Form 8-K - Current report

February 07 2024 - 4:52PM

Edgar (US Regulatory)

AMERICAN TOWER CORP /MA/0001053507false00010535072024-02-052024-02-050001053507exch:XNYSus-gaap:CommonStockMember2024-02-052024-02-050001053507exch:XNYSamt:A1375SeniorNotesDue2025Member2024-02-052024-02-050001053507amt:A1950SeniorNotesDue2026Memberexch:XNYS2024-02-052024-02-050001053507exch:XNYSamt:A0450SeniorNotesDue2027Member2024-02-052024-02-050001053507exch:XNYSamt:A0400SeniorNotesDue2027Member2024-02-052024-02-050001053507amt:A4125SeniorNotesDue2027Memberexch:XNYS2024-02-052024-02-050001053507exch:XNYSamt:A0500SeniorNotesDue2028Member2024-02-052024-02-050001053507exch:XNYSamt:A0875SeniorNotesDue2029Member2024-02-052024-02-050001053507exch:XNYSamt:A0950SeniorNotesDue2030Member2024-02-052024-02-050001053507exch:XNYSamt:A4625SeniorNotesDue2031Member2024-02-052024-02-050001053507exch:XNYSamt:A1000SeniorNotesDue2032Member2024-02-052024-02-050001053507exch:XNYSamt:A1250SeniorNotesDue2033Member2024-02-052024-02-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): February 5, 2024 AMERICAN TOWER CORPORATION

(Exact Name of Registrant as Specified in Charter) | | | | | | | | | | | | | | | | | |

Delaware | | 001-14195 | | 65-0723837 | |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) | |

116 Huntington Avenue

Boston, Massachusetts 02116

(Address of Principal Executive Offices) (Zip Code)

(617) 375-7500

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value | AMT | New York Stock Exchange |

| 1.375% Senior Notes due 2025 | AMT 25A | New York Stock Exchange |

| 1.950% Senior Notes due 2026 | AMT 26B | New York Stock Exchange |

| 0.450% Senior Notes due 2027 | AMT 27C | New York Stock Exchange |

| 0.400% Senior Notes due 2027 | AMT 27D | New York Stock Exchange |

| 4.125% Senior Notes due 2027 | AMT 27F | New York Stock Exchange |

| 0.500% Senior Notes due 2028 | AMT 28A | New York Stock Exchange |

| 0.875% Senior Notes due 2029 | AMT 29B | New York Stock Exchange |

| 0.950% Senior Notes due 2030 | AMT 30C | New York Stock Exchange |

| 4.625% Senior Notes due 2031 | AMT 31B | New York Stock Exchange |

| 1.000% Senior Notes due 2032 | AMT 32 | New York Stock Exchange |

| 1.250% Senior Notes due 2033 | AMT 33 | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(c) On October 26, 2023, American Tower Corporation (the “Company”) announced that the Company’s Board of Directors (the “Board”) appointed Steven O. Vondran as President and Chief Executive Officer of the Company, effective February 1, 2024.

The Compensation Committee (the “Committee”) of the Board considered the compensation arrangements with Mr. Vondran in light of such promotion. Accordingly, on February 5, 2024, the Committee approved a new base salary and cash bonus incentive target for the year ending December 31, 2024 for Mr. Vondran, effective as of February 1, 2024. The information in the table below sets forth the determinations of the Committee:

| | | | | | | | | | | |

| | | |

| Name and Title | | 2024 Base Salary | 2024 Target Cash Bonus Potential (% of Base Salary / $) |

| | | |

| Steven O. Vondran, President and Chief Executive Officer | $ | 1,000,000 | 200% / $2,000,000 |

In determining annual cash bonus incentive payments at the end of the year, the Committee bases its decisions on a number of factors, including achievement of pre-established Company financial goals and individual goals and objectives. If the Company exceeds its financial goals or Mr. Vondran exceeds his individual goals, the annual cash bonus incentive could be subject to increase by the Committee, up to a maximum of 200% of Mr. Vondran’s bonus target.

