BRIDGE INVESTMENT GROUP HOLDINGS INC. REPORTS SECOND QUARTER 2023 RESULTS SALT LAKE CITY, UTAH—August 7, 2023—Bridge Investment Group Holdings Inc. (NYSE: BRDG) (“Bridge” or the “Company”) today reported its financial results for the quarter ended June 30, 2023. Net Income (Loss) was $(2.8) million for the quarter ended June 30, 2023. On a basic and diluted basis, net income (loss) attributable to Bridge per share of Class A common stock was $(0.24). Distributable Earnings of Bridge Investment Group Holdings LLC (the “Operating Company”) were $35.0 million, or $0.20 per share after-tax, for the quarter ended June 30, 2023. Fee Related Earnings to the Operating Company were $35.1 million for the quarter ended June 30, 2023. Robert Morse, Bridge’s Executive Chairman, stated “Despite market headwinds in capital raising and deployment, Bridge delivered a solid quarter with the help of growth in many of our key financial metrics, including 43% year- over-year growth in fee-earning AUM and 33% year-over-year growth in recurring management fees. This has served our platform well, providing stability to our business during a period of volatility. We have remained patient and selective through unstable times as asset prices have adjusted, and more recently have found attractive opportunities to deploy meaningful capital. As we look forward, Bridge is poised for success across a number of growth vectors, including residential rental, logistics, credit and secondaries strategies.” Jonathan Slager, Bridge’s Chief Executive Officer, added “In uncertain times, forward integration and sector specialization is our vital differentiator. We're experiencing positive trends in most of our areas of focus and seeing green shoots on the transaction side as our deal pipelines grow. We are well-positioned to execute on the widening opportunity set we see today.” Common Dividend Bridge declared a quarterly dividend of $0.17 per share of its Class A common stock, payable on September 15, 2023 to its Class A common stockholders of record at the close of business on September 1, 2023. Additional Information Bridge Investment Group Holdings Inc. issued a full detailed presentation of its second quarter 2023 results, which can be viewed on the Investors section of our website at www.bridgeig.com. The presentation is titled “Second Quarter 2023 Earnings Presentation.” Conference Call and Webcast Information The Company will host a conference call on August 8, 2023 at 8:30 a.m. ET to discuss its second quarter 2023 results. Interested parties may access the conference call live over the phone by dialing 1-877-405-1210 (domestic) or 1-201-689-8721 (international) and requesting Bridge Investment Group Holdings Inc.’s Second Quarter 2023 Earnings Conference Call. Participants are asked to dial in a few minutes prior to the call to register for the event. The event will also be available live via webcast which can be accessed here or from our Investor Relations website https://ir.bridgeig.com. An audio replay of the conference call will be available approximately three hours after the conference call until 11:59 p.m. ET on August 22, 2023 and can be accessed by dialing 1-877-660-6853 (domestic) or 1-201-612-7415 (international), and providing the passcode 13739983. Exhibit 99.1

About Bridge Bridge is a leading, alternative investment manager, diversified across specialized asset classes, with approximately $48.9 billion of assets under management as of June 30, 2023. Bridge combines its nationwide operating platform with dedicated teams of investment professionals focused on select U.S. verticals across real estate, credit, renewable energy and secondaries strategies. Forward-Looking Statements This earnings release contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, which relate to future events or our future performance or financial condition. All statements other than statements of historical facts may be forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “outlook,” “could,” “believes,” “expects,” “potential,” “opportunity,” “continues,” “may,” “will,” “should,” “over time,” “seeks,” “predicts,” “intends,” “plans,” “estimates,” “anticipates,” “foresees” or negative versions of those words, other comparable words or other statements that do not relate to historical or factual matters. Accordingly, we caution you that any such forward- looking statements are based on our beliefs, assumptions and expectations as of the date made, taking into account all information available to us at that time. These statements are not guarantees of future performance, conditions or results and involve a number of risks and uncertainties that are difficult to predict and beyond our control. Actual results may differ materially from those express or implied in the forward-looking statements as a result of a number of factors, including but not limited to those risks described from time to time in our filings with the Securities and Exchange Commission. Any forward-looking statement speaks only as of the date on which it is made. Bridge undertakes no duty to publicly update any forward-looking statements made herein or on the webcast/conference call or otherwise, whether as a result of new information, future developments or otherwise, except as required by law. Nothing in this press release constitutes an offer to sell or solicitation of an offer to buy any securities of the Company or any investment fund managed by the Company or its affiliates. Shareholder Relations: Bonni Rosen Bridge Investment Group Holdings Inc. shareholderrelations@bridgeig.com Media: Charlotte Morse Bridge Investment Group Holdings Inc. (877) 866-4540 charlotte.morse@bridgeig.com

August 7, 2023 2nd Quarter 2023 Earnings Presentation

2 DISCLAIMER The information contained herein does not constitute or form part of, and should not be construed as, an offer or invitation to subscribe for, underwrite or otherwise acquire, any securities of Bridge Investment Group Holdings Inc. (“Bridge” or the “Company”), Bridge Investment Group Holdings LLC (the “Operating Company”) or any affiliate of Bridge, or any fund or other investment vehicle managed by Bridge or an affiliate of Bridge. This presentation should not form the basis of, or be relied on in connection with, any contract to purchase or subscribe for any securities of Bridge or any fund or other investment vehicle managed by Bridge or an affiliate of Bridge, or in connection with any other contract or commitment whatsoever. This presentation does not constitute a “prospectus” within the meaning of the Securities Act of 1933, as amended. Any decision to purchase securities of Bridge or any of its affiliates should be made solely on the basis of the information contained in a prospectus to be issued by Bridge in relation to a specific offering. Forward-Looking Statements This presentation contains forward-looking statements. All statements other than statements of historical facts contained in this presentation may be forward-looking statements. Statements regarding our future results of operations and financial position, business strategy and plans and objectives of management for future operations, including, among others, statements regarding expected growth, capital raising, expectations or targets related to financial and non-financial measures, future capital expenditures, fund performance and debt service obligations, are forward-looking statements. In some cases, you can identify forward-looking statements by terms, such as “may,” “will,” “should,” “expects,” “plans,” “seek,” “anticipates,” “plan,” “forecasts,” “outlook,” “could,” “intends,” “targets,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms or other similar expressions. Accordingly, we caution you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict and beyond our ability to control. Although we believe that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. If one or more events related to these forward-looking statements or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may differ materially from what we anticipate. Many of the important factors that will determine these results are beyond our ability to control or predict. We believe these factors include but are not limited to those risk factors described under the section entitled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022, filed with the United States Securities and Exchange Commission (the “SEC”) on February 27, 2023, which is accessible on the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with other cautionary statements included in this report and our other filings. You should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and, except as otherwise required by law, we do not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise. New factors emerge from time to time, and it is not possible for us to predict which will arise. We cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Industry Information Unless otherwise indicated, information contained in this presentation concerning our industry, competitive position and the markets in which we operate is based on information from independent industry and research organizations, other third-party sources and management estimates. Management estimates are derived from publicly available information released by independent industry analysts and other third-party sources, as well as data from our internal research, and are based on assumptions made by us upon reviewing such data, and our experience in, and knowledge of, such industry and markets, which we believe to be reasonable. In addition, projections, assumptions and estimates of the future performance of the industry in which we operate and our future performance are necessarily subject to uncertainty and risk due to a variety of factors, which could cause results to differ materially from those expressed in the estimates made by the independent parties and by us. Non-GAAP Financial Measures This presentation uses financial measures that are not presented in accordance with generally accepted accounted principles in the United States (“GAAP”), such as Distributable Earnings, Fee Related Earnings, Fee Related Revenues and Performance Related Earnings, to supplement financial information presented in accordance with GAAP. There are limitations to the use of the non-GAAP financial measures presented in this presentation. For example, the non-GAAP financial measures may not be comparable to similarly titled measures of other companies. Other companies may calculate non-GAAP financial measures differently than the Company, limiting the usefulness of those measures for comparative purposes. Throughout this presentation, all current period amounts are preliminary and unaudited.

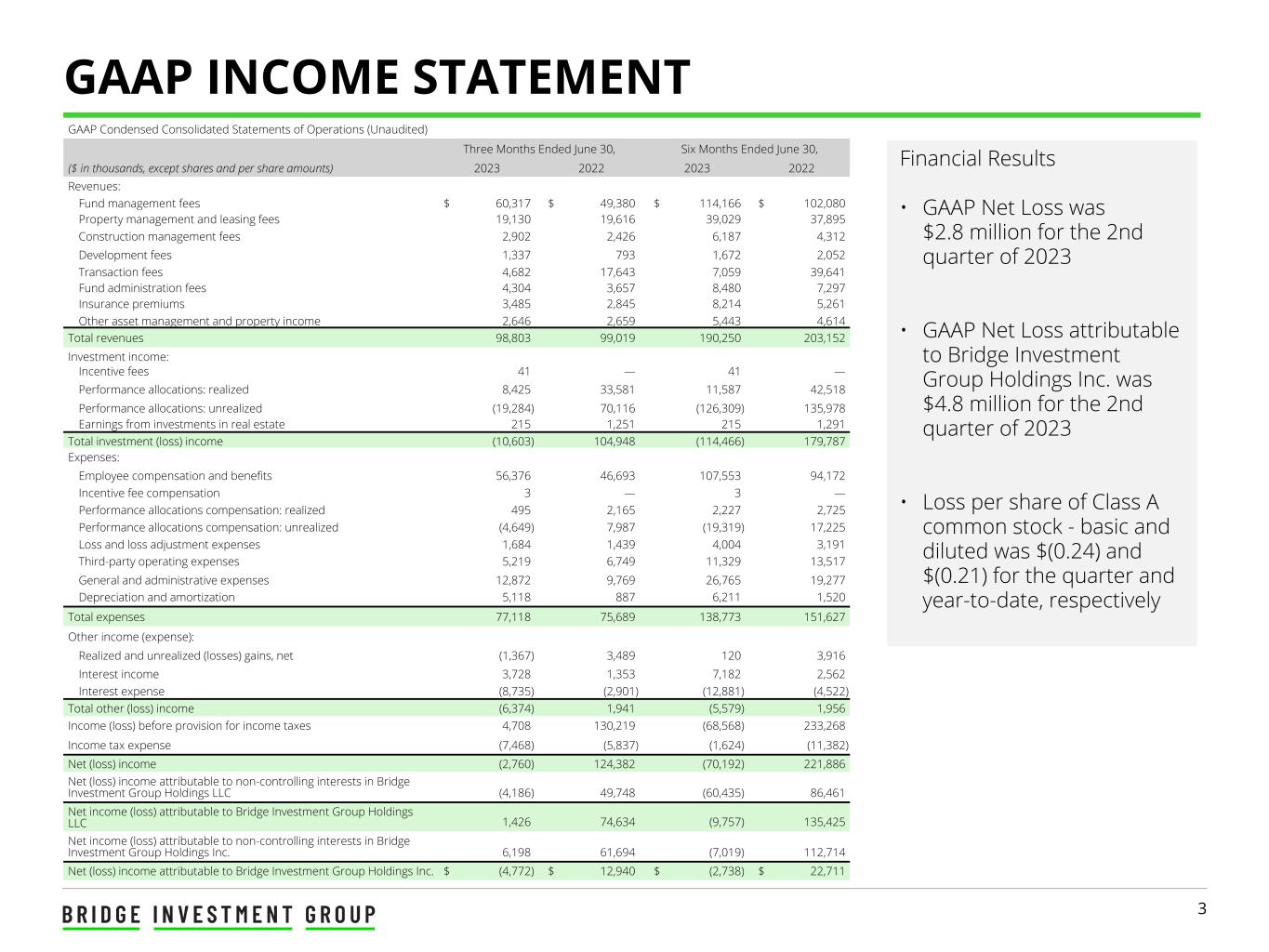

3 GAAP INCOME STATEMENT GAAP Condensed Consolidated Statements of Operations (Unaudited) Three Months Ended June 30, Six Months Ended June 30, ($ in thousands, except shares and per share amounts) 2023 2022 2023 2022 Revenues: Fund management fees $ 60,317 $ 49,380 $ 114,166 $ 102,080 Property management and leasing fees 19,130 19,616 39,029 37,895 Construction management fees 2,902 2,426 6,187 4,312 Development fees 1,337 793 1,672 2,052 Transaction fees 4,682 17,643 7,059 39,641 Fund administration fees 4,304 3,657 8,480 7,297 Insurance premiums 3,485 2,845 8,214 5,261 Other asset management and property income 2,646 2,659 5,443 4,614 Total revenues 98,803 99,019 190,250 203,152 Investment income: Incentive fees 41 — 41 — Performance allocations: realized 8,425 33,581 11,587 42,518 Performance allocations: unrealized (19,284) 70,116 (126,309) 135,978 Earnings from investments in real estate 215 1,251 215 1,291 Total investment (loss) income (10,603) 104,948 (114,466) 179,787 Expenses: Employee compensation and benefits 56,376 46,693 107,553 94,172 Incentive fee compensation 3 — 3 — Performance allocations compensation: realized 495 2,165 2,227 2,725 Performance allocations compensation: unrealized (4,649) 7,987 (19,319) 17,225 Loss and loss adjustment expenses 1,684 1,439 4,004 3,191 Third-party operating expenses 5,219 6,749 11,329 13,517 General and administrative expenses 12,872 9,769 26,765 19,277 Depreciation and amortization 5,118 887 6,211 1,520 Total expenses 77,118 75,689 138,773 151,627 Other income (expense): Realized and unrealized (losses) gains, net (1,367) 3,489 120 3,916 Interest income 3,728 1,353 7,182 2,562 Interest expense (8,735) (2,901) (12,881) (4,522) Total other (loss) income (6,374) 1,941 (5,579) 1,956 Income (loss) before provision for income taxes 4,708 130,219 (68,568) 233,268 Income tax expense (7,468) (5,837) (1,624) (11,382) Net (loss) income (2,760) 124,382 (70,192) 221,886 Net (loss) income attributable to non-controlling interests in Bridge Investment Group Holdings LLC (4,186) 49,748 (60,435) 86,461 Net income (loss) attributable to Bridge Investment Group Holdings LLC 1,426 74,634 (9,757) 135,425 Net income (loss) attributable to non-controlling interests in Bridge Investment Group Holdings Inc. 6,198 61,694 (7,019) 112,714 Net (loss) income attributable to Bridge Investment Group Holdings Inc. $ (4,772) $ 12,940 $ (2,738) $ 22,711 Financial Results • GAAP Net Loss was $2.8 million for the 2nd quarter of 2023 • GAAP Net Loss attributable to Bridge Investment Group Holdings Inc. was $4.8 million for the 2nd quarter of 2023 • Loss per share of Class A common stock - basic and diluted was $(0.24) and $(0.21) for the quarter and year-to-date, respectively

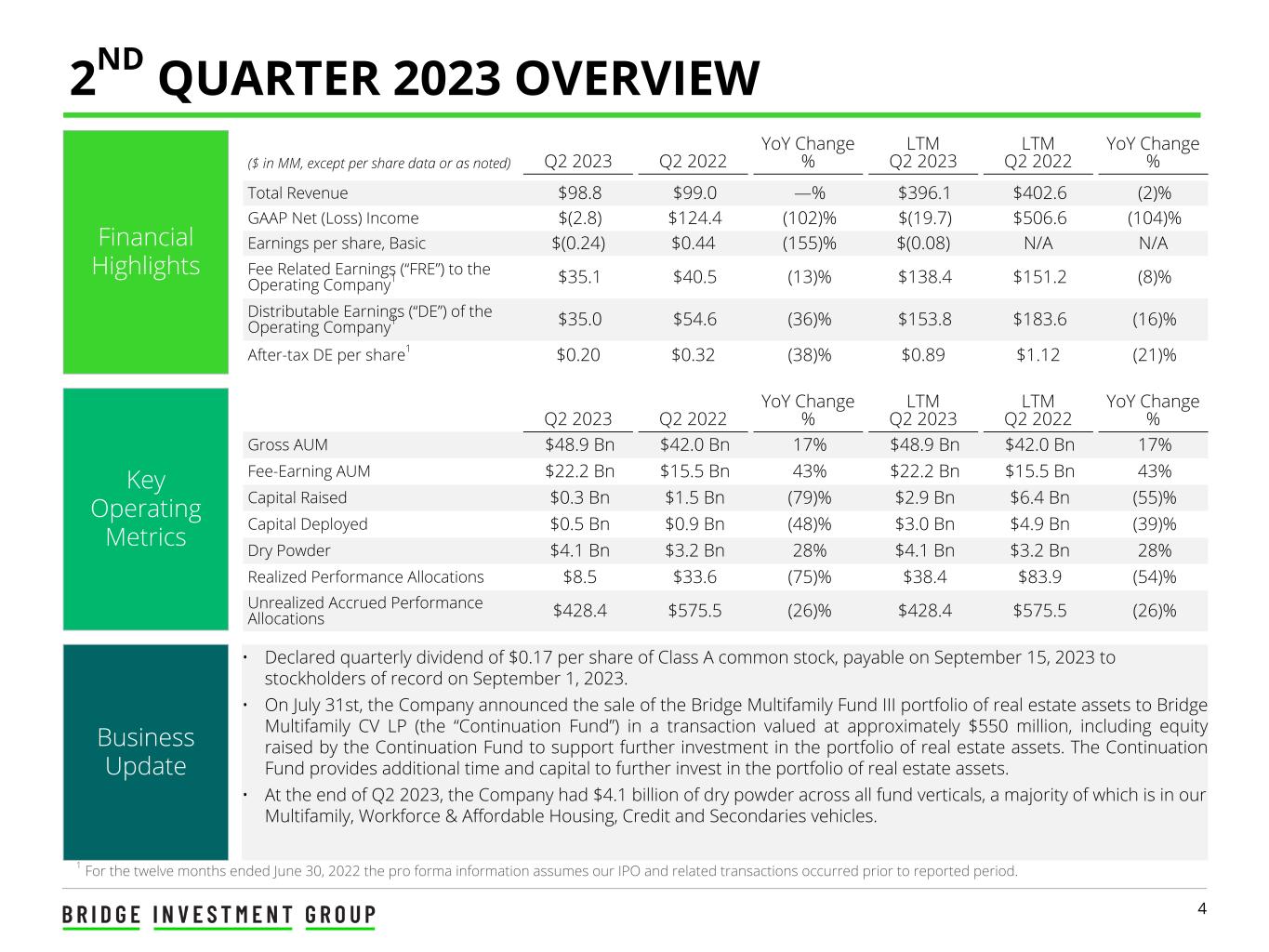

4 Financial Highlights 2ND QUARTER 2023 OVERVIEW Key Operating Metrics Business Update • Declared quarterly dividend of $0.17 per share of Class A common stock, payable on September 15, 2023 to stockholders of record on September 1, 2023. • On July 31st, the Company announced the sale of the Bridge Multifamily Fund III portfolio of real estate assets to Bridge Multifamily CV LP (the “Continuation Fund”) in a transaction valued at approximately $550 million, including equity raised by the Continuation Fund to support further investment in the portfolio of real estate assets. The Continuation Fund provides additional time and capital to further invest in the portfolio of real estate assets. • At the end of Q2 2023, the Company had $4.1 billion of dry powder across all fund verticals, a majority of which is in our Multifamily, Workforce & Affordable Housing, Credit and Secondaries vehicles. ($ in MM, except per share data or as noted) Q2 2023 Q2 2022 YoY Change % LTM Q2 2023 LTM Q2 2022 YoY Change % Total Revenue $98.8 $99.0 —% $396.1 $402.6 (2)% GAAP Net (Loss) Income $(2.8) $124.4 (102)% $(19.7) $506.6 (104)% Earnings per share, Basic $(0.24) $0.44 (155)% $(0.08) N/A N/A Fee Related Earnings (“FRE”) to the Operating Company1 $35.1 $40.5 (13)% $138.4 $151.2 (8)% Distributable Earnings (“DE”) of the Operating Company1 $35.0 $54.6 (36)% $153.8 $183.6 (16)% After-tax DE per share1 $0.20 $0.32 (38)% $0.89 $1.12 (21)% Q2 2023 Q2 2022 YoY Change % LTM Q2 2023 LTM Q2 2022 YoY Change % Gross AUM $48.9 Bn $42.0 Bn 17% $48.9 Bn $42.0 Bn 17% Fee-Earning AUM $22.2 Bn $15.5 Bn 43% $22.2 Bn $15.5 Bn 43% Capital Raised $0.3 Bn $1.5 Bn (79)% $2.9 Bn $6.4 Bn (55)% Capital Deployed $0.5 Bn $0.9 Bn (48)% $3.0 Bn $4.9 Bn (39)% Dry Powder $4.1 Bn $3.2 Bn 28% $4.1 Bn $3.2 Bn 28% Realized Performance Allocations $8.5 $33.6 (75)% $38.4 $83.9 (54)% Unrealized Accrued Performance Allocations $428.4 $575.5 (26)% $428.4 $575.5 (26)% 1 For the twelve months ended June 30, 2022 the pro forma information assumes our IPO and related transactions occurred prior to reported period.

