UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2023

Commission File Number: 001-34563

CONCORD MEDICAL SERVICES HOLDINGS LIMITED

Room 2701-05, Tower A, Global Trade Center

36 North Third Ring Road East, Dongcheng District

Beijing 100013

People’s Republic of China

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form

20-F x Form

40-F ¨

Concord Medical Reports Financial Results for

the First Half of 2023

BEIJING, September 22, 2023 /PRNewswire/ -- Concord

Medical Services Holdings Limited (“Concord Medical” or the “Company”) (NYSE: CCM), a healthcare provider specialized

in cancer treatment, research, education and prevention by establishing proton centers and cancer hospitals and operating an extensive

network of radiotherapy and diagnostic imaging centers in China, today announced its unaudited consolidated financial results for the

six months ended June 30, 2023[1].

2023 First Half Highlights

• Total net revenues were RMB284.5 million

(US$39.2 million) in the first half of 2023, representing a 97.2% increase from total net revenues of RMB144.3 million in the same period

last year. Total net revenues included the net revenues from the hospital business of RMB158.7 million (US$21.9 million) and the net revenues

from the network business of RMB125.8 million (US$17.3 million).

• Gross loss was RMB37.4 million (US$5.2

million) in the first half of 2023, compared to the gross loss of RMB88.7 million in the first half of 2022. The gross loss margin was

13.2% for the first half of 2023, compared to 61.5% for the same period last year.

• Net loss attributable to ordinary shareholders

in the first half of 2023 was RMB91.0 million (US$12.5 million), compared to RMB114.7 million in the same period last year.

• Basic and diluted loss per share for

Class A and Class B ordinary shares in the first half of 2023 were both RMB0.69 (US$0.10), compared to RMB0.87 in the same period last

year.

• Non-GAAP[2] net loss in the

first half of 2023 was RMB210.3 million (US$29.0 million), compared to non-GAAP net loss of RMB270.0 million in the same period last year.

Non-GAAP basic and diluted loss per share for Class A and Class B ordinary shares in the first half of 2023 were both RMB0.69 (US$0.10),

compared to RMB0.93 in the same period last year.

• Adjusted EBITDA[3] (non-GAAP)

was negative RMB148.4 million (US$20.5 million) in the first half of 2023, compared to negative RMB194.3 million in the same period last

year.

[1] This

announcement contains translations of certain RMB amounts into U.S. dollars at specified rates solely for the convenience of the reader.

Unless otherwise noted, all translations of RMB into U.S. dollars are made at a rate of RMB7.2513 to US$1.00, the noon buying rate in

New York City for cable transfers payable in RMB, as certified for customs purposes by the Federal Reserve Bank of New York on June 30,

2023.

[2] Non-GAAP

net loss and non-GAAP basic and diluted loss per share for Class A and Class B ordinary shares are defined as their most directly comparable

GAAP measures excluding the impact of share-based compensation expenses.

[3] Adjusted

EBITDA is defined as net income/(loss) plus interest expenses, net, income tax expenses, depreciation and amortization, share-based compensation

expenses and other adjustments. Other adjustments include foreign exchange gain/(loss), net, other (expense)/income, net, gain on disposal

of equity method investment and gain on disposal of long-lived equipment.

Dr. Jianyu Yang, Chairman and Chief Executive

Officer of Concord Medical, commented, “Concord Medical has delivered an outstanding performance in the first half of 2023, with

both its hospital business and network business achieving nearly 100% growth in terms of revenue. Although the hospital business is still

in its ramp-up period, its profitability is expected to improve as revenue gradually increases. On the other hand, Concord Medical’s

flagship hospital, Guangzhou Concord Cancer Center (“Guangzhou Hospital”), has completed the patient treatment clinical trials

for its proton therapy equipment for the upcoming official launch of the proton center. Our network business is currently on track, and

we will expedite the completion of existing orders while executing our market expansion plan as scheduled. We are confident that Concord

Medical will continue to deliver great performance throughout 2023.”

