UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2024

Commission file number: 001-38726

CNFinance Holdings Limited

(Exact Name of Registrant as Specified in Its Charter)

44/F, Tower G, No.

16 Zhujiang Dong Road

Tianhe District, Guangzhou

City, Guangdong Province 510620

People’s Republic

of China

+86-20-62316688

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F ☒

Form 40-F ☐

INFORMATION CONTAINED

IN THIS REPORT ON FORM 6-K

Change in Registrant’s Certifying

Accountants

CNFinance Holdings Limited (the “Company”) announced the

dismissal of KPMG Huazhen LLP (“KPMG”), the Company’s independent registered public accounting firm, and appointment

of HTL International, LLC (“HTL”) as the Company’s independent registered public accounting firm for the fiscal year

ended December 31, 2024, effective December 6, 2024. The appointment of HTL and dismissal of KPMG have been approved by the audit committee

of the Company’s Board of Directors. The Company’s decision to make this change was not the result of any disagreement between

the Company and KPMG on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure.

HTL succeeds KPMG, the Company’s previous independent registered

public accounting firm. The reports of KPMG on the Company’s consolidated financial statements for each of the fiscal years ended

December 31, 2022 and 2023 did not contain an adverse opinion or a disclaimer of opinion and were not qualified or modified as to uncertainty,

audit scope or accounting principle.

During each of the fiscal years ended December 31, 2022 and 2023 and

the subsequent period through December 6, 2024, there have been no disagreements between the Company and KPMG on any matter of accounting

principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction

of KPMG, would have caused KPMG to make reference to the subject matter of the disagreements in its report on the consolidated financial

statements, and there have been no “reportable events” as the term is described in Item 16F(a)(1)(v) of Form 20-F.

The Company had provided KPMG with a copy of the disclosure it is making

in this Current Report on Form 6-K and requested from KPMG a letter addressed to the Securities and Exchange Commission indicating whether

it agrees with such disclosure. A copy of KPMG’s letter dated December 6, 2024 is attached hereto as Exhibit 16.1.

During each of the fiscal years ended December 31, 2022 and 2023 and

the subsequent period through December 6, 2024, neither the Company, nor anyone on behalf of the Company, has consulted HTL regarding

either (a) the application of accounting principles to a specified transaction, either completed or proposed; or the type of audit opinion

that might be rendered on the Company’s consolidated financial statements, and neither a written report was provided to the Company

or oral advice was provided that HTL concluded was an important factor considered by the Company in reaching a decision as to the accounting,

auditing or financial reporting issue; or (b) any matter that was the subject of a disagreement as defined in Item 16F(a)(1)(iv) of Form

20-F and related instructions to Item 16F of Form 20-F, or any reportable events as described in Item 16F(a)(1)(v) of Form 20-F.

INCORPORATION BY REFERENCE

This report on Form 6-K shall be incorporated by reference into the

Company’s registration statement on Form F-3, as amended, which became effective on February 15, 2023 (File no. 333-259304), and

be a part thereof from the date on which this report is furnished to the SEC, to the extent not superseded by documents or reports subsequently

filed or furnished.

EXHIBIT INDEX

Signature

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

CNFINANCE HOLDINGS LIMITED |

| |

|

|

| Date: December 6, 2024 |

|

By: |

/s/ Bin Zhai |

| |

|

|

Name: |

Bin Zhai |

| |

|

|

|

Title: |

Chief Executive Officer and Chairman |

Exhibit 16.1

Date: December 6, 2024

Securities and Exchange Commission

Washington, D.C. 20549

Ladies and Gentlemen:

We were previously principal accountants for CNFinance Holdings Limited

and, under the date of April 26, 2024, we reported on the consolidated financial statements of CNFinance Holdings Limited as of

and for the years ended December 31, 2023 and 2022 and the effectiveness of internal control over financial reporting as of December 31,

2023. On December 6, 2024, we were dismissed.

We have read CNFinance Holdings Limited’s statements included

in its Form 6-K dated December 6, 2024, and we agree with such statements, except that we are not in a position to agree or disagree with

