UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16

UNDER THE U.S. SECURITIES EXCHANGE ACT OF 1934

For the month of August 2024

Commission File No. 001-41678

VCI Global Limited

(Name of registrant)

B03-C-8 & 10, Menara 3A, KL Eco City, No.3

Jalan Bangsar, 59200

Kuala Lumpur, Malaysia

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

On August 19, 2024, VCI Global Limited (the “Company”)

announced that its Board of Directors has approved a share repurchase program with authorization to purchase up to $10 million of the

Company’s outstanding ordinary share (the “Repurchase Program”). The volume and timing of any repurchases will be subject

to general market conditions, as well as the Company’s management of capital, other investment opportunities, and other factors.

The Repurchase Program does not obligate the Company to repurchase any specific number of shares, and may be modified, suspended, or discontinued

at any time at the Company’s discretion. A copy of the press release announcing the Repurchase Program is attached hereto as Exhibit

99.1 and incorporated herein by reference.

The information set forth in this Current Report

on Form 6-K, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act

of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed

incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth

by specific reference in such a filing.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the U.S. Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: August 22, 2024

| |

VCI Global Limited |

| |

|

| |

By: |

/s/ Victor Hoo |

| |

Name: |

Victor Hoo |

| |

Title: |

Director, Executive Chairman and

Chief Executive Officer |

Exhibit

99.1

PRESS

RELEASE

VCI

GLOBAL ANNOUNCES 44% REVENUE GROWTH IN ITS FINANCIAL RESULTS FOR THE SIX MONTHS ENDED JUNE 30, 2024; ANNOUNCES US$10 MILLION SHARE REPURCHASE

PROGRAM OVER 2 YEARS

August

19, 2024 | Globe Newswire

KUALA

LUMPUR, Malaysia, August 19, 2024 – VCI Global Limited (NASDAQ: VCIG) (Frankfurt: H0T) (“VCI Global,” “VCIG,”

or the “Company”) a diversified holding company specializing in consulting, fintech, artificial intelligence (AI), robotics

and cybersecurity, is proud to announce its unaudited financial results for the six months ended June 30, 2024 (the “Interim Results”)

(the “Financial Results”).

Financial

Highlights

| ● | VCI

Global achieved an impressive total revenue of $13.7 million for the six months ended June 30, 2024, marking a 44% YoY growth. |

| ● | Gross

profit experienced a substantial YoY growth of 57%, reaching $12.9 million for the six months ended June 30, 2024. |

| ● | Net

income surged to $5.4 million for the six months ended June 30, 2024, reflecting a remarkable growth of 25%. |

| ● | VCIG’s

business strategy consultancy revenue experienced a remarkable 151% YoY surge, reaching $11.2 million for the six months ended June 30,

2024. |

| ● | VCIG’s

fintech segment revenue experienced an impressive 183% YoY growth, reaching $0.7 million for the six months ended June 30, 2024. |

Authorization

of a Share Repurchase Program

VCIG’s

Board of Directors has authorized the implementation of a share repurchase program for up to US$10 million of the Company’s outstanding

ordinary shares over the next two years (the “Repurchase Program”). Under the Repurchase Program, VCIG may repurchase for

cash, from time to time, its ordinary shares through open market purchases pursuant to a Rule 10b-18 plan, in compliance with applicable

securities laws and other legal requirements.

The

Company’s proposed repurchases may be made from time to time on the open market at prevailing market prices, through negotiated

transactions off the market, in block trades, or through other legally permissible means. The timing and extent of any repurchases will

be influenced by market conditions, the trading price of its ordinary share, and other factors. These repurchases will also adhere to

restrictions relating to volume, price, and timing under applicable law. VCI Global expects to implement this Repurchase Program in a

manner consistent with market conditions and the interests of the Company’s shareholders. VCIG’s Board of Directors will

review the Repurchase Program periodically and may authorize adjustments to its terms and size accordingly.

