| Adjustments: (1) |

|

|

|

|

|

|

|

|

Revaluation of RFS liability |

|

(1.30 |

) |

|

|

0.28 |

|

|

|

(1.69 |

) |

|

|

0.80 |

|

|

Unrealized loss (gain) on derivatives, net |

|

0.36 |

|

|

|

(0.15 |

) |

|

|

0.26 |

|

|

|

(0.04 |

) |

|

Inventory valuation impacts, (favorable) unfavorable |

|

(0.68 |

) |

|

|

0.85 |

|

|

|

(0.33 |

) |

|

|

(0.46 |

) |

|

Call Option Lawsuits settlement |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.58 |

|

|

Adjusted earnings per share |

$ |

1.89 |

|

|

$ |

1.90 |

|

|

$ |

4.98 |

|

|

$ |

4.37 |

|

__________________________(1) Amounts are shown

after-tax, using the Company’s marginal tax rate, and are presented

on a per share basis using the weighted average shares outstanding

for each period.

| |

|

Reconciliation of Net Cash Provided By

Operating Activities to Free Cash

Flow |

| |

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

| (in millions) |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Net cash provided by operating activities |

$ |

370 |

|

|

$ |

156 |

|

|

$ |

984 |

|

|

$ |

868 |

|

| Less: |

|

|

|

|

|

|

|

|

Capital expenditures |

|

(50 |

) |

|

|

(57 |

) |

|

|

(150 |

) |

|

|

(145 |

) |

|

Capitalized turnaround expenditures |

|

(3 |

) |

|

|

(6 |

) |

|

|

(53 |

) |

|

|

(74 |

) |

|

Return on equity method investment |

|

1 |

|

|

|

— |

|

|

|

21 |

|

|

|

— |

|

|

Free cash flow |

$ |

318 |

|

|

$ |

93 |

|

|

$ |

802 |

|

|

$ |

649 |

|

| |

|

Reconciliation of Petroleum

Segment Net Income to EBITDA and

Adjusted EBITDA |

| |

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

| (in millions) |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Petroleum net income |

$ |

460 |

|

|

$ |

152 |

|

|

$ |

913 |

|

|

$ |

584 |

|

|

Interest income, net |

|

(26 |

) |

|

|

(13 |

) |

|

|

(65 |

) |

|

|

(24 |

) |

|

Depreciation and amortization |

|

50 |

|

|

|

47 |

|

|

|

141 |

|

|

|

140 |

|

|

Petroleum EBITDA |

|

484 |

|

|

|

186 |

|

|

|

989 |

|

|

|

700 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

Revaluation of RFS liability |

|

(174 |

) |

|

|

38 |

|

|

|

(228 |

) |

|

|

108 |

|

|

Unrealized loss (gain) on derivatives, net |

|

53 |

|

|

|

(25 |

) |

|

|

37 |

|

|

|

(8 |

) |

|

Inventory valuation impacts, (favorable) unfavorable (1) |

|

(82 |

) |

|

|

107 |

|

|

|

(48 |

) |

|

|

(63 |

) |

|

Petroleum Adjusted EBITDA |

$ |

281 |

|

|

$ |

306 |

|

|

$ |

750 |

|

|

$ |

737 |

|

| |

|

Reconciliation of Petroleum

Segment Gross Profit to Refining

Margin and Refining Margin Adjusted for Inventory Valuation

Impacts |

| |

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

| (in millions) |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Net sales |

