CoreCivic, Inc. (NYSE: CXW) (the Company)

announced today its financial results for the third quarter of

2022.

Damon T. Hininger, CoreCivic's President and Chief

Executive Officer, said, “We are pleased to continue executing on

our capital allocation strategy of reducing debt while also

returning capital to shareholders through our share repurchase

program. Since the initial repurchase program was authorized by our

board earlier this year, we have repurchased over 5% of our

outstanding shares, or a total of 6.6 million shares at a cost of

$74.5 million, and have authorization under the program to

repurchase $150.5 million more in shares of our common stock.

Hininger continued, “The resiliency of our cash

flows has allowed us to execute our share repurchase program while

reducing our outstanding debt balances by nearly $250 million so

far this year, reducing our future interest expense and improving

our long-term cost of borrowing. Our financial results for the

third quarter were in-line with our expectations, and we continued

producing stable financial results in a challenging labor market

and while occupancy restrictions implemented during the COVID-19

pandemic remained largely in place. We have increased staffing

levels at certain facilities in anticipation of increased occupancy

levels, and are poised to accept additional residential populations

as such occupancy restrictions are removed. Our financial results

also continue to be negatively impacted in the short-term by our La

Palma Correctional Center's transition to a new state contract

award that commenced in April 2022. We believe our operating and

capital allocation strategies have positioned us well to return to

earnings growth once the transition at our La Palma Correctional

Center is complete, which we expect to occur near the end of this

year, and as the remaining occupancy restrictions caused by the

pandemic are removed."

Financial Highlights – Third Quarter 2022

- Total revenue of $464.2 million

- CoreCivic Safety revenue of $423.2

million

- CoreCivic Community revenue of $26.4

million

- CoreCivic Properties revenue of $14.6

million

- Net Income of $68.3 million

- Diluted earnings per share of $0.58

- Adjusted Diluted EPS of $0.08

- Funds From Operations per diluted share of $0.28

- Normalized Funds From Operations per diluted share of

$0.29

- Adjusted EBITDA of $68.4 million

Third Quarter 2022 Financial Results Compared With Third

Quarter 2021

Net income in the third quarter of 2022 totaled

$68.3 million, or $0.58 per diluted share, compared with net income

in the third quarter of 2021 of $30.0 million, or $0.25 per diluted

share. Adjusted for special items, adjusted net income in the third

quarter of 2022 was $9.7 million, or $0.08 per diluted share

(Adjusted Diluted EPS), compared with adjusted net income in the

third quarter of 2021 of $33.7 million, or $0.28 per diluted share.

Special items for each period are presented in detail in the

calculation of Adjusted Diluted EPS in the Supplemental Financial

Information following the financial statements presented herein,

and for the third quarter of 2022 reflect, most notably, a gain on

sale of real estate assets of $83.8 million, including $77.5

million for the sale of our McRae Correctional Facility, which was

consummated in August 2022.

The decline in adjusted per share amounts was

primarily the result of transitioning to a new contract with the

state of Arizona at our 3,060-bed La Palma Correctional Center in

Arizona, the non-renewal of contracts in 2021 with the United

States Marshals Service (USMS) at the 1,033-bed Leavenworth

Detention Center in Kansas and the 600-bed West Tennessee Detention

Facility, and the expiration of a managed-only contract with Marion

County, Indiana at the Marion County Jail, which the County

replaced with a newly constructed facility. We expect

the transition at the La Palma facility to be complete near the end

of 2022. Our renewal rate on owned and controlled facilities

remained high at 95% over the previous five years. We believe our

renewal rate on existing contracts remains high due to a variety of

reasons including the aged and constrained supply of available beds

within the U.S. correctional system, our ownership of the majority

of the beds we operate, the value our government partners place in

the wide range of recidivism-reducing programs we offer to those in

our care, and the cost effectiveness of the services we

provide.

Earnings before interest, taxes, depreciation and

amortization (EBITDA) was $147.9 million in the third quarter of

2022, compared with $95.7 million in the third quarter of 2021.

Adjusted EBITDA was $68.4 million in the third quarter of 2022,

compared with $100.9 million in the third quarter of 2021. Adjusted

EBITDA decreased from the prior year quarter primarily due to the

previously mentioned transition of offender populations at our La

Palma Correctional Center, which resulted in a reduction in EBITDA

of $11.8 million, and the aforementioned non-renewal of contracts

at three facilities that collectively resulted in a reduction in

EBITDA of $2.7 million from the third quarter of 2021 to the third

quarter of 2022. Now that the contract with U.S. Immigration &

Customs Enforcement (ICE) at our La Palma Correctional Center has

expired, we expect average daily populations from ICE at our other

facilities in Arizona to increase in the fourth quarter of 2022,

including particularly at our Eloy Detention Center. We also

achieved higher staffing levels and incurred $5.6 million more in

temporary incentives than in the prior year quarter to attract and

retain facility staff in the challenging labor market. We believe

these investments in staffing are preparing us to manage the

increased number of residents we anticipate at our facilities once

the remaining occupancy restrictions caused by the pandemic are

removed.

