- Q2 Core Revenue Increased 19% Year-Over-Year

- Q2 Total Revenue Increased 22% Year-Over-Year

BILL (NYSE: BILL), a leading financial operations platform for

small and midsize businesses (SMBs), today announced financial

results for the second fiscal quarter ended December 31, 2023.

“We delivered strong growth during the quarter as we automated

financial operations for more than 470,000 businesses,” said René

Lacerte, BILL CEO and Founder. “We continue to drive innovation and

sharpen our focus on the most impactful initiatives to create value

for our customers, partners, and shareholders. With our powerful

platform, expanding ecosystem, and increasing scale, we are

uniquely positioned to be the essential financial operations

platform for millions of SMBs.”

“Our financial performance in the second quarter highlights the

strength of our business model and our commitment to deliver

balanced growth and profitability," said John Rettig, BILL

President and CFO. “Total revenue increased 22% year-over-year

while non-GAAP net income increased 48% year-over-year and

reflected a 23% margin.”

Financial Highlights for the Second Quarter of Fiscal

2024:

- Total revenue was $318.5 million, an increase of 22%

year-over-year.

- Core revenue, which consists of subscription and transaction

fees, was $275.0 million, an increase of 19% year-over-year.

Subscription fees were $63.3 million, up 3% year-over-year.

Transaction fees were $211.6 million, up 25% year-over-year.

- Float revenue, which consists of interest on funds held for

customers, was $43.5 million.

- Gross profit was $260.1 million, representing an 81.7% gross

margin, compared to $212.5 million, or an 81.7% gross margin, in

the second quarter of fiscal 2023. Non-GAAP gross profit was $273.7

million, representing an 85.9% non-GAAP gross margin, compared to

$225.4 million, or an 86.7% non-GAAP gross margin, in the second

quarter of fiscal 2023.

- Loss from operations was $67.7 million, compared to a loss from

operations of $112.5 million in the second quarter of fiscal 2023.

Non-GAAP income from operations was $44.3 million, compared to a

non-GAAP income from operations of $30.8 million in the second

quarter of fiscal 2023.

- Net loss was $40.4 million, or ($0.38) per share, basic and

diluted, compared to net loss of $95.1 million, or ($0.90) per

share, basic and diluted, in the second quarter of fiscal 2023.

Non-GAAP net income was $73.2 million, or $0.63 per diluted share,

compared to non-GAAP net income of $49.4 million, or $0.42 per

share, basic and diluted, in the second quarter of fiscal

2023.

Business Highlights and Recent Developments

- Served 473,500 businesses using our solutions as of the end of

the second quarter.1

- Processed $75 billion in total payment volume in the second

quarter, an increase of 11% year-over-year.

- Processed 26 million transactions during the second quarter, an

increase of 23% year-over-year.

- Repurchased approximately 2.7 million shares of BILL common

stock in the second quarter for a total cost of approximately $197

million.

Financial Outlook

We are providing the following guidance for the fiscal third

quarter ending March 31, 2024 and the full fiscal year ending June

30, 2024.

Q3 FY24 Guidance

FY24 Guidance

Total revenue (millions)

$299 - $309

$1,226 - $1,251

Year-over-year total revenue growth

10% - 13%

16% - 18%

Non-GAAP net income (millions)

$56 - $66

$245 - $270

Non-GAAP net income per diluted share

$0.48 - $0.57

$2.09 - $2.31

These statements are forward-looking and actual results may

differ materially. Refer to the Forward-Looking Statements safe

harbor below for information on the factors that could cause our

actual results to differ materially from these forward-looking

statements.

BILL has not provided a reconciliation of non-GAAP net income or

non-GAAP net income per share guidance measures to the most

directly comparable GAAP measures because certain items excluded

from GAAP cannot be reasonably calculated or predicted at this

time. Accordingly, a reconciliation is not available without

unreasonable effort.

1Businesses using more than one of our solutions are included

separately in the total for each solution utilized.

Conference Call and Webcast Information

In conjunction with this announcement, BILL will host a

conference call for investors at 1:30 p.m. PT (4:30 p.m. ET) today

to discuss fiscal second quarter 2024 results and our outlook for

the fiscal third quarter ending March 31, 2024 and the fiscal year

ending June 30, 2024. The live webcast and a replay of the webcast

will be available at the Investor Relations section of BILL’s

website:

https://investor.bill.com/events-and-presentations/default.aspx.

