Current Report Filing (8-k)

September 13 2021 - 7:09AM

Edgar (US Regulatory)

APi Group Corp false 0001796209 0001796209 2021-09-13 2021-09-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported) September 13, 2021

APi Group Corporation

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

Delaware

|

|

001-39275

|

|

98-1510303

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

1100 Old Highway 8 NW

New Brighton, MN

|

|

55112

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (651) 636-4320

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, par value $0.0001 per share

|

|

APG

|

|

The New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

☐

|

Emerging growth company

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

As previously disclosed in the Current Report on Form 8-K filed with the Securities and Exchange Commission on July 30, 2021 (the “Prior 8-K”) by APi Group Corporation (the “Company”), the Company entered into a Stock Purchase Agreement (the “Purchase Agreement”) with Carrier Global Corporation (“Carrier”), Carrier Investments UK Limited (“Seller”) and Chubb Limited (“Chubb”) pursuant to which the Company has agreed to acquire, and Seller has agreed to sell, the Chubb fire and security business (the “Business”), through the acquisition of Chubb for a purchase price of $3,100,000,000 (the “Acquisition”).

Consummation of the Acquisition remains subject to the satisfaction or waiver of certain customary closing conditions specified in the Purchase Agreement and as described in the Prior 8-K. If the Acquisition is consummated, we will be required to disclose information regarding the consummation of the Acquisition in a Current Report on Form 8-K as required by Item 2.01. This Current Report on Form 8-K is being filed to provide certain carve-out financial statements of the Business and to provide unaudited pro forma financial information of the Company and the Business giving effect to the Acquisition.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(a) Financial Statements of Businesses Acquired.*

The audited combined carve-out financial statements of the Business as of and for the years ended December 31, 2020 and 2019, the notes related thereto and the related Report of Independent Auditors, issued by PricewaterhouseCoopers LLP, dated June 30, 2021, are attached as Exhibit 99.1 and incorporated herein by reference.

The unaudited condensed combined carve-out financial statements of the Business as of and for the six months ended June 30, 2021 and 2020, and the notes related thereto, are attached hereto as Exhibit 99.2 and incorporated herein by reference.

* — Note: The Business has not yet been acquired. Financial statements are being provided pursuant to Rule 3-05 of Regulation S-X because the Acquisition constitutes a probable significant acquisition.

(b) Pro forma financial information.

The unaudited pro forma condensed combined balance sheet as of June 30, 2021, and the pro forma condensed combined statements of operations for the six months ended June 30, 2021 and the year ended December 31, 2020, and the notes related thereto, that give effect to the Acquisition of the Business are attached hereto as Exhibit 99.3 and incorporated herein by reference.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

API GROUP CORPORATION

|

|

|

|

|

By:

|

|

/s/ Andrea Fike

|

|

|

|

|

|

Name:

|

|

Andrea Fike

|

|

Title:

|

|

Senior Vice President, General Counsel and Secretary

|

Date: September 13, 2021

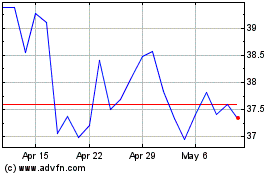

APi (NYSE:APG)

Historical Stock Chart

From Aug 2024 to Sep 2024

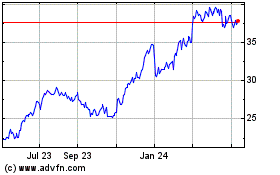

APi (NYSE:APG)

Historical Stock Chart

From Sep 2023 to Sep 2024