Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

November 22 2022 - 6:02AM

Edgar (US Regulatory)

Filed Pursuant to Rule 433 Registration

Statement No. 333-256031

Term Sheet dated November 21, 2022

supplementing the Preliminary Prospectus

Supplement dated November 21, 2022

Final Term Sheet

ArcelorMittal

$1,200,000,000 6.550% Notes due 2027

This final term sheet dated November 21, 2022, relates only to the securities described below and should be read together with the preliminary

prospectus supplement dated November 21, 2022, and the accompanying prospectus (including the documents incorporated by reference in the Preliminary Prospectus and the accompanying prospectus) (together, the “Preliminary Prospectus”)

before making a decision in connection with an investment in the securities. Terms used but not defined herein have the meaning ascribed to them in the Preliminary Prospectus.

|

|

|

| Issuer: |

|

ArcelorMittal |

|

|

| Security Description: |

|

6.550% Notes due 2027 |

|

|

| Size: |

|

$1,200,000,000 |

|

|

| Price: |

|

99.908% of face amount |

|

|

| Maturity Date: |

|

November 29, 2027, unless earlier redeemed |

|

|

| Coupon: |

|

6.550% per annum |

|

|

| Yield to Maturity: |

|

6.572% |

|

|

| Benchmark Treasury: |

|

UST 4.125% due October 31, 2027 |

|

|

| Benchmark Treasury Price and Yield: |

|

100-14+; 4.022% |

|

|

| Spread to Benchmark Treasury: |

|

T+255 bps |

|

|

| Interest Payment Dates: |

|

May 29 and November 29, commencing May 29, 2023 |

|

|

| Total Net Proceeds Before Expenses: |

|

The net proceeds of the Notes offering, after deduction of the underwriting discount of approximately $4,200,000, amount to approximately $1,194,696,000. |

|

|

| Use of Proceeds: |

|

ArcelorMittal intends to use the net proceeds of this offering for general corporate purposes. In addition, following the closing of this offering, commitments which remain available under the Bridge Facility Agreement related to

the financing of the intended acquisition of Companhia Siderúrgica do Pecém will, in accordance with the terms thereof, be cancelled in an amount equal to the amount by which this offering exceeds approximately $400 million, less

certain expenses and tax costs that may, pursuant to the terms of the Bridge Facility Agreement, be deducted from the amount to be cancelled. |

|

|

| Change of Control: |

|

101% |

|

|

| Make-whole Spread: |

|

T+40 bps |

|

|

| Par Call Date: |

|

October 29, 2027 |

|

|

| Trade Date: |

|

November 21, 2022 |

|

|

| Settlement Date: |

|

T+5; November 29, 2022 |

|

|

| CUSIP: |

|

03938LBE3 |

|

|

| ISIN: |

|

US03938LBE39 |

|

|

| Denominations/Multiple: |

|

$2,000 x $1,000 |

|

|

| Expected Security Ratings*: |

|

Baa3 (stable) / BBB- (stable) (Moody’s/S&P) |

|

|

| Underwriters: |

|

Joint Book-Running Managers BofA

Securities, Inc. Citigroup Global Markets Inc. J.P. Morgan

Securities LLC Mizuho Securities USA LLC Commerz Markets

LLC Credit Agricole Securities (USA) Inc. HSBC Securities

(USA) Inc. RBC Capital Markets, LLC SMBC Nikko Securities

America, Inc UniCredit Capital Markets LLC |

1

Filed Pursuant to Rule 433 Registration

Statement No. 333-256031

Term Sheet dated November 21, 2022

supplementing the Preliminary Prospectus

Supplement dated November 21, 2022

*Note: A securities rating is not a recommendation to buy, sell or hold securities and may be subject to

revision or withdrawal at any time.

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which

this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these

documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by contacting J.P.

Morgan Securities LLC by calling collect at 1-212-834-4533; BofA Securities, Inc. by calling 1-800-294-1322; Citigroup Global Markets Inc. by calling toll-free:

1-800-831-9146; or Mizuho Securities USA LLC by calling 1-866-271-7403.

MiFID II professionals/ECPs-only/No PRIIPs KID—Manufacturer Target Market

(MiFID II Product Governance) is eligible counterparties and professional clients only (all distribution channels). No PRIIPs Key Information Document (KID) has been prepared as not available to retail in EEA.

The underwriters expect to deliver the Notes on or about November 29, 2022, which will be five business days (as such term is used for purposes of

Rule 15c6-1 of the U.S. Exchange Act) following the date of pricing of the notes (this settlement cycle is being referred to as “T+5”). Under Rule 15c6-1 of

the U.S. Exchange Act, trades in the secondary market generally are required to settle in two business days unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade the notes on any date prior to the

second business day before delivery will be required to specify an alternative settlement cycle at the time of any such trade to prevent a failed settlement. Purchasers of the Notes who wish to make such trades should consult their own advisors.

ANY DISCLAIMERS OR OTHER NOTICES THAT MAY APPEAR BELOW ARE NOT APPLICABLE TO THIS COMMUNICATION AND SHOULD BE DISREGARDED. SUCH DISCLAIMERS OR

OTHER NOTICES WERE AUTOMATICALLY GENERATED AS A RESULT OF THIS COMMUNICATION BEING SENT VIA BLOOMBERG OR ANOTHER EMAIL SYSTEM.