The Committee also approved an equity grant for Mr. Vondran, with an award value of $10 million pursuant to the Company’s 2007 Equity Incentive Plan, as amended. The award value for Mr. Vondran is allocated 70% to performance-based restricted stock units (“PSUs”) and 30% to restricted stock units (“RSUs”). Each PSU grant is based on a three-year performance period, with the performance goals set at the beginning of the performance period. Each RSU grant vests 1/3rd annually over three years, commencing one year from the date of grant. The number of shares subject to each of these awards will be determined using the closing price of the Company’s common stock on March 11, 2024.

The Committee also determined that compensation for Thomas A. Bartlett, advisor to the Chief Executive Officer, will remain unchanged from the compensation approved for his previous role by the Committee on February 24, 2023. Mr. Bartlett will be eligible to earn a bonus for 2024, pro-rated for his length of service in 2024, and did not receive an equity grant for 2024.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| AMERICAN TOWER CORPORATION |

| (Registrant) |

| |

| Date: | February 7, 2024 | By: | /s/ Ruth T. Dowling |

| | Ruth T. Dowling |

| | Executive Vice President, Chief Administrative Officer, General Counsel and Secretary |

v3.24.0.1

Cover Cover

|

Feb. 05, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 05, 2024

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-14195

|

| Entity Tax Identification Number |

65-0723837

|

| Entity Address, Address Line One |

116 Huntington Avenue

|

| Entity Address, City or Town |

Boston

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02116

|

| City Area Code |

617

|

| Local Phone Number |

375-7500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Registrant Name |

AMERICAN TOWER CORP /MA/

|

| Entity Central Index Key |

0001053507

|

| Amendment Flag |

false

|

| NEW YORK STOCK EXCHANGE, INC. | Common Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $0.01 par value

|

| Trading Symbol |

AMT

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 1.375% Senior Notes due 2025 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

1.375% Senior Notes due 2025

|

| Trading Symbol |

AMT 25A

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 1.950% Senior Notes due 2026 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

1.950% Senior Notes due 2026

|

| Trading Symbol |

AMT 26B

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | Zero Point Four Five Zero Percent Senior Notes, Due 2027 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

0.450% Senior Notes due 2027

|

| Trading Symbol |

AMT 27C

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | Zero Point Five Zero Percent Senior Notes Due 2028 [Member] |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

0.500% Senior Notes due 2028

|

| Trading Symbol |

AMT 28A

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | One Point Zero Percent Senior Notes Due 2032 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

1.000% Senior Notes due 2032

|

| Trading Symbol |

AMT 32

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | Zero Point Eight Seven Five Percent Senior Notes, Due |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

0.875% Senior Notes due 2029

|

| Trading Symbol |

AMT 29B

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | One Point Two Five Zero Percent Senior Notes, Due 2033 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

1.250% Senior Notes due 2033

|

| Trading Symbol |

AMT 33

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 0.400% Senior Notes Due 2027 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

0.400% Senior Notes due 2027

|

| Trading Symbol |

AMT 27D

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 0.950% Senior Notes Due 2030 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

0.950% Senior Notes due 2030

|

| Trading Symbol |

AMT 30C

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 4.125% Senior Notes due 2027 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

4.125% Senior Notes due 2027

|

| Trading Symbol |

AMT 27F

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 4.625% Senior Notes Due 2031 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

4.625% Senior Notes due 2031

|

| Trading Symbol |

AMT 31B

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XNYS |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=amt_A1375SeniorNotesDue2025Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=amt_A1950SeniorNotesDue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=amt_A0450SeniorNotesDue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=amt_A0500SeniorNotesDue2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=amt_A1000SeniorNotesDue2032Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=amt_A0875SeniorNotesDue2029Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=amt_A1250SeniorNotesDue2033Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=amt_A0400SeniorNotesDue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=amt_A0950SeniorNotesDue2030Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=amt_A4125SeniorNotesDue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=amt_A4625SeniorNotesDue2031Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

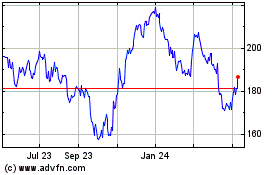

American Tower (NYSE:AMT)

Historical Stock Chart

From Apr 2024 to May 2024

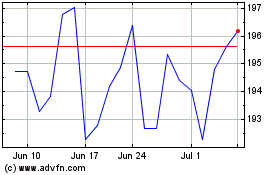

American Tower (NYSE:AMT)

Historical Stock Chart

From May 2023 to May 2024