Maui Land & Pineapple Reports 1st Quarter 2021 Results

May 03 2021 - 5:15PM

Maui Land & Pineapple Company, Inc. “MLP” (NYSE: MLP) reported

a net loss of $934,000, or $(0.05) per share, for the first quarter

of 2021, compared to a net loss of $1,074,000, or $(0.06) per

share, for the first quarter of 2020. The Company reported total

operating revenues of $2.06 million and $2.04 million during the

three months ended March 31, 2021 and 2020, respectively.

The Company did not have any real estate asset sales during the

first quarters of 2021 or 2020.

MLP completed the sale of its regulated utility assets of

Kapalua Water Company, Ltd. and Kapalua Waste Treatment Company,

Ltd. on May 1, 2021. The sale results in net proceeds of $4.2

million from Hawaii Water Service (HWS), a subsidiary of California

Water Service Group (NYSE: CWT). As part of the Hawaii Public

Utilities Commission approval of this transaction in March 2021,

the water and wastewater service areas have been expanded in order

to serve future developments within the Kapalua resort.

Additional Information

Additional information with respect to Maui Land & Pineapple

Company, Inc. and our operating results will be available on our

Form 10-Q filed with the Securities and Exchange Commission and our

website www.mauiland.com.

About Maui Land & Pineapple Company, Inc.

Maui Land & Pineapple Company, Inc. develops, sells, and

manages residential, resort, commercial, agricultural and

industrial real estate. The Company owns approximately 23,000 acres

of land on Maui and manages properties, utilities, and a nature

preserve at the Kapalua Resort.

Contact:Michael S. Hottamhotta@kapalua.com

|

MAUI LAND & PINEAPPLE COMPANY, INC. AND

SUBSIDIARIES |

|

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

AND |

|

COMPREHENSIVE LOSS |

|

|

|

(UNAUDITED) |

|

|

|

|

|

| |

|

|

|

| |

Three Months Ended March 31, |

|

|

|

2021 |

|

|

|

2020 |

|

| |

|

| |

(in thousands except |

| |

per share amounts) |

| OPERATING REVENUES |

|

|

|

| Real estate |

$ |

- |

|

|

$ |

69 |

|

| Leasing |

|

1,801 |

|

|

|

1,736 |

|

| Resort amenities and

other |

|

258 |

|

|

|

230 |

|

|

Total operating revenues |

|

2,059 |

|

|

|

2,035 |

|

| |

|

|

|

| OPERATING COSTS AND

EXPENSES |

|

|

|

| Real estate |

|

97 |

|

|

|

175 |

|

| Leasing |

|

840 |

|

|

|

776 |

|

| Resort amenities and

other |

|

412 |

|

|

|

570 |

|

| General and

administrative |

|

719 |

|

|

|

760 |

|

| Share-based compensation |

|

349 |

|

|

|

425 |

|

| Depreciation |

|

300 |

|

|

|

323 |

|

|

Total operating costs and expenses |

|

2,717 |

|

|

|

3,029 |

|

| |

|

|

|

| OPERATING LOSS |

|

(658 |

) |

|

|

(994 |

) |

| Other income |

|

13 |

|

|

|

- |

|

| Pension and other

post-retirement expenses |

|

(116 |

) |

|

|

(117 |

) |

| Interest expense |

|

(33 |

) |

|

|

(46 |

) |

| LOSS FROM CONTINUING

OPERATIONS |

$ |

(794 |

) |

|

$ |

(1,157 |

) |

| Income (Loss) from

discontinued operations, net |

|

(140 |

) |

|

|

83 |

|

| NET LOSS |

$ |

(934 |

) |

|

$ |

(1,074 |

) |

| Pension, net |

|

221 |

|

|

|

206 |

|

| TOTAL COMPREHENSIVE LOSS |

$ |

(713 |

) |

|

$ |

(868 |

) |

| |

|

|

|

| EARNINGS (LOSS) PER COMMON

SHARE-BASIC AND DILUTED |

|

|

|

|

Loss from Continuing Operations |

$ |

(0.04 |

) |

|

$ |

(0.06 |

) |

|

Income (Loss) from Discontinued Operations |

$ |

(0.01 |

) |

|

$ |

- |

|

|

Net Loss |

$ |

(0.05 |

) |

|

$ |

(0.06 |

) |

| |

|

|

|

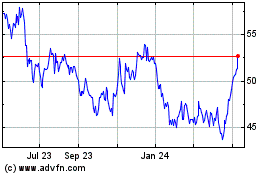

California Water Service (NYSE:CWT)

Historical Stock Chart

From Aug 2024 to Sep 2024

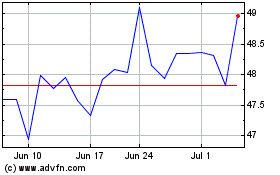

California Water Service (NYSE:CWT)

Historical Stock Chart

From Sep 2023 to Sep 2024