CREDIT MARKETS: Strong Day For Corporates, Treasurys

March 30 2011 - 4:56PM

Dow Jones News

The corporate bond market was buoyant Wednesday, supported by a

bullish stock market, and Treasurys had a stellar day after U.S.

jobs data came out short of expectations.

Investment-Grade Bonds

U.S. corporate borrowers flocked to the high-grade new issuance

market, but less so than Tuesday when $7.2 billion was sold. Some

issuers were scrambling to finalize deal terms before the close of

the first quarter and ahead of Friday's closely watched payrolls

data.

Archer Daniels Midland Co. (ADM) had $1.75 billion of debt on

offer, including 10- and 30-year notes. The $750 million 10-year

piece was launched with a risk premium of 95 basis points over

Treasurys while the $1 billion, 30-year tranche was launched at 120

basis points over Treasurys.

The deal includes a covenant that will be triggered if a change

of company control takes place, allowing noteholders to redeem

their securities at a premium of $101 cents on the dollar.

Meanwhile, Aviation Capital Group launched $750 million of

10-year notes that were expected to offer a 6.75% yield. The deal

was more than doubled in size from an originally planned $350

million due to heavy investor demand, according to a person

familiar with the issue.

Smaller deals were also on offer from Analog Devices Inc. (ADI)

with $375 million, Brandywine Operating Co. with $250 million, and

Verisk Analytics Inc. (VRSK) with $450 million.

So far this quarter there have been $274.9 billion of

investment-grade corporate bonds sold, said Dealogic.

In the secondary market, Time Warner Inc. (TWX) bonds were the

most actively traded, according to MarketAxess.

Junk Bonds

There was also a strong pipeline of high-yield debt sales to

match the investment-grade side. Some $90.56 billion has already

been sold this quarter--about $41 million from the highest

quarterly volume on record since 1995, according to Dealogic.

Auto parts maker Visteon Corp. (VC) is planning to sell $500

million of senior unsecured bonds by the end of this week, with

price guidance in the area of 6.75%.

Proceeds from the notes, which mature in 2019, with be used

along with cash on hand to retire Visteon's senior secured term

loan due 2017.

Also in the market is First Data Corp. with a $750 million bond

offering to help it repay term loans.

The eight-year senior secured notes are expected to price at par

with a 7.375% coupon, according to a person familiar with the deal,

at the tight end of earlier price guidance in the area of

7.375-7.625%.

Asset-Backed Securities

Over the next 24 months, more than $100 billion of credit card

ABS is scheduled to mature, with the majority of it due in the

first half of 2012. Consequently, credit card issuers should

"opportunistically issue longer-maturity fixed-rate ABS to lock in

the low interest rates available in the current environment," Wells

Fargo analysts said, noting there is "substantial pent-up demand"

for such deals.

Agency Mortgage-Backed Securities

With moderate origination, agency mortgage backed securities

continued to grind tighter, said Paul Jacob, a mortgage strategist

at Banc of Manhattan Capital. Risk premiums were last quoted at 144

basis points, down from 145 basis points Tuesday.

Municipal Bonds

Prices of top-rated tax-exempt bonds fell, as there has been

some pressure from dealers looking to sell inventory before

quarter-end. According to a benchmark scale from Thomson Reuters

Municipal Market Data, muni prices fell 2 to 4 basis points, with

the most pressure seen in bonds maturing from 2018 to 2031.

There are few new bond sales this week. But the downgrade late

Tuesday of DeKalb County in Georgia by Standard & Poor's, then

withdrawal of its ratings because of the county's "inability to

provide sufficient and consistent information" on its finances,

also weighed on the market.

Treasurys

Treasurys broke the longest losing streak in more than two

decades, with prices rising after weaker U.S. data and as the

government wrapped up its latest round of Treasury note

auctions.

The government had to pay up to find homes for its two-, five-

and seven-year notes this week--but the auctions' passing allowed

bond prices to rise leading into Friday's key nonfarm payrolls

report.

Kevin Walter, head of trading at BNP Paribas in New York, said

that many market participants are reluctant to head into Friday's

employment report low on Treasurys, having been burned in the past

when payrolls gained by less than expected.

Walter said there was buying interest out of Japan Wednesday and

believes Asian investors' interest in Treasurys could pick up even

more next week after their year-end.

In afternoon trading, the 10-year note was up 9/32 to yield

3.452%, and the two-year was up 1/32 to yield 0.801%.

-By Katy Burne, Dow Jones Newswires; 212-416-3084;

katy.burne@dowjones.com

--Kellie Geressy-Nilsen, Anusha Shrivastava, Kelly Nolan and

Deborah Lynn Blumberg contributed to this article.

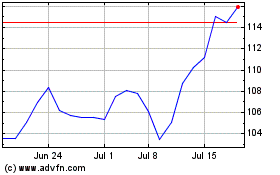

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jul 2023 to Jul 2024