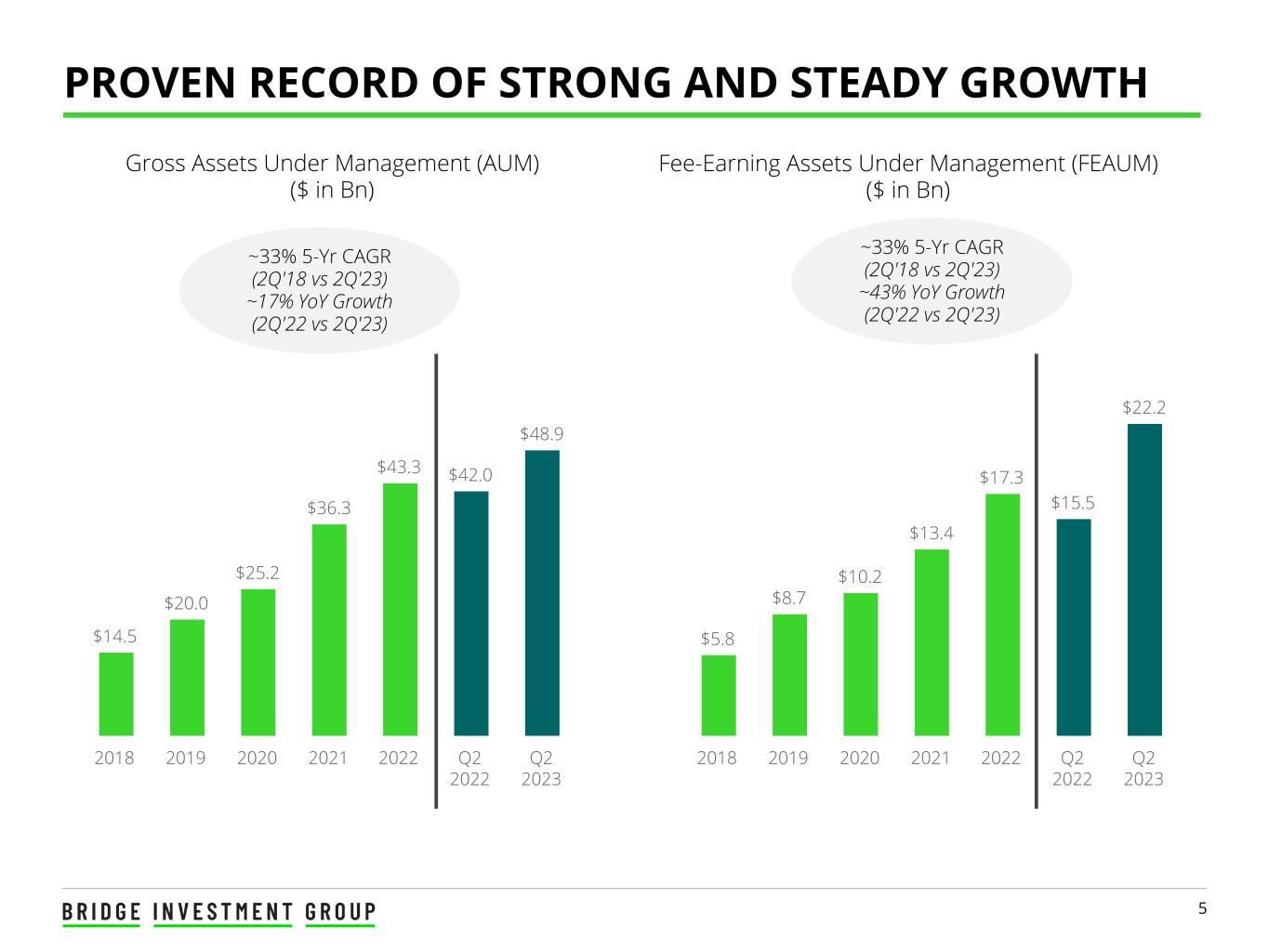

5 $14.5 $20.0 $25.2 $36.3 $43.3 $42.0 $48.9 2018 2019 2020 2021 2022 Q2 2022 Q2 2023 Gross Assets Under Management (AUM) ($ in Bn) Fee-Earning Assets Under Management (FEAUM) ($ in Bn) PROVEN RECORD OF STRONG AND STEADY GROWTH ~33% 5-Yr CAGR (2Q'18 vs 2Q'23) ~17% YoY Growth (2Q'22 vs 2Q'23) $5.8 $8.7 $10.2 $13.4 $17.3 $15.5 $22.2 2018 2019 2020 2021 2022 Q2 2022 Q2 2023 ~33% 5-Yr CAGR (2Q'18 vs 2Q'23) ~43% YoY Growth (2Q'22 vs 2Q'23)

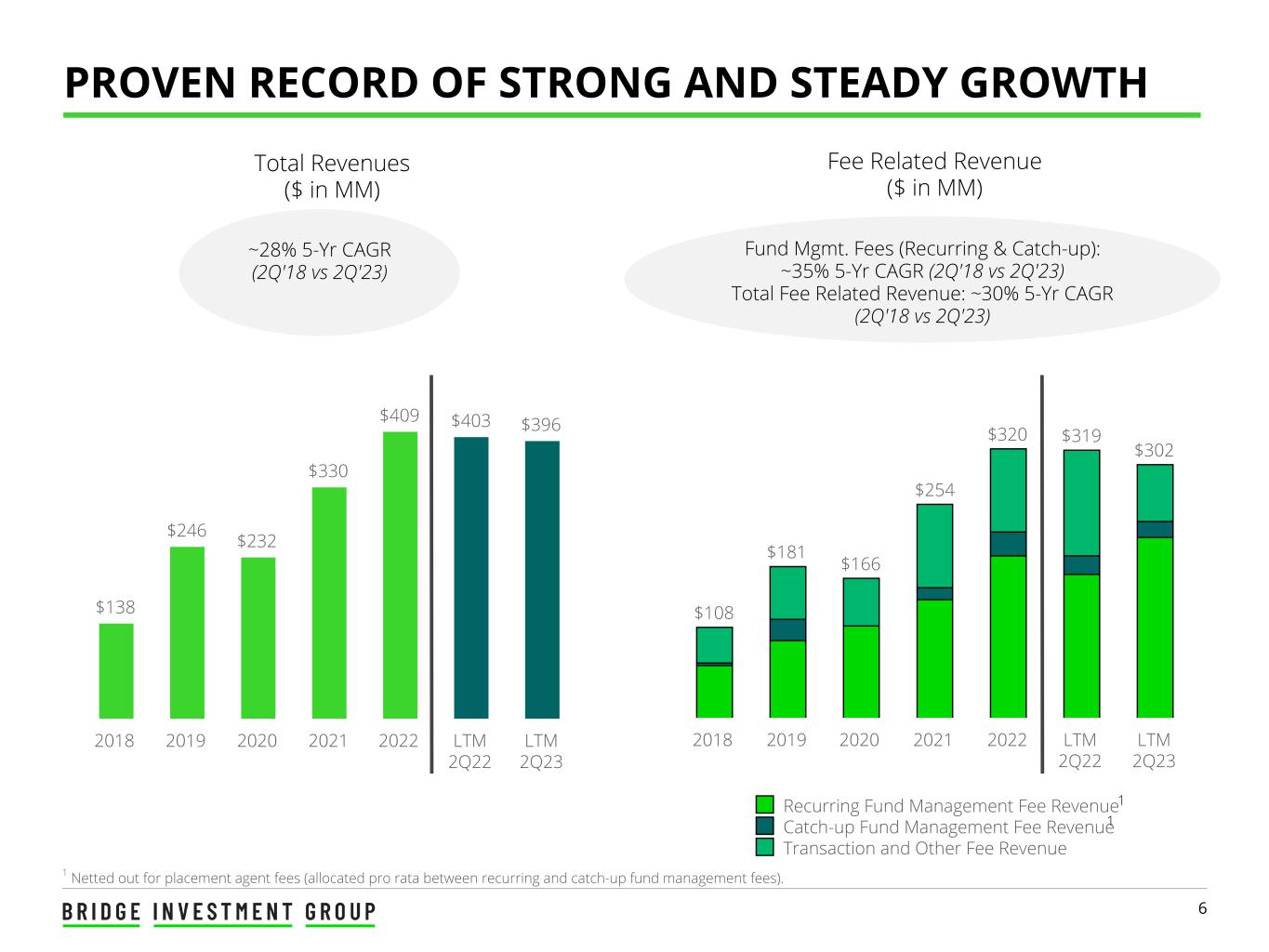

6 $108 $181 $166 $254 $320 $319 $302 Recurring Fund Management Fee Revenue Catch-up Fund Management Fee Revenue Transaction and Other Fee Revenue 2018 2019 2020 2021 2022 LTM 2Q22 LTM 2Q23 $138 $246 $232 $330 $409 $403 $396 2018 2019 2020 2021 2022 LTM 2Q22 LTM 2Q23 Total Revenues ($ in MM) Fee Related Revenue ($ in MM) PROVEN RECORD OF STRONG AND STEADY GROWTH ~28% 5-Yr CAGR (2Q'18 vs 2Q'23) Fund Mgmt. Fees (Recurring & Catch-up): ~35% 5-Yr CAGR (2Q'18 vs 2Q'23) Total Fee Related Revenue: ~30% 5-Yr CAGR (2Q'18 vs 2Q'23) 1 Netted out for placement agent fees (allocated pro rata between recurring and catch-up fund management fees). 1 1

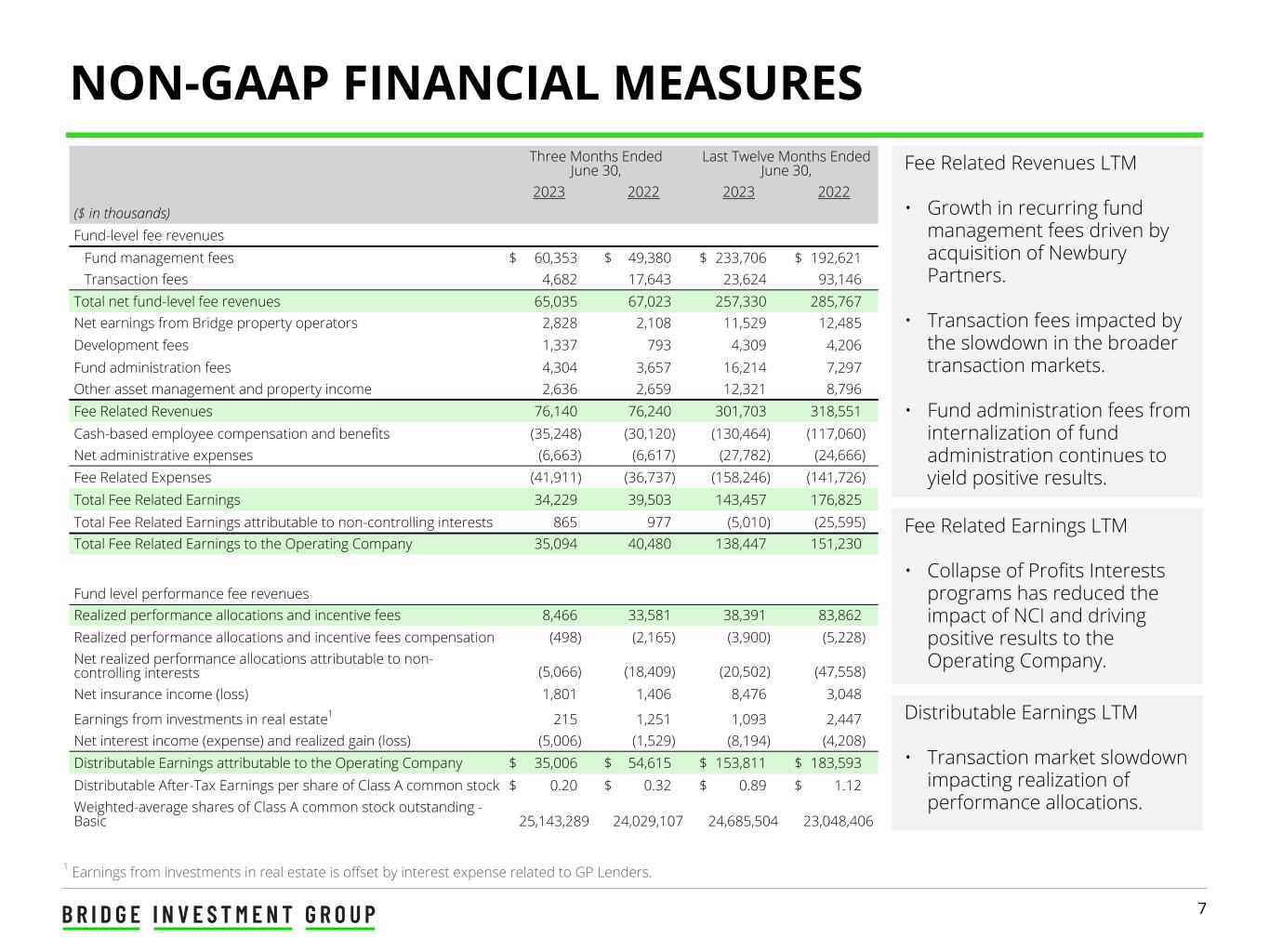

7 Distributable Earnings LTM • Transaction market slowdown impacting realization of performance allocations. Fee Related Earnings LTM • Collapse of Profits Interests programs has reduced the impact of NCI and driving positive results to the Operating Company. NON-GAAP FINANCIAL MEASURES Three Months Ended June 30, Last Twelve Months Ended June 30, 2023 2022 2023 2022 ($ in thousands) Fund-level fee revenues Fund management fees $ 60,353 $ 49,380 $ 233,706 $ 192,621 Transaction fees 4,682 17,643 23,624 93,146 Total net fund-level fee revenues 65,035 67,023 257,330 285,767 Net earnings from Bridge property operators 2,828 2,108 11,529 12,485 Development fees 1,337 793 4,309 4,206 Fund administration fees 4,304 3,657 16,214 7,297 Other asset management and property income 2,636 2,659 12,321 8,796 Fee Related Revenues 76,140 76,240 301,703 318,551 Cash-based employee compensation and benefits (35,248) (30,120) (130,464) (117,060) Net administrative expenses (6,663) (6,617) (27,782) (24,666) Fee Related Expenses (41,911) (36,737) (158,246) (141,726) Total Fee Related Earnings 34,229 39,503 143,457 176,825 Total Fee Related Earnings attributable to non-controlling interests 865 977 (5,010) (25,595) Total Fee Related Earnings to the Operating Company 35,094 40,480 138,447 151,230 Fund level performance fee revenues Realized performance allocations and incentive fees 8,466 33,581 38,391 83,862 Realized performance allocations and incentive fees compensation (498) (2,165) (3,900) (5,228) Net realized performance allocations attributable to non- controlling interests (5,066) (18,409) (20,502) (47,558) Net insurance income (loss) 1,801 1,406 8,476 3,048 Earnings from investments in real estate1 215 1,251 1,093 2,447 Net interest income (expense) and realized gain (loss) (5,006) (1,529) (8,194) (4,208) Distributable Earnings attributable to the Operating Company $ 35,006 $ 54,615 $ 153,811 $ 183,593 Distributable After-Tax Earnings per share of Class A common stock $ 0.20 $ 0.32 $ 0.89 $ 1.12 Weighted-average shares of Class A common stock outstanding - Basic 25,143,289 24,029,107 24,685,504 23,048,406 1 Earnings from investments in real estate is offset by interest expense related to GP Lenders. Fee Related Revenues LTM • Growth in recurring fund management fees driven by acquisition of Newbury Partners. • Transaction fees impacted by the slowdown in the broader transaction markets. • Fund administration fees from internalization of fund administration continues to yield positive results.

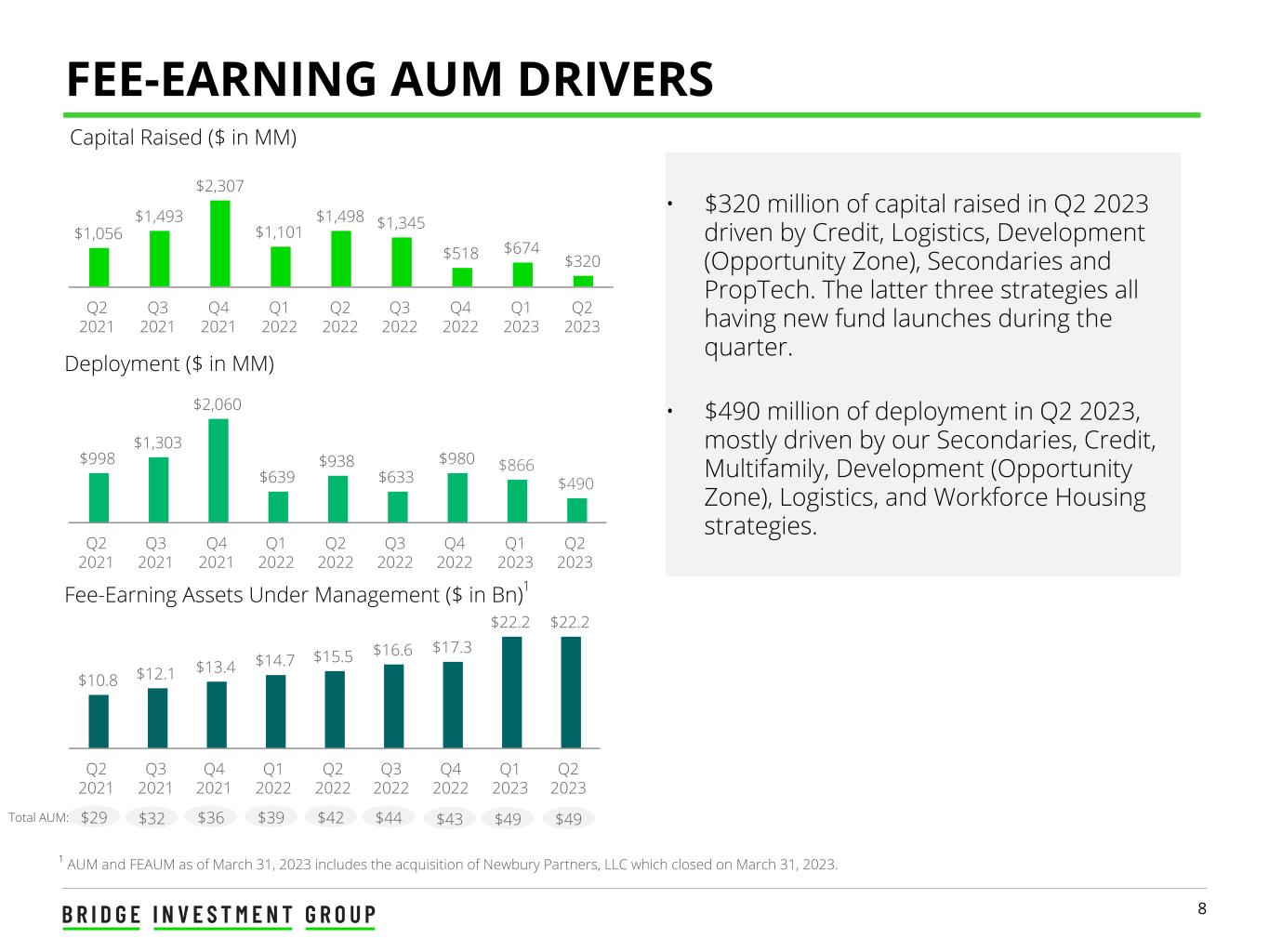

8 $1,056 $1,493 $2,307 $1,101 $1,498 $1,345 $518 $674 $320 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 • $320 million of capital raised in Q2 2023 driven by Credit, Logistics, Development (Opportunity Zone), Secondaries and PropTech. The latter three strategies all having new fund launches during the quarter. • $490 million of deployment in Q2 2023, mostly driven by our Secondaries, Credit, Multifamily, Development (Opportunity Zone), Logistics, and Workforce Housing strategies. Capital Raised ($ in MM) FEE-EARNING AUM DRIVERS Deployment ($ in MM) Fee-Earning Assets Under Management ($ in Bn)1 $29Total AUM: $32 $36 $39 $42 $44 $43 $49 $49 $998 $1,303 $2,060 $639 $938 $633 $980 $866 $490 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 $10.8 $12.1 $13.4 $14.7 $15.5 $16.6 $17.3 $22.2 $22.2 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 1 AUM and FEAUM as of March 31, 2023 includes the acquisition of Newbury Partners, LLC which closed on March 31, 2023.

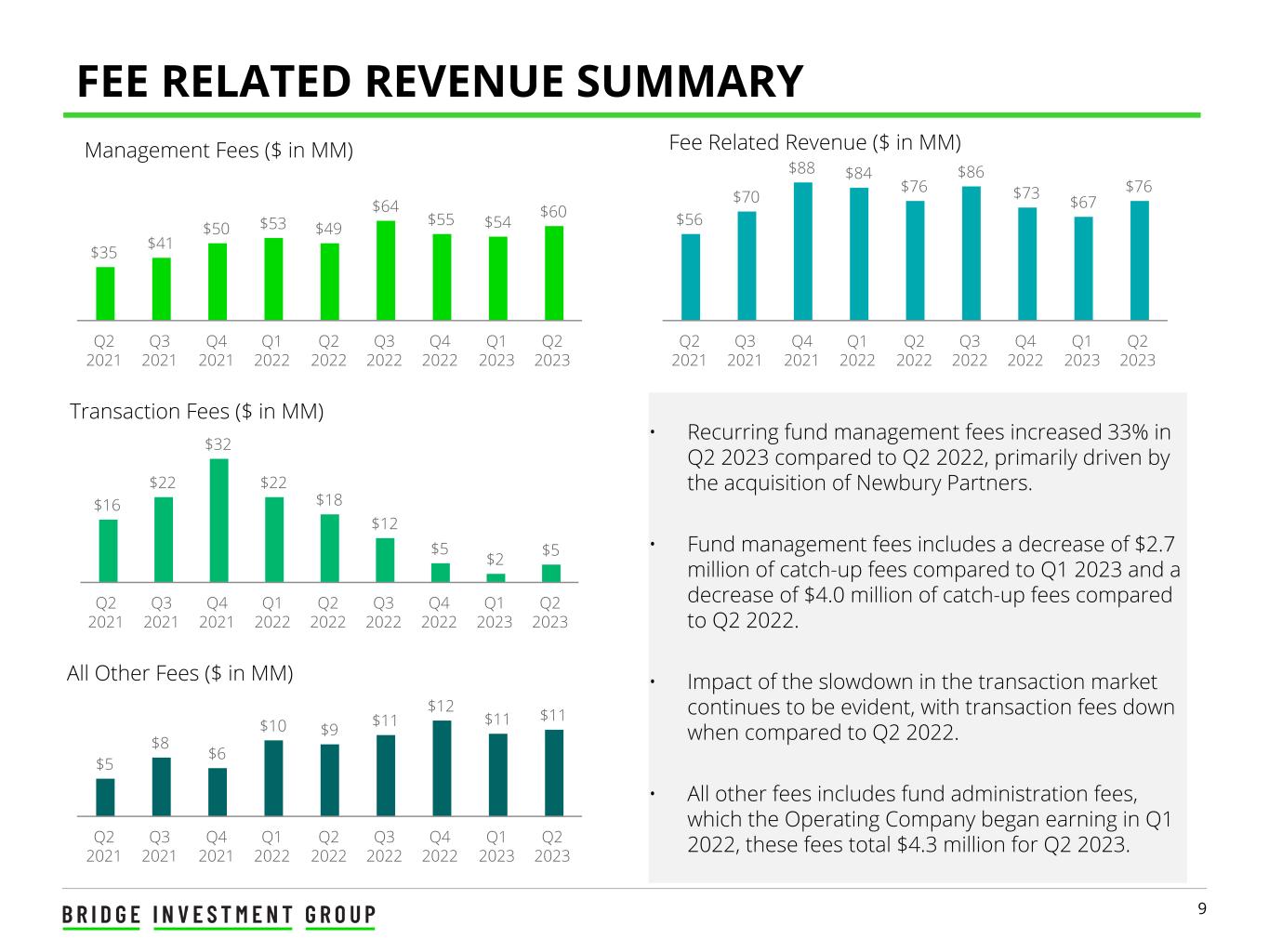

9 Management Fees ($ in MM) FEE RELATED REVENUE SUMMARY Transaction Fees ($ in MM) All Other Fees ($ in MM) Fee Related Revenue ($ in MM) • Recurring fund management fees increased 33% in Q2 2023 compared to Q2 2022, primarily driven by the acquisition of Newbury Partners. • Fund management fees includes a decrease of $2.7 million of catch-up fees compared to Q1 2023 and a decrease of $4.0 million of catch-up fees compared to Q2 2022. • Impact of the slowdown in the transaction market continues to be evident, with transaction fees down when compared to Q2 2022. • All other fees includes fund administration fees, which the Operating Company began earning in Q1 2022, these fees total $4.3 million for Q2 2023. $16 $22 $32 $22 $18 $12 $5 $2 $5 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 $35 $41 $50 $53 $49 $64 $55 $54 $60 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 $5 $8 $6 $10 $9 $11 $12 $11 $11 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 $56 $70 $88 $84 $76 $86 $73 $67 $76 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023