“Our

outstanding performance for the six months ended 2024 is a testament to the exceptional efforts and dedication of our team. We have successfully

advanced our strategic initiatives and strengthened our position in the market. Looking ahead, we remain committed to leveraging our

expertise to drive continued growth and deliver unparalleled value to our clients. Our focus remains on innovation and excellence, and

we are excited about the opportunities that lie ahead as we build on this momentum for future success,” said Dato’ Victor

Hoo, Group Executive Chairman and Chief Executive Officer of VCI Global.

Financial

Results

Revenue

was $13.7 million for the six months ended June 30, 2024, representing a 44% YoY increase from $9.5 million for the six months ended

June 30, 2023. This increase in revenue was primarily attributable to our ability to offer market-leading services that add value to

clients through our business strategy consultancy service offerings and solutions.

| ● | VCIG’s

revenue generated from business strategy consultancy segment increased by 151% to $11.2 million for the six months ended June 30, 2024,

compared to $4.5 million for the six months ended June 30, 2023. The gross profit margin of the business strategy consultancy revenue

was 93% for the six months ended June 30, 2024, compared to 73% for the six months ended June 30, 2023. |

| ● | The

Company’s revenue generated from fintech segment increased by 183% to $0.7 million for the six months ended June 30, 2024, compared

to $0.2 million for the six months ended June 30, 2023. |

| | |

For the Six Months Ended June 30 | |

| | |

2024 | | |

2023 | | |

Change | |

| | |

USD | | |

USD | | |

% | |

| Business strategy consultancy fee | |

| 11,160,748 | | |

| 4,453,647 | | |

| 150.6 | % |

| Technology development, solutions and consultancy | |

| 1,748,959 | | |

| 4,227,387 | | |

| (58.6 | )% |

| Interest income | |

| 677,086 | | |

| 239,645 | | |

| 182.5 | % |

| Others | |

| 139,908 | | |

| 604,631 | | |

| (76.9 | )% |

| Total revenue | |

| 13,726,701 | | |

| 9,525,310 | | |

| 44.1 | % |

Other

Income for the six months ended June 30, 2024, was $104 thousand, reflecting a decrease of 54% compared to $226 thousand for the six

months ended June 30, 2023.

EBITDA

reached $5.7 million for the six months ended June 30, 2024, reflecting a 41% margin on revenue and a notable increase of 26%, compared

to $4.5 million for the six months ended June 30, 2023. This surge was primarily driven by a rise in operating income.

Net

Income amounted to $5.4 million for the six months ended June 30, 2024, reflecting a 39% margin on revenue and a significant 25% increase

from $4.3 million for the six months ended June 30, 2023.

Cost

of Services was $844 thousand for the six months ended June 30, 2024, representing a significant decrease of 35% from $1.3 million for

the six months ended June 30, 2023.

| ● | Consultant

fee costs significantly decreased by $481 thousand, or 40%, to $735 thousand for the six months ended June 30, 2024. These costs represent

the expenses incurred by the Company for assisting its clients in engaging all the relevant professionals required during the listing

process, including but not limited to legal counsel, auditors, financial consultants, and U.S. capital markets consultants. Such consultant

fee payments are included and treated as part of our consultation services for clients during the IPO process. |

| ● | IT

expenses amounted to $9 thousand for the six months ended June 30, 2024, reflecting a significant decrease of 77% compared to $39 thousand

for the six months ended June 30, 2023. The gross profit margin of the technology development, solutions and consultancy revenue was

99.5% for the six months ended June 30, 2024. |

| ● | Training

costs amounted to $10 thousand for the six months ended June 30, 2024, reflecting a 76% decrease compared to $41 thousand for the six

months ended June 30, 2023. |

| ● | Other

cost of services amounted to $90 thousand for the six months ended June 30, 2024. |

| | |

For the Six Months Ended June 30 | |

| | |

2024 | | |

2023 | | |

Change | |

| | |

USD | | |

USD | | |

% | |

| Consultant fee | |

| 734,589 | | |

| 1,216,000 | | |

| (39.6 | )% |

| IT expenses | |

| 8,904 | | |

| 38,705 | | |

| (77.0 | )% |

| Training costs | |

| 10,098 | | |

| 41,217 | | |

| (75.5 | )% |

| Other | |

| 90,461 | | |

| - | | |

| 100.0 | % |

| Total | |

| 844,052 | | |

| 1,295,922 | | |

| (34.9 | )% |

Depreciation

expenses amounted to $108 thousand for the six months ended June 30, 2024, reflecting an 84% increase from $59 thousand for the six months

ended June 30, 2023. The increase was primarily due to acquisition of additional assets, such as new computers and accessories purchased

for our newly joined employees during the first half of 2024.