About BILL

BILL (NYSE: BILL) is a leading financial operations platform for

small and midsize businesses (SMBs). As a champion of SMBs, we are

automating the future of finance so businesses can thrive. Our

integrated platform helps businesses to more efficiently control

their payables, receivables and spend and expense management.

Hundreds of thousands of businesses rely on BILL’s proprietary

member network of millions to pay or get paid faster. Headquartered

in San Jose, California, BILL is a trusted partner of leading U.S.

financial institutions, accounting firms, and accounting software

providers. For more information, visit bill.com.

Note on Forward-Looking Statements

This press release and the accompanying conference call contain

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995, which are statements

other than statements of historical facts, and statements in the

future tense. Forward-looking statements are based on our

expectations as of the date of this press release and are subject

to a number of risks, uncertainties and assumptions, many of which

involve factors or circumstances that are beyond our control. These

statements include, but are not limited to, statements regarding

our expectations of future performance, including guidance for our

total revenue, non-GAAP net income, and non-GAAP net income per

share for the fiscal third quarter ending March 31, 2024 and full

fiscal year ending June 30, 2024, our expectations for the growth

of demand on our platform and the expansion of our customers’

utilization of our services. These risks and uncertainties include,

but are not limited to macroeconomic factors, including changes in

interest rates, inflation and volatile market environments, as well

as fluctuations in foreign exchange rates, our history of operating

losses, our recent rapid growth, the large sums of customer funds

that we transfer daily, the risk of loss, errors and fraudulent

activity, credit risk related to our BILL Divvy Corporate Cards,

our ability to attract new customers and convert trial customers

into paying customers, our ability to develop new products and

services, increased competition or new entrants in the marketplace,

the impact of our recent reduction-in-force, potential impacts of

acquisitions and investments, including our ability to integrate

acquired businesses, incorporate their technology effectively and

implement appropriate internal controls at such businesses our

relationships with accounting firms and financial institutions, and

the global impacts of the conflicts in Ukraine and in Israel, and

other risks detailed in the registration statements and periodic

reports we file with the SEC, including our quarterly and annual

reports, which may be obtained on the Investor Relations section of

BILL’s website

(https://investor.bill.com/financials/sec-filings/default.aspx) and

on the SEC website at www.sec.gov. You should not rely on these

forward-looking statements, as actual results may differ materially

from those contemplated by these forward-looking statements as a

result of such risks and uncertainties. All forward-looking

statements in this press release are based on information available

to us as of the date hereof. We assume no obligation to update or

revise the forward-looking statements contained in this press

release or the accompanying conference call because of new

information, future events, or otherwise.

Non-GAAP Financial Measures

In addition to financial measures prepared in accordance with

U.S. generally accepted accounting principles (GAAP), this press

release and the accompanying tables contain, and the conference

call will contain, non-GAAP financial measures, including non-GAAP

gross profit, non-GAAP gross margin, non-GAAP operating expenses,

non-GAAP income from operations, non-GAAP net income and non-GAAP

net income per share, basic and diluted. The non-GAAP financial

information is presented for supplemental informational purposes

only and is not intended to be considered in isolation or as a

substitute for, or superior to, financial information prepared and

presented in accordance with GAAP.

Investors are cautioned that there are material limitations

associated with the use of non-GAAP financial measures as an

analytical tool. Items excluded from non-GAAP gross profit and

non-GAAP gross margin include amortization of certain intangible

assets, stock-based compensation and related payroll taxes, and

depreciation expense. Items excluded from non-GAAP operating

expenses include amortization of certain intangible assets,

stock-based compensation and related payroll taxes, depreciation

expense, acquisition and integration-related expenses, and

restructuring. Items excluded from non-GAAP net income and non-GAAP

net income per share include stock-based compensation expense and

related payroll taxes, depreciation expense, amortization of

certain intangible assets, acquisition and integration-related

expenses, restructuring, amortization of debt issuance costs,

accretion of debt premium and income tax effect associated with

acquisitions and non-GAAP adjustments. It is important to note that

the particular items we exclude from, or include in, our non-GAAP

financial measures may differ from the items excluded from, or

included in, similar non-GAAP financial measures used by other

companies in the same industry. We also periodically review our

non-GAAP financial measures and may revise these measures to

reflect changes in our business or otherwise.