Funds From Operations (FFO) was $33.3 million, or

$0.28 per diluted share, in the third quarter of 2022, compared to

$54.9 million, or $0.45 per diluted share, in the third quarter of

2021. Normalized FFO, which excludes special items, was $33.9

million, or $0.29 per diluted share, in the third quarter of 2022,

compared with $58.6 million, or $0.48 per diluted share, in the

third quarter of 2021. Normalized FFO was negatively

impacted by the same factors that affected Adjusted EBITDA.

Adjusted Net Income, EBITDA, Adjusted EBITDA, FFO,

and Normalized FFO, and, where appropriate, their corresponding per

share amounts, are measures calculated and presented on the basis

of methodologies other than in accordance with generally accepted

accounting principles (GAAP). Please refer to the Supplemental

Financial Information and related note following the financial

statements herein for further discussion and reconciliations of

these measures to net income, the most directly comparable GAAP

measure.

Asset Dispositions

During the second quarter of 2022, we entered into an agreement

with the Georgia Building Authority (GBA) to sell our 1,978-bed

McRae Correctional Facility located in McRae, Georgia, and reported

in our Safety segment, for a sale price of $130.0 million. The sale

was completed on August 9, 2022, resulting in a gain on sale of

$77.5 million. We currently have a management contract with the

Federal Bureau of Prisons (BOP) at the McRae facility, which

expires November 30, 2022. As previously disclosed, we do not

expect the BOP to renew the contract upon its expiration. In

connection with the sale, we entered into an agreement with the GBA

to lease the facility through November 30, 2022 to allow us to

fulfill our obligations to the BOP.

During July 2022, we sold our Stockton Female Community

Corrections Facility and our Long Beach Community Corrections

Center, both located in California and reported in our Properties

segment. The sale of these properties to a third party generated

net sales proceeds of $10.9 million, resulting in a gain on sale of

$2.3 million. During July 2022, we also sold an undeveloped parcel

of land, generating net proceeds of $4.8 million and resulting in a

gain on sale of $4.2 million.

In September 2022, we entered into a Letter of Intent with a

third-party for the sale of our Roth Hall Residential Reentry

Center and the Walker Hall Residential Reentry Center, both located

in Philadelphia, Pennsylvania and reported in our Properties

segment, for a gross sales price of $6.3 million. Also in October

2022, we entered into an agreement with a third-party for the sale

of our idled Oklahoma City Transitional Center, reported in our

Community segment, for a gross sales price of $1.0 million. The

buyer intends to redevelop the property for an alternative use. We

recognized an impairment charge of $3.5 million during the third

quarter of 2022 associated with this facility, based on its

estimated net realizable value less costs to sell. These sales are

subject to customary closing conditions. If consummated, we expect

to use the net proceeds from these sales for general corporate

purposes, including for our share repurchase program and/or for

additional debt reduction.

Debt Repayments

During the third quarter of 2022, we reduced our debt balance by

$109.1 million, net of the change in cash. We purchased $3.6

million of our 4.625% Senior Notes in open market purchases,

reducing the outstanding balance of the 4.625% Senior Notes to

$166.5 million. The 4.625% Senior Notes mature in May

2023, which we currently expect to repay with cash on hand and

capacity under our $250.0 million Revolving Credit Facility, which

remains undrawn. We also purchased $33.5 million of our 8.25%

Senior Notes in open market purchases, reducing the outstanding

balance of the 8.25% Senior Notes to $641.5 million. Beyond the

maturity of our 4.625% Senior Notes in May 2023, we have no other

maturities until the 8.25% Senior Notes mature in April 2026.

Share Repurchases

On August 2, 2022, our Board of Directors authorized an increase

in our share repurchase program of up to an additional $75.0

million in shares of our common stock. As a result of the increased

authorization, the aggregate authorization under our share

repurchase program increased from the original authorization of up

to $150.0 million in shares of our common stock to up to $225.0

million in shares of our common stock. Through November 1, 2022, we

have repurchased 6.6 million shares of our common stock at an

aggregate purchase price of $74.5 million, excluding fees,

commissions and other costs related to the repurchases.

We currently have $150.5 million remaining under the Board

authorized share repurchase program. Additional repurchases of

common stock will be made in accordance with applicable securities

laws and may be made at management’s discretion within parameters

set by the Board of Directors from time to time in the open market,

through privately negotiated transactions, or otherwise. The share

repurchase program has no time limit and does not obligate us to

purchase any particular amount of our common stock. The

authorization for the share repurchase program may be terminated,

suspended, increased or decreased by our Board in its discretion at

any time.