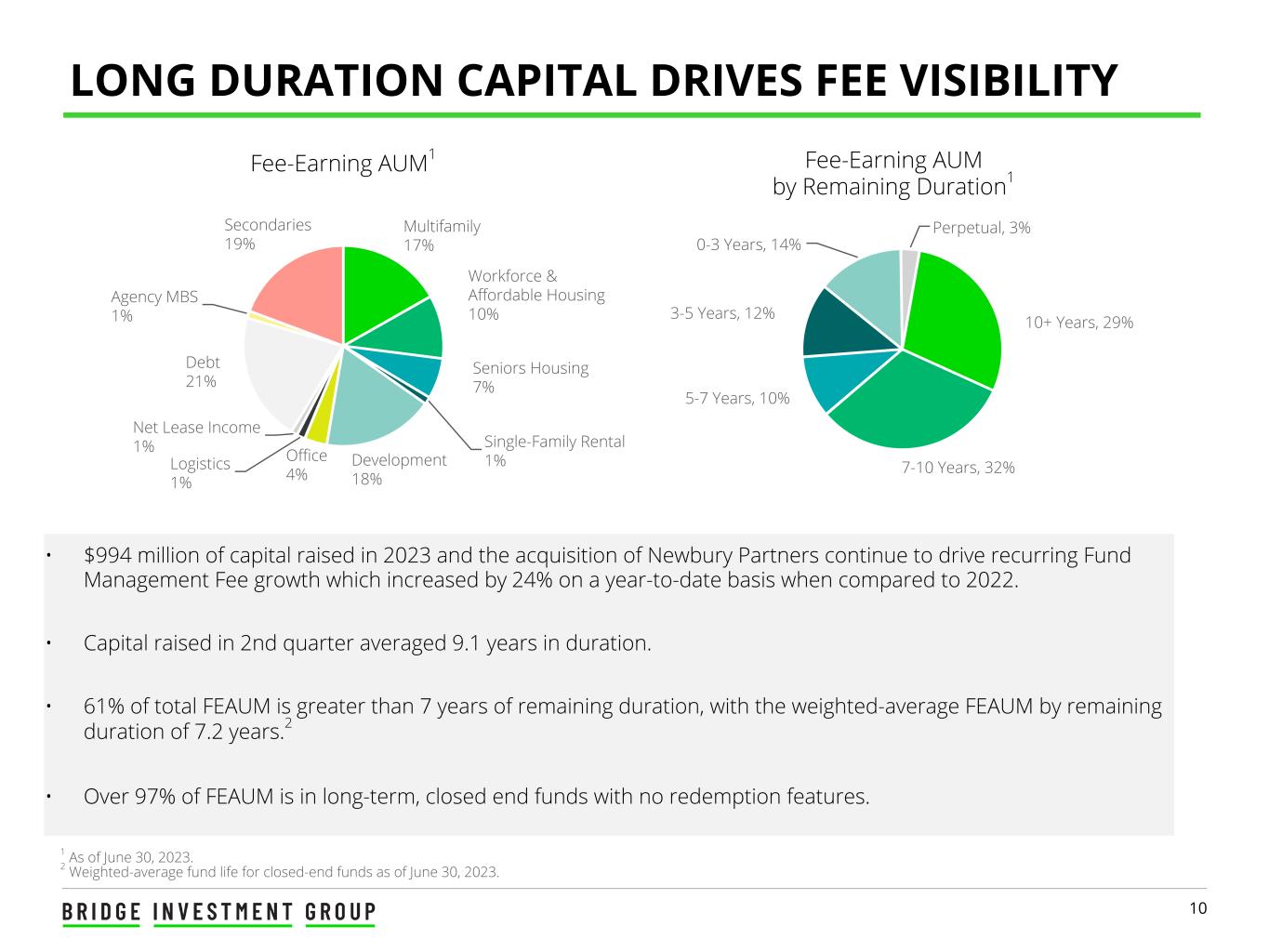

10 1 As of June 30, 2023. 2 Weighted-average fund life for closed-end funds as of June 30, 2023. LONG DURATION CAPITAL DRIVES FEE VISIBILITY • $994 million of capital raised in 2023 and the acquisition of Newbury Partners continue to drive recurring Fund Management Fee growth which increased by 24% on a year-to-date basis when compared to 2022. • Capital raised in 2nd quarter averaged 9.1 years in duration. • 61% of total FEAUM is greater than 7 years of remaining duration, with the weighted-average FEAUM by remaining duration of 7.2 years.2 • Over 97% of FEAUM is in long-term, closed end funds with no redemption features. Fee-Earning AUM1 Multifamily 17% Workforce & Affordable Housing 10% Seniors Housing 7% Single-Family Rental 1%Development 18% Office 4% Logistics 1% Net Lease Income 1% Debt 21% Agency MBS 1% Secondaries 19% Fee-Earning AUM by Remaining Duration1 10+ Years, 29% 7-10 Years, 32% 5-7 Years, 10% 3-5 Years, 12% 0-3 Years, 14% Perpetual, 3%

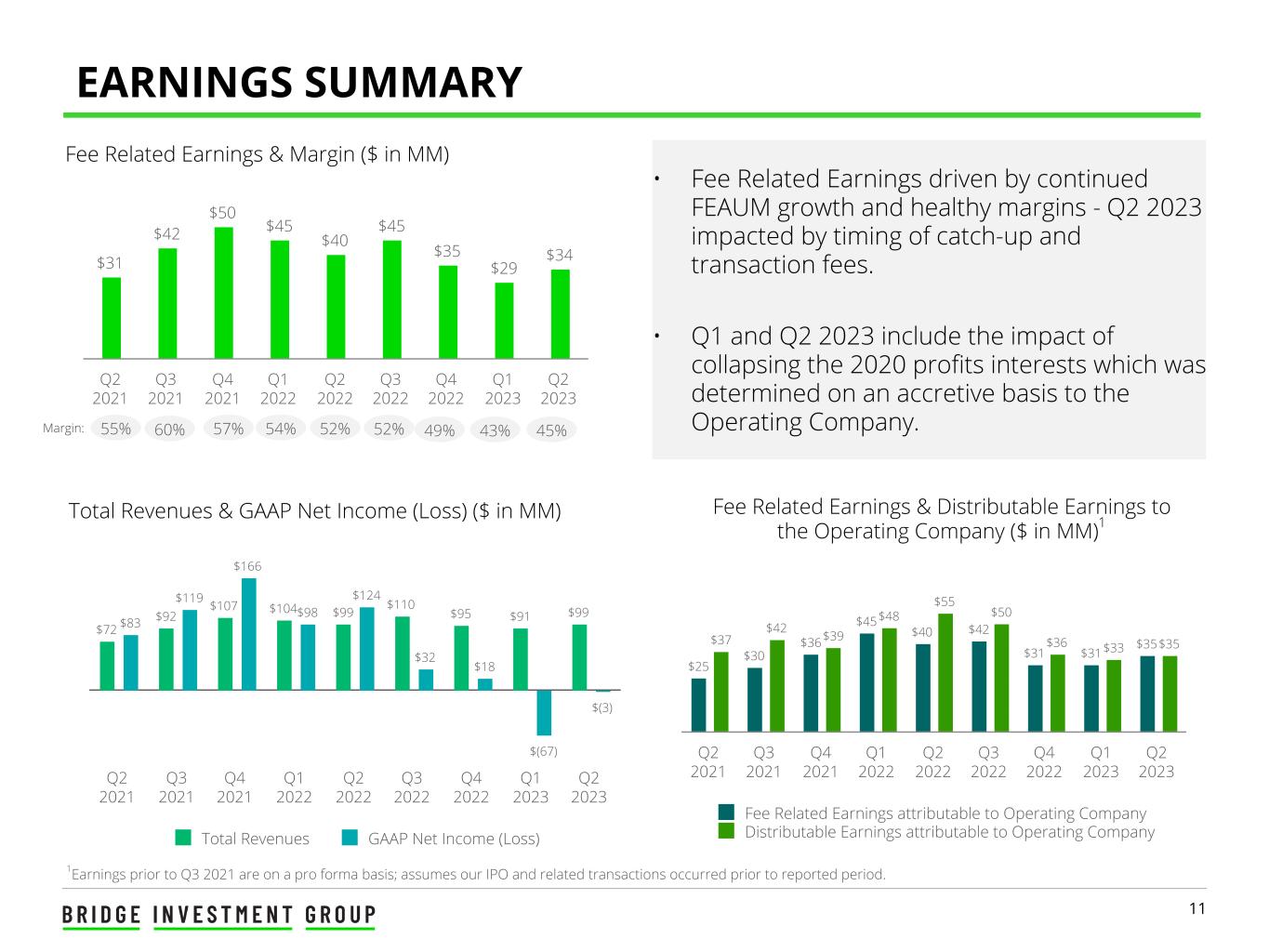

11 Total Revenues & GAAP Net Income (Loss) ($ in MM) 1Earnings prior to Q3 2021 are on a pro forma basis; assumes our IPO and related transactions occurred prior to reported period. EARNINGS SUMMARY Fee Related Earnings & Distributable Earnings to the Operating Company ($ in MM)1 • Fee Related Earnings driven by continued FEAUM growth and healthy margins - Q2 2023 impacted by timing of catch-up and transaction fees. • Q1 and Q2 2023 include the impact of collapsing the 2020 profits interests which was determined on an accretive basis to the Operating Company. Fee Related Earnings & Margin ($ in MM) $31 $42 $50 $45 $40 $45 $35 $29 $34 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 $72 $92 $107 $104 $99 $110 $95 $91 $99 $83 $119 $166 $98 $124 $32 $18 $(67) $(3) Total Revenues GAAP Net Income (Loss) Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 $25 $30 $36 $45 $40 $42 $31 $31 $35$37 $42 $39 $48 $55 $50 $36 $33 $35 Fee Related Earnings attributable to Operating Company Distributable Earnings attributable to Operating Company Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 55% 60% 57% 54% 52% 52% 49% 43% 45%Margin:

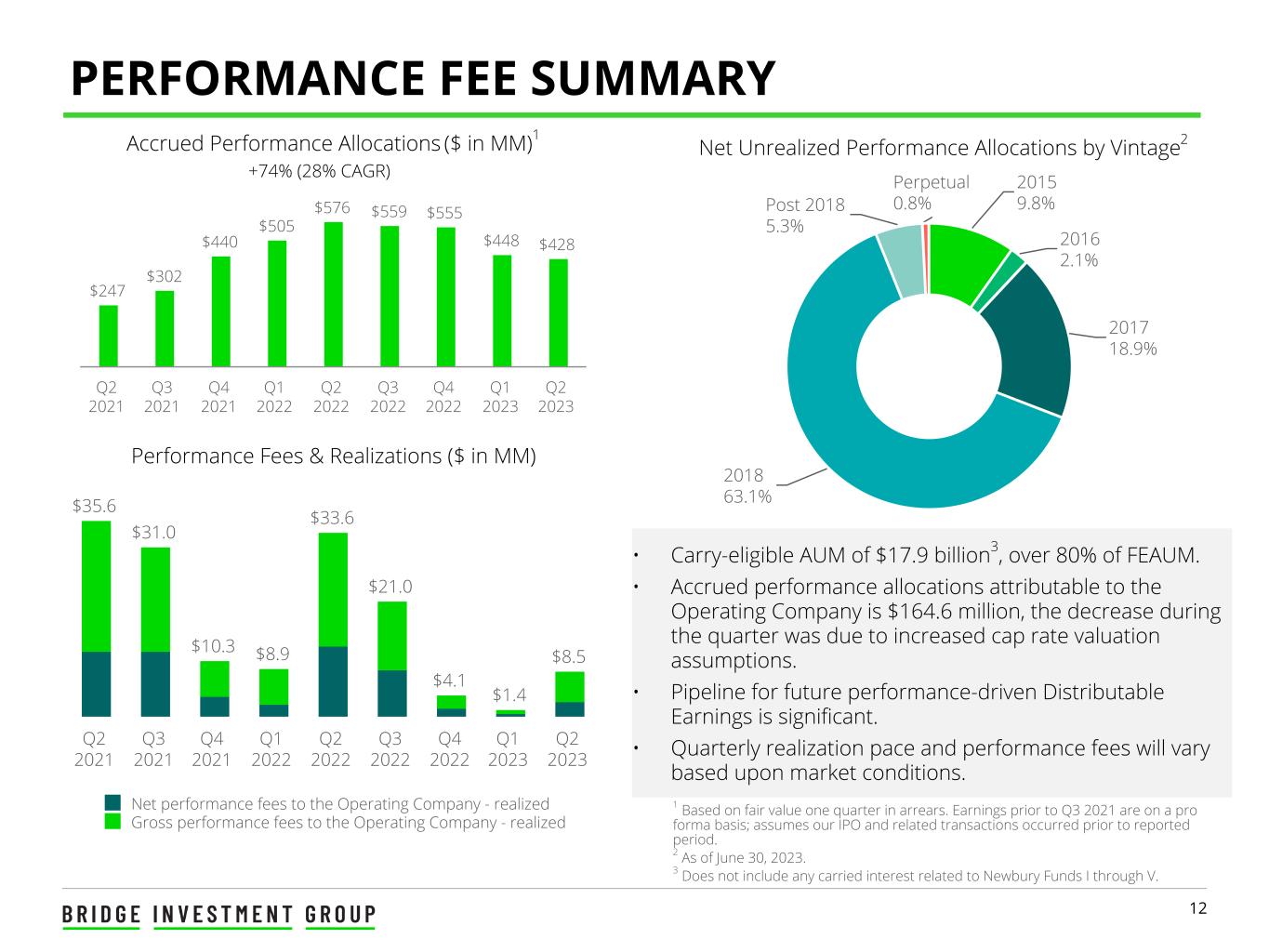

12 $247 $302 $440 $505 $576 $559 $555 $448 $428 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 +74% (28% CAGR) PERFORMANCE FEE SUMMARY Net Unrealized Performance Allocations by Vintage2Accrued Performance Allocations ($ in MM)1 1 Based on fair value one quarter in arrears. Earnings prior to Q3 2021 are on a pro forma basis; assumes our IPO and related transactions occurred prior to reported period. 2 As of June 30, 2023. 3 Does not include any carried interest related to Newbury Funds I through V. Performance Fees & Realizations ($ in MM) • Carry-eligible AUM of $17.9 billion3, over 80% of FEAUM. • Accrued performance allocations attributable to the Operating Company is $164.6 million, the decrease during the quarter was due to increased cap rate valuation assumptions. • Pipeline for future performance-driven Distributable Earnings is significant. • Quarterly realization pace and performance fees will vary based upon market conditions. $35.6 $31.0 $10.3 $8.9 $33.6 $21.0 $4.1 $1.4 $8.5 Net performance fees to the Operating Company - realized Gross performance fees to the Operating Company - realized Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 2015 9.8% 2016 2.1% 2017 18.9% 2018 63.1% Post 2018 5.3% Perpetual 0.8%

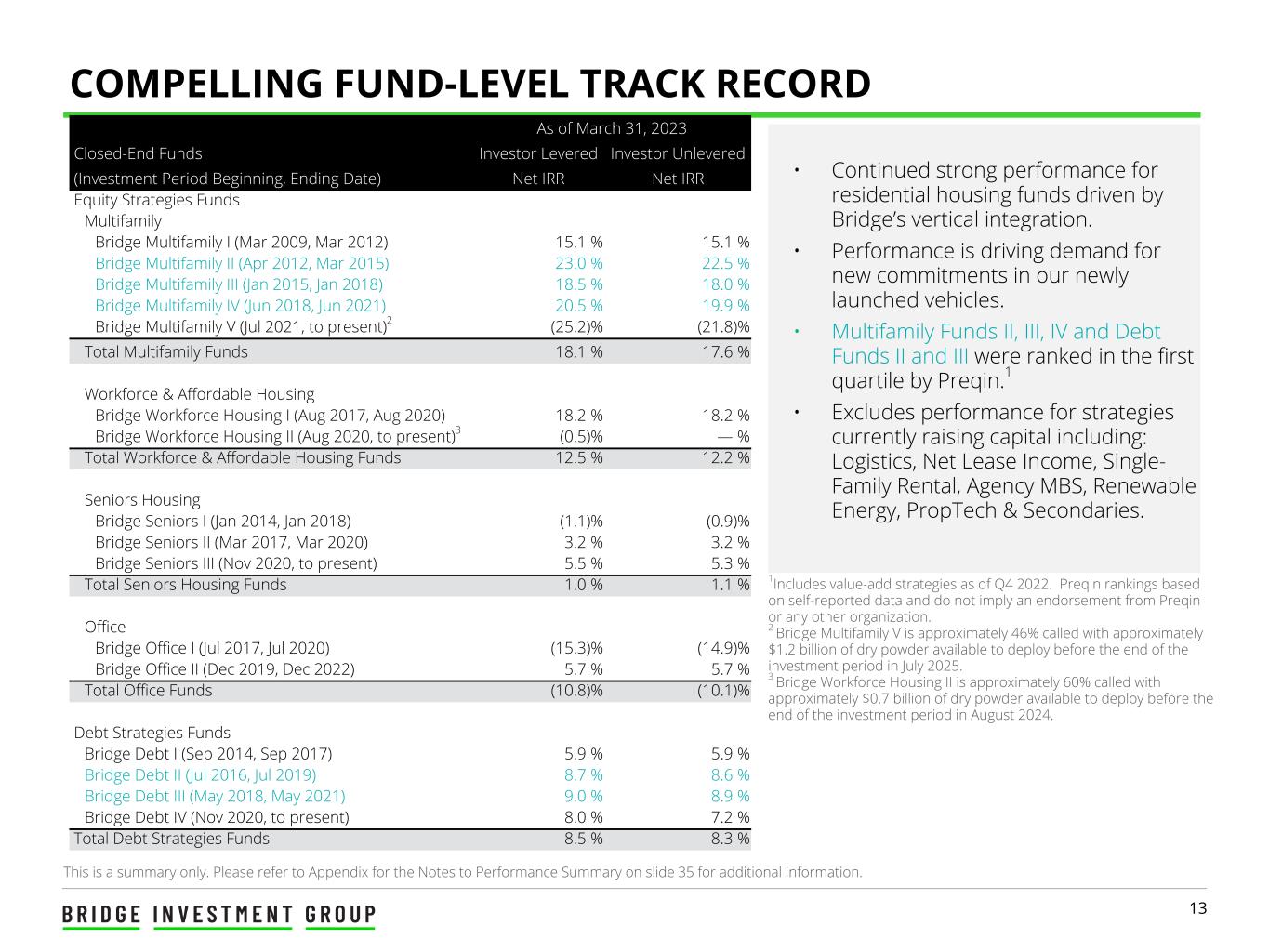

13 COMPELLING FUND-LEVEL TRACK RECORD This is a summary only. Please refer to Appendix for the Notes to Performance Summary on slide 35 for additional information. • Continued strong performance for residential housing funds driven by Bridge’s vertical integration. • Performance is driving demand for new commitments in our newly launched vehicles. • Multifamily Funds II, III, IV and Debt Funds II and III were ranked in the first quartile by Preqin.1 • Excludes performance for strategies currently raising capital including: Logistics, Net Lease Income, Single- Family Rental, Agency MBS, Renewable Energy, PropTech & Secondaries. 1Includes value-add strategies as of Q4 2022. Preqin rankings based on self-reported data and do not imply an endorsement from Preqin or any other organization. 2 Bridge Multifamily V is approximately 46% called with approximately $1.2 billion of dry powder available to deploy before the end of the investment period in July 2025. 3 Bridge Workforce Housing II is approximately 60% called with approximately $0.7 billion of dry powder available to deploy before the end of the investment period in August 2024. As of March 31, 2023 Closed-End Funds Investor Levered Investor Unlevered (Investment Period Beginning, Ending Date) Net IRR Net IRR Equity Strategies Funds Multifamily Bridge Multifamily I (Mar 2009, Mar 2012) 15.1 % 15.1 % Bridge Multifamily II (Apr 2012, Mar 2015) 23.0 % 22.5 % Bridge Multifamily III (Jan 2015, Jan 2018) 18.5 % 18.0 % Bridge Multifamily IV (Jun 2018, Jun 2021) 20.5 % 19.9 % Bridge Multifamily V (Jul 2021, to present)2 (25.2) % (21.8) % Total Multifamily Funds 18.1 % 17.6 % Workforce & Affordable Housing Bridge Workforce Housing I (Aug 2017, Aug 2020) 18.2 % 18.2 % Bridge Workforce Housing II (Aug 2020, to present)3 (0.5) % — % Total Workforce & Affordable Housing Funds 12.5 % 12.2 % Seniors Housing Bridge Seniors I (Jan 2014, Jan 2018) (1.1) % (0.9) % Bridge Seniors II (Mar 2017, Mar 2020) 3.2 % 3.2 % Bridge Seniors III (Nov 2020, to present) 5.5 % 5.3 % Total Seniors Housing Funds 1.0 % 1.1 % Office Bridge Office I (Jul 2017, Jul 2020) (15.3) % (14.9) % Bridge Office II (Dec 2019, Dec 2022) 5.7 % 5.7 % Total Office Funds (10.8) % (10.1) % Debt Strategies Funds Bridge Debt I (Sep 2014, Sep 2017) 5.9 % 5.9 % Bridge Debt II (Jul 2016, Jul 2019) 8.7 % 8.6 % Bridge Debt III (May 2018, May 2021) 9.0 % 8.9 % Bridge Debt IV (Nov 2020, to present) 8.0 % 7.2 % Total Debt Strategies Funds 8.5 % 8.3 %

