SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of March, 2022

Commission File Number 1-14732

COMPANHIA SIDERÚRGICA NACIONAL

(Exact name of registrant as specified in its charter)

National Steel Company

(Translation of Registrant's name into English)

Av. Brigadeiro Faria Lima 3400, 20º andar

São Paulo, SP, Brazil

04538-132

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports

under cover Form 20-F or Form 40-F. Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

|

RESULT

4Q21 and 2021

|

São Paulo, March 9, 2022 - Companhia Siderúrgica

Nacional ("CSN") (B3: CSNA3) (NYSE: SID) discloses its results for the fourth quarter of 2021 (4Q21) financial results

in Brazilian Reais, with all financial statements consolidated in accordance with accounting practices adopted in Brazil issued by the

Accounting Pronouncements Committee ("CPC"), approved by the Brazilian Securities and Exchange Commission ("CVM")

and the Federal Accounting Council ("CFC") and in accordance with international financial reporting standards (“IFRS”),

issued by the International Accounting Standards Board (“IASB”).

All comments presented herein refer to the Company’s

consolidated results for the fourth quarter of 2021 (4Q21) and the comparisons are between the fourth quarter of 2020 (4Q20) and

the third quarter of 2021 (3Q21). The price of the dollar was R$ 5.20 at 12/31/2020; R$ 5.44 on 09/30/2021 and R$ 5.58 on 12/31/2021.

4Q21 and 2021 Operational and

Financial Highlights

|

RECORD RESULTS IN THE MAIN ACTIVITY

SEGMENTS

The year 2021 was historic for CSN, with the strengthening

of all business segments and revenue of approximately R$ 48 billion, driven by the favorable price environment and increased sales volume.

Adjusted EBITDA exceeded the mark of R$ 22 billion,

with an Adjusted EBITDA margin of 45%, highlighting the strong cost control and operational efficiency.

In 4Q21, CSN recorded EBITDA of R$ 3.7 billion, with

an adjusted EBITDA margin of 35%.

|

|

MINING EBITDA REACHED R$ 10.7

BILLION IN 2021 WITH A MARGIN OF 60%

Mining result was driven by the strong performance

in the first half of the year. On the other hand, the result of 4Q21 was impacted by the strong rainfall volume and the scheduled operational

halts held in November.

Even with these effects, the total production plus

purchase of third parties was within the guidance disclosed by CSN and was 18% higher than in 2020.

|

|

STEEL INDUSTRY REACHES RECORD

EBITDA FOR THE YEAR WITH STRONG MARGIN INCREASE

Favorable price and demand environment was decisive

for overcoming the segment targets, which echoed in the increase of 310% steel adjusted EBITDA, in relation to 2020.

In 4Q21, the Company regained market share with the

increase in sales volume compared to 3Q21.

|

|

LEVERAGE TARGET ACHIEVED WITH

SOLID CASH GENERATION

Leverage level ended the year with a Net Debt/EBITDA

ratio of 0.76x versus 2.23x in 4Q20, and below the ceiling of 1x placed as guidance by the Company. Current level of leverage is the lowest

in the last ten years.

Annual Free Cash Flow reached the Record of $13.4

billion, an increase of 59% compared to 2020, mainly influenced by the Company's strong operating performance.

|

|

THE YEAR 2021 WAS MARKED BY THE

CONSOLIDATION OF THE GROWTH STRATEGY IN THE CEMENT SEGMENT

Integration of Elizabeth Cements helped break seasonality

and maintain the growth pace in 4Q21. In 2021, cement EBITDA was almost double over the previous year, reaching R$ 531 million with a

margin of 37%, one of the highest in the entire sector, which reinforces the Company's competitive differentials. In the quarter, pressure

on raw material costs led to a sequential decline of 4% in EBITDA.

|

|

|

For more information, please visit our website: https://ri.csn.com.br/ | 2 |

| RESULT 4Q21 and 2021 |

Consolidated Table – Highlights

¹ Adjusted EBITDA is calculated from net income

(loss), plus depreciation and amortization, taxes on income, net financial result, income from investment participation, income from other

operating income/expenses and includes a proportional participation of 37.27% of the EBITDA of the joint subsidiary MRS Logística.

² Adjusted Ebitda Margin is calculated from Adjusted

Ebitda divided by Management Net Revenue.

³ Adjusted Net Debt and Adjusted Cash/Availability

consider 37.27% of MRS, in addition to not considering Forfaiting and Cashed Risk transactions.

Consolidated Results

| · | Net revenue in 4Q21 totaled R$10,361

million, representing an increase of 5.8% when compared to 4Q20 and an increase of 1.1% compared to 3Q21. This result is a consequence

of the improvement in the steel segment, that showed volume recovery in the period, and the incorporation of Elizabeth Cimentos. The combination

of these factors ended up compensating for the lower revenue in the mining segment that was impacted by a higher volume of rains in October

and scheduled stopovers at both the mine and the port in November. In 2021, net revenue totaled R$48 billion, representing a significant

increase of 59.4% compared to 2020. This was the highest turnover ever recorded in the company's history and reinforces the excellent

moment and favorable environment in the main segments operated by CSN. |

| · | The cost of goods sold (COGS) totaled

R$ 6,606 million in 4Q21, representing an increase of 18% compared to 4Q20 and 11% compared to 3Q21. This increase in costs was a consequence

of the high prices of some raw materials such as coal and coke, in addition to the lower dilution of fixed costs in mining with the decrease

in volume production. |

| · | Gross margin reached 36.2% in 4Q21 and

was 5.8 p.p. lesser than 3Q21’s, as a result of the combination of lower operational efficiency and cost pressure in the period.

On the other hand, yearly gross profit achieved R$22.1 billion, with a gross margin of 46.1%, representing an increase of 9.7 p.p. compared

to 2020. This result reflects the favorable price environment observed in the main operational segments, in addition to the increase in

the volume of goods sold, resulting in greater dilution of fixed costs. |

| · | In 4Q21, sales, general and administrative

expenses totaled R$ 814 million, 6.8% higher than in 3Q21, as a consequence of the higher proportion of iron ore transoceanic freight

in the CIF modality, in addition to higher demurrage costs. |

| · | The group of other operating income and expenses

was negative in R$ 385 million in 4Q21, as a consequence of hedge accounting cash flow operations, which totaled R$ 208 million in the

period. |

| · | The financial result was negative in

R$ 460 million in 4Q21, which represents a 51% reduction compared to 3Q21 as a consequence of the lower cost of debt and the appreciation

of Usiminas shares. |

For more information, please visit our website: https://ri.csn.com.br/ | 3 |

| RESULT 4Q21 and 2021 |

·

The equity result was positive in R$ 19 million in 4Q21, a lesser

performance of that observed in the previous quarter due to the worsening of MRS Logística's operations, which was directly impacted

over the heavy rains on the period, that decreased the volume of moved cargo.