2022 Financial Guidance

Based on current business conditions, we are providing the

following update to our financial guidance for the full year

2022:

|

|

Guidance Full Year 2022 |

Prior Guidance Full Year

2022 |

|

|

$110.1 million - $114.1 million |

$106.6 million - $118.2 million |

|

|

$55.5 million - $59.5 million |

$52.0 million - $60.0 million |

|

|

$0.93 - $0.96 |

$0.89 - $0.99 |

|

|

$0.47 - $0.50 |

$0.44 - $0.50 |

|

|

$1.22 - $1.26 |

$1.19 - $1.26 |

- Normalized FFO per diluted share

|

$1.28 - $1.32 |

$1.25 - $1.32 |

|

|

$375.6 million - $378.1 million |

$375.2 million - $386.2 million |

|

|

$301.5 million - $304.0 million |

$299.0 million - $305.0 million |

During 2022, we expect to invest $82.5 million to $86.0 million

in capital expenditures, consisting of $33.5 million to $34.0

million in maintenance capital expenditures on real estate assets,

$30.0 million to $32.0 million for capital expenditures on other

assets and information technology, and $19.0 million to $20.0

million for facility renovations.

Supplemental Financial Information and Investor

Presentations

We have made available on our website supplemental financial

information and other data for the third quarter of

2022. Interested parties may access this information

through our website at http://ir.corecivic.com/ under “Financial

Information” of the Investors section. We do not

undertake any obligation and disclaim any duties to update any of

the information disclosed in this report.

Management may meet with investors from time to

time during the fourth quarter of 2022. Written

materials used in the investor presentations will also be available

on our website beginning on or about November 11, 2022.

Interested parties may access this information through our website

at http://ir.corecivic.com/ under “Events & Presentations” of

the Investors section.

Conference Call, Webcast and Replay

Information

We will host a webcast conference call at 10:00 a.m. central

time (11:00 a.m. eastern time) on Thursday, November 3, 2022, which

will be accessible through the Company's website at

www.corecivic.com under the “Events & Presentations” section of

the "Investors" page.

Please note there is a new process to access the live call for

those who wish to ask questions. To participate via telephone and

join the call live, please register in advance here

https://register.vevent.com/register/BId5639495ba264dd3b66eae4d5db8ced1.

Upon registration, telephone participants will receive a

confirmation email detailing how to join the conference call,

including the dial-in number and a unique passcode.

About CoreCivic

CoreCivic is a diversified, government-solutions company with

the scale and experience needed to solve tough government

challenges in flexible, cost-effective ways. We provide a broad

range of solutions to government partners that serve the public

good through high-quality corrections and detention management, a

network of residential and non-residential alternatives to

incarceration to help address America’s recidivism crisis, and

government real estate solutions. We are the nation’s largest owner

of partnership correctional, detention and residential reentry

facilities, and believe we are the largest private owner of real

estate used by government agencies in the United States. We have

been a flexible and dependable partner for government for nearly 40

years. Our employees are driven by a deep sense of service, high

standards of professionalism and a responsibility to help

government better the public good. Learn more at

www.corecivic.com.

Forward-Looking Statements

This press release contains statements as to our beliefs and

expectations of the outcome of future events that are

"forward-looking" statements within the meaning of Section 21E of

the Securities Exchange Act of 1934, as amended, and the Private

Securities Litigation Reform Act of 1995, as amended. These

forward-looking statements are subject to risks and uncertainties

that could cause actual results to differ materially from the

statements made. These include, but are not limited to, the risks

and uncertainties associated with: (i) changes in government

policy (including the United States Department of Justice, or DOJ,

not renewing contracts as a result of President Biden's Executive

Order on Reforming Our Incarceration System to Eliminate the Use of

Privately Operated Criminal Detention Facilities, or the Private

Prison EO) (two agencies of the DOJ, the United States Federal

Bureau of Prisons and the United States Marshals Service utilize

our services), legislation and regulations that affect utilization

of the private sector for corrections, detention, and residential

reentry services, in general, or our business, in particular,

including, but not limited to, the continued utilization of our

correctional and detention facilities by the federal government,

and the impact of any changes to immigration reform and sentencing

laws (our company does not, under longstanding policy, lobby for or

against policies or legislation that would determine the basis for,

or duration of, an individual’s incarceration or detention); (ii)

our ability to obtain and maintain correctional, detention, and

residential reentry facility management contracts because of

reasons including, but not limited to, sufficient governmental

appropriations, contract compliance, negative publicity and effects

of inmate disturbances; (iii) changes in the privatization of

the corrections and detention industry, the acceptance of our

services, the timing of the opening of new facilities and the

commencement of new management contracts (including the extent and

pace at which new contracts are utilized), as well as our ability

to utilize available beds; (iv) general economic and market

conditions, including, but not limited to, the impact governmental

budgets can have on our contract renewals and renegotiations, per

diem rates, and occupancy; (v) fluctuations in our operating

results because of, among other things, changes in occupancy

levels; competition; contract renegotiations or terminations;