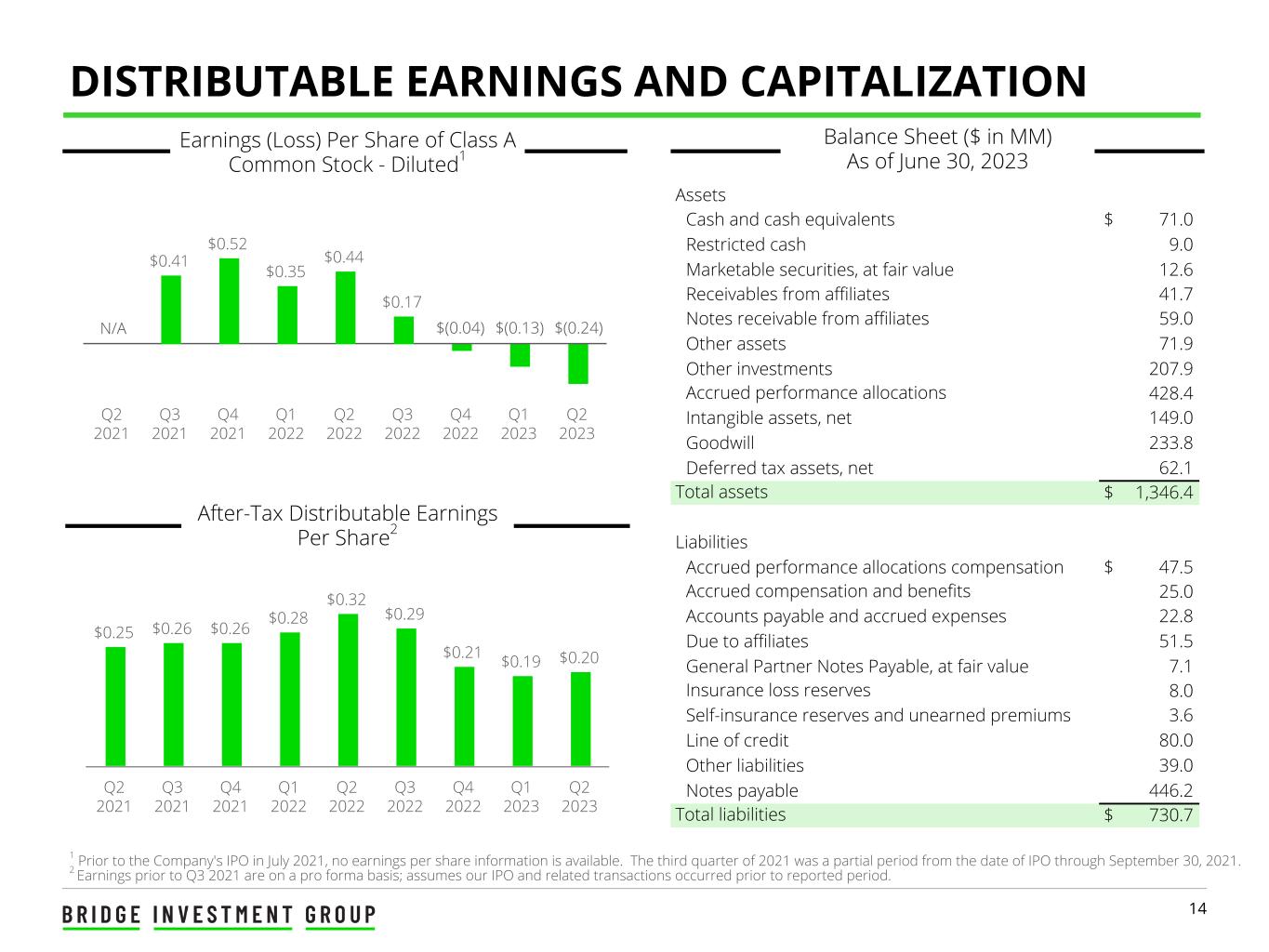

14 $0.41 $0.52 $0.35 $0.44 $0.17 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 DISTRIBUTABLE EARNINGS AND CAPITALIZATION Balance Sheet ($ in MM) As of June 30, 2023 After-Tax Distributable Earnings Per Share2 1 Prior to the Company's IPO in July 2021, no earnings per share information is available. The third quarter of 2021 was a partial period from the date of IPO through September 30, 2021. 2 Earnings prior to Q3 2021 are on a pro forma basis; assumes our IPO and related transactions occurred prior to reported period. $0.25 $0.26 $0.26 $0.28 $0.32 $0.29 $0.21 $0.19 $0.20 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Assets Cash and cash equivalents $ 71.0 Restricted cash 9.0 Marketable securities, at fair value 12.6 Receivables from affiliates 41.7 Notes receivable from affiliates 59.0 Other assets 71.9 Other investments 207.9 Accrued performance allocations 428.4 Intangible assets, net 149.0 Goodwill 233.8 Deferred tax assets, net 62.1 Total assets $ 1,346.4 Liabilities Accrued performance allocations compensation $ 47.5 Accrued compensation and benefits 25.0 Accounts payable and accrued expenses 22.8 Due to affiliates 51.5 General Partner Notes Payable, at fair value 7.1 Insurance loss reserves 8.0 Self-insurance reserves and unearned premiums 3.6 Line of credit 80.0 Other liabilities 39.0 Notes payable 446.2 Total liabilities $ 730.7 Earnings (Loss) Per Share of Class A Common Stock - Diluted1 N/A $(0.04) $(0.13) $(0.24)

COMPANY OVERVIEW

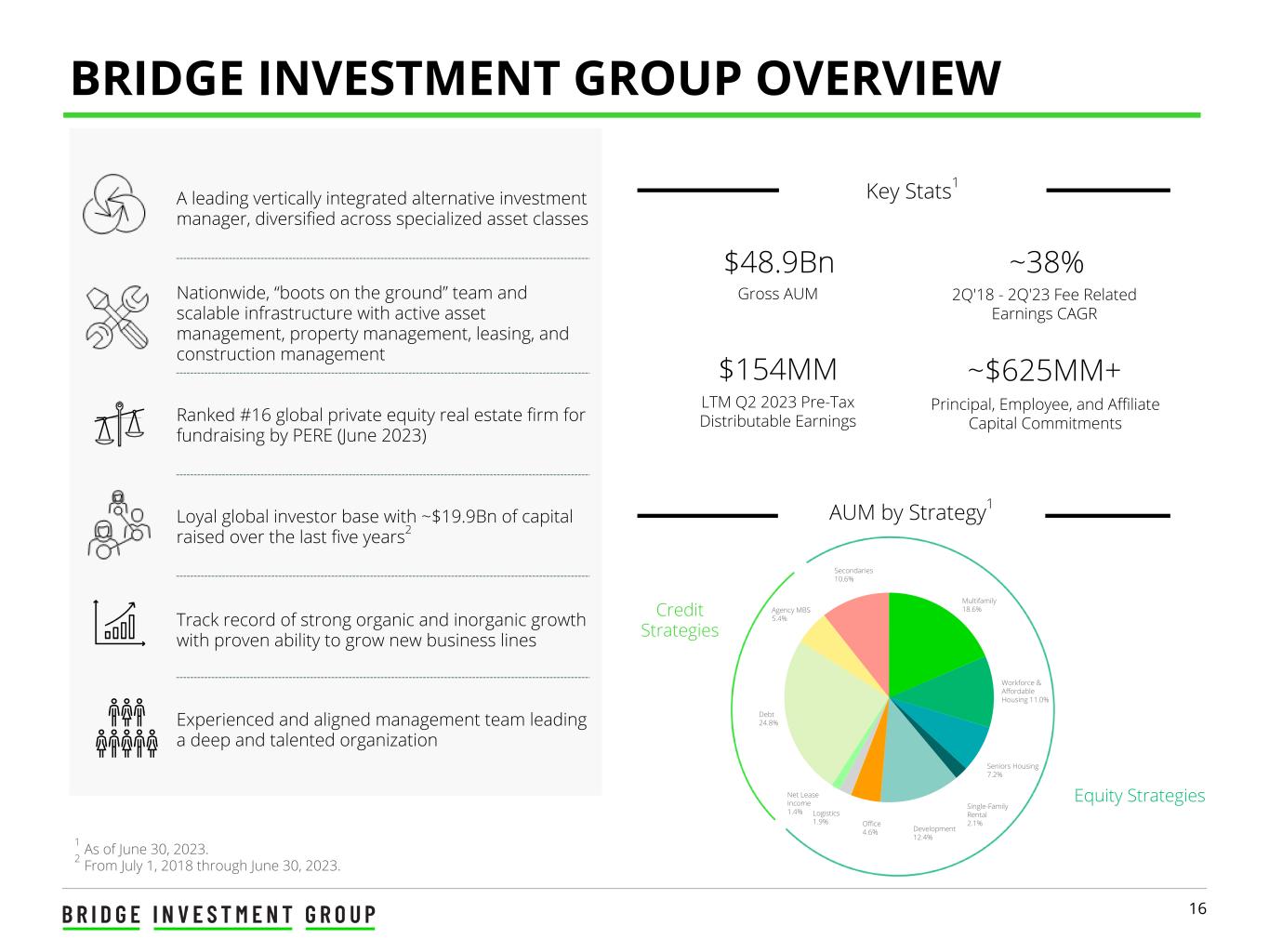

16 Multifamily 18.6% Workforce & Affordable Housing 11.0% Seniors Housing 7.2% Single-Family Rental 2.1% Development 12.4% Office 4.6% Logistics 1.9% Net Lease Income 1.4% Debt 24.8% Agency MBS 5.4% Secondaries 10.6% BRIDGE INVESTMENT GROUP OVERVIEW A leading vertically integrated alternative investment manager, diversified across specialized asset classes Nationwide, “boots on the ground” team and scalable infrastructure with active asset management, property management, leasing, and construction management Ranked #16 global private equity real estate firm for fundraising by PERE (June 2023) Loyal global investor base with ~$19.9Bn of capital raised over the last five years2 Key Stats1 $48.9Bn Gross AUM ~$625MM+ Principal, Employee, and Affiliate Capital Commitments LTM Q2 2023 Pre-Tax Distributable Earnings $154MM AUM by Strategy1 Equity Strategies Credit Strategies 2Q'18 - 2Q'23 Fee Related Earnings CAGR ~38% Experienced and aligned management team leading a deep and talented organization Track record of strong organic and inorganic growth with proven ability to grow new business lines 1 As of June 30, 2023. 2 From July 1, 2018 through June 30, 2023.

17 Strong Tailwinds from Favorable Industry Trends Diversified and Synergistic Business Model Spanning Real Estate, Credit, Renewable Energy and Secondaries Vertically Integrated Business Model and Scalable Infrastructure Drive Competitive Advantages and Attractive Investment Returns National Footprint with High-Touch Operating Model and Local Expertise High Proportion of Recurring Fees and “Sticky” Contractual Revenue Streams from Long-Duration Capital Proven Record of Fundraising Success with a Loyal Investor Base Significant Organic and Inorganic Opportunities to Accelerate Growth Long-Tenured Senior Management Team with High Alignment and Support of Deep and Talented Employee Pool BRIDGE INVESTMENT GROUP KEY INVESTMENT HIGHLIGHTS

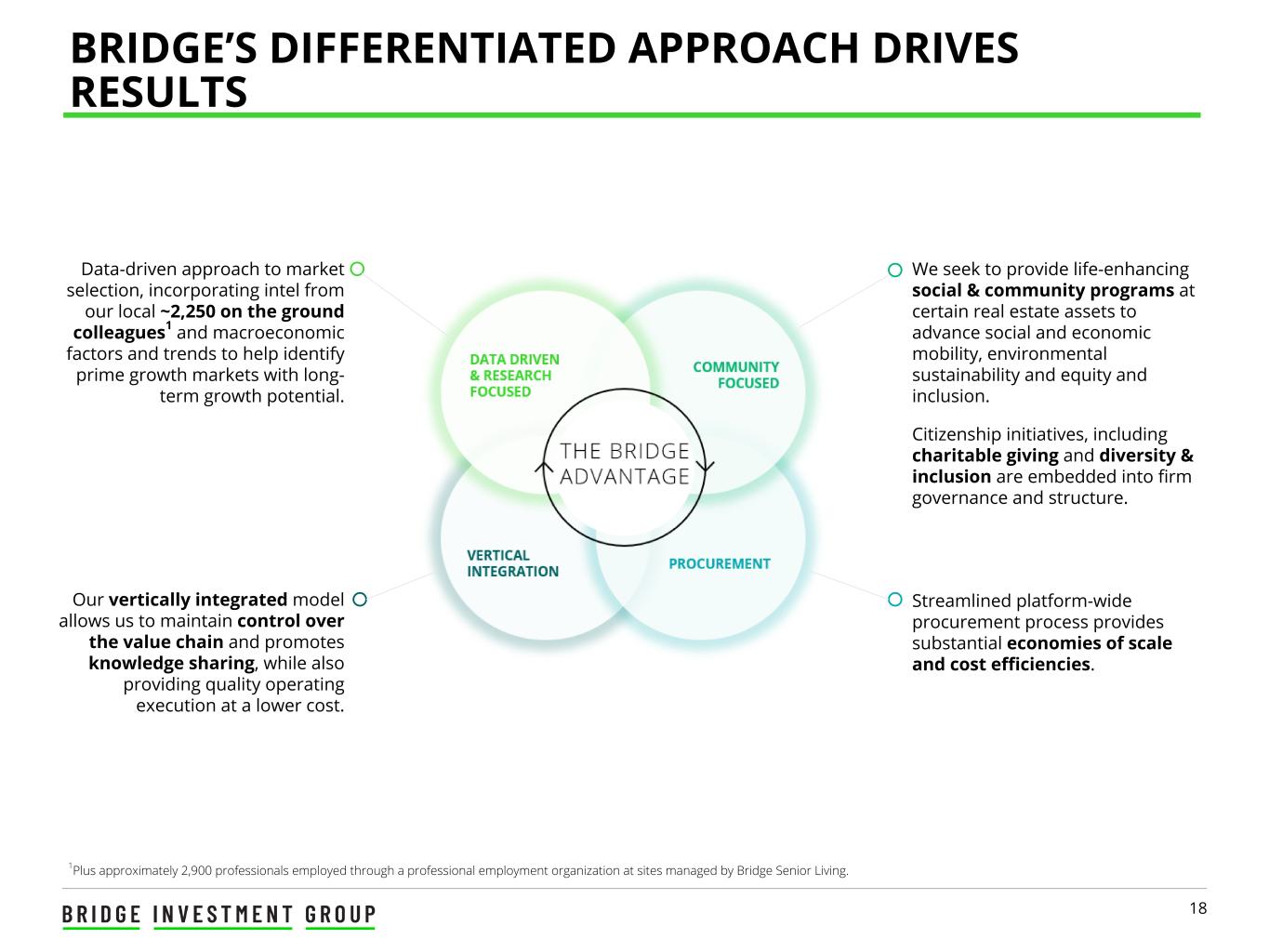

18 BRIDGE’S DIFFERENTIATED APPROACH DRIVES RESULTS 1Plus approximately 2,900 professionals employed through a professional employment organization at sites managed by Bridge Senior Living. Data-driven approach to market selection, incorporating intel from our local ~2,250 on the ground colleagues1 and macroeconomic factors and trends to help identify prime growth markets with long- term growth potential. We seek to provide life-enhancing social & community programs at certain real estate assets to advance social and economic mobility, environmental sustainability and equity and inclusion. Citizenship initiatives, including charitable giving and diversity & inclusion are embedded into firm governance and structure. Our vertically integrated model allows us to maintain control over the value chain and promotes knowledge sharing, while also providing quality operating execution at a lower cost. Streamlined platform-wide procurement process provides substantial economies of scale and cost efficiencies.

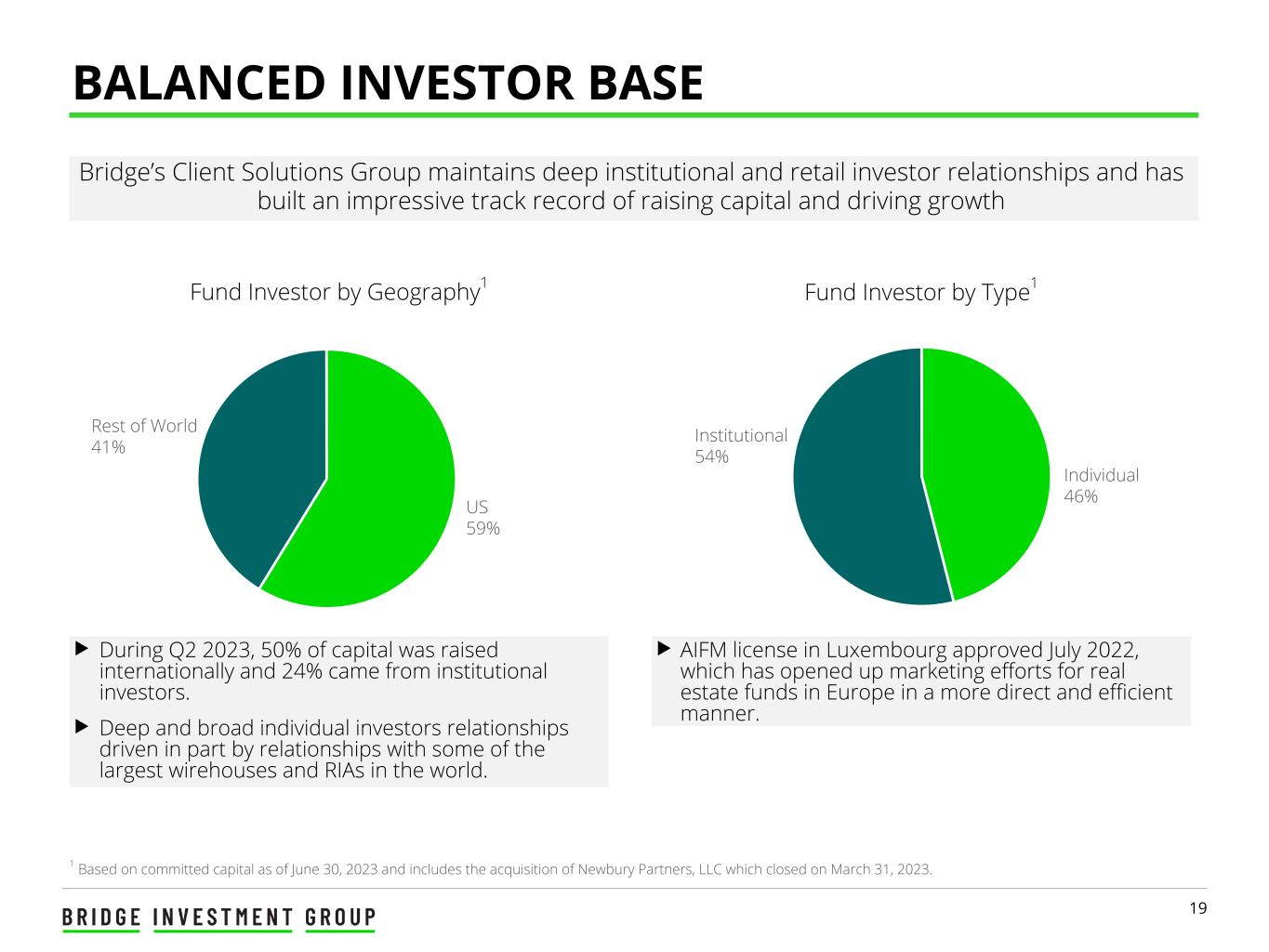

19 Individual 46% Institutional 54% BALANCED INVESTOR BASE Fund Investor by Geography1 Fund Investor by Type1 Bridge’s Client Solutions Group maintains deep institutional and retail investor relationships and has built an impressive track record of raising capital and driving growth u During Q2 2023, 50% of capital was raised internationally and 24% came from institutional investors. u Deep and broad individual investors relationships driven in part by relationships with some of the largest wirehouses and RIAs in the world. u AIFM license in Luxembourg approved July 2022, which has opened up marketing efforts for real estate funds in Europe in a more direct and efficient manner. US 59% Rest of World 41% 1 Based on committed capital as of June 30, 2023 and includes the acquisition of Newbury Partners, LLC which closed on March 31, 2023.

