Canagold Resources Ltd. (TSX: CCM, OTC-QB: CRCUF, Frankfurt:

CANA) (“Canagold” or the “Company”) is pleased to announce the

Updated Mineral Resource Estimate for New Polaris Gold Project

located approximately 100 kilometres south of Atlin, BC.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20230516005466/en/

Figure 1: Classification of the Polaris

Resource

Underground Mineral Resource Estimate (MRE): 2.97 million

tonnes (Mt)@ 11.6 grams per tonne gold (gpt Au) for 1.11 million

ounces (Moz) contained gold Indicated and 0.93 Mt @ 8.93 gpt Au for

0.27 Moz contained gold Inferred.

Highlights:

- 89% increase in the Indicated category contained ounces

of gold compared to the 2019 preliminary economic assessment

(“PEA”) resource due to a very successful 2021-22 infill drill

program.

- 23% Increase to the overall resource tonnage due to the

additional veins defined by the 2021-22 infill drilling that were

integrated into the new geological model.

- Gold grade improvement by 8% in the Indicated category

to 11.61 gpt Au, up from 10.8 gpt Au in the 2019 PEA due to

the refined geological model constrained by the additional

drilling.

- The updated 2023 MRE provides the Indicated category resource

required to underpin the Feasibility Study announced on October 11,

2022.

“Canagold’s 2021-22 exploration program has proved highly

successful in reaching our primary objective of adding more gold

ounces into the Indicated category,” said Catalin Kilofliski,

CEO of Canagold Resources. “The Company’s goal has been to hit

our target of more than one million ounces to feed into the

feasibility study currently underway with Ausenco Engineering.

Right now, we’re working with a potential mine plan that targets

100,000 ounces per year based on an approximatively 10-year mine

life and assuming the current drilling depth we’ve achieved to

date.”

The updated 2023 MRE reflects the Company’s success in

completing an additional 40,000 meters (“m”) of infill drilling,

targeting areas of previously inferred category resource from the

2019 PEA. The refined geological model now includes 17 vein domains

of at least 2 metre width. A grade shell was applied to the block

model and any outlying mineralized volumes too small to be

considered to have “reasonable prospects for eventual economic

extraction” were discarded to create the resource at each Au cutoff

grade. A base case cutoff grade of 4 gpt Au was selected which

covers the preliminary mining, processing and G&A costs at the

base case Au price, and using the inputs as summarized in the Notes

to the resource table, below.

New Polaris - Resource

Estimate, effective date: April 20, 2023 and Comparison to 2019

PEA

2023 Resource

2019 Resource

Difference as a

Percent:

Class

Cutoff

Tonnage (ktonnes)

Au (gpt)

Au (koz)

Tonnage (ktonnes)

Au (gpt)

Au (koz)

(2023-2019)/2019

(Au gpt)

Tonnage

Au Grade

Au Metal

Indicated

3

3,118

11.21

1,124

1,798

10.40

601

73%

8%

87%

4

2,965

11.61

1,107

1,687

10.80

586

76%

8%

89%

5

2,769

12.11

1,078

1,556

11.30

565

78%

7%

91%

6

2,525

12.75

1,035

1,403

12.00

541

80%

6%

91%

7

2,270

13.45

981

1,260

12.60

510

80%

7%

92%

8

2,049

14.09

928

1,105

13.30

473

85%

6%

96%

9

1,814

14.81

864

947

14.10

429

92%

5%

101%

10

1,594

15.55

797

1,639

9.50

501

-3%

64%

59%

Inferred

3

1,061

8.24

281

1,582

9.80

498

-33%

-16%

-44%

4

926

8.93

266

1,483

10.20

486

-38%

-12%

-45%

5

817

9.52

250

1,351

10.70

465

-40%

-11%

-46%

6

706

10.16

231

1,223

11.20

440

-42%

-9%

-48%

7

603

10.78

209

942

12.50

379

-36%

-14%

-45%

8

491

11.52

182

753

13.80

334

-35%

-17%

-46%

9

371

12.51

149

653

14.60

307

-43%

-14%

-51%

10

291

13.33

125

0

0.00

0

Notes to the Resource Table:

- Mineral resources are not mineral reserves and do not have

demonstrated economic viability. There is no certainty that all or

any part of the mineral resources will be converted into mineral

reserves.