·

In 4Q21, the Company's net income was R$ 1,061 million, a result

20% inferior to that recorded last quarter due to the lower operating result that ended up compensating the lower financial expenses and

taxes recorded in the period. In turn, net income for 2021 reached R$ 13.6 billion against the net income of R$ 4.3 billion recorded

in 2020, representing an increase of more than 217%, which attests to the Company's strong operating performance, in addition of the reflex

on the gain in the public offering of CSN Mineração shares and sales of part of USIMINAS' shares.

Adjusted EBITDA

*The Company discloses its adjusted EBITDA excluding

participation in investments and other operating income (expenses) because it understands that it should not be considered in the calculation

of recurring operating cash generation.

·

In 4Q21, adjusted EBITDA was R$ 3.727 million, with an adjusted

EBITDA margin of 34.9% or 5.7 p.p. below of that recorded in the previous quarter. This contraction was a consequence (i) of the seasonality

of the period that was also intensified in this quarter with a higher volume of rainfall, that impacted the mining and cement segments;

(ii) the freight cost that remained at high levels; and (iii) costs of some raw materials, such as coal and coke. In turn, EBITDA for

2021 reached a record level of R$ 22 billion, with an adjusted EBITDA margin of 44.8%, or 7.7 p.p. above that seen in 2020. The favorable

price environment and the increase in sales volume in all segments were factors that contributed to this result.

For more information, please visit our website: https://ri.csn.com.br/ | 4 |

| RESULT 4Q21 and 2021 |

Adjusted EBITDA (R$ MM) and Adjusted

Margin¹ (%)

¹ Adjusted EBITDA Margin is calculated from the

division between Adjusted EBITDA and Adjusted Net Revenue, which considers the 100% stakes in CSN Mineração’s consolidation

and 37.27% in MRS.

Adjusted Cash Flow¹

Adjusted Cash Flow in 4Q21 was positive at R$ 575

million, punctually affected by the increase in the Company's working capital and higher volumes of Capex and income tax. In 2021, Adjusted

Cash Flow reached R$ 13.4 billion, representing a growth of 59% compared to 2020, as a result of the improvement in operating results

driven by strong price realization in the steel, cement and mining segments.

Adjusted cash flow¹ in 4Q21

(R$MM)

¹ The concept of adjusted cash flow is calculated

from adjusted Ebitda, subtracting Ebitda from Jointly Controlled Companies, CAPEX, IR, Financial Results and Changes in Assets and Liabilities²,

excluding the effect of the Glencore advance.

² Adjusted Working Capital is composed of the

change in Net Working Capital, plus the change in accounts of long-term assets and liabilities and disregarding the net change in IR and

CS.

Indebtedness

On December 31, 2021, consolidated net debt reached

R$ 16,772 million, an increase of R$ 2.1 billion compared to the previous year, largely as a consequence of the repurchase programs made

in the period, and the exchange rate variation. As a result, indebtedness was above the expected guidance for the end of the year, but

with a leverage indicator (measured by the adjusted net debt/EBITDA ratio) of only 0.76x, i.e., below the 1x target, which reinforces

the Company's commitment to maintain its capital structure solid and sustainable levels.

For more information, please visit our website: https://ri.csn.com.br/ | 5 |

| RESULT 4Q21 and 2021 |

Indebtedness (R$ Billion) and

Net Debt /Adjusted EBITDA (x)

¹ Net Debt / EBITDA: To calculate the debt considers the final dollar

of each period and for net debt and EBITDA the average dollar of the period.

Continuing its debt extension plan, CSN concluded

in 4Q21 the issuance of its 11th issue of debentures in the amount of R$ 1.5 billion with maturities in 2027 and 2028. In addition, in

December 2021, the Company completed the process of extending its debt with Banco do Brasil, extending its payment period until 2025 and

2026. Additionally, the Company announced in February 2022 the first issuance of a CRI from CSN Cimentos, in the amount of R$ 1.2 billion

and maturing from 2030. Finally, in that same month, CSN issued a new $500 million Bond maturing in 2032, in addition to the repurchasing

of half of its issues due in 2026.

Amortization Schedule (R$ Bi)

¹ IFRS: does not consider participation in MRS (37.27%).

² Gross Debt/Management Net considers participation in MRS (37.27%)

and gross interest.

3 Medium term after completion of the Liability Management Plan.

Foreign Exchange Exposure

The

net foreign exchange exposure of the consolidated balance sheet of 12/31/2021 was negative by US$

149 million, as shown in the table below, representing a significative decrease when compared to

3Q21, as a consequence of cash reduction and lessen volume on the operations of cash flow hedge accounting.

The Cash Flow Hedge Accounting

adopted by CSN correlates the projected flow of dollar exports with future debt maturities in the same currency. Thus, the exchange variation

of the dollar debt is temporarily recorded in the equity, being brought to the result when the dollar revenues from said exports occur.

For more information, please visit our website: https://ri.csn.com.br/ | 6 |

| RESULT 4Q21 and 2021 |

Investments

There where invested a total of R$965 million in 4Q21, a level 21% higher than the R$ 800 million invested

on last quarter, as a result of the advance in productivity improvement and modernization projects to boost the performance of the UPV

plant, with emphasis on the coke battery project, and the expansion and fleet acquisition projects for mining. In 2021, CSN invested a

total of R$ 2,934 million, a level 73% higher than in 2020, which shows the efforts and advances in processing projects and capacity increase

in mining.

Net Working Capital

The Net Working Capital applied to the business totaled

R$1,586 million in 4Q21, an increase of 102% against 3Q21 due to the punctual increase in inventories, the increase in taxes to

be recovered, resulting from the recognition of PIS/COFINS credits, in addition to the gradual normalization of the advance line of customers

that was exceptionally high by the adjustments of amounts to be received under the form of provisional prices in mining.