2023 First Half Financial Results

Net Revenues

Hospital Business

Net revenues from the hospital business were RMB158.7

million (US$21.9 million) in the first half of 2023, representing a 91.5% increase from net revenues of RMB82.9 million in the first half

of 2022, mainly due to (1) gradually development and ramping up of Guangzhou Hospital and (2) business recovery of our three medical institutions

located in Shanghai, which were negatively affected by COVID-19 pandemic in the first half of 2022.

Network Business

Net revenues from the network business were RMB125.8

million (US$17.3 million), representing a 104.9% increase from net revenues of RMB61.4 million in the first half of 2022, mainly because

the business recovery of medical solutions since the relief of restrictive policies during the COVID-19 outbreaks.

Cost of Revenues

Hospital Business

Cost of revenues of the hospital business in the

first half of 2023 was RMB204.4 million (US$28.2 million), representing a 13.8% increase from cost of revenues of RMB179.7 million in

the first half of 2022, mainly because the increase of consumables and maintenance cost, lease cost and staff cost along with the development

of hospital business.

Network Business

Cost of revenues of the network business was RMB117.5

million (US$16.2 million), representing a 120.4% increase from RMB53.3 million in the first half of 2022, generally in line with the increase

in the net revenues from medical solutions.

Gross (Loss)/Profit and Gross Margin

Hospital Business

Gross loss from the hospital business was RMB45.7

million (US$6.3 million) in the first half of 2023, compared to RMB96.8 million in the same period last year. The gross loss margin of

the hospital business for the first half of 2023 was 28.8%, compared to the gross loss margin of 116.8% for the same period last year.

The improvement in gross loss margin of the hospital business was primarily because the increase in revenue generated from our hospital

business outpaced the increase in corresponding costs along with the ramping up of our medical institutions and their business recovery

from the impact of COVID-19 outbreaks.

Network Business

Gross profit from the network business was RMB8.3

million (US$1.1 million), compared to the gross profit of RMB8.1 million in the first half of 2022. The gross profit margin of the network

business for the first half of 2023 was 6.6%, compared to the gross profit margin of 13.2% for the same period last year. The decrease

in gross profit margin of the network business was primarily due to (1) the expiration of agreements with certain management and technical

support customers and less ongoing software development projects for our software development services, which resulted in the decrease

in our revenue generated from management and technical support, while we still incurred relatively stable fixed costs, and (2) the cooperation

with new customers at the initial stage with higher cost.

Operating Expenses

Selling expenses were RMB26.4 million (US$3.6

million) in the first half of 2023, compared to RMB26.4 million in the first half of 2022. Selling expenses as a percentage of net revenues

was 9.3% in the first half of 2023, compared to 18.3% in the first half of 2022.

General and administrative expenses were RMB150.2

million (US$20.7 million) in the first half of 2023, of which employee benefit expenses were RMB69.7 million (US$9.6 million). In the

same period of last year, general and administrative expenses were RMB130.5 million. The increase was mainly attributable to the increase

in provisions for allowance for doubtful accounts of accounts receivable and other receivables included in prepayments and other current

assets. General and administrative expenses as a percentage of net revenues was 52.8% in the first half of 2023, compared to 90.4% in

the first half of 2022.

Capital Expenditures

Comparing to RMB184.0 million in the first half

of 2022, capital expenditures were RMB46.5 million (US$6.4 million) in the first half of 2023, mainly due to the decrease in construction

fees and medical equipment payment for our hospital business.

Accounts Receivable

As of June 30, 2023, accounts receivable were

RMB98.1 million (US$13.5 million), representing a 24.7% decrease from accounts receivable of RMB130.3 million as of December 31, 2022.

The average period of sales outstanding for accounts receivable (also known as days sales outstanding) was 158 days in the first half

of 2023.

Bank Loans and Other Borrowings

As of June 30, 2023, the Company had bank loans

and other borrowings totaling RMB3.0 billion (US$415.2 million).

