Bloom Energy Corporation (NYSE: BE) reported today its total

revenue for the third quarter ended September 30, 2023, grew 37%

compared with the third quarter of 2022. The record revenue for the

quarter was driven by continued growth in Product and Service

revenue.

Third Quarter Highlights

- Revenue of $400.3 million in the third quarter of 2023, an

increase of 36.9% compared to $292.3 million in the third quarter

of 2022. Product and Service revenue of $352.5 million in the third

quarter of 2023, an increase of 40.7% compared to $250.6 million in

the third quarter of 2022.

- Gross margin of (1.3%) in the third quarter of 2023, a decrease

of 18.7 percentage points compared to 17.4% in the third quarter of

2022.

- Non-GAAP gross margin of 31.6% in the third quarter of 2023, an

increase of 12.4 percentage points compared to 19.1% in the third

quarter of 2022.

- Operating loss of $103.7 million in the third quarter of 2023,

a decrease of $51.1 million compared to $52.6 million in the third

quarter of 2022.

- Non-GAAP operating profit of $51.8 million in the third quarter

of 2023, an improvement of $80.3 million compared to a non-GAAP

operating loss of $28.5 million in the third quarter of 2022.

“Bloom Energy is executing at a high level on innovation and

growth,” said KR Sridhar, Chairman and CEO of Bloom Energy. “AI

adoption across all sectors of our society will become a forcing

function for data centers to adopt Bloom energy servers as a

quickly deployable primary power solution. The ability to quickly

deploy our energy servers together with our CHP solution for data

center cooling and carbon capture for sustainability creates a real

competitive advantage over virtually all alternatives in the

marketplace. We are excited with our results and future

prospects.”

Greg Cameron, President and CFO of Bloom Energy, added, “We had

a very strong third quarter and are executing across our company.

We achieved record third quarter revenues with expanding margins.

We have made significant progress on reducing our costs as we

continue to invest and innovate for our future. We are well

positioned to meet our 2023 goals.”

Summary of Key Financial Metrics

Preliminary Summary of GAAP Profit and Loss

Statements

($000), except EPS data

Q3’23

Q2’23

Q3’22

Q3’23 YTD

Q3’22 YTD

Revenue

400,268

301,095

292,274

976,554

736,549

Cost of Revenue

405,482

244,745

241,330

871,151

659,638

Gross (Loss) Profit

(5,214

)

56,350

50,944

105,403

76,911

Gross Margin

(1.3

%)

18.7

%

17.4

%

10.8

%

10.4

%

Operating Expenses

98,494

110,806

103,536

327,248

297,335

Operating Loss

(103,708

)

(54,456

)

(52,592

)

(221,845

)

(220,424

)

Operating Margin

(25.9

%)

(18.1

%)

(18.0

%)

(22.7

%)

(29.9

%)

Non-operating Expenses

65,291

11,607

4,485

84,782

33,812

Net Loss to Common Stockholders

(168,999

)

(66,061

)

(57,077

)

(306,627

)

(254,236

)

GAAP EPS, Basic and Diluted

$

(0.80

)

$

(0.32

)

$

(0.31

)

$

(1.47

)

$

(1.41

)

Preliminary Summary of Non-GAAP Financial

Information1

($000), except EPS data

Q3’23

Q2’23

Q3’22

Q3’23 YTD

Q3’22 YTD

Revenue

400,268

301,095

292,274

976,554

736,549

Cost of Revenue

273,888

239,678

236,349

730,329

556,430

Gross Profit

126,380

61,418

55,925

246,225

180,119

Gross Margin

31.6

%

20.4

%

19.1

%

25.2

%

24.5

%

Operating Expenses

74,580

87,357

84,449

254,457

272,620

Operating Income (Loss)

51,800

(25,940

)

(28,524

)

(8,232

)

(92,501

)

Operating Margin

12.9

%

(8.6

%)

(9.8

%)

(0.8

%)

(12.6

%)

Adjusted EBITDA

66,415

(8,421

)

(13,076

)

42,051

(46,320

)

Basic EPS

$

0.20

$

(0.17

)

$

(0.20

)

$

(0.19

)

$

(0.72

)

Diluted EPS

$

0.15

$

(0.17

)

$

(0.20

)

$

(0.19

)

$

(0.72

)

- A detailed reconciliation of GAAP to Non-GAAP financial

measures is provided at the end of this press release

Outlook

Bloom reaffirms outlook for the full-year 2023:

•

Revenue, billion:

$1.4 - $1.5

•

Product & Service Revenue, billion:

$1.25 - $1.35

•

Non-GAAP Gross Margin:

~25%

•

Non-GAAP Operating Margin:

Positive

Conference Call Details

Bloom will host a conference call today, November 8, 2023, at

2:00 p.m. Pacific Time (5:00 p.m. Eastern Time) to discuss its

financial results. To participate in the live call, analysts and

investors may call toll-free dial-in number: +1 (888) 330-2443 and

toll-dial-in-number +1 (240) 789-2728. The conference ID is

4781037. A simultaneous live webcast will also be available under

the Investor Relations section on our website at

https://investor.bloomenergy.com/. Following the webcast, an

archived version will be available on Bloom’s website for one year.

