America Movil Adds Stake in KPN - Analyst Blog

June 13 2012 - 1:20PM

Zacks

Mexican Telecom giant America Movil (AMX) has

raised its capital interest to 7.9% in a Dutch telecommunications

company, Koninklijke KPN NV. Previously, America Movil owned a 4.8%

stake in Koninklijke KPN. The company bought 8,000,000 ordinary

shares off exchange and now holds a total of 112,532,225 ordinary

shares in Koninklijke KPN.

In May, America Movil offered to increase its minority stake in

Koninklijke KPN NV (a Dutch telecommunications company) to 28% at

€8.0 per share, for an offer totalling €2.64 billion. However,

Koninklijke KPN rejected this, citing the offer as under valued.

Meanwhile, Koninklijke KPN is looking forward to a spin-off of its

German mobile subsidiary E-Plus allowing potential merger prospects

with Telefonica S.A.’s (TEF) German subsidiary

O2.

According to market reports, the merger of these two German

units will generate €4 billion in annual synergies making it

attractive for investors. Koninklijke KPN considers this

prospective merger as a significant strategy that would divert

shareholders’ attention from America Movil’s offer.

The company believes that the merger of E Plus and O2 will also

enhance KPN’s share value, and make America Movil’s offer less

attractive or push the offer price higher. Currently, shareholders

interest in selling stakes to America Movil outside the regular

market trading lies in a significant threat that would shift the

majority of the decision making power at KPN to Movil.

Acquisition plays a key role in driving growth at America Movil.

Last year, the company acquired Pay-TV firm Net Servicos, the

largest multi-service cable company in Latin America. In January,

the company collaborated with Claxson Interactive Group to acquire

DLA Inc. that adds video-on-demand service on cable-TV channels in

Latin America.

America Movil also entered into a partnership with

AT&T (T) in November last year, to expand its

reach in emerging markets in Asia and the Middle East. America

Movil will use AT&T's global network infrastructure to provide

Internet services worldwide. In exchange, the company will offer

virtual private network services to AT&T’s multinational

clients operating in Latin America.

Going forward, America Movil’s Tracfone plans to acquire Simple

Mobile, upon regulatory approval. Recently, America Movil also

acquired a 4.1% stake in Austria’s biggest telecom company Telekom

Austria.

We expect the company to continue focusing on its acquisition

strategies in order to stay afloat in a highly competitive telecom

market and tap the opportunities in wireless services and pay-TV

business.

We currently maintain a long-term Neutral recommendation on

America Movil. For the short term (1-3 months), the stock has a

Zacks #3 Rank (Hold).

AMER MOVIL-ADR (AMX): Free Stock Analysis Report

AT&T INC (T): Free Stock Analysis Report

TELEFONICA S.A. (TEF): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

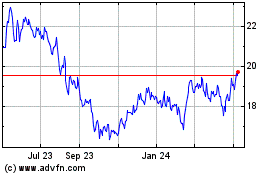

America Movil SAB de CV (NYSE:AMX)

Historical Stock Chart

From May 2024 to Jun 2024

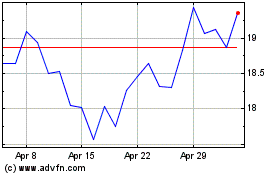

America Movil SAB de CV (NYSE:AMX)

Historical Stock Chart

From Jun 2023 to Jun 2024