SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of March, 2023

Commission File Number 1-14732

COMPANHIA SIDERÚRGICA NACIONAL

(Exact name of registrant as specified in its charter)

National Steel Company

(Translation of Registrant's name into English)

Av. Brigadeiro Faria Lima 3400, 20º andar

São Paulo, SP, Brazil

04538-132

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports

under cover Form 20-F or Form 40-F. Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

São Paulo, March 8, 2023 - Companhia Siderúrgica

Nacional ("CSN") (B3: CSNA3) (NYSE: SID) discloses its fourth quarter of 2022 (4Q22) and 2022 yearly financial results

in Brazilian Reais, with all financial statements consolidated in accordance with accounting practices adopted in Brazil issued by the

Accounting Pronouncements Committee ("CPC"), approved by the Brazilian Securities and Exchange Commission ("CVM")

and the Federal Accounting Council ("CFC") and in accordance with international financial reporting standards (“IFRS”),

issued by the International Accounting Standards Board (“IASB”).

The comments address the Company's consolidated results

in the fourth quarter of 2022 (4Q22) and the compared are for the third quarter of 2022 (3Q22), the fourth quarter of 2021 (4Q21)

and the year 2021. The price of the dollar was BRL 5.58 at 12/31/2021; BRL 5.41 on September 30, 2022, and BRL 5.22 on 12/31/2022.

For more information, please visit our website: https://ri.csn.com.br/ | 2 |

| 2022 and 4Q22 FINANCIAL RESULT |

Consolidated Table - Highlights

¹ Adjusted EBITDA is calculated from net income

(loss), plus depreciation and amortization, taxes on income, net financial result, income from investment participation, income from other

operating income/expenses and includes a proportional participation of 37.27% of the EBITDA of the joint subsidiary MRS Logística.

² Adjusted Ebitda Margin is calculated from Adjusted

Ebitda divided by Management Net Revenue.

³ Adjusted Net Debt and Adjusted Cash/Availability

consider 37.27% of MRS, in addition to not considering Forfaiting and Cashed Risk transactions.

Consolidated Results

| · | Net revenue totaled BRL 11,129 million

in the 4Q22, which represents a 2.1% increase when compared to 3Q22 as a consequence of the higher volume of iron ore sold in the period,

in addition to the higher realized price and the positive effect of the incorporation of Cimentos Brasil (ex-Lafarge Holcim Brasil) in

the consolidated results. These factors eventually compensated for the weaker dynamics observed in the steel market at the end of the

year. In 2022, net revenue totaled BRL 44,362 million, an annual reduction of 7.4% due mainly to operational challenges in mining, related

to a high volume of rainfall observed at the beginning of the year, in addition to all the instability in international iron ore prices.

The result, however, was partially offset by important acquisitions made by the Company, such as Cimentos Brasil and CEEE-G, both with

their results consolidated now in 4Q22. |

| · | The cost of goods sold (COGS) totaled

BRL 7,847 million in 4Q22, a reduction of 6.2% compared to the previous quarter, as a result of the reduction in the costs of some raw

materials such as coke and coal, in addition to a greater dilution of fixed costs due to the increase in mining sold volumes. In 2022,

the COGS totaled BRL 31 billion, representing an increase of 20% compared to 2021, due to higher raw material costs throughout the year,

mainly in the steel industry. |

| · | As a consequence of lower cost pressure, the

gross margin for the quarter reached 29.5%, meaning an increase of 6.2 p.p. compared to 3Q22. This performance mainly reflects

the operational improvement observed in the mining segment and the reduction of raw material costs in the steel industry. In 2022, however,

gross margin reached 30% and was 16.1 p.p. lower than in 2021, a year marked by extraordinary results due to the strong commodities prices.

|

| · | Sales, general and administrative expenses

totaled BRL 1,213 million in 4Q22, 52% higher than in the previous quarter as a consequence of the higher volume of iron ore traded

and the incorporation of Cimentos Brasil's operations, which ended up compensating for a seasonal weaker quarter on sales for the Brazilian

market. In 2022, expenses totaled BRL 3,250 million, 9.8% higher than in 2021. |

| · | The group of other operating income and expenses

was negative in BRL 952 million in 4Q22, mainly as a result of the cash flow hedge accounting operations that totaled BRL 640 million

in the period. In the year, the net result was negative in BRL 2.7 billion, a reversal of results when compared to 2021, which was positively

impacted by the iron ore hedge that was not continued in 2022. |

| · | In 4Q22, the financial result was negative

in BRL 1,181 million, representing an increase of 271% compared to the previous quarter, as a consequence of a higher costs of debt, in

addition to the negative effect of exchange variation. In the year, the financial result was negative by BRL 3.5 billion, mainly impacted

by the increase in interest paid in the period and the negative adjustment in Usiminas’ share value observed in the year. |

For more information, please visit our website: https://ri.csn.com.br/ | 3 |

| 2022 and 4Q22 FINANCIAL RESULT |

·

The equity result was positive at R$ 71 million in 4Q22, a reduction

of 24% compared to the last quarter, as a consequence of seasonality with a weaker performance of MRS, caused by the constant rains recorded

in the quarter. In 2022, equity reached R$ 238 million, an annual increase of 30% due to MRS's solid operating performance throughout

the year.

·

In 4Q22, CSN recorded a Net Income of BRL 197 million, even considering

the greater impacts with financial expenses and exchange variation verified in the period. In 2022, net income was R$ 2.2 billion, a reduction

of 84% compared to 2021, a period marked by the Company's historical record of profitability and by the effect of CSN Mineração's

IPO.

Adjusted EBITDA

*The Company discloses its adjusted EBITDA excluding

participation in investments and other operating income (expenses) because it understands that it should not be considered in the calculation

of recurring operating cash generation.

| · | Adjusted EBITDA in 4Q22 was BRL 3,123

million, with an adjusted EBITDA margin of 27.1% or 3.2 p.p. above the one recorded last quarter. This operational increase is a direct

consequence of the improvement in mining results, which accounted for 57% of the quarter’s performance and more than offset the

weaker dynamics observed for the steel segment. In 2022, Adjusted EBITDA reached BRL 13,817 million, a 30.1% lower result than in 2021,

due to lower operating results for the year, reflecting price reductions in iron ore and higher raw material costs in the steel segment.

|

For more information, please visit our website: https://ri.csn.com.br/ | 4 |

| 2022 and 4Q22 FINANCIAL RESULT |

Adjusted EBITDA (BRL MM) and Adjusted

EBITDA Margin¹ (%)

¹ Adjusted EBITDA Margin is calculated from the

division between Adjusted EBITDA and Adjusted Net Revenue, which considers the 100% stakes in CSN Mineração's consolidation

and 37.27% in MRS.

Adjusted Cash Flow¹

Adjusted Cash Flow in 4Q22 was negative in BRL 146

million, affected mainly by the higher volumes of Capex and financial expenses, in addition to the increase in taxes paid in the period.