About Non-GAAP Financial Measures

To supplement the consolidated financial statements

presented in accordance with United States Generally Accepted Accounting Principles (“GAAP”), Concord Medical uses certain

non-GAAP measures. The Company presents certain of its financial information that is adjusted from results based on GAAP to exclude the

impact of share-based compensation expenses, such as non-GAAP net loss and non-GAAP basic and diluted loss per share for Class A and Class

B ordinary shares. The Company believes excluding share-based compensation expenses from its GAAP financial measures is useful for its

management and investors to assess and analyze the Company’s core operating results, as such expense is not directly attributable

to the underlying performance of the Company’s business operations and do not impact its current cash earnings. Concord Medical

also believes these non-GAAP measures excluding share-based compensation expenses are important in helping investors to understand the

Company’s current financial performance and future prospects and to compare business trends among different reporting periods on

a consistent basis. In addition, Concord Medical also presents the non-GAAP measure of adjusted EBITDA, which is defined in this announcement

as net income/(loss) plus interest expenses, net, income tax expenses, depreciation and amortization, share-based compensation expenses

and other adjustments. Other adjustments include foreign exchange gain/(loss), net, other (expense)/income, net, gain on disposal of equity

method investment and gain on disposal of long-lived equipment. Furthermore, adjusted EBITDA eliminates the impact of items that the Company

does not consider to be indicative of the performance of the network business and hospital business. The Company believes investors will

similarly use adjusted EBITDA as one of the key metrics to evaluate its financial performance and to compare its current operating results

with corresponding historical periods and with other companies in the healthcare services industry. The presentation of these additional

measures should not be considered a substitute for or superior to GAAP results or as being comparable to results reported or forecasted

by other companies. The non-GAAP measures have been reconciled to GAAP measures in the attached financial information.

About Concord Medical

Concord Medical Services Holdings Limited is a

healthcare provider featuring a full cycle of premium oncology services including cancer diagnosis, treatment, education and prevention.

The Company focuses on providing multidisciplinary cancer care in all aspects of oncology healthcare services in its cancer hospitals

and equipping them with technologically advanced equipment such as the state-of-the-art proton therapy system. The Company is striving

to improve the quality and accessibility of cancer care through its network of self-owned cancer hospitals and clinics as well as partnered

hospitals across China. For more information, please see http://ir.ccm.cn.

Safe Harbor Statement

This announcement contains forward-looking statements.

These forward-looking statements can be identified by words or phrases such as “will,” “expects,” “anticipates,”

“future,” “intends,” “plans,” “believes,” “estimates” and similar expressions.

Forward-looking statements are inherently subject to uncertainties and contingencies beyond the Company’s control and based upon

premises with respect to future business decisions, which are subject to change. A number of important factors could cause actual results

to differ materially from those contained in any forward-looking statement. The Company does not undertake any obligation to update any

forward-looking statement, except as required under applicable law.

For more information, please contact:

Concord Medical Services Holdings Limited

Investor Relations

+86 10 5903 6688

ir@ccm.cn

Concord Medical Services Holdings Co., Ltd.

Consolidated Balance Sheets

(in thousands)