inflation and other increases in costs of operations, including a

continuing rise in labor costs; fluctuations in interest rates and

risks of operations; (vi) the duration of the federal

government’s denial of entry at the United States southern border

to asylum-seekers and anyone crossing the southern border without

proper documentation or authority in an effort to contain the

spread of COVID-19, a policy known as Title 42 (On April 1,

2022, the Center for Disease Control and Prevention, or CDC,

terminated Title 42, and began preparing for a resumption of

regular migration at the United States southern border, effective

May 23, 2022; however, on April 25, 2022, a judge issued a

temporary restraining order blocking the termination of Title 42

and on May 20, 2022, ruled that the administration violated

administrative law when it announced that it planned to cease Title

42.); (vii) government and staff responses to staff or

residents testing positive for COVID-19 within public and

private correctional, detention and reentry facilities, including

the facilities we operate; (viii) restrictions associated

with COVID-19 that disrupt the criminal justice system, along with

government policies on prosecutions and newly ordered legal

restrictions that affect the number of people placed in

correctional, detention, and reentry facilities, including those

associated with a resurgence of COVID-19; (ix) whether revoking our

REIT election, effective January 1, 2021, and our revised capital

allocation strategy can be implemented in a cost effective manner

that provides the expected benefits, including facilitating our

planned debt reduction initiative and planned return of capital to

shareholders; (x) our ability to successfully identify and

consummate future development and acquisition opportunities and

realize projected returns resulting therefrom; (xi) our ability to

have met and maintained qualification for taxation as a REIT for

the years we elected REIT status; and (xii) the availability of

debt and equity financing on terms that are favorable to us, or at

all. Other factors that could cause operating and financial results

to differ are described in the filings we make from time to time

with the Securities and Exchange Commission.

CoreCivic takes no responsibility for updating the information

contained in this press release following the date hereof to

reflect events or circumstances occurring after the date hereof or

the occurrence of unanticipated events or for any changes or

modifications made to this press release or the information

contained herein by any third-parties, including, but not limited

to, any wire or internet services.

CORECIVIC, INC. AND

SUBSIDIARIESCONSOLIDATED BALANCE

SHEETS(UNAUDITED AND AMOUNTS IN THOUSANDS, EXCEPT PER

SHARE AMOUNTS)

|

ASSETS |

|

September 30,2022 |

|

December 31,2021 |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

185,328 |

|

|

$ |

299,645 |

|

| Restricted cash |

|

|

13,833 |

|

|

|

11,062 |

|

| Accounts receivable, net of

credit loss reserve of $8,332 and $7,931, respectively |

|

|

293,395 |

|

|

|

282,809 |

|

| Prepaid expenses and other

current assets |

|

|

30,748 |

|

|

|

26,872 |

|

| Assets held for sale |

|

|

6,659 |

|

|

|

6,996 |

|

|

Total current assets |

|

|

529,963 |

|

|

|

627,384 |

|

| Real estate and related

assets: |

|

|

|

|

|

Property and equipment, net of accumulated depreciation of

$1,688,390 and $1,657,709, respectively |

|

|

2,176,050 |

|

|

|

2,283,256 |

|

|

Other real estate assets |

|

|

210,242 |

|

|

|

218,915 |

|

| Goodwill |

|

|

4,844 |

|

|

|

4,844 |

|

| Other assets |

|

|

349,827 |

|

|

|

364,539 |

|

| |

|

|

|

|

|

Total assets |

|

$ |

3,270,926 |

|

|

$ |

3,498,938 |

|

| |

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

| |

|

|

|

|

| Accounts payable and accrued

expenses |

|

$ |

295,671 |

|

|

$ |

305,592 |

|

| Current portion of long-term

debt |

|

|

177,556 |

|

|

|

35,376 |

|

|

Total current liabilities |

|

|

473,227 |

|

|

|

340,968 |

|

| |

|

|

|

|

| Long-term debt, net |

|

|

1,113,938 |

|

|

|

1,492,046 |

|

| Deferred revenue |

|

|

23,830 |

|

|

|

27,551 |

|

| Non-current deferred tax

liabilities |

|

|

97,689 |

|

|

|

88,157 |

|

| Other liabilities |

|

|

160,067 |

|

|

|

177,748 |

|

| |

|

|

|

|

|

Total liabilities |

|

|

1,868,751 |

|

|

|

2,126,470 |

|

| |

|

|

|

|

| Commitments and

contingencies |

|

|

|

|

| |

|

|

|

|

| Preferred stock ― $0.01 par

value; 50,000 shares authorized; none issued and outstanding at

September 30, 2022 and December 31, 2021, respectively |

|

|

- |

|

|

|

- |

|

| Common stock ― $0.01 par

value; 300,000 shares authorized; 114,981 and 120,285 shares issued

and outstanding at September 30, 2022 and December 31, 2021,

respectively |

|

|

1,150 |

|

|

|

1,203 |

|

| Additional paid-in

capital |

|

|

1,801,867 |

|

|

|

1,869,955 |

|

| Accumulated deficit |

|

|

(400,842 |

) |

|

|

(498,690 |

) |

|

Total stockholders’ equity |

|

|

1,402,175 |

|

|

|

1,372,468 |

|

| |

|

|

|

|

|

Total liabilities and stockholders' equity |

|

$ |

3,270,926 |

|

|

$ |

3,498,938 |

|

CORECIVIC, INC. AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF

OPERATIONS(UNAUDITED AND AMOUNTS IN THOUSANDS, EXCEPT PER

SHARE AMOUNTS)