We believe that these non-GAAP financial measures provide useful

information about our financial performance, enhance the overall

understanding of our past performance and future prospects and

allow for greater transparency with respect to important metrics

used by our management for financial and operational

decision-making. We believe that these measures provide an

additional tool for investors to use in comparing our core

financial performance over multiple periods with other companies in

our industry.

We adjust the following items from one or more of our non-GAAP

financial measures:

Stock-based compensation and related payroll taxes charged to

cost of revenue and operating expenses. We exclude stock-based

compensation, which is a non-cash expense, and related payroll

taxes from certain of our non-GAAP financial measures because we

believe that excluding these items provide meaningful supplemental

information regarding operational performance. In particular,

companies calculate stock-based compensation expenses using a

variety of valuation methodologies and subjective assumptions while

the related payroll taxes are dependent on the price of our common

stock and other factors that are beyond our control and do not

correlate to the operation of our business.

Depreciation expense. We exclude depreciation expense from

certain of our non-GAAP financial measures because we believe that

excluding this non-cash expense provides meaningful supplemental

information regarding operational performance. Depreciation expense

does not include amortization of capitalized internal-use software

costs paid in cash.

Amortization of intangible assets. We exclude amortization of

acquired intangible assets from certain of our non-GAAP financial

measures because we believe that excluding this non-cash expense

provides meaningful supplemental information regarding our

operational performance.

Acquisition and integration-related expenses. We exclude

acquisition and integration-related expenses from certain of our

non-GAAP financial measures because these costs would have not

otherwise been incurred in the normal course of our business

operations. In addition, we believe that acquisition and

integration-related expenses are non-recurring charges unique to a

specific acquisition. Although we may engage in future

acquisitions, such acquisitions and the associated acquisition and

integration-related expenses are considered unique and not

comparable to other acquisitions.

Restructuring. We exclude costs incurred in connection with

formal restructuring plans from certain of our non-GAAP financial

measures because these costs are exceptional and would have not

otherwise been incurred in the normal course of our business

operations.

Amortization of debt issuance costs, net of accretion premium.

We exclude amortization of debt issuance costs associated with our

issuance of our convertible senior notes and credit arrangement and

accretion of debt premium associated with our credit agreement from

certain of our non-GAAP financial measures because we believe that

excluding this non-cash interest expense provides meaningful

supplemental information regarding our operational performance.

Income tax effect associated with acquisitions. We exclude the

income tax effect associated with acquisitions from certain of our

non-GAAP financial measures because we believe that excluding this

provides meaningful supplemental information regarding our

operational performance.

There are material limitations associated with the use of

non-GAAP financial measures since they exclude significant expenses

and income that are required by GAAP to be recorded in our

financial statements. Please see the reconciliation tables at the

end of this release for the reconciliation of GAAP and non-GAAP

results.

Free Cash Flow

Free cash flow is a non-GAAP measure that we calculate as net

cash provided by (used in) operating activities, adjusted by

purchases of property and equipment and capitalization of

internal-use software costs. We believe that free cash flow is an

important liquidity measure of the cash that is available, after

capital expenditures, for operational expenses and investment in

our business. Free cash flow is useful to investors as a liquidity

measure because it measures our ability to generate or use cash.

One limitation of free cash flow is that it does not reflect our

future contractual commitments. Additionally, free cash flow does

not represent the total increase or decrease in our cash balance

for a given period. Once our business needs and obligations are

met, cash can be used to maintain a strong balance sheet and invest

in future growth.

BILL HOLDINGS, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited, in thousands)

December 31,

2023

June 30, 2023

ASSETS

Current assets:

Cash and cash equivalents

$

1,579,633

$

1,617,151

Short-term investments

972,621

1,043,110

Accounts receivable, net

26,652

28,233

Acquired card receivables, net

516,980

458,650

Prepaid expenses and other current

assets

204,726

170,111

Funds held for customers

3,655,435

3,355,909

Total current assets

6,956,047

6,673,164

Non-current assets:

