Announcement of New Revolving Credit Facility

November 04 2024 - 5:20PM

Willis Lease Finance Corporation (NASDAQ: WLFC) (“WLFC” or the

“Company”) today reported that on October 31, 2024, the Company

entered into a new, $1.0 billion, five-year, revolving credit

facility (the “Credit Agreement”) among WLFC, certain wholly-owned

subsidiaries of WLFC, as guarantors, the lenders party thereto from

time to time (the “Lenders”), and Bank of America, N.A., as

administrative agent, collateral agent, swing line lender, and

letter of credit issuer. The Credit Agreement replaced the existing

$500.0 million revolving credit agreement, dated as of June 7, 2019

(as amended and restated, the “Existing Credit Agreement”), among

WLFC, the lenders party thereto from time to time and MUFG Bank,

Ltd. as agent.

Under the Credit Agreement, WLFC may request an

additional increase of the aggregate commitments from time to time

up to an aggregate additional $250.0 million from the lenders, who

may elect to make such increase available, upon the satisfaction of

certain conditions.

Proceeds from the revolving credit facility may

be used for general corporate purposes. The credit facility will be

available on a revolving basis until October 31, 2029, and WLFC may

request to extend the maturity, subject to lender approval.

Loans under the Credit Agreement will bear

interest based on a floating rate (Term SOFR) plus a margin. In

addition, WLFC has agreed to pay Bank of America, N.A. an unused

line fee, quarterly in arrears, as well as pay other fees to Bank

of America, N.A. and to the Lenders as separately agreed upon in

writing.

The Credit Agreement also requires WLFC to

maintain, as of the last day of each Measurement Period (as defined

in the Credit Agreement), commencing with the last day of the

fiscal quarter ending December 31, 2024, a Consolidated Interest

Coverage Ratio (as defined in the Credit Agreement) of no less than

2.25 to 1.00, and a Consolidated Leverage Ratio (as defined in the

Credit Agreement ) of no greater than 4.25 to 1.00 through June 30,

2025 and no greater than 4.00 to 1.00 thereafter.

“We are very excited to have closed our new,

expanded revolving credit facility,” said Scott B. Flaherty, the

Company’s Chief Financial Officer. “Our new facility will provide

incremental capital to support the growth we are experiencing

across the WLFC platform.”

Willis Lease Finance

Corporation

Willis Lease Finance Corporation (“WLFC”) leases

large and regional spare commercial aircraft engines, auxiliary

power units and aircraft to airlines, aircraft engine manufacturers

and maintenance, repair and overhaul providers worldwide. These

leasing activities are integrated with engine and aircraft trading,

engine lease pools and asset management services through Willis

Asset Management Limited, as well as various end-of-life solutions

for engines and aviation materials provided through Willis

Aeronautical Services, Inc. Additionally, through Willis Engine

Repair Center®, Jet Centre by Willis, and Willis Aviation Services

Limited, the Company’s service offerings include Part 145 engine

maintenance, aircraft line and base maintenance, aircraft

disassembly, parking and storage, airport FBO and ground and cargo

handling services.

Except for historical information, the matters

discussed in this press release contain forward-looking statements

that involve risks and uncertainties. Do not unduly rely on

forward-looking statements, which give only expectations about the

future and are not guarantees. Forward-looking statements speak

only as of the date they are made, and we undertake no obligation

to update them. Our actual results may differ materially from the

results discussed in forward-looking statements. Factors that might

cause such a difference include, but are not limited to: the

effects on the airline industry and the global economy of events

such as war, terrorist activity and pandemics; changes in oil

prices, rising inflation and other disruptions to world markets;

trends in the airline industry and our ability to capitalize on

those trends, including growth rates of markets and other economic

factors; risks associated with owning and leasing jet engines and

aircraft; our ability to successfully negotiate equipment

purchases, sales and leases, to collect outstanding amounts due and

to control costs and expenses; changes in interest rates and

availability of capital, both to us and our customers; our ability

to continue to meet changing customer demands; regulatory changes

affecting airline operations, aircraft maintenance, accounting

standards and taxes; the market value of engines and other assets

in our portfolio; and risks detailed in the Company’s Annual Report

on Form 10-K and other continuing reports filed with the Securities

and Exchange Commission.

|

CONTACT: |

Scott B.

Flaherty |

| |

EVP & Chief Financial Officer |

| |

561.413.0112 |

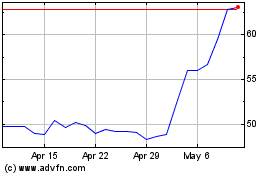

Willis Lease Finance (NASDAQ:WLFC)

Historical Stock Chart

From Nov 2024 to Dec 2024

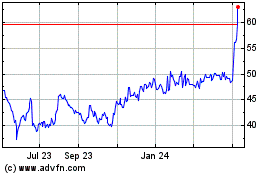

Willis Lease Finance (NASDAQ:WLFC)

Historical Stock Chart

From Dec 2023 to Dec 2024