A telephonic replay of the conference call will be available for

one week following the call, by dialing +1 (800) 770-2030 or +1

(647) 362 9199 and entering passcode 4781037.

Use of Non-GAAP Financial Measures

This release includes certain non-GAAP financial measures as

defined by the rules and regulations of the Securities and Exchange

Commission (SEC). These non-GAAP financial measures are in addition

to, and not a substitute for or superior to, measures of financial

performance prepared in accordance with U.S. GAAP. There are a

number of limitations related to the use of these non-GAAP

financial measures versus their nearest GAAP equivalents. For

example, other companies may calculate non-GAAP financial measures

differently or may use other measures to evaluate their

performance, all of which could reduce the usefulness of our

non-GAAP financial measures as tools for comparison. Bloom urges

you to review the reconciliations of its non-GAAP financial

measures to the most directly comparable U.S. GAAP financial

measures set forth in this press release, and not to rely on any

single financial measure to evaluate our business. With respect to

Bloom’s expectations regarding its 2023 Outlook, Bloom is not able

to provide a quantitative reconciliation of non-GAAP gross margin

and non-GAAP operating margin measures to the corresponding GAAP

measures without unreasonable efforts due to the uncertainty

regarding, and the potential variability of, reconciling items such

as stock-based compensation expense. Material changes to

reconciling items could have a significant effect on future GAAP

results and, as such, we believe that any reconciliation provided

would imply a degree of precision that could be confusing or

misleading to investors.

About Bloom Energy

Bloom Energy empowers businesses and communities to responsibly

take charge of their energy. The company’s leading solid oxide

platform for distributed generation of electricity and hydrogen is

changing the future of energy. Fortune 100 companies turn to Bloom

Energy as a trusted partner to deliver lower carbon energy today

and a net-zero future. For more information, visit

www.bloomenergy.com.

Forward-Looking Statements

This press release contains certain forward-looking statements,

which are subject to the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements generally relate to future events or our future

financial or operating performance. In some cases, you can identify

forward-looking statements because they contain words such as

“anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,”

“may,” “should,” “will” and “would” or the negative of these words

or similar terms or expressions that concern Bloom’s expectations,

strategy, priorities, plans or intentions. These forward-looking

statements include, but are not limited to, Bloom’s expectations

regarding: innovation and solutions; customer reaction to Bloom’s

products; Bloom’s liquidity position; market demand for energy

solutions; and Bloom’s 2023 outlook for revenue and profitability.

Readers are cautioned that these forward-looking statements are

only predictions and may differ materially from actual future

events or results due to a variety of factors including, but not

limited to: Bloom’s limited operating history; the emerging nature

of the distributed generation market and rapidly evolving market

trends; the significant losses Bloom has incurred in the past; the

significant upfront costs of Bloom’s Energy Servers and Bloom’s

ability to secure financing for its products; Bloom’s ability to

drive cost reductions and to successfully mitigate against

potential price increases; Bloom’s ability to service its existing

debt obligations; Bloom’s ability to be successful in new markets;

the ability of the Bloom Energy Server to operate on the fuel

source a customer will want; the success of the strategic

partnership with SK ecoplant in the United States and international

markets; timing and development of an ecosystem for the hydrogen

market, including in the South Korean market; continued incentives

in the South Korean market; adapting to the new government bidding

process in the South Korean market; the timing and pace of adoption

of hydrogen for stationary power; the risk of manufacturing

defects; the accuracy of Bloom’s estimates regarding the useful

life of its Energy Servers; delays in the development and

introduction of new products or updates to existing products;