|

|

For the Three Months EndedSeptember

30, |

|

For the Nine Months EndedSeptember

30, |

|

|

2022 |

|

2021 |

|

2022 |

|

2021 |

|

|

|

|

|

|

|

|

|

| REVENUE: |

|

|

|

|

|

|

|

|

Safety |

$ |

423,186 |

|

|

$ |

431,534 |

|

|

$ |

1,253,788 |

|

|

$ |

1,261,183 |

|

|

Community |

|

26,379 |

|

|

|

25,535 |

|

|

|

76,269 |

|

|

|

74,122 |

|

|

Properties |

|

14,587 |

|

|

|

13,940 |

|

|

|

43,704 |

|

|

|

54,927 |

|

|

Other |

|

59 |

|

|

|

185 |

|

|

|

135 |

|

|

|

251 |

|

|

|

|

464,211 |

|

|

|

471,194 |

|

|

|

1,373,896 |

|

|

|

1,390,483 |

|

|

|

|

|

|

|

|

|

|

| EXPENSES: |

|

|

|

|

|

|

|

|

Operating |

|

|

|

|

|

|

|

|

Safety |

|

342,190 |

|

|

|

314,283 |

|

|

|

987,472 |

|

|

|

926,990 |

|

|

Community |

|

22,022 |

|

|

|

20,427 |

|

|

|

63,531 |

|

|

|

61,551 |

|

|

Properties |

|

3,902 |

|

|

|

3,381 |

|

|

|

10,561 |

|

|

|

15,323 |

|

|

Other |

|

80 |

|

|

|

101 |

|

|

|

259 |

|

|

|

282 |

|

|

Total operating expenses |

|

368,194 |

|

|

|

338,192 |

|

|

|

1,061,823 |

|

|

|

1,004,146 |

|

|

General and administrative |

|

30,194 |

|

|

|

34,600 |

|

|

|

92,808 |

|

|

|

97,358 |

|

|

Depreciation and amortization |

|

31,931 |

|

|

|

33,991 |

|

|

|

96,218 |

|

|

|

100,787 |

|

|

Shareholder litigation expense |

|

- |

|

|

|

- |

|

|

|

1,900 |

|

|

|

54,295 |

|

|

Asset impairments |

|

3,513 |

|

|

|

5,177 |

|

|

|

3,513 |

|

|

|

9,351 |

|

|

|

|

433,832 |

|

|

|

411,960 |

|

|

|

1,256,262 |

|

|

|

1,265,937 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER INCOME

(EXPENSE): |

|

|

|

|

|

|

|

|

Interest expense, net |

|

(20,793 |

) |

|

|

(20,653 |

) |

|

|

(65,381 |

) |

|

|

(62,303 |

) |

|

Expenses associated with debt repayments and refinancing

transactions |

|

(783 |

) |

|

|

- |

|

|

|

(7,588 |

) |

|

|

(52,167 |

) |

|

Gain on sale of real estate assets, net |

|

83,828 |

|

|

|

- |

|

|

|

87,149 |

|

|

|

38,766 |

|

|

Other income (expense) |

|

(71 |

) |

|

|

49 |

|

|

|

934 |

|

|

|

(107 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INCOME BEFORE INCOME

TAXES |

|

92,560 |

|

|

|

38,630 |

|

|

|

132,748 |

|

|

|

48,735 |

|

|

|

|

|

|

|

|

|

|

|

Income tax expense |

|

(24,242 |

) |

|

|

(8,618 |

) |

|

|

(34,865 |

) |

|

|

(128,668 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET INCOME

(LOSS) |

$ |

68,318 |

|

|

$ |

30,012 |

|

|

$ |

97,883 |

|

|

$ |

(79,933 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| BASIC EARNINGS (LOSS)

PERSHARE |

$ |

0.59 |

|

|

$ |

0.25 |

|

|

$ |

0.82 |

|

|

$ |

(0.67 |

) |

|

|

|

|

|

|

|

|

|

| DILUTED EARNINGS (LOSS)

