Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

February 27 2025 - 6:46AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of

Foreign Private Issuer

Pursuant to Rule 13a-16 or

15d-16 under

the Securities Exchange Act of 1934

For the month of February, 2025

Commission File Number: 1-14678

CANADIAN IMPERIAL BANK OF COMMERCE

(Translation of registrant’s name into English)

CIBC Square, 81 Bay Street

Toronto, Ontario

Canada

M5J 0E7

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form

20-F or Form 40-F:

Form 20-F ☐ Form 40-F ☒

The information contained in this Form 6-K is incorporated by reference into the Registration Statements on Form S-8 File Nos. 333-130283, 333-09874 and 333-218913 and Form

F-3 File Nos. 333-219550, 333-220284, 333-272447, and

333-282307.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

CANADIAN IMPERIAL BANK OF COMMERCE |

|

|

|

|

| Date: February 27, 2025 |

|

|

|

By: |

|

/s/ Allison Mudge |

|

|

|

|

Name: |

|

Allison Mudge |

|

|

|

|

Title: |

|

Senior Vice-President |

Exhibit 99.1

CANADIAN IMPERIAL BANK OF COMMERCE

Earnings Coverage on Subordinated Indebtedness as at January 31, 2025

Interest requirements based on subordinated indebtedness were $497 million for the 12-month period ended

January 31, 2025. Earnings before income taxes and interest requirements on subordinated indebtedness, net of non-controlling interests, for the 12-month period

ended January 31, 2025, were $10,278 million, which was 20.7 times our interest requirements as described above.

This ratio is

calculated on the basis of amounts derived from our consolidated financial statements prepared in accordance with International Financial Reporting Standards (“IFRS”) for the 12-month period ended

January 31, 2025. The ratio reported is not defined by IFRS and does not have any standardized meaning under IFRS and thus may not be comparable to similar measures used by other issuers.

In calculating the ratio, non-controlling interests were adjusted to

before-tax equivalents using the applicable effective income tax rates.

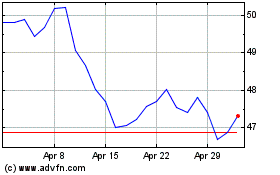

Canadian Imperial Bank o... (NYSE:CM)

Historical Stock Chart

From Feb 2025 to Mar 2025

Canadian Imperial Bank o... (NYSE:CM)

Historical Stock Chart

From Mar 2024 to Mar 2025