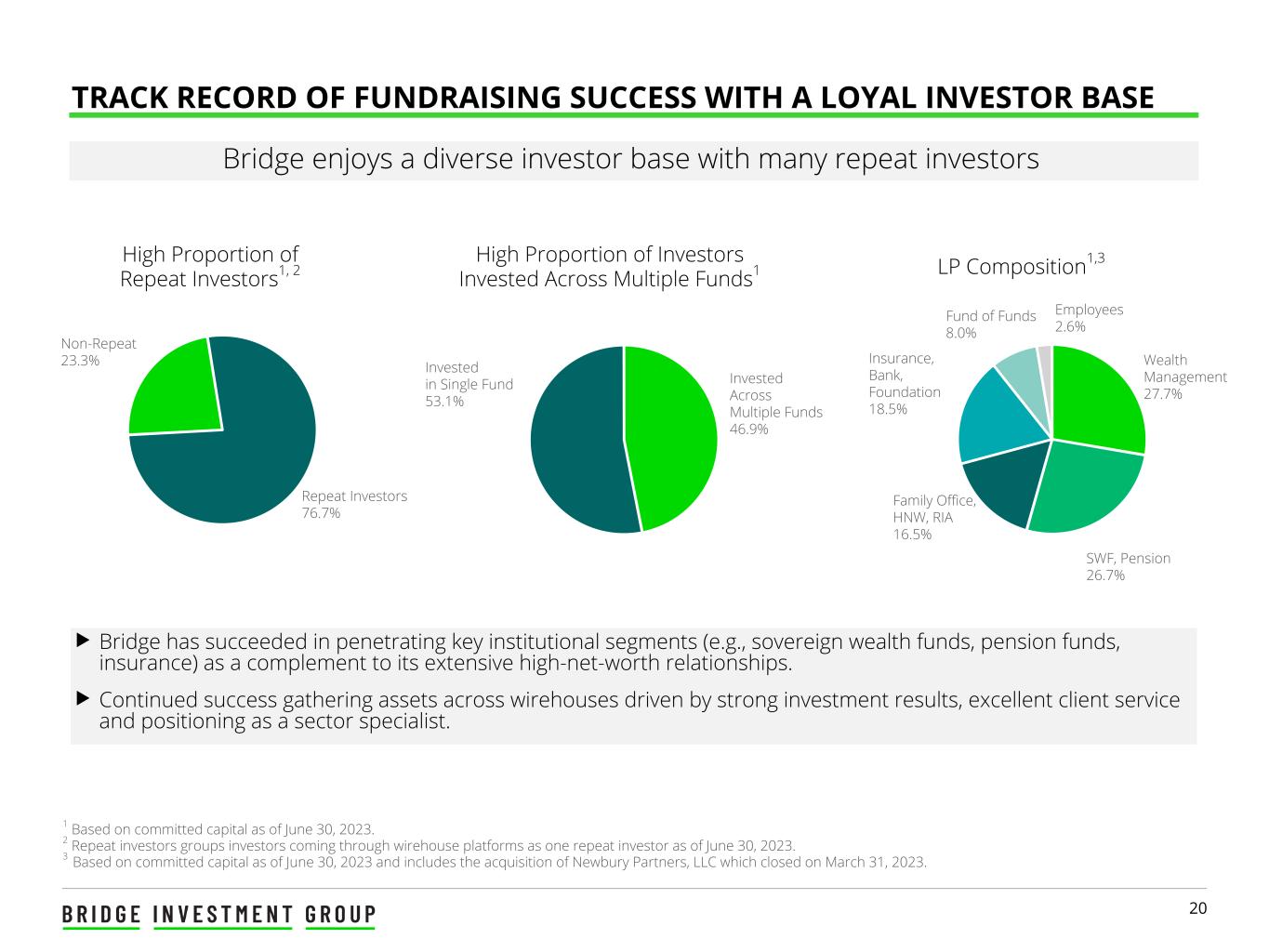

20 High Proportion of Repeat Investors1, 2 High Proportion of Investors Invested Across Multiple Funds1 LP Composition1,3 1 Based on committed capital as of June 30, 2023. 2 Repeat investors groups investors coming through wirehouse platforms as one repeat investor as of June 30, 2023. 3 Based on committed capital as of June 30, 2023 and includes the acquisition of Newbury Partners, LLC which closed on March 31, 2023. TRACK RECORD OF FUNDRAISING SUCCESS WITH A LOYAL INVESTOR BASE Bridge enjoys a diverse investor base with many repeat investors u Bridge has succeeded in penetrating key institutional segments (e.g., sovereign wealth funds, pension funds, insurance) as a complement to its extensive high-net-worth relationships. u Continued success gathering assets across wirehouses driven by strong investment results, excellent client service and positioning as a sector specialist. Non-Repeat 23.3% Repeat Investors 76.7% Invested Across Multiple Funds 46.9% Invested in Single Fund 53.1% Wealth Management 27.7% SWF, Pension 26.7% Family Office, HNW, RIA 16.5% Insurance, Bank, Foundation 18.5% Fund of Funds 8.0% Employees 2.6%

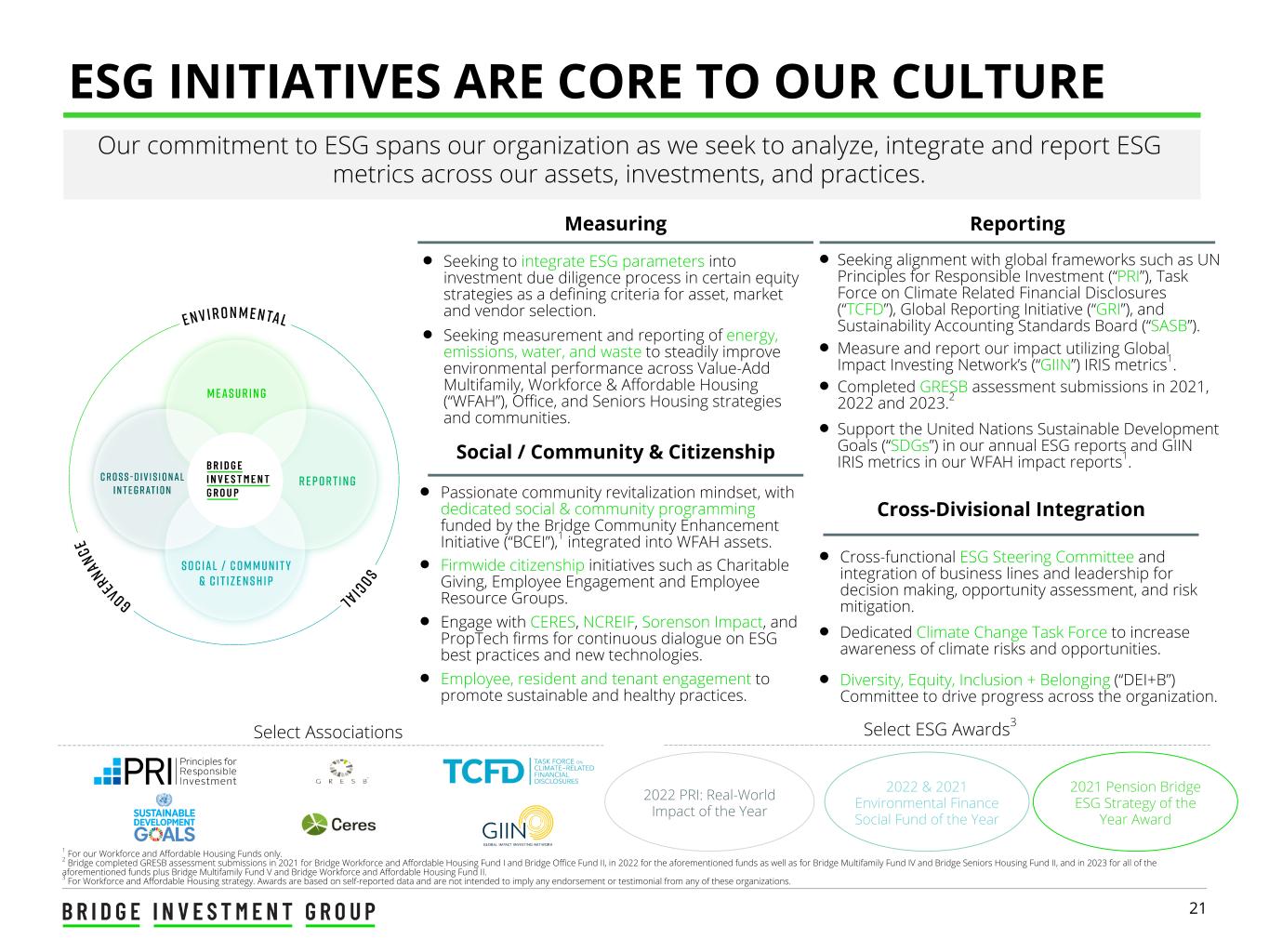

21 ESG INITIATIVES ARE CORE TO OUR CULTURE Our commitment to ESG spans our organization as we seek to analyze, integrate and report ESG metrics across our assets, investments, and practices. Select Associations Select ESG Awards3 2021 Pension Bridge ESG Strategy of the Year Award 2022 PRI: Real-World Impact of the Year 2022 & 2021 Environmental Finance Social Fund of the Year 1 For our Workforce and Affordable Housing Funds only. 2 Bridge completed GRESB assessment submissions in 2021 for Bridge Workforce and Affordable Housing Fund I and Bridge Office Fund II, in 2022 for the aforementioned funds as well as for Bridge Multifamily Fund IV and Bridge Seniors Housing Fund II, and in 2023 for all of the aforementioned funds plus Bridge Multifamily Fund V and Bridge Workforce and Affordable Housing Fund II. 3 For Workforce and Affordable Housing strategy. Awards are based on self-reported data and are not intended to imply any endorsement or testimonial from any of these organizations. Social / Community & Citizenship Cross-Divisional Integration l Passionate community revitalization mindset, with dedicated social & community programming funded by the Bridge Community Enhancement Initiative (“BCEI”),1 integrated into WFAH assets. l Firmwide citizenship initiatives such as Charitable Giving, Employee Engagement and Employee Resource Groups. l Engage with CERES, NCREIF, Sorenson Impact, and PropTech firms for continuous dialogue on ESG best practices and new technologies. l Employee, resident and tenant engagement to promote sustainable and healthy practices. l Cross-functional ESG Steering Committee and integration of business lines and leadership for decision making, opportunity assessment, and risk mitigation. l Dedicated Climate Change Task Force to increase awareness of climate risks and opportunities. l Diversity, Equity, Inclusion + Belonging (“DEI+B”) Committee to drive progress across the organization. Measuring Reporting l Seeking to integrate ESG parameters into investment due diligence process in certain equity strategies as a defining criteria for asset, market and vendor selection. l Seeking measurement and reporting of energy, emissions, water, and waste to steadily improve environmental performance across Value-Add Multifamily, Workforce & Affordable Housing (“WFAH”), Office, and Seniors Housing strategies and communities. l Seeking alignment with global frameworks such as UN Principles for Responsible Investment (“PRI”), Task Force on Climate Related Financial Disclosures (“TCFD”), Global Reporting Initiative (“GRI”), and Sustainability Accounting Standards Board (“SASB”). l Measure and report our impact utilizing Global Impact Investing Network’s (“GIIN”) IRIS metrics1. l Completed GRESB assessment submissions in 2021, 2022 and 2023.2 l Support the United Nations Sustainable Development Goals (“SDGs”) in our annual ESG reports and GIIN IRIS metrics in our WFAH impact reports1.

APPENDIX

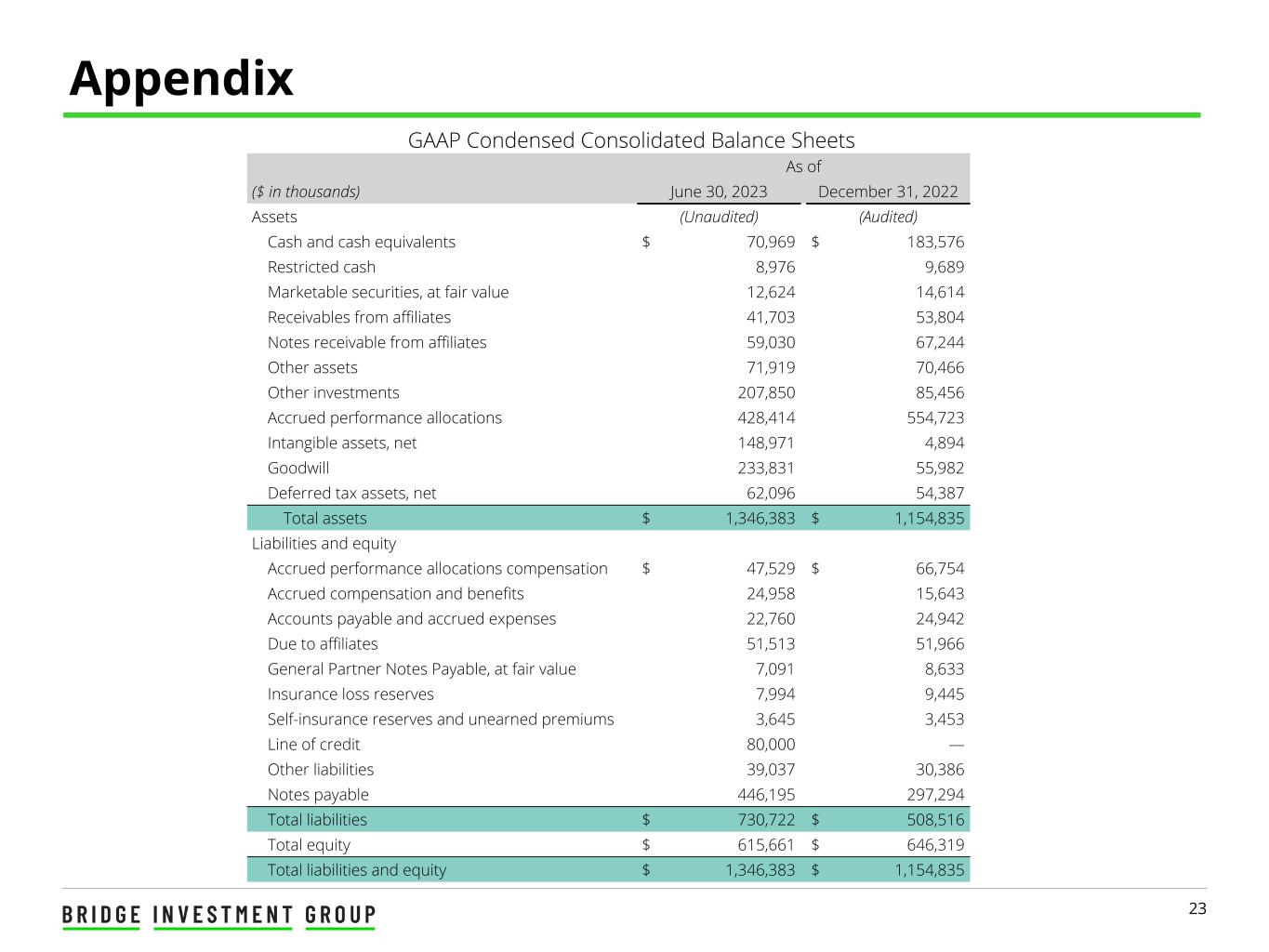

23 Appendix GAAP Condensed Consolidated Balance Sheets As of ($ in thousands) June 30, 2023 December 31, 2022 Assets (Unaudited) (Audited) Cash and cash equivalents $ 70,969 $ 183,576 Restricted cash 8,976 9,689 Marketable securities, at fair value 12,624 14,614 Receivables from affiliates 41,703 53,804 Notes receivable from affiliates 59,030 67,244 Other assets 71,919 70,466 Other investments 207,850 85,456 Accrued performance allocations 428,414 554,723 Intangible assets, net 148,971 4,894 Goodwill 233,831 55,982 Deferred tax assets, net 62,096 54,387 Total assets $ 1,346,383 $ 1,154,835 Liabilities and equity Accrued performance allocations compensation $ 47,529 $ 66,754 Accrued compensation and benefits 24,958 15,643 Accounts payable and accrued expenses 22,760 24,942 Due to affiliates 51,513 51,966 General Partner Notes Payable, at fair value 7,091 8,633 Insurance loss reserves 7,994 9,445 Self-insurance reserves and unearned premiums 3,645 3,453 Line of credit 80,000 — Other liabilities 39,037 30,386 Notes payable 446,195 297,294 Total liabilities $ 730,722 $ 508,516 Total equity $ 615,661 $ 646,319 Total liabilities and equity $ 1,346,383 $ 1,154,835

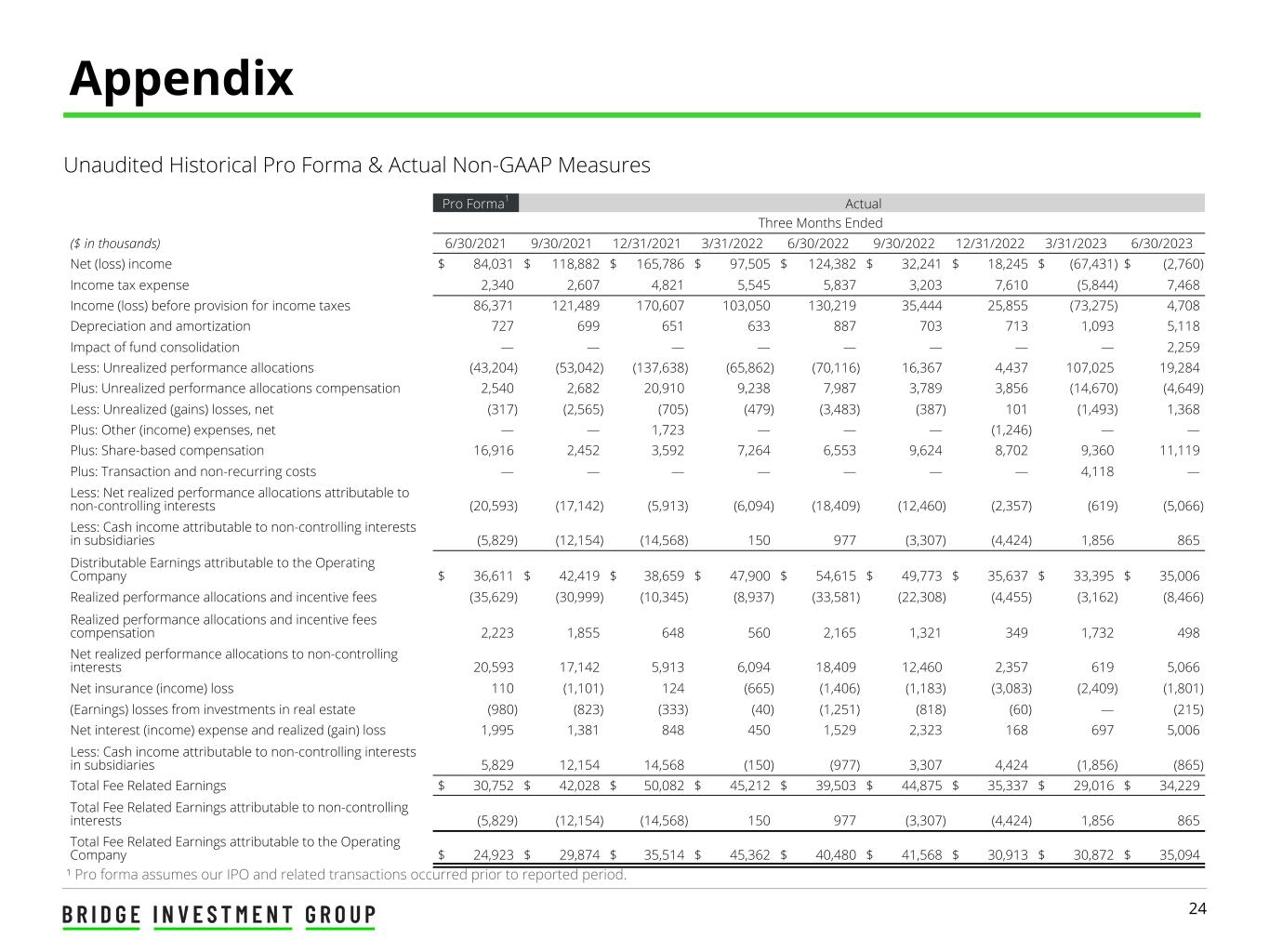

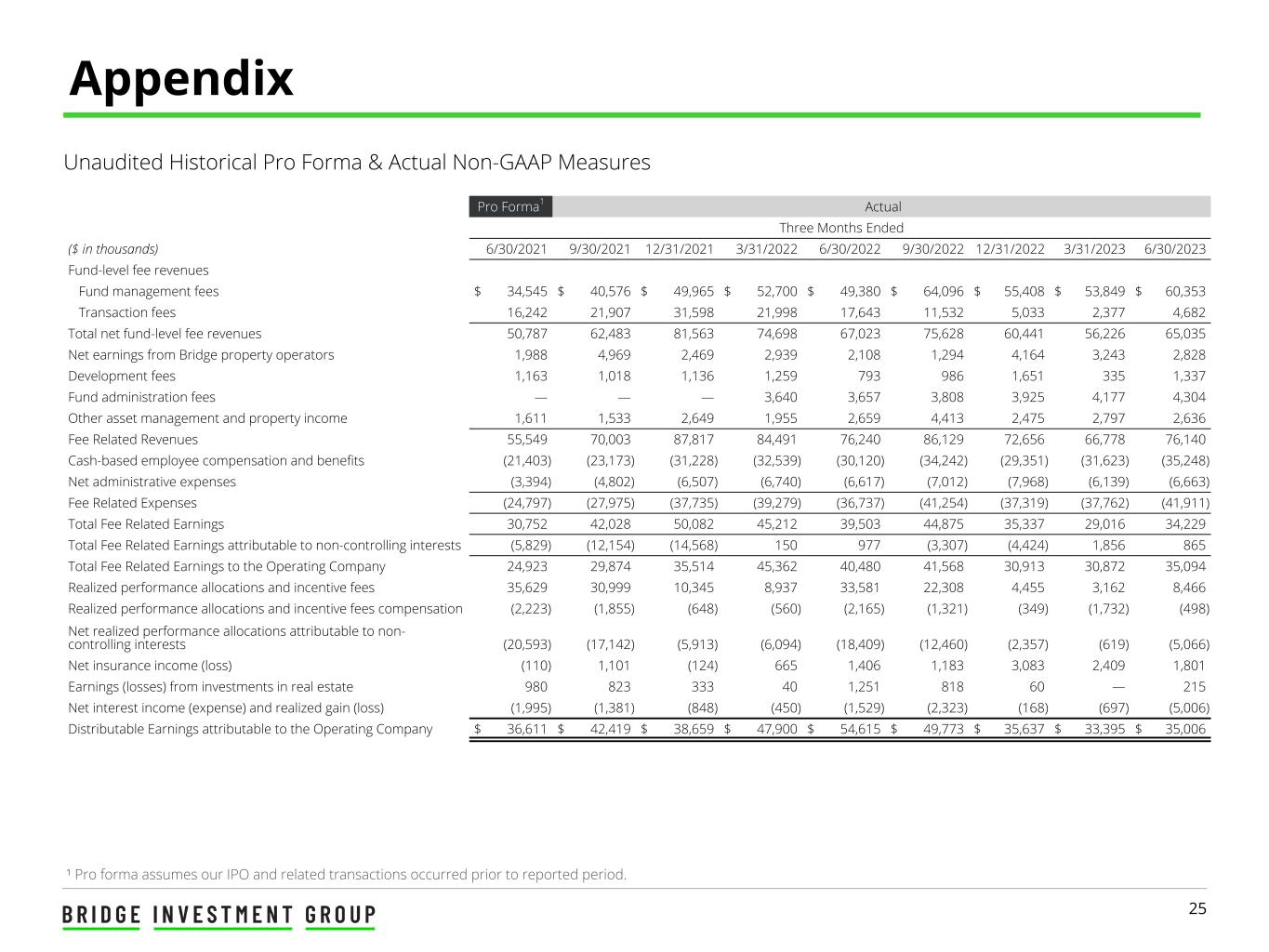

24 Appendix Unaudited Historical Pro Forma & Actual Non-GAAP Measures ¹ Pro forma assumes our IPO and related transactions occurred prior to reported period. Pro Forma1 Actual Three Months Ended ($ in thousands) 6/30/2021 9/30/2021 12/31/2021 3/31/2022 6/30/2022 9/30/2022 12/31/2022 3/31/2023 6/30/2023 Net (loss) income $ 84,031 $ 118,882 $ 165,786 $ 97,505 $ 124,382 $ 32,241 $ 18,245 $ (67,431) $ (2,760) Income tax expense 2,340 2,607 4,821 5,545 5,837 3,203 7,610 (5,844) 7,468 Income (loss) before provision for income taxes 86,371 121,489 170,607 103,050 130,219 35,444 25,855 (73,275) 4,708 Depreciation and amortization 727 699 651 633 887 703 713 1,093 5,118 Impact of fund consolidation — — — — — — — — 2,259 Less: Unrealized performance allocations (43,204) (53,042) (137,638) (65,862) (70,116) 16,367 4,437 107,025 19,284 Plus: Unrealized performance allocations compensation 2,540 2,682 20,910 9,238 7,987 3,789 3,856 (14,670) (4,649) Less: Unrealized (gains) losses, net (317) (2,565) (705) (479) (3,483) (387) 101 (1,493) 1,368 Plus: Other (income) expenses, net — — 1,723 — — — (1,246) — — Plus: Share-based compensation 16,916 2,452 3,592 7,264 6,553 9,624 8,702 9,360 11,119 Plus: Transaction and non-recurring costs — — — — — — — 4,118 — Less: Net realized performance allocations attributable to non-controlling interests (20,593) (17,142) (5,913) (6,094) (18,409) (12,460) (2,357) (619) (5,066) Less: Cash income attributable to non-controlling interests in subsidiaries (5,829) (12,154) (14,568) 150 977 (3,307) (4,424) 1,856 865 Distributable Earnings attributable to the Operating Company $ 36,611 $ 42,419 $ 38,659 $ 47,900 $ 54,615 $ 49,773 $ 35,637 $ 33,395 $ 35,006 Realized performance allocations and incentive fees (35,629) (30,999) (10,345) (8,937) (33,581) (22,308) (4,455) (3,162) (8,466) Realized performance allocations and incentive fees compensation 2,223 1,855 648 560 2,165 1,321 349 1,732 498 Net realized performance allocations to non-controlling interests 20,593 17,142 5,913 6,094 18,409 12,460 2,357 619 5,066 Net insurance (income) loss 110 (1,101) 124 (665) (1,406) (1,183) (3,083) (2,409) (1,801) (Earnings) losses from investments in real estate (980) (823) (333) (40) (1,251) (818) (60) — (215) Net interest (income) expense and realized (gain) loss 1,995 1,381 848 450 1,529 2,323 168 697 5,006 Less: Cash income attributable to non-controlling interests in subsidiaries 5,829 12,154 14,568 (150) (977) 3,307 4,424 (1,856) (865) Total Fee Related Earnings $ 30,752 $ 42,028 $ 50,082 $ 45,212 $ 39,503 $ 44,875 $ 35,337 $ 29,016 $ 34,229 Total Fee Related Earnings attributable to non-controlling interests (5,829) (12,154) (14,568) 150 977 (3,307) (4,424) 1,856 865 Total Fee Related Earnings attributable to the Operating Company $ 24,923 $ 29,874 $ 35,514 $ 45,362 $ 40,480 $ 41,568 $ 30,913 $ 30,872 $ 35,094