PERSHARE |

$ |

0.58 |

|

|

$ |

0.25 |

|

|

$ |

0.82 |

|

|

$ |

(0.67 |

) |

CORECIVIC, INC. AND

SUBSIDIARIESSUPPLEMENTAL FINANCIAL

INFORMATION (UNAUDITED AND AMOUNTS IN THOUSANDS, EXCEPT

PER SHARE AMOUNTS)

CALCULATION OF ADJUSTED NET INCOME AND ADJUSTED DILUTED

EPS

|

|

For the Three Months Ended September

30, |

|

For the Nine Months Ended September

30, |

|

|

2022 |

|

2021 |

|

2022 |

|

2021 |

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

$ |

68,318 |

|

|

$ |

30,012 |

|

|

$ |

97,883 |

|

|

$ |

(79,933 |

) |

| |

|

|

|

|

|

|

|

| Special items: |

|

|

|

|

|

|

|

|

Expenses associated with debt repayments and refinancing

transactions |

|

783 |

|

|

|

- |

|

|

|

7,588 |

|

|

|

52,167 |

|

|

Expenses associated with COVID-19 |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

2,434 |

|

|

Income taxes associated with change in corporate tax structure and

other special tax items |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

114,249 |

|

|

Gain on sale of real estate assets, net |

|

(83,828 |

) |

|

|

- |

|

|

|

(87,149 |

) |

|

|

(38,766 |

) |

|

Shareholder litigation expense |

|

- |

|

|

|

- |

|

|

|

1,900 |

|

|

|

54,295 |

|

|

Asset impairments |

|

3,513 |

|

|

|

5,177 |

|

|

|

3,513 |

|

|

|

9,351 |

|

|

Income tax expense (benefit) for special items |

|

20,959 |

|

|

|

(1,449 |

) |

|

|

19,543 |

|

|

|

(19,694 |

) |

| Adjusted net income |

$ |

9,745 |

|

|

$ |

33,740 |

|

|

$ |

43,278 |

|

|

$ |

94,103 |

|

| Weighted average common shares

outstanding – basic |

|

116,569 |

|

|

|

120,285 |

|

|

|

119,282 |

|

|

|

120,161 |

|

| Effect of dilutive

securities: |

|

|

|

|

|

|

|

|

Restricted stock-based awards |

|

881 |

|

|

|

641 |

|

|

|

774 |

|

|

|

397 |

|

|

Non-controlling interest – operating partnership units |

|

- |

|

|

|

1,123 |

|

|

|

- |

|

|

|

1,269 |

|

| Weighted average shares and

assumed conversions - diluted |

|

117,450 |

|

|

|

122,049 |

|

|

|

120,056 |

|

|

|

121,827 |

|

| Adjusted Diluted EPS |

$ |

0.08 |

|

|

$ |

0.28 |

|

|

$ |

0.36 |

|

|

$ |

0.77 |

|

CORECIVIC, INC. AND

SUBSIDIARIESSUPPLEMENTAL FINANCIAL

INFORMATION (UNAUDITED AND AMOUNTS IN THOUSANDS, EXCEPT

PER SHARE AMOUNTS)

CALCULATION OF FUNDS FROM OPERATIONS AND NORMALIZED

FUNDS FROM OPERATIONS

|

|

For the Three Months Ended September

30, |

|

For the Nine Months Ended September

30, |

|

|

2022 |

|

2021 |

|

2022 |

|

2021 |

| |

|

|

|

|

|

|

|

|

Net income (loss) |

$ |

68,318 |

|

|

$ |

30,012 |

|

|

$ |

97,883 |

|

|

$ |

(79,933 |

) |

| Depreciation and amortization

of real estate assets |

|

24,158 |

|

|

|

24,877 |

|

|

|

72,825 |

|

|

|

73,562 |

|

| Impairment of real estate

assets |

|

3,513 |

|

|

|

- |

|

|

|

3,513 |

|

|

|

1,308 |

|

| Gain on sale of real estate

assets, net |

|

(83,828 |

) |

|

|

- |

|

|

|

(87,149 |

) |

|

|

(38,766 |

) |

| Income tax expense for special

items |

|

21,165 |

|

|

|

- |

|

|

|

22,073 |

|

|

|

9,291 |

|

|

Funds From Operations |

$ |

33,326 |

|

|

$ |

54,889 |

|

|

$ |

109,145 |

|

|

$ |

(34,538 |

) |

| |

|

|

|

|

|

|

|

| Expenses associated with debt

repayments and refinancing transactions |

|

783 |

|

|

|

- |

|

|

|

7,588 |

|

|

|

52,167 |

|

| Expenses associated with

COVID-19 |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

2,434 |

|

| Income taxes associated with

change in corporate tax structure and other special tax items |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