The calculation of the Net Working Capital applied

to the business does not take glencore's advance, as shown in the following table:

For more information, please visit our website: https://ri.csn.com.br/ | 7 |

| RESULT 4Q21 and 2021 |

¹ Other CCL Assets: Considers

advance employees and other accounts receivable.

² Other CCL Liabilities:

Considers other accounts payable, dividends payable, installment taxes and other provisions.

³ Inventories: Does not

consider the effect of the provision for inventory losses. For the calculation of the SME are not considered the balances of warehouse

stocks.

Remuneration to shareholders

On December 6, 2021, CSN announced the opening of

a new repurchase program for the acquisition of up to 30,000,000 shares, lasting until June 30, 2022. To date, 29,038,600 common shares

have been acquired at an average price of R$ 25.15, representing an amount of R$ 730.3 million or 97% of the total program. As of December

31, 2021, the Company maintained a total of 45,790,000 shares in treasury. In addition, CSN Mineração also approved the

opening of its second repurchase program for the acquisition of up to 53,000,000 shares, of which 52,466,800 shares have already been

repurchased at an average price of R$ 6.21, representing 99% of the total amount of this program or an invested amount of R$ 325.8 million.

Considering all the programs, CSN repurchased over 4Q21 an amount equivalent to R$ 1.4 billion.

Additionally, the Board of Directors deliberated

for ratification at the next GSM, the distribution of dividends in the amount of R$ 904.5 million to be allocated to the minimum mandatory

dividend for 2021, equivalent to R$ 0.67/common share. These amounts will be added to the interest on equity declared in December in the

amount of R$ 257.0 million, completing the distribution of 25% of the profit for the period.

For more information, please visit our website: https://ri.csn.com.br/ | 8 |

| RESULT 4Q21 and 2021 |

Results by Business Segments

Net Revenue by Segment - 2021 (R$ million-before

eliminations)

For more information, please visit our website: https://ri.csn.com.br/ | 9 |

| RESULT 4Q21 and 2021 |

| Result 4Q21 (R$ million) |

Steel |

Mining |

Logistics (Port) |

Logistics (Railway) |

Energy |

Cement |

Corporate Expenses/Elimination |

Consolidated |

| |

|

|

|

|

|

|

|

|

| Net Revenue |

7,648 |

2,401 |

86 |

444 |

47 |

423 |

(687) |

10,361 |

| Domestic Market |

4,966 |

448 |

86 |

444 |

47 |

423 |

(957) |

5,456 |

| Foreign Market |

2,682 |

1,953 |

- |

- |

- |

- |

270 |

4,905 |

| COGS |

(5,096) |

(1,669) |

(60) |

(342) |

(39) |

(269) |

869 |

(6,606) |

| Gross profit |

2,552 |

733 |

26 |

101 |

8 |

154 |

182 |

3,755 |

| DGA/DVE |

(324) |

(86) |

(8) |

(42) |

(8) |

(72) |

(273) |

(814) |

| Depreciation |

285 |

232 |

8 |

119 |

4 |

56 |

(81) |

623 |

| Contr. Proportional EBITDA in Conj. |

- |

|

- |

- |

- |

- |

163 |

163 |

| Adjusted EBITDA |

2,513 |

878 |

26 |

178 |

4 |

137 |

(10) |

3,727 |

| |

|

|

|

|

|

|

|

|

| 3Q21 Result (R$ million) |

Steel |

Mining |

Logistics (Port) |

Logistics (Railway) |

Energy |

Cement |

Corporate Expenses/Elimination |

Consolidated |

| |

|

|

|

|

|

|

|

|

| Net Revenue |

7,627 |

2,804 |

70 |

508 |

66 |

387 |

(1,216) |

10,246 |

| Domestic Market |

5,508 |

971 |

70 |

508 |

66 |

387 |

(1,491) |

6,020 |

| Foreign Market |

2,118 |

1,833 |

- |

- |

- |

- |

275 |

4,226 |

| COGS |

(4,736) |

(1,883) |

(53) |

(325) |

(38) |

(229) |

1,322 |

(5,942) |

| Gross profit |

2,891 |

920 |

17 |

183 |

29 |

159 |

106 |

4,305 |

| DGA/DVE |

(302) |

(70) |

(7) |

(34) |

(9) |

(61) |

(281) |

(762) |

| Depreciation |

265 |

193 |

9 |

111 |

4 |

45 |

(94) |

533 |

| Contr. Proportional EBITDA in Conj. |

- |

|

- |

- |

- |

- |

220 |

220 |

| Adjusted EBITDA |

2,854 |

1,043 |

19 |

260 |

24 |

143 |

(49) |

4,295 |

| |

|

|

|

|

|

|

|

|

| Result 4Q20 (R$ million) |

Steel |

Mining |

Logistics (Port) |

Logistics (Railway) |

Energy |

Cement |

Corporate Expenses/Elimination |

Consolidated |

| |

|

|

|

|

|

|

|

|

| Net Revenue |

5,051 |

4,488 |

49 |

408 |

53 |

281 |

(537) |

9,794 |

| Domestic Market |

3,787 |

494 |

49 |

408 |

53 |

280 |

(907) |

4,165 |

| Foreign Market |

1,264 |

3,994 |

- |

- |

- |

1 |

370 |

5,629 |

| COGS |

(3,802) |

(2,051) |

(49) |

(290) |

(32) |

(172) |

800 |

(5,596) |

| Gross profit |

1,249 |

2,437 |

0 |

117 |

21 |

110 |

263 |

4,198 |

| DGVA |

(250) |

(46) |

6 |

(33) |

(8) |

(24) |

(387) |

(741) |

| Depreciation |

238 |

809 |

8 |

104 |

4 |

43 |

(89) |

1,118 |

| Contr. Proportional EBITDA in Conj. |

- |

|

- |

- |

- |

- |

162 |

162 |

| Adjusted EBITDA |

1,238 |

3,200 |

14 |

189 |

18 |

129 |

(51) |

4,738 |

Steel Result

According to the World Steel

Association (WSA), global crude steel production totaled 1,911 million tons (Mt) in 2021, up 3.6% from 2020. China alone produced 54%

of global production (1,032.8 Mt), but there was a 3% drop in Chinese production over the year due to the end of subsidies, in addition

to efforts to control carbon emissions in the period. Brazil produced 36 Mt, with an annual growth of 14.7%, in line with the verified

inventory recovery, mainly at the beginning of the year. For 2022, the expectation is that the market will remain favorable for steel

demand, which should sustain international prices in the short term. Additionally, coal and coke prices have undergone strong corrections

at the end of 2021 and have remained at a high level at the beginning of the year, which may be another factor in sustaining the price

of steel throughout 2022.