Bloom’s ability to secure partners in order to commercialize its

electrolyzer and carbon capture products; supply constraints; the

availability of rebates, tax credits and other tax benefits;

changes in the regulatory landscape; Bloom’s reliance on tax equity

financing arrangements; Bloom’s reliance upon a limited number of

customers; Bloom’s lengthy sales and installation cycle,

construction, utility interconnection and other delays and cost

overruns related to the installation of its Energy Servers;

business and economic conditions and growth trends in commercial

and industrial energy markets; global macroeconomic conditions,

including rising interest rates, recession fears and inflationary

pressures, or geopolitical events or conflicts; overall electricity

generation market; Bloom’s ability to protect its intellectual

property; and other risks and uncertainties detailed in Bloom’s SEC

filings from time to time. More information on potential factors

that may impact Bloom’s business are set forth in Bloom’s periodic

reports filed with the SEC, including our Annual Report on Form

10-K for the year ended December 31, 2022 as filed with the SEC on

February 21, 2023 and our Quarterly Reports on Form 10-Q for the

quarters ended March 31, 2023, June 30, 2023, and September 30,

2023, as filed with the SEC on May 9, 2023, August 3, 2023, and

November 8, 2023, respectively, as well as subsequent reports filed

with or furnished to the SEC from time to time. These reports are

available on Bloom’s website at www.bloomenergy.com and the SEC’s

website at www.sec.gov. Bloom assumes no obligation to, and does

not currently intend to, update any such forward-looking

statements.

The Investor Relations section of Bloom’s website at

investor.bloomenergy.com contains a significant amount of

information about Bloom Energy, including financial and other

information for investors. Bloom encourages investors to visit this

website from time to time, as information is updated and new

information is posted.

Condensed Consolidated Balance Sheets

(preliminary & unaudited) (in thousands, except share data)

September 30,

December 31,

2023

2022

Assets

Current assets:

Cash and cash equivalents1

$

557,384

$

348,498

Restricted cash1

42,614

51,515

Accounts receivable less allowance for

doubtful accounts of $119 as of September 30, 2023 and December 31,

20221, 2

334,495

250,995

Contract assets3

143,875

46,727

Inventories1

475,649

268,394

Deferred cost of revenue4

62,212

46,191

Prepaid expenses and other current

assets1

66,243

43,643

Total current assets

1,682,472

1,055,963

Property, plant and equipment, net1

490,535

600,414

Operating lease right-of-use assets1

127,973

126,955

Restricted cash1

37,698

118,353

Deferred cost of revenue

4,286

4,737

Other long-term assets1

33,208

40,205

Total assets

$

2,376,172

$

1,946,627

Liabilities and stockholders’

equity

Current liabilities:

Accounts payable1

$

153,793

$

161,770

Accrued warranty

16,537

17,332

Accrued expenses and other current

liabilities1, 5

116,480

144,183

Deferred revenue and customer deposits1,

6

119,157

159,048

Operating lease liabilities1

16,666

16,227

Financing obligations

39,093

17,363

Recourse debt

—

12,716

Non-recourse debt1

—

13,307

Total current liabilities

461,726

541,946

Deferred revenue and customer

deposits1

14,499

56,392

Operating lease liabilities1

133,602

132,363

Financing obligations

410,365

442,063

Recourse debt

840,492

273,076

Non-recourse debt1

1,483

112,480

Other long-term liabilities

8,805

9,491

Total liabilities

$

1,870,972

$

1,567,811

Commitments and contingencies

Stockholders’ equity:

Common stock: $0.0001 par value; Class A

shares - 600,000,000 shares authorized and 223,860,870 shares and

189,864,722 shares issued and outstanding and Class B shares -

600,000,000 shares authorized and 0 shares and 15,799,968 shares

issued and outstanding at September 30, 2023 and December 31, 2022,

respectively

21

20

Additional paid-in capital

4,360,080

3,906,491

Accumulated other comprehensive loss

(2,378

)

(1,251

)

Accumulated deficit

(3,871,110

)

(3,564,483

)

Total equity attributable to common

stockholders

486,613

340,777

Noncontrolling interest

18,587

38,039

Total stockholders’ equity

$

505,200

$

378,816

Total liabilities and stockholders’

equity

$

2,376,172

$

1,946,627

1

We have a variable interest entity related

to PPA V and a joint venture in the Republic of Korea, which

represent a portion of the consolidated balances recorded within

these financial statement line items.

In August 2023, we sold the PPA V entity

as a result of the PPA V Repowering of Energy Servers, as such the

consolidated balances recorded within these financial statement

line items as of September 30, 2023 exclude PPA V balances.

2

Including amounts from related parties of

$247.9 million and $4.3 million as of September 30, 2023 and

December 31, 2022, respectively.

3

Including amounts from related parties of

$3.4 million as of September 30, 2023. There was no respective

related party amounts as of December 31, 2022.

4

Including amounts from related parties of

$23.4 million as of September 30, 2023. There was no respective

related party amounts as of December 31, 2022.

5

Including amounts from related parties of

$5.7 million as of September 30, 2023. There was no respective

related party amounts as of December 31, 2022.

6

Including amounts from related parties of

$11.1 million as of September 30, 2023. There was no respective

related party amounts as of December 31, 2022.