25 Appendix Unaudited Historical Pro Forma & Actual Non-GAAP Measures ¹ Pro forma assumes our IPO and related transactions occurred prior to reported period. Pro Forma1 Actual Three Months Ended ($ in thousands) 6/30/2021 9/30/2021 12/31/2021 3/31/2022 6/30/2022 9/30/2022 12/31/2022 3/31/2023 6/30/2023 Fund-level fee revenues Fund management fees $ 34,545 $ 40,576 $ 49,965 $ 52,700 $ 49,380 $ 64,096 $ 55,408 $ 53,849 $ 60,353 Transaction fees 16,242 21,907 31,598 21,998 17,643 11,532 5,033 2,377 4,682 Total net fund-level fee revenues 50,787 62,483 81,563 74,698 67,023 75,628 60,441 56,226 65,035 Net earnings from Bridge property operators 1,988 4,969 2,469 2,939 2,108 1,294 4,164 3,243 2,828 Development fees 1,163 1,018 1,136 1,259 793 986 1,651 335 1,337 Fund administration fees — — — 3,640 3,657 3,808 3,925 4,177 4,304 Other asset management and property income 1,611 1,533 2,649 1,955 2,659 4,413 2,475 2,797 2,636 Fee Related Revenues 55,549 70,003 87,817 84,491 76,240 86,129 72,656 66,778 76,140 Cash-based employee compensation and benefits (21,403) (23,173) (31,228) (32,539) (30,120) (34,242) (29,351) (31,623) (35,248) Net administrative expenses (3,394) (4,802) (6,507) (6,740) (6,617) (7,012) (7,968) (6,139) (6,663) Fee Related Expenses (24,797) (27,975) (37,735) (39,279) (36,737) (41,254) (37,319) (37,762) (41,911) Total Fee Related Earnings 30,752 42,028 50,082 45,212 39,503 44,875 35,337 29,016 34,229 Total Fee Related Earnings attributable to non-controlling interests (5,829) (12,154) (14,568) 150 977 (3,307) (4,424) 1,856 865 Total Fee Related Earnings to the Operating Company 24,923 29,874 35,514 45,362 40,480 41,568 30,913 30,872 35,094 Realized performance allocations and incentive fees 35,629 30,999 10,345 8,937 33,581 22,308 4,455 3,162 8,466 Realized performance allocations and incentive fees compensation (2,223) (1,855) (648) (560) (2,165) (1,321) (349) (1,732) (498) Net realized performance allocations attributable to non- controlling interests (20,593) (17,142) (5,913) (6,094) (18,409) (12,460) (2,357) (619) (5,066) Net insurance income (loss) (110) 1,101 (124) 665 1,406 1,183 3,083 2,409 1,801 Earnings (losses) from investments in real estate 980 823 333 40 1,251 818 60 — 215 Net interest income (expense) and realized gain (loss) (1,995) (1,381) (848) (450) (1,529) (2,323) (168) (697) (5,006) Distributable Earnings attributable to the Operating Company $ 36,611 $ 42,419 $ 38,659 $ 47,900 $ 54,615 $ 49,773 $ 35,637 $ 33,395 $ 35,006

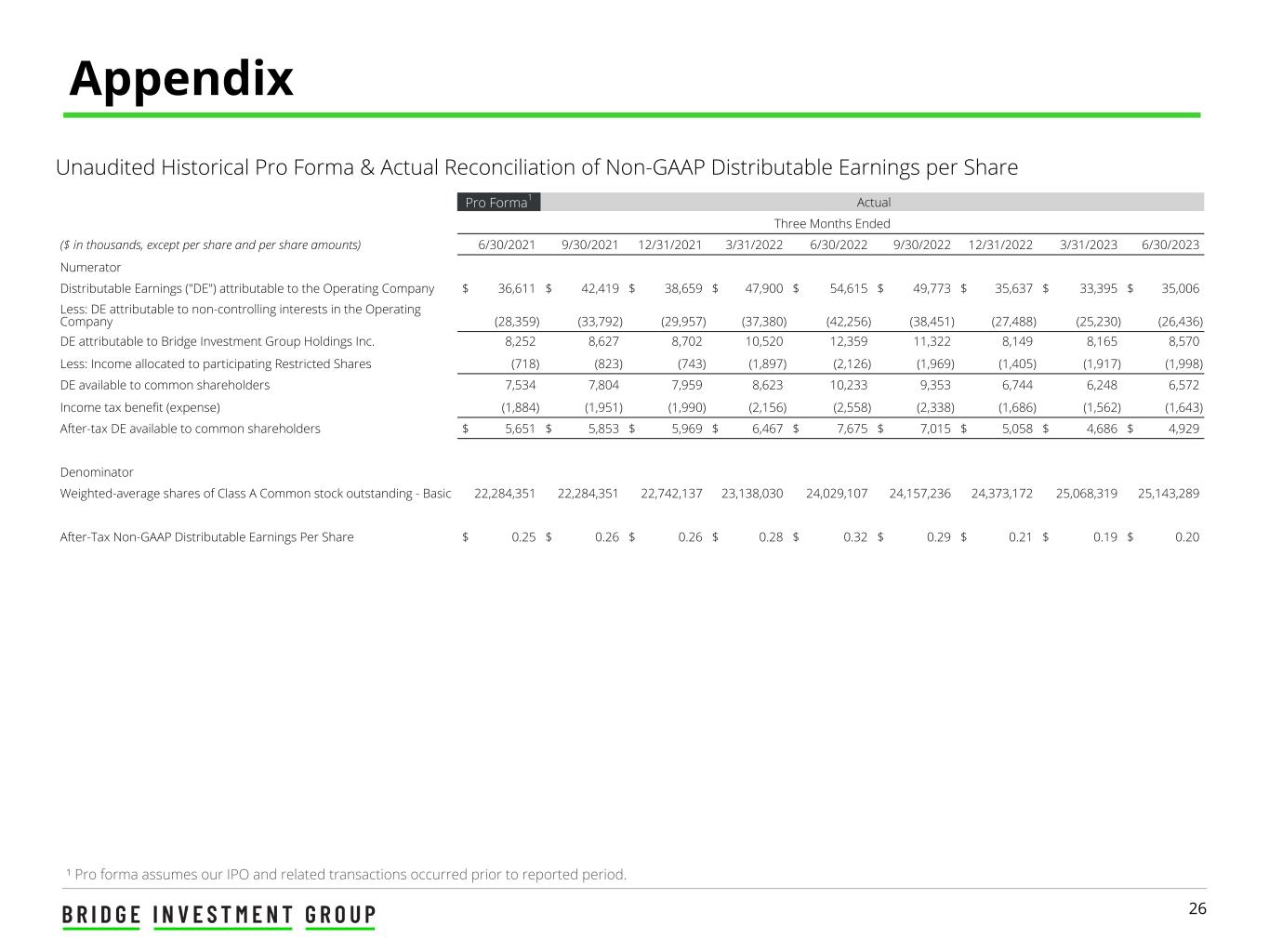

26 Appendix Unaudited Historical Pro Forma & Actual Reconciliation of Non-GAAP Distributable Earnings per Share ¹ Pro forma assumes our IPO and related transactions occurred prior to reported period. Pro Forma1 Actual Three Months Ended ($ in thousands, except per share and per share amounts) 6/30/2021 9/30/2021 12/31/2021 3/31/2022 6/30/2022 9/30/2022 12/31/2022 3/31/2023 6/30/2023 Numerator Distributable Earnings ("DE") attributable to the Operating Company $ 36,611 $ 42,419 $ 38,659 $ 47,900 $ 54,615 $ 49,773 $ 35,637 $ 33,395 $ 35,006 Less: DE attributable to non-controlling interests in the Operating Company (28,359) (33,792) (29,957) (37,380) (42,256) (38,451) (27,488) (25,230) (26,436) DE attributable to Bridge Investment Group Holdings Inc. 8,252 8,627 8,702 10,520 12,359 11,322 8,149 8,165 8,570 Less: Income allocated to participating Restricted Shares (718) (823) (743) (1,897) (2,126) (1,969) (1,405) (1,917) (1,998) DE available to common shareholders 7,534 7,804 7,959 8,623 10,233 9,353 6,744 6,248 6,572 Income tax benefit (expense) (1,884) (1,951) (1,990) (2,156) (2,558) (2,338) (1,686) (1,562) (1,643) After-tax DE available to common shareholders $ 5,651 $ 5,853 $ 5,969 $ 6,467 $ 7,675 $ 7,015 $ 5,058 $ 4,686 $ 4,929 Denominator Weighted-average shares of Class A Common stock outstanding - Basic 22,284,351 22,284,351 22,742,137 23,138,030 24,029,107 24,157,236 24,373,172 25,068,319 25,143,289 After-Tax Non-GAAP Distributable Earnings Per Share $ 0.25 $ 0.26 $ 0.26 $ 0.28 $ 0.32 $ 0.29 $ 0.21 $ 0.19 $ 0.20

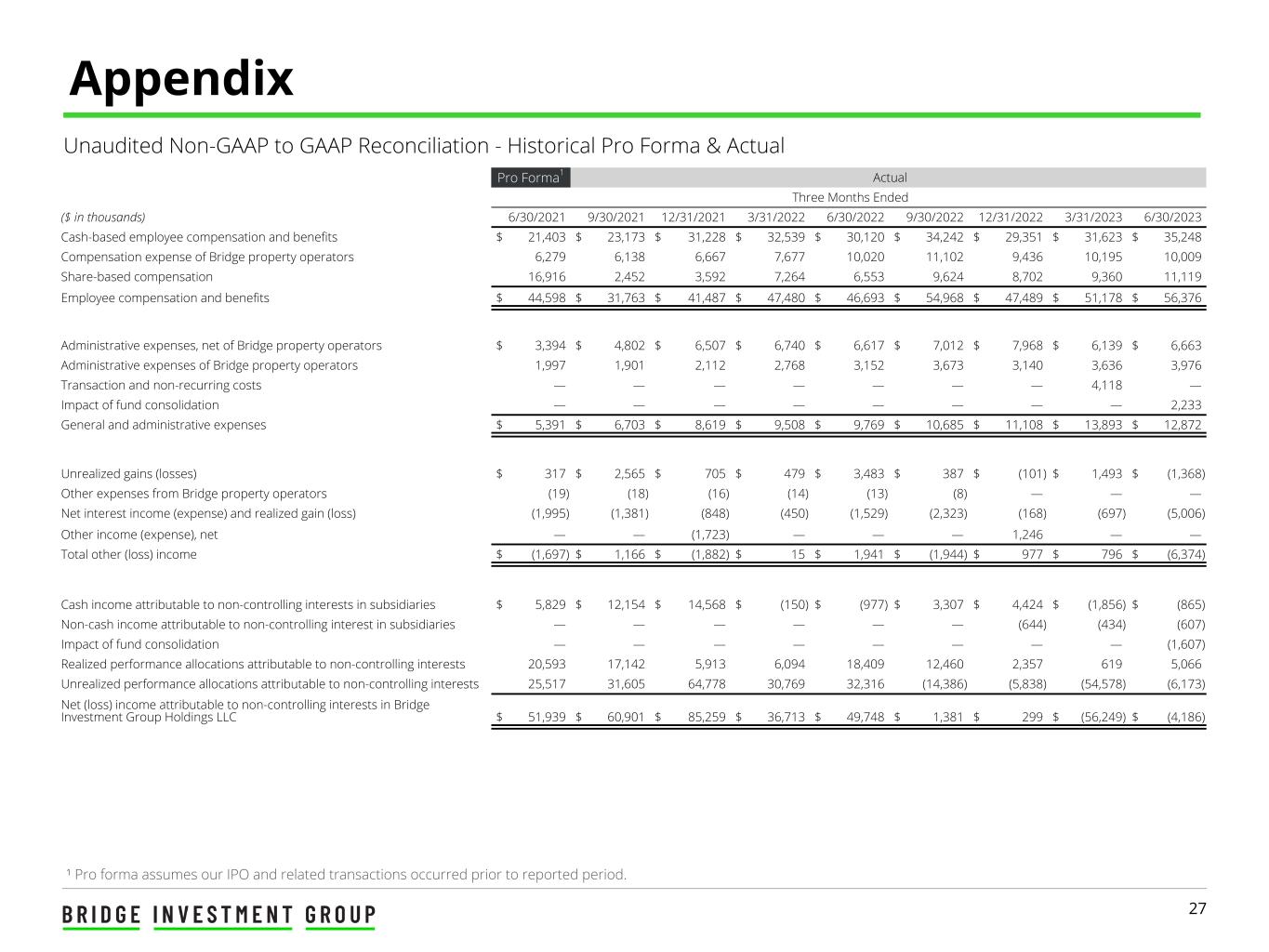

27 Appendix Unaudited Non-GAAP to GAAP Reconciliation - Historical Pro Forma & Actual ¹ Pro forma assumes our IPO and related transactions occurred prior to reported period. Pro Forma1 Actual Three Months Ended ($ in thousands) 6/30/2021 9/30/2021 12/31/2021 3/31/2022 6/30/2022 9/30/2022 12/31/2022 3/31/2023 6/30/2023 Cash-based employee compensation and benefits $ 21,403 $ 23,173 $ 31,228 $ 32,539 $ 30,120 $ 34,242 $ 29,351 $ 31,623 $ 35,248 Compensation expense of Bridge property operators 6,279 6,138 6,667 7,677 10,020 11,102 9,436 10,195 10,009 Share-based compensation 16,916 2,452 3,592 7,264 6,553 9,624 8,702 9,360 11,119 Employee compensation and benefits $ 44,598 $ 31,763 $ 41,487 $ 47,480 $ 46,693 $ 54,968 $ 47,489 $ 51,178 $ 56,376 Administrative expenses, net of Bridge property operators $ 3,394 $ 4,802 $ 6,507 $ 6,740 $ 6,617 $ 7,012 $ 7,968 $ 6,139 $ 6,663 Administrative expenses of Bridge property operators 1,997 1,901 2,112 2,768 3,152 3,673 3,140 3,636 3,976 Transaction and non-recurring costs — — — — — — — 4,118 — Impact of fund consolidation — — — — — — — — 2,233 General and administrative expenses $ 5,391 $ 6,703 $ 8,619 $ 9,508 $ 9,769 $ 10,685 $ 11,108 $ 13,893 $ 12,872 Unrealized gains (losses) $ 317 $ 2,565 $ 705 $ 479 $ 3,483 $ 387 $ (101) $ 1,493 $ (1,368) Other expenses from Bridge property operators (19) (18) (16) (14) (13) (8) — — — Net interest income (expense) and realized gain (loss) (1,995) (1,381) (848) (450) (1,529) (2,323) (168) (697) (5,006) Other income (expense), net — — (1,723) — — — 1,246 — — Total other (loss) income $ (1,697) $ 1,166 $ (1,882) $ 15 $ 1,941 $ (1,944) $ 977 $ 796 $ (6,374) Cash income attributable to non-controlling interests in subsidiaries $ 5,829 $ 12,154 $ 14,568 $ (150) $ (977) $ 3,307 $ 4,424 $ (1,856) $ (865) Non-cash income attributable to non-controlling interest in subsidiaries — — — — — — (644) (434) (607) Impact of fund consolidation — — — — — — — — (1,607) Realized performance allocations attributable to non-controlling interests 20,593 17,142 5,913 6,094 18,409 12,460 2,357 619 5,066 Unrealized performance allocations attributable to non-controlling interests 25,517 31,605 64,778 30,769 32,316 (14,386) (5,838) (54,578) (6,173) Net (loss) income attributable to non-controlling interests in Bridge Investment Group Holdings LLC $ 51,939 $ 60,901 $ 85,259 $ 36,713 $ 49,748 $ 1,381 $ 299 $ (56,249) $ (4,186)

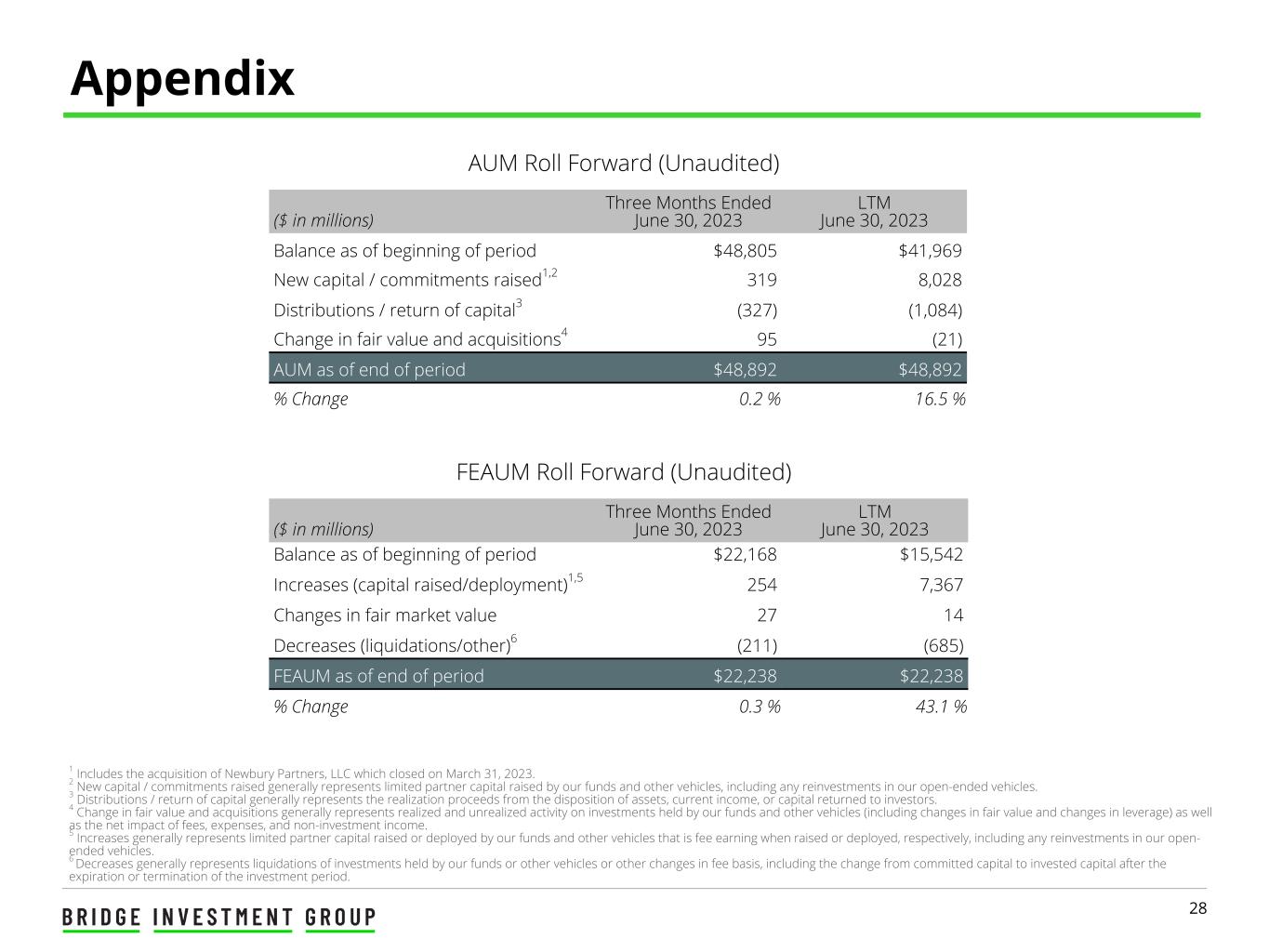

28 Appendix AUM Roll Forward (Unaudited) FEAUM Roll Forward (Unaudited) ($ in millions) Three Months Ended June 30, 2023 LTM June 30, 2023 Balance as of beginning of period $22,168 $15,542 Increases (capital raised/deployment)1,5 254 7,367 Changes in fair market value 27 14 Decreases (liquidations/other)6 (211) (685) FEAUM as of end of period $22,238 $22,238 % Change 0.3 % 43.1 % 1 Includes the acquisition of Newbury Partners, LLC which closed on March 31, 2023. 2 New capital / commitments raised generally represents limited partner capital raised by our funds and other vehicles, including any reinvestments in our open-ended vehicles. 3 Distributions / return of capital generally represents the realization proceeds from the disposition of assets, current income, or capital returned to investors. 4 Change in fair value and acquisitions generally represents realized and unrealized activity on investments held by our funds and other vehicles (including changes in fair value and changes in leverage) as well as the net impact of fees, expenses, and non-investment income. 5 Increases generally represents limited partner capital raised or deployed by our funds and other vehicles that is fee earning when raised or deployed, respectively, including any reinvestments in our open- ended vehicles. 6 Decreases generally represents liquidations of investments held by our funds or other vehicles or other changes in fee basis, including the change from committed capital to invested capital after the expiration or termination of the investment period. ($ in millions) Three Months Ended June 30, 2023 LTM June 30, 2023 Balance as of beginning of period $48,805 $41,969 New capital / commitments raised1,2 319 8,028 Distributions / return of capital3 (327) (1,084) Change in fair value and acquisitions4 95 (21) AUM as of end of period $48,892 $48,892 % Change 0.2 % 16.5 %