Steel Production (thousand tons)

In the case of CSN, plate production in 4Q21

totaled 988 mil tons, a volume 11% inferior compared to the previous quarter, due to the impacts caused by corrective maintenance in the

period, which affected both the production of plates and flat laminate, which showed a 16% reduction in production. In 2021, in turn,

plate production was 15% higher than in 2020, totaling 4,071 kton, the second largest production volume in CSN's history. On the other

hand, the production of flat laminates, our main market, increased by 12% compared to 2020 and reached 3,789 kton, which reinforces the

advances in the projects of debottlenecking and modernization of our plants. The same can be said for the production of long steels with

a total of 236 kton in 2021.

For more information, please visit our website: https://ri.csn.com.br/ | 10 |

| RESULT 4Q21 and 2021 |

Sales Volume (Kton) - Steel

In the fourth quarter of 2021, total sales

reached 1,024 thousand tons, volume 4% superior to that recorded in the third quarter of 2021, as a result of the increase in sales

volume on the distribution market and steel for construction, in addition to a higher volume of sales in the foreign market. Through the

year, the total sales were practically stable and compared to the one recorded in 2020 and only did not have a better performance due

to the commercial strategy adopted in 3Q21 to prioritize price over volume and the decrease in sales of European subsidiaries in the second

half.

In 4Q21, domestic sales totaled 690,000

tons of steel products, 2% higher than in 3Q21, which signals a resumption of sales even in a period of negative seasonality in addition

to the success in efforts to regain market share lost in the previous quarter. Of this total, 616,000 tons refer to flat steels and 74,000

tons to long steel, a record volume for CSN and reinforces that the construction scenario continued to warm at the end of the year.

In the foreign market, sales of 4Q21

totaled 333,000 tons, a volume 10% higher than in 3Q21, as a consequence of a greater dynamism in the zinc and metal sheet segments. During

the quarter, 30,000 tons were exported directly, and 303,000 tons were sold by subsidiaries abroad, 72,000 tons by LLC, 165,000 tons by

SWT and 66,000 tons by Lusosider.

In relation to the total sales volume in 4Q21,

the share of flat steel coated products accounted for 49%, a performance of 3.4 p.p. lower than 3Q21. Sales volumes for the construction

(+24%) and distribution (+5%) segments were the main positive highlights of the period. The year 2021 was marked by a 26% increase in

the sales volume of the automotive market, even with the persistence of the crisis in the supply of semiconductors. Additively, we also

had strong performance in the home-appliances (+19%) and industrial (+19%) segments.

|

According to the ANFAVEA (National Association of Motor Vehicle

Manufacturers), the production of in 2021 registered 2,248 thousand units, an increase of 11.6% compared to the previous year. Brazil

had a 3% increase in vehicle licensing between 2021x2020, while the exports of motor vehicles increased by 16% compared to 2020. In addition,

the year of 2021 was marked by greater diversification in the export of Brazilian vehicles, with increased exports to Colombian, Chilean

and Peruvian markets.

According to data from the Brazil Steel Institute

(IABr), crude steel production in the fourth quarter was 8.6Mt, a performance 2% lower than in the same period last year. Apparent

Consumption for the quarter was 8.8% lower than in 4Q20. The Steel Industry Confidence Indicator (ICIA) for December 2021 was 44.9 points,

below the 50 point dividing line, indicating a moment of greater uncertainty in the local market.

According to IBGE data, the production

of appliances for the year 2021 recorded a 4.5% reduction compared to the same period last year. In the quarterly comparison, the

fourth quarter showed a 15% decrease compared to 3Q21, due to a decrease in the production

of appliances in December, following the period seasonality.

|

Sale by Market Segment

|

For more information, please visit our website: https://ri.csn.com.br/ | 11 |

| RESULT 4Q21 and 2021 |

| · | Net revenue in Steel reached R$7,648

million in 4Q21, 0.3% higher than in 3Q21. As commented earlier, the increase in sales volume was partially offset by falling prices

in the domestic market. In this sense, the average price of 4Q21 in the domestic market was 10% lower than that of 3Q21, a performance

in line with the international. On the other hand, the exportation price increased 16% compared to last quarter, a performance pulled

by U.S. domestic prices that maintained the high tendency throughout the year of 2021. As a result, revenue from international markets

reached record highs and accounted for 35% of revenue for the quarter. The year 2021 was also marked by the record net revenue for the

steel industry, surpassing the mark of R$ 30 billion, with a result 81% higher than the revenue recorded in 2020. The consistent price

increase recorded throughout the year with the maintenance of a heated demand were the main factors that contributed to this solid performance.

|

| · | The cost of plate consumed in 4Q21 reached

R$3,673/t, down 1% compared to the previous quarter, due to lower raw material costs, mainly due to the fall in the price of iron ore.

Additionally, it is worth mentioning that although coal and coke prices have reached historical high levels, this behavior will only be

reflected in the 1Q22 result due to the inventory levels of these commodities. |

| · | In turn, adjusted EBITDA reached R$2,513

million in 4Q21, 12% lower than in 3Q21, which had been the company's all-time record, with an EBITDA margin of 32.9%. This lower

profitability in the period mainly reflects mostly in the seasonality and adjustments in steel prices in the Brazilian market. On the

other hand, 2021 reached an Adjusted EBITDA of R$ 9,893 million, an all-time record for the segment and a performance 310% higher than

in 2020, with an EBITDA margin of 32.9%, which represents an increase of 18.4 p.p. This result reflects the extraordinary moment in

which the sector passes, which has presented a sustainable dynamic of prices and demand, bringing a positive bias for the year 2022. |

For more information, please visit our website: https://ri.csn.com.br/ | 12 |

| RESULT 4Q21 and 2021 |

|

Adjusted EBITDA and Steel Margin

(R$ MM and %)

|

Mining Result

In mining, the year 2021 was marked by high volatility

in relation to the price of iron ore and sea freight. After a first half with historic iron ore price records in response to heated demand

and limited supply in the seaborne market, we had a second half of the year with strong adjustments due to concerns and uncertainties

regarding the Chinese steel market, especially in the regarding the greater control of steel production associated with carbon emissions,

inflationary pressures, energy and real estate crisis, in addition to issues related to Covid and its impacts on ports. After falling

more than 61%, the price of ore rose again at the end of the year, with new rounds of stimulus from the Chinese government and has remained

at a high level in early 2022 as Chinese authorities try to reach a balance between stimulating economic growth without bringing greater

inflationary pressures. In this context, ore averaged US$ 109.61/dmt (Platts, Fe62%, N. China) throughout 4Q21, 33% lower than in 3Q21

(US$ 162.94/dmt) and 18% lower than 4Q20 (US$ 133.7/dmt).