Directors’

fees amounted to $2.3 million for the six months ended June 30, 2024, representing a 94% growth, compared to $1.2 million for the six

months ended June 30, 2023. This increase was due to the rise in directors’ fees effective from January 2024. Additionally, in

the prior period, the Company only began paying directors’ fees to the Board of Directors starting from April 2023, upon the Company’s

listing on Nasdaq.

Operating

Income increased to $5.6 million for the six months ended June 30, 2024, reflecting a remarkable increase of 26% compared to $4.4 million

for the six months ended June 30, 2023.

As

a result, profit for the period was $5.4 million for the six months ended June 30, 2024, marking a strong 25% increase compared to $4.3

million for the six months ended June 30, 2023.

Cash

Position and Capital Allocation

Net

cash used in operating activities was $4.1 million for the six months ended June 30, 2024, a slight increase of $0.5 million, from $3.7

million for the six months ended June 30, 2023. This figure consists of our profit before tax of $5.6 million and was adjusted for non-cash

items, including $1.3 million for share-based payment for director fee, and the changes in operating assets and liabilities were $11.4

million of increase in trade and other receivables and $348 thousand of increase in trade and other payables.

Net

cash used in investing activities was $4.6 million for the first six months ended June 30, 2024, significantly increase as compared to

$2.8 million generated from the six months ended June 30, 2023. Cash used in or generated from investing activities was mainly due to

a $5.7 million investment in Fintech Scion Limited as part of our professional fees and $1.9 million from the disposal of our shares

in YY Group Holding Limited.

Net

cash generated from financing activities amounted to $8.6 million for the six months ended June 30, 2024, representing an increase of

$5.2 million from $3.3 million for the six months ended June 30, 2023. This increase was mainly due to $8.8 million in proceeds from

the At-The-Market Offering (ATM), private placements, warrant exercises, and follow-on public offerings.

Cash

and cash equivalents amounted to $1.2 million for the six months ended June 30, 2024, representing a decrease of 62%, compared to $3.3

million for the six months ended June 30, 2023. The Company believes this amount, along with planned actions, will be sufficient to fund

operations for at least the next 12 months. To improve liquidity, the Company plans to enhance the collection of outstanding receivables

totaling $30.1 million as of June 30, 2024, and reduce general and administrative expenses.

About

VCI Global Limited

VCI

Global is a diversified holding company. Through its subsidiaries, it focuses on consulting, fintech, AI, robotics, and cybersecurity.

Based in Kuala Lumpur, Malaysia, our main operations are centered in Asia, with significant visibility across Asia Pacific, the United

States, Europe, and the Middle East. VCIG primarily offers consulting services in capital markets, real estate, AI, and technology. In

technology businesses, the Company operates a proprietary financing platform that serves companies and individuals, as well as a secured

messaging platform serving governments and organizations. We also invest, incubate, accelerate, and commercialize businesses and technologies

in AI and robotics.

For

more information on the Company, please log on to https://v-capital.co/.

Cautionary

Note Regarding Forward-Looking Statements

This

press release contains forward-looking statements that are subject to various risks and uncertainties. Such statements include statements

regarding the Company’s ability to grow its business and other statements that are not historical facts, including statements which

may be accompanied by the words “intends,” “may,” “will,” “plans,” “expects,”

“anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,”