Adjusted Cash Flow¹ on 4Q22

(BRL MM)

¹ The concept of adjusted cash flow is calculated

from adjusted Ebitda, subtracting Ebitda from Jointly Controlled Companies, CAPEX, IT, Financial Results and Changes in Assets and Liabilities²,

excluding the effect of the Glencore advance.

² Adjusted Working Capital is composed by the

change in Net Working Capital, plus the change in accounts of long-term assets and liabilities and disregarding the net change in IT and

SC

Indebtedness

As of December 31, 2022, consolidated net debt reached

BRL 30,471 million, with the leverage indicator measured by the Net Debt/EBITDA ratio reaching 2.2x. This increase on leverage is a consequence

of a series of disbursements made through the period, mainly those related to the acquisition of CEEE-G like the disbursement of BRL 2.0

billion regarding the concession payment, in addition to distribution of dividends. However, when considering the resources with prepayment

of iron ore obtained in January in the debt at the end of the year, the leverage would be 2.0x and within the guidance disclosed by CSN,

which reinforces the transitory and exceptional effect of this leverage above the ceiling. Additionally, even with the largest volume

of financial disbursements, CSN maintained its policy of carrying a high cash, which in this quarter reached the level of BRL 12 billion.

For more information, please visit our website: https://ri.csn.com.br/ | 5 |

| 2022 and 4Q22 FINANCIAL RESULT |

¹ Net Debt / EBITDA: To calculate the debt considers

the final dollar of each period and for net debt and EBITDA the average dollar of the period.

The Company remains active in its goal of extending

the amortization period, focusing on long-term operations and the local capital market. Among the main movements of 4Q22, the 12th and

13th debentures were issued, in the amount of BRL 1.9 billion, with maturities in 2027, in addition, the conclusion of the 1st issue

of debentures from the Company’s subsidiary Prada in the amount of BRL 130 million maturing in 2024 and the 1st debenture

issue of the State Electric Power Generation Company - CEEE-G, in the amount of BRL 1.9 billion. also maturing in 2024.

Amortization Schedule (BRL Bi)

¹ IFRS: does not consider participation in MRS

(37.27%) .

² Gross Debt/Management Net considers participation

in MRS (37.27%) and gross interest.

3 Medium term after completion of the Liability

Management Plan.

Foreign Exchange Exposure

The accumulated net foreign

exchange exposure in the 2022 balance was USD 779 million, as shown in the table below, resulted from the increase in the Hedge Accounting

operations and in line with the company's policy of minimizing the impacts of exchange rate volatility on the result.

The Hedge Accounting adopted

by CSN correlates the projected flow of dollar exports with future debt maturities in the same currency. Thus, the exchange variation

of the dollar debt is temporarily recorded in the equity, being brought to the result when the dollar revenues from said exports occur.

For more information, please visit our website: https://ri.csn.com.br/ | 6 |

| 2022 and 4Q22 FINANCIAL RESULT |

Investments

A total of BRL 1,036

million were invested in 4Q22, a performance 23% higher

than the amount invested on last quarter, as a consequence of the acquisition of large equipment’s

for cement operations and the incorporation of current investments on the operations of Cimentos

Brasil. In the year, BRL 3,413 million were invested, an increase of 16% compared to 2021, mainly impacted by the Cimentos Brail incorporation

and the acceleration of Capex at the end of the year.

Net Working Capital

The Net Working Capital (NWC) applied to the business

totaled BRL 2,480 million in 4Q22, an increase of 85% when compared to 3Q22 as a consequence of the punctual increase in inventories

and accounts receivable, partially offset by the increase with suppliers. Compared to the same period last year, the Company's NWC was

66% higher, mainly impacted by the increase in receivables due to longer receipt times.

The calculation of the Net Working Capital applied

to the business does not take glencore's advance, as shown in the following table:

For more information, please visit our website: https://ri.csn.com.br/ | 7 |

| 2022 and 4Q22 FINANCIAL RESULT |

¹ Other CCL Assets: Considers

advance employees and other accounts receivable.

² Other CCL Liabilities:

Considers other accounts payable, dividends payable, installment taxes and other provisions.

³ Inventories: Does not

consider the effect of the provision for inventory losses. For the calculation of the SME are not considered the balances of warehouse

stocks.

Dividends

As disclosed on the Material Fact published on November

21, 2022, through the Asset Restructuring Agreement entered into between Rio Purus Participações S.A. and CFL Participações

S.A. (“CFL”), the shareholders committed to vote in favor of the distribution of dividends of up to BRL 2.3 billion at the

2023 Annual General Meeting. Therefore, the proposal for the allocation of results for the year 2022 reflects this amount, already considering

the R$ 700 million declared as interest on equity on December 23, 2022.

Closing of the CEEE-G

On October 21, 2022, the Company concluded the acquisition

process of 66.23% of the shares issued by the State Companhia Estadual de Geração de Energia Elétrica – CEEE-G

for the total price of BRL 928 million. The process also included the disbursement of more BRL 2.0 billion for the grant bonus. Additionally,

on December 22, 2022, CSN acquired another 32.74% stake of CEEE-G, for the transfer of shares held by Centrais Elétricas Brasileiras

S/A, in the amount of BRL 367 million. As a result, CSN now holds 99.0% of CEEE-G, adding 910Mw of Installed Capacity, with 15 own assets,

11 minority interests and 3 wind projects.