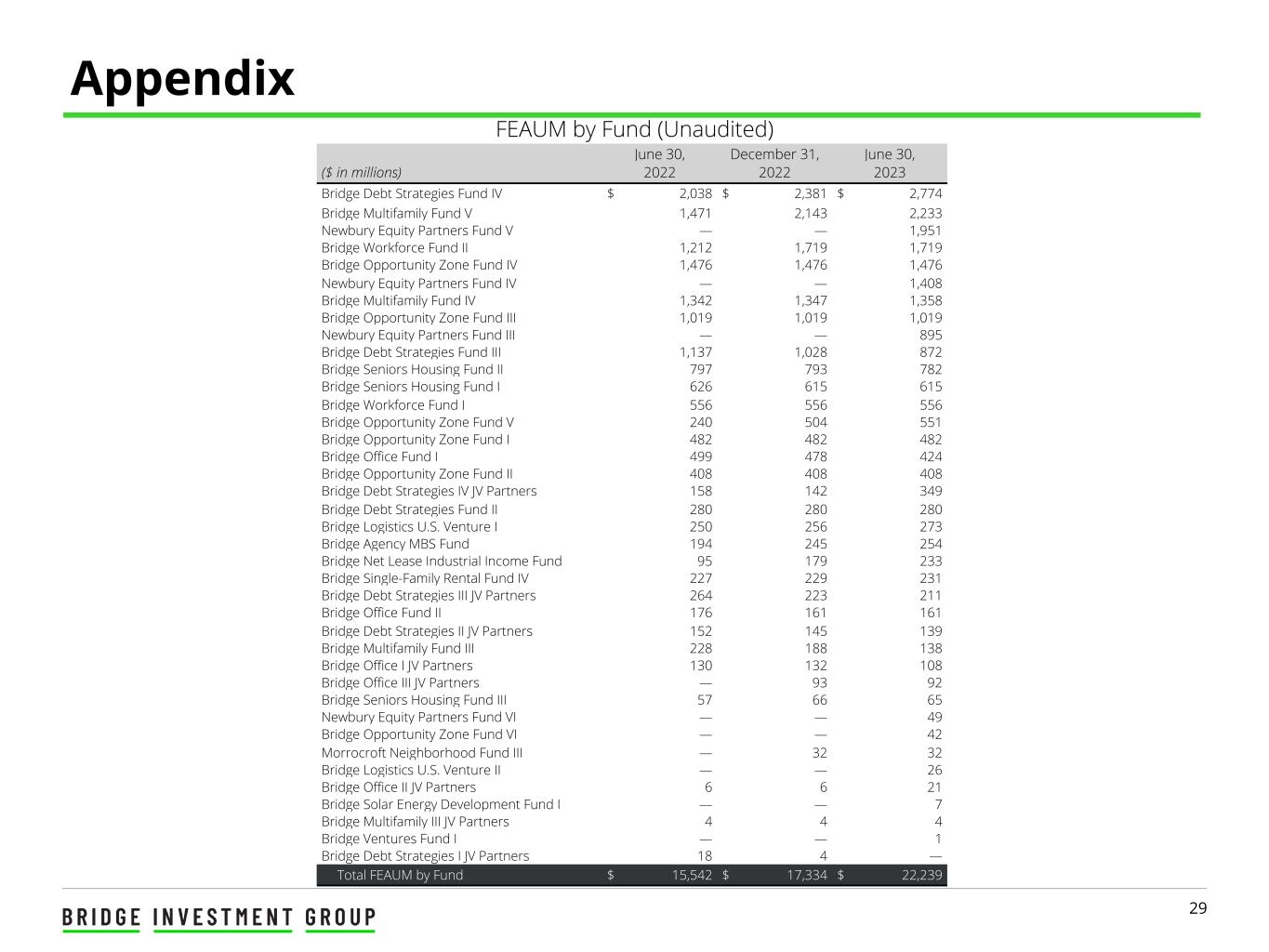

29 Appendix FEAUM by Fund (Unaudited) June 30, December 31, June 30, ($ in millions) 2022 2022 2023 Bridge Debt Strategies Fund IV $ 2,038 $ 2,381 $ 2,774 Bridge Multifamily Fund V 1,471 2,143 2,233 Newbury Equity Partners Fund V — — 1,951 Bridge Workforce Fund II 1,212 1,719 1,719 Bridge Opportunity Zone Fund IV 1,476 1,476 1,476 Newbury Equity Partners Fund IV — — 1,408 Bridge Multifamily Fund IV 1,342 1,347 1,358 Bridge Opportunity Zone Fund III 1,019 1,019 1,019 Newbury Equity Partners Fund III — — 895 Bridge Debt Strategies Fund III 1,137 1,028 872 Bridge Seniors Housing Fund II 797 793 782 Bridge Seniors Housing Fund I 626 615 615 Bridge Workforce Fund I 556 556 556 Bridge Opportunity Zone Fund V 240 504 551 Bridge Opportunity Zone Fund I 482 482 482 Bridge Office Fund I 499 478 424 Bridge Opportunity Zone Fund II 408 408 408 Bridge Debt Strategies IV JV Partners 158 142 349 Bridge Debt Strategies Fund II 280 280 280 Bridge Logistics U.S. Venture I 250 256 273 Bridge Agency MBS Fund 194 245 254 Bridge Net Lease Industrial Income Fund 95 179 233 Bridge Single-Family Rental Fund IV 227 229 231 Bridge Debt Strategies III JV Partners 264 223 211 Bridge Office Fund II 176 161 161 Bridge Debt Strategies II JV Partners 152 145 139 Bridge Multifamily Fund III 228 188 138 Bridge Office I JV Partners 130 132 108 Bridge Office III JV Partners — 93 92 Bridge Seniors Housing Fund III 57 66 65 Newbury Equity Partners Fund VI — — 49 Bridge Opportunity Zone Fund VI — — 42 Morrocroft Neighborhood Fund III — 32 32 Bridge Logistics U.S. Venture II — — 26 Bridge Office II JV Partners 6 6 21 Bridge Solar Energy Development Fund I — — 7 Bridge Multifamily III JV Partners 4 4 4 Bridge Ventures Fund I — — 1 Bridge Debt Strategies I JV Partners 18 4 — Total FEAUM by Fund $ 15,542 $ 17,334 $ 22,239

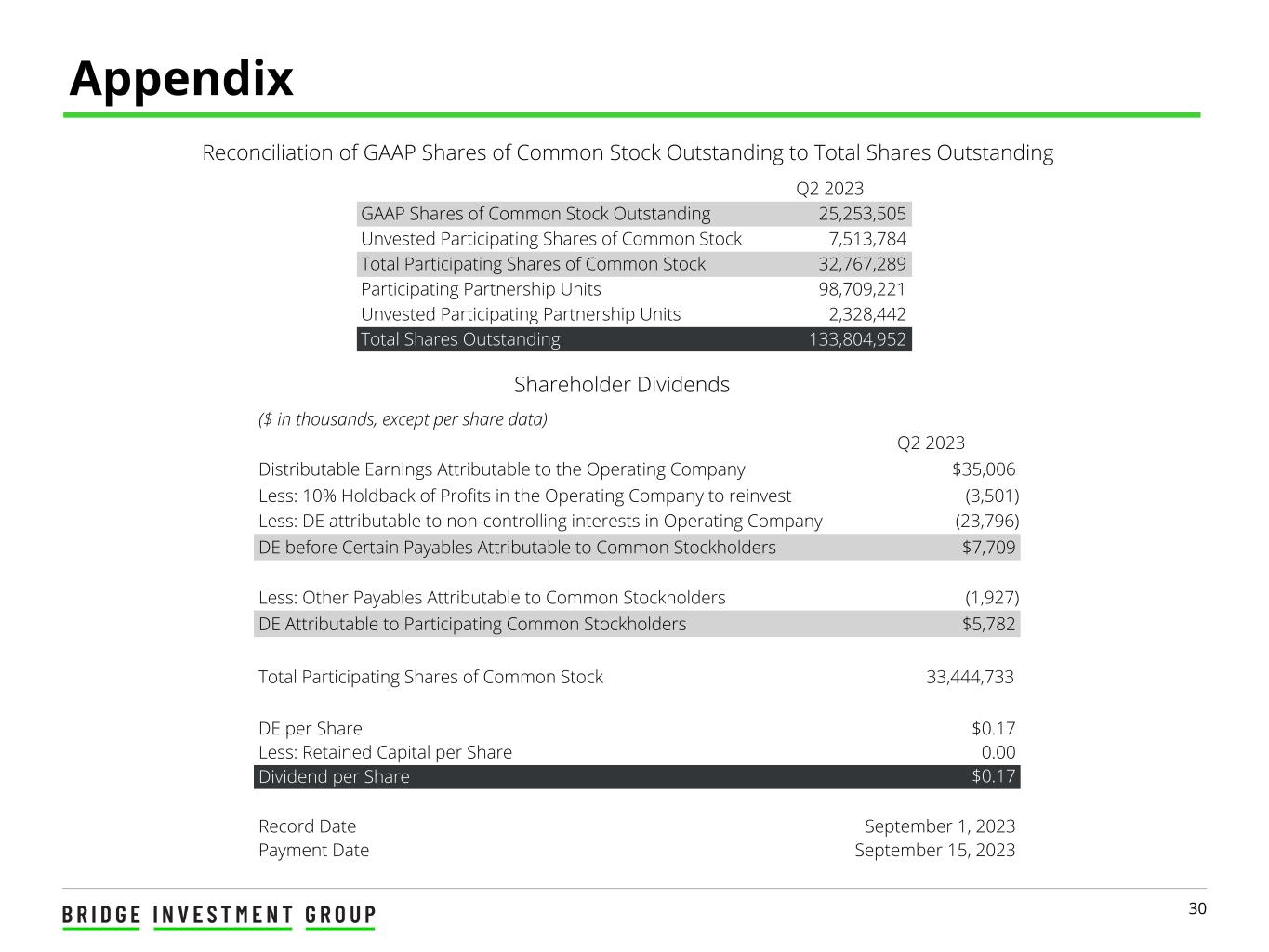

30 Appendix Reconciliation of GAAP Shares of Common Stock Outstanding to Total Shares Outstanding Q2 2023 GAAP Shares of Common Stock Outstanding 25,253,505 Unvested Participating Shares of Common Stock 7,513,784 Total Participating Shares of Common Stock 32,767,289 Participating Partnership Units 98,709,221 Unvested Participating Partnership Units 2,328,442 Total Shares Outstanding 133,804,952 Shareholder Dividends ($ in thousands, except per share data) Q2 2023 Distributable Earnings Attributable to the Operating Company $35,006 Less: 10% Holdback of Profits in the Operating Company to reinvest (3,501) Less: DE attributable to non-controlling interests in Operating Company (23,796) DE before Certain Payables Attributable to Common Stockholders $7,709 Less: Other Payables Attributable to Common Stockholders (1,927) DE Attributable to Participating Common Stockholders $5,782 Total Participating Shares of Common Stock 33,444,733 DE per Share $0.17 Less: Retained Capital per Share 0.00 Dividend per Share $0.17 Record Date September 1, 2023 Payment Date September 15, 2023

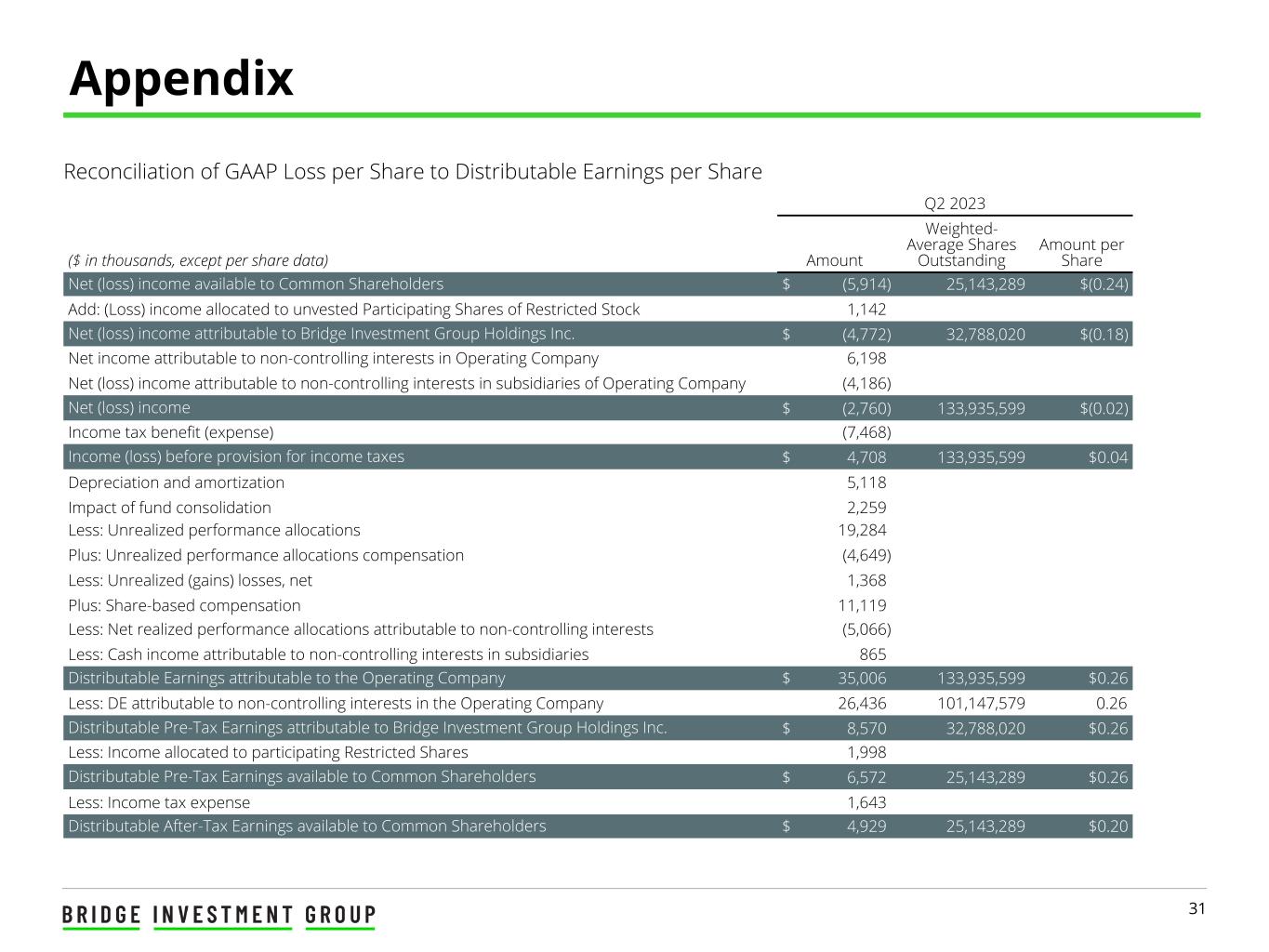

31 Appendix Reconciliation of GAAP Loss per Share to Distributable Earnings per Share Q2 2023 ($ in thousands, except per share data) Amount Weighted- Average Shares Outstanding Amount per Share Net (loss) income available to Common Shareholders $ (5,914) 25,143,289 $(0.24) Add: (Loss) income allocated to unvested Participating Shares of Restricted Stock 1,142 Net (loss) income attributable to Bridge Investment Group Holdings Inc. $ (4,772) 32,788,020 $(0.18) Net income attributable to non-controlling interests in Operating Company 6,198 Net (loss) income attributable to non-controlling interests in subsidiaries of Operating Company (4,186) Net (loss) income $ (2,760) 133,935,599 $(0.02) Income tax benefit (expense) (7,468) Income (loss) before provision for income taxes $ 4,708 133,935,599 $0.04 Depreciation and amortization 5,118 Impact of fund consolidation 2,259 Less: Unrealized performance allocations 19,284 Plus: Unrealized performance allocations compensation (4,649) Less: Unrealized (gains) losses, net 1,368 Plus: Share-based compensation 11,119 Less: Net realized performance allocations attributable to non-controlling interests (5,066) Less: Cash income attributable to non-controlling interests in subsidiaries 865 Distributable Earnings attributable to the Operating Company $ 35,006 133,935,599 $0.26 Less: DE attributable to non-controlling interests in the Operating Company 26,436 101,147,579 0.26 Distributable Pre-Tax Earnings attributable to Bridge Investment Group Holdings Inc. $ 8,570 32,788,020 $0.26 Less: Income allocated to participating Restricted Shares 1,998 Distributable Pre-Tax Earnings available to Common Shareholders $ 6,572 25,143,289 $0.26 Less: Income tax expense 1,643 Distributable After-Tax Earnings available to Common Shareholders $ 4,929 25,143,289 $0.20

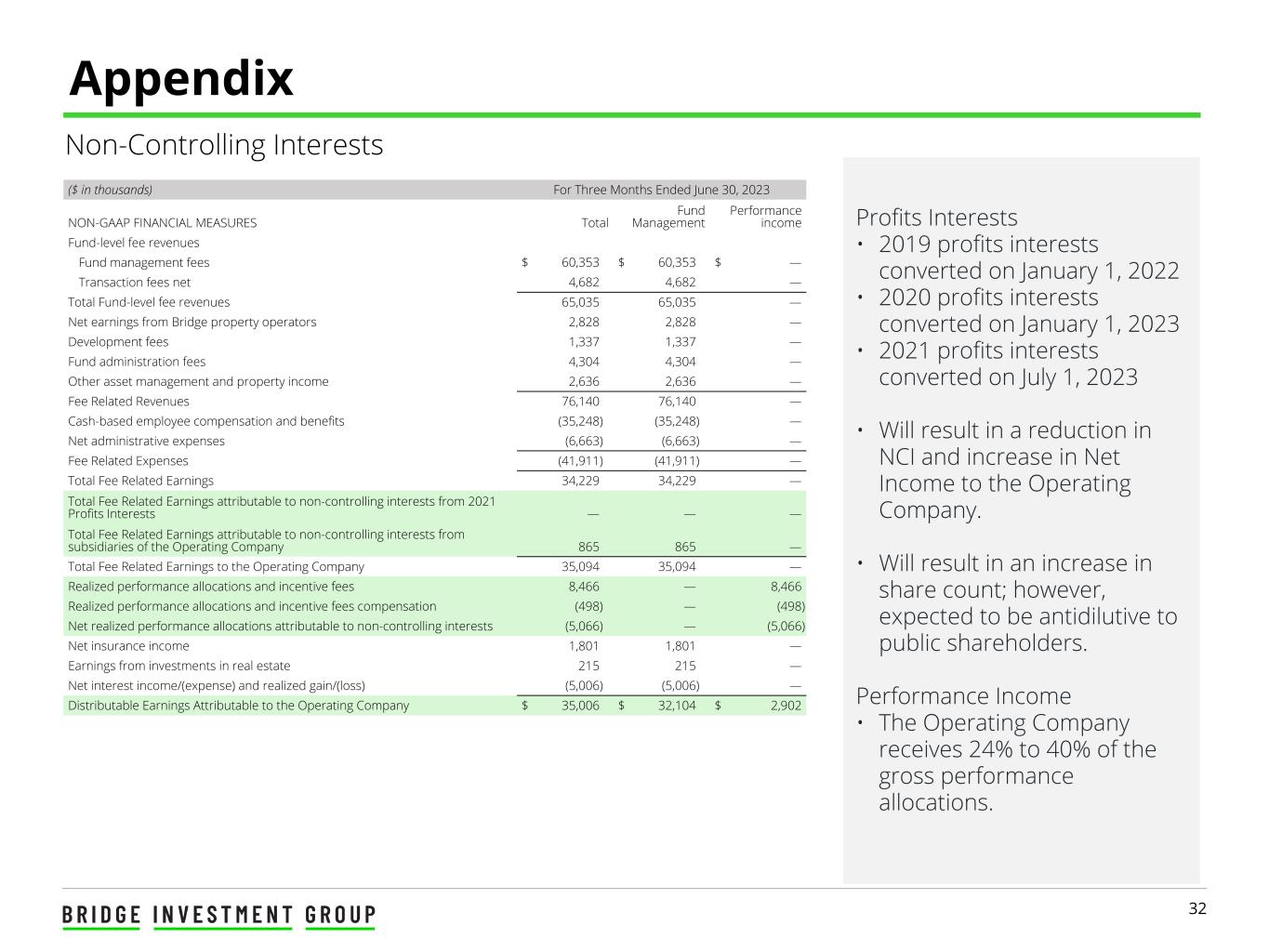

32 Appendix Profits Interests • 2019 profits interests converted on January 1, 2022 • 2020 profits interests converted on January 1, 2023 • 2021 profits interests converted on July 1, 2023 • Will result in a reduction in NCI and increase in Net Income to the Operating Company. • Will result in an increase in share count; however, expected to be antidilutive to public shareholders. Performance Income • The Operating Company receives 24% to 40% of the gross performance allocations. Non-Controlling Interests ($ in thousands) For Three Months Ended June 30, 2023 NON-GAAP FINANCIAL MEASURES Total Fund Management Performance income Fund-level fee revenues Fund management fees $ 60,353 $ 60,353 $ — Transaction fees net 4,682 4,682 — Total Fund-level fee revenues 65,035 65,035 — Net earnings from Bridge property operators 2,828 2,828 — Development fees 1,337 1,337 — Fund administration fees 4,304 4,304 — Other asset management and property income 2,636 2,636 — Fee Related Revenues 76,140 76,140 — Cash-based employee compensation and benefits (35,248) (35,248) — Net administrative expenses (6,663) (6,663) — Fee Related Expenses (41,911) (41,911) — Total Fee Related Earnings 34,229 34,229 — Total Fee Related Earnings attributable to non-controlling interests from 2021 Profits Interests — — — Total Fee Related Earnings attributable to non-controlling interests from subsidiaries of the Operating Company 865 865 — Total Fee Related Earnings to the Operating Company 35,094 35,094 — Realized performance allocations and incentive fees 8,466 — 8,466 Realized performance allocations and incentive fees compensation (498) — (498) Net realized performance allocations attributable to non-controlling interests (5,066) — (5,066) Net insurance income 1,801 1,801 — Earnings from investments in real estate 215 215 — Net interest income/(expense) and realized gain/(loss) (5,006) (5,006) — Distributable Earnings Attributable to the Operating Company $ 35,006 $ 32,104 $ 2,902