2

Filed Pursuant to Rule 433 Registration

Statement No. 333-256031

Term Sheet dated November 21, 2022

supplementing the Preliminary Prospectus

Supplement dated November 21, 2022

Final Term Sheet

ArcelorMittal

$1,000,000,000 6.800% Notes due 2032

This final term sheet dated November 21, 2022, relates only to the securities described below and should be read together with the preliminary

prospectus supplement dated November 21, 2022, and the accompanying prospectus (including the documents incorporated by reference in the Preliminary Prospectus and the accompanying prospectus) (together, the “Preliminary Prospectus”)

before making a decision in connection with an investment in the securities. Terms used but not defined herein have the meaning ascribed to them in the Preliminary Prospectus.

|

|

|

| Issuer: |

|

ArcelorMittal |

|

|

| Security Description: |

|

6.800% Notes due 2032 |

|

|

| Size: |

|

$1,000,000,000 |

|

|

| Price: |

|

99.371% of face amount |

|

|

| Maturity Date: |

|

November 29, 2032, unless earlier redeemed |

|

|

| Coupon: |

|

6.800% per annum |

|

|

| Yield to Maturity: |

|

6.888% |

|

|

| Benchmark Treasury: |

|

UST 4.125% due November 15, 2032 |

|

|

| Benchmark Treasury Price and Yield: |

|

102-11+; 3.838% |

|

|

| Spread to Benchmark Treasury: |

|

T+305 bps |

|

|

| Interest Payment Dates: |

|

May 29 and November 29, commencing May 29, 2023 |

|

|

| Total Net Proceeds Before Expenses: |

|

The net proceeds of the Notes offering, after deduction of the underwriting discount of approximately $4,500,000, amount to approximately $989,210,000. |

|

|

| Use of Proceeds: |

|

ArcelorMittal intends to use the net proceeds of this offering for general corporate purposes. In addition, following the closing of this offering, commitments which remain available under the Bridge Facility Agreement related to

the financing of the intended acquisition of Companhia Siderúrgica do Pecém will, in accordance with the terms thereof, be cancelled in an amount equal to the amount by which this offering exceeds approximately $400 million, less

certain expenses and tax costs that may, pursuant to the terms of the Bridge Facility Agreement, be deducted from the amount to be cancelled. |

|

|

| Change of Control: |

|

101% |

|

|

| Make-whole Spread: |

|

T+50 bps |

|

|

| Par Call Date: |

|

August 29, 2032 |

|

|

| Trade Date: |

|

November 21, 2022 |

|

|

| Settlement Date: |

|

T+5; November 29, 2022 |

|

|

| CUSIP: |

|

03938LBF0 |

|

|

| ISIN: |

|

US03938LBF04 |

|

|

| Denominations/Multiple: |

|

$2,000 x $1,000 |

|

|

| Expected Security Ratings*: |

|

Baa3 (stable) / BBB- (stable) (Moody’s/S&P) |

|

|

| Underwriters: |

|

Joint Book-Running Managers BofA

Securities, Inc. Citigroup Global Markets Inc. J.P. Morgan

Securities LLC Mizuho Securities USA LLC Commerz Markets

LLC Credit Agricole Securities (USA) Inc. HSBC Securities

(USA) Inc. RBC Capital Markets, LLC SMBC Nikko Securities

America, Inc UniCredit Capital Markets LLC |

3

Filed Pursuant to Rule 433 Registration

Statement No. 333-256031

Term Sheet dated November 21, 2022

supplementing the Preliminary Prospectus

Supplement dated November 21, 2022

*Note: A securities rating is not a recommendation to buy, sell or hold securities and may be subject to

revision or withdrawal at any time.

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which

this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these

documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by contacting J.P.

Morgan Securities LLC by calling collect at (212) 834-4533; BofA Securities, Inc. by calling

1-800-294-1322; Citigroup Global Markets Inc. by calling toll-free: 1-800-831-9146; or Mizuho Securities USA LLC by calling

1-866-271-7403.

MiFID II

professionals/ECPs-only/No PRIIPs KID—Manufacturer Target Market (MiFID II Product Governance) is eligible counterparties and professional clients only (all distribution channels). No PRIIPs Key Information Document (KID) has been prepared as

not available to retail in EEA.

The underwriters expect to deliver the Notes on or about November 29, 2022, which will be five business days

(as such term is used for purposes of Rule 15c6-1 of the U.S. Exchange Act) following the date of pricing of the notes (this settlement cycle is being referred to as “T+5”). Under Rule 15c6-1 of the U.S. Exchange Act, trades in the secondary market generally are required to settle in two business days unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish

to trade the notes on any date prior to the second business day before delivery will be required to specify an alternative settlement cycle at the time of any such trade to prevent a failed settlement. Purchasers of the Notes who wish to make such

trades should consult their own advisors.

ANY DISCLAIMERS OR OTHER NOTICES THAT MAY APPEAR BELOW ARE NOT APPLICABLE TO THIS COMMUNICATION AND

SHOULD BE DISREGARDED. SUCH DISCLAIMERS OR OTHER NOTICES WERE AUTOMATICALLY GENERATED AS A RESULT OF THIS COMMUNICATION BEING SENT VIA BLOOMBERG OR ANOTHER EMAIL SYSTEM.

4

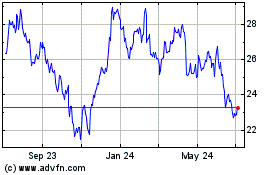

Arcelor Mittal (NYSE:MT)

Historical Stock Chart

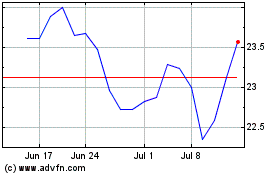

From Aug 2024 to Sep 2024

Arcelor Mittal (NYSE:MT)

Historical Stock Chart

From Sep 2023 to Sep 2024