For more information, please visit our website: https://ri.csn.com.br/ | 8 |

| 2022 and 4Q22 FINANCIAL RESULT |

Results by Business Segments

For more information, please visit our website: https://ri.csn.com.br/ | 9 |

| 2022 and 4Q22 FINANCIAL RESULT |

| Result 4Q22 (BRL million) |

Steel |

Mining |

Logistics (Porto) |

Logistics (Railway) |

Energy |

Cement |

Corporate Expenses/Elimination |

Consolidated |

| |

|

|

|

|

|

|

|

|

| Net Revenue |

6,055 |

3,529 |

86 |

608 |

154 |

1,181 |

(483) |

11,129 |

| Domestic Market |

4,501 |

336 |

86 |

608 |

154 |

1,181 |

(949) |

5,917 |

| Foreign Market |

1,554 |

3,193 |

|

|

|

|

466 |

5,212 |

| COGS |

(5,214) |

(1,878) |

(58) |

(382) |

(139) |

(900) |

724 |

(7,847) |

| Gross profit |

840 |

1,651 |

28 |

226 |

15 |

281 |

241 |

3,282 |

| DGA/DVE |

(341) |

(139) |

(9) |

(52) |

(17) |

(148) |

(507) |

(1,213) |

| Depreciation |

326 |

268 |

11 |

96 |

29 |

132 |

(38) |

825 |

| Proportional EBITDA of joint contr |

|

|

|

|

|

|

229 |

229 |

| Adjusted EBITDA |

826 |

1,779 |

30 |

270 |

27 |

265 |

(75) |

3,123 |

| |

|

|

|

|

|

|

|

|

| Result 3Q22 (BRL million) |

Steel |

Mining |

Logistics (Porto) |

Logistics (Railway) |

Energy |

Cement |

Corporate Expenses/Elimination |

Consolidated |

| |

|

|

|

|

|

|

|

|

| Net Revenue |

7,698 |

2,527 |

69 |

653 |

48 |

778 |

(875) |

10,897 |

| Domestic Market |

5,655 |

437,50 |

69 |

653 |

48 |

778 |

(1,091) |

6,549 |

| Foreign Market |

2,044 |

2,089 |

|

|

|

|

215 |

4,348 |

| COGS |

(6,426) |

(1,800) |

(54) |

(397) |

(53) |

(501) |

873 |

(8,359) |

| Gross profit |

1,272 |

727 |

14 |

256 |

(5) |

276 |

(3) |

2,538 |

| DGA/DVE |

(334) |

(63) |

(7) |

(37) |

(10) |

(100) |

(248) |

(798) |

| Depreciation |

313 |

253 |

9 |

108 |

4 |

82 |

(78) |

689 |

| Proportional EBITDA of joint contr |

|

|

|

|

|

|

285 |

285 |

| Adjusted EBITDA |

1,251 |

916 |

16 |

327 |

(10) |

257 |

(44) |

2,713 |

| |

|

|

|

|

|

|

|

|

| Result 4Q21 (BRL million) |

Steel |

Mining |

Logistics (Porto) |

Logistics (Railway) |

Energy |

Cement |

Corporate Expenses/Elimination |

Consolidated |

| |

|

|

|

|

|

|

|

|

| Net Revenue |

7,648 |

2,401 |

86 |

444 |

47 |

423 |

(687) |

10,361 |

| Domestic Market |

4,966 |

447,97 |

86 |

444 |

47 |

423 |

(957) |

5,456 |

| Foreign Market |

2,682 |

1,953 |

|

|

|

|

270 |

4,905 |

| COGS |

(5,096) |

(1,669) |

(60) |

(342) |

(39) |

(269) |

869 |

(6,606) |

| Gross profit |

2,552 |

733 |

26 |

101 |

8 |

154 |

182 |

3,755 |

| DGVA |

(324) |

(86) |

(8) |

(42) |

(8) |

(72) |

(273) |

(814) |

| Depreciation |

285 |

232 |

8 |

119 |

4 |

56 |

(81) |

623 |

| Proportional EBITDA of joint contr |

|

|

|

|

|

|

163 |

163 |

| Adjusted EBITDA |

2,513 |

878 |

26 |

178 |

4 |

137 |

(10) |

3,727 |

Steel Result

According to the World Steel

Association (WSA), global crude steel production accrued 1,831.5 million tons (Mt) in 2022, representing a 4.3% decline compared to 2021,

also reflecting the effects of the conflict between Russia and Ukraine and its developments in the European market. In 2022, the European

Union reduced its production by 10.5% due to the closure of several steel plants as a consequence of the energy restriction verified after

the conflict began. In the year, only the Middle East showed increased production due to the announcement of major real estate and infrastructure

projects in the region. In turn, China produced 55.3% of the global volume (1,013 Mt), which corresponds to a retraction of 2.1 p.p. in

relation to the same period and 2021, mainly resulting from the direct impact of production interruptions due to covid's zero policy and

heat wave, which increased energy rationing in the country. However, the outlook for 2023 is positive as we see several stimuli being

announced to resume China's economic growth, apart from the easing of policies against Covid. Brazil produced 36.1Mt in 2022, which corresponds

to an annual decline of 5.8%, mainly impacted by the cost pressures faced throughout the year, in addition to a more difficult basis for

comparison due to the strong volumes verified in the previous year.

Steel Production (thousand tons)

In the case of CSN, plate production in 4Q22

totaled 959,000 tons, a performance 6.5% lower than in the previous quarter. In turn, the production of flat laminates, our main operation

market, reached 873 kton, which represents a 1.4% reduction compared to 3Q22, in line with the operational seasonality. In 2022, plate

production reached 3,774,000 tons, down 7.3% from the previous year, due to scheduled stoppages and pressures on production costs and

on the supply chain, due to the conflict between Russia and Ukraine.

For more information, please visit our website: https://ri.csn.com.br/ | 10 |

| 2022 and 4Q22 FINANCIAL RESULT |

Sales Volume (Kton) - Steel

Total sales reached 1,008 thousand tons in

the fourth quarter of 2022, a volume 1.6% lower than in the same period of 2021. When analyzing the behavior in the different markets,

it is perceived that the domestic market sales were the main responsible for the contraction, adding up to 740 thousand tons of

sold steel products, which represents a reduction of 14% when compared to 3Q22, as a result of the seasonality that was even more pronounced

at the end of this year due to the World Cup and uncertainties related to the political environment. In the foreign market, 4Q22 sales

totaled 269 thousand tons and were 11% lower than those in 3Q22, considering a lower sales volume verified in the European market. In

the quarter, 8,000 tons were exported directly and 261,000 tons were sold by subsidiaries abroad, of which 39,000 tons by LLC, 154,000

tons by SWT and 69,000 tons by Lusosider.

Regarding 2022, the total sold volume was 4,392 thousand

tons, a 4.6% lower level than in 2021, with 3,077 thousand tons being sold from the domestic market and 1,315 thousand tons abroad. Of

this total, the foreign market showed the greatest retraction (-7.8% p.a.) explained by the energy instability and lower growth rates

in the European market.

In relation to the total sales volume in 4Q22,

all segments showed a retraction compared to the previous quarter, with Industry (-25.7%) and Distribution (-9.4%) appearing among the

main highlights. In the annual comparison, the year was positive, with an increase in sales volume in most sectors, with Distribution

(+29.6%) and Construction (+20%) being the main beneficiaries and were partially offset by Home Appliances (-42.6%) and Packaging (-14.3%)

segments.

For more information, please visit our website: https://ri.csn.com.br/ | 11 |

| 2022 and 4Q22 FINANCIAL RESULT |

| According to ANFAVEA (Associação Nacional dos

Fabricantes de Veículos Automotores), the 2022 car production registered 2,370 thousand units, an increase of 5.4% in relation

to the previous quarter. The Association also projects a 2.2% growth for 2023, with a production of 2,421 thousand units of vehicles,

driven by a growth in light vehicles.

According to data from the Instituto Aço

Brasil (IABr), the production of Crude Steel in 2022 reached 26.7 Mton, a 6.3% lower performance than in 2021. Apparent Consumption

was 23.5 Mton, a 11% drop in the annual comparison. In turn, the Steel Industry Confidence Indicator for the month of December was 42.6

points, a reduction of 10.8 p.p. compared to September and below the 50-point dividing line, indicating lower confidence for the next

six months in the local market.