| | |

December 31, | | |

| |

| | |

2022 | | |

June 30, 2023 | |

| | |

RMB | | |

RMB | | |

US$ | |

| | |

(Audited) | | |

(Unaudited) | | |

(Unaudited) | |

| ASSETS | |

| | | |

| | | |

| | |

| Current assets | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

| 158,283 | | |

| 243,382 | | |

| 33,564 | |

| Restricted cash, current portion | |

| 1,060 | | |

| 21,203 | | |

| 2,924 | |

| Accounts receivable, net | |

| 130,271 | | |

| 98,109 | | |

| 13,530 | |

| Prepayments and other current assets, net | |

| 385,351 | | |

| 445,453 | | |

| 61,431 | |

| Inventories | |

| 84,835 | | |

| 42,691 | | |

| 5,887 | |

| Total current assets | |

| 759,800 | | |

| 850,838 | | |

| 117,336 | |

| | |

| | | |

| | | |

| | |

| Non-current assets | |

| | | |

| | | |

| | |

| Property, plant and equipment, net | |

| 3,259,145 | | |

| 3,262,114 | | |

| 449,866 | |

| Right-of-use assets, net | |

| 594,897 | | |

| 593,014 | | |

| 81,780 | |

| Goodwill | |

| 575,427 | | |

| 575,427 | | |

| 79,355 | |

| Intangible assets, net | |

| 353,766 | | |

| 340,121 | | |

| 46,905 | |

| Deposits for non-current assets | |

| 8,932 | | |

| 4,645 | | |

| 641 | |

| Long-term investments | |

| 437,874 | | |

| 423,059 | | |

| 58,343 | |

| Other non-current assets | |

| 15,093 | | |

| 20,852 | | |

| 2,876 | |

| Total non-current assets | |

| 5,245,134 | | |

| 5,219,232 | | |

| 719,766 | |

| | |

| | | |

| | | |

| | |

| Total assets | |

| 6,004,934 | | |

| 6,070,070 | | |

| 837,102 | |

| | |

| | | |

| | | |

| | |

| LIABILITIES AND EQUITY | |

| | | |

| | | |

| | |

| Current liabilities | |

| | | |

| | | |

| | |

| Accounts payable | |

| 146,748 | | |

| 131,587 | | |

| 18,147 | |

| Accrued expenses and other liabilities | |

| 419,881 | | |

| 414,746 | | |

| 57,195 | |

| Income tax payable | |

| 818 | | |

| 1,696 | | |

| 234 | |

| Operating lease liabilities, current | |

| 35,916 | | |

| 42,606 | | |

| 5,876 | |

| Short-term bank and other borrowings | |

| 168,601 | | |

| 213,186 | | |

| 29,400 | |

| Long-term bank and other borrowings, current portion | |

| 343,982 | | |

| 526,528 | | |

| 72,612 | |

| Derivative liability | |

| 5,290 | | |

| 5,562 | | |

| 767 | |

| Total current liabilities | |

| 1,121,236 | | |

| 1,335,911 | | |

| 184,231 | |

| | |

| | | |

| | | |

| | |

| Non-current liabilities | |

| | | |

| | | |

| | |

| Long-term bank and other borrowings, non-current portion | |

| 2,471,427 | | |

| 2,271,445 | | |

| 313,247 | |

| Deferred tax liabilities | |

| 112,577 | | |

| 105,647 | | |

| 14,569 | |

| Operating lease liabilities, non-current | |

| 199,953 | | |

| 201,145 | | |

| 27,739 | |

| Other long-term liabilities | |

| 84,084 | | |

| 67,980 | | |

| 9,375 | |

| Total non-current liabilities | |

| 2,868,041 | | |

| 2,646,217 | | |

| 364,930 | |

| | |

| | | |

| | | |

| | |

| Total liabilities | |

| 3,989,277 | | |

| 3,982,128 | | |

| 549,161 | |

| | |

| | | |

| | | |

| | |

| EQUITY | |

| | | |

| | | |

| | |

| Class A ordinary shares | |

| 68 | | |

| 68 | | |

| 10 | |

| Class B ordinary shares | |

| 37 | | |

| 37 | | |

| 5 | |

| Treasury stock | |

| (7 | ) | |

| (7 | ) | |

| (1 | ) |

| Additional paid-in capital | |

| 1,930,633 | | |

| 2,026,075 | | |

| 279,409 | |

| Accumulated other comprehensive loss | |

| (27,766 | ) | |

| (45,137 | ) | |

| (6,225 | ) |

| Accumulated deficit | |

| (3,766,931 | ) | |

| (3,857,916 | ) | |

| (532,031 | ) |

| Total Concord Medical Services Holdings Limited shareholders' deficit | |

| (1,863,966 | ) | |

| (1,876,880 | ) | |

| (258,833 | ) |

| Noncontrolling interests | |

| 3,879,623 | | |

| 3,964,822 | | |

| 546,774 | |

| | |

| | | |

| | | |

| | |

| Total equity | |

| 2,015,657 | | |

| 2,087,942 | | |

| 287,941 | |

| | |

| | | |

| | | |

| | |

| Total liabilities and equity | |

| 6,004,934 | | |

| 6,070,070 | | |

| 837,102 | |

Concord Medical Services Holdings Co., Ltd.