Operating lease right-of-use assets,

net

63,505

68,988

Property and equipment, net

86,577

81,564

Intangible assets, net

320,985

361,427

Goodwill

2,396,509

2,396,509

Other assets

48,788

54,366

Total assets

$

9,872,411

$

9,636,018

LIABILITIES AND STOCKHOLDERS'

EQUITY

Current liabilities:

Accounts payable

$

8,772

$

8,519

Accrued compensation and benefits

33,228

32,901

Deferred revenue

17,327

26,328

Other accruals and current liabilities

268,409

194,733

Borrowings from credit facilities, net

135,021

135,046

Customer fund deposits

3,655,435

3,355,909

Total current liabilities

4,118,192

3,753,436

Non-current liabilities:

Deferred revenue

4,174

410

Operating lease liabilities

67,725

72,477

Convertible senior notes, net

1,708,208

1,704,782

Other long-term liabilities

22,267

18,944

Total liabilities

5,920,566

5,550,049

Commitments and contingencies

Stockholders' equity:

Common stock

2

2

Additional paid-in capital

5,088,799

4,946,623

Accumulated other comprehensive income

(loss)

237

(4,488

)

Accumulated deficit

(1,137,193

)

(856,168

)

Total stockholders' equity

3,951,845

4,085,969

Total liabilities and stockholders'

equity

$

9,872,411

$

9,636,018

BILL HOLDINGS, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(Unaudited, in thousands except

per share amounts)

Three Months Ended

December 31,

Six Months Ended

December 31,

2023

2022

2023

2022

Revenue

Subscription and transaction fees (2)

$

274,992

$

231,095

$

540,134

$

445,706

Interest on funds held for customers

43,503

28,911

83,346

44,224

Total revenue

318,495

260,006

623,480

489,930

Cost of revenue

Service costs (2)

47,239

36,965

92,143

71,786

Depreciation and amortization of

intangible assets (1)

11,138

10,502

22,260

20,789

Total cost of revenue

58,377

47,467

114,403

92,575

Gross profit

260,118

212,539

509,077

397,355

Operating expenses

Research and development (2)

86,489

78,910

175,552

154,030

Sales and marketing (2)

118,305

164,683

236,704

283,308

General and administrative (2)

85,583

69,381

170,909

136,119

Depreciation and amortization of

intangible assets (1)

12,324

12,028

25,141

24,055

Restructuring

25,091

—

25,091

—

Total operating expenses

327,792

325,002

633,397

597,512

Loss from operations

(67,674

)

(112,463

)

(124,320

)

(200,157

)

Other income, net

28,919

17,022

58,227

22,970

Loss before provision for (benefit from)

income taxes

(38,755

)

(95,441

)

(66,093

)

(177,187

)

Provision for (benefit from) income

taxes

1,666

(365

)

2,189

(471

)

Net loss

$

(40,421

)

$

(95,076

)

$

(68,282

)

$

(176,716

)

Net loss per share attributable to common

stockholders, basic and diluted

$

(0.38

)

$

(0.90

)

$

(0.64

)

$

(1.68

)

Weighted-average number of common shares

used to compute net loss per share attributable to common

stockholders, basic and diluted

105,914

105,906

106,350

105,494

___________________

(1)

Depreciation expense does not include

amortization of capitalized internal-use software costs paid in

cash.

(2)

Includes stock-based compensation charged

to revenue and expenses as follows (in thousands):

Three Months Ended

December 31,

Six Months Ended

December 31,

2023

2022

2023

2022

Revenue - subscription and transaction

fees

$

486

$

—

$

856

$

—

Cost of revenue

2,388

2,298

4,934

4,299

Research and development

26,160

26,981

53,526

47,831

Sales and marketing

12,789

69,522

26,674

98,779

General and administrative

20,322

20,641

41,302

41,152

Restructuring

3,355

—

3,355

—

Total stock-based compensation (3)

$

65,500

$

119,442

$

130,647

$

192,061

(3)

Consists of acquisition related equity

awards (Acquisition Related Awards), which include equity awards

assumed and retention equity awards granted to certain employees of

acquired companies in connection with acquisitions and modified

equity awards in connection with the Restructuring Plan

(Restructuring Awards), and non-acquisition related equity awards

(Non-Acquisition Related Awards), which include all other equity

awards granted to existing employees and non-employees in the

ordinary course of business. The following table presents

stock-based compensation recorded for the periods presented and as

a percentage of total revenue:

