UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-8

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

VERB

TECHNOLOGY COMPANY, INC.

(Exact

name of Registrant as specified in its charter)

| Nevada |

|

90-1118043 |

| (State

or other jurisdiction of |

|

(I.R.S.

Employer |

| incorporation

or organization) |

|

Identification

Number) |

3024

Sierra Juniper Court

Las

Vegas, Nevada 89138

(855)

250-2300

(Address,

including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Verb

Technology Company, Inc.

2019

Stock and Incentive Compensation Plan

(Full

title of the plan)

Rory

J. Cutaia

Chief

Executive Officer

Verb

Technology Company, Inc.

3024

Sierra Juniper Court

Las

Vegas, NV 89138

(855)

250-2300

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Please

send copies of all communications to:

Gregory

Sichenzia, Esq.

Marcelle

S. Balcombe, Esq.

Sichenzia

Ross Ference Carmel LLP

1185

Avenue of the Americas, 31st Floor

New

York, NY 10036

(212)

930-9700

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

| |

|

Emerging

growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

EXPLANATORY

NOTE

This

Registration Statement on Form S-8 (this “Registration Statement”) is being filed by Verb Technology Company, Inc.,

a Nevada corporation (the “Company”) to register an additional 15,000,000 shares of common stock, $0.0001 par value

per share (the “Common Stock”), issuable under the Verb Technology Company, Inc. 2019 Stock and Incentive Compensation

Plan, as amended (the “2019 Plan”). The Company previously registered an aggregate of 200,000 shares of Common Stock

on Form S-8 (File No.: 333-235684) issuable pursuant to the Company’s 2019 Plan. The additional shares being registered are

to cover future grants under the Company’s 2019 Plan to employees, consultants and directors, as may be approved by the Company’s

Board of Directors from time to time. The Company is not offering any shares of Common Stock hereunder for sale in a capital-raising

transaction.

This

Registration Statement also includes a prospectus (the “Reoffer Prospectus”) prepared in accordance with General Instruction

C of Form S-8 and in accordance with the requirements of Part I of Form S-3. This Reoffer Prospectus for shares granted under the

2019 Plan may be used for the reoffer and resale of shares of Common Stock on a continuous or delayed basis that may be deemed to

be “restricted securities” and/or “control securities” within the meaning of the Securities Act of 1933, as amended

(the “Securities Act”), and the rules and regulations promulgated thereunder, that are issuable to certain of our

executive officers, employees, consultants and directors identified in the Reoffer Prospectus. The number of shares of Common Stock included

in the Reoffer Prospectus represents shares of Common Stock issuable to the selling stockholders pursuant to equity awards, including

stock options and restricted stock grants, granted to the selling stockholders and does not necessarily represent a present intention

to sell any or all such shares of Common Stock.

As

specified in General Instruction C of Form S-8, until such time as we meet the registrant requirements for use of Form S-3, the number

of shares of Common Stock to be offered by means of this reoffer prospectus, by each of the selling security holders, and any other person

with whom he or she is acting in concert for the purpose of selling our shares of Common Stock, may not exceed, during any three month

period, the amount specified in Rule 144(e) of the Securities Act.

Part

I

INFORMATION

REQUIRED IN THE SECTION 10(a) PROSPECTUS

Item

1. Plan Information.

The

Company will provide each recipient of a grant under the 2019 Plan (the “Recipients”) with documents that contain

information related to the 2019 Plan, and other information including, but not limited to, the disclosure required by Item 1 of Form

S-8, which information is not required to be and is not being filed as a part of this Registration Statement on Form S-8 (the “Registration

Statement”) or as prospectuses or prospectus supplements pursuant to Rule 424 under the Securities Act. The foregoing information

and the documents incorporated by reference in response to Item 3 of Part II of this Registration Statement, taken together, constitute

a prospectus that meets the requirements of Section 10(a) of the Securities Act. A Section 10(a) prospectus will be given to each Recipient

who receives shares of Common Stock covered by this Registration Statement, in accordance with Rule 428(b)(1) under the Securities Act.

Item

2. Registrant Information and Employee Plan Annual Information.

The

documents containing the information specified in Part I of this Registration Statement will be sent or given to participants in the

2019 Plan, as specified by Rule 428(b)(1) promulgated under the Securities Act. Such documents need not be filed with the Securities

and Exchange Commission (the “Commission” or the “SEC”) either as part of this Registration Statement

or as prospectuses or prospectus supplements pursuant to Rule 424 promulgated under the Securities Act. These documents and the documents

incorporated by reference in this Registration Statement pursuant to Item 3 of Part II of this Registration Statement, taken together,

constitute a prospectus that meets the requirement of Section 10(a) of the Securities Act.

Rory

J. Cutaia

Chief

Executive Officer

3024

Sierra Juniper Court

Las

Vegas, NV 89138

REOFFER

PROSPECTUS

VERB

TECHNLOGY COMPANY, INC.

Up

to 109,829 Shares of Common Stock

Issuable

under certain grants under

Verb

Technology Company, Inc. 2019 Stock and Incentive Compensation Plan

This

reoffer prospectus relates to the public resale, from time to time, of an aggregate of 109,829 shares (the “Shares”)

of our common stock, $0.0001 par value per share (the “Common Stock”) by certain security holders identified herein

in the section entitled “Selling Securityholders”. Such shares may be acquired in connection with common stock underlying

options issued under the Verb Technology Company, Inc. 2019 Stock and Incentive Compensation Plan. You should read this prospectus carefully

before you invest in our Common Stock.

Such

resales shall take place on Nasdaq, or such other stock market or exchange on which our Common Stock may be listed or quoted, in negotiated

transactions or otherwise, at market prices prevailing at the time of the sale or at prices otherwise negotiated (see “Plan of

Distribution” starting on page 6 of this prospectus). We will receive no part of the proceeds from sales made under this reoffer

prospectus. The Selling Securityholders will bear all sales commissions and similar expenses. Any other expenses incurred by us in connection

with the registration and offering and not borne by the Selling Securityholders will be borne by us.