Consolidated Profit & Loss

(in thousands, except for number of shares and

per share data)

| | |

June 30, 2022 | | |

June 30, 2023 | |

| | |

RMB | | |

RMB | | |

US$ | |

| | |

(Unaudited) | | |

(Unaudited) | | |

(Unaudited) | |

| Revenues, net of business tax, value-added tax and related surcharges | |

| | | |

| | | |

| | |

| Hospital | |

| 82,865 | | |

| 158,707 | | |

| 21,887 | |

| Network | |

| 61,397 | | |

| 125,806 | | |

| 17,349 | |

| Total net revenues | |

| 144,262 | | |

| 284,513 | | |

| 39,236 | |

| Cost of revenues: | |

| | | |

| | | |

| | |

| Hospital | |

| (179,686 | ) | |

| (204,433 | ) | |

| (28,193 | ) |

| Network | |

| (53,311 | ) | |

| (117,503 | ) | |

| (16,204 | ) |

| Total cost of revenues | |

| (232,997 | ) | |

| (321,936 | ) | |

| (44,397 | ) |

| | |

| | | |

| | | |

| | |

| Gross loss | |

| (88,735 | ) | |

| (37,423 | ) | |

| (5,161 | ) |

| | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | |

| Selling expenses | |

| (26,416 | ) | |

| (26,362 | ) | |

| (3,635 | ) |

| General and administrative expenses | |

| (130,466 | ) | |

| (150,240 | ) | |

| (20,719 | ) |

| | |

| | | |

| | | |

| | |

| Operating loss | |

| (245,617 | ) | |

| (214,025 | ) | |

| (29,515 | ) |

| Interest expense | |

| (68,325 | ) | |

| (84,374 | ) | |

| (11,636 | ) |

| Foreign exchange gain/(loss), net | |

| 33,881 | | |

| (2,444 | ) | |

| (337 | ) |

| Gain on disposal of long-lived equipment | |

| - | | |

| 62 | | |

| 9 | |

| Interest income | |

| 3,562 | | |

| 5,800 | | |

| 800 | |

| Income from equity method investments | |

| 5,488 | | |

| 10,099 | | |

| 1,393 | |

| Other (expense)/income, net | |

| (850 | ) | |

| 13,623 | | |

| 1,879 | |

| Gain on disposal of equity method investment | |

| - | | |

| 37,498 | | |

| 5,171 | |

| | |

| | | |

| | | |

| | |

| Loss before income tax | |

| (271,861 | ) | |

| (233,761 | ) | |

| (32,236 | ) |

| Income tax expenses | |

| 9,677 | | |

| 23,417 | | |

| 3,229 | |

| Net loss | |

| (262,184 | ) | |

| (210,344 | ) | |

| (29,007 | ) |

| | |

| | | |

| | | |

| | |

| Net loss attributable to noncontrolling interests | |

| (147,532 | ) | |

| (119,359 | ) | |

| (16,460 | ) |

| Net loss attributable to Concord Medical Services Holdings Limited | |

| (114,652 | ) | |

| (90,985 | ) | |

| (12,547 | ) |

| | |

| | | |

| | | |

| | |

| Loss per share for Class A and Class B ordinary shares | |

| | | |

| | | |

| | |

| Basic | |

| (0.87 | ) | |

| (0.69 | ) | |

| (0.10 | ) |

| Diluted | |

| (0.87 | ) | |

| (0.69 | ) | |

| (0.10 | ) |

| | |

| | | |

| | | |

| | |

| Weighted average number of class A and class B ordinary shares outstanding: | |