According to IBGE data, the production

of appliances for the year 2022 recorded a 13.3% reduction compared to the previous year. For 2023, the market is expected to perform

better, recovering after the low performance observed in 2022.

|

Sales by Market Segment

|

| · | Net revenue in Steel reached BRL 6,055

million in 4Q22, a performance 21.4% lower than in 3Q22, as a result of a more accentuated seasonality verified in this quarter that

combined lower sales due to the instability of the electoral period, uncertainties regarding the economic cycle and the World Cup, with

lower prices. In this sense, the average price of 4Q22 in the domestic market was 8.1% lower than presented in 3Q22, a performance

that follows the downward trend observed in international prices in the second half of the year. In turn, the foreign market price was

15.2% lower compared to last quarter, a performance pulled by the economic slowdown in Europe. In 2022, the steel company's net revenue

reached BRL 29,341 million and was 2.5% lower than in 2021, the best year ever recorded by the Company, which reinforces the resilience

of the result even in a period marked by greater instability. |

| · | The plate cost in 4Q22 reached

BRL 3.923/ton, representing a further decrease of 5.2% compared to the previous quarter, as a result of the reduction in raw material

costs for production, mainly coal and coke. |

Cost of plate with deprec. (R$/t)

|

4Q22 Production Cost

|

| · | The steel industry's Adjusted EBITDA

reached BRL 826 million in 4Q22 and was 34% lower than in 3Q22, with an EBITDA margin of 13.6% (-2.6 p.p.). Despite the lower production

costs, the lower prices practiced and the decrease in the volume produced ended up increasing the pressure on fixed costs and compromising

the period's profitability. In 2022, adjusted EBITDA of the steel segment accrued BRL 6,006 million, with an EBITDA margin of 20.5%. Though

the result configurates a reduction of 39.3% compared to 2021, this was the second-best historical result on steel from CSN. |

For more information, please visit our website: https://ri.csn.com.br/ | 12 |

| 2022 and 4Q22 FINANCIAL RESULT |

|

Adjusted EBITDA and Steel Margin

(BRLMM and %) |

Mining Result

2022 was marked by a series of challenges for the

mining sector. The high volume of rainfall in Brazil, the war between Russia and Ukraine and the uncertainties related to the Chinese

economy were elements that brought instability to the transoceanic iron ore market throughout the year. Additionally, regarding China,

the restrictive policies put in place last year by the Government as ways to curb Covid's waves in the country, the housing market crisis

and energy rationing generated by the heat wave, in the third quarter, impacted industrial production and had a direct impact on the price

of iron ore. On the other hand, since the end of last year, several policies of economic stimulus and easing in health rules have been

observed, especially after the re-election of Xi Jinping for his third term, which has improved not only the expectations of the iron

ore market, but also the estimates of Chinese GDP growth for the year 2023. In the midst of this context and despite reaching values below

USD 80.0/ton, the price of iron ore ended the quarter with a price above USD 115.0/ton, with an average of USD 99.00/dmt (Platts,

Fe62%, N. China) in 4Q22, 4.17 % lower than 3Q22 (USD 103.31/dmt) and 9.68% below 4Q21 (USD 109.61/dmt).

|

Total Production - Mining

(thousand tones)

|

Sales Volume -Mining

(thousand tons)

|

In relation to sea freight, the Route BCI-C3 (Tubarão-Qingdao)

presented an average of USD 20.58/wmt in 4Q22, which represents a significant reduction of 14.4% in relation to the shipping

cost from the previous quarter, as a reflection of a bigger offer of ships in the transoceanic market, in addition to the lower pressure

on fuel costs.

| · | Iron ore production totaled 9,334 thousand

tons in the 4Q22, which represents a reduction of 3% compared to 3Q22, as a result of seasonality, with the increase in rainfall at the

end of the year, impacting production and outflow. In 2022, the total produced volume was 33,7 Mton, an annual reduction of 6.8%, but

within the 34 Mton guidance disclosed by the Company. In addition, it is worth remembering that the lower volume production in 2022 was

a direct consequence of the impacts of rainfall recorded at the beginning of the year, in addition to the ramp-up of projects connected

to the Central Plant (CMAI3, spiralis and re-crushing). |

For more information, please visit our website: https://ri.csn.com.br/ | 13 |

| 2022 and 4Q22 FINANCIAL RESULT |

| · | On the other hand, sales volume reached

9,729 thousand tons in the 4Q22, a performance 7.0% higher than the previous quarter as a result of a higher concentration of shipments

before the rain period, boosted by inventory consumption and the use of third-party ports that eventually offset the lower volume produced.

Additionally, there was sales growth for the foreign market given the lower consumption on domestic market. In 2022, the sold volume was

33,329 thousand tons an increase of 0.3% compared to 2021, with the second half of the year as the main driver of this result, especially

after the operational difficulties faced at the beginning of the year. |

| · | Net revenue totaled BRL 3,529 million

in 4Q22, 40% higher than last quarter, as a result of the combination of higher sales volume with better price realization, especially

when considering the lower impact of provisioning prices observed in this quarter. Unit net revenue was $69.16 per wet ton, an

increase of 29.9% against 3Q22, a performance that reflects the sales concentration at the end of December when the price of iron ore

was higher, in addition to cheaper sea freight. In 2022, net revenue reached BRL 12,525 million, a reduction of 31% compared to 2021,

due to the operational challenges faced at the beginning of the year, in addition to a lower average price – unit net revenue in

2022 was USD 73.61 comparing with USD 100.89 in 2021. |

| · | In turn, the cost of products

sold from mining totaled BRL 1,878 million in 4Q22, an increase of 4.4% compared to the past quarter, as a result of

higher sales volume and the use of third-party ports. The C1 Cost reached USD 21.3/t in the 4Q22 and was 9.5% higher than that

observed in 3Q22, mainly as a result of the lower produced volume and greater demurrage. In 2022, the GOGS reached BRL 7.105 billion,

a reduction of 7.8% compared to last year. |

·

Adjusted EBITDA reached BRL 1,779 million in 4Q22, with quarterly

EBITDA margin of 50.4% or 14.2 p.p. higher than that recorded in 3Q22. The increase in realized prices combined with the increase in sales

were the main drivers of the result that made the margin of the quarter exceed the mark of 50%. In the year, Adjusted EBITDA reached BRL

6,072 million, a reduction of 43.4% compared to the previous year's record result, reflecting not only the lowest production recorded

though year, but also the lowest average price practiced in the period.

Cement Result

Despite the challenges that the rise in interest

rates has brought to the real estate segment, the cement market has shown some resilience, with infrastructure projects and structured

construction helping to compensate for the smaller launch of new housing units and fall of informal construction. And according to the

National Union of the Cement Industry (SNIC), cement sales reached 63,052 Mton in 2022, down less than 3% compared to the previous year.

For 2023, the expectation of the syndicate is that the segment will grow by 1%, driven by the increase in infrastructure projects, such

as road and sanitary. In addition, the new government has shown interest in strengthening housing programs for low incomes, which can

result in even greater dynamism for the sector. On the other hand, the Industrial Entrepreneur Confidence Index (ICEI), measured by the

Brazilian Chamber of the Construction Industry (CBIC), presented a deceleration in the values and presented an average of 50.8, still

a positive level, but that shows greater uncertainty of the entrepreneurs in relation to the future perspectives.