This

reoffer prospectus has been prepared for the purposes of registering our shares of Common Stock under the Securities Act to allow for

future sales by Selling Securityholders on a continuous or delayed basis to the public without restriction, provided that the amount

of shares of Common Stock to be offered or resold under this Reoffer Prospectus by each Selling Securityholder or other person with whom

he or she is acting in concert for the purpose of selling shares of Common Stock, may not exceed, during any three-month period, the

amount specified in Rule 144(e) under the Securities Act. We have not entered into any underwriting arrangements in connection with the

sale of the shares covered by this reoffer prospectus. The Selling Securityholders identified in this reoffer prospectus, or their pledgees,

donees, transferees or other successors-in-interest, may offer the shares covered by this reoffer prospectus from time to time through

public or private transactions at prevailing market prices, at prices related to prevailing market prices or at privately negotiated

prices.

Investing

in our Common Stock involves risks. See “Risk Factors” beginning on page 4 of this reoffer prospectus. These are

speculative securities.

Our

Common Stock is quoted on the Nasdaq Capital Market under the symbol “VERB” and the last reported sale price of our Common

Stock on December 27, 2024 was $6.60 per share.

NEITHER

THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED

IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The

date of this prospectus is December 30, 2024

VERB

TECHNOLOGY COMPANY, INC.

TABLE

OF CONTENTS

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus and the documents and information incorporated by reference in this prospectus include forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act

of 1934, as amended, or the Exchange Act. These statements are based on our management’s beliefs and assumptions and on information

currently available to our management. Such forward-looking statements include those that express plans, anticipation, intent, contingency,

goals, targets or future development and/or otherwise are not statements of historical fact.

All

statements in this prospectus and the documents and information incorporated by reference in this prospectus that are not historical

facts are forward-looking statements. We may, in some cases, use terms such as “anticipates,” “believes,” “could,”

“estimates,” “expects,” “intends,” “may,” “plans,” “potential,”

“predicts,” “projects,” “should,” “will,” “would” or similar expressions

or the negative of such items that convey uncertainty of future events or outcomes to identify forward-looking statements.

Forward-looking

statements are made based on management’s beliefs, estimates and opinions on the date the statements are made and we undertake

no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except

as may be required by applicable law. Although we believe that the expectations reflected in the forward-looking statements are reasonable,

we cannot guarantee future results, levels of activity, performance or achievements.

We

caution you therefore that you should not rely on any of these forward-looking statements as statements of historical fact or as guarantees

or assurances of future performance.

Information

regarding market and industry statistics contained in this prospectus, including the documents that we incorporate by reference, is included

based on information available to us that we believe is accurate. It is generally based on academic and other publications that are not

produced for purposes of securities offerings or economic analysis. Forecasts and other forward-looking information obtained from these

sources are subject to the same qualifications and the additional uncertainties accompanying any estimates of future market size, revenue

and market acceptance of products and services. Except as required by U.S. federal securities laws, we have no obligation to update forward-looking

information to reflect actual results or changes in assumptions or other factors that could affect those statements.

PROSPECTUS

SUMMARY

The

Commission allows us to “incorporate by reference’’ certain information that we file with the Commission,

which means that we can disclose important information to you by referring you to those documents. The information incorporated by reference

is considered to be part of this prospectus, and information that we file later with the Commission will update automatically, supplement

and/or supersede the information disclosed in this prospectus. Any statement contained in a document incorporated or deemed to be incorporated

by reference in this prospectus shall be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement

contained in this prospectus or in any other document that also is or is deemed to be incorporated by reference in this prospectus modifies

or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded,

to constitute a part of this prospectus. You should read the following summary together with the more detailed information regarding

our company, our Common Stock and our financial statements and notes to those statements appearing elsewhere in this prospectus or incorporated

herein by reference.

Except

where the context otherwise requires, the terms, “we,” “us,” “our” or

“the Company,” refer to the business of Verb Technology Company, Inc., a Nevada corporation.

Our

Company

Our

business is currently comprised of three distinct, yet complimentary business units, all three of which are currently operating and generating

revenue, and one of which is currently operating in “stealth mode” as we continue to refine the user experience for that

business unit as we continue to ramp sales. The first business unit is MARKET.live focused on interactive video-based social commerce.

Our MARKET.live platform is a multi-vendor, livestream social shopping destination leveraging the convergence of ecommerce and entertainment.

Brands, retailers and creators that join MARKET.live have the ability to broadcast livestream shopping events simultaneously on numerous

social media channels, including TikTok, YouTube, LinkedIn, Facebook, Instagram, Twitch, as well as on MARKET.live, reaching exponentially

larger audiences. The Company’s recent technological integrations with META, created a seamless, native, friction-free checkout

process for Facebook and Instagram users to purchase MARKET.live vendors’ products within each of those popular apps. This integration

allows Facebook and Instagram users to browse products featured in MARKET.live shoppable videos, place products in a native shopping

cart and checkout – all without leaving Facebook or Instagram. We recently announced a technology integration with Pinterest and

we will continue to expand the universe of social platforms our clients can access through our platform.

Last

year we completed development work on a new MARKET.live capability that facilitated a deeper integration into the TikTok Shop social

media platform, designed to expose MARKET.live shoppable programming to tens of millions of potential viewers/purchasers. This capability

allows shoppers watching a MARKET.live stream on TikTok to stay on that site and check out through that site, eliminating the friction

or reluctance of TikTok users to leave their TikTok feed in order to complete their purchase on MARKET.live. Our technology integration

allows the purchase data to flow back through MARKET.live and to the individual vendors and stores on MARKET.live seamlessly for fulfillment

of the orders.

Earlier

this year, we announced an expanded strategic relationship with TikTok evidenced by a formal partnership with TikTok Shop pursuant to

which MARKET.live became a service provider for TikTok Shop and officially designated as a TikTok Shop Partner (TSP). Under the terms

of the partnership, TikTok Shop refers consumer brands, retailers, influencers and affiliates leads to MARKET.live for a menu of MARKET.live

contract-based recurring fee revenue services that include, among other things, assistance in onboarding to TikTok Shop and establishing

a TikTok store, hosting training sessions and webinars for prospective TikTok Shop sellers, full creative services including content

creation and full remote and in-studio production services, host/influencer casting and management, TikTok Shop maintenance and enhancements

for existing TikTok clients’ stores. The same services are currently provided to consumer brands that contact us directly or through

several brand agencies with which we maintain affiliate relationships.