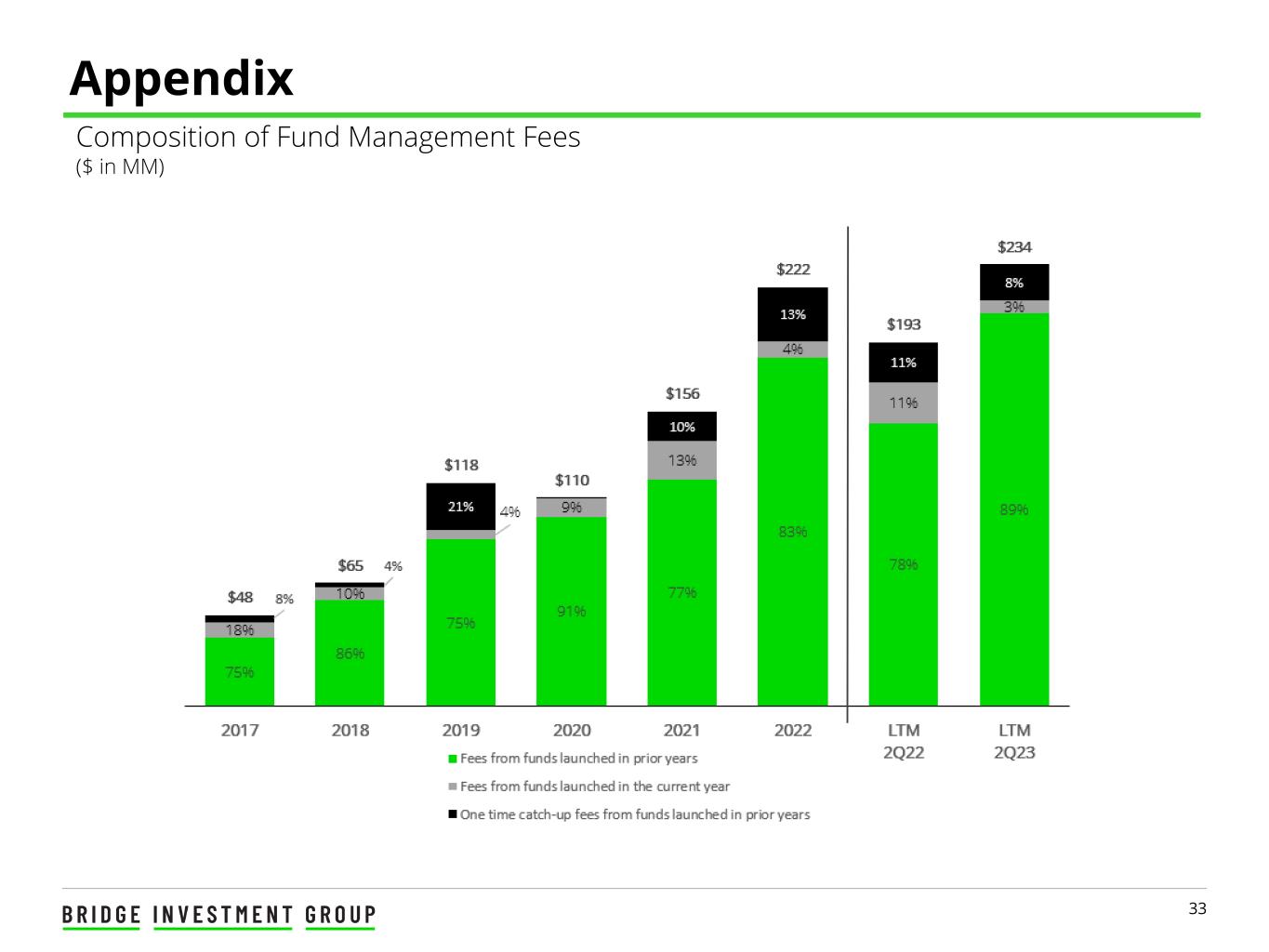

33 Appendix Composition of Fund Management Fees ($ in MM)

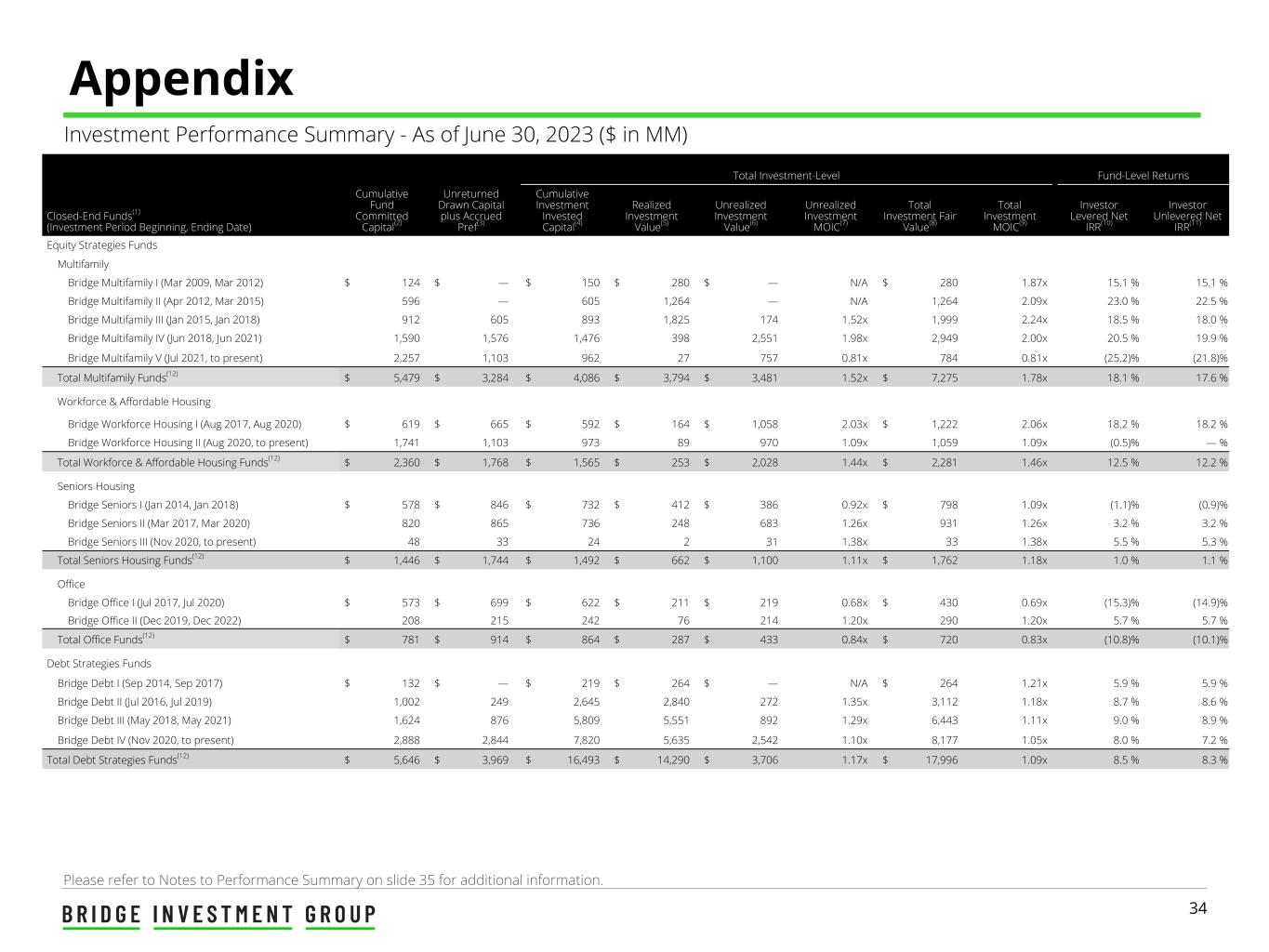

34 Investment Performance Summary - As of June 30, 2023 ($ in MM) Appendix Total Investment-Level Fund-Level Returns Closed-End Funds(1) (Investment Period Beginning, Ending Date) Cumulative Fund Committed Capital(2) Unreturned Drawn Capital plus Accrued Pref(3) Cumulative Investment Invested Capital(4) Realized Investment Value(5) Unrealized Investment Value(6) Unrealized Investment MOIC(7) Total Investment Fair Value(8) Total Investment MOIC(9) Investor Levered Net IRR(10) Investor Unlevered Net IRR(11) Equity Strategies Funds Multifamily Bridge Multifamily I (Mar 2009, Mar 2012) $ 124 $ — $ 150 $ 280 $ — N/A $ 280 1.87x 15.1 % 15.1 % Bridge Multifamily II (Apr 2012, Mar 2015) 596 — 605 1,264 — N/A 1,264 2.09x 23.0 % 22.5 % Bridge Multifamily III (Jan 2015, Jan 2018) 912 605 893 1,825 174 1.52x 1,999 2.24x 18.5 % 18.0 % Bridge Multifamily IV (Jun 2018, Jun 2021) 1,590 1,576 1,476 398 2,551 1.98x 2,949 2.00x 20.5 % 19.9 % Bridge Multifamily V (Jul 2021, to present) 2,257 1,103 962 27 757 0.81x 784 0.81x (25.2) % (21.8) % Total Multifamily Funds(12) $ 5,479 $ 3,284 $ 4,086 $ 3,794 $ 3,481 1.52x $ 7,275 1.78x 18.1 % 17.6 % Workforce & Affordable Housing Bridge Workforce Housing I (Aug 2017, Aug 2020) $ 619 $ 665 $ 592 $ 164 $ 1,058 2.03x $ 1,222 2.06x 18.2 % 18.2 % Bridge Workforce Housing II (Aug 2020, to present) 1,741 1,103 973 89 970 1.09x 1,059 1.09x (0.5) % — % Total Workforce & Affordable Housing Funds(12) $ 2,360 $ 1,768 $ 1,565 $ 253 $ 2,028 1.44x $ 2,281 1.46x 12.5 % 12.2 % Seniors Housing Bridge Seniors I (Jan 2014, Jan 2018) $ 578 $ 846 $ 732 $ 412 $ 386 0.92x $ 798 1.09x (1.1) % (0.9) % Bridge Seniors II (Mar 2017, Mar 2020) 820 865 736 248 683 1.26x 931 1.26x 3.2 % 3.2 % Bridge Seniors III (Nov 2020, to present) 48 33 24 2 31 1.38x 33 1.38x 5.5 % 5.3 % Total Seniors Housing Funds(12) $ 1,446 $ 1,744 $ 1,492 $ 662 $ 1,100 1.11x $ 1,762 1.18x 1.0 % 1.1 % Office Bridge Office I (Jul 2017, Jul 2020) $ 573 $ 699 $ 622 $ 211 $ 219 0.68x $ 430 0.69x (15.3) % (14.9) % Bridge Office II (Dec 2019, Dec 2022) 208 215 242 76 214 1.20x 290 1.20x 5.7 % 5.7 % Total Office Funds(12) $ 781 $ 914 $ 864 $ 287 $ 433 0.84x $ 720 0.83x (10.8) % (10.1) % Debt Strategies Funds Bridge Debt I (Sep 2014, Sep 2017) $ 132 $ — $ 219 $ 264 $ — N/A $ 264 1.21x 5.9 % 5.9 % Bridge Debt II (Jul 2016, Jul 2019) 1,002 249 2,645 2,840 272 1.35x 3,112 1.18x 8.7 % 8.6 % Bridge Debt III (May 2018, May 2021) 1,624 876 5,809 5,551 892 1.29x 6,443 1.11x 9.0 % 8.9 % Bridge Debt IV (Nov 2020, to present) 2,888 2,844 7,820 5,635 2,542 1.10x 8,177 1.05x 8.0 % 7.2 % Total Debt Strategies Funds(12) $ 5,646 $ 3,969 $ 16,493 $ 14,290 $ 3,706 1.17x $ 17,996 1.09x 8.5 % 8.3 % Please refer to Notes to Performance Summary on slide 35 for additional information.

35 Notes to Performance Summary Appendix The investment performance presented herein is intended to illustrate the performance of investments held by the funds and other vehicles we manage and the potential for which is relevant to the performance-based fees to Bridge. Other than the Investor Unlevered Net IRR and the Investor Levered Net IRR numbers presented, the cash flows in the investment performance do not reflect the cash flows used in presentations of fund performance due to the fund-level expenses, reserves, and reinvested capital. (1) Closed-End Funds does not include performance for (i) Opportunity Zone funds as such funds are invested in active development projects and have minimal stabilized assets, (ii) funds that are currently raising capital, including our open-ended funds, (iii) funds related to the acquisition of the investment management business of Gorelick Brothers' Capital, LLC that closed on January 31, 2022 where Bridge is not acting as the general partner, or (iv) funds related to the acquisition of the investment management business of Newbury Partners, LLC that closed on March 31, 2023. Each fund identified contemplates all associated parallel and feeder limited partnerships in which investors subscribe and accordingly share common management. All intercompany accounts and transactions have been eliminated in the combined presentation. Values and performance are the combined investor returns gross of any applicable legal entity taxes. (2) Cumulative Fund Committed Capital represents total capital commitments to the fund (excluding joint ventures or separately managed accounts). (3) Unreturned Drawn Capital plus Accrued Pref represents the amount the fund needs to distribute to its investors as a return of capital and a preferred return before the General Partner is entitled to receive performance fees or allocations from the fund. (4) Cumulative Investment Invested Capital represents the total cost of investments since inception (including any recycling or refinancing of investments). This figure will differ from Cumulative Paid- In Capital, which represents the total contributions or drawn down commitments from all investors since inception. (5) Realized Investment Value represents net cash proceeds received in connection with all investments, including distributions from investments and disposition proceeds. (6) Unrealized Investment Value represents the estimated liquidation values that are generally based upon appraisals, contracts and internal estimates. There can be no assurance that Unrealized Investment Fair Value will be realized at valuations shown, and realized values will depend on numerous factors including, among others, future asset-level operating results, asset values and market conditions at the time of disposition, transaction costs, and the timing and manner of disposition, all of which may differ from the assumptions on which the Unrealized Investment Value are based. Direct fund investments in real property are held at cost minus transaction expenses for the first six months. (7) Unrealized Investment MOIC represents the Multiple on Invested Capital (“MOIC”) for Total Investment Fair Value associated with unrealized investments before management fees, fund-level expenses and carried interest, divided by Cumulative Investment Invested Capital attributable to those unrealized investments. (8) Total Investment Fair Value represents the sum of Realized Investment Value and Unrealized Investment Value, before management fees, expenses and carried interest. (9) Total Investment MOIC represents the MOIC for Total Investment Fair Value divided by Cumulative Investment Invested Capital. (10) Investor Levered Net IRR is an annualized realized and unrealized internal rate of return to fee-paying fund investors, computed from inception based on the effective dates of cash inflows (capital contributions) and cash outflows (distributions) and the remaining fair value, net of the investors actual management fees, fund-level expenses, and carried interest. Net return information reflects aggregated fund-level returns for fee-paying investors using actual management fees paid by the fund. The actual management fee rates from individual investors will be higher and lower than the actual aggregate fund-level rate. This return may differ from actual investor level returns due to timing, variance in fees paid by investors, and other investor-specific investment costs such as taxes. Because IRRs are time-weighted calculations, for newer funds with short measurement periods, IRRs may be amplified by fund leverage and early fund expenses and may not be meaningful. For IRRs calculated with an initial date less than one year from the reporting date, the IRR presented is de-annualized, representing such period's return. (11) Investor Unlevered Net IRR is an annualized realized and unrealized internal rate of return to fee-paying fund investors, computed from inception based on the effective dates of cash inflows (capital contributions and drawdowns on fund lines of credit) and cash outflows (distributions and repayments on fund lines of credit) and the remaining fair value (after removing outstanding balances on fund lines of credit), net of the investors actual management fees, fund-level expenses, and carried interest. Net return information reflects aggregated fund-level returns for fee- paying investors using actual management fees paid by the fund. The actual management fee rates from individual investors will be higher and lower than the actual aggregate fund-level rate. Because IRRs are time-weighted calculations, for newer funds with short measurement periods, this IRR may be amplified by early fund expenses and may not be meaningful. For IRRs calculated with an initial date less than one year from the reporting date, the IRR presented is de-annualized, representing such period's return. (12) Any composite returns presented herein do not represent actual returns received by any one investor and are for illustrative purposes only. Composite performance is based on actual cash flows of the funds within a strategy over the applicable timeframes and are prepared using certain assumptions. Each fund has varied investment periods and investments were made during different market environments; past performance of prior funds within a strategy is not a guarantee of future results. Fund investors generally pay fees based on a defined percentage of total commitments during the investment period and invested capital thereafter, but some fund investors may pay fees based on invested capital for the life of the fund according to the applicable governing documents.

36 Glossary Assets Under Management Assets under management, or AUM, represents the sum of (a) the fair value of the assets of the funds and vehicles we manage, plus (b) the contractual amount of any uncalled capital commitments to those funds and vehicles (including our commitments to the funds and vehicles and those of Bridge affiliates). Our AUM is not reduced by any outstanding indebtedness or other accrued but unpaid liabilities of the assets we manage. Our calculations of AUM and fee-earning AUM may differ from the calculations of other investment managers. As a result, these measures may not be comparable to similar measures presented by other investment managers. In addition, our calculation of AUM includes uncalled commitments to (and the fair value of the assets in) the funds and vehicles we manage from Bridge and Bridge affiliates, regardless of whether such commitments or investments are subject to fees. Our definition of AUM is not based on any definition contained in the agreements governing the funds and vehicles we manage or advise. Distributable Earnings Distributable Earnings, or DE, is a key performance measure used in our industry and is evaluated regularly by management in making resource deployment and compensation decisions, and in assessing our performance. DE differs from net income before provision for income taxes, computed in accordance with U.S. GAAP in that it does not include depreciation and amortization, income (loss) from consolidated fund investments, unrealized performance allocations and related compensation expense, unrealized gains (losses), share-based compensation, cash income attributable to non-controlling interests, charges (credits) related to corporate actions and non-recurring items. Although we believe the inclusion or exclusion of these items provides investors with a meaningful indication of our core operating performance, the use of DE without consideration of the related U.S. GAAP measures is not adequate due to the adjustments described herein. This measure supplements and should be considered in addition to and not in lieu of the results of operations discussed further in our most recent annual report on Form 10-K and quarterly report of Form 10-Q under “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Components of our Results of Operations—Combined Results of Operations” prepared in accordance with U.S. GAAP. Our calculations of DE may differ from the calculations of other investment managers. As a result, these measures may not be comparable to similar measures presented by other investment managers. Dry Powder Dry Powder represents of uncalled committed capital that is available for investment. Fee-Earning AUM Fee-Earning AUM, or FEAUM, reflects the assets from which we earn management fee revenue. The assets we manage that are included in our FEAUM typically pay management fees based on capital commitments, invested capital or, in certain cases, NAV, depending on the fee terms.

37 Glossary (cont'd) Fee Related Earnings Fee Related Earnings, or FRE, is a supplemental performance measure used to assess our ability to generate profits from fee- based revenues that are measured and received on a recurring basis. FRE differs from income before provision for income taxes computed in accordance with U.S. GAAP in that it adjusts for the items included in the calculation of Distributable Earnings, and also adjusts Distributable Earnings to exclude realized performance allocations income and related compensation expense, net insurance income, earnings from investments, net interest (interest income less interest expense), net realized gain (loss), income (loss) from consolidated fund investments, and, if applicable, certain general and administrative expenses when the timing of any future payment is uncertain. FRE is not a measure of performance calculated in accordance with U.S. GAAP. The use of FRE without consideration of the related U.S. GAAP measures is not adequate due to the adjustments described herein. Our calculations of FRE may differ from the calculations of other investment managers. As a result, these measures may not be comparable to similar measures presented by other investment managers. Fee Related Expenses Fee Related Expenses is a component of Fee Related Earnings. Fee Related Expenses differs from expenses computed in accordance with U.S. GAAP in that it does not include incentive fee compensation, performance allocations compensation, share-based compensation, loss and loss adjustment expenses associated with our insurance business, depreciation and amortization, or charges (credits) related to corporate actions and non-recurring items, expenses from consolidated fund investments, and expenses attributable to non-controlling interest in consolidated entities. Additionally, Fee Related Expenses is reduced by the costs associated with our property operations, which are managed internally in order to enhance returns to the Limited Partners in our funds. Fee Related Expenses are used in management’s review of the business. Please refer to the reconciliation to the comparable line items on the consolidated and combined statements of operations. Fee Related Revenues Fee Related Revenues is a component of Fee Related Earnings. Fee Related Revenues is comprised of fund management fees, transaction fees net of any third-party operating expenses, net earnings from Bridge property operators, development fees, and other asset management and property income. Net earnings from Bridge property operators is calculated as a summation of property management, leasing fees and construction management fees less third-party operating expenses and property operating expenses. Property operating expenses is calculated as a summation of employee compensation and benefits, general and administrative expenses and interest expense at our property operators. We believe our vertical integration enhances returns to our shareholders and fund investors, and we view the net earnings from Bridge property operators as part of our fee related revenue as these services are provided to essentially all of the real estate properties in our equity funds. Net earnings from Bridge property operators is a metric that is included in management’s review of our business. Please refer to the reconciliation to the comparable line items on the combined statements of operations. Fee Related Revenues differs from revenue computed in accordance with U.S. GAAP in that it excludes insurance premiums and income (loss) from consolidated fund investments. Additionally, Fee Related Revenues is reduced by the costs associated with our property operations, which are managed internally in order to enhance returns to the Limited Partners in our funds.

38 Glossary (cont'd) Fund Management Fees Fund management fees refers to fees we earn for advisory services provided to our funds, which are generally based on total commitments, invested capital or net asset value managed by us. Fund management fees are generally based on a quarterly measurement period and amounts are paid in advance of recognizing revenue. Operating Company Bridge Investment Group Holdings LLC, or the Operating Company, acts as a holding company of certain affiliates that provide an array of asset management services. The Operating Company is the ultimate controlling entity, through its wholly owned subsidiary Bridge Fund Management Holdings LLC, of the investment manager entities, which we refer to collectively as the Fund Managers. Sponsored Funds Sponsored Funds refers to the funds, co-investment vehicles and other entities and accounts that are managed by Bridge, and which are structured to pay fees.