In the case of CSN Cimentos, the Company consolidated

the operating and financial results of Cimentos Brasil (formerly Lafarge Holcim Brasil) and intends to advance in the process of capturing

synergies. Sales in the 4Q22 totaled 2,897 kton, a result 53.3% higher than the previous quarter, as a result

of the increase in the participation of Cimentos Brasil's operations. In 2022, the volume sold was 7,243 kton, an increase of 53.8% compared

to the previous year, also reflecting the integration of Cimentos Brasil, even considering only 4 months of operation in the year's results.

For more information, please visit our website: https://ri.csn.com.br/ | 14 |

| 2022 and 4Q22 FINANCIAL RESULT |

|

Sales Volume - Cements (thousand tones)

|

* LafargeHolcim's operations were integrated in September 2022.

| · | Net revenue reached an all-time high

of BRL 1,181 million in the 4Q22, a performance 52% higher compared to last quarter, driven by the increase in sold volume, pulled down

by a slight reduction in the average price realized in the period. In 2022, Net Revenue reached BRL 2,820 million, representing an increase

of 97.2%, for the reasons already explained. |

| · | In turn, unit costs also rose in the

quarter, pressured by the increase in raw materials and fuels. |

| · | Adjusted EBITDA in the segment increased

by 2% compared to the previous quarter, reaching BRL 265 million in 4Q22 and with an adjusted EBITDA margin of 22.4%, a level 10.7 p.p.

lower than that seen in 3Q22. This worsening of profitability, however, is temporary and should be reversed as the Company experiences

lower costs with raw material and advances in capturing synergies and taking advantages of the benefits of self-production of energy.

In relation to 2022, adjusted EBITDA was BRL 784 million, an increase of 47.5% over 2021, but with an EBITDA margin of 27.8%, or 9.3 p.p.

minor. |

Energy Result

The year of 2022 was a historic year for the

Energy operations segment of the Company, with acquisitions of four operations that increased installed capacity by 1,066.3 MW, in addition

to adding another 356MW in minority interests. With this, the Company, in addition to becoming self-sufficient, began to have an energy

surplus that will later be sold in the free market, making the segment a true business unit for CSN. Additionally, the benefit of self-production

will allow a reduction of approximately 60% in energy costs, bringing significant impacts on the profitability of the segments.

In 4Q22, the traded energy volume generated

a net revenue of BRL 154 million, an increase of 221% over the last quarter, recovering operating results with a positive adjusted

EBITDA of BRL 27 million and EBITDA margin of 17.8%. In 2022, energy operations achieved revenues of BRL 293 million, with an EBTDA

of BRL 3 million and EBITDA margin of 1.1%, representing only one quarter of incorporation of CEEE-G.

Logistics Result

Railway Logistics: In 4Q22, net revenue

reached BRL 608 million, with adjusted EBITDA of BRL 270 million and adjusted EBITDA margin of 44.5%. Compared to 3Q22, net revenue decreased

7% due to the seasonality of the operation, with a reduction in transported goods. In the same comparison line, adjusted EBITDA was 17.3%

lower. In the year, net revenue reached BRL 2,312 million in 2022, an annual increase of 25.7%, while Adjusted EBITDA grew 25%, reaching

BRL 1,104 million and with an EBITDA margin of 47.8%.

For more information, please visit our website: https://ri.csn.com.br/ | 15 |

| 2022 and 4Q22 FINANCIAL RESULT |

Port Logistics: In the 4Q22, 335,000

tons of steel products were shipped by Sepetiba Tecon, in addition to 15,000 containers, 3,000 tons of general cargo and 281,000 tons

of bulk. Compared to the previous quarter, the Company had a change in its shipment mix, returning the relevance of the volume of grains,

with a quarterly increase of 4.9%, against an 89% reduction in overall cargo volume. As a result, the net revenue of the port

segment was 25.8% higher than in the last quarter, reaching BRL 86 million in 4Q22 and positively impacting the adjusted EBITDA

of the period, which achieved BRL 30 million in the quarter, with an EBITDA margin of 34.8%. In 2022, the segment recorded net revenue

of BRL 308 million and EBITDA of BRL 90 million, with a margin of 29.3%, levels practically stable compared to 2021. Were shipped in

2022 by Tecon, 1,322,000 tons of steel products, in addition to 62,000 containers, 42,000 tons of general cargo and 918,000 tons of bulk.

For more information, please visit our website: https://ri.csn.com.br/ | 16 |

| 2022 and 4Q22 FINANCIAL RESULT |

ESG - Environmental, Social

& Governance

ESG COMMITMENTS - CSN GROUP

| AXIS |

ESG Goals |

|

Natural Capital

|

Climate Change |

| ü Reduce CO2e emissions per ton of crude steel by 20% by 2035, WSA (World Steel Association) methodology compared to base year 2018. |

| ü Reduce CO2e per ton of cement by 28% by 2030, reaching 375 kgCO2e/t cement, GCCA methodology - Global Cement and Concrete Association, base year 2020. |

| ü Reduce CO2e emissions per ton of ore produced by 30% by 2035 (scopes 1 and 2), base year 2019. |

| ü Carbon Neutral by 2044 in CSN Mineração scopes 1 and 2 emissions. |

| Atmospheric Emissions |

| ü Reduce 40% of emissions of particulate matter per ton of crude steel produced in UPV by 2030, base year 2019. |

| Efficiency in Water Use and Effluent Management |

| ü Reduce new water consumption for iron ore production by at least 10% per ton of ore produced by 2030 compared to the base year 2018. |

| Dam Management and Mischaracterization |

| ü Perform the complete mischaracterization of the dams built upstream of the CSN Group by 2030. |

|

Intellectual Capital

|

Governance, Ethics and Compliance |

| ü Continuously increase our Index of Compliance with the best governance practices provided for in CVM Resolution No. 80/2022 (considered "Practice" and "Partialpractice"). |

| ü Realize training with 90% of active employees in the CSN Group on compliance, covering the code of ethics and anti-corruption policy. |

|

Human and Social Capital

|

Health and safety at work |

| ü Continuously achieve the zero-fatality rate throughout the CSN Group (own and third parties). |

| ü Reduce by 30% the frequency rate of accidents (CAF+SAF – own and third parties) by 2030 in the CSN Group compared to 2020 (factor of 1 million HHT). |

| ü Reduce by 30% the number of days of sick leave by accident with own employees by 2030 compared to 2021. |

| Diversity and Inclusion |

| ü Achieve 28% female representation in the CSN Group by 2025 compared to 2020. |

For more information, please visit our website: https://ri.csn.com.br/ | 17 |

| 2022 and 4Q22 FINANCIAL RESULT |

ESG PERFORMANCE - CSN GROUP

The Company continues following the model of reporting

its ESG results aligned with relevance and materiality for all stakeholders, in order to offer greater transparency and access to the

main results and indicators, enabling its monitoring in an agile and effective way.