The

second business unit is GO FUND YOURSELF!, a revolutionary interactive social crowd funding platform for public and private companies

seeking broad-based exposure across numerous social media channels for their crowd-funded Regulation CF and Regulation A offerings. The

platform combines a ground-breaking interactive TV show with MARKET.live’s back-end capabilities allowing viewers to tap on their

screen to facilitate an investment, in real time, as they watch companies presenting before the show’s panel of “Titans”.

Presenting companies that sell consumer products are able to offer their products directly to viewers during the show in real time through

shoppable onscreen icons. The Go Fund Yourself business unit generates revenue from cash fees we charge to issuers to appear on the show

and for marketing, ad, and content creation and distribution services. For those issuers that sell products during each airing of the

show through our platform, we charge a fee up to 25% of the gross sales revenue for all products sold.

Our

Corporate Information

We

are a Nevada corporation that was incorporated in December 2012. Our principal executive and administrative offices are located at 3024

Sierra Juniper Court, Las Vegas, NV 89138, and our telephone number is (855) 250-2300. Our website address is https://www.verb.tech.

We are subject to the informational requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

and in accordance therewith, we file annual, quarterly and current reports, proxy statements and other information with the SEC. The

SEC maintains a website that contains reports, proxy and information statements, and other information regarding issuers that file electronically

with the SEC. The address of the SEC’s website is www.sec.gov. We make available free of charge on or through our website our Annual

Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished

pursuant to Section 13(a) or 15(d) of the Exchange Act, as soon as reasonably practicable after we electronically file such material

with or otherwise furnish it to the SEC. Information on or accessed through our website or the SEC’s website is not incorporated

into this reoffer prospectus.

THE

OFFERING

| Outstanding

Common Stock: |

|

993,120

shares of our Common Stock are outstanding as of December 30, 2024. |

| |

|

|

| Common

Stock Offered: |

|

Up

to 109,829 shares of Common Stock for sale by the selling securityholders (which include our executive officers and directors) for

their own account pursuant to the 2019 Plan. |

| |

|

|

| Selling

Securityholders: |

|

The

selling securityholders are set forth in the section entitled “Selling Securityholders” of this reoffer prospectus on

page 4. The amount of securities to be offered or resold by means of the reoffer prospectus by the designated selling securityholders

may not exceed, during any three month period, the amount specified in Rule 144(e). |

| |

|

|

| Use

of proceeds: |

|

We

will not receive any proceeds from the sale of our Common Stock by the selling securityholders. We would, however, receive proceeds

upon the exercise of the stock options by those who receive options under the 2019 Plan and exercise such options for cash. Any cash

proceeds will be used by us for general corporate purposes. |

| |

|

|

| Risk

Factors: |

|

The

securities offered hereby involve a high degree of risk. See “Risk Factors.” |

| |

|

|

| Nasdaq

trading symbol: |

|

VERB |

RISK

FACTORS

An

investment in shares of our Common Stock is highly speculative and involves a high degree of risk. We face a variety of risks that may

affect our operations or financial results and many of those risks are driven by factors that we cannot control or predict. Before investing

in our Common Stock, you should carefully consider the risks below and set forth under the caption “Risk Factors” and elsewhere

in our most recent Annual Report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, that we have filed or

may file with the Securities and Exchange Commission (the “SEC”), which are incorporated by reference herein, and subsequent

reports filed with the SEC, together with the financial and other information contained or incorporated by reference in this prospectus.

If any of these risks actually occurs, our business, prospects, financial condition and results of operations could be materially adversely

affected. In that case, the trading price of our Common Stock would likely decline and you may lose all or a part of your investment.

Only those investors who can bear the risk of loss of their entire investment should invest in our Common Stock.

USE

OF PROCEEDS

The

shares which may be sold under this reoffer prospectus will be sold for the respective accounts of each of the Selling Securityholders

listed herein (which includes our executive officers and directors). Accordingly, we will not realize any proceeds from the sale of the

shares of our Common Stock. We will receive proceeds from the exercise of the options; however, no assurance can be given as to when

or if any or all of the options will be exercised. If any options are exercised, the proceeds derived therefrom will be used for working

capital and general corporate purposes. All expenses of the registration of the shares will be paid by us. See “Selling Securityholders”

and “Plan of Distribution.”

SELLING

SECURITYHOLDERS

We

are registering for resale the shares covered by this prospectus to permit the Selling Securityholders identified below and their pledgees,

donees, transferees and other successors-in-interest that receive their securities from a Selling Securityholder as a gift, partnership

distribution or other non-sale related transfer after the date of this prospectus to resell the shares when and as they deem appropriate.

The Selling Securityholders acquired, or may acquire, these shares from us pursuant to the 2019 Plan. The shares may not be sold or otherwise

transferred by the Selling Securityholders unless and until the applicable awards vest and are exercised, as applicable, in accordance

with the terms and conditions of the 2019 Plan.

The

following table sets forth:

| |

● |

the

name of each Selling Securityholder; |

| |

|

|

| |

● |

the

number and percentage of shares of our Common Stock that each Selling Securityholder beneficially owned as of December 30,

2024 prior to the offering for resale of the shares under this prospectus; |

| |

|

|

| |

● |

the

number of shares of our Common Stock that may be offered for resale for the account of each Selling Securityholder under this prospectus;

and |

| |

|

|

| |

● |

the

number and percentage of shares of our Common Stock to be beneficially owned by each Selling Securityholder after the offering of

the resale shares (assuming all of the offered resale shares are sold by such Selling Securityholder). |

Information

with respect to beneficial ownership is based upon information obtained from the Selling Securityholders. Because the Selling Securityholders

may offer all or part of the shares of Common Stock, which they own pursuant to the offering contemplated by this reoffer prospectus,

and because its offering is not being underwritten on a firm commitment basis, no estimate can be given as to the amount of shares that

will be held upon termination of this offering.