Three Months Ended

December 31,

As a % of total

revenue

Six Months Ended

December 31,

As a % of total

revenue

Three Months Ended

December 31,

Six Months Ended

December 31,

2023

2022

2023

2022

2023

2022

2023

2022

Acquisition Related Awards

$

4,003

$

63,962

1

%

25

%

$

9,073

$

92,914

1

%

19

%

Restructuring Awards

3,355

—

1

%

—

%

3,355

—

1

%

—

%

Non-Acquisition Related Awards

58,142

55,480

18

%

21

%

118,219

99,147

19

%

20

%

Total stock-based compensation

$

65,500

$

119,442

20

%

46

%

$

130,647

$

192,061

21

%

39

%

BILL HOLDINGS, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Unaudited, in thousands)

Three Months Ended

December 31,

Six Months Ended

December 31,

2023

2022

2023

2022

Cash flows from operating

activities:

Net loss

$

(40,421

)

$

(95,076

)

$

(68,282

)

$

(176,716

)

Adjustments to reconcile net loss to net

cash provided by operating activities:

Stock-based compensation

65,500

119,305

130,647

191,925

Amortization of intangible assets

20,222

19,994

40,443

39,763

Depreciation of property and equipment

3,240

2,535

6,958

5,081

Amortization of capitalized internal-use

software costs

2,387

977

3,739

1,901

Amortization of debt issuance costs, net

of accretion of debt premium

1,762

1,771

3,523

3,483

Amortization of premium (accretion of

discount) on investments in marketable debt securities

(11,078

)

(8,186

)

(24,171

)

(10,401

)

Provision for losses on acquired card

receivables and other financial assets

16,288

8,431

28,689

15,042

Non-cash operating lease expense

2,164

2,376

4,552

4,718

Deferred income taxes

(74

)

(527

)

(116

)

(826

)

Other

(2,052

)

(414

)

(2,615

)

516

Changes in assets and liabilities:

Accounts receivable

(3,317

)

(2,278

)

390

(7,052

)

Prepaid expenses and other current

assets

4,553

(3,284

)

(151

)

(4,623

)

Other assets

(166

)

(742

)

(1,240

)

(1,880

)

Accounts payable

2,741

2,000

233

3,511

Other accruals and current liabilities

23,230

11,161

20,944

15,408

Operating lease liabilities

(2,494

)

(2,408

)

(4,917

)

(4,794

)

Other long-term liabilities

(15

)

1

(47

)

35

Deferred revenue

(2,788

)

(406

)

(5,237

)

(1,709

)

Net cash provided by operating

activities

79,682

55,230

133,342

73,382

Cash flows from investing

activities:

Cash paid for acquisition, net of acquired

cash and cash equivalents

—

(28,902

)

—

(28,902

)

Purchases of corporate and customer fund

short-term investments

(590,652

)

(781,282

)

(990,240

)

(1,641,193

)

Proceeds from maturities of corporate and

customer fund short-term investments

524,336

845,314

1,281,505

1,683,413

Proceeds from sale of corporate and

customer fund short-term investments

—

5,088

—

5,088

Purchases of loans held for investment

(77,357

)

—

(110,113

)

—

Principal repayments of loans held for

investment

68,970

—

94,300

—

Acquired card receivables, net

29,991

5,590

(12,342

)

(102,353

)

Purchases of property and equipment

(352

)

(1,785

)

(755

)

(3,161

)

Capitalization of internal-use software

costs

(5,117

)

(5,746

)

(10,762

)

(10,510

)

Proceeds from beneficial interest

—

—

—

2,080

Other

—

500

—

1,000

Net cash provided by (used in) investing

activities

(50,181

)

38,777

251,593

(94,538

)

Cash flows from financing

activities:

Purchase of capped calls

—

—

—

—

Customer fund deposits liability and

other

390,960

351,318

299,770

325,846

Prepaid card deposits

(2,505

)

(4,108

)

(16,484

)

6,815

Repurchase of common stock

(199,841

)

—

(211,902

)

—

Proceeds from line of credit

borrowings

—

37,500

—

37,500

Proceeds from exercise of stock

options

2,106

4,316

5,052

8,217

Proceeds from issuance of common stock

under the employee stock purchase plan

—

—

7,846

8,494

Contingent consideration payout

—

—

(5,471

)

