Venus Concept Announces Completion of $6.72 Million Private Placement Financing

November 18 2022 - 8:30AM

Venus Concept Inc. (“Venus Concept” or the “Company”) (NASDAQ:

VERO), a global medical aesthetic technology leader, today

announced that it has completed a non-brokered private placement

(the “Private Placement”) of convertible preferred stock (the

“Preferred Shares”) and common stock (the “Common Shares”) of the

Company. Pursuant to the Private Placement, an aggregate of

3,185,000 Preferred Shares and 1,750,000 Common Shares were issued,

resulting in aggregate gross proceeds to the Company of $6.72

million before offering expenses, which will be used for working

capital and general corporate purposes.

The Common Shares were issued at a price of

$0.20 per share, and the Preferred Shares were issued at $2.00 per

share. Each Preferred Share is convertible into 10 Common Shares

(i) at the option of the holder or (ii) at the option of the

Company within 30 days following the earlier of (a) the 30-trading

day VWAP of the Common Shares exceeding $1.25 or (b) the Company

reporting two consecutive fiscal quarters of positive free cash

flow.

The Preferred Shares portion of the financing

was led by the Company’s existing investors: EW Healthcare

Partners, Masters Special Situations, LLC and its affiliates, and

HealthQuest Capital. The Common Shares portion of the financing was

led by Rajiv De Silva, Chief Executive Officer of Venus Concept,

Dr. Hemanth Varghese, President & Chief Business Officer of

Venus Concept, and Dr. S. Tyler Hollmig, an independent director of

Venus Concept.

“We appreciate the continued support from our

existing investors who participated in this capital raise,” said

Rajiv De Silva, Chief Executive Officer of Venus Concept. “This

financing provides Venus Concept with additional capital to advance

our operating initiatives, key R&D priorities and the ongoing

comprehensive assessment of the Company, which is currently

underway. This assessment is focused on achieving a profitable and

sustainable growth profile for the Company. We expect to commence

implementation of the transformation plan resulting from the

assessment during the first quarter of 2023. We intend to update

the investment community on our progress as part of our fourth

quarter earnings call in March 2023.”

The offer and sale of the foregoing securities

are being made in a transaction not involving a public offering and

have not been registered under the Securities Act of 1933, as

amended (the “Securities Act”), or applicable state securities

laws, and will be sold in a private placement pursuant to Section

4(a)(2) and/or Regulation D of the Securities Act. The securities

may not be offered or sold in the United States absent registration

or pursuant to an exemption from the registration requirements of

the Securities Act and applicable state securities laws. The

Company has agreed to file a registration statement covering the

resale of the Common Shares acquired by the investors in the

private placement, including the Common Shares issuable upon

conversion of the Preferred Shares.

This press release does not constitute an offer

to sell or the solicitation of an offer to buy the securities, nor

shall there be any sale of the securities in any state or

jurisdiction in which such offer or sale would be unlawful prior to

the registration or qualification under the securities laws of such

state or jurisdiction.

About Venus Concept

Venus Concept is an innovative global medical

aesthetic technology leader with a broad product portfolio of

minimally invasive and non-invasive medical aesthetic and hair

restoration technologies and reach in over 60 countries and 16

direct markets. Venus Concept’s product portfolio consists of

aesthetic device platforms, including Venus Versa, Venus Legacy,

Venus Velocity, Venus Fiore, Venus Viva, Venus Glow, Venus Bliss,

Venus BlissMAX, Venus Epileve and Venus Viva MD. Venus Concept’s

hair restoration systems include NeoGraft® and the ARTAS iX®

Robotic Hair Restoration system. Venus Concept has been backed by

leading healthcare industry growth equity investors including EW

Healthcare Partners (formerly Essex Woodlands), HealthQuest

Capital, Longitude Capital Management, Aperture Venture Partners,

and Masters Special Situations.

Cautionary Statement Regarding

Forward-Looking Statements

This communication contains contains

“forward-looking” statements within the meaning of Section 27A

of the Securities Act of 1933, as amended and Section 21E of

the Securities Exchange Act of 1934, as amended. Any statements

contained herein that are not of historical facts may be deemed to

be forward-looking statements. In some cases, you can identify

these statements by words such as such as “anticipates,”

“believes,” “plans,” “expects,” “projects,” “future,” “intends,”

“may,” “should,” “could,” “estimates,” “predicts,” “potential,”

“continue,” “guidance,” and other similar expressions that are

predictions of or indicate future events and future trends. These

forward-looking statements include, but are not limited to,

statements about our financial performance; the growth in demand

for our systems and other products; and general economic

conditions, including the global economic impact of COVID-19, and

involve risks and uncertainties that may cause results to differ

materially from those set forth in the statements. These

forward-looking statements are based on current expectations,

estimates, forecasts, and projections about our business and the

industry in which the Company operates and management's beliefs and

assumptions and are not guarantees of future performance or

developments and involve known and unknown risks, uncertainties,

and other factors that are in some cases beyond our control. As a

result, any or all of our forward-looking statements in this

communication may turn out to be inaccurate. Factors that could

materially affect our business operations and financial performance

and condition include, but are not limited to, those risks and

uncertainties described under Part II Item 1A—“Risk Factors” in our

Quarterly Reports on Form 10-Q and Part I Item 1A—“Risk Factors” in

our Annual Report on Form 10-K for the fiscal year ended

December 31, 2021. You are urged to consider these factors

carefully in evaluating the forward-looking statements and are

cautioned not to place undue reliance on the forward-looking

statements. The forward-looking statements are based on information

available to us as of the date of this communication. Unless

required by law, the Company does not intend to publicly update or

revise any forward-looking statements to reflect new information or

future events or otherwise.

Investor Relations Contact:

ICR Westwicke on behalf of Venus Concept:

Mike Piccinino, CFA

VenusConceptIR@westwicke.com

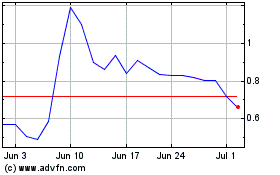

Venus Concept (NASDAQ:VERO)

Historical Stock Chart

From Aug 2024 to Sep 2024

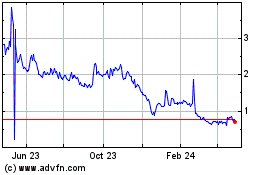

Venus Concept (NASDAQ:VERO)

Historical Stock Chart

From Sep 2023 to Sep 2024