The

number of shares in the column “Number of Shares Being Offered’’ represents all of the shares of our Common Stock that

each Selling Securityholder may offer under this prospectus. We do not know how long the Selling Securityholders will hold the shares

before selling them or how many shares they will sell. The shares of our Common Stock offered by this prospectus may be offered from

time to time by the Selling Securityholders listed below. We cannot assure you that any of the Selling Securityholders will offer for

sale or sell any or all of the shares of Common Stock offered by them by this prospectus.

| | |

Number

of Shares Beneficially

Owned Prior to Offering (1) | |

Number

of

Shares Being | | |

Number

of Shares Beneficially

Owned After Offering (2) | |

| Securityholders | |

Number | |

Percent

(%) | | |

Offered | | |

Number | | |

Percent

(%) | |

| Rory

J. Cutaia | |

1,574 | (3) |

| *

| | |

| 52,890 | (4) | |

| 54,464 | | |

| 4.9 | |

| James

P. Geiskopf | |

1,027 | (5) |

| *

| | |

| 16,310 | (6) | |

| 17,337 | | |

| 1.6 | |

| Kenneth

S. Cragun | |

457 | (7) |

| *

| | |

| 8,155 | (8) | |

| 8,612 | | |

| | * |

| Bill

J. Rivard | |

253 | (9) |

| *

| | |

| 23,455 | (10) | |

| 23,708 | | |

| 2.1 | |

| Edmund

C. Moy | |

930 | (11) |

| *

| | |

| 9,019 | (12) | |

| 9,949 | | |

| | * |

| (1) |

The

number and percentage of shares beneficially owned is determined in accordance with Rule

13d-3 of the Securities Exchange Act of 1934, as amended, and the information is not necessarily

indicative of beneficial ownership for any other purpose. Under such rule, beneficial ownership

includes any shares as to which the Selling Securityholder has sole or shared voting power

or investment power and also any shares which the Selling Securityholder has the right to

acquire within 60 days. Applicable percentage ownership is based on 993,120 shares of Common

Stock outstanding as of December 30, 2024.

|

| |

|

| (2) |

Assumes

that all shares of Common Stock to be offered, as set forth above, are sold pursuant to this

offering and that no other shares of Common Stock are acquired or disposed of by the Selling

Securityholders prior to the termination of this offering. Because the Selling Securityholders

may sell all, some or none of their shares of Common Stock or may acquire or dispose of other

shares of Common Stock, no reliable estimate can be made of the aggregate number of shares

of Common Stock that will be sold pursuant to this offering or the number or percentage of

shares of Common Stock that each Selling Securityholder will own upon completion of this

offering.

|

| |

|

| (3) |

Includes:

(i) 846 shares of common stock held directly by Mr. Cutaia, (ii) 30 shares of common stock held by Cutaia Media Group Holdings, LLC

(an entity over which Mr. Cutaia has dispositive and voting authority), (iii) 7 shares of common stock held by Mr. Cutaia’s

spouse (as to which shares, he disclaims beneficial ownership), (iv) 1 share of common stock held jointly by Mr. Cutaia and his spouse,

(v) 666 shares of common stock underlying stock options exercisable within 60 days of December 30, 2024 and (vi) 24 shares of common

stock underlying restricted stock units that will vest within 60 days of December 30, 2024. This amount excludes 50,981 shares of

common stock underlying restricted stock units and 1,910 shares of common stock underlying stock options that will not vest within

60 days of December 30, 2024. |

| |

|

| (4) |

Includes:

(i) 1,910 shares of common stock underlying stock options and (ii) 50,981 shares of common stock underlying restricted stock units. |

| |

|

| (5) |

Includes:

(i) 168 shares of common stock held directly, and (ii) 1 share of common stock held by Mr.

Geiskopf’s children and (ii) 858 shares of common stock underlying stock options exercisable

within 60 days of December 30, 2024. This amount excludes 16,310 shares of common stock underlying

restricted stock units that will not vest within 60 days of December 30, 2024.

|

| |

|

| (6) |

Includes:

(i) 16,310 shares of common stock underlying restricted stock units.

|

| |

|

| (7) |

Includes:

(i) 19 shares

of common stock held directly, and (ii) 438 shares of common stock underlying stock options

exercisable within 60 days of December 30, 2024. This amount excludes 8,155 shares of common

stock underlying restricted stock units that will not vest within 60 days of December 30,

2024.

|

| (8) |

Includes:

(i) 8,155 shares of common stock underlying restricted stock units.

|

| |

|

| (9) |

Includes:

(i) 239 shares of common stock held directly and (ii) 14 shares of common stock underlying stock options exercisable within 60 days

of December 30, 2024. This amount excludes 23,450 shares of common stock underlying restricted stock units and 5 shares of common

stock underlying stock options that will not vest within 60 days of December 30, 2024. |

| |

|

| (10) |

Includes:

(i) 5 shares of common stock underlying stock options and (ii) 23,450 shares of common stock

underlying restricted stock units.

|

| |

|

| (11) |

Includes:

930 shares of common stock underlying stock options exercisable within 60 days of December

30, 2024. This amount excludes 9,019 shares of common stock underlying stock options that

will not vest within 60 days of December 30, 2024.

|

| |

|

| (12) |

Includes:

9,019 shares of common stock underlying stock options.

|

PLAN

OF DISTRIBUTION

We

are registering the Shares covered by this prospectus to permit the Selling Stockholders to conduct public secondary trading of these

Shares from time to time after the date of this prospectus. We will not receive any of the proceeds of the sale of the Shares offered

by this prospectus. The aggregate proceeds to the Selling Stockholders from the sale of the Shares will be the purchase price of the

Shares less any discounts and commissions. We will not pay any brokers’ or underwriters’ discounts and commissions in connection

with the registration and sale of the Shares covered by this prospectus. The Selling Stockholders reserve the right to accept and, together

with their respective agents, to reject, any proposed purchases of Shares to be made directly or through agents.