—

Net cash provided by financing

activities

190,720

389,026

78,811

386,872

Effect of exchange rate changes on cash,

cash equivalents, restricted cash and restricted cash

equivalents

173

459

(7

)

182

Net increase in cash, cash equivalents,

restricted cash, and restricted cash equivalents

220,394

483,492

463,739

365,898

Cash, cash equivalents, restricted

cash, and restricted cash equivalents, beginning of period

4,468,186

3,425,121

4,224,841

3,542,715

Cash, cash equivalents, restricted

cash, and restricted cash equivalents, end of period

$

4,688,580

$

3,908,613

$

4,688,580

$

3,908,613

Reconciliation of cash, cash

equivalents, restricted cash, and restricted cash equivalents

within the condensed consolidated balance sheets to the amounts

shown in the condensed consolidated statements of cash flows

above:

Cash and cash equivalents

$

1,579,633

$

1,616,758

$

1,579,633

$

1,616,758

Restricted cash included in other current

assets

103,462

103,809

103,462

103,809

Restricted cash included in other

assets

7,116

6,724

7,116

6,724

Restricted cash and restricted cash

equivalents included in funds held for customers

2,998,369

2,181,322

2,998,369

2,181,322

Total cash, cash equivalents,

restricted cash, and restricted cash equivalents, end of

period

$

4,688,580

$

3,908,613

$

4,688,580

$

3,908,613

BILL HOLDINGS, INC.

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

(Unaudited, in thousands except

percentages and per share amounts)

Three Months Ended

December 31,

Six Months Ended

December 31,

2023

2022

2023

2022

Reconciliation of gross profit:

GAAP gross profit

$

260,118

$

212,539

$

509,077

$

397,355

Add:

Depreciation and amortization of

intangible assets (1)

11,138

10,502

22,260

20,789

Stock-based compensation and related

payroll taxes charged to cost of revenue

2,446

2,353

5,074

4,419

Non-GAAP gross profit

$

273,702

$

225,394

$

536,411

$

422,563

GAAP gross margin

81.7

%

81.7

%

81.7

%

81.1

%

Non-GAAP gross margin

85.9

%

86.7

%

86.0

%

86.2

%

___________________

(1)

Consists of depreciation of property and

equipment and amortization of developed technology, excluding

amortization of capitalized internal-use software costs paid in

cash.

Three Months Ended

December 31,

Six Months Ended

December 31,

2023

2022

2023

2022

Reconciliation of operating

expenses:

GAAP research and development expenses

$

86,489

$

78,910

$

175,552

$

154,030

Less - stock-based compensation and

related payroll taxes

(26,550

)

(27,310

)

(54,437

)

(48,667

)

Non-GAAP research and development

expenses

$

59,939

$

51,600

$

121,115

$

105,363

GAAP sales and marketing expenses

$

118,305

$

164,683

$

236,704

$

283,308

Less - stock-based compensation and

related payroll taxes

(13,009

)

(69,818

)

(27,091

)

(100,010

)

Non-GAAP sales and marketing expenses

$

105,296

$

94,865

$

209,613

$

183,298

GAAP general and administrative

expenses

$

85,583

$

69,381

$

170,909

$

136,119

Less:

Stock-based compensation and related

payroll taxes

(20,547

)

(20,989

)

(41,934

)

(41,907

)

Acquisition and integration-related

expenses

(872

)

(215

)

(969

)

(215

)

Non-GAAP general and administrative

expenses

$

64,164

$

48,177

$

128,006

$

93,997

Three Months Ended

December 31,

Six Months Ended

December 31,

2023

2022

2023

2022

Reconciliation of loss from

operations:

GAAP loss from operations

$

(67,674

)

$

(112,463

)

$

(124,320

)

$

(200,157

)

Add:

Depreciation and amortization of

intangible assets (1)

23,462

22,530

47,401

44,844

Stock-based compensation and related

payroll taxes charged to cost of revenue and operating expenses

(2)

62,552

120,470

128,536

195,003

Acquisition and integration-related

expenses

872

215

969

215

Restructuring

25,091

—

25,091

—

Non-GAAP income from operations

$

44,303

$

30,752

$

77,677

$

39,905

___________________

(1)

Excludes amortization of capitalized

internal-use software costs paid in cash.