Regarding the sea freight, Route BCI-C3 (Tubarão-Qingdao)

reached an average of US$ 31.04/wmt in 4Q21, which represents a slight retraction of 2% in relation to the previous quarter,

as a result of the continuity of the crisis of logistic transport faced in the transoceanic market.

| · | Iron ore production totaled 7 million

tons in 4Q21, which represents a decrease of 33% compared to 3Q21, as a consequence of scheduled maintenance stoppages carried out in

November, in addition to a lower volume of ore purchases from third parties and the heavy rains that occurred especially in the states

of Minas Gerais and Rio de Janeiro, in October. The year 2021, however, was marked by an 18% increase in the volume produced. Additionally,

it is worth noting that the total production plus purchases from third parties was within the guidance disclosed by the Company. |

For more information, please visit our website: https://ri.csn.com.br/ | 13 |

| RESULT 4Q21 and 2021 |

| · | Sales volume reached 7,719 million

tons in 4Q21, a 6% lower performance than the previous quarter as a result of the lower volume of shipments, due to the programmed

stop and the high level of humidity verified in the period. The sales volume in 2021 was 7% higher than in 2020. |

| · | In 4Q21, net revenue

from mining totaled R$2,401 million, 14.3% lower than in the previous quarter, as a result of the combination of lower prices realized

with a lower volume of shipments, reflecting the same effects that impacted production in this quarter. Unit net revenue was US$

55.84 per wet ton, which represents a 15% decrease against the previous quarter. The 33% drop in the benchmark index was partially

offset by the positive impact of sales in lagged quotation periods, in addition to the lower impact of the realization of sales prices

made in periods prior to 4Q21. Compared to 2020, the year was extremely positive for the Company and net revenue totaled more than R$18

billion, 42% higher than the previous year and with unitary net revenue of US$100.83/t against US$78.96 /t in 2020. The main highlight

of the year was precisely the appreciation of the price of ore, which reached the mark of US$ 233.00/t in May, boosting the segment's

result to a level never reached before. |

| · | The cost of goods sold from mining totaled R$

1,669 million in 4Q21, which represents a decrease of 11% compared to the previous quarter, resulting from the lower volume

of purchase of third parties and the lower amount of products sold. The C1 Cost was USD 21.6/t in 4Q21, 15% higher when compared

to 3Q21, mainly the result of a lower dilution of fixed cost due to the drop in volume produced, in addition to the increase in port expenditure

associated with the scheduled halt on TECAR, higher demurrage and the increase in the dollar in the period. |

| · | In turn, Adjusted EBITDA

reached R$ 878 million in 4Q21, with a quarterly EBITDA margin of 36.6% or 0.6 p.p. lower than in 3Q21. The lower dilution of fixed

costs combined with the lowest prices, the lower numbers of shipped cargo, the increase in C1 and demurrage were the main responsible

for the pressure of CSN mining margins this quarter. In the year, adjusted EBITDA reached the record value of R$10.7 billion, 30% higher

than 2020’s EBITDA, mainly due to the strong performance achieved in the first half of the year. Ebitda margin in 2021, in turn,

was 60% or 5.4p.p. lower than in 2020, given the pressure faced in some costs throughout the year, such as the increase in sea freight.

|

Cement Result

2021 was another positive year for the Brazilian

cement market. Domestic sales totaled 64.7 million tons, an increase of 6.6% compared to 2020. The fourth quarter of 2021, however, was

marked by the expected seasonality of the end of the year and recorded a decrease in the sales rate of 11.7% compared to the previous

quarter. For the year 2022, the National Union of the Cement Industry (SNIC) expects an accommodation period, with an expected growth

of 0.5% and limited by the rise in interest rates and the decrease in national GDP growth. On the other hand, 2022 is an election year

and, despite the instability inherent in the process, the government itself has already announced that it intends to inject R$ 389 billion

in investments in infrastructure projects, which should insure the demand for cements.

In the case of CSN Cimentos, sales in 4Q21

were 8.8% higher than in the previous quarter, totaling 1,336kton, and 26.5% higher than in 4Q20. Contributing to this performance

was the incorporation of Elizabeth Cimentos, which accounted for 20% of sales in the period. In the year's results, 2021 goes down in

history as the period of consolidation of the strategy for the sector, with strong evolution in its own operations, acquisitions of strategic

assets and completion of the corporate restructuring that left the company ready to unlock its growth projects. The volume sold in 2021

was 4,710kton, 18% higher than in 2020 (or 8% growth if we disregard the acquisition of Elizabeth). The commercial strategy of prioritizing

bagged material and concentrating sales in smaller retail

stores has proven effective, as in 4Q21 the main drivers of activity growth were the continuity of construction and renovations through

self-construction.

For more information, please visit our website: https://ri.csn.com.br/ | 14 |

| RESULT 4Q21 and 2021 |

|

Sales Volume - Cements

(thousand tones) |

* Alhandra's operations were

integrated in September 2021.

| · | As a result, the segment's net revenue

reached R$423 million in 4Q21, a performance 9% higher than in the previous quarter, as a result of the incorporation of Elizabeth Cimentos,

which ended up offsetting the seasonality of the period and the high rainfall recorded in October. Regarding the FOB price realized in

the quarter, we had a 3.9% retraction in relation to the previous quarter, due to changes in the sales mix. On the other hand, we had

a 31.6% increase in the FOB price in 2021 when compared to 2020, which shows the positive and sustainable trend we have seen for cement

prices in Brazil. |

| · | Unit costs also rose, but to a lesser

extent, as a result of the increase in the price of imported coke and higher consumption of clinker, in addition to the scheduled stop

in November. |

| · | Thus, adjusted EBITDA in the segment

decreased 4% compared to the previous quarter, reaching R$ 137 million and adjusted EBITDA margin of 32.5%. This reduction is still a

reflection of administrative expenses related to the integration and capture of synergies with Elizabeth Cimentos and the pressure on

raw material costs. For 2021, cement operations reached a record EBITDA of R$ 531 million, 96% higher than in 2020, and with an EBITDA

margin of 37% or 5.6 p.p. above the one presented in 2020. |

Logistics Result

Rail Logistics: In 4Q21, net revenue reached

R$ 444 million, with adjusted EBITDA of R$ 178 million and adjusted EBITDA margin of 40.1%. Compared to 3Q21, net revenue decreased 13%

due to rainfall recorded in the period that impacted the volume of goods transported, and with an adjusted EBITDA of 32% inferior. In

2021, rail logistics reached a record result, with net revenue of R$1,839 million (23% higher than 2020) and with EBITDA of R$ 833 million,

also 23% higher than last year, and with an EBITDA margin of 48%.