Condensed Consolidated Statements of

Operations (preliminary & unaudited) (in thousands, except net

loss per share data)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2023

2022

2023

2022

Revenue:

Product

$

304,976

$

213,243

$

713,427

$

520,415

Installation

21,916

22,682

66,762

48,964

Service

47,535

37,347

130,496

111,012

Electricity

25,841

19,002

65,869

56,158

Total revenue1

400,268

292,274

976,554

736,549

Cost of revenue:

Product

182,832

158,176

457,591

393,337

Installation

25,902

28,333

77,881

57,836

Service

57,370

41,792

165,877

124,646

Electricity

139,378

13,029

169,802

83,819

Total cost of revenue

405,482

241,330

871,151

659,638

Gross (loss) profit

(5,214

)

50,944

105,403

76,911

Operating expenses:

Research and development

35,126

36,146

122,309

112,286

Sales and marketing

20,002

23,275

73,935

65,084

General and administrative

43,366

44,115

131,004

119,965

Total operating expenses

98,494

103,536

327,248

297,335

Loss from operations

(103,708

)

(52,592

)

(221,845

)

(220,424

)

Interest income

7,419

1,109

13,771

1,364

Interest expense

(68,037

)

(13,099

)

(93,736

)

(41,000

)

Other (expense) income, net

(1,577

)

4,472

(3,660

)

254

Loss on extinguishment of debt

(1,415

)

—

(4,288

)

(4,233

)

(Loss) gain on revaluation of embedded

derivatives

(114

)

54

(1,213

)

623

Loss before income taxes

(167,432

)

(60,056

)

(310,971

)

(263,416

)

Income tax provision

646

336

1,083

888

Net loss

(168,078

)

(60,392

)

(312,054

)

(264,304

)

Less: Net gain (loss) attributable to

noncontrolling interest

921

(3,315

)

(5,427

)

(9,768

)

Net loss attributable to common

stockholders

(168,999

)

(57,077

)

(306,627

)

(254,536

)

Less: Net loss attributable to redeemable

noncontrolling interest

—

—

—

(300

)

Net loss before portion attributable to

redeemable noncontrolling interest and noncontrolling interest

$

(168,999

)

$

(57,077

)

$

(306,627

)

$

(254,236

)

Net loss per share available to common

stockholders, basic and diluted

$

(0.80

)

$

(0.31

)

$

(1.47

)

$

(1.41

)

Weighted average shares used to compute

net loss per share available to common stockholders, basic and

diluted

210,930

186,487

208,798

180,762

1

Including related party revenue of $125.7

million and $361.0 million for the three and nine months ended

September 30, 2023, respectively and $12.5 million and $30.2

million for the three and nine months ended September 30, 2022,

respectively.

Condensed Consolidated Statement of Cash

Flows (preliminary & unaudited) (in thousands)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2023

2022

2023

2022

Cash flows from operating

activities:

Net loss

$

(168,078

)

$

(60,392

)

$

(312,054

)

$

(264,304

)

Adjustments to reconcile net loss to net

cash used in operating activities:

Depreciation and amortization

14,615

15,485

50,283

46,182

Non-cash lease expense

8,356

9,353

24,540

18,153

(Loss) gain on disposal of property, plant

and equipment

(19

)

—

177

(523

)

Revaluation of derivative contracts

114

(11,320

)

1,213

(9,640

)

Impairment of assets related to PPA V and

PPA IIIa

130,111

—

130,111

44,800

Derecognition of loan commitment asset

related to SK ecoplant Second Tranche Closing

52,792

—

52,792

—

Stock-based compensation

21,315

23,686

77,160

81,460

Amortization of warrants and debt issuance

costs

1,514

704

3,300

2,355

Loss on extinguishment of debt

1,415

—

4,288

4,233

Unrealized foreign currency exchange

loss

1,517

810

3,029

3,086

Other

—

—

—

3,487

Changes in operating assets and

liabilities:

Accounts receivable1

16,100

6,820

(83,851

)

15,758

Contract assets2

(108,692

)

7,606

(97,148

)

(567

)

Inventories

(8,969

)

(47,973

)

(206,315

)

(110,797

)

Deferred cost of revenue3

(8,370

)

139

(15,914

)

(8,856

)

Customer financing receivable

—

—

—

2,510

Prepaid expenses and other current

assets

(22,807

)

(9,953

)

(20,849

)

(15,766

)

Other long-term assets

10,219

(730

)

13,634

(730

)

Operating lease right-of-use assets and

operating lease liabilities

(8,432

)

(260

)

(23,879

)

2,162

Finance lease liabilities

171

451

907

499

Accounts payable

(41,589

)

