Announcement of Series A Preferred Stock Purchase Agreement

October 01 2024 - 7:00AM

Willis Lease Finance Corporation (NASDAQ: WLFC) (“WLFC”) today

reported that on September 27, 2024, WLFC entered into a Series A

Preferred Stock Purchase Agreement with the Development Bank of

Japan Inc., which refinances WLFC’s $50 million of aggregate Series

A-1 and Series A-2 preferred stock into one $65 million preferred

stock series with a seven-year term, at the rate per annum of 8.35%

per share.

“The Development Bank of Japan’s preferred stock

investment is the result of a strong, long-term relationship

between our two organizations, and we are proud to have them as

partners,” said Scott B. Flaherty, Executive Vice President and

Chief Financial Officer of WLFC. “The expansion of their investment

provides WLFC with incremental equity to support the continued

growth of our business.”

Willis Lease Finance

Corporation

Willis Lease Finance Corporation leases large

and regional spare commercial aircraft engines, auxiliary power

units and aircraft to airlines, aircraft engine manufacturers and

maintenance, repair, and overhaul providers worldwide. These

leasing activities are integrated with engine and aircraft trading,

engine lease pools and asset management services through Willis

Asset Management Limited, as well as various end-of-life solutions

for engines and aviation materials provided through Willis

Aeronautical Services, Inc. Additionally, through Willis Engine

Repair Center®, Jet Centre by Willis, and Willis Aviation Services

Limited, the Company’s service offerings include Part 145 engine

maintenance, aircraft line and base maintenance, aircraft

disassembly, parking and storage, airport FBO and ground and cargo

handling services.

Except for historical information, the matters

discussed in this press release contain forward-looking statements

that involve risks and uncertainties. Do not unduly rely on

forward-looking statements, which give only expectations about the

future and are not guarantees. Forward-looking statements speak

only as of the date they are made, and we undertake no obligation

to update them. Our actual results may differ materially from the

results discussed in forward-looking statements. Factors that might

cause such a difference include, but are not limited to: the

effects on the airline industry and the global economy of events

such as war, terrorist activity and the COVID-19 pandemic; changes

in oil prices, rising inflation and other disruptions to world

markets; trends in the airline industry and our ability to

capitalize on those trends, including growth rates of markets and

other economic factors; risks associated with owning and leasing

jet engines and aircraft; our ability to successfully negotiate

equipment purchases, sales and leases, to collect outstanding

amounts due and to control costs and expenses; changes in interest

rates and availability of capital, both to us and our customers;

our ability to continue to meet changing customer demands;

regulatory changes affecting airline operations, aircraft

maintenance, accounting standards and taxes; the market value of

engines and other assets in our portfolio; and risks detailed in

WLFC’s Annual Report on Form 10-K and other continuing reports

filed with the Securities and Exchange Commission.

|

CONTACT: |

Scott B. Flaherty |

|

|

EVP & Chief Financial Officer |

|

|

561.349.9989 |

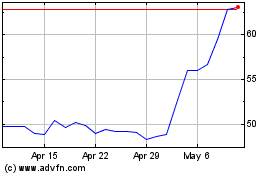

Willis Lease Finance (NASDAQ:WLFC)

Historical Stock Chart

From Nov 2024 to Dec 2024

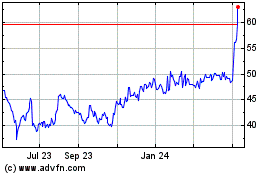

Willis Lease Finance (NASDAQ:WLFC)

Historical Stock Chart

From Dec 2023 to Dec 2024