The

Shares offered by this prospectus may be sold from time to time to purchasers:

| |

● |

directly

by the Selling Stockholders, or |

| |

|

|

| |

● |

through

underwriters, broker-dealers or agents, who may receive compensation in the form of discounts, commissions or agent’s commissions

from the Selling Stockholders or the purchasers of the Shares. |

Any

underwriters, broker-dealers or agents who participate in the sale or distribution of the Shares may be deemed to be “underwriters”

within the meaning of the Securities Act. As a result, any discounts, commissions or concessions received by any such broker-dealer or

agents who are deemed to be underwriters will be deemed to be underwriting discounts and commissions under the Securities Act. Underwriters

are subject to the prospectus delivery requirements of the Securities Act and may be subject to certain statutory liabilities under the

Securities Act and the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We will make copies of this

prospectus available to the Selling Stockholders for the purpose of satisfying the prospectus delivery requirements of the Securities

Act. To our knowledge, there are currently no plans, arrangements or understandings between the Selling Stockholders and any underwriter,

broker-dealer or agent regarding the sale of the Shares by the Selling Stockholders.

The

Shares may be sold in one or more transactions at:

| |

● |

prevailing

market prices at the time of sale; |

| |

● |

prices

related to such prevailing market prices; |

| |

● |

varying

prices determined at the time of sale; or |

These

sales may be effected in one or more transactions:

| |

● |

on

any national securities exchange or quotation service on which the Shares may be listed or quoted at the time of sale, including

Nasdaq; |

| |

● |

in

the over-the-counter market; |

| |

● |

in

transactions otherwise than on such exchanges or services or in the over-the-counter market; |

| |

● |

any

other method permitted by applicable law; or |

| |

● |

through

any combination of the foregoing. |

These

transactions may include block transactions or crosses. Crosses are transactions in which the same broker acts as an agent on both sides

of the trade.

At

the time a particular offering of the Shares is made, a prospectus supplement, if required, will be distributed, which will set forth

the name of the Selling Stockholders, the aggregate amount of Shares being offered and the terms of the offering, including, to the extent

required, (1) the name or names of any underwriters, broker-dealers or agents, (2) any discounts, commissions and other terms constituting

compensation from the Selling Stockholders and (3) any discounts, commissions or concessions allowed or reallowed to be paid to broker-dealers.

The

Selling Stockholders will act independently of us in making decisions with respect to the timing, manner, and size of each resale or

other transfer. There can be no assurance that the Selling Stockholders will sell any or all of the Shares under this prospectus. Further,

we cannot assure you that the Selling Stockholders will not transfer, distribute, devise or gift the Shares by other means not described

in this prospectus. In addition, any Shares covered by this prospectus that qualify for sale under Rule 144 of the Securities Act may

be sold under Rule 144 rather than under this prospectus. The Shares may be sold in some states only through registered or licensed brokers

or dealers. In addition, in some states the Shares may not be sold unless they have been registered or qualified for sale or an exemption

from registration or qualification is available and complied with.

The

Selling Stockholders and any other person participating in the sale of the Shares will be subject to the Exchange Act. The Exchange Act

rules include, without limitation, Regulation M, which may limit the timing of purchases and sales of any of the Shares by the Selling

Stockholders and any other person. In addition, Regulation M may restrict the ability of any person engaged in the distribution of the

Shares to engage in market-making activities with respect to the particular Shares being distributed. This may affect the marketability

of the Shares and the ability of any person or entity to engage in market-making activities with respect to the Shares.

The

Selling Stockholders may indemnify any broker or underwriter that participates in transactions involving the sale of the Shares against

certain liabilities, including liabilities arising under the Securities Act.

LEGAL

MATTERS

The

validity of the issuance of the securities offered by this prospectus will be passed upon for us by Sichenzia Ross Ference Carmel LLP,

New York, New York.

EXPERTS

The

consolidated balance sheet of the Company as of December 31, 2023, the related consolidated statements of operations, stockholders’

equity and cash flows for the year ended December 31, 2023 and the related notes, have been audited by Grassi

& Co., CPAs, P.C., an independent registered public accounting firm, as stated in their report which is incorporated herein by reference.

The consolidated balance sheet of the Company as of December 31, 2022, the related consolidated statements of operations,

stockholders’ equity and cash flows for the year ended December 31, 2022 and the related notes, have been audited by Weinberg &

Company, P.A., the former independent registered public accounting firm of the Company, as stated in their report which is incorporated

herein by reference. Such financial statements have been incorporated herein by reference in reliance on the report of such firm given

upon their authority as experts in accounting and auditing.

INCORPORATION

OF CERTAIN DOCUMENTS BY REFERENCE

INFORMATION

INCORPORATED BY REFERENCE

We

are incorporating by reference certain information that we have filed with the Commission under the informational requirements of the

Exchange Act, which means that we disclose important information to you by referring to another document filed separately with the Company.

The information contained in the documents we are incorporating by reference is considered to be a part of this reoffer prospectus, and

the information that we later file with the Commission will automatically update and supersede the information contained or incorporated

by reference in this reoffer prospectus.

The

following documents filed with the Commission are incorporated by reference in this reoffer prospectus:

| |

● |

Our

Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the SEC on April 1, 2024; |

| |

|

|

| |

● |

Our

Current Reports on Form 8-K filed on January 4, 2024, February 5, 2024, March 15, 2024, March 15, 2024, March 19, 2024, March 19, 2024, March 27, 2024, March 29, 2024, April 8, 2024, April 25, 2024, May 2, 2024, May 10, 2024, August 12, 2024, September 3, 2024,

September 4, 2024, September 6, 2024, September 27, 2024, October 7, 2024, October 11, 2024, and October 28, 2024; |

| |

|

|

| |

● |

Our

Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2024, filed on May 10, 2024; our Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2024, filed on August 14, 2024; and our Quarterly Report on Form 10-Q for the quarterly

period ended September 30, 2024, filed on November 5, 2024. |

| |

|

|

| |

● |

The

description of our common stock contained in Exhibit 4.13 of our Annual Report on Form 10-K for the fiscal year ended December 31,

2023 filed with the SEC on April 1, 2024, including any amendment or report filed for the purpose of updating such description. |

All

documents subsequently filed by us with the Commission under Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act (other than current

reports on Form 8-K furnished pursuant to Item 2.02 or Item 7.01 of Form 8-K, including any exhibits included with such information,

unless otherwise indicated therein) prior to the termination or completion of the offering made pursuant to this prospectus are also

incorporated herein by reference and will automatically update and supersede information contained or incorporated by reference in this

prospectus.