“hopes,” “potential” or similar words. These forward-looking statements are based only on our current beliefs, expectations, and

assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy,

activities of regulators, future regulations, and other future conditions. Because forward-looking statements relate to the future, they

are subject to inherent uncertainties, risks, and changes in circumstances that are difficult to predict and many of which are outside

of our control. Therefore, you should not rely on any of these forward-looking statements. Actual results could differ materially from

those described in these forward-looking statements due to certain factors, including without limitation, the Company’s ability

to achieve profitable operations, customer acceptance of new products, the effects of the spread of coronavirus (COVID-19) and future

measures taken by authorities in the countries wherein the Company has supply chain partners, the demand for the Company’s products

and the Company’s customers’ economic condition, the impact of competitive products and pricing, successfully managing and,

general economic conditions and other risk factors detailed in the “Risk Factors” section of the Annual Report on 20-F of

the Company for the year ended December 31, 2023, filed with the United States Securities and Exchange Commission (“SEC”)

on April 30, 2024, and its subsequent SEC filings. The forward-looking statements contained in this press release are made as of the

date of this press release, and the Company does not undertake any responsibility to update the forward-looking statements in this release,

except in accordance with applicable law.

CONTACT INFORMATION:

For media

queries, please contact:

VCI Global

Limited

enquiries@v-capital.co

View original

content:

https://www.globenewswire.com/en/news-release/2024/08/19/2932096/0/en/VCI-Global-Announces-44-Revenue-Growth-in-Its-Financial-Results-for-the-Six-Months-Ended-June-30-2024-Announces-US-10-Million-Share-Repurchase-Program-Over-2-Years.html

Financial

Tables

VCI

Global Limited and Its Subsidiaries

Interim

Condensed Consolidated Statements of Financial Position

| | |

As of

June 30,

2024

(Unaudited) | | |

As of

December 31,

2023

(Audited) | |

| | |

USD | | |

USD | |

| ASSETS | |

| | |

| |

| | |

| | |

| |

| Non-current assets | |

| | |

| |

| Financial assets measured at fair value through other comprehensive income | |

| 9,407,260 | | |

| 8,360,497 | |

| Financial assets measured at fair value through profit and loss | |

| 15,814 | | |

| 15,861 | |

| Property and equipment | |

| 798,309 | | |

| 696,865 | |

| Right-of-use of assets | |

| 184,790 | | |

| 262,337 | |

| Intangible assets | |

| 1,661,734 | | |

| 1,024,316 | |

| Loan receivables | |

| 8,318,386 | | |

| 4,619,070 | |

| Deferred tax assets | |

| 72,002 | | |

| 74,009 | |

| Total non-current assets | |

| 20,458,295 | | |

| 15,052,955 | |

| | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Trade and other receivables | |

| 30,105,568 | | |

| 6,308,063 | |

| Loan receivables | |

| 4,990,001 | | |

| 3,350,889 | |

| Cash and bank balances | |

| 1,244,958 | | |

| 1,010,455 | |

| Income tax asset | |

| - | | |

| - | |

| Total current assets | |

| 36,340,527 | | |

| 10,669,407 | |

| | |

| | | |

| | |

| Total assets | |

| 56,798,822 | | |

| 25,722,362 | |

| | |

| | | |

| | |

| LIABILITIES AND EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Trade and other payables | |

| 4,457,488 | | |

| 4,223,722 | |

| Warrant liabilities | |

| 1,614,286 | | |

| 428,025 | |

| Lease liabilities | |

| 135,395 | | |

| 154,788 | |

| Bank and other borrowings | |

| 150,031 | | |

| 147,577 | |

| Income tax payable | |

| 149,701 | | |

| 54,739 | |

| Total current liabilities | |

| 6,506,901 | | |

| 5,008,851 | |

| | |

| | | |

| | |

| Non-current liabilities | |

| | | |

| | |

| Lease liabilities | |

| 56,250 | | |

| 118,749 | |

| Bank and other borrowings | |

| 36,132 | | |

| 53,455 | |

| Amount due to related parties | |

| - | | |

| 283,346 | |

| Total non-current liabilities | |

| 92,382 | | |

| 455,550 | |

| | |

| | | |

| | |

| Total liabilities | |

| 6,599,283 | | |

| 5,464,401 | |

VCI

Global Limited and Its Subsidiaries

Interim

Condensed Consolidated Statements of Financial Position (Unaudited)