Quantitative indicators are presented in comparison

with the previous annual period, for better monitoring. Some metrics are compared with the same period of the previous year, and others

with the average of the previous period, ensuring a comparison based on seasonality and periodicity.

More detailed historical data on CSN's performance

and initiatives can be verified in Integrated Report 2021. The Integrated Report follows internationally

recognized guidelines and frameworks, such as GRI (Global Reporting Initiative), IIRC (International Integrate Reporting Council), SASB

(Sustainability Accounting Standards Board) and TCFD (Task Force on Climate Related Financial Disclosures) and are presented with due

correlation with the SDGs (Sustainable Development Goals) and principles of the UN Global Compact. The assurance of ESG indicators and

targets occurs annually for the closing of the Integrated Report, so the information contained in the quarterly releases is subject to

adjustments resulting from this process. The next Integrated Report, for the period 2022, is expected to be published in April 2023,

in which details regarding the status and performance of all goals and indicators will be presented.

It is also possible to monitor CSN's ESG performance

in an agile and transparent manner, on our website, through the following e-mail address: ESG.csn.com.br

ESG RATING

External recognitions in indexes and ratings

shows that the Company is evolving in transparency and reporting of the main ESG actions and indicators, and in line with sustainable

development.

The year 2022 provided an evolution in three

important ESG ratings. CSN received a new rating from Sustainalytics, reducing the score related to ESG risks from 39.1 to 26.0. Of the

155 steel and mining companies evaluated globally, CSN achieved the 4th best score in the industry.

CSN was also the only Brazilian company in the

steel, mining and construction sector named in the S&P Global Sustainability Yearbook 2023, being classified as the company in

the steel industry that has advanced the most in ESG practices in the world, receiving the stamp of "Industry Mover".

And also, in the rating of the MSCI, CSN went from the score "CCC" to "B".

Additionally, in response to external requests

from investors and other stakeholders, the Company reports to CDP (Disclosure Insight Action) the guidelines followed in relation to

Climate Changes and Water Safety. In 2022, CSN Mineração's score, company controlled by CSN, evolved on Climate Changes

from "B -" to "B" and from "C" to "B" in Water Safety. The CSN Group, despite the even more restrictive

changes in methodology, maintained the scores achieved in 2021, respectively B for Climate Change and B- for Water Safety.

For more information, please visit our website: https://ri.csn.com.br/ | 18 |

| 2022 and 4Q22 FINANCIAL RESULT |

PERFORMANCE OF THE MAIN ESG TARGETS

| |

Indicators¹ |

Unit |

Indicator

Base Year |

2022 |

Status |

Goal |

Year |

| Environmental |

Steel Emission Intensity (WSA)2 |

tCO2and/t raw steel |

2.10

(Base year 2018) |

1.99 |

|

1.68

|

2035

|

| Intensity of Emission Cements (CSI)3 |

kgCO2and/t cement |

519

(Base year2020) |

481 |

|

374 |

2030 |

| Mining Emission Intensity (GHG)4 and 5 |

kgCO2and ore /t |

5.77

(Base year 2019) |

7.24 |

|

4.04 |

2035 |

| Social |

Frequency Rate6 |

CAF+SAF |

2.46

(Base year 2020) |

1.79 |

|

1.72 |

2030 |

| Governance |

Diversity (in the functional women framework) |

% |

14%

(Base year2020) |

20.5 |

|

28% |

2025 |

¹ The units acquired in 2022 by CSN Cimentos

and CSN Energia were not incorporated for this report.

² Considers emissions according to WSA methodology

and production of UPV and SWT units.

³ In 2022, the CSN Cimentos Alhandra unit began

to be considered in the data management of CSN Cimentos.

4 Considers the emissions of scopes 1 and

2 divided per ton of iron ore produced at CSN Mineração, according to the methodology of the Brazilian GHG Protocol Program.

5 Considers the emissions only of the mobile

combustion category of Scope 1 of CSN Mineração that represent 95% of the scope 1 emissions of CSN Mineração,

emphasizing that the emission of scope 2 is zero due to the electrical consumption coming from 100% of renewable sources. The data reported

in the Company's Integrated Report 2021 considers the total emissions of csn mining, scopes 1 and 2.

6 The rate considers accidents with and

without removal of own employees and third parties/1 million hours worked.

For more information, please visit our website: https://ri.csn.com.br/ | 19 |

| 2022 and 4Q22 FINANCIAL RESULT |

CLIMATE CHANGE

In

the last quarter of 2022, during CSN Day, CSN announced its ambition to provide society with essential carbon neutral

emission materials by 2050. In addition, the MAC curve (marginal abatement cost curve) of the

Steel industry was updated, with assumptions of reduction of emissions and cost of detailed projects, in which were also incorporated

the projects of emission reduction of SWT in the Blue phase, which extends until 2030. The Mining MAC curve was also reviewed, considering

the projects to reduce pre-defined emissions in the construction of the goal of reducing GHG emissions by 2035 and neutrality by 2044.

In 2023, the MAC curve of CSN Cimentos Brasil will be revised and updated with the entry of the new Brazilian plants acquired (Cimentos

Brasil and Alhandra).

Also, in

4Q22, CSN finalized the quantitative assessment of climate risks for all business segments and its first study of climate scenarios. These

two fronts allow Company’s managers to consider factors related to climate change in strategic decision-making. The study will be

made available in greater detail in the Integrated Report 2022, scheduled for publication in April 2023.

In 2022,

there was a reduction of 5% on intensity of the Steel industry in relation to the base year. The reduction is justified by the better

performance of the Presidente Vargas Plant (RJ) and the use of renewable energy at SWT in Germany.

In cement

operations, the Alhandra (PB) unit began to make up the annual report. This unit has an average emission intensity higher than other CSN

plants (625 kgCO2e/t cement). However, even with the entry of Alhandra, there was a 7% reduction in GHG emissions compared to 2020. This

is justified by the entry of the co-processing project in the Arcos unit, increasing the rate of alternative fuels, contributing to the

decarbonization journey.

The year

2022 was also marked by heavy rains in the first quarter in the state of Minas Gerais that substantially damaged the operation and production

at CSN Mineração. As a consequence of these factors, a specific mobile combustion emission (>95% of CSN Mineração's

Scope 1 emissions) of 7.24 kgCO2e/ton of ore was recorded, 15% higher than 2021. New projects are expected to enter and decarbonization

is expected to be more intense only in 2024.