DISCLOSURE

OF COMMISSION POSITION ON INDEMNIFICATION

FOR

SECURITIES ACT LIABILITIES

Insofar

as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling the

registrant, the registrant has been informed that in the opinion of the Commission such indemnification is against public policy as expressed

in the Securities Act and is therefore unenforceable.

WHERE

YOU CAN FIND MORE INFORMATION

We

file annual, quarterly and other reports, proxy statements and other information with the SEC. Our SEC filings are available to the public

over the Internet at the SEC’s website at http://www.sec.gov. Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and

Current Reports on Form 8-K, including any amendments to those reports, and other information that we file with or furnish to the SEC

pursuant to Section 13(a) or 15(d) of the Exchange Act can also be accessed free of charge by linking directly from our website at thecoretecgroup.com.

These filings will be available as soon as reasonably practicable after we electronically file such material with, or furnish it to,

the SEC. Information contained on our website is not part of this prospectus.

The

Registrant hereby undertakes to provide without charge to each person, including any beneficial owner, to whom a copy of this prospectus

is delivered, upon written or oral request of any such person, a copy of any and all of the information that has been incorporated by

reference in this prospectus but not delivered with the prospectus other than the exhibits to those documents, unless the exhibits are

specifically incorporated by reference into the information that this prospectus incorporates. Requests for documents should be directed

to Verb Technology Company, Inc., Attention: Investor Relations, 3024 Sierra Juniper Court, Las Vegas, Nevada 89138, phone number (855)

250-2300.

VERB

TECHNOLOGY COMPANY, INC.

UP

TO 109,829 SHARES OF COMMON STOCK

REOFFER

PROSPECTUS

December

30, 2024

Part

II

INFORMATION

REQUIRED IN THE REGISTRATION STATEMENT

Item

3. Incorporation of Documents by Reference.

The

following documents filed by the Registrant with the Securities and Exchange Commission are incorporated by reference into this Registration

Statement (excluding any portions of such documents that have been “furnished” but not “filed” for purposes of

the Securities Exchange Act of 1934, as amended (the “Exchange Act”)):

| |

● |

Our

Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the SEC on April 1, 2024; |

| |

● |

Our

Current Reports on Form 8-K filed on January 4, 2024, February 5, 2024, March 15, 2024, March 15, 2024, March 19, 2024, March 19, 2024, March 27, 2024, March 29, 2024, April 8, 2024, April 25, 2024, May 2, 2024, May 10, 2024, August 12, 2024, September 3, 2024,

September 4, 2024, September 6, 2024, September 27, 2024, October 7, 2024, October 11, 2024, and October 28, 2024; |

| |

● |

Our

Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2024, filed on May 10, 2024; our Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2024, filed on August 14, 2024; and our Quarterly Report on Form 10-Q for the quarterly

period ended September 30, 2024, filed on November 5, 2024. |

| |

● |

The

description of our common stock contained in Exhibit 4.13 of our Annual Report on Form 10-K for the fiscal year ended December 31,

2023 filed with the SEC on April 1, 2024, including any amendment or report filed for the purpose of updating such description. |

In

addition, all documents subsequently filed by the Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, prior

to the filing of the post-effective amendment to this Registration Statement which indicates that all securities offered have been sold

or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference in this Registration Statement

and to be a part hereof from the date of the filing of such documents.

Any

statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded

for purposes of this Registration Statement to the extent that a statement contained herein, (or in any other subsequently filed document

which also is incorporated or deemed to be incorporated by reference herein), modifies or supersedes such statement. Any such statement

so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

Under

no circumstances will any information filed under current items 2.02 or 7.01 of Form 8-K be deemed incorporated herein by reference unless

such Form 8-K expressly provides to the contrary.

You

may request a copy of these filings, at no cost, by writing or telephoning us at the following address: Verb Technology Company, Inc.,

Attention: Corporate Secretary, 3024 Sierra Juniper Court, Las Vegas, Nevada 89138, phone number (855) 250-2300.

Item

4. Description of Securities

Not

applicable.

Item

5. Interests of Named Experts and Counsel

Not

applicable.

Item

6. Indemnification of Directors and Officers

We

are a Nevada corporation and generally governed by the Nevada Private Corporations Code, Title 78 of the Nevada Revised Statutes (“NRS”).

Section

78.138 of the NRS provides that, unless the corporation’s articles of incorporation provide otherwise, a director or officer will

not be individually liable unless it is proven that (i) the director’s or officer’s acts or omissions constituted a breach

of his or her fiduciary duties, and (ii) such breach involved intentional misconduct, fraud, or a knowing violation of the law.

Section

78.7502 of the NRS permits a company to indemnify its directors and officers against expenses, judgments, fines, and amounts paid in

settlement actually and reasonably incurred in connection with a threatened, pending, or completed action, suit, or proceeding, if the

officer or director (i) is not liable pursuant to Section 78.138 of the NRS, or (ii) acted in good faith and in a manner the officer

or director reasonably believed to be in or not opposed to the best interests of the corporation and, if a criminal action or proceeding

had no reasonable cause to believe the conduct of the officer or director was unlawful. Section 78.7502 of the NRS also precludes indemnification

by the corporation if the officer or director has been adjudged by a court of competent jurisdiction, after exhaustion of all appeals,

to be liable to the corporation or for amounts paid in settlement to the corporation, unless and only to the extent that the court determines

that in view of all the circumstances, the person is fairly and reasonably entitled to indemnity for such expenses and requires a corporation

to indemnify its officers and directors if they have been successful on the merits or otherwise in defense of any claim, issue, or matter

resulting from their service as a director or officer.