CNFinance Holdings Limited’s statements that (i) HTL International, LLC is appointed as CNFinance Holdings Limited’s independent

registered public accounting firm for the fiscal year ended December 31, 2024 and (ii) that neither CNFinance Holdings Limited, nor anyone

on its behalf, has consulted HTL International, LLC regarding either (a) the application of accounting principles to a specified transaction,

either completed or proposed; or the type of audit opinion that might be rendered on the CNFinance Holdings Limited’s consolidated

financial statements, and neither a written report was provided to the CNFinance Holdings Limited or oral advice was provided that HTL

International, LLC concluded was an important factor considered by the CNFinance Holdings Limited in reaching a decision as to the accounting,

auditing or financial reporting issue; or (b) any matter that was the subject of a disagreement as defined in Item 16F(a)(1)(iv) of Form

20-F and related instructions to Item 16F of Form 20-F, or any reportable events as described in Item 16F(a)(1)(v) of Form 20-F.

Very truly yours,

/s/ KPMG Huazhen LLP

Exhibit 99.1

CNFinance Announces Change of Auditor

GUANGZHOU, China, December 6, 2024 /PRNewswire/ -- CNFinance Holdings

Limited (NYSE: CNF) (“CNFinance” or the “Company”), a leading home equity loan service provider

in China, today announced the dismissal of KPMG Huazhen LLP (“KPMG”), the Company’s independent registered public accounting

firm, and appointment of HTL International, LLC (“HTL”) as the Company’s independent registered public accounting firm

for the fiscal year ended December 31, 2024, effective December 6, 2024.

The appointment of HTL was made after a careful and thorough evaluation

process and has been approved by the audit committee of the Company’s board of directors.

HTL succeeds KPMG, the Company’s previous independent registered

public accounting firm. The reports of KPMG on the Company’s consolidated financial statements for each of the fiscal years ended

December 31, 2022 and 2023 did not contain an adverse opinion or a disclaimer of opinion and were not qualified or modified as to uncertainty,

audit scope or accounting principle.

During each of the fiscal years ended December 31, 2022 and 2023 and

the subsequent period through December 6, 2024, there have been no disagreements between the Company and KPMG on any matter of accounting

principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction

of KPMG, would have caused KPMG to make reference to the subject matter of the disagreements in its report on the consolidated financial

statements, and there have been no “reportable events” as the term is described in Item 16F(a)(1)(v) of Form 20-F.

The Company is working closely with KPMG and HTL

to ensure a seamless transition.

The audit committee would like to express its

sincere gratitude to KPMG for its quality of services rendered to the Company over the past years.

About CNFinance Holdings Limited

CNFinance Holdings Limited (NYSE: CNF) (“CNFinance”

or the “Company”) is a leading home equity loan service provider in China. CNFinance, through its operating subsidiaries

in China, conducts business by connecting demands and supplies through collaborating with sales partners and trust companies under the

trust lending model, and sales partners, local channel partners and commercial banks under the commercial bank partnership model. Sales

partners and local channel partners are responsible for recommending micro- and small-enterprise (“MSE”) owners with

financing needs to the Company and the Company introduces eligible borrowers to licensed financial institutions with sufficient funding

sources including trust companies and commercial banks who will then conduct their own risk assessments and make credit decisions. The

Company’s primary target borrower segment is MSE owners who own real properties in Tier 1 and Tier 2 cities and other major cities

in China. The Company’s risk mitigation mechanism is embedded in the design of its loan products, supported by an integrated online

and offline process focusing on risks of both borrowers and collateral and further enhanced by effective post-loan management procedures.

For more information, please contact:

CNFinance

E-mail: ir@cashchina.cn

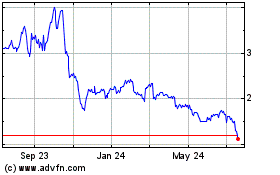

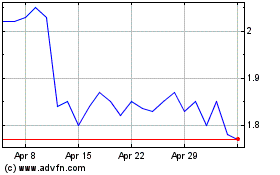

CNFinance (NYSE:CNF)

Historical Stock Chart

From Jan 2025 to Feb 2025

CNFinance (NYSE:CNF)

Historical Stock Chart

From Feb 2024 to Feb 2025