Will PepsiCo Beat in 4Q? - Analyst Blog

February 11 2013 - 4:40AM

Zacks

PepsiCo, Inc. (PEP) is set to report fourth

quarter 2012 results on Feb 14. Last quarter it posted a 3.45%

positive surprise. Let’s see how things are shaping up for this

announcement.

Growth Factors this Past Quarter

Though earnings beat the Zacks Consensus Estimates, they

declined year over year due to a sluggish top line. Revenues

declined in the quarter due to currency headwinds and

re-franchising of the beverage business in China and Mexico.

Excluding these headwinds, organic revenues grew year over year

primarily on the back of price increases. Both snacks and beverage

volumes improved in the quarter. However, beverage volumes declined

in North America.

The overall carbonated soft drinks’ (CSD) volumes in North

America have been weak since the past few months. Changing consumer

preferences, increasing health consciousness and growing regulatory

pressures are affecting beverage sales. This is hurting CSD volumes

for PepsiCo as well as other beverage companies like The

Coca-Cola Company (KO).

Earnings Whispers?

Our proven model does not conclusively show that PepsiCo is

likely to beat earnings this quarter. That is because a stock needs

to have both a positive Earnings ESP (Read: Zacks Earnings ESP: A

Better Method) and a Zacks Rank of #1, 2 or 3 for this to happen.

That is not the case here as you will see below.

Zacks ESP: The Earnings ESP is 0.0%.

Zacks #3 Rank (Hold).PepsiCo’s Zacks #3 Rank

(Hold) lowers the predictive power of ESP because the Zacks Rank #3

when combined with a 0.0% ESP makes surprise prediction

difficult.

We caution against stocks with Zacks #4 and #5 Ranks (Sell rated

stocks) going into the earnings announcement, especially when the

company is seeing negative estimate revisions momentum.

Management expects pricing gains to moderate in the fourth

quarter than the third quarter. The structural changes are expected

to hurt fourth quarter revenues by 2.5%, lower than the third

quarter. Currency is expected to hurt both revenue and operating

profit by approximately 1% in the fourth quarter, significantly

lesser than the third quarter. The lower headwinds from currency

and structural changes could result in better top-line growth in

the fourth quarter. Commodity inflation is also expected to

moderate in the fourth quarter.

Other Stocks to Consider

Here are some other companies you may want to consider as our

model shows they have the right combination of elements to post an

earnings beat this quarter:

Coca-Cola FEMSA S.A.B de C.V. (KOF), with an

Earnings ESP of +7.87% and a Zacks Rank #2 (Buy)

Kellogg Company (K), with an Earnings ESP of

+0.97% and a Zacks Rank #2 (Buy)

KELLOGG CO (K): Free Stock Analysis Report

COCA COLA CO (KO): Free Stock Analysis Report

COCA-COLA FEMSA (KOF): Free Stock Analysis Report

PEPSICO INC (PEP): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

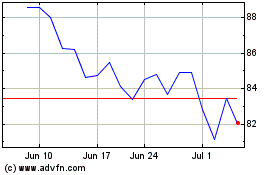

Coca Cola FEMSA SAB De CV (NYSE:KOF)

Historical Stock Chart

From Aug 2024 to Sep 2024

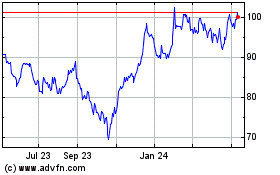

Coca Cola FEMSA SAB De CV (NYSE:KOF)

Historical Stock Chart

From Sep 2023 to Sep 2024