- Resources are reported using the 2014 CIM Definition Standards

and were estimated using the 2019 CIM Best Practices

Guidelines.

- The base case Mineral Resource has been confined by "reasonable

prospects of eventual economic extraction" shape using the

following assumptions:

- Metal prices of US$1,750/oz Au and Forex of 0.75 $US:$CDN;

- Payable metal of 99% Au;

- Offsite costs (refining, transport and insurance) of

US$7/oz;

- Mining cost of CDN$82.78/t , Processing costs of CDN$105.00/t

and G&A and site costs of CDN$66.00/t.

- Metallurgical Au recovery of 90.5%;

- NSR (CDN$/t)=Au*90.5%*US$74.72g/t;

- The specific gravity is 2.81 for the entire deposit;

- Numbers may not add due to rounding.

About the Mineral Resource Estimate

- A comprehensive statistical review of all available QA/QC assay

data from the drilling was undertaken as part of the 2023 MRE.

- Interpolation was by inverse distance squared (“ID2”), which is

a change from Ordinary kriging used in the 2019 PEA. However,

variograms were created on a global basis to aid in determination

of Classification parameters.

- Gold values were capped for each individual domain of the

geological model based on statistical probability plots.

- The 2023 MRE is based on a 5 m block model using a Percentage

Model (meaning that the percentage of the block within the domain

is used for the MRE).

- A constant specific gravity of 2.81 g/cc is used for all blocks

in the model, based on an average of measured sample SG’s.

- Indicated classification of a block required either 1) average

distance to two drill holes of 35 m, maximum distance 50 m and

minimum number of two quadrants, or 2) average distance to two

drill holes of 50 m, maximum distance 70 m and minimum number of

two quadrants, or 3) distance to closest drill hole of 10 m,

maximum distance of 50 m used and minimum number of three drill

holes used.

- The classification was checked for cohesiveness, with a

cohesive shape of Indicated and Inferred material produced.

- The base case cutoff grade of 4 gpt Au is based on a

US$1,750/ounce price of gold and preliminary recovery, processing

and mining costs which are based on preliminary production rate

values as summarized in the Notes to the resource table.

- The 2023 MRE table presents undiluted values of gold grade and

contained gold ounces.

- The following factors, among others, could affect the 2023 MRE:

assumptions used in generating confining shapes, stope design;

mining methods; metal recoveries, mining and process cost

assumptions and commodity price and exchange rate assumptions. The

QP is not aware of any environmental, permitting, legal, title,

taxation, socioeconomic, marketing, political, or other relevant

factors that could materially affect the 2023 MRE.

About New Polaris

New Polaris is Canagold’s flagship asset, which is the 100%

owned gold mine project located in northwestern B.C. about 100

kilometres south of Atlin, B.C. and 60 kilometres northeast of

Juneau, Alaska. The property consists of 61 contiguous

Crown-granted mineral claims and one modified grid claim covering

850 hectares. New Polaris lies within the Taku River Tlingit First

Nation (“TRTFN”) traditional territory. Canagold is firmly

committed to working closely with the TRFTN on all aspects of

project’s, consultations, planning and future development plans.

The Company’s primary objective is to build a successful long-term

partnership with TRTFN, in order to plan and create together a

project with a long-lasting positive impact on the environment, the

members of the TRTFN, the local community of Atlin and other

surrounding communities.

Feasibility Study

The updated Mineral Resource Estimate will be integrated into

the New Polaris Feasibility Study (“FS”) that commenced in 2022 and

that the Company continues to advance over the course of 2023.

The FS is a definitive study building on the 2019 Preliminary

Economic Assessment (“PEA”) that demonstrated reasonable prospects

for eventual economic extraction of the New Polaris Project. Using

a gold price of US $1,500 per oz, the PEA indicated cash costs of

US$400 per oz, an after-tax Net Present Value (NPV with 5%

discount) of CA$469 million with an after-tax Internal Rate of

Return (IRR) of 56% and a 1.9 year pay-back period.

The PEA proposed an underground mine with a 750 tonnes per day

(tpd) process plant that would operate year-round, producing

approximately 80 koz of dore■ gold annually at full production. The

project site would include an on-site camp and airstrip, as well as

a downstream barge landing site. Major bulk supplies for mining and

processing would be barged along the Taku River to the barge

landing site between May and September. Minor supplies and

personnel would be flown to and from the mine site via small

aircraft or helicopter.