ENVIRONMENTAL MANAGEMENT

NATURAL CAPITAL - ENVIRONMENTAL INDICATORS

| Air

quality CSN¹ |

Unidade |

2021 |

2022 |

Δ% |

| NOX Emission |

t |

5,924 |

5,570 |

-6 |

| SOX issue |

t |

2,805 |

3,094 |

10 |

| MP issue |

t |

3,328 |

4,079 |

23 |

¹ Considers all steel units and cement

units in the CSN Group.

| Water Management² |

Unit |

2021 |

2022 |

Δ% |

| Water catchment |

Megaliter |

99,782 |

92,212 |

-8 |

| Water disposal |

Megaliter |

75,689 |

70,457 |

-7 |

| Water consumption |

Megaliter |

24,093 |

21,754 |

-10 |

² Considers all csn group

producing units in Brazil and abroad

| Water Management² |

Unit |

2021 |

2022 |

Δ% |

| Intensity by steel production |

m³/ t raw steel |

16.1 |

15.7 |

-2 |

| Intensity per cement production |

m³/t cement |

0.10 |

0.07 |

-3 |

| Intensity by ore production |

m³/t ore |

0.21 |

0.26 |

23 |

² Considers all csn group producing

units in Brazil and abroad

For more information, please visit our website: https://ri.csn.com.br/ | 20 |

| 2022 and 4Q22 FINANCIAL RESULT |

| Waste Management² |

Unit |

2021 |

2022 |

Δ% |

| Waste Class 1 |

t |

45,141 |

47,565 |

5 |

| Waste Class 2 |

t |

3,403,728 |

3,520,728 |

3 |

| Percentage reuse and co-processing³ |

% |

95% |

93% |

-2 |

² Considers all csn group producing

units in Brazil and abroad

³Considers

waste intended for co-processing, recycling, refining and area recovery

DAM MANAGEMENT

In 2022, all dams of CSN Mineração

– a company controlled by CSN – were at zero emergency level, that is, with stability guaranteed according to current national

legislation. In continuity with the decharacterization schedule of the dams, the decharacterization of the Vigia and B5 Auxiliary Dams

were completed, and the decharacterization process of Barragem do Vigia is ongoing, which will be completed in the first half of 2023,

in addition to B4, with completion scheduled for 2028, as scheduled:

The stabilization works of the

B2A Dam, belonging to Minérios Nacional, a company of the CSN Group, are also underway and which in 2022 was classified as emergency

level 02. Due to advances in the works and the constant evolution in safety factors, the framework of the structure at level 1 and the

continuity of the decharacterization process are expected to finish at the first quarter of 2023, the decharacterization is expected to

be completed in 2026.

SOCIAL DIMENSION

HEALTH AND SAFETY AT WORK

The health and

safety of people is the Company's top priority and, in 2022, the

lowest historical level of the frequency rate (CAF+SAF: accidents with and without removal of own employees

and third parties) was recorded. There were 1.79 accidents/million man-hours worked, a decrease of about 25% compared to 2021, which is

the best indicator in the last 8 years, and the largest percentage of reduction since the beginning

of the compilation of data from the units in 2014, establishing a new milestone for the CSN group. In addition, the year was marked by

the absence of accidents with the removal of own employees in the following units: Cements (VR), Alhandra (PB), Ores Nacional (Fernandinho),

Porto Real and Prada Distribuição.

| · | Management and monitoring of the health and

safety of own employees and third parties: |

| Health

and safety at work¹ |

2021 |

2022 |

Δ% |

| Number of accidents with and without leave | Own |

113 |

89 |

-21 |

| Number of accidents with and without leave | third party |

67 |

57 |

-15 |

| Fatality | Own |

0 |

3 |

- |

| Fatality | third party |

2 |

1 |

- |

| CAF+SAF+FT accident frequency rate | factor 1 MM HHT | Own |

2.59 |

1.91 |

-26 |

| CAF+SAF+FT accident frequency rate | factor 1 MM HHT | third party |

2.13 |

1.64 |

-23 |

| CAF+SAF+FT accident frequency rate | factor 1 MM HHT | own and third parties |

2.40 |

1.79 |

-25 |

| Severity rate of accidents factor of 1MM HHT | own and third parties |

229 |

413 |

+80 |

¹ Considers all csn group

units in Brazil.

For more information, please visit our website: https://ri.csn.com.br/ | 21 |

| 2022 and 4Q22 FINANCIAL RESULT |

PEOPLE MANAGEMENT

Diversity

among people is a lever for CSN's innovation and business growth, which promotes a transformation of our society. Initiatives and actions

related to the evolution of talent recruitment, evaluation and recognition processes reflect in practice mechanisms that promote gender

representativeness and equality, people with disabilities (PCDs) and minority groups in operational positions and leadership positions.

In 2020, the goal of doubling the female workforce at CSN was set by 2025, from 14% to 28%. As a result, the result of the representation

of women in the CSN Group increased from 17.5% in December 2021 to 20.5% in December 2022, an increase of 17% in the period.

| Employment |

Unit |

2021 |

2022 |

Δ% |

| Women on the staff¹ |

% |

17.5 |

20.5 |

+17 |

| Women in leadership positions² |

% |

11.0 |

12.7 |

+15 |

| People with disabilities² |

% |

1.24 |

1.44 |

+16 |

| Racial Diversity² |

|

|

|

|

| • Yellow |

% |

1.4 |

1.4 |

- |

| • White |

% |

42.5 |

41.2 |

-3.0 |

| • Indigenous |

% |

0.3 |

0.3 |

- |

| • Negra (Pretos and Pardos) |

% |

52.7 |

54.3 |

+3.0 |

| • Not informed |

% |

3.0 |

2.8 |

-6.6 |

| Turnover² |

% |

17.9 |

19.3 |

+7.8 |

¹ Data

consider employees allocated in Brazil, CLT, Apprentice, Internship and Program - Empower

² Data does not consider employees

"Non-CLT" and "Internship Program".

VALUE CHAIN

In 2022, 538 suppliers

were evaluated in social and environmental criteria considering the chain of all units in Brazil. Additionally, in 4Q22, CSN developed

a specific ESG Risk Assessment questionnaire for 100 suppliers indicated as critical for the Company

that addresses topics such as: health and safety management, community engagement, diversity and inclusion, whistleblowing channel, code

of ethics, certifications, climate risk management, water scarcity and biodiversity.

The diagnosis will help CSN assess

and manage potential socio-environmental and imaging risks, as well as influence its supply chain in the adoption of best market practices.

| Sustainable Value Chain¹ |

Unit |

2021 |

2022 |

Δ% |

| Purchases from local suppliers² |

% |

31.6 |

27.8 |

-12 |

| Local suppliers² (Service) |

% |

46.1 |

42.1 |

-8.6 |

| Local Suppliers² (Materials) |

% |

27.8 |

23.7 |

-14 |

¹ Considers CSN Group in

Brazil.

² Percentage over total suppliers

in each category. Those suppliers who are in the same state (federative unit) of the evaluated operational unit are considered "local"

as "local" as "local" as "local" of the operational unit evaluated.