$ |

2,298 |

|

|

$ |

2,474 |

|

|

$ |

6,290 |

|

|

$ |

7,497 |

|

| Less: |

|

|

|

|

|

|

|

|

Cost of materials and other |

|

(1,691 |

) |

|

|

(2,167 |

) |

|

|

(4,939 |

) |

|

|

(6,414 |

) |

|

Direct operating expenses (exclusive of depreciation and

amortization) |

|

(105 |

) |

|

|

(103 |

) |

|

|

(310 |

) |

|

|

(314 |

) |

|

Depreciation and amortization |

|

(50 |

) |

|

|

(47 |

) |

|

|

(141 |

) |

|

|

(140 |

) |

|

Gross profit |

|

452 |

|

|

|

157 |

|

|

|

900 |

|

|

|

629 |

|

| Add: |

|

|

|

|

|

|

|

|

Direct operating expenses (exclusive of depreciation and

amortization) |

|

105 |

|

|

|

103 |

|

|

|

310 |

|

|

|

314 |

|

|

Depreciation and amortization |

|

50 |

|

|

|

47 |

|

|

|

141 |

|

|

|

140 |

|

|

Refining margin |

|

607 |

|

|

|

307 |

|

|

|

1,351 |

|

|

|

1,083 |

|

| Inventory valuation impacts,

(favorable) unfavorable (1) |

|

(82 |

) |

|

|

107 |

|

|

|

(48 |

) |

|

|

(63 |

) |

|

Refining margin adjusted for inventory valuation

impacts |

$ |

525 |

|

|

$ |

414 |

|

|

$ |

1,303 |

|

|

$ |

1,020 |

|

__________________________(1) The Petroleum

Segment’s basis for determining inventory value under GAAP is

First-In, First-Out (“FIFO”). Changes in crude oil prices can cause

fluctuations in the inventory valuation of crude oil, work in

process and finished goods, thereby resulting in a favorable

inventory valuation impact when crude oil prices increase and an

unfavorable inventory valuation impact when crude oil prices

decrease. The inventory valuation impact is calculated based upon

inventory values at the beginning of the accounting period and at

the end of the accounting period. In order to derive the inventory

valuation impact per total throughput barrel, we utilize the total

dollar figures for the inventory valuation impact and divide by the

number of total throughput barrels for the period.

| |

|

Reconciliation of Petroleum

Segment Total Throughput Barrels |

| |

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| Total throughput barrels per

day |

212,420 |

|

201,657 |

|

203,388 |

|

200,098 |

| Days in the period |

92 |

|

92 |

|

273 |

|

273 |

|

Total throughput barrels |

19,542,631 |

|

18,552,434 |

|

55,524,925 |

|

54,626,789 |

| |

|

Reconciliation of Petroleum

Segment Refining Margin per Total Throughput

Barrel |

| |

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

|

(in millions, except for per throughput barrel data) |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Refining margin |

$ |

607 |

|

$ |

307 |

|

$ |

1,351 |

|

$ |

1,083 |

| Divided by: total throughput

barrels |

|

20 |

|

|

19 |

|

|

56 |

|

|

55 |

|

Refining margin per total throughput barrel |

$ |

31.05 |

|

$ |

16.56 |

|

$ |

24.33 |

|

$ |

19.82 |

| |

|

Reconciliation of Petroleum

Segment Refining Margin Adjusted for Inventory

Valuation Impacts per Total Throughput Barrel |

| |

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

| (in millions, except for

throughput barrel data) |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Refining margin adjusted for inventory valuation impacts |

$ |

525 |

|

$ |

414 |

|

$ |

1,303 |

|

$ |

1,020 |

| Divided by: total throughput

barrels |

|

20 |

|

|

19 |

|

|

56 |

|

|

55 |

|

Refining margin adjusted for inventory valuation impacts

per total throughput barrel |

$ |

26.87 |

|

$ |

22.34 |

|

$ |

23.46 |

|

$ |

18.66 |

| |

|

Reconciliation of Petroleum

Segment Direct Operating Expenses per Total

Throughput Barrel |

| |

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

| (in millions, except for

throughput barrel data) |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Direct operating expenses (exclusive of depreciation and