Port Logistics: In 4Q21, 282,000 tons

of steel products were shipped by Sepetiba Tecon, in addition to 19,000 containers, 12,000 tons of general cargo and 314,000 tons of bulk.

Compared to the previous quarter, the two most significant variations were in the overall load volume, with an increase of 165%, and steel

products, which increased by 21% due to the increase in the sales of coils and plates in the period. In 2021, there was a 22% decrease

in the volume of containers due to the crisis faced in the logistics segment throughout the year, which generally affected all the seafood

companies. To mitigate the effects of this retraction in container volume, TECON sought new markets and began operating sugar shipments,

in addition to new bulk, including solid bulk, limestone, pellet ore, gypsum, dolomite and large general cargo projects. The net revenue

of the port segment was 23% higher than in the last quarter, reaching R$ 86 million in 4Q21. With the operational improvement in administrative

expenses, adjusted EBITDA increased 35%, reaching R$ 26 million in the quarter and adjusted EBITDA margin of 30.2%, or 2.7

p.p. higher. In 2021, port logistics revenue reached a record value of R$ 311 million, 21% higher than in 2020, and with record EBITDA

of R$ 91 million, an increase of 22% compared to last year.

For more information, please visit our website: https://ri.csn.com.br/ | 15 |

| RESULT 4Q21 and 2021 |

Energy Result

In 4Q21, the volume of energy traded generated

net revenue of R$47 million, with an adjusted EBITDA of R$ 4 million and an adjusted EBITDA margin of 7.8%. Compared to

the third quarter of 2021, net revenue decreased by 29%, due to the scheduled stoppages carried out in the period that demanded lower

energy volumes. Adjusted EBITDA fell by 85%, mainly due to the fact that the sector has high fixed costs. In 2021, the energy segment

posted net revenue of R$223 million and Adjusted EBITDA of R$62 million, which represents an increase of 29% and 93%, respectively, compared

to 2020.

ESG - Environmental, Social & Governance

Since 2020, we have been working on the development

of the diagnosis and internal analysis of our ESG actions based on frameworks and methodologies used in the evaluations of

ESG rating agencies. This process presented us with gaps and opportunities, which we classified, prioritized, and delegated internally

in order to continuously improve our ESG practices. In 2021, the efficiency of this process can also be recognized through the significant

improvement in the evaluation of our performance measured by the world's leading ESG rating agencies, among them: S&P Global, Sustainalytics,

FTSE4Good Index, CDP, ISS ESG, which qualify us, in many cases, above the industry average.

ENVIRONMENTAL DIMENSION

Environmental Management

CSN maintains several instruments of Socio-environmental

Management and Sustainability in order to act in a propositional way and serve the various stakeholders involved in the communities

and businesses in which it operates. We constantly work to transform natural resources into prosperity and sustainable development. To

this end, the Company monitors and guarantees the proper functioning of its Environmental Management System (EMS), implemented according

to the requirements of the international standard ISO 14001: 2015, certified by an independent international body in all its main units.

In 2021, we achieved ISO 14001:2015 certification in two more units, TECAR Port (RJ) – our port unit – and arcos (MG) certification

in our cement plant.

The year also marked the first certification in ISO

9001 – Quality Management System, the Port of TECAR (RJ), Mina Casa de Pedra (MG) and Mineração ERSA (RO).

In addition, when starting its 2021 performance evaluation

cycle, the areas with the most interface with the ESG theme established goals related to the payment of variable remuneration (PPR), with

the objective of strengthening the proactive culture in the face of the main sustainability challenges and proposing innovative solutions

to reinforce the commitment of the CSN Group with socio-environmental aspects.

As a highlight in the search for better performance

in the use of natural resources, we closed the year 2021 with a drop of 16.2% in the specific capture of water per ton of steel produced,

when compared to the year 2020, from 22.1 m³/t of steel in 2020 to 18.5m³/t of steel in 2021. Compared to 2019, the reduction

is even more significant, with a 27.7% reduction.

With regard to the search for reduction of waste

disposal in landfills, the Presidente Vargas Plant, in 2021, reached the mark of 34.7% annual reduction in the shipment of process mud

to class II landfills, when the target proposed by the company was a reduction of 10%. This positive result and beyond what was expected

was achieved due to alternative destination strategies, such as market prospecting of new customers for mud consumption and the use of

waste for recovery of areas degraded by erosive processes.

For more information, please visit our website: https://ri.csn.com.br/ | 16 |

| RESULT 4Q21 and 2021 |

It is also notelike the reuse of FEA powder residue

generated by the Steel Industry, for the internal production of metal briquets, whose reuse target was 60% to 80% of the generation of

this waste. In 2021 the proposed goal was reached, presenting a reuse of 76% of the volume generated, September being a month to sand

out, when 100% of the volume generated was used for internal production of metallic briquets.

Climate Change

The 4Q21 marks the company's support for the ICO2,

B3's Carbon Efficient Index, which demonstrates our commitment to the transparency of our emissions, on the road to a low-carbon economy.

The index is composed of shares of companies in the IBrX50 index that transparently demonstrate their practices in relation to their greenhouse

gas emissions.

In addition, we improved our performance in CDP (Disclosure

Insight Action) in the Climate Change module when we move from C to B.

CSN invests efforts and resources to reduce greenhouse

gas emissions and mitigate impacts related to climate change.