SOCIAL RESPONSIBILITY

In 2022, 4,643 young people were directly benefited

and 246,916 people were impacted by the projects developed or supported by the CSN Foundation. BRL 26 million were invested in social

responsibility, reaching more than BRL 200 million in the last three years for social projects. Among them,

the Garoto Cidadão program stands out, a sociocultural project that serves 2,533 children and adolescents in the main cities where

the company is inserted. In the last quarter of 2022, two new units were inaugurated, one in the urban area of Coxim/MS and the other

in Heliopolis/SP. In total, more than 10,000 young people have already passed through the project.

For more information, please visit our website: https://ri.csn.com.br/ | 22 |

| 2022 and 4Q22 FINANCIAL RESULT |

| |

2021 |

2022 |

Δ% |

| Young people benefited¹ |

4,578 |

4,643 |

+1.4 |

| Public reached² |

215,227 |

246,916 |

+14.7 |

| |

|

|

| |

|

|

|

|

|

¹ Young people benefited

by the projects Citizen Boy, Empower, Young Apprentice, Internship, Steel Drums and Football.

² Public present in the

public presentations, carried out by the projects: Citizen Boy, Truck, Steel Drums, Cultural Center and Stories That Stay.

In

continuity with the legacy built by the CSN Fundação, the Company implemented in 2022 a new

instrument to integrate its strategic planning of social-private investment: the Theory of Change of the CSN Group

(access here). Focusing on improving the economic, social and environmental conditions of local communities,

this new tool determines a strategic positioning of territorial development based on contemporary models of Corporate Social Investment

(CSI). The theory is based on three strategic pillars: urban entrepreneurism, urban jobs, and rural productive inclusion. More details

on the process of building and developing the Theory of Change will be made available in the Integrated Report 2022, scheduled to be

published in April 2023.

Additionally,

in compliance with the commitment signed in 2021, CSN Mineração and CSN Fundação

began in 4Q22 the development of a due diligence on human rights in the municipality of Congonhas/MG.

In partnership with the Center for Human Rights and Companies of the Getúlio Vargas Foundation, a research was initiated focusing

on the internal evaluation of processes, systems and people, regarding the identification and management of Adverse Risks to Human Rights

in the communities close to the operation of the Casa de Pedra mine, based on the UN Guiding Principles

framework for Business & Human Rights. The completion of the process and its developments are planned for the first half of 2023.

For more information, visit the website: www.fundaçaocsn.org.br.

For more information, please visit our website: https://ri.csn.com.br/ | 23 |

| 2022 and 4Q22 FINANCIAL RESULT |

Capital Markets

In the fourth quarter of 2022, CSN's shares

appreciated by 14.4%, while the Ibovespa index declined by 0.3%. In 2022, CSN shares fell by 41.8% while the Ibovespa rose by 4.7%. The

average daily value (CSNA3) traded on B3, was BRL 185.21 million in 4Q22 and BRL 223.51 million in 2022. On the New York Stock Exchange

(NYSE), American Depositary Receipts (ADRs) of the Company appreciated by 16.0% in dollars, while the Dow Jones index rose by 15.4%. The

average daily trading volume of ADRs (SID) on the NYSE in 4Q22 was US$ 10.9 million.

| |

4Q22 |

2022 |

| Number of shares in thousands |

1,326,094 |

1,326,094 |

| Market Value |

|

|

| Closing Quote (R$/share) |

14.55 |

14.55 |

| Closing Quote (USD/ADR) |

2.76 |

2.76 |

| Market Value (BRL million) |

19,295 |

19,295 |

| Market Value (USD million) |

3,660 |

3,660 |

| Change in period |

|

|

| CSNA3 (BRL) |

14.4% |

-41,8% |

| SID (USD) |

16.0% |

-37.8% |

| Ibovespa (BRL) |

-0.3% |

4.7% |

| Dow Jones (USD) |

15.4% |

-8.8% |

| Volume |

|

|

| Daily average (thousand shares) |

13,356 |

12,148 |

| Daily average (BRL thousand) |

185,214 |

223,512 |

| Daily average (thousand ADRs) |

4,075 |

5,550 |

| Daily average (USD thousand) |

10,931 |

20,737 |

|

Source: Bloomberg

|

|

|

| |

|

|

|

Result Conference Call:

| 4Q22 and 2022 Presentation Webcast |

Investor Relations Team |

Conference call in Portuguese with Simultaneous Translation into

English

|

Marcelo Cunha Ribeiro - CFO and Executive Director

of IR

|

| March 9, 2023 |

Pedro Gomes de Souza (pedro.gs@csn.com.br)

|

| 11:30 am (Brasilia time) |

Danilo Dias (danilo.dias.dd1@csn.com.br)

|

| 09:30 am (New York Time) |

Rafael Byrro (rafael.byrro@csn.com.br)

|

| +55 11 3181-8565 / +55 11 4090-1621 |

|

| Code: CSN |

|

| Tel. Replay: +55 11 4118-5151 |

|

| Replay code: 219011# |

|

Webcast: click here

|

|

Some of the statements contained herein are future

perspectives that express or imply expected results, performance, or events. These perspectives include future results that may be influenced

by historical results and statements made in 'Perspectives'. Current results, performance and events may differ significantly from hypotheses

and perspectives and involve risks such as: general and economic conditions in Brazil and other countries; interest rate and exchange

rate levels, protectionist measures in the U.S., Brazil and other

countries, changes in laws and regulations, and general competitive factors (globally, regionally, or nationally)

For more information, please visit our website: https://ri.csn.com.br/ | 24 |

| 2022 and 4Q22 FINANCIAL RESULT |

INCOME STATEMENT

CONSOLIDATED - Corporate Law - In Thousands of

Reais

For more information, please visit our website: https://ri.csn.com.br/ | 25 |

| 2022 and 4Q22 FINANCIAL RESULT |

BALANCE SHEET

CONSOLIDATED - Corporate Law - In Thousands of

Reais

For more information, please visit our website: https://ri.csn.com.br/ | 26 |

| 2022 and 4Q22 FINANCIAL RESULT |

CASH FLOW

CONSOLIDATED - Corporate Law - In Thousands of

Reais

For more information, please visit our website: https://ri.csn.com.br/ | 27 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: March 9, 2023

|

COMPANHIA SIDERÚRGICA NACIONAL |

|

|

|

By: |

/S/ Benjamin Steinbruch

|

| |

Benjamin Steinbruch

Chief Executive Officer

|

|

|

|

|

|

By: |

/S/ Marcelo Cunha Ribeiro

|

| |

Marcelo Cunha Ribeiro

Chief Financial and Investor Relations Officer

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

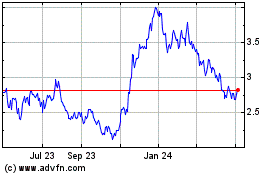

Companhia Siderurgica Na... (NYSE:SID)

Historical Stock Chart

From Nov 2024 to Dec 2024

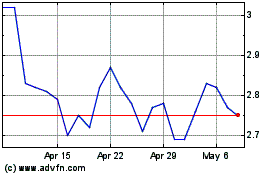

Companhia Siderurgica Na... (NYSE:SID)

Historical Stock Chart

From Dec 2023 to Dec 2024