Section

78.751 of the NRS permits a Nevada corporation to indemnify its officers and directors against expenses incurred by them in defending

a civil or criminal action, suit, or proceeding as they are incurred and in advance of final disposition thereof, upon determination

by the stockholders, the disinterested board members, or by independent legal counsel. Section 78.751 of the NRS provides that the articles

of incorporation, the bylaws, or an agreement may require a corporation to advance expenses as incurred upon receipt of an undertaking

by or on behalf of the officer or director to repay the amount if it is ultimately determined by a court of competent jurisdiction that

such officer or director is not entitled to be indemnified by the corporation if so provided in the corporation’s articles of incorporation,

bylaws, or other agreement. Section 78.751 of the NRS further permits the corporation to grant its directors and officers additional

rights of indemnification under its articles of incorporation, bylaws, or other agreement.

Section

78.752 of the NRS provides that a Nevada corporation may purchase and maintain insurance or make other financial arrangements on behalf

of any person who is or was a director, officer, employee, or agent of the corporation, or is or was serving at the request of the corporation

as a director, officer, employee, or agent of another company, partnership, joint venture, trust, or other enterprise, for any liability

asserted against him and liability and expenses incurred by him in his capacity as a director, officer, employee, or agent, or arising

out of his status as such, whether or not the corporation has the authority to indemnify him against such liability and expenses. We

have obtained insurance policies insuring our directors and officers against certain liabilities they may incur in their capacity as

directors and officers. Under such policies, the insurer, on our behalf, may also pay amounts for which we have granted indemnification

to the directors or officers.

The

foregoing discussion of indemnification merely summarizes certain aspects of indemnification provisions and is limited by reference to

the above discussed sections of the NRS.

In

addition, our Articles of Incorporation and our Amended and Restated Bylaws (the “Bylaws”) generally eliminates director

and officer liability or any act or failure to act in his or her capacity as a director or officer. Our Bylaws provide that we must advance

expenses incurred, or reasonably expected to be incurred, within three (3) months of any proceeding to which the indemnitee was or is

a party or is otherwise involved by reason of the fact that he or she was serving or acting in a covered capacity. An indemnitee is entitled

to advances, to the fullest extent permitted by applicable law, solely upon the execution and delivery to us of an undertaking providing

that the indemnitee agrees to repay the advance to the extent it is ultimately determined that he or she was not entitled to be indemnified

by us under the provisions of the Bylaws, the Articles of Incorporation, or an agreement between us and the indemnitee.

Insofar

as indemnification for liabilities arising under the Securities Act may be permitted to our directors, officers, and controlling persons

pursuant to the foregoing provisions, or otherwise, we have been advised that in the opinion of the Commission such indemnification is

against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification

against such liabilities (other than the payment by us of expenses incurred or paid by our director, officer, or controlling person in

the successful defense of any action, suit, or proceeding) is asserted by such director, officer, or controlling person in connection

with the securities being registered, we will, unless in the opinion of our counsel the matter has been settled by controlling precedent,

submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in

the Securities Act and will be governed by the final adjudication of such issue.

Item

7. Exemption from Registration Claimed

Not

applicable.

Item

8. Exhibits

Item

9. Undertakings

| 1. |

The

undersigned Registrant hereby undertakes: |

| |

(a) |

To

file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement: |

| |

(i) |

To

include any prospectus required by Section 10(a)(3) of the Securities Act; |

| |

(ii) |

To

reflect in the prospectus any facts or events arising after the effective date of the Registration Statement (or the most recent

post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set

forth in the Registration Statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if

the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end

of the estimated maximum offering range may be reflected in the form of prospectus filed with the Securities and Exchange Commission

pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum

aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective Registration Statement. |

| |

(iii) |

To

include any material information with respect to the plan of distribution not previously disclosed in the Registration Statement

or any material change to such information in the Registration Statement; |

Provided,

however, that paragraphs (a)(i) and (a)(ii) do not apply if the information required to be included in a post-effective amendment

by those paragraphs is contained in reports filed with or furnished to the Securities and Exchange Commission by the Registrant pursuant

to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in the Registration Statement.

| |

(b) |

That,

for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a

new Registration Statement relating to the securities offered herein, and the offering of such securities at that time shall be deemed

to be the initial bona fide offering thereof. |

| |

(c) |

To

remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering. |

| 2. |

The

undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of

the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each

filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference

in the Registration Statement shall be deemed to be a new Registration Statement relating to the securities offered herein, and the

offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. |

| 3. |

Insofar

as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons

of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the

Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore,

unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of

expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action,

suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered,

the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court

of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities

Act and will be governed by the final adjudication of such issue. |

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, as amended, the Registrant certifies that it has reasonable grounds to believe that

it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by

the undersigned, thereunto duly authorized, in Las Vegas, NV, on this 30th day of December, 2024.

| |

VERB

TECHNOLOGY COMPANY, INC. |

| |

|

| |

By: |

/s/

Rory J. Cutaia |

| |

|

Rory

J. Cutaia |

| |

|

Chief

Executive Officer |

POWER

OF ATTORNEY

KNOW

ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints Rory J. Cutaia, as his or her

true and lawful attorneys-in-fact and agents, with full power of substitution and resubstitution, for him or her and in their name, place

and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments) to this Registration Statement,

and to file the same, with all exhibits thereto and other documents in connection therewith, with the Securities and Exchange Commission,

granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and

thing requisite and necessary to be done in connection therewith, as fully to all intents and purposes as he or she might or could do

in person, hereby ratifying and confirming all that said attorneys-in-fact and agents or any of them, or his or her substitute or substitutes,

may lawfully do or cause to be done by virtue hereof.

Pursuant

to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities

and on the dates indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/

Rory J. Cutaia |

|

Chief

Executive Officer & Chairman of the Board of |

|

December

30, 2024 |

| Rory

J. Cutaia |

|

Directors

and Director (Principal Executive Officer) |

|

|

| |

|

|

|

|

| |

|

|

|

|

| /s/

Bill J. Rivard |

|

Interim

Chief Financial Officer (Principal Financial Officer and |

|

December

30, 2024 |

| Bill

J. Rivard |

|

Principal

Accounting Officer) |

|

|

| |

|

|

|

|

| |

|

|

|

|

| /s/

James P. Geiskopf |

|

Lead

Director |

|

December

30, 2024 |

| James

P. Geiskopf |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| /s/

Kenneth S. Cragun |

|

Director |

|

December

30, 2024 |

| Kenneth

S. Cragun |

|

|

|

|

| |

|

|

|

|

| /s/

Edmund C. Moy |

|

Director |

|

December

30, 2024 |

| Edmund

C. Moy |

|

|

|

|

Exhibit

5.1

December

30, 2024

VIA

ELECTRONIC TRANSMISSION

Securities

and Exchange Commission

100

F Street, N.E.