| | | |

| | | |

| | |

| Basic | |

| 131,053,858 | | |

| 131,053,858 | | |

| 131,053,858 | |

| Diluted | |

| 131,053,858 | | |

| 131,053,858 | | |

| 131,053,858 | |

| Other comprehensive loss, net of tax of nil | |

| | | |

| | | |

| | |

| Foreign currency translation, net tax of nil | |

| (41,890 | ) | |

| (17,371 | ) | |

| (2,396 | ) |

| Total other comprehensive loss, net of tax | |

| (41,890 | ) | |

| (17,371 | ) | |

| (2,396 | ) |

| Comprehensive loss | |

| (304,074 | ) | |

| (227,715 | ) | |

| (31,403 | ) |

| Comprehensive loss attributable to noncontrolling interests | |

| (147,532 | ) | |

| (119,359 | ) | |

| (16,460 | ) |

| Comprehensive loss attributable to Concord Medical Services Holdings Limited’s shareholders | |

| (156,542 | ) | |

| (108,356 | ) | |

| (14,943 | ) |

Reconciliations of non-GAAP

results of operations measures to the nearest comparable GAAP measures (*)

(in RMB thousands, except per share data

unaudited)

| | |

For the six months ended | | |

For the six months ended | |

| | |

June 30, 2022 | | |

June 30, 2023 | |

| | |

| | |

| | |

Non- | | |

| | |

| | |

Non- | |

| | |

GAAP | | |

| | |

GAAP | | |

GAAP | | |

| | |

GAAP | |

| | |

Measure | | |

Adjustment | | |

Measure | | |

Measure | | |

Adjustment | | |

Measure | |

| Operating loss | |

| (245,617 | ) | |

| (7,861 | ) | |

| (253,478 | ) | |

| (214,025 | ) | |

| - | | |

| (214,025 | ) |

| Net loss | |

| (262,184 | ) | |

| (7,861 | ) | |

| (270,045 | ) | |

| (210,344 | ) | |

| - | | |

| (210,344 | ) |

Basic

loss per share for Class A and Class B ordinary shares | |

| (0.87 | ) | |

| (0.06 | ) | |

| (0.93 | ) | |

| (0.69 | ) | |

| - | | |

| (0.69 | ) |

Diluted

loss per share for Class A and Class B ordinary shares | |

| (0.87 | ) | |

| (0.06 | ) | |

| (0.93 | ) | |

| (0.69 | ) | |

| - | | |

| (0.69 | ) |

(*) The only adjustment is share-based compensation.

Reconciliation from net income

to adjusted EBITDA(*) (in RMB thousands, unaudited)

| | |

For the six months ended | | |

For the six months ended | |

| | |

June 30, 2022 | | |

June 30, 2023 | |

| Net loss | |

| (262,184 | ) | |

| (210,344 | ) |

| Interest expenses, net | |

| 64,763 | | |

| 78,574 | |

| Income tax expenses | |

| (9,677 | ) | |

| (23,417 | ) |

| Depreciation and amortization | |

| 53,732 | | |

| 55,537 | |

| Share-based compensation | |

| (7,861 | ) | |

| - | |

| Other adjustments | |

| (33,031 | ) | |

| (48,739 | ) |

| Adjusted EBITDA | |

| (194,258 | ) | |

| (148,389 | ) |

| EBITDA margin | |

| -135 | % | |

| -52 | % |

(*) Definition of adjusted EBITDA:

Adjusted EBITDA is defined as net loss plus interest expenses, net, income tax expenses, depreciation and amortization, share-based compensation

expenses and other adjustments. Other adjustments include foreign exchange gain/(loss), net, other (expense)/income, net, gain on disposal

of equity method investment and gain on disposal of long-lived equipment.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

CONCORD MEDICAL SERVICES HOLDINGS LIMITED |

| |

|

|

| |

By: |

/s/ Jianyu Yang |

| |

Name: |

Jianyu Yang |

| |

Title: |

Chairman and Chief Executive Officer |

Date: September 22, 2023

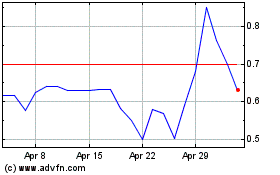

Concord Medical Services (NYSE:CCM)

Historical Stock Chart

From Dec 2024 to Jan 2025

Concord Medical Services (NYSE:CCM)

Historical Stock Chart

From Jan 2024 to Jan 2025