Through the use of software with artificial intelligence,

the Marginal Abatement Cost Curve (MAC Curve) was generated from the current GHG emissions scenario, as well as emission projections in

a normal business environment, and projections of low Carbon scenarios, considering the feasibility and impact of different mitigation

options.

120 proposals for technologies applicable to the

steel and cement branches that have already undergone a prior analysis of applicability within our units have been mapped. Among these

initiatives there are improvements in the production process to disruptive technologies such as the use of DRI and Hydrogen.

The Tool also assists in the construction of carbon

pricing scenarios and provided the Company to develop its Roadmap for Decarbonization and disclose its new GEE reduction targets. Between

the new targets, we highlight:

| · | In Steel: Reduction of 10% of the emission intensity

by ton/steel produced by 2030 and a reduction of 20% by 2035 (base year 2018), according to the WSA methodology. |

| · | In Mining: Reduction of 30% of GEE emissions,

per ton of ore produced, intensity by 2035, and net zero reach by 2044 in scopes 1 and 2. |

| · | In cement production, in 2021, we achieved a

significant reduction in our GHG emissions of 8% when compared to 2020 emissions, reaching the industry target projected for 2030 according

to the Brazilian Cement Technology Roadmap, with this we set as a goal to reduce by 28% (base year 2020) our emissions by 2030, reaching

20 years in advance the sector target established for 2050. |

In 4Q21 we also conclude the qualitative assessment

of risks and opportunities related to climate change for all segments of CSN, carried out on the basis of the TCFD (Task Force for Climate

Related Financial Disclosures) guidelines.

For more information, please visit our website: https://ri.csn.com.br/ | 17 |

| RESULT 4Q21 and 2021 |

Dam Management

We closed the year 2021 with all, the dams of CSN

Mineração remaining at zero emergency level, which is the best level according to the National Mining Agency (ANM).

In continuity with the decharacterization schedule

of our dams, the work of the belt channel of the Vigia Dam was completed, which is in a process of decharacterization with completion

expected in 2023.

The Fernandinho dam (B2A), owned by the company Ores

Nacional, which had in the first half of the year, its stabilization operation interrupted at the request of the National Mining Agency

(ANM), was able to restart again in 4Q21 the works that are resulting in a substantial evolution of its safety factors.

SOCIAL DIMENSION

Safety of Work

Safety is our top priority, in 4Q21 CSN ended the

period with a frequency rate of accidents with and without leave (CAF+SAF) of 2.6 per million HHT, which demonstrates a slight increase

in relation to the performance of 3Q21 of 2.4. However, 2021 ended with a frequency rate (CAF+SAF – accidents with or without leave)

of 2.4 accidents/million men worked hours, a reduction of 2% compared to 2020, the lowest result in the last 7 years.

We highlight in this scenario the reduction of frequency

rates (CAF+SAF - accidents with or without leave) of logistics (16.2%), metallurgy (1.9%) and steel (7.9%) when compared to 3Q21.

COVID-19

In order to provide greater access for its employees

to vaccines, CSN, in partnership with local governments, conducted vaccination campaigns in its units considered as essential service

providers. An internal survey was also launched for all its public in order to measure the population already vaccinated, guide, monitor

and collect compliance with the vaccination scheme of all its employees.

By the end of 2021, 75% of the workforce had full

vaccination coverage, with 94% of the workforce with at least the first dose of the vaccine.

DIVERSITY

Diversity and Inclusion

is an important to the transformation of our society and drives our business, initiatives in 2021 reflect in practice mechanisms that

promote equity and bring sustainable results of representativeness and equality.

Towards our commitment to

arrive in 2025 with 28% of Women in the CSN group, we intensified the Programa Capacitar Mulheres in The Steel Industry in Volta Redonda

and Mining in Congonhas and started the first class of Young Apprentices exclusively for women in FTL (Trasnordestina Logística

Railway). The class of 30 Young Women is a disruptive movement in the sector that aims at representing the railway in a sustainable way.

The result of Gender Representativeness in the CSN Group in 2021 was 17.5%,

an increase of 20.7% compared to the previous year. In relation to the absolute number, the company added 1,073 women, reaching 4,444

in December.

For more information, please visit our website: https://ri.csn.com.br/ | 18 |

| RESULT 4Q21 and 2021 |

In relation to the result

of Representativeness of people with disabilities, in 2021 we had a growth of 15%, compared to 2020, with practices aimed at the inclusion

of these citizens, such as the Empowering Person with Disabilities, launched in 2021 with the objective of training and hiring. In addition,

goals were rattled to all the group's businesses, directing everyone to a path of greater inclusion and diversity.

SOCIAL RESPONSIBILITY

In 2021, the CSN Foundation completed 60 years of

operation, with the development of actions aligned with the sustainable development goals (SDGs) established by the United Nations (UN).

It materializes in its projects and programs, including the SDDs of 1. Poverty Eradication; 4. Quality Education; 5. Gender Equality;

8. Decent Work and Economic Growth; 10. Reduction of Inequalities and 17. Partnerships and Means of Implementation.

The CSN Foundation believes in the transformation

of society through education and cultural expression. Among its actions, the Kid Citizen conducts a sociocultural project that serves

2,550 children and adolescents in the main cities where CSN is inserted. In 2021, its operations expanded with the opening of three more

units of the Garoto Cidadão project in Mato Grosso do Sul.

Highlights of the CSN Foundation

in the period:

| · | CSN invested more than R$ 103

million in social responsibility with contributions to 104 projects in 27 cities. |

| · | The

CSN Foundation is present in 31 cities with direct actions. |

| · | 452

cultural actions carried out with an audience reach of 215,227 views. |

| · | 474

students awarded scholarship programs. |

| · | 4,578

young people impacted by the projects carried out by the CSN Foundation. |

GOVERNANCE

CSN has been working on

the formalization of its main ESG commitments. In the third quarter, the first meeting of the ESG Committee, a non-statutory advisory

body to the Board of Directors of the CSN Group, took place, and whose composition includes its senior executive leadership. At this first

meeting, the establishment of an Integrated ESG Management Commission was approved, to be composed of ambassadors appointed by the members

of the body, so that its main functions will be to implement an open innovation and sustainability system. In addition, the Commission

will be responsible for the action plans and initiatives organized from the materiality matrix of the CSN Group that are in the process

of updating and will bring even more robustness to the implementation of the Committee in 2022. The new materiality matrix will be presented

in the next Integrated Report 2021.

