false000091591300009159132024-10-072024-10-070000915913us-gaap:CommonStockMember2024-10-072024-10-070000915913us-gaap:SeriesAPreferredStockMember2024-10-072024-10-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________________

FORM 8-K

_________________________________

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 7, 2024

_________________________________

ALBEMARLE CORPORATION

(Exact name of registrant as specified in charter)

_________________________________

| | | | | | | | | | | | | | |

| Virginia | | 001-12658 | | 54-1692118 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

4250 Congress Street, Suite 900

Charlotte, North Carolina 28209

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (980) 299-5700

Not applicable

(Former name or former address, if changed since last report.)

_________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a- 12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| COMMON STOCK, $.01 Par Value | | ALB | | New York Stock Exchange |

| DEPOSITARY SHARES, each representing a 1/20th interest in a share of 7.25% Series A Mandatory Convertible Preferred Stock | | ALB PR A | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On October 7, 2024, in connection with the implementation of the new operating structure described in Item 7.01 below, Kristin Coleman will cease serving as Executive Vice President, General Counsel and Corporate Secretary of Albemarle Corporation (the “Company”), and her last day of employment will be November 4, 2024. Ms. Coleman’s separation meets the definition of a qualifying termination under the Company’s severance program applicable to its named executive officers (other than its Chief Executive Officer) and under the standard terms of the Company’s equity awards. As a result, Ms. Coleman will be eligible to receive certain payments and benefits following her separation in accordance therewith.

In addition, in connection with the implementation of such new operating structure, John C. Barichivich III will cease serving as Vice President, Corporate Controller and Chief Accounting Officer of the Company effective upon the appointment of his successor, and his last day of employment will be December 31, 2024. Mr. Barichivich will be entitled to severance under the Albemarle Corporation Severance Pay Plan, and his separation meets the definition of a qualifying termination under the standard terms of the Company’s equity awards. As a result, Mr. Barichivich will be eligible to receive certain payments and benefits following his separation in accordance therewith.

Item 7.01. Submission of Matters to a Vote of Security Holders.

On October 7, 2024, the Company issued a press release announcing a new operating structure that will transition from two core global units to a fully integrated functional model designed to increase agility, deliver significant cost savings and maintain long-term competitiveness. A copy of the press release is filed as Exhibit 99.1 hereto and incorporated herein by reference.

The information in this Item 7.01, including Exhibit 99.1, is furnished pursuant to Item 7.01 of Form 8-K and shall not be deemed “filed” for the purposes of Section 18 of the Exchange Act or otherwise subject to the liability of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

Cautionary Statement Regarding Forward-Looking Statements

This Current Report on Form 8-K contains statements concerning Albemarle’s and its subsidiaries’ expectations, anticipations, intentions, beliefs, or strategies regarding the future, which constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements, which are based on assumptions that we have made as of the date of this Current Report on Form 8-K and are subject to known and unknown risks and uncertainties that could cause actual results, conditions and events to differ materially from those anticipated, often contain words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “should,” “would,” “will” and variations of such words and similar expressions. Factors that could cause actual results to differ materially from the outlook expressed or implied in any forward-looking statement include, without limitation those factors detailed in the reports Albemarle files with the SEC, including those described under “Risk Factors” in Albemarle’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, which are available on the investor section of our website (investors.albemarle.com). These forward-looking statements speak only as of the date of this Current Report on Form 8-K. Albemarle assumes no obligation to provide any revisions to any forward-looking statements should circumstances change, except as otherwise required by securities and other applicable laws.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit | | |

| Number | | Exhibit |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | ALBEMARLE CORPORATION |

| | | |

| Date: October 7, 2024 | | By: | /s/ Neal R. Sheorey |

| | | Neal R. Sheorey |

| | | Executive Vice President and Chief Financial Officer |

Albemarle Announces New Operating Structure to Increase Agility, Drive Cost Efficiencies and Maintain Long-Term Competitiveness

Decision marks next step in comprehensive review of cost and operating structure

CHARLOTTE, N.C., Oct. 7, 2024 – Albemarle Corporation (NYSE: ALB), a global leader in providing essential elements for mobility, energy, connectivity and health, today announced the company’s new operating structure to adapt to dynamic market conditions.

Albemarle’s operating structure will transition from two core global business units – Energy Storage and Specialties – to a fully integrated functional model designed to increase agility, deliver significant cost savings and maintain long-term competitiveness. The move is the next step in the company’s comprehensive review of its cost and operating structure.

As part of this change, effective Nov. 1:

•Specialties Business President Netha Johnson will become chief operations officer and continues to report to Chairman and CEO Kent Masters. In this role, he will lead global manufacturing, research and technology, capital projects and process chemistry execution. Johnson joined Albemarle in 2018 and has more than 25 years of experience in global manufacturing, leadership and general management.

•Energy Storage Business President Eric Norris will become chief commercial officer and continues to report to Masters. In this role, he will oversee enterprise product management, sales and commercial excellence. Norris joined Albemarle in 2018 and has more than 25 years of experience in strategy, corporate development and general management.

“The long-term growth potential of our industry is significant, and this structure enables Albemarle to take greater advantage of our world-class resources, global conversion network and process chemistry expertise while driving to a lower-cost structure,” said Masters. “As our industry evolves, our new operating structure is designed to flex with the complexities of our markets, improve customer centricity and cost-effectively strengthen our core capabilities to maintain our leadership position.”