(2)

Excludes stock-based compensation charged

to Restructuring.

Three Months Ended

December 31,

Six Months Ended

December 31,

2023

2022

2023

2022

Reconciliation of net loss:

GAAP net loss

$

(40,421

)

$

(95,076

)

$

(68,282

)

$

(176,716

)

Add (less):

Depreciation and amortization of

intangible assets (1)

23,462

22,530

47,401

44,844

Stock-based compensation and related

payroll taxes charged to cost of revenue and operating expenses

62,552

120,470

128,536

195,003

Acquisition and integration-related

expenses

872

215

969

215

Restructuring

25,091

—

25,091

—

Amortization of debt issuance costs, net

of accretion of debt premium

1,762

1,771

3,523

3,483

Income tax effect associated with

acquisitions

(94

)

(526

)

(136

)

(526

)

Non-GAAP net income

$

73,224

$

49,384

$

137,102

$

66,303

___________________

(1)

Excludes amortization of capitalized

internal-use software costs paid in cash.

Three Months Ended

December 31,

Six Months Ended

December 31,

2023

2022

2023

2022

Reconciliation of net loss per share

attributable to common stockholders, basic and

diluted:

GAAP net loss per share attributable to

common stockholders, basic and diluted

$

(0.38

)

$

(0.90

)

$

(0.64

)

$

(1.68

)

Add:

Depreciation and amortization of

intangible assets (1)

0.21

0.21

0.44

0.43

Stock-based compensation and related

payroll taxes charged to cost of revenue and operating expenses

0.59

1.14

1.21

1.85

Acquisition and integration-related

expenses

0.01

0.00

0.01

0.00

Restructuring

0.24

—

0.24

—

Amortization of debt issuance costs, net

of accretion of debt premium

0.02

0.02

0.03

0.03

Income tax effect associated with

acquisitions

(0.00

)

(0.00

)

(0.00

)

(0.00

)

Non-GAAP net income per share attributable

to common stockholders, basic

$

0.69

$

0.47

$

1.29

$

0.63

Non-GAAP net income per share attributable

to common stockholders, diluted

$

0.63

$

0.42

$

1.17

$

0.56

___________________

(1)

Excludes amortization of capitalized

internal-use software costs paid in cash.

Three Months Ended

December 31,

Six Months Ended

December 31,

2023

2022

2023

2022

Shares used to compute GAAP and non-GAAP

net income (loss) per share attributable to common stockholders,

basic

105,914

105,906

106,350

105,494

Shares used to compute GAAP and non-GAAP

net income (loss) per share attributable to common stockholders,

diluted

116,712

117,258

117,471

118,039

BILL HOLDINGS, INC.

FREE CASH FLOW

(Unaudited, in thousands)

Three Months Ended

December 31,

Six Months Ended

December 31,

2023

2022

2023

2022

Net cash provided by operating

activities

$

79,682

$

55,230

$

133,342

$

73,382

Purchases of property and equipment

(352

)

(1,785

)

(755

)

(3,161

)

Capitalization of internal-use software

costs

(5,117

)

(5,746

)

(10,762

)

(10,510

)

Free cash flow

$

74,213

$

47,699

$

121,825

$

59,711

BILL HOLDINGS, INC.

REMAINING PERFORMANCE

OBLIGATIONS

(Unaudited, in thousands)

December 31,

2023

June 30, 2023

Remaining performance obligations to be

recognized as revenue:

Within 2 years

$

92,509

$

101,177

Thereafter

17,461

29,960

Total

$

109,970

$

131,137

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240208644139/en/

IR Contact:

Karen Sansot ksansot@hq.bill.com

Press Contact:

John Welton john.welton@hq.bill.com

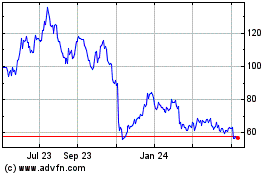

BILL (NYSE:BILL)

Historical Stock Chart

From Dec 2024 to Jan 2025

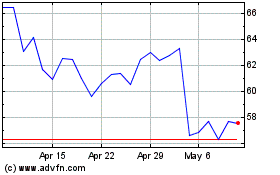

BILL (NYSE:BILL)

Historical Stock Chart

From Jan 2024 to Jan 2025