(11,943

)

(5,695

)

38,642

Accrued warranty

1,631

1,597

(795

)

1,597

Accrued expenses and other current

liabilities4

4,782

18,519

(30,937

)

502

Deferred revenue and customer

deposits5

(30,275

)

(2,558

)

(57,041

)

(12,716

)

Other long-term liabilities

(590

)

(9,980

)

(1,320

)

(9,980

)

Net cash used in operating activities

(133,169

)

(69,939

)

(494,364

)

(168,453

)

Cash flows from investing

activities:

Purchase of property, plant and

equipment

(21,335

)

(36,179

)

(67,485

)

(80,907

)

Proceeds from sale of property, plant and

equipment

(22

)

—

3

—

Net cash used in investing activities

(21,357

)

(36,179

)

(67,482

)

(80,907

)

Cash flows from financing

activities:

Proceeds from issuance of debt

(35

)

—

633,983

—

Payment of debt issuance costs

(3,711

)

—

(19,539

)

—

Repayment of debt of PPA V and PPA

IIIa

(118,538

)

—

(118,538

)

(30,212

)

Debt make-whole payment related to PPA

IIIa debt

—

—

—

(2,413

)

Repayment of recourse debt

—

(6,533

)

(72,852

)

(17,262

)

Proceeds from financing obligations

—

—

2,702

—

Repayment of financing obligations

(4,747

)

(12,346

)

(13,475

)

(28,821

)

Distributions and payments to

noncontrolling interests

(2,265

)

(1,557

)

(2,265

)

(5,972

)

Proceeds from issuance of common stock

6,745

7,852

16,003

15,150

Proceeds from public share offering

—

385,396

—

385,396

Public share offering costs

—

(13,407

)

—

(13,407

)

Buyout of noncontrolling interest

(6,864

)

—

(6,864

)

—

Proceeds from issuance of Series B

redeemable convertible preferred stock

—

—

310,957

—

Contributions from noncontrolling

interest

—

2,815

6,979

2,815

Purchase of capped call related to

convertible notes

—

—

(54,522

)

—

Other

(250

)

(63

)

(408

)

(63

)

Net cash (used in) provided by financing

activities

(129,665

)

362,157

682,161

305,211

Effect of exchange rate changes on cash,

cash equivalent and restricted cash

(657

)

(896

)

(985

)

(1,643

)

Net (decrease) increase in cash, cash

equivalents and restricted cash

(284,848

)

255,143

119,330

54,208

Cash, cash equivalents and restricted

cash:

Beginning of period

922,544

414,179

518,366

615,114

End of period

637,696

669,322

637,696

669,322

1

Including changes in related party

balances of $241.9 million and $6.8 million for the three months

ended September 30, 2023 and 2022, respectively, and $243.6 million

and $8.2 million for the nine months ended September 30, 2023 and

2022, respectively.

2

Including changes in related party

balances of $3.4 million for the three and nine months ended

September 30, 2023. There were no associated related party balances

for the three and nine months ended September 30, 2022.

3

Including changes in related party

balances of $23.4 million for the three and nine months ended

September 30, 2023. There were no associated related party balances

for the three and nine months ended September 30, 2022.

4

Including changes in related party

balances of $5.7 million for the three and nine months ended

September 30, 2023. There were no associated related party balances

for the three and nine months ended September 30, 2022.

5

Including changes in related party

balances of $11.1 million for the three and nine months ended

September 30, 2023. There were no associated related party balances

for the three and nine months ended September 30, 2022.

Reconciliation of GAAP to Non-GAAP

Financial Measures (preliminary & unaudited) (in thousands,

except percentages)

Q3’23

Q2’23

Q3’22

Q3’23 YTD

Q3’22 YTD

GAAP revenue

400,268

301,095

292,274

976,554

736,549

GAAP cost of sales

405,482

244,745

241,330

871,151

659,638

GAAP gross (loss) profit

(5,214

)

56,350

50,944

105,403

76,911

Non-GAAP adjustments:

Stock-based compensation expense

5,581

5,067

4,981

14,809

13,608

Impairment charge (PPA V, PPA IIIa)

123,700

—

—

123,700

44,800

Restructuring charges

725

—

—

725

—

PPA V Sales property tax

1,588

—

—

1,588

—

Non-GAAP gross profit

126,380

61,417

55,925

246,225

135,319

GAAP gross margin %

(1.3

%)

18.7

%

17.4

%

10.8

%

10.4

%

Non-GAAP adjustments

32.9

%

1.7

%

1.7

%

14.4

%

7.9

%

Non-GAAP gross margin %

31.6

%

20.4

%

19.1

%

25.2

%

18.4

%

Q3’23

Q2’23

Q3’22

Q3’23 YTD

Q3’22 YTD

GAAP loss from operations

(103,708

)