| | |

As of

June 30,

2024

(Unaudited) | | |

As of

December 31,

2023

(Audited) | |

| | |

USD | | |

USD | |

| Capital and reserves | |

| | |

| |

| Share capital | |

| 36,374,551 | | |

| 9,589,508 | |

| Capital reserve | |

| 1,384,838 | | |

| 1,423,433 | |

| Fair value reserve | |

| (1,132,440 | ) | |

| 365,389 | |

| Translation reserve | |

| 1,163,566 | | |

| 587,526 | |

| Retained earnings | |

| 13,674,424 | | |

| 9,183,823 | |

| Attributable to equity owners of the Company | |

| 51,464,939 | | |

| 21,149,679 | |

| Non-controlling interests | |

| (1,265,400 | ) | |

| (891,718 | ) |

| Total equity | |

| 50,199,539 | | |

| 20,257,961 | |

| Total equity and liabilities | |

| 56,798,822 | | |

| 25,722,362 | |

VCI

Global Limited and Its Subsidiaries

Interim

Condensed Consolidated Statements of Comprehensive Income (Unaudited)

| | |

Six months

ended

June 30,

2024 | | |

Six months

ended

June 30,

2023 | |

| | |

USD | | |

USD | |

| Revenue | |

| 13,033,862 | | |

| 9,525,310 | |

| Revenue – related party | |

| 692,839 | | |

| - | |

| Total revenue | |

| 13,726,701 | | |

| 9,525,310 | |

| Other income | |

| 104,172 | | |

| 225,992 | |

| Cost of services | |

| (844,052 | ) | |

| (1,295,922 | ) |

| Depreciation | |

| (108,235 | ) | |

| (58,790 | ) |

| Directors’ fees | |

| (2,262,483 | ) | |

| (1,164,477 | ) |

| Employee benefits expenses | |

| (1,633,475 | ) | |

| (1,664,608 | ) |

| Impairment allowance on trade receivables | |

| (78,110 | ) | |

| - | |

| Rental expenses | |

| (57,059 | ) | |

| (32,124 | ) |

| Legal and professional fees | |

| (748,571 | ) | |

| (315,736 | ) |

| Finance cost | |

| (6,102 | ) | |

| (3,401 | ) |

| Other operating expenses | |

| (2,530,143 | ) | |

| (785,912 | ) |

| Profit before income tax | |

| 5,562,643 | | |

| 4,430,332 | |

| Income tax expense | |

| (175,189 | ) | |

| (134,138 | ) |

| Profit for the period | |

| 5,387,454 | | |

| 4,296,194 | |

| Other comprehensive income/(loss): | |

| | | |

| | |

| Currency translation arising from consolidation | |

| - | | |

| 272,678 | |

| Fair value adjustment on financial assets measured at fair value through other comprehensive income | |

| (1,173,700 | ) | |

| - | |

| Transfer upon disposal of equity instruments | |

| (1,487,922 | ) | |

| - | |

| Total comprehensive income for the period | |

| 2,725,832 | | |

| 4,568,872 | |

| | |

| | | |

| | |

| Profit attributable to: | |

| | | |

| | |

| Equity owners of the Company | |

| 5,916,519 | | |

| 4,542,382 | |

| Non-controlling interests | |

| (529,065 | ) | |

| (246,188 | ) |

| Total | |

| 5,387,454 | | |

| 4,296,194 | |

| | |

| | | |

| | |

| Total comprehensive income attributable to: | |

| | | |

| | |

| Equity owners of the Company | |

| 3,254,897 | | |

| 4,815,060 | |

| Non-controlling interests | |

| (529,065 | ) | |

| (246,188 | ) |

| Total | |

| 2,725,832 | | |

| 4,568,872 | |

VCI

Global Limited and Its Subsidiaries

Interim

Condensed Consolidated Statements of Cash Flows (Unaudited)