amortization) |

$ |

105 |

|

$ |

103 |

|

$ |

310 |

|

$ |

314 |

| Divided by: total throughput

barrels |

|

20 |

|

|

19 |

|

|

56 |

|

|

55 |

|

Direct operating expenses per total throughput

barrel |

$ |

5.39 |

|

$ |

5.53 |

|

$ |

5.58 |

|

$ |

5.74 |

| |

|

Reconciliation of Nitrogen Fertilizer

Segment Net Income (Loss) to

EBITDA and Adjusted EBITDA |

| |

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

|

(in millions) |

|

2023 |

|

|

2022 |

|

|

|

2023 |

|

|

2022 |

| Nitrogen Fertilizer

net income (loss) |

$ |

1 |

|

$ |

(20 |

) |

|

$ |

162 |

|

$ |

191 |

|

Interest expense, net |

|

8 |

|

|

8 |

|

|

|

22 |

|

|

26 |

|

Depreciation and amortization |

|

23 |

|

|

22 |

|

|

|

59 |

|

|

64 |

|

Nitrogen Fertilizer EBITDA and Adjusted

EBITDA |

$ |

32 |

|

$ |

10 |

|

|

$ |

243 |

|

$ |

281 |

| |

|

Reconciliation of Total Debt and Net Debt and Finance Lease

Obligations to EBITDA Exclusive of Nitrogen

Fertilizer |

| |

| (in millions) |

Twelve Months Ended September 30,

2023 |

|

Total debt and finance lease obligations (1) |

$ |

1,590 |

| Less: Nitrogen Fertilizer debt

and finance lease obligations (1) |

|

547 |

|

Total debt and finance lease obligations exclusive of Nitrogen

Fertilizer |

|

1,043 |

| |

|

| EBITDA exclusive of Nitrogen

Fertilizer |

|

1,179 |

| |

|

| Total debt and finance

lease obligations to EBITDA exclusive of Nitrogen

Fertilizer |

|

0.88 |

| |

|

| Consolidated cash and cash

equivalents |

|

889 |

| Less: Nitrogen Fertilizer cash

and cash equivalents |

|

89 |

|

Cash and cash equivalents exclusive of Nitrogen Fertilizer |

|

800 |

| |

|

| Net debt and finance lease

obligations exclusive of Nitrogen Fertilizer (2) |

|

243 |

| |

|

| Net debt and finance

lease obligations to EBITDA exclusive of Nitrogen

Fertilizer (2) |

$ |

0.21 |

__________________________(1) Amounts are shown

inclusive of the current portion of long-term debt and finance

lease obligations.(2) Net debt represents total

debt and finance lease obligations exclusive of cash and cash

equivalents.

| |

|

|

|

| |

|

|

|

| |

Three Months Ended |

|

Twelve Months Ended September 30,

2023 (1) |

| (in millions) |

|

December 31, 2022 |

|

March 31, 2023 |

|

June 30, 2023 |

|

September 30, 2023 |

|

| Consolidated |

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

172 |

|

$ |

259 |

|

$ |

168 |

|

$ |

354 |

|

$ |

953 |

|

Interest expense, net |

|

|

18 |

|

|

18 |

|

|

16 |

|

|

11 |

|

|

63 |

|

Income tax expense |

|

|

50 |

|

|

56 |

|

|

44 |

|

|

84 |

|

|

234 |

|

Depreciation and amortization |

|

|

73 |

|

|

68 |

|

|

72 |

|

|

81 |

|

|

294 |

|

EBITDA |

|

|

313 |

|

|

401 |

|

|

300 |

|

|

530 |

|

|

1,544 |

| Nitrogen Fertilizer |

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

|

95 |

|

|

102 |

|

|

60 |

|

|

1 |

|

|

258 |

|

Interest expense, net |

|

|

8 |

|

|

7 |

|

|

7 |

|

|

8 |

|

|

30 |

|

Depreciation and amortization |

|

|

19 |

|

|

15 |

|

|

20 |

|

|

23 |

|

|

77 |

|

EBITDA |

|

|

122 |

|

|

124 |

|

|

87 |

|

|

32 |

|

|

365 |

| |

|

|

|

|

|

|

|

|

|

|

| EBITDA exclusive of

Nitrogen Fertilizer |

|

$ |

191 |

|

$ |

277 |

|

$ |

213 |

|

$ |

498 |

|

$ |

1,179 |

__________________________(1) Due to rounding,

numbers within this table may not add or equal to totals

presented.

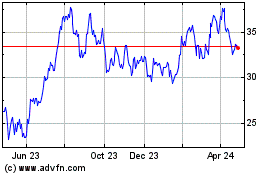

CVR Energy (NYSE:CVI)

Historical Stock Chart

From Jan 2025 to Feb 2025

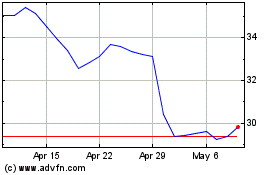

CVR Energy (NYSE:CVI)

Historical Stock Chart

From Feb 2024 to Feb 2025