(54,456

)

(52,592

)

(221,845

)

(220,424

)

Non-GAAP adjustments:

Stock-based compensation expense

21,564

28,479

24,031

79,596

82,938

Impairment charge (PPA V, PPA IIIa)

130,088

—

—

130,088

44,800

PPA V Sales property tax

1,588

—

—

1,588

—

Restructuring charges

2,226

—

—

2,226

—

Amortization of acquired intangible

assets

42

37

37

115

185

Non-GAAP profit (loss) from

operations

51,800

(25,940

)

(28,524

)

(8,232

)

(92,501

)

GAAP operating margin %

(25.9

%)

(18.1

%)

(18.0

%)

(22.7

%)

(29.9

%)

Non-GAAP adjustments

38.8

%

9.5

%

8.2

%

21.9

%

17.4

%

Non-GAAP operating margin %

12.9

%

(8.6

%)

(9.8

%)

(0.8

%)

(12.6

%)

Reconciliation of GAAP Net Loss to

non-GAAP Net Profit (Loss) and Computation of non-GAAP Net Profit

(Loss) per Share (EPS) (preliminary & unaudited) (in thousands,

except share data)

Q3’23

Q2’23

Q3’22

Q3’23 YTD

Q3’22 YTD

Net loss to Common Stockholders

(168,999

)

(66,061

)

(57,077

)

(306,627

)

(254,236

)

Non-GAAP adjustments:

Add back: Gain (loss) for non-controlling

interests

921

(2,998

)

(3,315

)

(5,427

)

(10,068

)

Loss (gain) on derivative liabilities

114

1,216

(54

)

1,213

(623

)

Impairment charge (PPA V, PPA IIIa and

Goodwill)

130,088

—

—

130,088

46,757

Loss on China JV investment

—

—

—

—

1,446

Loss on extinguishment of debt

1,415

2,873

—

4,288

4,233

Amortization of acquired intangible

assets

42

37

37

115

185

Restructuring charges

2,226

—

—

2,226

—

PPA V Sales property tax

1,588

—

—

1,588

—

Stock-based compensation expense

21,564

28,479

24,031

79,596

82,938

Interest expense on SK loan commitment

52,792

—

—

52,792

—

Adjusted Net Profit (Loss)

41,751

(36,454

)

(36,378

)

(40,148

)

(129,368

)

Adjusted net profit (loss) per share

(EPS), Basic

$

0.20

$

(0.17

)

$

(0.20

)

$

(0.19

)

$

(0.72

)

Adjusted net profit (loss) per share

(EPS), Diluted

$

0.15

$

(0.17

)

$

(0.20

)

$

(0.19

)

$

(0.72

)

Weighted average shares outstanding

attributable to common, Basic

210,930

208,692

186,487

208,798

180,762

Weighted-average shares outstanding

attributable to common, Diluted

274,337

208,692

186,487

208,798

180,762

Reconciliation of GAAP Net Loss to

Adjusted EBITDA (preliminary & unaudited) (in thousands)

Q3’23

Q2’23

Q3’22

Q3’23 YTD

Q3’22 YTD

Net loss to Common Stockholders

(168,999

)

(66,061

)

(57,077

)

(306,627

)

(254,236

)

Add back: (Gain) loss for non-controlling

interests

921

(2,998

)

(3,315

)

(5,427

)

(10,068

)

Loss (gain) on derivative liabilities

114

1,216

(54

)

1,213

(623

)

Impairment charge (PPA V, PPA IIIa and

Goodwill)

130,088

—

—

130,088

46,757

Loss on China JV investment

—

—

—

—

1,446

Loss on extinguishment of debt

1,415

2,873

—

4,288

4,233

Stock-based compensation expense

21,564

28,479

24,031

79,596

82,938

Restructuring charges

2,226

—

—

2,226

—

PPA V Sales property tax

1,588

—

—

1,588

—

Amortization of acquired intangible

assets

42

37

37

115

185

Interest expense on SK loan commitment

52,792

—

—

52,792

—

Adjusted Net Profit (Loss)

41,751

(36,454

)

(36,378

)

(40,148

)

(129,368

)

Depreciation & amortization

14,615

17,519

15,485

50,283

46,182

Income tax provision

646

178

336

1,083

888

Interest expense (income), Other expense

(income), net

9,403

10,336

7,518

30,833

35,978

Adjusted EBITDA

66,415

(8,421

)

(13,076

)

42,051

(46,320

)

Use of non-GAAP financial measures

To supplement Bloom Energy condensed consolidated financial

statement information presented on a GAAP basis, Bloom Energy

provides financial measures including non-GAAP gross profit (loss),

non-GAAP gross margin, non-GAAP operating profit (loss) (non-GAAP

earnings from operations), non-GAAP operating profit (loss) margin,

non-GAAP net earnings, non-GAAP basic and diluted earnings per

share and Adjusted EBITDA. Bloom Energy also provides forecasts of

non-GAAP gross margin and non-GAAP operating margin.