114,249 |

|

| Shareholder litigation

expense |

|

- |

|

|

|

- |

|

|

|

1,900 |

|

|

|

54,295 |

|

| Goodwill and other

impairments |

|

- |

|

|

|

5,177 |

|

|

|

- |

|

|

|

8,043 |

|

| Income tax benefit for special

items |

|

(206 |

) |

|

|

(1,449 |

) |

|

|

(2,530 |

) |

|

|

(28,985 |

) |

|

Normalized Funds From Operations |

$ |

33,903 |

|

|

$ |

58,617 |

|

|

$ |

116,103 |

|

|

$ |

167,665 |

|

|

|

|

|

|

|

|

|

|

| Funds From Operations Per

Diluted Share |

$ |

0.28 |

|

|

$ |

0.45 |

|

|

$ |

0.91 |

|

|

$ |

(0.28 |

) |

| Normalized Funds From

Operations Per Diluted Share |

$ |

0.29 |

|

|

$ |

0.48 |

|

|

$ |

0.97 |

|

|

$ |

1.38 |

|

CORECIVIC, INC. AND

SUBSIDIARIESSUPPLEMENTAL FINANCIAL

INFORMATION (UNAUDITED AND AMOUNTS IN THOUSANDS, EXCEPT

PER SHARE AMOUNTS)