| | |

Six months

ended

June 30,

2024 | | |

Six months

ended

June 30,

2023 | |

| | |

USD | | |

USD | |

| Operating activities | |

| | |

| |

| Profit before income tax | |

| 5,562,643 | | |

| 4,430,332 | |

| Adjustments for: | |

| | | |

| | |

| Impairment allowance of trade receivables | |

| 78,110 | | |

| - | |

| Reversal on impairment allowance of trade receivable | |

| (13,649 | ) | |

| - | |

| Bad debt written-off | |

| 189 | | |

| - | |

| Unrealised foreign exchange (gain)/loss | |

| (20,182 | ) | |

| 172,498 | |

| Depreciation of property and equipment | |

| 37,802 | | |

| 24,792 | |

| Depreciation of ROU | |

| 70,433 | | |

| 33,998 | |

| Share based payment – Director fees | |

| 1,265,377 | | |

| - | |

| Gain on disposal of investment | |

| - | | |

| (167,167 | ) |

| Interest expense | |

| 6,102 | | |

| 3,401 | |

| Interest income | |

| (799 | ) | |

| (202 | ) |

| Operating cash flow before movement in working capital | |

| 6,986,026 | | |

| 4,497,652 | |

| Trade and other receivables | |

| (5,758,606 | ) | |

| (8,615,611 | ) |

| Loan receivables | |

| (5,632,631 | ) | |

| - | |

| Trade and other payables | |

| 348,285 | | |

| 546,538 | |

| Cash used in operations | |

| (4,056,926 | ) | |

| (3,571,421 | ) |

| Interest received | |

| - | | |

| - | |

| Income tax paid | |

| (78,742 | ) | |

| (109,073 | ) |

| Net cash used in operating activities | |

| (4,135,668 | ) | |

| (3,680,494 | ) |

| | |

| | | |

| | |

| Investing activities | |

| | | |

| | |

| Purchase of property and equipment | |

| (158,289 | ) | |

| (138,375 | ) |

| Purchase of intangible assets | |

| (665,191 | ) | |

| - | |

| Interest received | |

| 799 | | |

| 202 | |

| Acquisition of financial assets measured at fair value through other comprehensive income | |

| (5,700,000 | ) | |

| - | |

| Proceeds from disposal of financial assets measured at fair value through other comprehensive income | |

| 1,910,350 | | |

| 2,913,530 | |

| Net cash (used in)/ generated from investing activities | |

| (4,612,331 | ) | |

| 2,775,357 | |

| | |

| | | |

| | |

| Financing activities | |

| | | |

| | |

| Proceeds from issuance of share capital | |

| 6,471,433 | | |

| - | |

| Proceeds from initial public offering, net of issuance costs | |

| - | | |

| 3,739,990 | |

| Proceeds from following public offering, net of issuance costs | |

| 2,314,050 | | |

| - | |

| Interest paid | |

| (6,102 | ) | |

| (3,401 | ) |

| Repayment of other borrowings | |

| (16,433 | ) | |

| (21,665 | ) |

| Advance to related parties | |

| (275,663 | ) | |

| (336,113 | ) |

| Repayment of operating lease | |

| (67,461 | ) | |

| (34,142 | ) |

| Contribution from non-controlling interest | |

| 131,206 | | |

| - | |

| Net cash generated from financing activities | |

| 8,551,030 | | |

| 3,344,669 | |

VCI

Global Limited and Its Subsidiaries

Interim

Condensed Consolidated Statements of Cash Flows (Unaudited)

| | |

Six months

ended

June 30,

2024 | | |

Six months

ended

June 30,

2023 | |

| | |

USD | | |

USD | |

| Net (decrease)/ increase in cash and cash equivalents | |

| (196,969 | ) | |

| 2,439,532 | |

| Effect of foreign exchange | |

| 431,472 | | |

| (11,702 | ) |

| Cash and bank balances at beginning of the period | |

| 1,010,455 | | |

| 856,058 | |

| Cash and bank balances at end of the period | |

| 1,244,958 | | |

| 3,283,888 | |

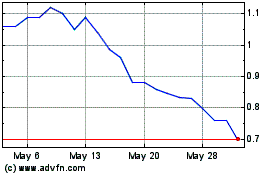

VCI Global (NASDAQ:VCIG)

Historical Stock Chart

From Oct 2024 to Nov 2024

VCI Global (NASDAQ:VCIG)

Historical Stock Chart

From Nov 2023 to Nov 2024