These non-GAAP financial measures are not computed in accordance

with, or as an alternative to, GAAP in the United States.

- The GAAP measure most directly comparable to non-GAAP gross

profit (loss) is gross profit (loss).

- The GAAP measure most directly comparable to non-GAAP gross

margin is gross margin.

- The GAAP measure most directly comparable to non-GAAP operating

profit (loss) (non-GAAP earnings from operations) is operating

profit (loss) (earnings from operations).

- The GAAP measure most directly comparable to non-GAAP operating

margin is operating margin.

- The GAAP measure most directly comparable to non-GAAP net

earnings is net earnings.

- The GAAP measure most directly comparable to non-GAAP diluted

earnings per share is diluted earnings per share.

- The GAAP measure most directly comparable to Adjusted EBITDA is

net earnings.

Reconciliations of each of these non-GAAP financial measures to

GAAP information are included in the tables above or elsewhere in

the materials accompanying this news release.

Use and economic substance of non-GAAP financial measures

used by Bloom Energy

Non-GAAP gross profit (loss) and non-GAAP gross margin are

defined to exclude charges relating to stock-based compensation

expense, PPA V and PPA IIIa repowering related impairment charges,

restructuring charges, and PPA V Sales property tax. Non-GAAP net

earnings and non-GAAP diluted earnings per share consist of net

earnings or diluted net earnings per share excluding charges

relating to stock-based compensation expense, gain (loss) for

non-controlling interest, loss (gain) on derivatives liabilities,

PPA V and PPA IIIa repowering related impairment charges, goodwill

impairment, interest expense on SK loan commitment, restructuring

charges, PPA V Sales property tax, loss on debt extinguishment,

loss on China JV investment and the amortization of acquired

intangible assets. Adjusted EBITDA is defined as net profit (loss)

before interest expense, provision for income tax, depreciation and

amortization expense, charges relating to stock-based compensation

expense, gain (loss) for non-controlling interest, loss (gain) on

derivatives liabilities, PPA V and PPA IIIa repowering related

impairment charges, goodwill impairment, interest expense on SK

loan commitment, restructuring charges, PPA V Sales property tax,

loss on debt extinguishment, loss on China JV investment and the

amortization of acquired intangible assets. Bloom Energy management

uses these non-GAAP financial measures for purposes of evaluating

Bloom Energy’s historical and prospective financial performance, as

well as Bloom Energy’s performance relative to its competitors.

Bloom Energy believes that excluding the items mentioned above from

these non-GAAP financial measures allows Bloom Energy management to

better understand Bloom Energy’s consolidated financial performance

as management does not believe that the excluded items are

reflective of ongoing operating results. More specifically, Bloom

Energy management excludes each of those items mentioned above for

the following reasons:

- Stock-based compensation expense consists of equity awards

granted based on the estimated fair value of those awards at grant

date. Although stock-based compensation is a key incentive offered

to our employees, Bloom Energy excludes these charges for the

purpose of calculating these non-GAAP measures, primarily because

they are non-cash expenses and such an exclusion facilitates a more

meaningful evaluation of Bloom Energy current operating performance

and comparisons to Bloom Energy operating performance in other

periods.

- Gain (loss) for non-controlling interest represents allocation

to the non-controlling interests under the hypothetical liquidation

at book value (HLBV) method and are associated with our Bloom

Energy legacy PPA entities and the joint venture in the Republic of

Korea.

- Loss (gain) on derivatives liabilities represents non-cash

adjustments to the fair value of the embedded derivatives.

- PPA V repowering related impairment charge represents non-cash

impairment charge on old server units decommissioned upon

repowering of $123.7 million and non-cash impairment charge on

non-recoverable production insurance of $6.4 million.

- PPA IIIa repowering related impairment charge represents

non-cash impairment charges on old server units decommissioned upon

repowering of $44.8 million.

- Goodwill impairment related to the acquisition of BE Japan in

Q2 2021.

- Interest expense on SK loan commitment recognized as a result

of automatic conversion of 13.5 million shares of our Series B

redeemable convertible preferred stock to shares of our Class A

common stock.

- Restructuring charges represented by severance expense recorded

in the third quarter of 2023.