Backed by the positive results of the updated Mineral Resource

Estimate, the Company is evaluating the prospect of increased

annual gold production, potentially increasing the throughput

design basis underlying the FS.

The FS is supported by Ausenco Engineering Canada Inc.

(“Ausenco”) who have been retained to provide basic engineering and

study services for surface infrastructure and the process plant,

freight logistics and environmental baseline work. AMC Mining

Consultants (Canada) Ltd. (“AMC”) have been retained to provide all

study requirements associated with mining. The Company expects to

conclude the FS during 2024.

Qualified Person

The 2023 MRE was prepared by Sue Bird, M Sc., P.Eng. V.P. of

Resources and Engineering at Moose Mountain Technical Services, an

independent Qualified Person as defined by NI 43-101. Sue has also

reviewed and approved the technical information about the 2023 MRE

contained in this news release.

Garry Biles, P.Eng, President & COO for Canagold Resources

Ltd, is the Qualified Person who reviewed and approved the contents

of this news release.

About Canagold

Canagold Resources Ltd. is a growth-oriented gold exploration

company focused on advancing the New Polaris Project through

feasibility and permitting. Canagold is also seeking to grow its

assets base through future acquisitions of additional advanced

projects. The Company has access to a team of technical experts

that can help unlock significant value for all Canagold

shareholders.

“Catalin Kilofliski”

Catalin Kilofliski Chief Executive Officer

Neither the Toronto Stock Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX)

accepts responsibility for the adequacy or accuracy of this

release.

Cautionary Note Regarding Forward-Looking Statements

This news release contains “forward-looking statements” within

the meaning of the United States private securities litigation

reform act of 1995 and “forward-looking information” within the

meaning of applicable Canadian securities legislation. Statements

contained in this news release that are not historical facts are

forward-looking information that involves known and unknown risks

and uncertainties. Forward-looking statements in this news release

include, but are not limited to, statements with respect to the

future performance of Canagold, and the Company's plans and

exploration programs for its mineral properties, including the

timing of such plans and programs. In certain cases,

forward-looking statements can be identified by the use of words

such as "plans", "has proven", "expects" or "does not expect", "is

expected", "potential", "appears", "budget", "scheduled",

"estimates", "forecasts", "at least", "intends", "anticipates" or

"does not anticipate", or "believes", or variations of such words

and phrases or state that certain actions, events or results "may",

"could", "would", "should", "might" or "will be taken", "occur" or

"be achieved".

Forward-looking statements involve known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of the Company to be materially

different from any future results, performance or achievements

expressed or implied by the forward-looking statements. Such risks

and other factors include, among others risks related to the

uncertainties inherent in the estimation of mineral resources;

commodity prices; changes in general economic conditions; market

sentiment; currency exchange rates; the Company's ability to

continue as a going concern; the Company's ability to raise funds

through equity financings; risks inherent in mineral exploration;

risks related to operations in foreign countries; future prices of

metals; failure of equipment or processes to operate as

anticipated; accidents, labor disputes and other risks of the

mining industry; delays in obtaining governmental approvals;

government regulation of mining operations; environmental risks;

title disputes or claims; limitations on insurance coverage and the

timing and possible outcome of litigation. Although the Company has

attempted to identify important factors that could affect the

Company and may cause actual actions, events or results to differ

materially from those described in forward-looking statements,

there may be other factors that cause actions, events or results

not to be as anticipated, estimated or intended. There can be no

assurance that forward-looking statements will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements. Accordingly,

do not place undue reliance on forward-looking statements. All

statements are made as of the date of this news release and the

Company is under no obligation to update or alter any

forward-looking statements except as required under applicable

securities laws.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230516005466/en/

Knox Henderson, VP Corporate Development Tel: (604)

604-416-0337; Cell: (604) 551-2360 Toll Free: 1-877-684-9700 Email:

knox@canagoldresources.com Website: www.canagoldresources.com

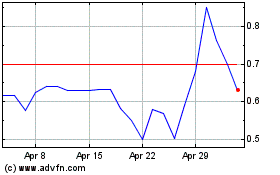

Concord Medical Services (NYSE:CCM)

Historical Stock Chart

From Dec 2024 to Jan 2025

Concord Medical Services (NYSE:CCM)

Historical Stock Chart

From Jan 2024 to Jan 2025