INNOVATION

The Innovation agenda for the fourth quarter of 2021

of the CSN Group was marked by the progress of initiatives and investment growth aligned with the company's ESG goals. With the updating

of our commitments to combat climate change, we participated alongside important investors such as Breakthrough Ventures, Bill Gates'

green fund, in the investment round of the Israeli green hydrogen startup, H2Pro, which aims to produce green hydrogen on a large scale,

efficiently and at low cost. With this we have mapped many initiatives for the use of Green Hydrogen in our operations and that will help

us in accelerating the energy transition of our activities.

Focusing on the theme of Industry 4.0, we made an

investment in startup Oico - B2B (Business to Business) marketplace for civil construction that with innovative technology we will be

able to scale our sales channels. Clarke Energia was also a strategic investment made by CSN Inova Ventures in the fourth quarter. Working

on the theme of Greentechs (Energy Technology), this startup positions itself as a digital energy manager and better access to the free

energy market.

We started at CSN Mineração, the implementation

of an autonomous system of the truck fleet of The Casa de Pedra Mine (Congonhas - MG), which will support the possibility of remote, systemic,

and high-precision operation of tractors and semi-autonomous in the fleet of drills. With the implementation of this innovative project,

we will have the possibility of reducing the fleet of mechanical diesel trucks and consequently the reduction of atmospheric emissions,

in addition to greater efficiency and safety of our workers.

For more information, please visit our website: https://ri.csn.com.br/ | 19 |

| RESULT 4Q21 and 2021 |

With more than 70 years of experience, the CSN Research

Center located in Volta Redonda maintains the evolution of our portfolio through the development of new steel products. In 2021, about

100 new steels were under development, with 4 new specifications released in the last quarter of 2021. In the year, we reinforced our

performance in advanced techniques such as Augmented Reality and numerical simulation for process optimization and product development

and application. We have started commissioning the Vacuum Induction Furnace and Gleeble the most modern thermomechanical simulator of

steel processes in Latin America.

In parallel and in synergy with our venture capital

fund theses, we have advanced in the consolidation of the Graphene Skills Cell and pilot projects, in addition to initiating the commissioning

of the pilot plant in CCU (Carbon Capture and Utilization) that aims to produce ecological blocks from waste.

Capital Markets

In the fourth quarter of 2021, CSN shares

fell 13%, while the Ibovespa fell 5.5%. The average daily value (CSNA3) traded at B3, in turn, was R$ 311.3 million. On the New York

Stock Exchange (NYSE), the Company's American Depositary Receipts (ADRs) devaluation of 15.6%, while the Dow Jones rose

1.45%. The daily average trading with ADRs (SID) on the NYSE was $17.0 million.

| 4Q21 |

| Number of shares in thousands |

1,387,524.0 |

| Market Value |

|

| Closing Quote (R$/share) |

24.99 |

| Closing Quote (US$/ADR) |

4.44 |

| Market Value (R$ million) |

34,674 |

| Market Value (US$ million) |

6,214 |

| Change in period |

|

| CSNA3 (BRL) |

-13.0% |

| SID (USD) |

-1.6% |

| Ibovespa (BRL) |

-5.54% |

| Dow Jones (USD) |

1.45% |

| Volume |

|

| Daily average (thousand shares) |

12,489 |

| Daily average (R$ thousand) |

311,315 |

| Daily average (thousand ADRs) |

3,922 |

| Daily average (US$ thousand) |

17,043 |

|

Source: Bloomberg

|

|

Conference Call:

4Q21

Investor Conference Call & Webcast

Conference call in Portuguese with Simultaneous Translation into

English

10 March 2021 11:30 am (Brasilia time) 9:30 a.m. (New York Time) DI +1 412 717-9627 / TF +1 844 204-8942 Code: CSN Tel. Replay: +55 11 3193-1012 senha: 9435121# Webcast:

click here |

Marcelo Cunha Ribeiro – CFO and Executive Director of RI

Pedro Gomes de Souza (pedro.gs@csn.com.br)

Jaqueline Furrier (jaqueline.furrier@csn.com.br)

Danilo Dias (danilo.dias.dd1@csn.com.br)

|

Some of the statements contained herein are future

perspectives that express or imply expected results, performance or events. These perspectives include future results that may be influenced

by historical results and statements made in 'Perspectives'. Current results, performance and events may differ significantly from hypotheses

and perspectives and involve risks such as: general and economic conditions in Brazil and other countries; interest rate and exchange

rate levels, protectionist measures in the U.S., Brazil and other countries, changes in laws and regulations, and general competitive

factors (globally, regionally or nationally)

|

For more information, please visit our website: https://ri.csn.com.br/ | 20 |

| RESULT 4Q21 and 2021 |

INCOME STATEMENT

CONSOLIDATED - Corporate Law - In Thousands of Reais

For more information, please visit our website: https://ri.csn.com.br/ | 21 |

| RESULT 4Q21 and 2021 |

BALANCE SHEET

CONSOLIDATED - Corporate Law - In Thousands of Reais

For more information, please visit our website: https://ri.csn.com.br/ | 22 |

| RESULT 4Q21 and 2021 |

For more information, please visit our website: https://ri.csn.com.br/ | 23 |

| RESULT 4Q21 and 2021 |

CASH FLOW

CONSOLIDATED - Corporate Law - In Thousands of Reais

For more information, please visit our website: https://ri.csn.com.br/ | 24 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: March 9, 2022

|

COMPANHIA SIDERÚRGICA NACIONAL |

|

|

|

By: |

/S/ Benjamin Steinbruch

|

| |

Benjamin Steinbruch

Chief Executive Officer

|

|

|

|

|

|

By: |

/S/ Marcelo Cunha Ribeiro

|

| |

Marcelo Cunha Ribeiro

Chief Financial and Investor Relations Officer

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

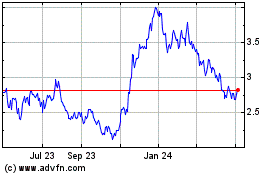

Companhia Siderurgica Na... (NYSE:SID)

Historical Stock Chart

From Nov 2024 to Dec 2024

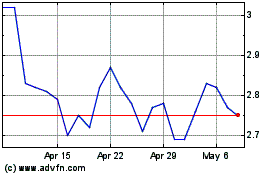

Companhia Siderurgica Na... (NYSE:SID)

Historical Stock Chart

From Dec 2023 to Dec 2024