- PPA V Sales property tax related to PPA V repowering of old

server units.

- Loss on debt extinguishment related to PPA V and PPA IIIa

repowering.

- Loss on China JV investment upon sale of our equity

interest.

- Amortization of acquired intangible assets.

- Adjusted EBITDA is defined as Adjusted Net Income (Loss) before

depreciation and amortization expense, provision for income tax,

interest expense (income), other expense (income), net. We use

Adjusted EBITDA to measure the operating performance of our

business, excluding specifically identified items that we do not

believe directly reflect our core operations and may not be

indicative of our recurring operations.

For more information about these non-GAAP financial measures,

please see the tables captioned “Reconciliation of GAAP to Non-GAAP

Financial Measures,” “Reconciliation of GAAP Net Loss to non-GAAP

Net Profit (Loss) and Computation of non-GAAP Net Profit (Loss) per

Share (EPS),” and “Reconciliation of GAAP Net Loss to Adjusted

EBITDA” set forth in this release, which should be read together

with the preceding financial statements prepared in accordance with

GAAP.

Material limitations associated with use of non-GAAP

financial measures

These non-GAAP financial measures have limitations as analytical

tools, and these measures should not be considered in isolation or

as a substitute for analysis of Bloom Energy results as reported

under GAAP. Some of the limitations in relying on these non-GAAP

financial measures are:

- Items such as stock-based compensation expense that is excluded

from non-GAAP gross profit (loss), non-GAAP gross margin, non-GAAP

operating expenses, non-GAAP operating profit (loss) (non-GAAP

earnings from operations), non-GAAP operating margin, non-GAAP net

earnings, and non-GAAP diluted earnings per share can have a

material impact on the equivalent GAAP earnings measure.

- Gain (loss) for non-controlling interest and loss (gain) on

derivatives liabilities, though not directly affecting Bloom

Energy's cash position, represent the loss (gain) in value of

certain assets and liabilities. The expense associated with this

loss (gain) in value is excluded from non-GAAP net earnings, and

non-GAAP diluted earnings per share and can have a material impact

on the equivalent GAAP earnings measure.

- Other companies may calculate non-GAAP gross profit, non-GAAP

gross profit margin, non-GAAP operating profit (non-GAAP earnings

from operations), non-GAAP operating profit margin, non-GAAP net

earnings, non-GAAP diluted earnings per share and Adjusted EBITDA

differently than Bloom Energy does, limiting the usefulness of

those measures for comparative purposes.

Compensation for limitations associated with use of non-GAAP

financial measures

Bloom Energy compensates for the limitations on its use of

non-GAAP financial measures by relying primarily on its GAAP

results and using non-GAAP financial measures only as a supplement.

Bloom Energy also provides a reconciliation of each non-GAAP

financial measure to its most directly comparable GAAP measure

within this news release and in other written materials that

include these non-GAAP financial measures, and Bloom Energy

encourages investors to review those reconciliations carefully.

Usefulness of non-GAAP financial measures to

investors

Bloom Energy believes that providing financial measures

including non-GAAP gross profit (loss), non-GAAP gross margin,

non-GAAP operating profit (loss) (non-GAAP earnings from

operations), non-GAAP operating profit (loss) margin, non-GAAP net

earnings, non-GAAP diluted earnings per share in addition to the

related GAAP measures provides investors with greater transparency

to the information used by Bloom Energy management in its financial

and operational decision making and allows investors to see Bloom

Energy’s results “through the eyes” of management. Bloom Energy

further believes that providing this information better enables

Bloom Energy investors to understand Bloom Energy’s operating

performance and to evaluate the efficacy of the methodology and

information used by Bloom Energy management to evaluate and measure

such performance. Disclosure of these non-GAAP financial measures

also facilitates comparisons of Bloom Energy’s operating

performance with the performance of other companies in Bloom

Energy’s industry that supplement their GAAP results with non-GAAP

financial measures that may be calculated in a similar manner.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231108608052/en/

Investor Relations: Ed Vallejo Bloom Energy +1 (267)

370-9717 Media: Amanda Song Bloom Energy

press@bloomenergy.com

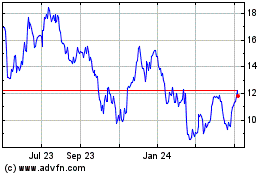

Bloom Energy (NYSE:BE)

Historical Stock Chart

From Jan 2025 to Feb 2025

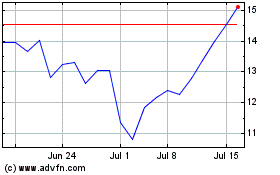

Bloom Energy (NYSE:BE)

Historical Stock Chart

From Feb 2024 to Feb 2025