CALCULATION OF EBITDA AND ADJUSTED EBITDA

|

|

For the Three Months EndedSeptember

30, |

|

For the Nine Months EndedSeptember

30, |

|

|

2022 |

|

2021 |

|

2022 |

|

2021 |

| |

|

|

|

|

|

|

|

|

Net income (loss) |

$ |

68,318 |

|

|

$ |

30,012 |

|

$ |

97,883 |

|

|

$ |

(79,933 |

) |

| Interest expense |

|

23,455 |

|

|

|

23,097 |

|

|

73,139 |

|

|

|

69,865 |

|

| Depreciation and

amortization |

|

31,931 |

|

|

|

33,991 |

|

|

96,218 |

|

|

|

100,787 |

|

| Income tax expense |

|

24,242 |

|

|

|

8,618 |

|

|

34,865 |

|

|

|

128,668 |

|

|

EBITDA |

$ |

147,946 |

|

|

$ |

95,718 |

|

$ |

302,105 |

|

|

$ |

219,387 |

|

| Expenses associated with debt

repayments and refinancing transactions |

|

783 |

|

|

|

- |

|

|

7,588 |

|

|

|

52,167 |

|

| Expenses associated with

COVID-19 |

|

- |

|

|

|

- |

|

|

|

|

2,434 |

|

| Gain on sale of real estate

assets, net |

|

(83,828 |

) |

|

|

- |

|

|

(87,149 |

) |

|

|

(38,766 |

) |

| Shareholder litigation

expense |

|

- |

|

|

|

- |

|

|

1,900 |

|

|

|

54,295 |

|

| Asset impairments |

|

3,513 |

|

|

|

5,177 |

|

|

3,513 |

|

|

|

9,351 |

|

|

Adjusted EBITDA |

$ |

68,414 |

|

|

$ |

100,895 |

|

$ |

227,957 |

|

|

$ |

298,868 |

|

GUIDANCE -- CALCULATION OF ADJUSTED NET INCOME, FUNDS

FROM OPERATIONS, EBITDA & ADJUSTED EBITDA

| |

For the Year Ending December 31,

2022 |

| |

Low End of Guidance |

|

High End of Guidance |

|

Net income |

$ |

110,105 |

|

|

$ |

114,105 |

|

|

Expenses associated with debt repayments and refinancing

transactions |

|

7,588 |

|

|

|

7,588 |

|

|

Gain on sale of real estate assets, net |

|

(87,149 |

) |

|

|

(87,149 |

) |

|

Shareholder litigation expense |

|

1,900 |

|

|

|

1,900 |

|

|

Asset impairments |

|

3,513 |

|

|

|

3,513 |

|

|

Income tax expense for special items |

|

19,543 |

|

|

|

19,543 |

|

| Adjusted net income |

$ |

55,500 |

|

|

$ |

59,500 |

|

| |

|

|

|

| Net income |

$ |

110,105 |

|

|

$ |

114,105 |

|

|

Depreciation and amortization of real estate assets |

|

97,000 |

|

|

|

97,500 |

|

|

Gain on sale of real estate assets, net |

|

(87,149 |

) |

|

|

(87,149 |

) |

|

Asset impairments |

|

3,513 |

|

|

|

3,513 |

|

|

Income tax benefit for special items |

|

22,164 |

|

|

|

22,164 |

|

| Funds From Operations |

$ |

145,633 |

|

|

$ |

150,133 |

|

|

Expenses associated with debt repayments and refinancing

transactions |

|

7,588 |

|

|

|

7,588 |

|

|

Shareholder litigation expense |

|

1,900 |

|

|

|

1,900 |

|

|

Income tax benefit for special items |

|

(2,621 |

) |

|

|

(2,621 |

) |

| Normalized Funds From

Operations |

$ |

152,500 |

|

|

$ |

157,000 |

|

| Diluted EPS |

$ |

0.93 |

|

|

$ |

0.96 |

|

| Adjusted Diluted EPS |

$ |

0.47 |

|

|

$ |

0.50 |

|

| FFO per diluted share |

$ |

1.22 |

|

|

$ |

1.26 |

|

| Normalized FFO per diluted

share |

$ |

1.28 |

|

|

$ |

1.32 |

|

| |

|

|

|

| Net income |

$ |

110,105 |

|

|

$ |

114,105 |

|

| Interest expense |

|

96,500 |

|

|

|

95,500 |

|

| Depreciation and

amortization |

|

128,000 |

|

|

|

128,000 |

|

| Income tax expense |

|

41,043 |

|

|

|

40,543 |

|

| EBITDA |

$ |

375,648 |

|

|

$ |

378,148 |

|

|

Expenses associated with debt repayments and refinancing

transactions |

|

7,588 |

|

|

|

7,588 |

|

|

Gain on sale of real estate assets, net |

|

(87,149 |

) |

|

|

(87,149 |

) |

|

Asset impairments |

|

3,513 |

|

|

|

3,513 |

|

|

Shareholder litigation expense |

|

1,900 |

|

|

|

1,900 |

|

|

Adjusted EBITDA |

$ |

301,500 |

|

|

$ |

304,000 |

|

NOTE TO SUPPLEMENTAL FINANCIAL INFORMATION

Adjusted Net Income, EBITDA, Adjusted EBITDA, FFO, and

Normalized FFO, and, where appropriate, their corresponding per

share metrics are non-GAAP financial measures. The Company believes

that these measures are important operating measures that

supplement discussion and analysis of the Company's results of

operations and are used to review and assess operating performance

of the Company and its properties and their management teams. The

Company believes that it is useful to provide investors, lenders

and security analysts disclosures of its results of operations on

the same basis that is used by management.

FFO, in particular, is a widely accepted non-GAAP supplemental

measure of performance of real estate companies, grounded in the

standards for FFO established by the National Association of Real

Estate Investment Trusts (NAREIT). NAREIT defines FFO

as net income computed in accordance with GAAP, excluding gains (or

losses) from sales of property and extraordinary items, plus

depreciation and amortization of real estate and impairment of

depreciable real estate and after adjustments for unconsolidated

partnerships and joint ventures calculated to reflect funds from

operations on the same basis. EBITDA, Adjusted EBITDA,

and Normalized FFO are useful as supplemental measures of

performance of the Company's properties because such measures do

not take into account depreciation and amortization, or with

respect to EBITDA, the impact of the Company's tax provisions and

financing strategies. Because the historical cost accounting

convention used for real estate assets requires depreciation

(except on land), this accounting presentation assumes that the

value of real estate assets diminishes at a level rate over

time. Because of the unique structure, design and use

of the Company's properties, management believes that assessing

performance of the Company's properties without the impact of

depreciation or amortization is useful. The Company may make

adjustments to FFO from time to time for certain other income and

expenses that it considers non-recurring, infrequent or unusual,

even though such items may require cash settlement, because such

items do not reflect a necessary or ordinary component of the

ongoing operations of the Company. Normalized FFO

excludes the effects of such items. The Company calculates Adjusted

Net Income by adding to GAAP Net Income expenses associated with

the Company’s debt repayments and refinancing transactions, and

certain impairments and other charges that the Company believes are

unusual or non-recurring to provide an alternative measure of

comparing operating performance for the periods presented.

Other companies may calculate Adjusted Net Income, EBITDA,

Adjusted EBITDA, FFO, and Normalized FFO differently than the

Company does, or adjust for other items, and therefore

comparability may be limited. Adjusted Net Income,

EBITDA, Adjusted EBITDA, FFO, and Normalized FFO and, where

appropriate, their corresponding per share measures are not

measures of performance under GAAP, and should not be considered as

an alternative to cash flows from operating activities, a measure

of liquidity or an alternative to net income as indicators of the

Company's operating performance or any other measure of performance

derived in accordance with GAAP. This data should be

read in conjunction with the Company's consolidated financial

statements and related notes included in its filings with the

Securities and Exchange Commission.

| Contact: |

Investors: Cameron Hopewell -

Managing Director, Investor Relations - (615) 263-3024 |

| |

Financial Media: David Gutierrez,

Dresner Corporate Services - (312) 780-7204 |

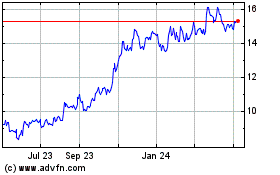

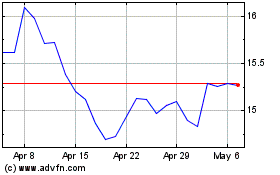

CoreCivic (NYSE:CXW)

Historical Stock Chart

From Jun 2024 to Jul 2024

CoreCivic (NYSE:CXW)

Historical Stock Chart

From Jul 2023 to Jul 2024