Washington,

DC 20549

Re:

Verb Technology Company, Inc. - Form S-8 Registration Statement

Ladies

and Gentlemen:

We

refer to the above-captioned registration statement on Form S-8 (the “Registration Statement”) under the Securities Act of

1933, as amended (the “Act”), filed by Cyngn Inc., a Delaware corporation (the “Company”), with the Securities

and Exchange Commission.

We

have examined the originals, photocopies, certified copies or other evidence of such records of the Company, certificates of officers

of the Company and public officials, and other documents as we have deemed relevant and necessary as a basis for the opinion hereinafter

expressed. In such examination, we have assumed the genuineness of all signatures, the authenticity of all documents submitted to us

as certified copies or photocopies and the authenticity of the originals of such latter documents.

Based

on our examination mentioned above, we are of the opinion that the securities being issued pursuant to the Registration Statement are

duly authorized and will be, when so issued, legally and validly issued, and fully paid and non-assessable.

We

hereby consent to the filing of this opinion as Exhibit 5.1 to the Registration Statement. In giving the foregoing consent, we do not

hereby admit that we are in the category of persons whose consent is required under Section 7 of the Act, or the rules and regulations

of the Securities and Exchange Commission.

| |

Very truly yours, |

| |

|

| |

/s/ Sichenzia Ross Ference Carmel LLP |

| |

|

| |

Sichenzia Ross Ference Carmel LLP |

1185

AVENUE OF THE AMERICAS | 31ST FLOOR | NEW YORK, NY | 10036

T (212) 930-9700 | F (212) 930-9725 | WWW.SRFC.LAW

Exhibit

23.1

CONSENT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We

consent to the incorporation by reference in the Registration Statement on Form S-8 pertaining to the 2019 Stock and Incentive Compensation

Plan, as amended, of Verb Technology Company, Inc. of our report dated April 17, 2023, which includes an explanatory paragraph as to

the Company’s ability to continue as a going concern, with respect to the consolidated financial statements of Verb Technology

Company, Inc. as of and for the year ended December 31, 2022. included in its Annual Report (Form 10-K) for the year ended December 31,

2023, filed with the Securities and Exchange Commission. We also consent to the reference to our firm under the caption “Experts”

in such Registration Statement.

/s/Weinberg

& Company, P.A.

Los

Angeles, California

December

30, 2024

Exhibit

23.2

CONSENT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We

hereby consent to the inclusion in this Registration Statement of Verb Technology Company, Inc., and Subsidiaries. (the “Company”)

on Form S-8 of our report dated April 1, 2024 except for Note 17, as to which date is May 31, 2024, with respect to the consolidated

financial statements of Verb Technology Company, Inc., included in its Annual Report on Form 10K for the year ended December 31, 2023.

We also consent to the reference to our firm under the heading “Experts” in such Registration Statement.

/s/

Grassi & Co., CPAs, P.C.

Jericho,

New York

December

30, 2024

Exhibit

107

Calculation

of Filing Fee Table

FORM

S-8

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

(Form

Type)

VERB

TECHNOLOGY COMPANY, INC.

(Exact

Name of Registrant As Specified in its Charter)

Table

1: Newly Registered Securities

| |

|

Security

Type |

|

Security

Class

Title |

|

Fee

Calculation

Rule |

|

Amount

Registered(1) |

|

|

Proposed

Maximum

Offering

Price

Per

Share |

|

|

Maximum

Aggregate

Offering Price |

|

|

Fee

Rate |

|

|

Amount

of Registration

Fee |

|

| Newly

Registered Securities |

|

| Fees

to Be Paid |

|

Equity |

|

Common

Stock |

|

457(c)

and (h) |

|

|

15,000,000 |

(2) |

|

$ |

6.0417 |

(3) |

|

$ |

90,625,500 |

|

|

|

0.00015310 |

|

|

$ |

13,874.76 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fees

Previously Paid |

|

- |

|

- |

|

- |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

| Total

Offering Amounts |

|

|

$ |

90,625,500 |

|

|

|

- |

|

|

$ |

13,874.76 |

|

| Total

Fees Previously Paid |

|

|

$ |

- |

|

|

|

- |

|

|

$ |

- |

|

| Total

Fee Offsets |

|

|

|

- |

|

|

|

- |

|

|

$ |

- |

|

| Net

Fees Due |

|

|

$ |

- |

|

|

|

- |

|

|

$ |

13,874.76 |

|

| |

(1) |

Pursuant

to Rule 416(a) promulgated under the U.S. Securities Act of 1933, as amended, there are also being registered an indeterminable number

of additional securities as may be issued to prevent dilution resulting from stock splits, stock dividends, or similar transactions. |

| |

(2) |

Represents

shares of common stock reserved for future issuance under the Company’s 2019 Stock and Incentive Compensation Plan, as amended. |

| |

(3) |

Estimated

solely for the purpose of calculating the registration fee under Rule 457(c) and (h) of the Securities Act on the basis of the average

of the high and low sales price per share of common stock on December 23, 2024, as reported on the Nasdaq Capital Market. |

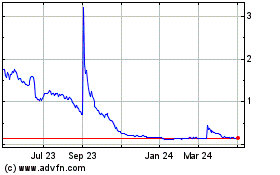

Verb Technology (NASDAQ:VERB)

Historical Stock Chart

From Feb 2025 to Mar 2025

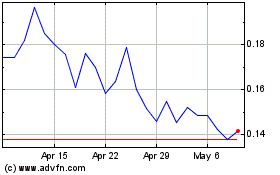

Verb Technology (NASDAQ:VERB)

Historical Stock Chart

From Mar 2024 to Mar 2025