Current Report Filing (8-k)

November 01 2021 - 4:16PM

Edgar (US Regulatory)

0000899051falseCommon Stock, par value $.01 per shareALLNYSECommon Stock, par value $.01 per shareALLCHX00008990512021-11-012021-11-010000899051all:SubordinatedDebenturesDue2053At5.10PercentMember2021-11-012021-11-010000899051us-gaap:SeriesGPreferredStockMember2021-11-012021-11-010000899051us-gaap:SeriesHPreferredStockMember2021-11-012021-11-010000899051all:SeriesIPreferredStockMember2021-11-012021-11-010000899051us-gaap:CommonStockMemberexch:XNYS2021-11-012021-11-010000899051us-gaap:CommonStockMemberexch:XCHI2021-11-012021-11-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15 (d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): November 1, 2021

THE ALLSTATE CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

1-11840

|

|

36-3871531

|

(State or other

jurisdiction of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

2775 Sanders Road, Northbrook, Illinois 60062

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code (847) 402-5000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbols

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.01 per share

|

ALL

|

New York Stock Exchange

Chicago Stock Exchange

|

|

5.100% Fixed-to-Floating Rate Subordinated Debentures due 2053

|

ALL.PR.B

|

New York Stock Exchange

|

|

Depositary Shares represent 1/1,000th of a share of 5.625% Noncumulative Preferred Stock, Series G

|

ALL PR G

|

New York Stock Exchange

|

|

Depositary Shares represent 1/1,000th of a share of 5.100% Noncumulative Preferred Stock, Series H

|

ALL PR H

|

New York Stock Exchange

|

|

Depositary Shares represent 1/1,000th of a share of 4.750% Noncumulative Preferred Stock, Series I

|

ALL PR I

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ____

Section 2 – Financial Information

Section 2.01. Completion of Acquisition or Disposition of Assets.

On November 1, 2021, pursuant to the Stock Purchase Agreement (the “Purchase Agreement”), dated January 26, 2021, by and among Allstate Insurance Company (“ALIC Seller”), an indirect wholly owned subsidiary of The Allstate Corporation (the “Registrant”), and Allstate Financial Insurance Holdings Corporation (“AAC Seller” and, together with ALIC Seller, each a “Seller” and, together, the “Sellers”), a direct wholly owned subsidiary of the Registrant and Everlake US Holdings Company (f/k/a Antelope US Holdings Company) (the “Buyer), a corporation incorporated under the laws of the State of Delaware and an affiliate of an investment fund associated with Blackstone Inc., the Sellers completed the previously announced sale of all of the shares of capital stock of Allstate Life Insurance Company, a wholly owned subsidiary of ALIC Seller (“ALIC”), and Allstate Assurance Company, a wholly owned subsidiary of AAC Seller (“AAC”) to the Buyer (together with the other transactions contemplated by the Purchase Agreement, the “Transaction”) for total proceeds of approximately $4 billion, which is inclusive of Blackstone’s approximately $2.8 billion of purchase price, as well as increases in statutory surplus since March 31, 2020. The Purchase Agreement also provides for potential contingent consideration payable to ALIC Seller of $25 million each year from 2025 through and including 2034, for up to $250 million in the aggregate, based on the monthly average of the daily 10-year treasury rate for the trailing three year period to each such year.

The following unaudited pro forma condensed consolidated statement of financial position of the Registrant, giving effect to the Transaction and to the sale of Allstate Life Insurance Company of New York to Wilton Reassurance Company (together with the Transaction, the “Divestitures”) as if the Divestitures occurred on June 30, 2021, is attached as Exhibit 99.1 to this report and is incorporated herein by reference:

(i) The unaudited pro forma condensed consolidated statement of financial position as of June 30, 2021; and

(ii) notes to unaudited pro forma condensed consolidated statement of financial position.

Section 8 – Other Events

Item 8.01. Other Events.

On November 1, 2021, the Registrant issued a press release announcing that it had completed the previously announced sale of ALIC and AAC. A copy of the press release is attached as Exhibit 99.2 to this report and is incorporated herein by reference.

Section 9 – Financial Statements and Exhibits

Item 9.01. Financial Statements and Exhibits.

(a) Not Applicable

(b) The Registrant’s unaudited pro forma condensed consolidated statement of financial position as of June 30, 2021, is set forth in Exhibit 99.1 hereto and is incorporated herein by reference

(c) Not Applicable

(d) Exhibits

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

99.1

|

|

|

|

99.2

|

|

|

|

104

|

|

Cover Page Interactive Data File (formatted as inline XBRL).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

THE ALLSTATE CORPORATION

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Daniel G. Gordon

|

|

|

|

|

Name:

|

Daniel G. Gordon

|

|

|

|

Title:

|

Vice President, Assistant General

|

|

|

|

|

Counsel and Assistant Secretary

|

|

|

|

|

|

|

Date:

|

November 1, 2021

|

|

|

|

|

|

|

|

|

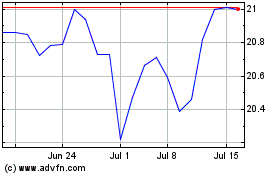

Allstate (NYSE:ALL-I)

Historical Stock Chart

From Aug 2024 to Sep 2024

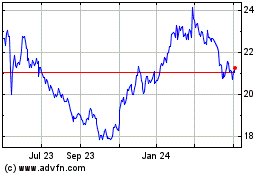

Allstate (NYSE:ALL-I)

Historical Stock Chart

From Sep 2023 to Sep 2024