In addition, the following leaders will report to Masters:

•Melissa Anderson will become chief transformation officer, effective Nov. 1, which reflects her current oversight of people, strategy and transformation.

•Stacy Grant will become general counsel, corporate secretary and chief compliance officer, effective immediately, and succeeds Kristin Coleman, who is leaving the company. Grant joined Albemarle in 2023 and previously served as vice president & deputy general counsel, global corporate affairs.

•Cynthia Lima remains chief external affairs and communications officer and will add oversight responsibility for product stewardship.

•Mark Mummert will become chief capital, resources and integrated supply chain officer, effective Nov. 1, which includes expanded responsibility for resources, joint venture management, customer service and operational excellence.

•Neal Sheorey remains chief financial officer and will add oversight responsibilities for information technology, global business services and real estate.

•Michael Simmons remains president of Ketjen, a wholly owned subsidiary.

Albemarle will continue to report results across its three existing operating segments: Energy Storage, Specialties and Ketjen. During a conference call to discuss its third-quarter 2024 results, Albemarle will provide a further update on its cost and operating structure, including estimated financial impacts. The call is scheduled for Nov. 7 at 8 a.m. ET.

About Albemarle

Albemarle Corporation (NYSE: ALB) leads the world in transforming essential resources into critical ingredients for mobility, energy, connectivity and health. We partner to pioneer new ways to move, power, connect and protect with people and planet in mind. A reliable and high-quality global supply of lithium and bromine allows us to deliver advanced solutions for our customers. Learn more about how the people of Albemarle are enabling a more resilient world at Albemarle.com, LinkedIn and on X (formerly known as Twitter) @AlbemarleCorp.

Albemarle regularly posts information to www.albemarle.com, including notification of events, news, financial performance, investor presentations and webcasts, non-GAAP reconciliations, U.S. Securities and Exchange Commission filings and other information regarding the company, its businesses and the markets it serves.

Forward-Looking Statements

This press release contains statements concerning our expectations, anticipations, intentions, beliefs or strategies regarding the future, which constitute forward- looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements, which are based on assumptions that we have made as of the date hereof and are subject to known and unknown risks and uncertainties that could cause actual results, conditions and events to differ materially from those anticipated, often contain words such as "anticipate," "believe," "could," "estimate," "expect," "focus," "intend," "may," "should," "would," "will" and variations of such words and similar expressions. Forward-looking statements may include, without limitation, statements regarding future or expected: operating structure, cost savings, long-term competitiveness, industry growth potential, market conditions, and all other information relating to matters that are not historical facts. Factors that could cause our actual results to differ materially from the outlook expressed or implied in any forward-looking statement include, without limitation: changes in economic and business conditions; adverse changes in liquidity or financial or operating performance; fluctuations in lithium market prices, and the other factors detailed from time to time in the reports we file with the U.S. Securities and Exchange Commission, including those described under "Risk Factors" in our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q. These forward-looking statements speak only as of the date of this press release. We assume no obligation to provide any revisions to any forward-looking statements should circumstances change, except as otherwise required by securities and other applicable laws.

Media Contact: Peter Smolowitz, +1 (980) 308-6310, media@albemarle.com

Investor Relations Contact: +1 (980) 299-5700, invest@albemarle.com

v3.24.3

Cover Document

|

Oct. 07, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 07, 2024

|

| Entity Registrant Name |

ALBEMARLE CORPORATION

|

| Entity Incorporation, State or Country Code |

VA

|

| Entity File Number |

001-12658

|

| Entity Tax Identification Number |

54-1692118

|

| Entity Address, Address Line One |

4250 Congress Street, Suite 900

|

| Entity Address, City or Town |

Charlotte

|

| Entity Address, State or Province |

NC

|

| Entity Address, Postal Zip Code |

28209

|

| City Area Code |

980

|

| Local Phone Number |

299-5700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0000915913

|

| Common Stock |

|

| Cover [Abstract] |

|

| Title of 12(b) Security |

COMMON STOCK, $.01 Par Value

|

| Trading Symbol |

ALB

|

| Security Exchange Name |

NYSE

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

COMMON STOCK, $.01 Par Value

|

| Trading Symbol |

ALB

|

| Security Exchange Name |

NYSE

|

| Series A Preferred Stock |

|

| Cover [Abstract] |

|

| Title of 12(b) Security |

DEPOSITARY SHARES, each representing a 1/20th interest in a share of 7.25% Series A Mandatory Convertible Preferred Stock

|

| Trading Symbol |

ALB PR A

|

| Security Exchange Name |

NYSE

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

DEPOSITARY SHARES, each representing a 1/20th interest in a share of 7.25% Series A Mandatory Convertible Preferred Stock

|

| Trading Symbol |

ALB PR A

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesAPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

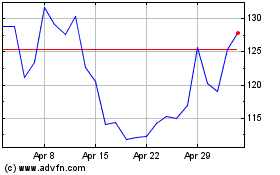

Albemarle (NYSE:ALB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Albemarle (NYSE:ALB)

Historical Stock Chart

From Dec 2023 to Dec 2024